- 1World Bank Group, Washington, DC, United States

- 2National Drought Mitigation Center, University of Nebraska-Lincoln, Lincoln, NE, United States

Introduction

Droughts have been described as a creeping, slow-onset hazard, but they can also develop as flash droughts within just a few days or weeks (Yuan et al., 2023). In addition to conflict and price shocks, droughts are the main drivers of food insecurity. One single drought can impact a child's physical development and livelihood throughout their lifetime (Hyland and Russ, 2019). Women and girls are disproportionately affected and climate change is leading to an even more challenging situation (Alston, 2013). A recent global study revealed that moderate to extreme droughts reduce gross domestic product per capita growth rates between 0.39 and 0.85 percentage points, whereas low- and middle-income countries in arid areas are sustaining the highest relative losses (Zaveri et al., 2023). Simultaneously, humanitarian costs are exceeding the rates of donor support. While humanitarian funding requirements have increased from US$ 20.3 billion in 2016 (59% funded) to US$ 56 billion in 2023 (43% funded),1 reactive, slow, and inefficient approaches are dominating the disaster risk finance landscape. There is a lot of room for improvement around risk financing for drought shocks. The World Bank's Development Policy Loan with a Catastrophe Deferred Drawdown Option (CatDDO), for instance, provided US$ 834 million in payouts for floods and landslides and US$ 1,279 million for tropical storms between 2009 and 2023. Droughts only received US$ 25 million, roughly 0.6% of all CatDDO payouts (Plichta and Poole, 2023).

There are several large-scale initiatives to tackle drought risk at different scales. What all initiatives have in common is that they aim to prevent drought emergencies from developing into long-lasting crises, which would lead to increased human suffering, higher response costs, and more severe economic impacts. The UN World Food Programme's R4 rural resilience initiative,2 for instance, enables vulnerable households to better manage climate-related risks by increasing their food and income security. The World Bank's Disaster Risk Finance and Insurance Program (DRFIP)3 and the African Risk Capacity (ARC) (Awondo, 2019), a risk pool with 35 member countries, enable parametric drought insurance at the sovereign level. In parallel, ARC also supports drought-related humanitarian activities, for instance through ARC's replica programme that allows UN agencies and other humanitarian actors to match ARC country insurance policies.

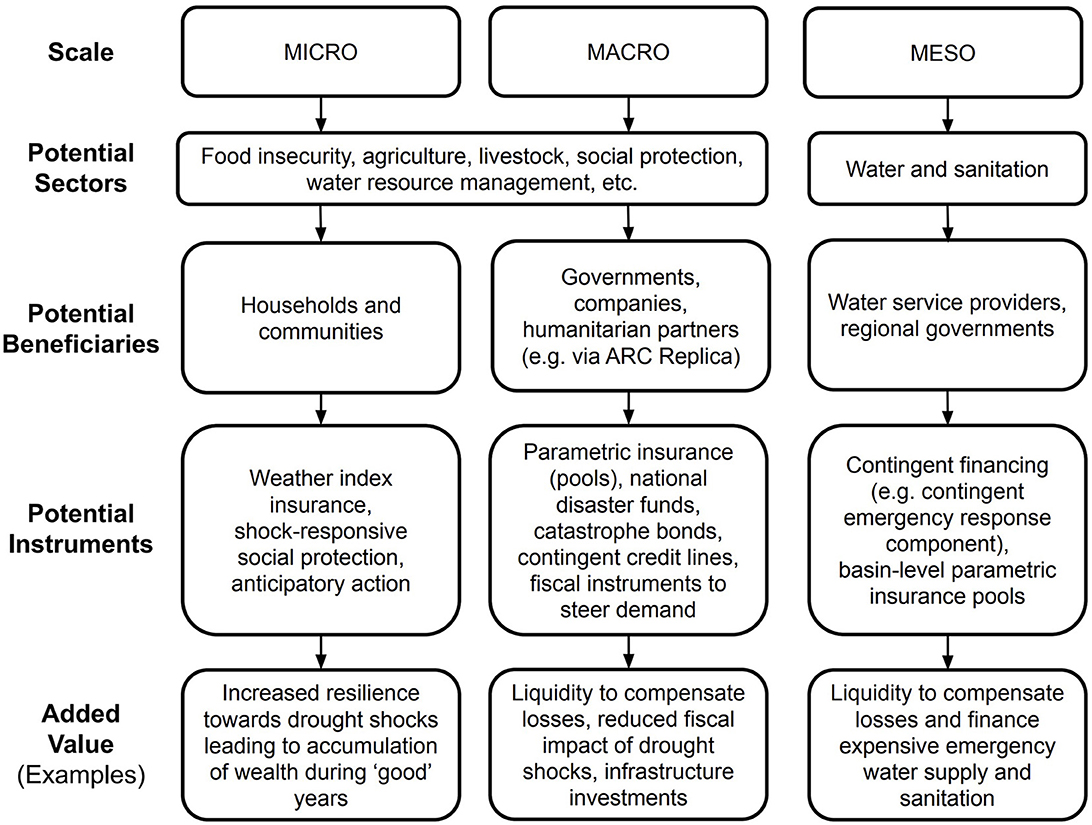

Climate change adaptation is still lacking the funding to provide financial safety nets for vulnerable households and governments at scale (Roberts et al., 2021). In the case of the water and sanitation (WatSan) sector of low-income countries, however, drought risk finance services are exceptionally underdeveloped. We argue that closing the “mesoscale” gap between micro and macro level applications by collaborating directly with the WatSan sector of low-income countries is vital for various reasons. On the one hand, water service providers are key stakeholders in ensuring water-related services for the public, agriculture, ecosystems (services), and critical infrastructure, such as schools, hospitals, and industry during times of crisis. On the other hand, targeted risk financing solutions could stabilize revenue streams and buttress the creditworthiness of water service providers in the long term.

Meso-scale drought risk finance objectives

The main objectives of drought risk finance instruments for the WatSan sector are to:

1) strengthen technical capacities, for instance regarding the tailoring and interpretation of drought risk information for specific regional needs (e.g., the interpretation of early warnings),

2) enable investments in WatSAn infrastructure, especially in regions lacking basic drinking water access (e.g., Haiti) or with high non-revenue water losses (e.g., Kenya, where the largest utilities record 58% losses, above the national average of 42%) (Macharia et al., 2020),

3) ensure largely uninterrupted water supply during drought, and

4) compensate for losses that might lead to an economic downward spiral.

As illustrated in Figure 1, various existing instruments at (inter)national financial institutions could be adapted to facilitate a broader use of drought risk financing instruments for the water sector. The World Bank's Program-for-Results Financing (PforR), for instance, could be tailored to enable capacity building regarding the interpretation of drought indices or to incentivize water conservation. CatDDOs or the Contingent Emergency Response Component (CERC), could provide immediate liquidity. Using national and regional data-driven information products would ensure buy-in via the co-design of novel approaches, simultaneously increasing the transparency and accountability of implementing organizations and donors. The mere existence of flexible financial instruments for the water service sector does not solve the issue of affordability. Risk pooling, however, could be part of the solution.

Figure 1. Meso-scale risk financing for the water and sanitation sector to complement other instruments at the micro and macro scale. CatDDO, Development Policy Loan with a Catastrophe Deferred Drawdown Option; CERC, Contingency Emergency Response Component.

Risk pooling and cross-fertilization effects

Risk pooling for drought is one of the most promising approaches to transfer the risk of extreme weather events to capital markets, even in scenarios in which droughts exhibit some degree of spatial autocorrelation (Baum et al., 2018). It can have positive impacts on the operating costs, the costs of information, and the costs of capital. The capacity of catastrophe risk pools to diversify the risk portfolio and retain a portion of losses using joint reserves can reduce the insurance premium paid by the participating countries. According to an actuarial analysis4 conducted for the expansion of the Caribbean Catastrophe Risk Insurance Facility Segregated Portfolio Company (CCRIF) to Central America, risk pooling benefits translated into premium savings of an estimated 27 percent for the two countries analyzed (Honduras and Nicaragua) compared to the cost of coverage if countries would have approached the open market individually. The analysis found further that retaining losses through joint reserves increased the premium savings by 40 percent or more.

Since the WatSan sector acts as a gatekeeper for vital services that humans in urban and rural environments depend on, any successful financial instrument that strengthens its resilience could lead to a cross-fertilization effect across other, potentially transboundary meso-level sectors. Examples include hydropower generation, reservoir operation and watershed management, or irrigation and water user associations.

Understanding vertical and horizontal complexity

There are dozens of operational drought indices, which vary in number and type of data sources, complexity, and application area (Svoboda et al., 2016). Most data about past, present, and future drought conditions are available, but often not accessible to decision-makers as actionable information in a standardized format. In addition, matching the cumulative distribution functions of climate monitoring and forecasting datasets can make them more consistent or compatible with each other, but it does not solve the issue of having to communicate uncertainties. Both satellite-derived weather/climate data and probabilistic forecasts can suffer from a multitude of limitations, ranging from a difference in accuracy due to topography (Mahmoud et al., 2020) or certain land surface classes (Taiwo et al., 2023), to forecasting uncertainties that vary depending on factors like land-atmosphere interaction (Findell et al., 2024), teleconnections (e.g., El Niño) (Liu et al., 2023), model resolution and physics, or data being assimilated into the model.

Since water resources are very closely related to human lives and livelihoods, the vertical complexity of understanding drought hazard conditions needs to be complemented by an understanding of the horizontal complexity related to socioeconomic vulnerabilities and coping capacities. Compound, cascading, and cross-sectoral risk factors that might be spatially and/or temporally decoupled from the drought shock need to be considered as well (United Nations Office for Disaster Risk Reduction, 2021)—individually for the characteristics of every region's water sector. Therefore, the development, piloting, and roll-out of new drought monitoring indices and related disaster risk finance products require linking a quantitative drought risk perspective with the expertise and risk perception of water service providers and other regional stakeholders.

Linking drought research to capacity building

Independently from the chosen meso-level financial instrument, a robust drought monitoring product is needed. The Combined Drought Indicator (CDI) was developed by the National Drought Mitigation Center at the University of Nebraska-Lincoln as a fundamental source of information for the US Drought Monitor5 and several low-income countries (Svoboda et al., 2002; Bayissa et al., 2019). Whenever the CDI has been operationalized in a country, it has been coupled with institutional and capacity-building upgrades to facilitate the necessary validation and feedback mechanisms that make the process of publishing the CDI each month as important as the product itself. In its standard configuration, the CDI is currently calculated based on a weighted combination of the Standardized Precipitation Index (SPI, 40%), land surface temperature (20%), root-zone soil moisture (20%), and the Normalized Difference Vegetation Index (NDVI, 20%) as a proxy for vegetation health. However, advanced machine learning algorithms, such as Least Absolute Shrinkage and Selection Operation (LASSO) or random forest regression, could be applied to select different climate variables and automatically assign relative weights to each variable for specific WatSan use cases. Once historically calibrated and validated in collaboration with meso-level stakeholders, critical thresholds in this CDI could then be used to trigger financial support aiming to mitigate the impacts of drought, simultaneously reducing response costs and bureaucratic hurdles through pre-agreed funding and interventions.

Discussion

Increasing both the resilience and shock protection of meso-level stakeholders in the water sector does not necessarily require reinventing the wheel. In addition to micro- and macro-level success stories, several countries have explored climate risk finance solutions for the water sector. Uruguay, for instance, generates over 98 percent of all electricity from renewable sources, primarily wind and hydropower. Below-average rainfall can lead to critical water levels in reservoirs, which are essential for generating electric power. When this occurs, the Uruguayan electric power company, Administración Nacional de Usinas y Transmisiones Eléctricas (UTE), is forced to generate electricity using thermal methods, requiring the purchase of oil at high prices on international markets. In 2013, UTE obtained a US$ 450 million climate insurance policy to protect against drought shocks.6 This climate insurance helps compensate for the financial losses incurred from having to switch to more expensive thermal energy generation methods.

Targeted capacity-building and hands-on training are essential to ensure the buy-in of the WatSan sector. This should include scenario-based analysis for different drought return periods to understand the impacts of more frequent, less severe events and rare, extreme events, representing statistical tails.

Mapping the landscape of all relevant parties and getting meso-level stakeholders on board as early as possible in the development process is vital for various reasons. First, it ensures the development of a shared vision and the synchronization of technical efforts with existing decision-making workflows, policies, regulatory frameworks, and potentially existing risk finance instruments. Second, it allows for thinking beyond individual projects to build trust across all stakeholders, including researchers and donors. Third, a transparent “convergence of evidence” process prevents the development of analytical black boxes. The CDI, for instance, requires the combination of climate variables from various sources (e.g., satellite-derived, modeled, or assimilated datasets), an understanding of underlying methods, and clear communication of uncertainties or critical thresholds. Finally, meso-level drought risk financing can prepare water service providers in low-income countries for the impacts of climate change, such as more severe, more frequent, or different types of drought (i.e., flash droughts). In addition, the utilization of novel stress-testing approaches (Becher et al., 2023) can allow water service providers to better understand and manage the risk of multiple assets failing simultaneously. In summary, drought risk financing can strengthen national risk ownership—not as a standalone instrument, but in combination with early warning systems, infrastructure investments, community-based adaptation programs, and public-private partnerships.

Author contributions

ME: Conceptualization, Writing – original draft, Writing – review & editing. NE: Conceptualization, Supervision, Writing – original draft. MS: Supervision, Writing – original draft.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Conflict of interest

ME and NE were employed by World Bank Group.

The remaining author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1. ^https://fts.unocha.org/appeals/overview/2023

2. ^https://innovation.wfp.org/project/r4-rural-resilience-initiative

4. ^https://openknowledge.worldbank.org/entities/publication/ef10a5c6-8e7b-539e-9253-96b5958e7cbf

5. ^https://droughtmonitor.unl.edu/

6. ^https://www.worldbank.org/en/results/2018/01/10/uruguay-insurance-against-rain-oil-prices

References

Alston, M. (2013). Women and adaptation: Women and adaptation. WIREs Clim. Change 4, 351–358. doi: 10.1002/wcc.232

Awondo, S. N. (2019). Efficiency of region-wide catastrophic weather risk pools: implications for African risk capacity insurance program. J. Dev. Econ. 136, 111–118. doi: 10.1016/j.jdeveco.2018.10.004

Baum, R., Characklis, G. W., and Serre, M. L. (2018). Effects of geographic diversification on risk pooling to mitigate drought-related financial losses for water utilities. Water Resour. Res. 54, 2561–2579. doi: 10.1002/2017WR021468

Bayissa, Y. A., Tadesse, T., Svoboda, M., Wardlow, B., Poulsen, C., Swigart, J., et al. (2019). Developing a satellite-based combined drought indicator to monitor agricultural drought: a case study for Ethiopia. GISci. Rem. Sens. 56, 718–748. doi: 10.1080/15481603.2018.1552508

Becher, O., Pant, R., Verschuur, J., Mandal, A., Paltan, H., Lawless, M., et al. (2023). A multi-hazard risk framework to stress-test water supply systems to climate-related disruptions. Earth's Fut. 11:e2022EF.002946. doi: 10.1029/2022EF002946

Findell, K. L., Yin, Z., Seo, E., Dirmeyer, P. A., Arnold, N. P., Chaney, N., et al. (2024). Accurate assessment of land–atmosphere coupling in climate models requires high-frequency data output. Geosci. Model Dev. 17, 1869–1883. doi: 10.5194/gmd-17-1869-2024

Hyland, M., and Russ, J. (2019). Water as destiny – the long-term impacts of drought in sub-Saharan Africa. World Dev. 115, 30–45. doi: 10.1016/j.worlddev.2018.11.002

Liu, Y., Donat, M. G., England, M. H., Alexander, L. V., Hirsch, A. L., and Delgado-Torres, C. (2023). Enhanced multi-year predictability after El Niño and La Niña events. Nat. Commun. 14:6387. doi: 10.1038/s41467-023-42113-9

Macharia, P., Kreuzinger, N., and Kitaka, N. (2020). Applying the water-energy nexus for water supply—a diagnostic review on energy use for water provision in Africa. Water. 12:2560. doi: 10.3390/w12092560

Mahmoud, M. T., Mohammed, S. A., Hamouda, M. A., and Mohamed, M. M. (2020). Impact of topography and rainfall intensity on the accuracy of IMERG precipitation estimates in an arid region. Rem. Sens. 13:13. doi: 10.3390/rs13010013

Plichta, M., and Poole, L. (2023). The State of pre-arranged Financing for Disasters. Available online at: https://static1.squarespace.com/static/61542ee0a87a394f7bc17b3a/t/6554aa7feef3b21f22365271/1700047493081/The+state+of+pre+arranged+financing+for+disasters+2023.pdf (accessed May 22, 2024).

Roberts, J. T., Weikmans, R., Robinson, S. A., Ciplet, D., Khan, M., and Falzon, D. (2021). Rebooting a failed promise of climate finance. Nat. Clim. Chang 11, 180–182. doi: 10.1038/s41558-021-00990-2

Svoboda, M., Fuchs, B. A., Integrated Drought Management Programme, World Meteorological Organization, Global Water Partnership, University of Nebraska–Lincoln, et al. (2016). Handbook of drought indicators and indices. Geneva: World Meteorological Organization. Available online at: http://www.droughtmanagement.info/handbook-drought-indicators-and-indices/ (accessed November 1, 2017).

Svoboda, M., LeComte, D., Hayes, M., Heim, R., Gleason, K., Angel, J., et al. (2002). The drought monitor. Bull. Amer. Meteor. Soc. 83, 1181–1190. doi: 10.1175/1520-0477-83.8.1181

Taiwo, B. E., Kafy, A. A., Samuel, A. A., Rahaman, Z. A., Ayowole, O. E., Shahrier, M., et al. (2023). Monitoring and predicting the influences of land use/land cover change on cropland characteristics and drought severity using remote sensing techniques. Environ. Sustain. Indic. 18:100248. doi: 10.1016/j.indic.2023.100248

United Nations Office for Disaster Risk Reduction (2021). GAR Special report on drought. Geneva: United Nations (2021), 173. (Global assessment report on disaster risk reduction).

Yuan, X., Wang, Y., Ji, P., Wu, P., Sheffield, J., Otkin, J. A., et al. (2023). A global transition to flash droughts under climate change. Science 380, 187–191. doi: 10.1126/science.abn6301

Zaveri, E. D., Damania, R., and Engle, N. (2023). Droughts and deficits – the global global impact of droughts on economic growth. World Bank policy research working paper 10453. Available online at: https://openknowledge.worldbank.org/server/api/core/bitstreams/8b8659c6-8087-46f2-907e-0d69a0a89d56/content (accessed September 13, 2023).

Keywords: climate change, drought, disaster risk management, water services, risk financing

Citation: Enenkel M, Engle NL and Svoboda M (2024) A major blind spot in drought risk financing: water services in low-income countries. Front. Clim. 6:1297002. doi: 10.3389/fclim.2024.1297002

Received: 19 September 2023; Accepted: 03 June 2024;

Published: 21 June 2024.

Edited by:

Diriba Korecha Dadi, University of California, Santa Barbara, United StatesReviewed by:

Tesfaye Dessu Geleta, Jimma University, EthiopiaCopyright © 2024 Enenkel, Engle and Svoboda. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Markus Enenkel, bWVuZW5rZWxAd29ybGRiYW5rLm9yZw==

Markus Enenkel

Markus Enenkel Nathan L. Engle1

Nathan L. Engle1 Mark Svoboda

Mark Svoboda