- Climate and Energy Research Group, Norwegian Institute of International Affairs (NUPI), Oslo, Norway

The European Commission has announced far-reaching reforms to accelerate the reduction of greenhouse gas emissions. Among the proposals constituting the European Green Deal is the adoption of a Carbon Border Adjustment Mechanism (CBAM) to prevent carbon leakage. In practice, however, CBAM will not only act as a shield for the European Emissions Trading System (ETS) but also incentivize other countries to implement compatible carbon pricing schemes. We argue that the EU's CBAM thus de facto has the features of a climate club, but the current proposals and debate do not address how the club would be governed. While the literature focuses on legal and economic aspects of CBAM design, there is little debate about the governance challenges it entails. We identify two major challenges. CBAM will put pressure on trade partners to introduce carbon pricing and/or bring it into line with the price of EU ETS allowances. However, the future availability and thus price of ETS allowances is determined within the EU. Secondly, the method for calculating embedded carbon is left to the discretion of the European Commission. EU policymakers need to acknowledge the challenges that follow from setting up a de facto climate club, and that addressing them involves a trade-off between maintaining control over the direction and ambition of climate policy and CBAM's legitimacy.

Introduction

Faced with the limitations of multilateral politics within the United Nations Framework Convention on Climate Change, some scholars have advocated an alternative approach: climate clubs. This describes a group of enthusiastic countries with high mitigation ambitions that institutionalizes collaboration and induces less ambitious countries to follow suit (Victor, 2011; Nordhaus, 2015, 2020; Falkner, 2016; Keohane et al., 2017). While some view a climate club as a theoretical construct that is unrealistic or too aggressive (Chen and Zeckhauser, 2018; Zefferman, 2018), Tagliapietra and Wolff (2021) argue that conditions are now ideal for a climate club between China, the European Union (EU) and the United States (Falkner et al., 2022).

Rather than taking a theoretical model of a climate club as our starting point, we turn our attention to ongoing processes within the EU, which has taken action that solidifies its global climate leadership (Oberthür and Dupont, 2021). The December 2019 European Green Deal proposal from the European Commission is not only the most comprehensive environmental policy framework in the history of the Union—it also has important international implications. One of the main elements of the European Green Deal, operationalized in the July 2021 “Fit for 55” communication, is that of shielding some of the EU's industries from carbon leakage with a Carbon Border Adjustment Mechanism (CBAM). This means that goods imported into the EU in five carbon-intensive sectors will be subject to payment of a carbon fee if they come from a country that does not have equivalent emissions pricing scheme. This will at least partially level the playing field for European producers as European climate ambition is ramped up. Since the EU is the world's largest market for manufactured goods (in terms of combined import/export volume), CBAM will create a strong incentive for trade partners to gravitate toward the EU's climate policy approach and introduce carbon pricing schemes in their own markets.

Following the initial Commission proposal, CBAM became one of the most debated issues on the international scene, producing “howls of protest from EU trade partners” (Fleming and Giles, 2021), most notably the BASIC/BRICS states, Japan, and the United States (BASIC, 2021; Gläser et al., 2021; Hook, 2021; Mishra, 2021). That said, thanks to the Paris Agreement and growing environmental consciousness, CBAM probably faces a more receptive international environment than past EU international environmental initiatives.

While the CBAM proposal may be viewed as yet another case of the EU projecting its regulatory power in the area of environmental policy (Selin and VanDeveer, 2006; Bradford, 2020), in this Perspective article, we propose to instead look at the CBAM as a de facto climate club. Apart from or precisely because of the need to shield its own ambitious climate policy, the EU establishes itself as the “coalition of the willing” needed to launch such a club and CBAM determines the rules of entry to the club. Trade partners of the EU can have their companies pay border adjustment fees or can implement their own carbon pricing to gain unrestricted access to the European market and reap the carbon payments themselves.

Much of the current policy and academic commentary focuses on the details of CBAM design (Weko et al., 2020; Eicke et al., 2021), more specifically its effectiveness and compatibility with World Trade Organization (WTO) rules (Monjon and Quirion, 2010, 2011; Dobson, 2022). However, the success of EU climate leadership may be equally dependent on whether and how the governance of CBAM is formulated as an invitation to cooperate. In a communiqué following their July 2021 meeting, G20 Finance Ministers noted the need for closer international coordination on carbon pricing. Canada, the United Kingdom and the United States have all presented visions of their own carbon market markets, including carbon border adjustment measures (Simon, 2021b).

The climate club literature says little about how to govern a climate club once it has been created. This paper aims to make an early contribution on that point and mobilize further research in this area. Much is at stake. CBAM is a mechanism for handling differences in climate ambition and emissions pricing in a world that cannot reach an agreement on binding reduction targets. If CBAM fails, it will be difficult for the EU to uphold its climate ambitions and there may be a backlash against carbon pricing and international climate cooperation (Gläser et al., 2021). As one commentator noted, it might turn out to be “too weak to be effective and too strong to do any good” (Buschbaum, 2021). By contrast, a robust CBAM governance arrangement may boost cooperation and incentivise the proliferation and coupling of carbon markets.

In the rest of this article, we first sketch the roots of the EU CBAM and the Emissions Trading System which it is meant to protect, and which remains at its core. We then list the ideal typical elements of a climate club, showing that the EU CBAM can be seen as one, and emphasizing that this should be acknowledged by European policymakers, who otherwise risk downplaying the governance challenges that entails. We conclude by exploring the governance challenges that this de facto climate club faces, and sketch two alternative paths that EU policymakers can follow: either staying on the current unilateral path, relying on Europe's regulatory and market power, or seeking a more multilateral path, where those partner countries that wish to join the “club” can have a say about its “system boundaries” i.e., defining the exact input materials whose embedded emissions must be added when calculating the embedded emissions of a complex good covered by CBAM (García Molyneux and Mertenskötter, 2021). Both paths have their own risks and potential benefits, and it will be an important decision on the part of the EU to either acknowledge its climate club role or stick by the minimal vision of CBAM as merely a shield for the internal market and climate ambition.

The Origins of the EU's CBAM Proposal

Established in 2005, the European Union's Emissions Trading System (ETS) is the world's largest cap-and-trade market for greenhouse gas emissions. ETS is the cornerstone of EU climate policy and is expected to provide for emissions reductions in the most cost-effective way possible.

Already in the first phase of the ETS (2005-2007), industrial actors voiced concerns about the risk of “carbon leakage”, i.e., the flight of polluting industry to countries without carbon pricing schemes (Skjærseth and Wettestad, 2009). A proposal for carbon border adjustments was first tabled in 2007 (Wettestad, 2022), but the EU decided to solve the issue of leakage with free allowances, derogation, and by leaving some sectors out of the ETS entirely. However, allowance oversupply contributed to low carbon prices for many years (Grosjean et al., 2016).

To achieve the EU-wide 2050 net-zero target and the 2030 55% emissions reduction target, it is necessary both to extend the ETS to sectors that were previously off the hook and to substantially raise allowance prices. These rising ambitions also put border adjustment measures back on the agenda. In December 2019, the European Commission signaled its intention to propose CBAM as part of the European Green Deal, and in July 2021 the idea was operationalized in the “Fit for 55” package (European Commission, 2021b).

Under the proposed CBAM, “EU importers will buy carbon certificates corresponding to the carbon price that would have been paid, had the goods been produced under the EU's carbon pricing rules. Conversely, once a non-EU producer can show that they have already paid a price for the carbon used in the production of the imported goods in a third country, the corresponding cost can be fully deducted for the EU importer” (European Commission, 2021a). In other words, CBAM will mirror the EU ETS carbon price. CBAM will be introduced gradually, in parallel with the phasing out of ETS free allowances (by 2035). Initially, restrictions will apply only to five energy-intensive, carbon leakage-prone sectors: iron and steel, cement, fertilizer, aluminum, and electricity. The CBAM reporting system will be introduced first, in 2023, and importers will start paying actual adjustment fees in 2026.

Importantly, countries that export goods to the EU will be incentivised to adjust their carbon pricing policies. As such, CBAM is not just another element of EU internal climate regulation or even EU trade policy. We argue that it displays all features of a climate club in which members commit to stronger domestic climate measures and economic measures are implemented against those who are outside club.

CBAM as a de facto Climate Club

The climate club literature envisages a situation where a coalition of the willing, enthusiastic countries come together dissatisfied with the existing level of climate policy ambition (Heal and Kunreuther, 2017; Keohane et al., 2017; Leal-Arkas, 2020). The formalization of the club entails clear entry conditions for new members. The club's political utility hinges on its ability to provide “carrots”, i.e., excludable benefits to members (Hovi et al., 2016). Such club goods can take different forms, with the two most prominent being preferential trade agreements (Kuhn et al., 2019) or other forms of cooperation, e.g., on research and development, innovation or industrial initiatives (Carraro, 2017). A club can also use “sticks”, either coercing non-members to join or additionally increasing the advantage for existing members through sanctions (Nordhaus, 2015; Shaw and Fu, 2020). Finally, it may offer side-payments to cover part of entry costs (Sælen, 2016; Sprinz et al., 2018).

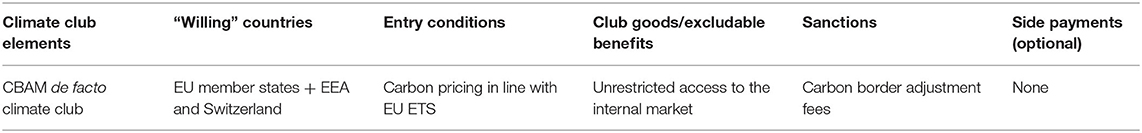

Through the introduction of CBAM, the EU sets up a de facto climate club. Using the climate club terminology, CBAM can be described as follows (see also Table 1): the coalition of the willing comprises EU member states, members of the European Economic Area, and those with coupled emissions trading schemes, that is Switzerland. The club good (excludable benefit) is unrestricted access to the EU's internal market, while non-members are subject to sanctions in the form of border adjustment fees. In the current form of CBAM proposed by the Commission, no side-payments are envisaged, as revenues go to the EU budget. Membership can be expanded when partners meet the entry conditions, outlined in Article 9 of the CBAM regulation: “a reduction in the number of CBAM certificates to be surrendered in order for the carbon price paid in the country of origin for the declared embedded emissions to be taken into account” (European Commission, 2021b, p. 32). This means that entry into the club requires that the third country's carbon price be adjusted (either by regulation or market price convergence) to that of the EU ETS (note that sanctions apply to companies, while such policy change is required from states, complicating matters). According to the EU, it “will engage with third countries whose trade to the EU is affected by this Regulation to explore possibilities for dialogue and cooperation […] It should also explore possibilities for concluding agreements to take into account their carbon pricing mechanism” (European Commission, 2021b, 3—our italics).

Unlike the climate clubs envisaged in the academic literature, CBAM is not to be introduced explicitly as a club (compare: Bierbrauer et al., 2021), but unilaterally as an element of EU climate policy, and this leaves its future governance unaddressed. Leaving this issue unacknowledged, raises questions about the depth and extent of “dialogue and cooperation” that the Commission envisages.

Governance Challenges for the CBAM Climate Club

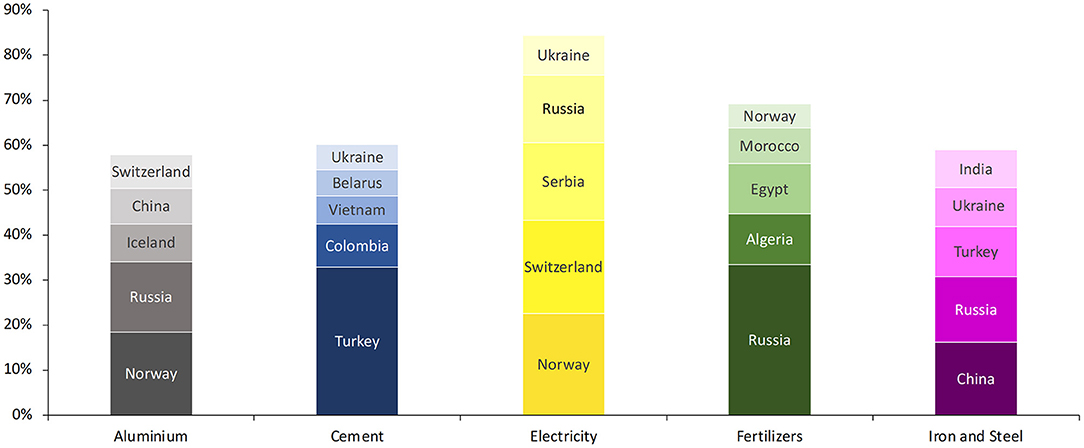

The unilateral mode of setting up a de facto climate club means that apart from EU member states, none of the countries that fulfill “entry conditions” and thus become—again, de facto—members of the club, have any say in its design, internal functioning, direction and system boundaries. Is this a problem in itself? Possibly. The EU—both in the sense of the member states and European Commission policymakers—need to balance control over the way CBAM serves as a tool of its climate policy, and the way it becomes a tool of international climate governance as well as trade policy. In the latter role, EU CBAM raises a lot of questions over its legitimacy—even before it has been set up, but more importantly once it is in place. The pressure for aligning their carbon pricing regimes—and so, joining the club—will differ between Europe's trade partners, and this pressure will be particularly high in its near neighborhood, where most of the import in the five CBAM sectors comes from (Figure 1).

Figure 1. Top five trade partners in the five sectors under EU CBAM (Source: COMTRADE). The data reflects the state before February 2022, and sanctions imposed on Russia and Belarus, as well as constraints on exports from Ukraine due to the war should be noted.

We can perhaps have a glimpse of this near future and the challenges posed by the EU CBAM by looking at the three non-EU countries that are already tied to the ETS—i.e., the first “external” members of the club: Norway, Switzerland and the UK. Synthesizing the statements made in a recent consultation process by stakeholders from these three countries, we can note two major issues raised (European Commission, 2020).

Firstly, although the ETS is a market-based mechanism, in principle transparent and allowing the market to determine the most effective price level, past experience indicates that this is not the case. After prices dropped in 2012, in 2013 the Commission proposed “backloading” i.e., changing the timing of emissions allowances to take some of the surplus off the market and raise the price. A more permanent measure to raise the price was the already mentioned Market Stabilizing Reserve from 2015 (Wettestad and Jevnaker, 2016). The 2021 hike in allowance prices has pushed the most affected member states, e.g., Poland and Spain, to form a coalition for a new amendment, banning alleged speculation on the allowance price (Simon, 2021a), although a later report by the European Securities and Markets Authority asserted that “high-frequency trading firms and market makers engaging in algorithmic trading” are “only holding small net positions” and are not a major driver of EUA price increases (ESMA, 2022, p. 7). Furthermore, the ETS price is distorted by free allowances, subsidies, and other politically driven measures. On top of that, a “floating” carbon price is impractical as a border tariff, adding both uncertainty and red tape. The take home message for CBAM affected non-EU states is that EU ETS allowance prices are unpredictable and depend on political actors and processes within the EU.

Secondly, who will develop the principles and rules of CBAM specifically, including how to calculate and define carbon content? Who will set system boundaries? Internally, these questions are contentious enough, as they touch upon the division of labor between the Commission, Parliament and Council (García Molyneux and Mertenskötter, 2021). Analysts of carbon markets label these issues “monitoring, reporting and verification” (Keohane et al., 2017) and non-EU stakeholders express concern about the blurriness and arbitrariness of the currently proposed system as well as the discretion that the Commission will exercise. UK-based KPMG notes that countries may “resist the EU imposing its own compliance and enforcement regime on them” and asks “whether or not there will be global cooperation to achieve such alignment”. Verification is key to achieving a level playing field, but the rules remain unspecified and subject to unilateral change.

Discussion: The Tough Choice Between a Unilateral and a Multilateral Path

The main purpose of the Commission's proposal for CBAM as part of the European Green Deal is to prevent carbon leakage. It is designed as a shield for the climate leader when the rest of the world lags in terms of climate policy ambition. In practice, however, CBAM is likely to not only act as a shield for the EU ETS but also to incentivize other countries to implement compatible carbon pricing schemes.

Neither the EU's current CBAM proposal nor the academic climate-club literature addresses how such a constellation would be governed. The puzzle is how to ensure that it is not entirely top-down and that non-EU countries have some say, without creating a mechanism that enables them to undermine EU climate ambition. This is an important question, as CBAM may be less politically sustainable if it is perceived as too unfair.

If, after the formation of the club, the EU ramps up its ambition and leaves other “club members” behind once more, the shield will be needed again, and will be the same logic as when CBAM was originally created. It is not surprising that Europe's trade partners that will be affected oppose the mechanism but, ultimately, we also must accept that CBAM itself is the governance mechanism for handling the divergence in climate policy ambition. For that reason, and for the sake of global climate change mitigation efforts, the EU should not cede control of its ETS because of CBAM, unless that would imply carbon market coupling and expansion of carbon pricing to cover most important emitters, or eventually the entire world.

While CBAM is a way of bridging parallel climate ambition universes and allowing them to interact with each other while remaining separate, in terms of the method for calculating embedded emissions we need to see harmonization. The focus so far has been on the highly challenging technical and accounting aspects of this problem. However, it is also a question of governance which requires legitimacy, or more precisely the perception of fairness and legitimacy by third parties.

The problem that the EU faces right now is the potential trade-off between control and legitimacy, with two kinds of risks involved. It is reasonable to argue that the EU CBAM does not need alliances, because it is a hard-nosed economic incentive-based scheme. It is through its market and regulatory power that the EU will bring other partners on board, not by being receptive to their interests, needs and opinions. This same story can also be retold in the language of climate leadership and Europe's normative power, where the source of legitimacy is not deliberation and dialogue, but rather increasing ambition in climate action, and thus contributing to a common good. Either way, this unilateral path means maintaining full control but carries a high risk of delegitimizing both the CBAM and the climate policy it seeks to shield if international partners perceive it as protectionist and driven by trade concerns rather than environmental goals. We should emphasize that this is about perceived legitimacy, and EU's persuasion can minimize this trade-off in practice.

An alternative path is more deliberative and multilateral. EU policymakers should acknowledge the “climate club” nature of CBAM and see trade partners as potential members. To make CBAM an acknowledged instrument of climate policy, the question of monitoring, reporting and verification is fundamental, and we could imagine an intergovernmental commission, or an institution set up under the auspices of the G20 and in line with WTO rules, that could handle the complexities of calculating embedded carbon content and system boundaries. This way, the EU would cede some control, which carries the risk of reducing climate ambitions, but would increase the legitimacy of the CBAM climate club, making it more likely to prevail and succeed.

Data Availability Statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author/s.

Author Contributions

KS contributed with the general framing, literature review, and writing up the paper. IO provided the initial paper idea, data visualization, and contributed to writing and editing the paper. IS contributed with several readings, additional literature review, and data gathering for the figure. All authors contributed to the article and approved the submitted version.

Funding

This research was funded by the Swedish Energy Agency (grant number 48620-1) and the Swedish Research Council Formas (grant number 2019-01993).

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

BASIC (2021). Joint Statement Issued at the Conclusion of the 30th BASIC Ministerial Meeting on Climate Change hosted by India on 8th April 2021. South African Government. Available online at: https://www.gov.za/nr/speeches/joint-statement-issued-conclusion-30th-basic-ministerial-meeting-climate-change-hosted (accessed December 15, 2021).

Bierbrauer, F., Felbermayr, G., Ockenfels, A., Schmidt, K. M., and Südekum. (2021). ‘A CO2-Border Adjustment Mechanism as a Building Block of a Climate Club', Kiel Policy Briefs, 151. Available at: https://www.ifw-kiel.de/publications/kiel-policy-briefs/2021/a-co2-border-adjustment-mechanism-as-a-building-block-of-a-climate-club-16065/ (accessed December 9, 2021).

Bradford, A. (2020). The Brussels Effect: How the European Union Rules the World. New York, NY: Oxford University Press.

Buschbaum, L. M. (2021). CBAM! The Global Energy Transition Podcast - Episode 2, Energy Transition. Available online at: https://energytransition.org/2021/11/podcast-episode-2/ (accessed December 10, 2021).

Carraro, C. (2017). Clubs, R&D, and Climate Finance: Incentives for Ambitious GHG Emission Reductions. Cambridge, MA.

Chen, C., and Zeckhauser, R. (2018). Collective action in an asymmetric world. J. Public Econ. 158, 103–112. doi: 10.1016/j.jpubeco.2017.12.009

Dobson, N. (2022). “Climate protection versus trade: dilemmas for the EU,” in Handbook on European Union Climate Change Policy and Politics. Elgar Handbooks in Energy, the Environment and Climate Change, eds T. Rayner, and K. Szulecki. Cheltenham: Edward Elgar Publishing.

Eicke, L., Weko, S., Apergi, M., and Marian, A. (2021). Pulling up the carbon ladder? Decarbonization, dependence, and third-country risks from the European carbon border adjustment mechanism. Energy Res. Soc. Sci. 80, 102240 doi: 10.1016/j.erss.2021.102240

ESMA (2022). Final Report. Emission Allowances and Associated Derivatives. Paris: European Securities and Markets Authority.

European Commission (2020). EU Green Deal (Carbon Border Adjustment Mechanism), Have Your Say. Available online at: https://ec.europa.eu/info/law/better-regulation/have-your-say/initiatives/12228-EU-Green-Deal-carbon-border-adjustment-mechanism-/public-consultation_en (accessed January 21, 2022).

European Commission (2021a). Carbon Border Adjustment Mechanism, European Commission- European Commission. Available online at: https://ec.europa.eu/commission/presscorner/detail/en/qanda_21_3661 (accessed December 9, 2021).

European Commission (2021b). Proposal for a Regulation of the European Parliament and the Council Establishing a Carbon Border Adjustment Mechanism'. Brussels: European Commission.

Falkner, R. (2016). A minilateral solution for global climate change? On Bargaining efficiency, club benefits, and international legitimacy. Perspect. Polit. 14, 87–101. doi: 10.1017/S1537592715003242

Falkner, R., Nasiritousi, N., and Reischl, G. (2022). Climate clubs: politically feasible and desirable? Clim. Policy 22, 480–487. doi: 10.1080/14693062.2021.1967717

Fleming, S., and Giles, C. (2021). OECD Seeks Global Plan for Carbon Prices to Avoid Trade Wars. Financial Times. Available online at: https://www.ft.com/content/334cf17a-e1f1-4837-807a-c4965fe497f3 (accessed December 15, 2021).

García Molyneux, C., and Mertenskötter, P. (2021). Will the EU CBAM Cover More Than What You Think? Complex Goods, System Boundaries, and Circumvention Under the Commission's CBAM Proposal, Inside Energy & Environment. Available online at: https://www.insideenergyandenvironment.com/2021/07/will-the-eu-cbam-cover-more-than-what-you-think-complex-goods-system-boundaries-and-circumvention-under-the-commissions-cbam-proposal/ (accessed December 10, 2021).

Gläser, A., Casper, O., Li, L., Kardish, C., Holovko, I., Makarov, I., et al. (2021). Less Confrontation, More Cooperation. Berlin: Germanwatch. Available online at: https://germanwatch.org/en/20355 (accessed December 9, 2021).

Grosjean, G., Acworth, W., Flachsland, C., and Marschinski, R. (2016). After monetary policy, climate policy: is delegation the key to EU ETS reform? Clim. Policy 16, 1–25. doi: 10.1080/14693062.2014.965657

Heal, G., and Kunreuther, H. (2017). An alternative framework for negotiating climate policies. Climat. Change 144, 29–39. doi: 10.1007/s10584-017-2043-8

Hook, L. (2021). John Kerry Warns EU Against Carbon Border Tax. Financial Times. Available online at: https://www.ft.com/content/3d00d3c8-202d-4765-b0ae-e2b212bbca98 (accessed December 15,2021).

Hovi, J., Sprinz, D. F., Sælen, H., and Underdal, A. (2016). Climate change mitigation: a role for climate clubs? Palgr. Commun. 2, 1–9. doi: 10.1057/palcomms.2016.20

Keohane, N., Petsonk, A., and Hanafi, A. (2017). Toward a club of carbon markets. Climat. Change 144, 81–95. doi: 10.1007/s10584-015-1506-z

Kuhn, T., Pestow, R., and Zenker, A. (2019). Building climate coalitions on preferential free trade agreements. Environ. Resour. Econ. 74, 539–569. doi: 10.1007/s10640-019-00331-0

Leal-Arkas, R. (2020). Climate clubs and international trade across the European and International Landscape. European Energy and Environmental Law Review. 29, 72–88. doi: 10.54648/EELR2020031

Mishra, A. R. (2021). BRICS Summit Is Likely to Strongly Oppose Carbon Tax Proposed by EU, Green Fiscal Policy Network. Online at: https://greenfiscalpolicy.org/brics-summit-is-likely-to-strongly-oppose-carbon-tax-proposed-by-eu/ (accessed December 15, 2021).

Monjon, S., and Quirion, P. (2010). How to design a border adjustment for the European Union Emissions Trading System? Energy Policy 38, 5199–5207. doi: 10.1016/j.enpol.2010.05.005

Monjon, S., and Quirion, P. (2011). Addressing leakage in the EU ETS: Border adjustment or output-based allocation? Ecol. Econ. 70, 1957–1971. doi: 10.1016/j.ecolecon.2011.04.020

Nordhaus, W. (2015). Climate clubs: overcoming free-riding in International climate policy. Am. Econ. Rev. 105, 1339–1370. doi: 10.1257/aer.15000001

Nordhaus, W. (2020). The Climate Club. Available online at: https://www.foreignaffairs.com/articles/united-states/2020-04-10/climate-club (accessed December 14, 2020).

Oberthür, S., and Dupont, C. (2021). The European Union's international climate leadership: towards a grand climate strategy? J Eur Public Policy 28, 1095–1114. doi: 10.1080/13501763.2021.1918218

Sælen, H. (2016). Side-payments: an effective instrument for building climate clubs? Int. Environ. Agreements Polit. Law Econ. 16, 909–932. doi: 10.1007/s10784-015-9311-8

Selin, H., and VanDeveer, S. D. (2006). Raising global standards: hazardous substances and E-waste management in the European Union. Environ. Sci. Policy Sustain. Dev. 48, 6–18. doi: 10.3200/ENVT.48.10.6-18

Shaw, D., and Fu, Y.-H. (2020). Climate clubs with tax revenue recycling, tariffs, and transfers. Clim. Change Econ. 11, 2040008. doi: 10.1142/S2010007820400084

Simon, F. (2021a). Europe's Energy Price Hike Fuelled by Speculators. Spain and Poland. Available online at: www.euractiv.com; https://www.euractiv.com/section/emissions-trading-scheme/news/europes-energy-price-hike-fuelled-by-speculators-spain-and-poland-say/ (accessed December 16, 2021).

Simon, F. (2021b). John Kerry: Carbon Border Tariffs Are ‘A Legitimate Idea to Have on the Table'. Available online at: www.euractiv.com; https://www.euractiv.com/section/emissions-trading-scheme/interview/john-kerry-carbon-border-tariffs-are-a-legitimate-idea-to-have-on-the-table/ (accessed December 15, 2021).

Skjærseth, J. B., and Wettestad, J. (2009). The origin, evolution and consequences of the EU emissions trading system. Global Environ. Polit. 9, 101–122. doi: 10.1162/glep.2009.9.2.101

Sprinz, D. F., Sælen, H., Underdal, A., and Hovi, J. (2018). The effectiveness of climate clubs under Donald Trump. Clim. Policy 18, 828–838. doi: 10.1080/14693062.2017.1410090

Tagliapietra, S., and Wolff, G. B. (2021). Form a climate club: United States, European Union and China. Nature 591, 526–528. doi: 10.1038/d41586-021-00736-2

Victor, D. G. (2011). Global Warming Gridlock: Creating More Effective Strategies for Protecting the Planet. Cambridge: Cambridge University Press.

Weko, S., Eicke, L., Marian, A., and Apergi, M. (2020). The Global Impacts of an EU Carbon Border Adjustment Mechanism. Potsdam.

Wettestad, J. (2022). “Proactive prevention of carbon leakage in the EU? The rise of a carbon border adjustment mechanism,” in Handbook on European Union Climate Change Policy and Politics. Elgar Handbooks in Energy, the Environment and Climate Change. eds T. Rayner, and K. Szulecki. Cheltenham: Edward Elgar Publishing.

Wettestad, J., and Jevnaker, T. (2016). Rescuing EU Emissions Trading: The Climate Policy Flagship. London: Palgrave Macmillan (Palgrave pivot).

Keywords: climate clubs, European Union, carbon pricing, climate governance, UNFCC, leadership, regulatory power

Citation: Szulecki K, Overland I and Smith ID (2022) The European Union's CBAM as a de facto Climate Club: The Governance Challenges. Front. Clim. 4:942583. doi: 10.3389/fclim.2022.942583

Received: 13 May 2022; Accepted: 15 June 2022;

Published: 11 July 2022.

Edited by:

Lin Zhang, City University of Hong Kong, Hong Kong SAR, ChinaReviewed by:

Kenneth Bruninx, KU Leuven, BelgiumCopyright © 2022 Szulecki, Overland and Smith. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Kacper Szulecki, a2FjcGVyLnN6dWxlY2tpQG51cGkubm8=

Kacper Szulecki

Kacper Szulecki Indra Overland

Indra Overland Ida Dokk Smith

Ida Dokk Smith