95% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Clim. , 30 November 2021

Sec. Climate Law and Policy

Volume 3 - 2021 | https://doi.org/10.3389/fclim.2021.714334

This article is part of the Research Topic Carbon Pricing and Trading View all 6 articles

The aim of this article is to consider the market-based instruments, such as the ETS system, for the internalization of the CO2-equivalent emissions issued from the agricultural sector. We use a hypothetical market valuation of the emissions and we extend the analysis to the optional pricing with double barriers. According to our results, the purpose of attaining the levels of carbon emissions recommended by the French public authorities, with a level of reductions down by 50.00% in 2030, could be successful would the terminal range of optional prices stand between 76.35 and 89.56 Eur.

The sustainability of agricultural systems is a complex issue involving multiple factors that fit broadly within economic, social, and environmental areas (Talukder et al., 2020). This article does not address the question of what types of agricultural systems are sustainable, having in mind that agriculture has impacts on ecosystems through land clearing, habitat fragmentation, desertification, soil erosion, eutrophication, loss of biodiversity, and pollution (Burney et al., 2010; Conway and Barbier, 2013). What this article tries to emphasize on is how putting a price on carbon footprints from the agricultural activities can contribute—among many other necessary devices within the reach of public decision-makers—to saving the climate as a global public good.

The EU aims to be climate-neutral by 2050: An announcement made by the European Commission in 2020 (European Commission, 2020). Unfortunately, when it comes to agriculture, this goal is rather unattainable with current measures. On the basis of the study by Lóránt and Allen (2019), we know that improving the efficiency of production, changing what, and how commodities are produced, as well as increasing the sequestration capacity, are all options available to the sector. Yet, none of these approaches can deliver the mitigation level necessary for a net-zero future. Without major changes in land use, these options used together could lead to emission reductions of at most 46% by 2050. That is why carbon neutral scenarios rely on the land sparing approach, according to which tremendous increases in agricultural yields (up to 30%) enable to free up land that would be afforested or used to produce biomass energy (Aubert et al., 2019)1. This line of reasoning is very questionable. We thus have to envisage other devices, such as the market-based mechanisms.

Regardless of the economic sector at stake, effective allocation of depollution efforts requires a complex coordination of agents and stakeholders. This can be achieved by introducing a mechanism that gives a price to the environmental damage at the margin, that is, a price for the occurrence of the additional unit of what is socially considered to be an environmental damage, or, equivalently, a price that compensates for the offset of the additional unit of the environmental damage at stake (Bureau, 2005). The interest of market mechanisms is then to rely on the decentralized behavior of economic agents for internalizing the negative externalities such as the emissions of GHGs. For the public policies guidance, this approach is a means to undertake interventions that are coherent at a sector-based level. It ensures that all agents are subjected to the same economic valorization of marginal damages (Bureau and Hourcade, 1998).

The international community has decided to limit the worldwide temperature rise to at most 2°C (MEEM, 2016). In detail, the Paris Agreement aims to substantially reduce global GHG emissions in an effort to limit the global temperature increase in this century to 2°C above preindustrial levels, while pursuing the means to limit the increase to 1.5°C. One of the major challenges is to maintain the level of social wealth, generated within the economic activities, without emitting more GHGs into the atmosphere. Indeed, the additional emissions do not permit attaining the carbon neutrality that is usually endorsed through natural or technological processes. The economic and financial instruments that lead to an implicit or explicit carbon price make it possible to diffuse clear signals on the benefits to emit less GHGs or, symmetrically, to warn of their costs to the society. For instance, the 2015 French energy transition law for the environmentally oriented economic growth opted for a growing carbon tax. Its amount was projected to be of 56.00 Eur in 2020 and 100.00 Eur in 20302. The internalization of negative externalities can equally be implemented via the emission allowance market, in an equivalent monetary metric, such as the European Emissions Trading System (ETS).

The negative externalities are typically assessed by means of the environmental standards. The latter must be related to the costs of protection that they jointly impose on the economy and the society. The search for the least cost means that agents have an interest in minimizing these costs. This leads us to focus on the regulation by economic instruments such as the eco-taxation or the market for emission permits (Dragicevic and Sinclair-Desgagné, 2010). These send the signal of the real price, pollution included, of the economic activities. Within the carbon emissions trading, polluters that emit more than the quota of CO2-equivalent emissions set by the regulator are financially penalized, for which they are required to buy allowances for their excessive emissions. On the contrary, polluters that achieve to reduce their emissions below the quota can sell their surplus allowances and can thus benefit from the sales revenues. They will therefore choose between abating an additional pollution unit, if the cost of doing it is lower than the carbon price, and paying the tax or buying an emission permit, if the marginal cost of depollution turns out to be costly. Based on these facts, environmental taxation and emission permit markets bring us to the Pigouvian analysis (Bureau and Mougeot, 2004). The flexibility and incentives provided by economic instruments are therefore the guarantee to enact the least cost abatement system. In turn, any savings in costs can be re-oriented toward other public policy concerns.

ETS considers four main economic sectors, which are aviation, manufacturing, and construction industries with combustion of fuels, stationary installations in the energy and industrial sectors, as well as the industrial installations (EEA, 2018). As pointed out by Verschuuren (2018), the agricultural sector faces three challenges: reducing GHG emissions, adapting to the climate change, and producing enough food for a growing population. In 2019, agriculture produced 19% of total GHG emissions in France, be it the second highest source of emissions in the country (REE, 2021). Reducing the GHG emissions issued from the agricultural sector is thus of prime importance. Agriculture being a non-ETS sector, the agricultural emissions are solely covered by the Effort Sharing Decision/Regulation3, at least as far as the emissions from livestock are concerned (Official Journal of the European Union (OJ), 2009). Although the cornerstone of the European climate policy relies on ETS, which covers about half of the European emissions, policy discussions on pricing agricultural emissions have been relatively absent to date. To achieve the EU's long-term cost-effective mitigation targets, Grosjean et al. (2018) first estimated that agriculture should reduce its emissions by 36.00% in 2030, and by 42.00% to 49.00% in 2050. What is more, to reduce the agricultural emissions, the last authors suggest to opt for market-based instruments. With regard to the recent revision of the objectives made by the European bodies, we plan to go further and target carbon neutrality in 2050 by fixing a lofty 50% reduction in emissions, as compared to 1990 levels, as early as 2030.

That being said, the integration of agriculture and land use into the emissions trading is challenging. As a matter of fact, ETS is considered problematic because of the difficulty of measuring emissions and emission reductions at the farm level (Verschuuren, 2021). And yet, solutions exist (Brandt and Svendsen, 2010). In any case, such an undertaking can help shape the political architecture. Indeed, unlike the EU-ETS where the emissions reduction is on track, reductions in the non-ETS sectors have so far been far behind the objectives of the climate policy. Therefore, the extension of carbon pricing to non-ETS areas is an opportunity to make climate policy more effective. Besides, the inclusion of agriculture into the EU-ETS gives it market economy virtues, that is, climate protection revenues or higher emission rights can be generated through such a mechanism (Isermeyer et al., 2021).

The purpose of this article is to consider the market-based instruments at disposal, such as the ETS system, for the internalization of the CO2-equivalent emissions issued from the agricultural sector. We use a hypothetical market valuation of the emissions and we extend the analysis, issued from the literature on derivative contracts (Black and Scholes, 1973), to the optional pricing with double barriers. Our approach is motivated by the fact that the derivative pricing mechanism contains information on the density of pricing of the underlying assets. Thereby, combining time-series data with information extracted from options is highly useful for the market forecasting (Christoffersen et al., 2013). Furthermore, the issue of missing markets for negative externalities, for the Pareto or socially optimal allocation of resources, can be overridden through the study of the artificial market (Oyevaar et al., 2016). Albeit the fact that the carbon market is already operational, imagining a derivatives market for agricultural-based pollution can be included as a useful artifact for the monetary internalization of external diseconomics.

Our methodology permits the French agricultural sector to reduce emissions from sectors outside the EU-ETS, for the 2021–2030 period, in the absence of carbon taxes. Indeed, governments now work on emission pricing schemes to meet their contributions under the Paris Agreement on climate change. In a previous paper, Daskalakis et al. (2009) valued a call option written on emission allowances. We extend their work in considering double barriers as a way to incorporate targeted levels of the internalization of negative externalities. Actually, taking into account solely the option prices would have given the market assessment of pollution without knowing whether it fully acknowledges the severity of GHG damages needed to be offsetted. And we know that carbon markets often produce prices that are deemed too low relative to the social cost of carbon (Bayer and Aklin, 2020). Working with targeted levels of emissions enables us to set France on a responsible path to becoming climate neutral by 2050.

According to our results, the purpose of attaining the levels of carbon emissions recommended by the French public authorities, with a level of reductions down by 50.00% in 2030, could be successful would the hypothetical range of prices stand between 76.35 and 89.56 Eur. This should lead to a pattern in which calls and puts follow the same quasi-linear increase until reaching, in 2024, the optional market equilibrium. Afterward, the levels of calls should continue to follow a similar trajectory, whereas the levels of puts ought to be, until the final time step, on a diminishing growing path. In the long-run perspective, buying allowances is more onerous while selling them is moderately valuable, such that the economic internalization of agricultural polluting turns into an inevitable punitive incentive. Yet, in regard to the beginning of the time series, the gradual increase of put values ends up with high rewarding.

The paper proceeds as follows. Section 2 shortly recalls the Black–Scholes pricing model applied to the ETS carbon pricing system. Section 3 illustrates our simulation examples. In section 4, concluding remarks are given.

The EU-ETS is a cornerstone of the EU's policy to combat climate change and its key tool for reducing GHG emissions cost-effectively (European Commission, 2021a). According to Uhrig-Homburg and Wagner (2008), there is trading potential for a standardized option-style CO2 derivative contract on carbon electronic marketplaces. Therefore, we shall mobilize the well-known Black–Scholes derivatives pricing model in order to see what it could teach us on the severity of pollution that needs to be offsetted.

Although derivatives are mostly used to hedge against investment risks, that is, they allow offsetting the risk of any adverse price movements of the underlying entities, trading is more intensive on the derivatives markets than on the spot markets, and we know how much liquidity is a precondition for the success of ETS (Ibikunle and Gregoriou, 2018). The result of greater intensity in trading is that derivatives markets have taken the lead over their underlying market in the price discovery process (Arrata et al., 2013). The optional pricing should therefore provide us with the real cost of pollution coming from the agricultural sector.

The Black–Scholes model is a mathematical model simulating the dynamics of a financial market containing derivative financial instruments such as options. The key property of the model is that an option has a unique correct price regardless of the risk of the underlying security and its expected return. An options contract offers the buyer the opportunity to buy or sell the underlying asset (Dragicevic, 2018). In our case, we are not strictly interested in buying or selling emission allowances. What interests us is whether the market price for options will rise or decline based on the related allowances' performance. By adding both upper and lower trigger prices placed on the underlying asset, we wish to see to what extent the carbon market price is close to efficiently internalizing the negative externalities due to the agricultural pollution. Traders use double-barrier options when they have an opinion on volatility but not on the direction of the underlying asset's next price move. We instead transform them into a price tunnel in which carbon neutrality is on the right path.

Let us first recall the Black–Scholes options pricing formula (Black and Scholes, 1973). Although the model makes a certain number of assumptions, like the payment of dividends or the absence of transaction costs, we shall focus on the principal model variables. Indeed, the emission allowances do not pay any interest or dividends and their purpose is not to achieve the appreciation value but to comply with regulatory requirements (Uhrig-Homburg and Wagner, 2008). Likewise, transaction costs have no significant influence on the option prices when traders do not adjust their trading positions frequently (Dong, 2021). The formula for call options—the right but not the obligation to purchase the underlying asset, which in the present study matches with the right to possess the emission allowances – is as follows4:

with

and

where C corresponds to the call premium, that is, the amount paid for a call option; S is the stock price which, in our case, corresponds to the market value of the CO2-equivalent emission allowance; N is the cumulative standard normal distribution of prices calculated with respect to d1, that is,the probability that a random variable will be less than or equal to the actual price value; K is the option striking price, which we transpose into the time-evolving carbon prices estimated by the public authorities as of enabling to reach a targeted level of internalization of the emissions of GHGs; r is the risk-free interest rate, which we set to 0.045 and corresponds to the interest one gets from a non-risky investment; σ reflects the standard deviation of the carbon prices, meaning how widely spread the carbon prices are; and t is the time to expiration in years, that is, the specific time an option contract expires.

The left part of the above-expression provides information on the expected benefit obtainable by purchasing the underlying asset. The right part corresponds to the present value of paying the exercise price upon expiration. Even if the Black–Scholes model is meant to assess European-style options, that can be only exercised on the terminal date, the optional pricing is considered to be a very good indicator of the future values of an asset. For instance, the future value of the impending negative externalities to be offsetted by the agricultural stakeholders can be considered as an illustrative example.

With the purpose of refining the analysis built from the standard Black–Scholes formalization, we decide to extend the pricing model by injecting two preset barriers. This gives rise to derivatives termed barrier options (Andersen et al., 2002), the existence of which usually depends upon the price of the underlying asset. In short, double barrier optional pricing is a more sophisticated financial tool, with fixed upper and lower bounds6, of the current asset price. Provided the hypothetical nature of the market valuation of agricultural pollution and the prognosis carried out in the present study, we have decided to compute optional discounted barrier values instead.

The lower barrier expresses the minimum value of the carbon price enabling the market to correctly penalize the emitters of CO2-equivalent emissions. Let us recall that we are in search of the least-cost solution. The upper boundary simply corresponds to the implied volatility of an emission permit one might expect over the life of the option. As expectations rise, implied volatility rises as well. Departing from the impending pricing of CO2-equivalent emissions expressed by the public authorities, which is assumed to enable reaching the desired carbon offsetting, our aim is to see the distance that separates the non-linear price dynamics from the linear price evolution of double barrier options.

Our study deals with the minimization of CO2-equivalent emissions, if the polluter pays principle—such as the ETS carbon pricing system—be applied to agricultural activities in France. For that purpose, we have decided to put into use the well-known Black–Scholes pricing model and to apply it to the public data at disposal. The time series of carbon prices from 2009 until 2018, that is, the European Emission Allowances (EUA) from which the option prices have been computed, have been obtained from the online database held by the English think-tank Sandbag (Sandbag, 2019). The total quantities of CO2-equivalent emissions, going from 1990 up to 2016, have been downloaded from the website of the Food and Agriculture Organization Corporate Statistical Database (FAOSTAT, 2019).

Provided the objectives of reductions in emissions recommended by the French authorities, which can be translated into having a CO2-equivalent emission allowance value of 100.00 Eur per ton in 2030, we have calculated the carbon prices from 2020 until 2030 as follows:

where t corresponds to the yearly time step. Through the introduction of the square root of a point in time augmented by the random function, the evolution of carbon prices is considered to be subjected to non-linear dynamics in uncertainty. We thus take account of the option pricing model assumption according to which markets are efficient, such that their evolution cannot be predicted with certainty. In other words, policy makers have neither a preference for early nor for late resolution of uncertainty in a way that market-based calibration is needed (van der Ploeg, 2021).

Through a linear regression of the tons recorded between 1990 and 2016, we have then calculated the CO2-equivalent emissions. The following equation results:

where t corresponds to the yearly time step. At a 95% confidence level, the coefficient of determination is of R2 = 0.82, which implies that, in comparison to the available data, the goodness of the regression fit is high. This formula enables us to make projections on the emissions until 2030 as well as to incorporate, as compared to 1990 levels, the scenario of reductions in emissions of 50% in 2030.

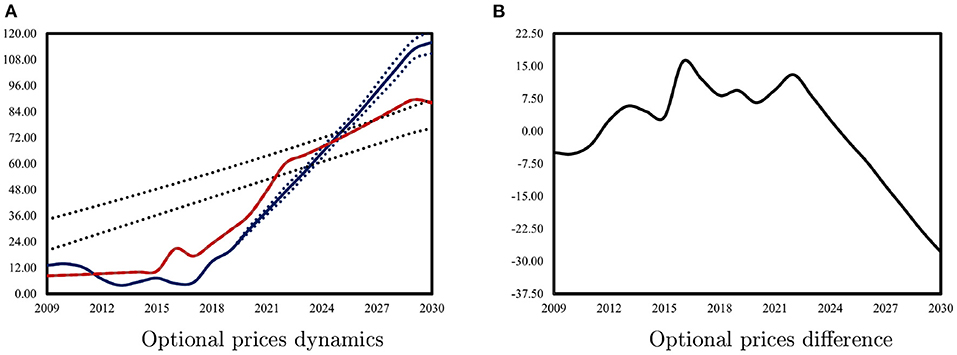

Figure 1A depicts the discounted price dynamics of CO2-equivalent emission allowances. With respect to the public decision-aid tools (MEEM, 2016), the corridor with double barriers corresponds to what we estimate as what should have been and what should be the carbon price range, that is, from [20.00, 40.00] Eur in 20097 up to [80.00, 100.00] Eur in 2030. Those prices yield optional discounted barrier values of [18.01, 36.45] Eur in 2009 until reaching the terminal values of [76.35, 89.56] Eur at the end of the time scale. These results are plausible, bearing in mind that the price per ton of CO2 in 2030 is estimated at 71.00 Eur for an objective of reducing emissions by 40.00% (European Commission, 2021b).

Figure 1. ETS CO2-equivalent (tCO2e) price dynamics. The x-axis represents the time-line. The y-axis measures the option prices of carbon allowances. In (A), the blue line corresponds to the levels of calls (optional purchasing prices). The blue dotted lines indicate the standard deviation of the calls. The red line corresponds to the levels of puts (optional selling prices). The black dotted lines depict the double-barrier optional values according to the public recommendations on carbon prices. (B) illustrates, through the black full line, the gap between puts and calls.

With a relatively small absolute value of the difference between the levels of puts and of calls—from −4.88 (± 0.00) to 3.28 (± 0.00) Eur (Figure 1B)—it can be noticed that the hypothetical option prices have been relatively close between 2009 and 2015. Nevertheless, it can also be mentioned that, after being relatively close to the down-barrier in 2009, both call and put values evolve below the carbon corridor prices. Let us recall that the purpose of the former is to efficiently internalize the carbon emissions. In 2016, the gap widens up to −16.05 (± 0.00) Eur. It then falls progressively down to 2.65 (± 1.19) Eur in 2024, with a linearized average decline of 12.04%. According to the extrapolation of the levels of calls and puts conducted from 2020, the gap between the optional selling and buying prices increases from −2.43 (± 1.11) Eur in 2025 to a significant gap of −27.85 (± 2.65) Eur in 2030. This corresponds to a linearized average difference enlargement of 61.23%. Therefore, the distance ought to widen steadily until 2030, be it the year experiencing the greatest gap in absolute terms.

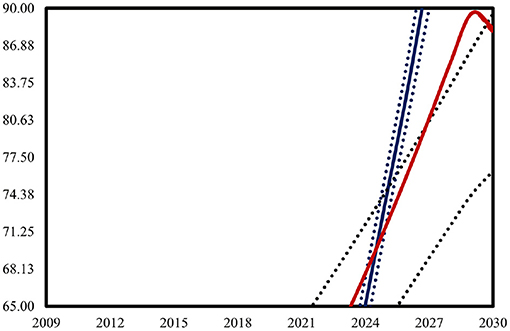

Figure 2 corresponds to a zoomed picture of the price dynamics where the intersection between calls and puts takes place, that is, where the optional market equilibrium is supposed to occur. The equilibrium market value between the option prices is encountered on two occasions, that is, at a value of 8.09 (± 0.00) in 2012 as well as at a value of 73.09 (± 1.11) Eur in 2025. It depicts the Pareto pricing or the social optimum for internalizing the GHG emissions issued from the agricultural activities. Beyond these dates, the call value of carbon emission allowances is found to be greater than the put value, such that the pollution fee exceeds the financial compensation for reducing the tons of CO2-equivalent emissions. What can also be mentioned is that the option market equilibrium price is inside the corridor with double barriers, which implies that the public recommendations on the future carbon pricing match well the extrapolated trend of the optional assessment.

Figure 2. Focus on the ETS CO2-equivalent (tCO2e) price dynamics of carbon allowances. The x-axis represents the time-line. The y-axis measures the option prices. The blue line corresponds to the levels of calls (optional purchasing prices). The blue dotted lines indicate the standard deviation of the calls. The red line corresponds to the levels of puts (optional selling prices). The black dotted lines depict the double-barrier optional values according to the public recommendations on carbon prices.

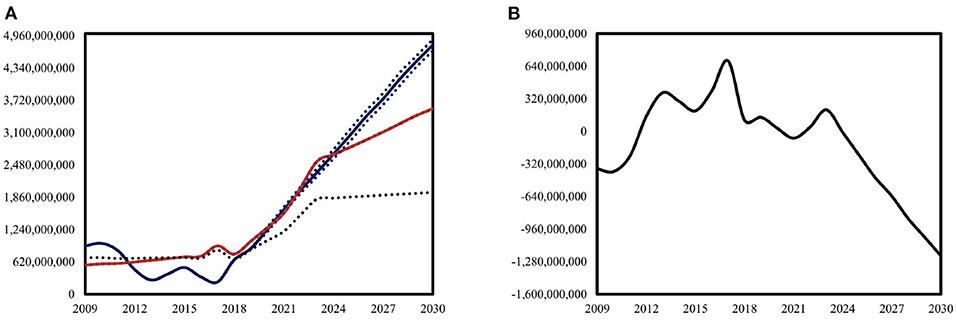

Figure 3A illustrates the cost dynamics of CO2-equivalent emission allowances, that is, the values of calls and puts multiplied by the quantities of both the emissions recorded between 2009 and 2019, as well as their projections estimated until 2030. Those give rise to optional cost and benefit values. The pattern of differences between benefits and costs Figure 3B is dissimilar to that of prices, with intersections between the optional cost and benefit values on four occasions, that is at the value of 547, 125, 729 (± 0.00) Eur in 2012, 1, 267, 056, 990 (± 18, 880, 460) Eur in 2020, 2, 020, 796, 874 (± 31, 819, 893) Eur in 2022 and that of 2, 689, 586, 677 (± 47, 469, 260) Eur in 2024. They are supposed to depict the social optimum with respect to both prices and quantities. For carbon neutrality to be reachable in 2050, the down-barrier now corresponds to the cost dynamics respectful of the recommended reductions in emissions of 50.00% in 2030. Until 2020, the optional benefit value follows tightly the down-barrier, whereas the cost value oscillates around it. While exceeding the barrier in regard to the targeted emissions, both benefit and cost values follow, until 2024, a convergent trend. Beyond that date, the cost dynamics then enters into a trend of moderate increase, when in fact the benefit dynamics continues, until 2030, its course in form of a sharp quasi-linear increase.

Figure 3. (A) Optional costs dynamics. (B) Optional costs difference. ETS CO2-equivalent (tCO2e) cost. The x-axis represents the time-line. The y-axis measures the optional cost values of carbon allowances. In (A), the blue line corresponds to the levels of cost calls (optional cost values). The blue dotted lines indicate the standard deviation of the cost calls. The red line corresponds to the levels of cost puts (optional benefit values). The black dotted line corresponds to the down-barrier optional cost values according to the public recommendations both on carbon prices and on the CO2-equivalent emissions' reductions. In (B), the black full line illustrates the difference between optional costs and benefits.

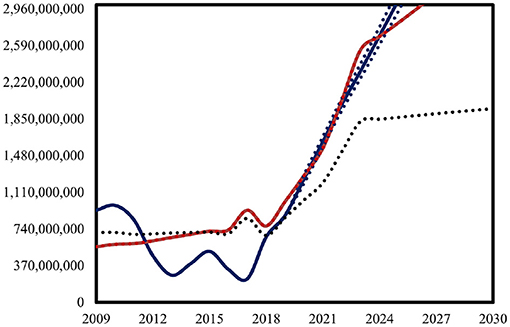

Figure 4 corresponds to the enlargement of the benefit–cost dynamics from the previous figure. In spite of the balance between optional benefit and cost values, the outlook of which occurs in 2024, the cost call value of carbon emission allowances exceeds that of the cost put value from that year. In that respect, the theoretical agricultural cost of polluting turns into a punitive-policy incentive, for rewarding the reduction of CO2-equivalent emissions is less valued by the optional market indicators. Indeed, in 2030, a 50.00% cut in emissions ought to lead to a total cost value of 1, 954, 351, 684 Eur, which is below the forecasted cost value by 43.49% and below the prognosed benefit value by 54.87%. Put differently, although selling emission allowances provides with a multiplicative benefit of 3.84, buying emission permits corresponds to a multiplicative penalty of 4.84. In turn, the public recommendations on the reductions of carbon emissions should lead to a long-term context in which buying allowances becomes much more onerous and selling them becomes (1) moderately valuable, as compared to the market assessment of optional calls, and nonetheless (2) becomes highly valuable with regard to the beginning of the time series under review.

Figure 4. Focus on the ETS CO2-equivalent (tCO2e) cost dynamics. The x-axis represents the time-line. The y-axis measures the optional cost values of carbon allowances. The blue line corresponds to the levels of cost calls (optional cost values). The blue dotted lines indicate the standard deviation of the cost calls. The red line corresponds to the levels of cost puts (optional benefit values). The black dotted line corresponds to the down-barrier optional cost values according to the public recommendations both in terms of carbon prices and reductions of the CO2-equivalent emissions.

If we now add up the discounted cost dynamics between 2009 and 2030, the total optional cost of the time-line under consideration amounts to 40, 263, 271, 131 Eur, while the total optional benefit reaches the value of 37, 152, 358, 701 Eur. If the reduction by 50.00% in CO2-equivalent emissions be attained, the total cost would be of 26, 885, 426, 256 Eur8. The analysis at an aggregated level thus leads to a similar conclusion than that previously stated. Although selling emission allowances provides a total multiplicative benefit of 1.38, buying emission permits corresponds to a total multiplicative penalty of 1.49. Nevertheless, multiplicative factors with respect to those taken into account at an average yearly basis are lower by 49.76% in buying and by 38.19% in selling. Accordingly, the short-term perspective accentuates the soundness of optional pricing and, by the same occasion, the artificial market valuing of negative externalities.

Microeconomic principles describe the objective of the economic actors as that of the maximization of their profits. Despite the costly internalization of environmental damages and frequent distortion of producers on their real costs (Weitzman, 1974), companies—whatever the sector under consideration—are no longer able to obviate the internalization of negative externalities; simply because the GHG emissions, also known as non-market public bads, have well and truly become environmentally and socially harmful. Internalization takes place under the impetus of environmental policies, which are intended to create stimulants that modify the behavior of firms vis-à-vis the damages endorsed by the community.

In the event of severe damages, the emissions trading market approach is considered to ensure that the overall quantitative emission constraint is met. In contrast, when the damage is constant, the eco-tax approach is preferable because it avoids exorbitant effort costs (Criqui and Bureau, 2009). Nevertheless, Requate and Unold (2003) and Saint-Paul (2004) conclude that there is no irrevocable hierarchy between the two instruments. Assuming that it is impossible for the regulatory authority to transmit ideal prices or quantities (Weitzman, 1974), the attempt of this paper is to approach the problem by considering the hypothetical market valuation of emission allowances (Nicholls and Murdock, 2012).

In order to assess the cost of internalizing the negative externalities issued from the agricultural activities, we have employed, by applying the Black–Scholes optional pricing model with a double-barrier, a theoretical optional carbon pricing. Provided that, since 1990, the emissions recorded in France follow a decreasing trend that might not be a long-term steady state, addressing the issue within the context of an existing market, while being tackled through an optional pricing setting, seems to be a reasonable way to approach this ongoing problem. In point of fact, the market-design is to be considered as fictive, for the agricultural sector is currently not subject to any market-based internalization system.

Furthermore, the problem is not only in choosing the right discount factor, which has been profusely discussed in the literature on climate change (Nordhaus, 2007; Stern, 2007), but also in choosing the time length under consideration. With regard to the public policy target of reaching a 20.00% cut in GHG emissions compared with those recorded in 1990 (European Commission, 2019), France achieved, in 2016, a reduction in emissions by 13.54%, with respect to 1990, and by 1.62%, in comparison to 2009, which corresponds to an expected excess of the annual CO2-equivalent emissions by 3.00% (Roussel, 2018). We have thus imposed an ambitious target of emission reductions, as compared to 1990 levels, of 50% by 2030. Otherwise, net-zero agriculture in 2050 would be simply out of reach.

Would the public authorities make use of the optional pricing as a frame of reference or as a focal point (Schelling, 1960), that is, as a decision-aid tool that creates convergent expectations on which social optimum to strive for, the eventual discrepancies—with respect to the objective in emissions reduction—could be minimized. All the more so as the absence of market trading keeps the public policy from being fully implemented. In that manner, the progressive subsidy tightening under the European Common Agricultural Policy (CAP) (de La Hamaide, 2018) could be monetarily valued in reference to the scheme proposed in this article. Indeed, the CAP has three clean environmental goals one of which is tacking climate change. In the 2014–2020 period, 25% of the CAP funding went toward actions relevant for the climate (European Commission, 2021c). Nevertheless, the carbon pricing enables to give additional incentives to reduce the GHG emissions, because the economic agents are strongly encouraged to make necessary efforts should the pollution control be insufficient. In case the agricultural sector does not provide enough efforts to combat climate change, the European authorities could reduce subsidies proportionally to how far the sector is to achieving its environmental objectives. We are typically in a framework of conditional payments.

The European Green Deal aims to make Europe the world's first climate-neutral continent by 2050 and the EU can use the CAP as a tool to influence policy-making in the area of climate change (McEldowney, 2020). Despite the fact that environmental concerns are present in the agenda of the CAP, agricultural GHG emissions sill account for 10% of the EU total emissions (EUROSTAT, 2018). Therefore, there is an urgency to fundamentally restructure the European agricultural policy because a strict alignment of the conditional payments with the goals of the Paris Agreement is not established (Heyl et al., 2021). Although the CAP shapes the EU's agricultural sector (Hodge et al., 2015), such as fighting against climate change (Alliance Environment, 2019), the CAP programs have been found to be insufficient (Alliance Environment, 2019; Pe'er et al., 2019). This indicates the need of a much more fundamental change of the CAP to deliver on environmental challenges (Pe'er et al., 2020). By connecting the EU-ETS with the French agriculture through a derivatives market, we are able to tackle the pressing issue of carbon neutrality through a real price signal, which will encourage emissions abatement and low-carbon investments (Delbosc and de Perthuis, 2009).

In summary, let us point out that our methodology, based on the theoretical optional market evaluation, is meant to measure the upcoming costs and benefits of complying both with the environmental standards and with the regulatory stringency. It could—just as much—be applied to the industrial sectors already subject to the carbon pricing. Let us recall that the EU-ETS has been severely criticized for years in view of the fact that, due to an abundance of carbon credits and exemptions for major emitters, carbon prices were too low to reduce emissions (Storrow, 2018). Introducing an artificial market pricing, such as a derivatives market with preset barriers, could solve this problem by imposing levels of internalization that reflect on the true severity of damages. This is especially so since the issue of GHG emissions is now considered to be among the main priorities of the public and private decision-makers.

The original contributions presented in the study are included in the article/supplementary materials, further inquiries can be directed to the corresponding author/s.

AD has accomplished everything.

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

The author would like to thank the fellows from the French National Research Institute for Agriculture, Food and Environment (INRAE). AD is also grateful to the editors and to the three referees for their thorough comments and suggestions, which significantly contributed to improving the quality of the paper.

1. ^In 2021, the European Commission adopted a package of proposals to reduce greenhouse gas (GHG) emissions of all economic sectors by 55% by 2030, compared to 1990 levels. Accordingly, the regulation on land use, forestry, and agriculture sets an overall EU target for carbon removals by natural sinks, equivalent to 310 million tonnes of CO2 emissions by 2030 (Euronews, 2021).

2. ^The public authorities currently in place want to legislate the goal of carbon neutrality in 2050 (Wakim, 2019).

3. ^The Effort Sharing legislation establishes annual GHGs targets for Member States for the periods 2013–2020 and 2021–2030 (European Commission, 2019).

4. ^The formula for put options—the right but not the obligation to sell the underlying assets—corresponds to the call value, added with the present value of the exercise price, subtracted from the emission allowance value.

5. ^Provided the existence of the public recommendations on carbon pricing until 2030 (MEEM, 2016), we can consider a rather high risk-free rate, for potential buyers and sellers of emission allowances are aware of the upcoming cost of pollution. In addition, the rate fits with that recommended by Lebègue (2005) for public long-term investment projects.

6. ^A multitude of strategies—such as knock-in and knock-out contracts—exist both in literature on barrier options (Hull, 2011) and in real-world finance. We shall not focus on those, for we borrow the instrument to obtain a point of reference, or a focal point (Schelling, 1960), regarding some public policy target.

7. ^The launch of the EU-ETS was accompanied by a value per allowance of around 20.00 Eur (Chevallier et al., 2011).

8. ^Be it a value of twenty-six billion eight hundred eighty-five million four hundred twenty-six thousand two hundred fifty-six euros.

Alliance Environment (2019). Evaluation Study of the Impact of the CAP on Climate Change and Greenhouse Gas Emissions. Report. Brussels.

Andersen, L., Andreasen, J., and Eliezer, D. (2002). Static replication of barrier options: some general results. J. Comput. Fin. 5, 1–25. doi: 10.2139/ssrn.220010

Arrata, W., Bernales, A., and Coudert, V. (2013). The Effects of Derivatives on Underlying Financial Markets: Equity Options, Commodity Derivatives and Credit Default Swaps, 50 Years of Money and Finance: Lessons and Challenges. SUERF—The European Money and Finance Forum.

Aubert, P.-M., Schwoob, M.-H., and Poux, X. (2019). Agroecology and Carbon Neutrality in Europe by 2050: What are the Issues? IDDRI Study no2.

Bayer, P., and Aklin, M. (2020). The European Union Emissions Trading System reduced CO2 emissions despite low prices. Proc. Natl. Acad. Sci. U.S.A. 117, 8804–8812. doi: 10.1073/pnas.1918128117

Black, F., and Scholes, M. (1973). The pricing of options and corporate liabilities. J. Polit. Econ. 81, 637–654. doi: 10.1086/260062

Brandt, U., and Svendsen, G. (2010). Should Farmers Participate in the EU ETS? Permit Price, Measurement and Technology. Mimeo.

Bureau, D. (2005). Économie des instruments de protection de l'environnement. Revue Française d'Économie 19, 83–110. doi: 10.3406/rfeco.2005.1561

Bureau, D., and Hourcade, J-C. (1998). Les Dividendes Économiques d'une Réforme Fiscale Écologique, Rapport du CAE, n°8. La Documentation Française, Paris.

Bureau, D., and et Mougeot, M. (2004). Politiques Environnementales, Fiscalité et Compétitivité des Entreprises, Rapport du CAE, n°54, Paris: La Documentation Française.

Burney, J., Davis, S., and Lobell, D. (2010). Greenhouse gas mitigation by agricultural intensification. Proc. Natl. Acad. Sci. U.S.A. 107, 12052–12057. doi: 10.1073/pnas.0914216107

Chevallier, J., Le Pen, Y., and Sévi, B. (2011). Options introduction and volatility in the EU ETS. Resour. Energy Econ. 33, 855–880. doi: 10.1016/j.reseneeco.2011.07.002

Christoffersen, P., Jacobs, K., and Young Chang, B. (2013). Forecasting with option-implied information. Handb. Econ. Forecast. 2, 581–656. doi: 10.1016/B978-0-444-53683-9.00010-4

Conway, G., and Barbier, E. (2013). After the Green Revolution: Sustainable Agriculture for Development. London: Routledge.

Criqui, P., and Bureau, D. (2009). Écotaxes et Quotas d'Émissions Échangeables CO2, Références Economiques CEDD, No.6.

Daskalakis, G., Psychoyios, D., and Markellos, R. (2009). Modeling CO2 emission allowance prices and derivatives: evidence from the European trading scheme. J. Bank. Fin. 33, 1230–1241. doi: 10.1016/j.jbankfin.2009.01.001

de La Hamaide, S. (2018). EU Proposes to Cut Farm Subsidies, France Says Unacceptable. Reuters Business News.

Delbosc, A., and de Perthuis, C. (2009). Carbon Markets: The Simple Facts. Report, United Nations Global Impact.

Dong, Y. (2021). Transaction costs in option pricing: an extension model. Adv. Soc. Sci. Educ. Human. Res. 543, 276–283. doi: 10.2991/assehr.k.210407.056

Dragicevic, A. (2018). Stochastic shadow pricing of renewable natural resources. Environ. Model. Assess. 24, 49–60. doi: 10.1007/s10666-018-9599-1

Dragicevic, A., and Sinclair-Desgagné, B. (2010). Éco-Fiscalité et Réduction d'Émissions de Gaz à Effet de Serre, in Le Québec Économique 2010 : Vers un Plan de Croissance pour le Québec. Presses de l'Université Laval, Québec.

European Commission (2020). Committing to Climate-Neutrality by 2050: Commission Proposes European Climate Law and Consults on the European Climate Pact. Available online at: https://ec.europa.eu/commission/presscorner/detail/en/ip_20_335

European Commission (2021a). EU Emissions Trading System. Available online at: https://ec.europa.eu/clima/policies/ets_en

European Commission (2021b). Proposal for a Directive of the European Parliament and of the Council amending Directive 2003/87/EC Establishing a System for Greenhouse Gas Emission Allowance Trading within the Union. Available online at: https://ec.europa.eu/info/sites/default/files/revision-eu-ets_with-annex_en_0.pdf

European Commission (2021c). 2030 Climate Target Plan. Available online at: https://ec.europa.eu/clima/policies/eu-climate-action/2030_ctp_en

European Commission, (2019). Effort sharing: Member States' emission targets, Available online at: https://effortsharing.ricardo-aea.com/

EUROSTAT (2018). Agri-Environmental Indicator—Greenhouse Gas Emissions. Available online at: https://ec.europa.eu/eurostat

FAOSTAT (2019). Agriculture Total. Available online at: http://www.fao.org/faostat/fr/#data/GT

Grosjean, G., Fuss, S., Koch, N., Bodirsky, B., De Cara, S., and Axworth, W. (2018). Options to overcome the barriers to pricing European agricultural emissions. Clim. Policy 18, 151–169. doi: 10.1080/14693062.2016.1258630

Heyl, K., Döring, T., Garske, B., Stubenrauch, J., and Ekardt, F. (2021). The common agricultural policy beyond 2020: a critical review in light of global environmental goals. Rev. Eur. Comp. Int. Environ. Law 30, 95–106. doi: 10.1111/reel.12351

Hodge, I., Hauck, J., and Bonn, A. (2015). The alignment of agricultural and nature conservation policies in the European Union. Conserv. Biol. 29, 996–1005. doi: 10.1111/cobi.12531

Hull, J. (2011). Options, Futures and Other Derivatives, 8th Edn. Upper Saddle River, NJ: Prentice-Hall.

Ibikunle, G., and Gregoriou, A. (2018). Carbon Markets: Microstructure, Pricing and Policy. Berlin: Springer.

Isermeyer, F., Heidecke, C., and Osterburg, B. (2021). Integrating Agriculture into Carbon Pricing, Thünen Working Paper 310017, Johann Heinrich von Thünen-Institut (vTI). Federal Research Institute for Rural Areas, Forestry and Fisheries.

Lóránt, A., and Allen, B. (2019). Net-Zero Agriculture in 2050: How to Get There. Report by the Institute for European Environmental Policy.

McEldowney, J. (2020). EU Agricultural Policy and Climate Change, Briefing from the European Parliamentary Research Service, European Parliament.

MEEM (2016). Le Prix du Carbone, Levier de la Transition Énergétique. Ministère de l'Environnement, de l'Énergie et de la Mer.

Nicholls, A., and Murdock, A. (2012). Social Innovation: Blurring Boundaries to Reconfigure Markets. Basingstoke: Palgrave Macmillan.

Nordhaus, W. (2007). A review of the Stern Review on the Economics of Climate Change. J. Econ. Lit. 45, 686–702. doi: 10.1257/jel.45.3.686

Official Journal of the European Union (OJ) (2009). Decision No 406/2009/EC of the European Parliament and of the Council of 23 April 2009 on the Effort of Member States to Reduce Their Greenhouse Gas Emissions to Meet the Community's Greenhouse Gas Emission Reduction Commitments up to 2020.

Oyevaar, M., Vazquez-Brust, D., and van Bommel, H. (2016). Globalization and Sustainable Development: A Business Perspective. London: Macmillan International Higher Education.

Pe'er, G., Bonn, A., Bruelheide, H., Dieker, P., Eisenhauer, N., Feindt, P., et al. (2020). Actions needed for the EU common agricultural policy to address sustainability challenges. People Nat. 2, 305–316. doi: 10.1002/pan3.10080

Pe'er, G., Zinngrebe, Y., Moreira, F., Sirami, C., Schindler, S., Müller, R., and Lakner, S. (2019). A greener path for the EU Common Agricultural Policy. Science 365, 449–451. doi: 10.1126/science.aax3146

REE (2021). Les Émissions de Gaz à Effet de Serre de l'Agriculture, L'Environnement en France. Rapport sur l'État de l'Environnement.

Requate, T., and Unold, W. (2003). Environmental policy incentives to adopt advanced abatement technology: will the true ranking please stand up? Eur. Econ. Rev. 47, 125–146. doi: 10.1016/S0014-2921(02)00188-5

Roussel, F. (2018). Pourquoi les Agriculteurs N'Arrivent Pas à Réduire Leurs Émissions de GES. Available online at: ActuEnvironnement.com

Saint-Paul, G. (2004). Fiscalité Environnementale et Compétitivité, Rapport du CAE, No.54, Complément au rapport, Paris: La Documentation Française.

Sandbag (2019). Tracking the European Union Emissions Trading System Carbon Market Price. Available online at: https://sandbag.be/index.php/carbon-price-viewer/

Stern, N. (2007). The Economics of Climate Change: The Stern Review. Cambridge: Cambridge University Press.

Storrow, B. (2018). Carbon Prices Are Too Low to Reduce Emissions. Scientific American. Available online at: https://www.scientificamerican.com/article/carbon-prices-are-too-low-to-reduce-emissions/

Talukder, B., Blay-Palmer, A., vanLoon, G., and Hipel, K. (2020). Towards complexity of agricultural sustainability assessment: main issues and concerns. Environ. Sustain. Indicat. 6:100038. doi: 10.1016/j.indic.2020.100038

Uhrig-Homburg, M., and Wagner, M. (2008). Derivative instruments in the EU emissions trading scheme – an early market perspective. Energy Environ. 19, 635–655. doi: 10.1260/095830508784815892

Verschuuren, J. (2018). Towards an EU regulatory framework for climate-smart agriculture: the example of soil carbon sequestration. Transnat. Environ. Law 7, 301–322. doi: 10.1017/S2047102517000395

Verschuuren, J. (2021). Towards EU Carbon Framing Legislation: What is the Role of the ETS? Available online at: https://www.lawandglobalisation.nl/towards-eu-carbon-farming-legislation-what-is-the-role-of-the-ets/

Wakim, N. (2019). Climat : Le Gouvernement Veut Inscrire dans la Loi L'Objectif de Neutralité Carbone en 2050. Le Monde, Édition du 7 Février.

Keywords: bioeconomics, ETS, options, Black-Scholes model, CO2-equivalent emissions, climate change, agriculture, European Common Agricultural Policy

Citation: Dragicevic AZ (2021) Internalizing CO2-Equivalent Emissions Issued From Agricultural Activities. Front. Clim. 3:714334. doi: 10.3389/fclim.2021.714334

Received: 25 May 2021; Accepted: 25 October 2021;

Published: 30 November 2021.

Edited by:

Ugur Soytas, Technical University of Denmark, DenmarkReviewed by:

Nadia Ahmad, Barry University, United StatesCopyright © 2021 Dragicevic. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Arnaud Zlatko Dragicevic, YXJuYXVkLmRyYWdpY2V2aWNAZ21haWwuY29t

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.