- 1Engineering Institute of Technology, West Perth, Australia

- 2Programa de Engenharia Ambiental, Universidade Federal do Rio de Janeiro, Rio de Janeiro, Brazil

Introduction: This study examines the complex link between regular maintenance procedures and the effectiveness of business-related assets in Australia. Commercial buildings are essential to the country’s economy, and the variables affecting their worth must be carefully analysed.

Methods: This study evaluates the relationship between asset value and maintenance frequency, examines how maintenance practices affect building performance, and considers industry perspectives on improperly versus correctly maintained assets.

Results: The study’s findings highlight the significance of renovations, along with adaptive reuse, in raising asset value; however, despite various maintenance techniques available, the Australian commercial building industry has challenges. Budgetary constraints, for instance, pose a significant hurdle, with many companies struggling to allocate sufficient funds for comprehensive maintenance plans. The findings of this research highlight the positive shift towards technology-driven maintenance procedures in business establishments in Australia. The adoption of computerised Maintenance Management Systems (CMMS) and Building Management Systems (BMS) is rising, automating repetitive tasks, improving maintenance procedures, and enabling data-driven decisions.

Discussion: This study thoroughly explains the complex processes influencing the value and usefulness of commercial architecture resources in the Australian setting by addressing the differing perspectives within the real estate industry. Future research on this topic should focus on recognising the psychological components of decision-making concerning maintenance practices. Investigating how psychological prejudices, perceptions of danger, and organisational culture affect the choices made by property owners, facility administration, and others can help us better understand why some maintenance methods are preferred over others.

1 Introduction

An essential component of facility administration is the maintenance of commercial building assets, directly affecting real estate’s usefulness, longevity, and cost. Understanding the effects of routine maintenance on the value of assets is crucial in Australia, which has strict building standards and guidelines. The building industry in Australia has organically evolved with a focus on more resilient and sustainable building designs (Amarnath, 2023). Due to this expansion, maintaining commercial assets by changing regulations, standards, and environmental factors is now more important than ever. Australia’s building industry is distinguished by various architectural designs and materials, highlighting the necessity for customised maintenance plans. Advocates contend that routine maintenance significantly impacts overall performance and asset value (Fitch Solutions Group Limited 2023b). In addition to guaranteeing adherence to construction codes, proper maintenance improves energy efficiency, safety, and overall user happiness. Furthermore, in the housing market, well-maintained buildings are frequently considered more appealing, which can result in higher property values (Fitch Solutions Group Limited 2023a). Conversely, detractors argue that empirical data do not well support the idea that routine maintenance indisputably increases asset value (Bokrantz et al., 2020). They contended that factors such as location, financial conditions, and market dynamics are more important in determining the value of real estate. Some even contend that placing too much importance on maintenance could diminish returns, mainly if the building requires more work than necessary (Mergent 2023f). It is imperative to bridge this gap in perspectives to make well-informed decisions as Australia’s commercial building market changes. To determine the effect of routine maintenance on the functionality and worth of business assets throughout Australia, this study examines case studies, empirical findings, and existing businesses building on the literature (Cecconi and Luca, 2023). This study aims to thoroughly understand the association between upkeep procedures and assets in the rapidly changing Australian real estate sector by examining both sides of the debate.

The main goal of this study is to determine how routine maintenance affects the effectiveness and worth of assets in commercial buildings in Australia with the following objectives: (1) to assess the connection between asset value and maintenance frequency; (2) to investigate how maintenance procedures affect building performance measures; (3) to investigate market views of neglected instead of maintained properly assets; and (4) to evaluate the financial return on upkeep expenses.

Commercial buildings are valuable assets in the real estate industry. Several factors affect their continued performance and value, but regular upkeep cannot be overlooked regular upkeep (Fitri et al., 2023). The industry’s divergent views on the concrete effects of maintenance procedures on the values of these assets serve as the foundation for this study. This study aims to contribute to a more thorough understanding of the complex relationship between routine maintenance and the value and functionality of business architectural assets in the Australian context by examining both sides of the debate (Adhesives and Sealants Industry, 2023). Furthermore, this study aims to determine whether sustainable maintenance techniques affect how much people think commercial assets are worth (Pomè et al., 2023).

First, the economic significance of commercial assets in Australia’s real estate sector emphasises the necessity for thorough research on the variables that affect their value. Commercial buildings play a significant role in the economy as centres for business activities. Property shareholders, investors, and legislators who want to make well-informed choices on distributing resources, investments, and regulatory frameworks must comprehend how maintenance practices—or the lack thereof—affect their value. Second, the Australian building industry is defined by a wide variety of architectural styles, construction materials, and environmental factors define the Australian building industry (Khi, 2023).

In each of these distinct scenarios, the effect of preservation on asset value is probably different. Concentrating on the Australian market enables a more in-depth investigation of the special difficulties and possibilities of managing real estate in this context. The maintenance value of this connection is further complicated by Australia’s building industry’s continued focus on sustainability and energy efficiency (Tanfield et al., 2023). Maintaining commercial buildings in compliance with changing environmental standards requires an awareness of how environmentally friendly methods add to the asset value, which is why they are frequently incorporated into maintenance schedules.

Additionally, it is critical to identify factors that can support the long-term stability that characterises business property values as the world’s real estate market experiences uncertainties along with fluctuations. Suppose regular maintenance is shown to be a significant driver of asset value. In that case, it may act as a stabilising force during periods of economic instability and provide stakeholders with a tactical instrument for the long-term management of assets.

The perception of the effect of routine maintenance on the asset value is a significant challenge facing Australia’s commercial building industry. Some stakeholders contend that regular maintenance raises the value of properties, whereas others contend that insufficient empirical data substantiates this assertion. This divergent viewpoint breeds uncertainty for those looking for efficient handling of asset strategies, buyers, policymakers, and property owners (Mergent 2023e). The lack of a definitive understanding makes it difficult to make well-informed decisions about the distribution of resources and the establishment of regulations. Consequently, it is imperative to clarify the connection between routine maintenance procedures and the market value of commercial buildings in the context of Australian tangible estate.

2 Literature review

2.1 Maintenance frequency and asset valuation: a critical review

The literature on property ownership and facility administration has extensively debated the connections between the regularity of maintenance and the valuation of resources in commercial buildings. According to proponents, ongoing upkeep actions significantly contribute to increased asset value; however, detractors believe there is insufficient hard data to substantiate this assertion (Mergent 2023b). A commonly held belief is that regular maintenance, such as planned examinations, fixes, and precautions, guarantees that a structure will continue to function at its best throughout time. This can, therefore, have a favourable impact on the market value of high-rise residential assets. Regularly maintained buildings are frequently considered as well-maintained assets (Mergent 2023h). It can draw on prospective tenants, and buyers prepared to spend more to guarantee well-maintained, solidly constructed property. However, another counterargument suggests no clear relationship exists between asset value and upkeep frequency (Au-Yong, et al., 2023). Appreciating that the upkeep of a building is unquestionably necessary for the asset to last a long time, a variety of factors may directly affect how much a building’s worth is affected by it (Mergent 2023a). These variables may include the state of the economy, local market patterns, and the needs of tenants or purchasers in a particular area.

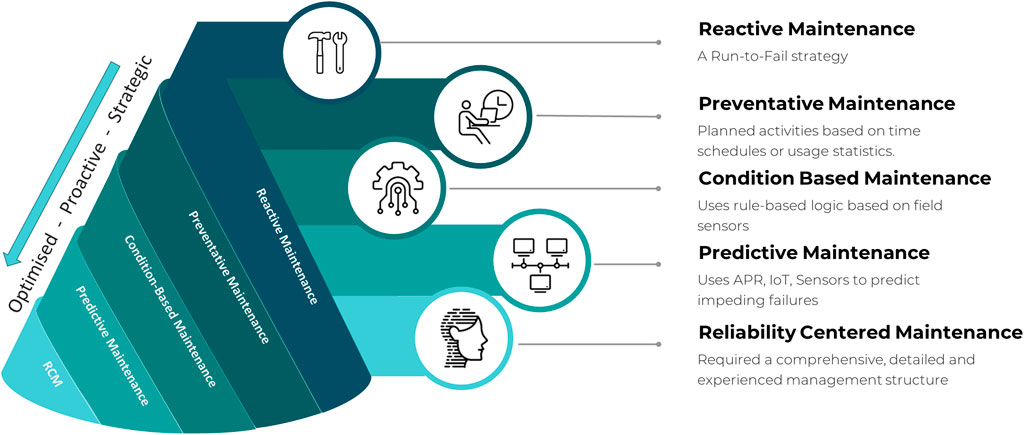

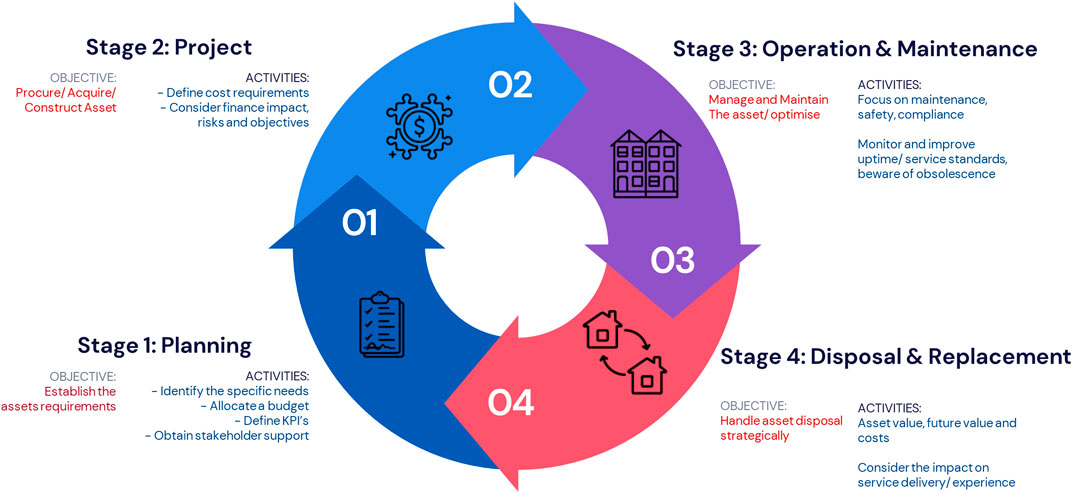

Figure 1 presents a visual story of the interaction between the different interface points that regular maintenance and the subsequent influence on the asset throughout its lifecycle. This image highlights the possible impact of routine maintenance procedures on the perceived value of architectural assets by emphasising the multiple phases where maintenance plays an intricate part in the asset’s life and longevity. Through graphical depiction, this illustration aims to illustrate the complex balance necessary to maximise asset value through planned and timely repair interventions. Overall, it provides visual assistance for understanding the intricate dynamics that highlight the relationship between maintenance procedures and commercial real estate financial assessment. The fundamental thrust of the proposal is that servicing may not be the only element influencing asset valuation; rather, investor opinions are shaped by various factors. A landmark study on the asset appraisal of a sample of business properties with different servicing histories was conducted by Smith and Bollinger (2001). According to previous research, regular maintenance positively correlates with improved property values. Structures with regular and established maintenance schedules receive higher ratings than those with inconsistent or erratic ones (Mergent 2023c). Critics argue that these studies may oversimplify the intricate dynamics of residential property markets, in which critical external considerations include location, consumer demand, and economic data.

In addition, it is essential to consider the time component of service frequency. Certain scholars contend that the timing of maintenance tasks, such as planned improvements and restorations, can significantly affect assets worth more than the regularity of the service itself (Mergent 2023d). For example, a well-timed renovation aligned with ecological goals or market trends can significantly increase a building’s perceived value and, by extension, its valuation. A complex picture emerges from a comprehensive asset valuation and maintenance periodicity research analysis. Although specific studies indicate a favourable association between consistent upkeep and increased property value, other studies highlight the complex nature of housing markets and propose that external variables and well-planned scheduling of maintenance tasks could have an equal or more significant impact (Mergent, 2023i). For those involved in the business structure industry, a thorough understanding is essential as it helps them create maintenance plans that are both efficient and sensitive to the ever-changing Australian residential property market.

2.2 Performance metrics in commercial buildings: insights from maintenance practices

Understanding how maintenance procedures affect the performance indicators in commercial structures is essential to guaranteeing long-term and effective operation. Maintenance procedures directly impact the efficient and optimised operation of HVAC systems, illumination, and other vital components, improving opportunities to guarantee peak performance and lowering energy use and operating expenses (Mergent 2023g). Their research findings demonstrated that improved energy consumption and well-maintained construction equipment correlate positively. This realisation is especially pertinent, given Australia’s increasing emphasis on energy efficiency and green construction methods.

A crucial indicator influenced by maintenance procedures is the content of building inhabitants. Adequately maintained facilities provide a cozy and secure work atmosphere that enhances employees’ and tenants’ happiness and efficiency. Tenant occupancy and happiness were related to regular upkeep (Plunkett Research, 2023). This highlights that upkeep involves more than just maintaining the building’s structural strength; it also entails providing its occupants with satisfactory experiences.

In addition to age-related challenges, (Nguyen et al., 2013), mentioned that the maintenance of commercial buildings in Australia is also influenced by shifting usage patterns and evolving tenant preferences. With the rise of flexible workspaces and collaborative environments, property owners must adapt their maintenance strategies to accommodate changing needs. This includes investing in amenities such as coworking spaces, communal areas, increased sustainability, and advanced technology infrastructure to enhance tenant satisfaction and attract prospective occupants. However, aligning maintenance practices with evolving market demands poses logistical and financial challenges for property owners, requiring careful planning and resource allocation to maintain competitiveness in the market (Nguyen et al., 2013).

The safety and adherence of industrial structures to applicable codes and regulations significantly depend on the quality of their maintenance methods. Routine maintenance, repairs, and inspections also create inspections (Rodrigues et al., 2023). Adherence to safety regulations and construction rules is mandated by law as a vital component of a structure’s performance. The importance of service in commercial properties’ general performance and lifespan is highlighted by its emphasis on minimising safety concerns and upholding compliance.

The functionality of business structures is closely linked to their longevity and endurance, and these attributes are greatly influenced by maintenance procedures (Ruseruka et al., 2023). Prevention efforts and a well-executed maintenance strategy guarantee the long-term integrity of building structures and structural components. Thus, the building’s lifetime is increased, and fewer significant repairs or replacements are required (Fitch Solutions Group Limited, 2023c). Below are the hierarchical levels of different maintenance strategies, with the lowest level requiring minimum management involvment, while the top of the pyramid requires specialised skills and significantly more manpower but also offers significantly greater reliability and assurances.

2.3 Market perceptions of maintenance: implications for property values

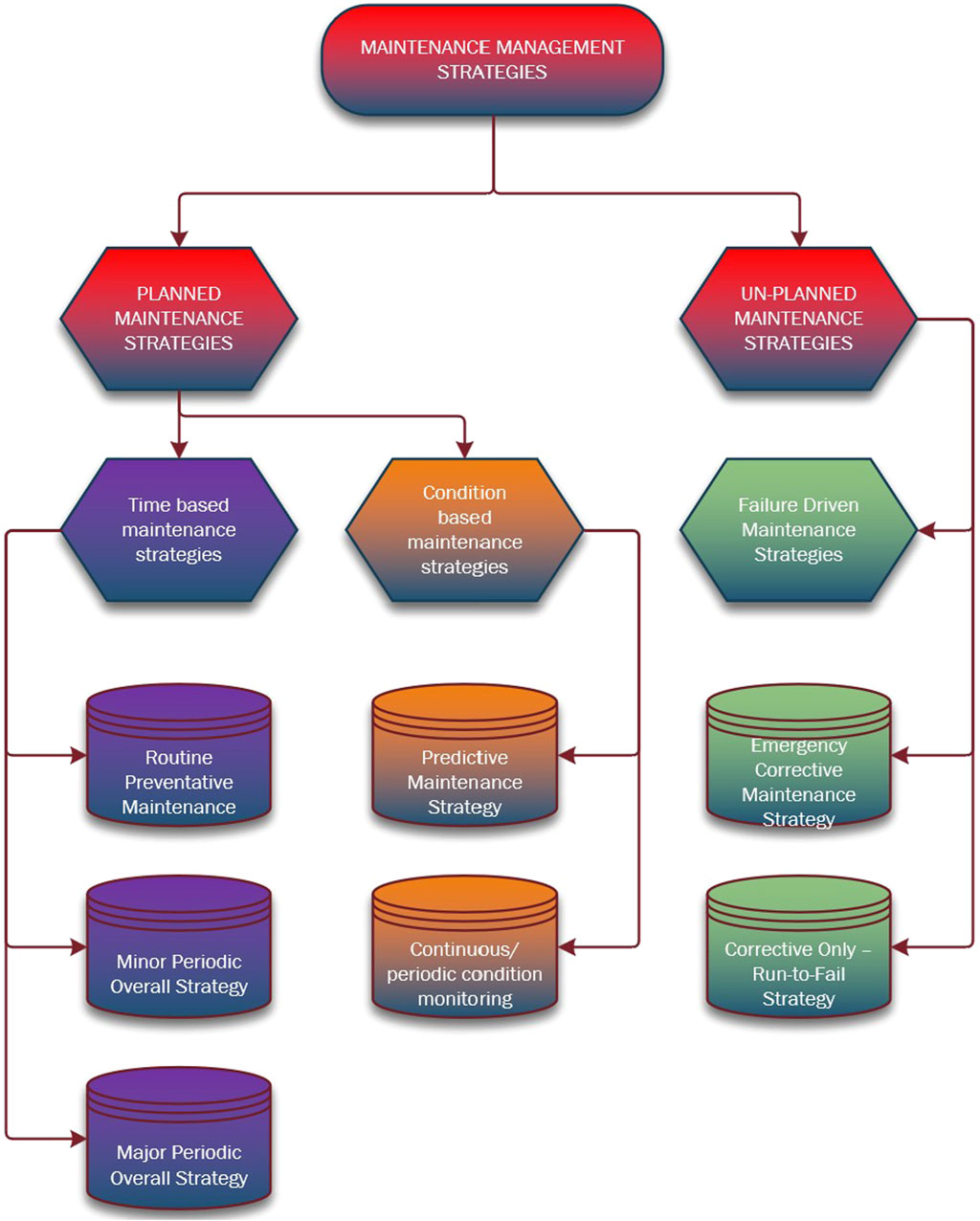

Figure 2 provides a graphical representation of the different maintenance strategies adopted in Australian commercial buildings, with the more strategic and complex strategy, RCM, positioned at the top, while the less involved, less technical strategy of reactive or run to fail is positioned at the bottom due to its limited technical involvement. The market views upkeep as essential, as it significantly impacts the value of business appraisals. This section reviews the literature to determine how the market considers well-maintained business properties versus those neglected and how this affects property prices.

All stakeholders value well-maintained commercial buildings (Fafouti et al., 2023). A building’s overall state of affairs, sanitation, and aesthetic appeal are crucial when making decisions. Neglected properties can be viewed as more dangerous assets or require significant additional renovation funding, reducing market appeal.

Building maintenance perceptions significantly affect property values. According to a Property Evaluation Institute study, properly serviced buildings typically fetch higher prices. Evaluating how maintenance affects property values is difficult because many factors affect the high-rise residential asset market (Yang, 2023). This equation includes location-specific considerations, buyer preferences, and financial conditions all play a part. Some contend that measuring how services affect property prices is complex and subjective, especially without uniform measures for assessing the calibre of upkeep.

Figure 3 graphically represents the different maintenance strategies implemented in commercial asset buildings depending on resources, technical skill, and geographical regions. This study examined several perspectives on how regular maintenance affects asset value and the general market view. This study explores the ramifications of market dynamics by navigating through different perspectives on assets that have been neglected versus those that have been well maintained. This study adds to the nuanced knowledge of how industry players view the value and relevance of maintenance in creating a real estate environment by analysing the complex interactions between maintenance methods and market attitudes.

2.3.1 What this means for real estate investors

Understanding how the market views upkeep is essential for real estate investors to make intelligent choices. Ignoring maintenance can result in lower property prices, more prolonged vacancies, and trouble finding good tenants (Ferrara et al., 2023). Diligent and deliberate upkeep can increase a property’s competitive edge and yield more significant returns on expenditure. In conclusion, market views on maintenance significantly affect the real estate industry’s property prices. Well-maintained buildings align with the tastes of tenants and buyers, raising their market prices. However, determining the specific effect of preservation on property values requires an in-depth understanding of market forces, buyer preferences, and local development (Gaspari et al., 2023). To optimise property value in the ever-changing Australian real estate scene, this research synthesis highlights the importance of strategic maintenance methods for investors and property owners (Hodavand et al., 2023). This highlights the necessity of aligning market needs.

2.4 Economic returns on maintenance investments: a comprehensive review

Those involved in the real estate industry must understand the financial benefits of maintaining commercial properties. To give readers a thorough grasp of how repairs and maintenance affect earnings, this section evaluates the body of the available literature, considering factors such as property recognition, maintenance expenses, and ultimate financial sustainability.

Property appreciation is a significant source of financial reward for those who own property, while upkeep expenditures are frequently connected to rising asset prices (Electricity Committee, 2023). According to research conducted by the Residential Economics Research Group, facilities that undergo strategic and periodic repairs tend to appreciate faster than those that undergo less frequent or neglected maintenance. A property in good condition’s perceived worth and condition increases its monetary value, which benefits property owners monetarily (Phibbs, et al., 2021).

Although maintenance expenditures help properties appreciate value, it is essential to weigh the accompanying costs (Hook et al., 2023). Assessing the financial benefits of maintenance operations requires a thorough cost-benefit analysis. Research by the Housing Economics Institute emphasises the importance of weighing repair costs above expected advantages, including higher property values, longer asset lifespans, and possible reductions in energy usage (Cheng ChinTiong et al., 2023). The goal of efficient maintenance plans is to maximise the beneficial effects on the worth of the property while decreasing expenses to maximise returns.

By analysing the relationship between maintenance costs and subsequent returns, this study explored the financial feasibility of these investments. This study seeks to clarify the complex financial dynamics supporting routine maintenance by closely examining how maintenance affects the value of assets and operational effectiveness. The knowledge acquired from this investigation is crucial for interested parties seeking to maximise financial gains within managing commercial buildings. This report provides a thorough understanding of the financial ramifications of maintenance investments and adds insightful viewpoints to larger conversations on financial tactics in the real estate sector.

2.4.1 Management of long-term assets and financial viability

Maintenance investments are financially viable, even if they do not immediately yield profits. An effective maintenance program helps business structures manage their assets over the long run. According to studies published in the Asset Management Journal, preventative upkeep raises the value of real estate. It lowers the chance that costly replacements or fixes will be necessary, protecting the asset’s overall financial stability (Cheng Hanlei et al., 2023). Financial sustainability is key for investors and individuals seeking consistent asset returns. Another aspect of the economic rewards associated with maintenance spending is preserving an advantage in the marketplace. Renters are more likely to choose correctly maintained buildings, which lowers vacancy times and increases rental income. Tenancy satisfaction, general market competitiveness, and efficient maintenance practices were all correlated, according to the results of the Properties Investment Trends Foundation (Milošević et al., 2023). The capacity to attract and maintain tenants strongly affects financial gains from commercial real estate.

Including sustainability in its maintenance makes the study of economic returns more intricate. Potential savings in expenses and increased property values are facilitated using green building techniques and environmentally friendly maintenance (Tavakoli et al., 2023). According to studies conducted by the Sustainable Architectural Research Consortium, sustainable maintenance techniques help companies meet their environmental objectives and improve their financial performance by lowering operating costs and raising their appeal in the market.

Even if maintenance payments have the potential to yield financial gains, there are obstacles to fully reaping these benefits. Budgetary restrictions, difficulty forecasting future market dynamics, and the requirement for effective exchanges between facility managers and property owners are some of these difficulties (Hossain et al., 2023). Optimising the financial benefits of maintenance efforts requires addressing these issues.

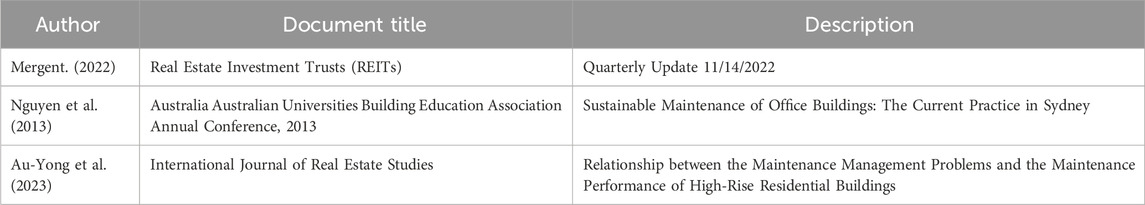

2.5 Literature gap

Existing literature on maintenance in industrial structures, specifically in the Australian context, demonstrates a significant deficiency in comprehending the complex correlation between maintenance methods, asset value, and efficiency. A comprehensive framework that considers a broader range of financial, ecological, and market considerations is lacking despite several studies examining the beneficial association between periodic upkeep and the value of properties. Furthermore, most studies tend to ignore the comprehensive influence of management on the economic benefits and overall success of commercial properties in favour of concentrating on specific factors, such as energy efficiency or genuine appreciation. Moreover, little research has been conducted on how the market views service and its effects on property value as a thorough review of published literature was performed, including those documents noted in Table 1. Property managers and owners must know how prospective tenants, customers, and investors view well-maintained versus neglected facilities to make informed strategic decisions. This market-centric viewpoint and the financial benefits of maintenance expenditures are not well combined.

3 Methodology

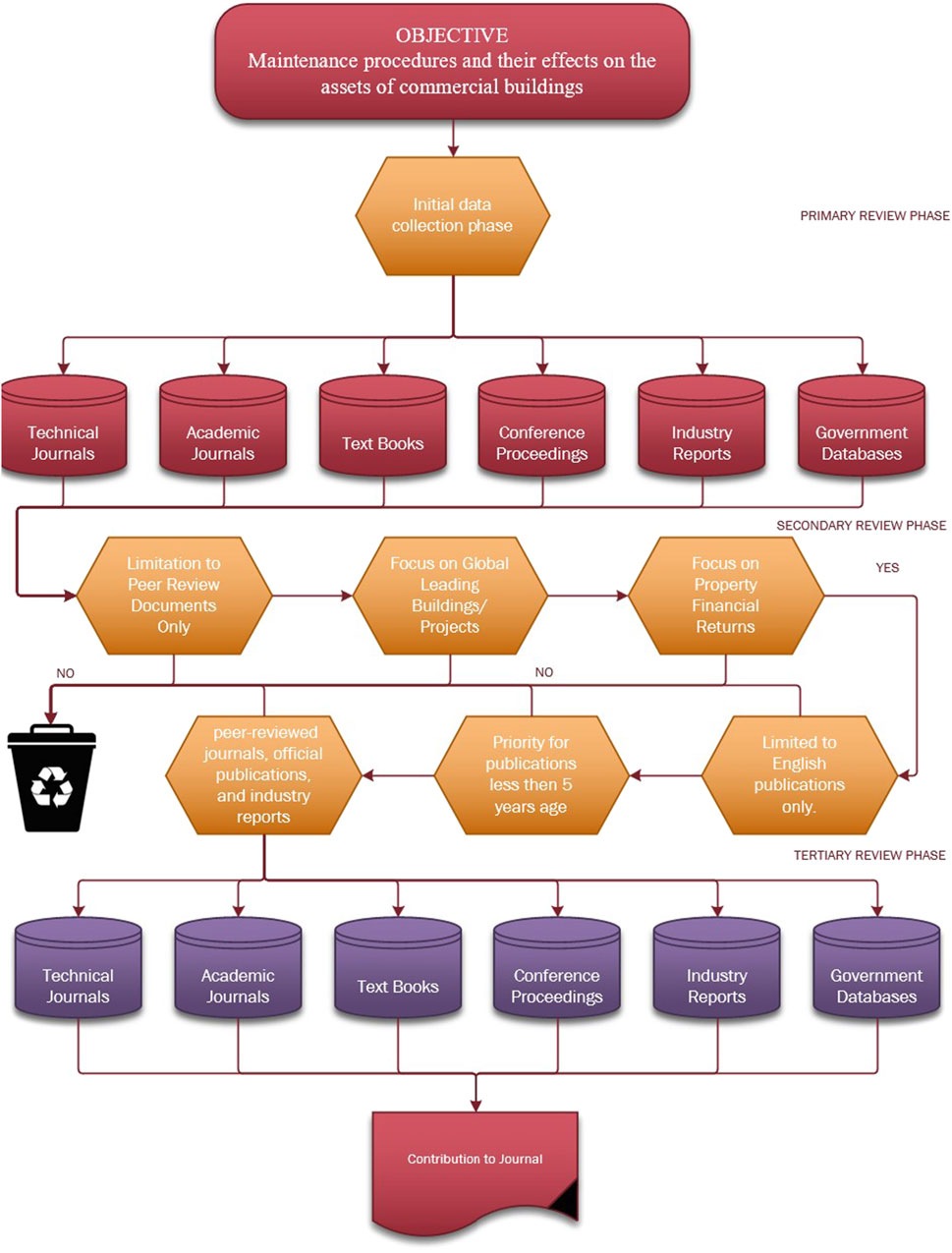

The underlying philosophy of this study–interpretivism–recognises the subjectivity of people’s experiences and views in forming the complex relationship between maintenance procedures and the functioning and value of business-building assets (Omar et al., 2023a). This line of thinking aligns with the realisation that different stakeholder viewpoints in the legitimate Australian estate market add to a more complex understanding of maintenance impacts.

A design based on descriptive statistics was used to methodically outline and examine the features of maintenance procedures and their effects on the assets of commercial buildings. This design effectively achieves the research goal of offering a thorough overview of the complex relationship among maintenance, market thought, and economic returns (Farrell et al., 2023). This makes it easier to thoroughly investigate the current circumstances, guaranteeing that the examination captures a comprehensive understanding of the topic.

The deductive method created an empirical basis derived from current literature. Data analysis was used to test and improve the framework. By offering an organised and methodical inquiry, the deductive approach facilitates the examination of established concepts linked to the preservation of commercial buildings (Halder and Afsari, 2023).

Because this study was thorough, gathering secondary data was deemed appropriate. This approach entails compiling data from previously published sources, such as scholarly journals, business reports, government documents, and pertinent databases. The benefit of secondary data is that they can be accessed at a lower cost and with greater efficiency than primary data, providing access to a broader range of information.

In the context of commercial properties that are similar to Australian assets, the selected data was directly related to comparable maintenance procedures, market perceptions, and financial returns. To ensure the validity and dependability of the gathered data, a focus is placed on reliable sources such as peer-reviewed journals, official publications, and industry reports (Omar et al., 2023b). Recent data are preferred for capturing the present developments and conditions because of the dynamic nature of property markets.

Figure 4 represents the methodical arrangement implemented to identify the most critical conclusions compared to a literature review (Lam et al., 2023). This matrix classifies the data based on themes such as the effect of upkeep on property value, market thoughts, and financial rewards. A systematic register of outcomes was created to simplify the referenced analysis and particular data points with pertinent ideas and themes. During the third review stage we were able to improve the information retrieval process.

The coded data were subjected to a thematic analysis process that yielded insights, trends, and recurrent patterns about business maintenance. This analysis aided the synthesis of essential themes that guided the research goals. Assessments were made between various sources and over time to identify trends and variances in the influence of upkeep on the value of high rise residential buildings and general performance. Identifying associations and trends in the data makes possible a more comprehensive understanding of the interactions between maintenance procedures, consumer perceptions, and financial returns.

All sources have been properly cited and referenced, and their intellectual property rights are respected (Kaewunruen et al., 2023). When required, permission is requested by copyright law. There are few problems with confidentiality because secondary data are readily available to the public. Nevertheless, care must be exercised when referencing particular case studies or confidential information when using gathered data. This research preserves objectivity by demonstrating findings in the literature and avoiding charging particular prejudices or tastes. An open strategy was used to protect honesty during the investigation.

The availability and completeness of pertinent secondary data were prerequisites for this study. Outdated or incomplete information can restrict the application of the analysis. Because this study is interpretive, the subjectivity in interpreting results is recognised. By using well-established theories and forthcoming reporting, bias can be reduced as much as possible. This mathematical methodology uses secondary data-collection techniques in conjunction with a design based on description, a method based on deductive reasoning, and an interpretive theoretical framework (GlobalData PLC 2023b). This research aims to provide in-depth knowledge of the impact of upkeep on commercial construction assets in the Australian context using a methodological process that involves information compilation, a company, and analysis. Restrictions and ethical issues were thoroughly addressed to guarantee the reliability and accuracy of the findings.

4 Results

4.1 Maintenance practices in Australian commercial buildings: a comprehensive overview

Determining the intricate nature of the worth and functionality of Australian business-related buildings requires a thorough understanding of the maintenance techniques used in these structures. This section presents an in-depth summary of standard maintenance procedures, highlighting the types, frequencies, and tactical factors related to the Australian commercial property market.

Previous research highlights differences in the amount and duration of maintenance tasks in Australian commercial structures (GlobalData PLC 2023a). Although regular maintenance is necessary, different structures and industries require different periods and intervals for this type of work. For example, large-scale commercial buildings typically undergo more rigorous and frequent repair procedures, including preventive care and monthly inspections. Conversely, smaller companies might take a more reactive stance and address maintenance problems as they develop.

Commercial properties in Australia require various maintenance procedures, from regular inspections to extensive repairs and renovations. Preventive maintenance aims to identify possible problems before they become more serious (GlobalData PLC, 2023c). This includes the routine inspection of construction systems and equipment. Corrective repair is another common practice that ensures commercial assets’ continued functionality and security by promptly addressing identified problems. Predictive repair, in which data and technology are employed to predict maintenance requirements, is becoming increasingly popular in commercial buildings with higher levels of technology.

Strategic considerations are pivotal in shaping maintenance practices in Australian commercial structures. Notably, sustainability has emerged as a key focus area, with many businesses integrating eco-friendly practices into their maintenance schedules. This aligns with the Australian property construction industry’s broader sustainability goals, which include using environmentally friendly materials, waste reduction initiatives, and energy-efficient renovations. Other factors that influence strategic maintenance planning include building-specific regulations, usage trends, and the age of the building. While newer constructions may prioritise technology-driven maintenance solutions, older buildings often require more extensive renovations.

The findings of this research highlight the positive shift towards technology-driven maintenance procedures in business establishments in Australia. The adoption of computerised Maintenance Management Systems (CMMS) and Building Management Systems (BMS) is rising, automating repetitive tasks, improving maintenance procedures, and enabling data-driven decisions. Real-time monitoring of building systems through Internet of Things (IoT) devices allows for preventative care by identifying anomalies before they escalate and paints a promising picture of the future of maintenance.

Despite various maintenance techniques available, the Australian commercial building industry has challenges. Budgetary constraints, for instance, pose a significant hurdle, with many companies struggling to allocate sufficient funds for comprehensive maintenance plans. Balancing the immediate benefits of maintenance against long-term costs is another complex task for facility managers and property owners. Moreover, disparities in specialised maintenance fields, such as the adoption of advanced technology, further impede effective implementation.

Within the Australian construction sector, there are differences in maintenance practices among various industries. For instance, retail spaces might prioritise aesthetics and consumer experience, resulting in greater cosmetic maintenance procedures. Manufacturing facilities, on the other hand, may place more emphasis on safety precautions and the maintenance of machinery. It is essential to understand these industry-specific variances to customise maintenance plans to meet the particular requirements and goals of various business sectors. This thorough analysis of Australian building maintenance procedures offers insightful information on the ever-changing landscape of conservation and upkeep in the real estate industry (Green, 2022). The strategies, types, and frequency of considerations highlight the variety of approaches businesses employ to guarantee the best possible operations, longevity, and future viability for business. assets. This fundamental knowledge paves the way for additional investigations into the complex interrelationships among maintenance procedures, consumer attitudes, and financial returns on expenditures in commercial real estate.

4.2 Market perceptions of well-maintained versus neglected assets: insights from stakeholders

Comprehending stakeholders’ perspectives regarding well-maintained and neglected workplace assets is essential to deciphering the factors that impact market value and overall desirable qualities. Building owners and their tenants are crucial in determining how the market is perceived, and the state of the business structure frequently affects their choices. Research shows buyers strongly prefer well-maintained properties (Fiorini and Aiello, 2022). A building’s overall appearance, system performance, and conditions, both inside and outside, significantly influence buyers’ choices. Well-maintained buildings are considered lower-risk spending, and potential building owners will be prepared to pay more for building assets committed to continuous maintenance requiring little immediate attention (Fan Ng, 2020).

Tenants’ opinions significantly impact the value of commercial buildings worth the market. Properly maintained characteristics are more appealing to prospective tenants and also help increase the degree of satisfaction among tenants. Buildings with proactive maintenance typically have higher tenant retention rates because tenants guarantee a cozy and helpful work area (English and Kaltungo, 2022). This tenant-centric viewpoint supports the idea that well-maintained properties draw and maintain quality tenants while enhancing market perceptions. The market environment was further clarified from the perspectives of professionals in the field, such as facility managers, inspectors, and real estate professionals. Professionals in a business state with well-maintained commercial buildings have a higher chance of obtaining good evaluations and appraisals. A property’s state and upkeep history significantly affect its perceived worth. Industry insiders stress that careful maintenance improves commercial asset competitiveness and durability over time, in addition to immediate appeal to consumers.

This study explores divergent market views of well-maintained and neglected properties in commercial real estate. By analysing the disparate perspectives on maintenance procedures, this study aims to reveal how maintenance affects resources’ perceived worth and usefulness. Through an exhaustive investigation of industry viewpoints, this study seeks to clarify the concrete ramifications of the careless versus conscientious upkeep of commercial assets. This research adds essential information to the ongoing conversation on asset management by illuminating market attitudes and educating stakeholders while promoting a greater comprehension of the complex variables influencing the alleged worth of commercial real estate holdings.

Risk reduction is something that all stakeholders are interested in, compared to institutional purchasers and individual investors. Investors feel more confident and secure when they invest in adequately maintained assets because they are perceived as having a lower inherent risk. Conversely, neglected structures are viewed as possible financial liabilities requiring large sums of money for maintenance and upgrades (Mergent, 2022). Decisions regarding investments are directly influenced by how risk is perceived, and consumers are prone to interact with assets that show a dedication to upkeep, which lowers the uncertainty surrounding unanticipated problems.

Initial perceptions count heavily in the real estate marketplace, and a commercial building’s visual appeal shapes these early opinions. A neglected property that shows signs of deterioration may find it difficult to draw attention, but well-kept, high-rise residential assets make a good impression (Worthington, 2022). A building’s overall appearance, cleanliness, and curb appeal affect how prospective tenants and buyers see it and how the market perceives the asset. Although the benefits of well-maintained assets are evident, it can be difficult to alter market perceptions, particularly for abandoned buildings that require restoration. Transparent record-keeping initiatives to improve effective communication are necessary to overcome the stigma associated with neglect. If stakeholders perceive an unmistakable dedication to resolving maintenance issues, they may become cautiously optimistic, eventually shifting their perceptions.

Concerns about sustainability have an increasing impact on market opinion. Green building techniques and energy-efficient maintenance are regarded as more favourable. Societal values align with the attachment to environmental responsibility and shareholders and tenants who care about the environment, indicating a preference for properties that help achieve sustainability objectives. Stakeholder insights offer a detailed picture of how the Australian market views well-maintained and poorly-maintained commercial building assets. Tenant fulfilment, buyer tastes, risk mitigation, business analyst assessments, aesthetic appeal, and environmentally friendly considerations work together to create a complex web of perceptions that affect the value of markets (Plunkett Research, 2022). In the dynamic Australian real estate environment, property owners, shareholders, and industry professionals looking for ways to strategically position themselves while enhancing the market appeal they have for their business holdings must acknowledge the variety of viewpoints stakeholders hold.

4.3 Economic returns and property values: analysing the impact of maintenance investments

A critical aspect of the investment property scene is the financial returns on upkeep investments made in commercial structures. This section explores the complex relationship between cleaning methods and how they directly affect property value. It offers a detailed examination of how beneficial upkeep affects monetary benefits in an Australian setting.

Property Admiration is one of the primary measures of financial returns on maintenance investments. In terms of commercial properties, well-maintained materials typically appreciate faster than their neglected counterparts (Hübner, 2022). According to research conducted by the Residential Economics Research Company, a proactive preservation plan incorporating routine inspections, preventative measures, and prompt repairs significantly increases the property’s value for prospective buyers. Building appearance, usability, and general state significantly impact how the market perceives a building, affecting the extent to which a property will increase in value over time.

A thorough cost-benefit analysis is necessary to comprehend the financial benefits of maintenance investments. Although maintenance incurs upfront costs, long-term savings frequently offset these costs. The field of economics emphasises the importance of weighing maintenance expenses against expected advantages, such as higher property values, longer asset lifespans, and possible energy savings (Pengly and Tirapas, 2022). When making strategic decisions regarding maintenance strategies that maximise property asset values, find the right compromise between minimising expenses and maximising the advantageous effects on property value.

This study aimed to understand how different maintenance approaches affect structural performance and reliability measures. It also examines the financial effects of these investments, explaining the relationship between the money allotted and the increased value as follows: This study provides a thorough understanding of the wide-ranging impacts of maintenance spending on asset endurance within the larger context of operating and economic concerns, which is crucial for optimising maintenance investments.

Maintenance expenditures influence the long-term management of assets and the financial sustainability of commercial buildings. In addition to raising a property’s value, routine upkeep reduces risk. According to the Asset Management Association Journal, a well-executed schedule for upkeep lowers the likelihood of significant repairs and replacements, ensuring the asset’s overall financial health (Olanrewaju, 2022). Shareholders and asset owners seek consistent returns from real estate holdings and long-term assets. Therefore, management is essential.

The financial benefits of maintenance investments are directly related to market competitiveness. Tenants find properly maintained buildings more appealing, which lowers vacancy rates and raises rental income. According to the Property Capital Investment Patterns Institute, landlord satisfaction, overall competitiveness in the marketplace, and efficient maintenance strategies are correlated (Wood and Rachel, 2013). Reputably maintained commercial properties have an advantage over their rivals, drawing in high-calibre tenants and boosting profits with steady rental income.

Sustainability considerations have an increasing impact on the financial returns from maintenance investments. In addition to aligning with environmental objectives, buildings that use green building techniques and energy-efficient maintenance can result in potential cost savings and increased property values (Jesus, 2022). According to research conducted by the Sustainable Development Building Investigation Consortium, investments in environmentally friendly maintenance techniques lower operating costs and boost market desirability. In this case, economic returns also include continued operational efficacy, value for money, and instantaneous property value.

Realising the full financial benefits of maintenance investments presents challenges. The scope of thorough maintenance plans may be limited by budgetary constraints, which can result in reactive or deferred service procedures. Furthermore, forecasting future market conditions with precision presents difficulties when attempting to maximise economic returns. Property shareholders and facility managers must communicate effectively to achieve financial outcomes and match maintenance tactics with economic goals. The financial success of commercial structures in Australia is significantly shaped by strategic upkeep, as evidenced by an analysis of financial returns on upkeep investments (Weerasinghe, 2022). Maintenance’s financial situation is influenced by various factors such as competitiveness in the marketplace, sustainability considerations, long-term handling of assets, cost-benefit analyses, and property admiration. Acknowledging the complex nature of these financial returns is crucial for interested parties seeking well-informed choices regarding investments and upkeep plans in the ever-changing Australian property sector.

4.4 Correlations and patterns: unveiling relationships between maintenance, performance metrics, and asset value

Understanding the complex relationships between asset value, performance metrics, and upkeep practices is crucial for comprehending the dynamics of the commercial leasing sector. This section explores the relationships and trends that surface from the collected information analysis, offering insights into how performance metrics, and thus the total value of business property assets, are impacted by strategic upkeep in the power source in the Australian context.

The analysis reveals strong relationships between maintenance procedures and essential performance indicators in commercial buildings. Routine inspections and preventive maintenance positively impact performance metrics such as energy efficiency, system dependability, and general building functionality (Sarvari et al., 2022). Structures implementing strategic maintenance plans typically demonstrate increased operational efficiency, leading to better performance metrics and increased asset value.

Notable relationships were found between maintenance procedures and energy conservation. Energy efficiency indicators show that sustainable maintenance practices benefit the building, such as frequent system optimisation and energy-efficient upgrades. Studies conducted by the Sustainable Future Creating Research Consortium show that spending on sustainable maintenance increases Energy Star assessments and other environmentally friendly benchmarks and lowers operating costs (Iwaniec et al., 2020). The relationship between energy use efficiency and environmentally friendly upkeep highlights the possibility of financial gains from reduced utility costs and increased market appeal.

The correlation between preventative upkeep and the usefulness of building assets exhibits discernible patterns. The structures and elements of commercial buildings that prioritise preventive care and address problems before they worsen tend to last longer (Mangaundan, 2022). This pattern strengthens the idea that strategic maintenance choices lead to long-term asset value extension and sustained operational efficiency by positively affecting performance metrics of asset longevity. The relationship between perceived asset value and maintenance frequency is explained visually, emphasising how crucial maintenance practices determine a structure’s performance. The graphic illustrates the study’s investigation of the complex dynamics supporting the commercial real estate business. It highlights the importance of comprehensively grasping how maintenance impacts asset features and values intricately.

Correlations between occupancy rates and upkeep practices significantly affect a building’s performance. Tenants are more likely to provide positive feedback on well-maintained buildings, which increases satisfaction levels. This relationship is not limited to tenant satisfaction; it also holds for more general performance indicators such as occupancy and lease continuation rates. Prioritising maintenance helps commercial properties attract high-quality tenants and maintain a competitive advantage in the market, both of which improve the overall performance of buildings.

The analysis reveals a distinct pattern concerning risk mitigation and how it affects asset value. Structures with strategic repair strategies successfully reduce the risk of unforeseen problems, system breakdowns, and possible disruptions. Higher asset values were directly correlated with a decrease in perceived danger. Investors and other stakeholders with a track record of implementing risk-reduction techniques are more likely to place a higher value on business assets because they understand the financial benefits of reduced risks and liabilities.

Concerning the influence of renovation and reuse for adaptive purposes on asset value. When well-maintained buildings undergo refurbishment or repurposing projects, their asset values usually increase. Periodic upkeep and strategic upgrades improve an asset’s marketplace appeal, drawing in new tenants and possibly raising property value (Almobarek et al., 2022). The relationship between regular consumption, renovation, and adaptive reuse highlights the potential financial gains from revitalisation initiatives.

Although correlations and patterns yield insightful information, they identify patterns in diverse businesses, such as real estate markets. Numerous factors, such as location, industry, and economic conditions, affect asset value maintenance. Understanding these complexities is essential for stakeholders seeking to navigate difficulties and maximise financial returns through well-informed maintenance strategies.

4.5 Limitations

This research assignment was developed based on a thorough secondary data scope of existing journals and technical publications. While the contents and results are well documented, additional or altered results may occur if the scope is extended to a qualitative survey of building tenants, facilities managers, property managers and asset managers. This research highlights the perceived impressions Australian tenants and occupants have on preventive maintenance strategies.

5 Conclusion

5.1 Critical evaluation

Opportunities and difficulties were revealed by critically examining the connections among the worth of assets, performance measures, and maintenance procedures of Australian commercial structures. Although the associations between preventive upkeep and beneficial performance metrics are promising, there are obstacles to implementing and recognising sustainable practices. The observed patterns, such as the relationship between asset worth and risk reduction, provide important information about the financial effects of maintenance choices. However, generalising these patterns is difficult because of the complexity of the business real estate landscape, which includes market trends specific to industry variations. Furthermore, the analysis highlights the significance of renovations, along with adaptive reuse, in raising asset value; however, the effectiveness of such initiatives depends on the surrounding circumstances. The main challenge is navigating the many variables that affect the financial returns on service investments. This study also emphasises the necessity of adopting a multifaceted approach to pattern recognition, considering the dynamic nature of the market. Finally, the critical analysis offers a framework for making tactical choices; however, it also necessitates a fair comprehension of the complex ways in which maintenance affects the assets of commercial buildings. To improve the relevance of these findings to the Australian property market, future studies should probe more deeply into the subtleties unique to the business and the changing dynamics of the market.

5.2 Recommended approaches for future research

Expanding on the critical examination of asset value, performance indicators, and upkeep procedures in Australian businesses, the following suggestions for future studies in this field could improve the breadth and relevance of the research.

Industry-specific research should be prioritised in future research projects to identify subtleties that could affect maintenance methods and their financial consequences. Different industries, such as manufacturing, retail, and office spaces, may exhibit different trends and relationships. By examining these sector-specific dynamics in greater detail, stakeholders can customise their maintenance plans to meet the specific requirements of each industry.

Researchers can capture the changing nature of the preservation impacts over time by conducting longitudinal investigations. A more thorough and dynamic analysis will result from understanding how maintenance decisions affect the outcomes and value of assets across various phases of the economy, market circumstances, and technological advancements. The long-term effects of adaptive reuse projects and resilient maintenance techniques can be monitored through longitudinal research.

While quantitative data are useful for concluding, qualitative research techniques such as stakeholder surveys and interviews may provide a deeper comprehension of the issues, concerns, and motivations about maintenance practices. A comprehensive understanding of the complex relationships examined in this study can be gained by combining the quantitative and qualitative findings from tenants, facility managers, and property owners.

Comparative studies conducted in various Australian regions will help clarify regional differences in maintenance impacts. Different regions may experience distinct effects from the same factors in maintenance practices, including climate, legal frameworks, and economic conditions (Abideen et al., 2022). By enhancing our understanding of geography, comparative studies will enable us to make recommendations specific to individual regions.

Future studies should examine the effects of cutting-edge technologies such as artificial intelligence (AI), statistical analysis, building information modelling (BIM) and Digital Twins on maintenance objectives, as technology is vital to maintenance procedures. Examining the impact of such developments on asset values and performance metrics can shed light on how smart and resilient businesses are developing.

5.3 Topics for further analysis

a) Examining maintenance methods in Australian commercial structures laid the groundwork for additional research that provides insights into evolving structures and emerging patterns. The following topics offer encouraging directions for future research:

b) Future research should focus on how modern technologies such as automation, machine learning, and Internet of Things (IoT) devices are integrated into commercial construction and maintenance. Understanding how these technologies affect the value of assets, performance of general metrics, and effectiveness of maintenance procedures is essential. Stakeholders can navigate the changing landscape by investigating the opportunities and potential obstacles linked to the broad acceptance of smart building innovations.

c) Future studies should concentrate on the connection between business structure maintenance procedures and emergency preparedness. Examining how preventive maintenance increases a structure’s ability to withstand emergencies and how this affects asset value can benefit policymakers and property owners alike.

d) Future research on this topic should focus on recognising the psychological components of decision-making concerning maintenance practices. Investigating how psychological prejudices, perceptions of danger, and organisational culture affect the choices made by property owners, facility administration, and others can help us better understand why some maintenance methods are preferred over others.

e) Future research can examine the relationship between maintenance procedures and using a circular economy through business establishments as sustainability becomes increasingly important. Examining how maintenance tactics can align with circular economy tenets such as resource efficiency and reuse will advance a more comprehensive understanding of sustainable development practices.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

JW: Writing–original draft. AE: Writing–review and editing. MS: Writing–review and editing. AH: Writing–review and editing.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Acknowledgments

JW acknowledges the technical, academic, and mental support and encouragement received from his supervisors AE, MS, and AH, which have made this paper possible.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abideen, D. K., Yunusa-Kaltungo, A., Manu, P., and Cheung, C. (2022). A systematic review of the extent to which BIM is integrated into operation and maintenance. Sustainability 14, 8692. doi:10.3390/su14148692

Adhesives and Sealants Industry (2023). Curtain wall restoration at award-winning tower in. Chic. Adhesives Sealants Industry 30, 31–32.

Agarwal (2023). Important maintenance KPIs to monitor, track and improve team performance. Available at: https://www.selecthub.com/cmms/maintenance-kpi.

Almobarek, M., Mendibil, K., Alrashdan, A., and Mejjaouli, S. (2022). Fault types and frequencies in predictive maintenance 4.0 for chilled water system at commercial buildings: an industry survey. Buildings 12, 1995. doi:10.3390/buildings12111995

Amarnath, N. (2023). Clean energy could create up to 4.7 jobs for every commercial building. Available at: https://www.proquest.com/trade-journals/clean-energy-could-create-up-4-7-jobs-every/docview/2878920248/se-2.

Au-Yong, Peng, C., Tem, J., and Chua, S. (2023). Relationship between the maintenance management problems and the maintenance performance of high-rise residential buildings. Int. J. Real Estate Stud. 17, 90–101. doi:10.11113/intrest.v17n2.311

Bokrantz, J., Skoogh, A., Berlin, C., Wuest, T., and Stahre, J. (2020). Smart Maintenance: an empirically grounded conceptualization. Int. J. Prod. Econ. 223, 107534. 0925-5273. doi:10.1016/j.ijpe.2019.107534

Cecconi, F. R., and Luca, R. (2023). Data driven economic scenarios for retrofitting residential buildings in a northern Italian region. IOP Conf. Ser. Earth Environ. Sci. 1196, 012113. doi:10.1088/1755-1315/1196/1/012113

Cheng, C. T., Gabriel, H. T. L., Chin, H.-C., and Leng, P. C. (2023a). Effects of multifaceted street art on price premium of pre-war commercial buildings: the case of georgetown UNESCO world heritage site. Land 12, 626. doi:10.3390/land12030626

Cheng, H., Li, J., Lu, J., Lo, S.-L., and Xiang, Z. (2023b). Incentive-driven information sharing in leasing based on a Consortium blockchain and evolutionary game. J. Theor. Appl. Electron. Commer. Res. 18, 206–236. doi:10.3390/jtaer18010012

English, L., and Kaltungo, A. Y. (2022). A practical application of methodologies to determine asset criticality and work order prioritization. Eng. Rep. 4, e12555. doi:10.1002/eng2.12555

Fafouti, A. E., Vythoulka, A., Delegou, E. T., Farmakidis, N., Ioannou, M., Perellis, K., et al. (2023). Designing cultural routes as a tool of responsible tourism and sustainable local development in isolated and less developed islands: the case of symi island in Greece. Land 12, 1590. doi:10.3390/land12081590

Fan Ng, C. (2020). Perception and evaluation of buildings: the effects of style and frequency of exposure. Collabra Psychol. 6 (1), 44. doi:10.1525/collabra.324

Farrell, K., Hassan, Md K., Hossain, Md D., Ahmed, B., Rahnamayiezekavat, P., Douglas, G., et al. (2023). Water mist fire suppression systems for building and industrial applications: issues and challenges. Fire 6, 40. doi:10.3390/fire6020040

Ferrara, M., Peretti, C., Fabrizio, E., and Paolo Corgnati, S. (2023). On the multi-domain impacts of coupling mechanical ventilation to radiant systems in residential buildings. Energies 16, 4870. doi:10.3390/en16134870

Fiorini, L., and Aiello, M. (2022). Automatic optimal multi-energy management of smart homes. Energy Inf. 5, 68–20. doi:10.1186/s42162-022-00253-0

Fitch Solutions Group Limited (2023a). Kuwait real estate report - Q4 2023. Available at: https://www.proquest.com/reports/kuwait-real-estate-report-q4-2023/docview/2871958740/se-2.

Fitch Solutions Group Limited (2023b). Qatar real estate report - Q4 2023. Available at: https://www.proquest.com/reports/qatar-real-estate-report-q4-2023/docview/2873614317/se-2.

Fitch Solutions Group Limited (2023c). South Korea real estate report – 2023. Available at: https://www.proquest.com/reports/south-korea-real-estate-report-2023/docview/2861002797/se-2.

Fitri, I., Siregar, F., Silvana, S., Ariffin, N. F. M., Readly, F. G., and Indira, S. S. (2023). An adaptive reuse development through highest and best use assessment: case study the ex-warenhuis, medan, Indonesia. IOP Conf. Ser. Earth Environ. Sci. 1188 (1), 012045. doi:10.1088/1755-1315/1188/1/012045

Gaspari, J., Antonini, E., and Marchi, L. (2023). Enabling technologies to support energy transition in social housing. TECHNE J. Technol. Archit. Environ., 143–152. doi:10.36253/techne-13622

Globa Data PLC (2023d). Powerlong commercial management holdings ltd (9909). Available at: https://www.proquest.com/reports/powerlong-commercial-management-holdings-ltd-9909/docview/2528755738/se-2.

GlobalData, P. L. C. (2023e). Mitsubishi heavy industries ltd (7011). Available at: https://www.proquest.com/reports/mitsubishi-heavy-industries-ltd-7011/docview/2348180591/se-2.

GlobalData PLC (2023a). Building energy SpA. Available at: https://www.proquest.com/reports/building-energy-spa/docview/2595011012/se-2.

GlobalData PLC (2023b). ReNu energy ltd (RNE). Available at: https://www.proquest.com/reports/renu-energy-ltd-rne/docview/2610737890/se-2.

GlobalData PLC (2023c). Zhongxing shenyang commercial building group company limited (000715). Available at: https://www.proquest.com/reports/zhongxing-shenyang-commercial-building-group/docview/2553808121/se-2.

Green, N. (2022). The property ticker: AXA buys 758-bed PBSA asset; empiric sells southampton PBSA asset for £13m; Stark acq 600 Stores.and more, JP morgan chase and company. Available at: https://www.proquest.com/reports/property-ticker/docview/2755777431/se-2.

Halder, S., and Afsari, K. (2023). Robots in inspection and monitoring of buildings and infrastructure: a systematic review. Appl. Sci. 13, 2304. doi:10.3390/app13042304

Hodavand, F., Issa, J. R., and Sadeghi, N. (2023). Digital twin for fault detection and diagnosis of building operations: a systematic review. Buildings 13, 1426. doi:10.3390/buildings13061426

Hook, M., Hernandez, D., Grimm, D., and Li, H. (2023). Hydrogen’s potential role in LDCs’ transition to a low-carbon future. Energy Law J. 44, 31–64.

Hossain, J., Kadir, A. F. A., Hanafi, A. N., Shareef, H., Khatib, T., Baharin, K. A., et al. (2023). A review on optimal energy management in commercial buildings. Energies 16, 1609. doi:10.3390/en16041609

Hübner, D., Moghayedi, A., and Michell, K. (2022). The impact of industry 4.0 technologies on the environmental sustainability of commercial property by reducing the energy consumption. IOP Conf. Ser. Earth Environ. Sci. 1101, 062018. doi:10.1088/1755-1315/1101/6/062018

Iwaniec, D. M., Cook, E. M., Davidson, M. J., Berbés-Blázquez, M., Georgescu, M., Scott Krayenhoff, E., et al. (2020). The co-production of sustainable future scenarios. Landsc. Urban Plan. 197, 103744. 0169-2046. doi:10.1016/j.landurbplan.2020.103744

Jesus, De, Oreta, A., Grio, M. E. D., Mendoza, R., Garciano, L. E. O., Ibabao, R., et al. (2022). Seismic screening and structural investigation of heritage buildings for adaptive reuse: a survey study at iloilo city, Philippines. IOP Conf. Ser. Earth Environ. Sci. 1091, 012008. doi:10.1088/1755-1315/1091/1/012008

Kaewunruen, S., AbdelHadi, M., Kongpuang, M., Pansuk, W., and Remennikov, A. M. (2023). Digital Twins for managing railway bridge maintenance, resilience, and climate change adaptation. Sensors 23, 252. doi:10.3390/s23010252

Khi, T. M. (2023) SG property intelligence: keppel south central commercial building unveiled. New York, New York, United States: JPMorgan Chase & Company.

Lam, K. H., To, W. M., and Lee, P. K. C. (2023). Smart building management system (SBMS) for commercial buildings—key attributes and usage intentions from building professionals’ perspective. Sustainability. 15, 80. doi:10.3390/su15010080

Lubush (2022). Commercial building maintenance checklist. Available at: https://remedial.com.au/blogs/commercial-building-maintenance-checklist.

Mangaundan, R. (2022). Sustainable facilities ISHN 56:7. Available at: https://www.proquest.com/trade-journals/sustainable-facilities/docview/2632216791/se-2.

Mergent (2022). Real estate investment trusts (REITs) - quarterly update 11/14/2022. Available at: https://www.proquest.com/reports/real-estate-investment-trusts-reits-quarterly/docview/2747009141/se-2.

Mergent (2023a). Evi industries, inc. Available at: https://www.proquest.com/reports/evi-industries-inc/docview/1860776047/se-2.

Mergent (2023b). Ihs inc. Available at: https://www.proquest.com/reports/ihs-inc/docview/2567941100/se-2.

Mergent (2023c). Lok'n store group plc. Available at: https://www.proquest.com/reports/lokn-store-group-plc/docview/1860770842/se-2.

Mergent (2023d). Moore stephens international limited. Available at: https://www.proquest.com/reports/moore-stephens-international-limited/docview/1860764164/se-2.

Mergent (2023e). Nonresidential building construction - quarterly update 4/17/2023. Available at: https://www.proquest.com/reports/nonresidential-building-construction-quarterly/docview/2802416760/se-2.

Mergent (2023f). Nonresidential building construction - quarterly update 7/17/2023. Available at: https://www.proquest.com/reports/nonresidential-building-construction-quarterly/docview/2839426419/se-2.

Mergent (2023g). Real estate – quarterly update 2/13/2023. Available at: https://www.proquest.com/reports/real-estate-quarterly-update-2-13-2023/docview/2778309799/se-2.

Mergent (2023h). Sellafield limited. Available at: https://www.proquest.com/reports/sellafield-limited/docview/1860781557/se-2.

Mergent (2023i). Westdale asset management, ltd. Available at: https://www.proquest.com/reports/westdale-asset-management-ltd/docview/1860760065/se-2.

Milošević, M. R., Milošević, D. M., Stević, D. M., and Kovačević, M. (2023). Interval valued pythagorean fuzzy AHP integrated model in a smartness assessment framework of buildings. Axioms 12, 286. doi:10.3390/axioms12030286

Nguyen, D., Ding, G. K., and Runeson, G. (2013). “Sustainable maintenance of office buildings: the current practice in sydney, Australia,” in Australian Universities Building Education Association Annual Conference, Auckland, New Zealand, November, 2013.

Olanrewaju, A. L. (2022). An artificial neural network analysis of rework in sustainable buildings. IOP Conf. Ser. Earth Environ. Sci. 1101, 022003. doi:10.1088/1755-1315/1101/2/022003

Omar, M., Mahmoud, A., and Abdul Aziz, S. ’ardin B. (2023a). Critical factors affecting fire safety in high-rise buildings in the emirate of sharjah, UAE. UAE. Fire. 6, 68. doi:10.3390/fire6020068

Omar, M., Mahmoud, A., and Abdul Aziz, S. ’ardin B. (2023b). Fire safety index for high-rise buildings in the emirate of sharjah, UAE. UAE. Fire 6, 51. doi:10.3390/fire6020051

Pengly, K., and Tirapas, C. (2022). A survey of phnom penh apartment shophouses’ conditions for future housing adaptability revitalization in phnom penh. IOP Conf. Ser. Earth Environ. Sci. 1101, 042024. doi:10.1088/1755-1315/1101/4/042024

Phibbs, P., and Gurran, N. (2021). The role and significance of planning in the determination of house prices in Australia: recent policy debates. Environ. Plan. A Econ. Space 53 (3), 457–479. doi:10.1177/0308518X21988942

Plunkett Research (2022). Williams industrial services group inc. Available at: https://www.proquest.com/reports/williams-industrial-services-group-inc/docview/2768539286/se-2.

Plunkett Research (2023). Janitorial, landscape maintenance, carpet cleaning, building maintenance and pest exterminators (insect extermination) industry (U.S.) analytics. Available at: https://www.proquest.com/reports/janitorial-landscape-maintenance-carpet-cleaning/docview/2779945113/se-2.

Pomè, A. P., Tagliaro, C., Celani, A., and Ciaramella, G. (2023). Is digitalization worth the hassle? Two cases of innovation building operation and maintenance. IOP Conf. Ser. Earth Environ. Sci. 1176, 012031. doi:10.1088/1755-1315/1176/1/012031

Rodrigues, R. C., Sousa, H., and Gondim, I. A. (2023). SMARTS-based decision support model for CMMS selection in integrated building maintenance management. Buildings 13, 2521. doi:10.3390/buildings13102521

Ruseruka, C., Mwakalonge, J., Comert, G., Siuhi, S., and Perkins, J. (2023). Road condition monitoring using vehicle built-in cameras and gps sensors: a deep learning approach. Vehicles 5, 931–948. doi:10.3390/vehicles5030051

Sarvari, H., Chan, D. W. M., Sahib, A. I., Sahani Jayasena, N., Rakhshanifar, M., and Al-Gburi, G. (2022). Determining the main criteria for selecting appropriate methods for repair and maintenance of commercial real estate in Iran. Facilities 40, 281–296. doi:10.1108/f-07-2020-0086

Schmarzo (2020). Understanding how to transform your economic value curve. Available at: https://medium.com/@schmarzo_9052/understanding-how-to-transform-your-economic-value-curve-fe8c2dda4b52.

Tanfield, K., Heywood, C., Warren-Myers, G., Kalantari, M., and Shojaei, D. (2023). ISO 19650.3 and the digitisation of operations in strata-titled residential apartment developments. IOP Conf. Ser. Earth Environ. Sci. 1176, 012020. doi:10.1088/1755-1315/1176/1/012020

Tavakoli, S., Loengbudnark, W., Eklund, M., Voinov, A., and Khalilpour, K. (2023). Impact of COVID-19 pandemic on energy consumption in office buildings: a case study of an Australian university campus. Sustainability 15, 4240. doi:10.3390/su15054240

Weerasinghe, A. S., Ramachandra, T., and Rotimi, J. O. B. (2022). Towards sustainable commercial buildings: an analysis of operation and maintenance (O&M) costs in Sri Lanka. Smart Sustain. Built Environ. 11, 454–468. doi:10.1108/sasbe-04-2020-0032

Wood, G., and Rachel, O. V. (2013). When and why do landlords retain property investments? Urban Stud. 50, 3243–3261. doi:10.1177/0042098013484544

Worthington, K. B. (2022). Brookfield asset management: a solid 3Q22; flagship fundraising cycle in full swing; asset management spin on track. New York, New York, United States: JP Morgan Chase & Company.

Keywords: asset value, building performance, commercial buildings, real estate industry, routine maintenance

Citation: West J, Evangelista A, Siddhpura M and Haddad A (2024) Asset maintenance in Australian commercial buildings. Front. Built Environ. 10:1404934. doi: 10.3389/fbuil.2024.1404934

Received: 21 March 2024; Accepted: 29 May 2024;

Published: 14 June 2024.

Edited by:

Diogo Ribeiro, Instituto Superior de Engenharia do Porto (ISEP), PortugalReviewed by:

Maria Oliveira, Polytechnic Institute of Porto, PortugalManuel Tender, Instituto Superior de Engenharia do Porto (ISEP), Portugal

Copyright © 2024 West, Evangelista, Siddhpura and Haddad. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Jye West, anllLndlc3RAZ21haWwuY29t

Jye West

Jye West Ana Evangelista

Ana Evangelista Milind Siddhpura

Milind Siddhpura Assed Haddad

Assed Haddad