94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

PERSPECTIVE article

Front. Blockchain, 01 September 2022

Sec. Blockchain for Good

Volume 5 - 2022 | https://doi.org/10.3389/fbloc.2022.965604

Crypto gaming guilds are an evolution of traditional gaming guilds, communities of players concentrated on mutual support. In the contrast to the scope of traditional guilds, crypto gaming guilds have been established as organizations focused on earning money. Crypto gaming guilds concentrate on players from developing countries, offering them a chance to earn income without the necessity to invest funds for playing play-to-earn games. The communication of these guilds is full of positive stories of people alleviated from poverty or raising through hierarchies of their guild. Yet this bright image has its dark side and crypto gaming guilds provide ample opportunities for criticism. While in the traditional gaming guilds players have a central role, in crypto gaming guilds they have become inferior compared to other stakeholders. The reason is that new stakeholder groups, investors and game studios, have risen to prominence as they bring in money to the guild. Given the fact that players often come from developing countries with low wages, this situation creates a potential for their exploitation. Yet even without exploitation, the content of their new jobs has characteristics very similar to infamous “bullshit jobs”, pointless and unnecessary employment. It remains open whether crypto gaming guilds will fulfill their publicly communicated promises or turn evil in the future. However, in both cases, they will face their dark side. And they will either overcome it or embrace it.

“It is just a clear tangible way in which crypto is improving people’s lives… we are thrilled to be involved…”—Arianna Simpson on investing in a crypto gaming guild Yield Guild Games, a16z (venture capital firm Andreessen Horowitz; Bankless, 2021).

Within a few years, the crypto world has revolutionized numerous fields. Recently, it started to influence the gaming industry, the more-than-$200 billion market (Fortune Business Insights, 2020). One of the innovations the crypto brought there is a “play-to-earn” (P2E) business model. The P2E model turns over the financial logic of gaming: Instead of having players paying developers to access the game, players are now paid to play it.

The emergence of the P2E model led to the establishment of a large number of crypto gaming guilds. These are organizations that collect in-game assets and lend them to players to earn income by playing the games. The P2E jobs have attracted tens of thousands of players, often from developing countries. These players, as the guilds like to communicate (e.g., Yield Guild Games, 2022a), collectively earn millions of dollars.

The crypto gaming guilds often highlight opportunities they provide to poor communities in developing countries (e.g., Shin 2021; Avocado Guild 2022a). However, they less often point out how good business it is for them when taking a cut of, for example, 30% of the player’s earnings (Yield Guild Games, 2021a). Moreover, for many players earning in this way, gaming may lose its joy and become just a “bullshit job” (Graeber, 2018; Butler, 2021).

In this commentary, I shed some light on the dark side of crypto gaming guilds. I believe that ethical issues that lie in the background deserve to be acknowledged by the guilds and the society—both for the benefit of players and the guilds.

Crypto gaming guilds represent a new phenomenon even in the fast-moving crypto world. They first emerged in 2020, with Yield Guild Games serving as an exemplar (Yield Guild Games, 2022c). Crypto gaming guilds build on top of traditional gaming guilds, communities of players sharing common objectives and providing mutual support, which emerged in the late 1990s with the advent of multiplayer online games (BeInCrypto, 2022). At this time, guilds focused almost exclusively on their players as these represented their members as well as their “raison d’être”. However, this changed with crypto gaming guilds that focus more on earning, rather than gaming, opportunities for their players. While the community aspect remains important, crypto gaming guilds are primarily job providers and investment vehicles.

The history of crypto gaming guilds is tied to Axie Infinity, the first globally successful P2E game (John, 2021b). The game lets players breed little digital monsters called Axies and test their strengths in battles with other players. With the spread of the Covid-19 pandemic, Axie Infinity became a source of income for some communities in developing countries, especially in the Philippines (Callon-Butler, 2020). There were two main sources of income in the game. The first came from battles, in which winners were rewarded a small number of crypto tokens by the game. The second, and more lucrative one, was breeding Axies and selling them to other players. To breed an Axie, a player needed to combine two Axies and spend some crypto tokens. The number of crypto tokens to be spent increased exponentially with a number of times given Axies were previously used for breeding. The demand for newly-bred Axies was driven mainly by new players as a new player first needed to buy Axies to play a game and earn tokens. The game attracted a lot of attention and that caused the entry costs to skyrocket, reaching more than $1.000 to be invested to buy a team of Axies and play the game (John, 2021b). This caused a critique of the game being an example of a Ponzi Scheme, in which new players fund the earnings of current players (Perkmann, 2021). The problem is that the P2E aspect of the game requires a constant inflow of new money, both for buying the Axies and through it creating demand for crypto tokens.

Unsurprisingly, the entry costs were too high for aspiring earners from developing countries. That created an opportunity for a so-called “scholarship” profit-sharing model. In this model, Axie owners lend their monsters to new players-scholars in exchange for part of the earnings players-scholars make from playing (Callon-Butler, 2020).

Crypto gaming guilds apply the scholarship model on a large scale. Yield Guild Games, the first-mover in the industry, attracted millions of dollars in seed funding in a few months, including well-known venture capital firms such as a16z (formerly Andreessen Horowitz; Yield Guild Games, 2022d). With all the funding and the rapid growth of the P2E industry, Yield Guild Games was able to harness $824 million in assets by the end of 2021. A large part of them is in the form of various in-game assets, such as those representing individual Axies. At the same moment, these assets were lent to more than 10,000 players-scholars who were part of the guild.

The success of Yield Guild Games attracted new entrants to the crypto gaming guild industry. At the same time, potential profits raised the interest of investors in funding crypto gaming guild ventures. For example, a guild Merit Circle raised over $100 million in its 2021s launch (Merit Circle, 2021a). On the same note, Avocado Guild raised $45 million and attracted more than 10,000 players at the end of 2021 (iNEWS, 2021; Avocado Guild, 2022b).

Traditional gaming guilds, which have been established in online multiplayer games since the late 1990s, have been a form of players’ communities (BeInCrypto, 2022). The primary reason for participation in guilds was the mutual support of players in reaching game objectives, and socialization. Gaming guilds primarily served the purpose of enhancing the gaming experience. However, as some games have had in-game assets that could be unofficially traded and turned into real money, the primary motivation has partially changed over time. In some countries, especially with low labor costs and weak institutions, there were several instances in which guilds deviated from the original idea. For example, there are stories of prisoners being forced to play online games to earn in-game assets (Vincent, 2011). Similarly, some guilds used their members to provide low-cost in-game customer support to other players in exchange for money from game studios (Zhang and Fung, 2014).

The history of guilds is not short of negative excesses and exploitation of players. Still, these activities were largely constrained with game studios frequently prohibiting secondary economies that involve trading in-game assets for money (e.g., Blizzard Entertainment, 2008). The P2E business model removes the constraints. In contrast, it directly involves game studios in the trading process and incentivizes them to support these secondary economies. To support them, the P2E model provides straightforward clearing mechanisms built in the game and allows simple transfer from in-game assets (tokens) to money. Therefore, it would be surprising not to see the excesses encountered in the era of traditional gaming guilds repeated by crypto gaming guilds in the future. In fact, crypto gaming guilds already frequently collaborate with game studios, for example, by sending their players to provide alpha testing of games in exchange for receiving in-game assets and early insight into games (e.g., Merit Circle, 2022). The issue is that in such cases the value players generate for their guilds is not clear. Alpha versions of games are not available to the public and thus lack established economies that would provide information on this value. Therefore, the earnings players get for their work do not likely reflect its value.

Potential exploitation of players is a decision that is controlled by the guild. However, another aspect of the dark side, the specific content of players-scholars’ jobs, is a different story. First of all, it is important to note that while we are speaking of games, players-scholars do not think of them as sources of fun or learning. Instead, they see them as a source of income. Take, for example, two interviews with Yield Guild Game scholars (Yield Guild Games, 2022a; Yield Guild Games, 2022b). In them the game is mentioned only as a means of earning money. The focus is mainly on the opportunities the job brought for future entrepreneurial activities of scholars and improving their livelihood. This is certainly a bright side of the story. On the other hand, it should not hide the actual content of the job: Players spend hours and hours generating in-game assets (new Axies in the case discussed) that others can buy from them to be able to play or speed up their progress. The value they get from the game does not come from fun or learning, but from the money they receive. In this sense, the P2E model is an evolution of the free-to-play model in which games are available for free and studios make up their living by selling value-added services, additional product features, or in-game assets (Shi et al., 2015). However, instead of a game studio directly selling these additional packages, they are sold by players who receive them in exchange for the time (with a studio making revenues in the background). Note that players spend their time creating things that can be generated instantly and without any costs by game studios with a change in the game code. This creates an interesting economic paradox: A new business model (P2E) creates new variable costs (players’ time used to generate assets to be sold) that are not present in previous business models (including free-to-play, but also others) without decreasing any other costs.

With this job being completely unnecessary (as it may be perfectly substituted by a change in the code by a game studio), it is an exemplar of what Graeber (2018) calls a “bullshit job”. A bullshit job (Graeber, 2018) is “… a form of paid employment that is so completely pointless, unnecessary, or pernicious that even the employee cannot justify its existence …” Note that when Graeber speaks of justifying the existence of a job, he does not speak about monetary rewards but the meaning of a job. Butler (2021) follows this line of argument saying that: “Ultimately, in-game labour is just a re-branding of gameplay designed to be dull enough that rich players will pay to outsource it to poor players. … Floors don’t have to be swept in the metaverse unless they’re designed to need sweeping.” In this quote, he points out that the P2E game needs to have purposively designed boring parts that would encourage some (richer) players to outsource it to others. Despite all the enthusiastic communication of the crypto gaming guilds of revolutionizing games and work (e.g., Shin 2021; Avocado Guild 2022a), they are crippling both—by taking the fun out of games for all players and meaningful contributions out of work. While the quote of Arianna Simpson (Bankless, 2021) at the beginning of this opinion piece well illustrates the expectation of the positive futures the crypto will bring to the world, crypto gaming guilds are making them rather dystopian.

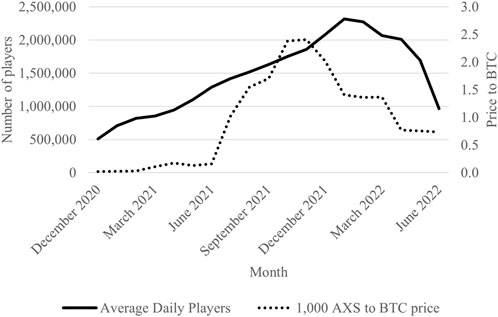

Using the P2E model for a game ties its popularity to monetary rewards. The joy of gaming becomes secondary. This is evident in Figure 1, illustrating the evolution of Axie Infinity. When the price of one of the game tokens, AXS, started to fall (relative to bitcoin, BTC), the number of players quickly decreased. Over the period from the end of 2020 until the half of 2022, the correlation between price and number of players stood at a very strong value of 0.76. Note that in a situation of decreasing token price, the price to enter the game (to buy a team of Axies) decreases. In case the game would be played for fun, we should see an increase in players as the entrance costs became less prohibitive. However, this was not happening. Without new players that must buy their Axies to play a game (see the description of the game’s mechanics above), the main source of income for current players vanished. At this moment, it is important to note that players at the peak of the game’s popularity (especially the second half of 2021) participated in an environment in which their income, in dollar terms, rapidly grew over time with the increasing price of game’s crypto tokens (Figure 1). Without a prospect of future growth of income and ultimately its rapid decrease, there was no reason to play the game for players looking for earnings, which meant that they left the game or not even started playing it. Thus, it seems that monetary motivation was the factor behind keeping players active and attracting newcomers. The economy of the game and players’ interest in it largely worked only until the money was flowing in, supporting its accusation to be a Ponzi scheme (Perkmann, 2021).

FIGURE 1. The relationship between the price of AXS token and the average number of players of Axie Infinity.

The P2E model is in the early stage of development and subject to the volatility of players’ interest in individual games, earnings highly fluctuate (Merit Circle, 2022). For example, the price of the SLP token, another token in Axie Infinity, ranged between $0.009 and $0.041 only over February 2022 (CoinMarketCap, 2022), which is a 450% difference. This makes earnings for a player-scholar unstable and hard to predict. With crypto gaming guilds taking a cut of scholar’s earnings instead of providing a stable income, a large portion of earning risk remains with the player-scholar. As crypto gaming guilds usually focus on multiple games, they may solve the issue with low earnings by “transferring” players-scholars to more profitable games. Nevertheless, this practice can only partially mitigate a high uncertainty in players’ earnings that is present even over relatively short time periods. Moreover, players-scholars may be transferred to games they enjoy even less and in which they do activities that are even more pointless.

As evident from the above text, crypto gaming guilds have three main groups of stakeholders: game studios, investors, and players (John, 2021a). Players no longer have a central role among them. For example, the whitepaper of Yield Guild Games (Yield Guild Games, 2021b) emphasizes benefits for investors and games (game studios). Whitepaper’s subtitle “Seeking yield across the metaverse” is also telling in who has the upper hand among its stakeholders. The fact that crypto gaming guilds also distribute a portion of their governance tokens among scholars can hardly change the balance back to the state of traditional gaming guilds.

While the P2E model in games may not be as aggressive as illustrated above, crypto gaming guilds are not incentivized to seek and support less aggressive games. Their goal is not to find joy for their players-scholars but for jobs.

On a larger scale, the issue of appropriation of generated revenues may provide a blow to the narrative of enriching poor communities in developing countries (Shin, 2021; Avocado Guild, 2022a). Revenues for guilds are generated mainly through players leveraging their time using the guild’s assets. These assets are bought using money from investors that subsequently share part of the revenues. As at least a significant part of investors come from developed countries (in the case of Yield Guild Games most of its venture capital come from firms from these countries, Yield Guild Games, 2022d), one can ask whether crypto guilds does not serve as a tool of neocolonialism (e.g., Rao, 2000) that continues to extract resources from the developing world.

In this commentary, I pointed out several ethical issues of crypto gaming guilds. Their dark side is represented by their deviation from the original idea of players’ communities to organizations in which players represent a mere workforce. Moreover, characteristics of P2E jobs are very close to those of “bullshit jobs” by offering pointless and unnecessary work. What is worse, since the guilds focus on developing countries with low wages, the players could be easily exploited.

One should acknowledge that the P2E model is still in its infancy with Axie Infinity starting in 2018 and gaining significant traction 2 years later (John, 2021b). The game studio behind Axie Infinity recently made the game more accessible for starting players (Takahashi, 2022). The P2E will certainly continue to evolve.

In contrast to the criticism of the dark side of crypto gaming guilds raised above, one can see the positives they bring. They certainly provide room for (at least some) players-scholars to earn their living and improve their situation (Shin, 2021; Yield Guild Games, 2022a; Yield Guild Games, 2022b). Some of players-scholars get a chance to build their network as managers of scholars. Many guilds also distribute part of the ownership to scholars (e.g., Yield Guild Games, 2021b), which is a common policy in the crypto-world. Guilds generally support players in learning the game in the tradition of gaming guilds as players’ communities (BeInCrypto, 2022) and developing other skills like communication or crypto-world literacy (Shin, 2021; Avocado Guild, 2022a). Both could be valuable in players-scholars’ future careers. On a similar note, in December 2021, several guilds raised money to support the typhoon-struck Philippines (e.g., Merit Circle, 2021b; Yield Guild Games, 2022b), from which a large number of their players-scholars come.

However, do crypto gaming guilds improve people’s lives as it was quoted at the beginning of this commentary? At least in some cases, they indisputably do. Yet do the bright side prevail over the dark one? And is this a way we like to see for getting people jobs in which they can find self-fulfillment? That remains to be answered in coming years with the evolution of the play-to-earn model and the crypto gaming guilds themselves.

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

The author confirms being the sole contributor of this work and has approved it for publication.

The research is supported by the Masaryk University research project MUNI/A/1447/2021 Organizations and challenges of a discontinuous world. The author thanks the editor, the reviewers, and his colleague Mikhail Monashev for invaluable feedback on this perspective.

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Avocado Guild (2022a). Avocado guild, dive into the PlayToEarn metaverse. Join Our Discord Now. Avocado Guild. Available at: https://avocadoguild.com/(Accessed March 14, 2022).

Avocado Guild (2022b). The avocadian: Issue 3. Available at: https://heyzine.com/flip-book/cc1e395774.html.

Bankless (2021). 85 - the crypto gaming revolution | Arianna Simpson. Available at: http://podcast.banklesshq.com/85-the-crypto-gaming-revolution-arianna-simpson.

BeInCrypto (2022). GameFi guilds: Why millions are invested in them. BeInCrypto. Available at: https://beincrypto.com/gamefi-guilds-why-millions-are-invested-in-them/(Accessed February 27, 2022).

Blizzard Entertainment (2008). WoW -> support -> gold buying. World of Warcraft. Available at: https://web.archive.org/web/20080225153350/http://www.worldofwarcraft.com/info/basics/antigold.html (Accessed February 27, 2022).

Butler, P. (2021). Play-to-earn” and bullshit jobs. Paul Butler.org. Available at: https://paulbutler.org/2021/play-to-earn-and-bullshit-jobs/(Accessed February 14, 2022).

Callon-Butler, L. (2020). The NFT game that makes cents for Filipinos during COVID. CoinDesk. Available at: https://www.coindesk.com/markets/2020/08/26/the-nft-game-that-makes-cents-for-filipinos-during-covid/(Accessed February 27, 2022).

CoinMarketCap (2022). Smooth Love Potion price today, SLP to USD live, marketcap and chart. CoinMarketCap. Available at: https://coinmarketcap.com/currencies/smooth-love-potion/(Accessed March 11, 2022).

Fortune Business Insights (2020). Gaming market size, share, growth. Fortune Business Insights. Available at: https://www.fortunebusinessinsights.com/gaming-market-105730 (Accessed March 11, 2022).

iNEWS (2021). A comprehensive interpretation of Avocado Guild, what is the difference between the chain game guild that creates the largest amount of financing? iNEWS. Available at: https://inf.news/en/economy/9ada9a3e82973d8626ff792b5fd8d502.html (Accessed March 14, 2022).

John, J. (2021a). How YGG is changing gaming. Decentralised.co. Available at: https://www.decentralised.co/how-ygg-is-changing-gaming/(Accessed February 27, 2022).

John, J. (2021b). To infinity and beyond. Decentralised.co. Available at: https://www.decentralised.co/to-infinity-and-beyond/(Accessed February 27, 2022).

Merit Circle (2022). 7 - treasury report march 2022. Merit Circle’s Newsletter. Available at: https://meritcircle.substack.com/p/7-treasury-report-march-2022 (Accessed March 11, 2022).

Merit Circle (2021a). Looking back at 2021: The year of play-to-earn. Medium. Available at: https://medium.com/@meritcircle/looking-back-at-2021-the-year-of-play-to-earn-f8fefadfeb4c (Accessed February 27, 2022).

Merit Circle (2021b). Merit Circle on twitter. Twitter. Available at: https://twitter.com/MeritCircle_IO/status/1471869547435241478 (Accessed March 7, 2022).

Perkmann, M. (2021). Axie infinity: Gaming NFT revolution or Ponzi scheme? Coinmonks. Available at: https://medium.com/coinmonks/axie-infinity-gaming-nft-revolution-or-ponzi-scheme-3d81b1647429 (Accessed February 27, 2022).

Rao, N. (2000). “Neocolonialism” or “globalization”?: Postcolonial theory and the demands of political economy. Interdisciplinary literary studies, 1 (2 (Spring 2000)), 165–184.

Shi, S. W., Xia, M., and Huang, Y. (2015). From minnows to whales: An empirical study of purchase behavior in freemium social games. Int. J. Electron. Commer. 20, 177–207. doi:10.1080/10864415.2016.1087820

Shin, L. (2021). How yield guild games is revolutionizing the future of work and investment. Unchained Podcast. Available at: https://unchainedpodcast.com/how-yield-guild-games-is-revolutionizing-the-future-of-work-and-investment/(Accessed February 14, 2022).

Takahashi, D. (2022). Sky mavis soft launches Axie infinity: Origin as a free-to-play title. VentureBeat. Available at: https://venturebeat.com/2022/04/06/sky-mavis-soft-launches-axie-infinity-origin-as-a-free-to-play-title/(Accessed July 22, 2022).

Vincent, D. (2011). China used prisoners in lucrative internet gaming work. The Guardian. Available at: https://www.theguardian.com/world/2011/may/25/china-prisoners-internet-gaming-scam (Accessed February 14, 2022).

Yield Guild Games (2022a). Scholar stories episode 01: Maverick. Available at: https://www.youtube.com/watch?v=eGX5_hj7Npw (Accessed July 22, 2022).

Yield Guild Games (2022b). Scholar stories episode 02: Vin. Available at: https://www.youtube.com/watch?v=vF2Dh1Jdc8g (Accessed July 22, 2022).

Yield Guild Games (2022d). YGG pilipinas: Typhoon odette PH relief efforts updates. Yield Guild Games. Available at: https://yieldguild.medium.com/ygg-pilipinas-typhoon-odette-ph-relief-efforts-updates-58deaade7b61 (Accessed March 7, 2022).

Yield Guild Games (2022c). YGG: 2021 Year end retrospective. Yield Guild Games. Available at: https://medium.com/yield-guild-games/ygg-2021-year-end-retrospective-5957dcafc212 (Accessed February 14, 2022).

Yield Guild Games (2021a). Yield guild explains: Play-to-Earn and scholarships. Yield Guild Games. Available at: https://medium.com/yield-guild-games/yield-guild-explains-play-to-earn-and-scholarships-bb1e097c2a61 (Accessed February 14, 2022).

Yield Guild Games (2021b). Yield guild games: Whitepaper. Available at: https://yieldguild.io/YGG-Whitepaper-English.pdf.

Keywords: crypto gaming guilds, play-to-earn games, ethical issues, developing countries, bullshit jobs

Citation: Jirásek M (2022) The dark side of crypto gaming guilds. Front. Blockchain 5:965604. doi: 10.3389/fbloc.2022.965604

Received: 09 June 2022; Accepted: 10 August 2022;

Published: 01 September 2022.

Edited by:

Leanne Ussher, Copenhagen Business School, DenmarkReviewed by:

Laura Ebert, State University of New York at New Paltz, United StatesCopyright © 2022 Jirásek. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Michal Jirásek, bWlqaXJhc2VrQG1haWwubXVuaS5jeg==

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.