- 1Department of Environmental Science and Policy, George Mason University, Fairfax, VA, United States

- 2Department of Geography, Planning and Environment, Institute for Management Research, Radboud University, Nijmegen, Netherlands

Information and communication technology (ICT) plays a critical role in environmental governance; however, research into power in governance has not focused on the impact of ICT. In this study, we analyze the use of blockchain in a voluntary carbon offset market using the “Four Faces of Power” (compulsory, institutional, structural, and productive) conceptual framework to determine how ICT can change the power dynamics within a network of stakeholders. Proponents have proposed that blockchain technology can solve several issues that carbon marketplaces and offsets face, such as cybersecurity, traceability, and financial liquidity. Despite these proposals, there is little scholarship on existing cases using blockchain in carbon offsets. We found that the use of blockchain technology by the company Veridium changed the compulsory and institutional power dynamics within the network of stakeholders it was a member of. Veridium’s choice to use blockchain technology was likely the result of structural and productive power dynamics surrounding the technology at the time. The power dynamics changed because the use of blockchain for Veridium’s carbon offset market caused additional stakeholders to join the network of stakeholders. The new stakeholders held greater compulsory and institutional power than Veridium. This research contributes to the limited scholarship focused on ICT and power in environmental governance. Empirically it contributes to the ongoing discussion around the possibilities of blockchain technology for climate policy.

Introduction

The use of technology in governance has been a growing interest for governance scholars over the last 30 years. As the application of information and communication technology (ICT) proliferates - not only in number but in variety - questions about its role and impacts on governance may only become more critical. These questions are particularly pertinent for environmental governance. Environmental governance can be defined as the processes, institutions, and practices that determine how individual behavior or collective actions manage socio-ecological systems (Mol, 2009; Bennett and Satterfield, 2018). The utilization of ICT for gathering data and interpreting environmental conditions is central to our understanding and response to many environmental concerns such as climate change (Ascui et al., 2018; Gabrys, 2019). The role of ICT in environmental governance led to research on informational governance and its meaning for environmental governance (Mol, 2006). Recent examinations of ICT1 in environmental governance have studied the roles of environmental sensing technology and what the growth of “smart cities” could mean for society (Gabrys, 2020; Löfgren and Webster, 2020). ICT use - not just in governance but in society at large - has captured the interest of critical theorists (Iliadis and Russo, 2016; Feenberg, 2017). Critical theorists interested in technology and questions around the use of big data in society have focused on how ICT may change power dynamics in society (Iliadis and Russo, 2016; Feenberg, 2017). Some have gone as far as to suggest that data, and the ability to use it, has become a form of power (Kitchin and Lauriault, 2014; Iliadis and Russo, 2016). While power is an often-discussed topic in governance literature, how ICT may change power dynamics is not. We aim to understand how ICT choice can change the power dynamics between stakeholders within a network of stakeholders. We used a case study approach to analyze the integration of cutting-edge technology as part of an effort to address climate change. For our case study, we analyzed the use of blockchain technology by the company Veridium for carbon offsets.

The emission of greenhouse gases (GHGs) and the destruction of natural carbon sinks drive anthropogenic climate change (Masson-Delmotte et al., 2021). One of the instruments used in climate governance to address climate change has been carbon offsets (Lansing, 2013). Carbon offsets, which represent activities that reduce GHGs in the atmosphere, are typically purchased to offset activities that emit GHGs (van Kooten and Johnston, 2016; Günther et al., 2020). Carbon offsets are often utilized in carbon markets to combat climate change (White et al., 2018; Collins, 2019; Hartmann and Thomas, 2020). Carbon offsets through programs such as REDD + can be produced as commodities to be bought and sold in financial markets (van Kooten and Johnston, 2016; Veridium, 2017a). REDD + stands for: Reducing Emissions from Deforestation and forest Degradation in developing countries (UNFCCC, 2010). REDD+ is a carbon offset and economic development program established by the United Nations Framework Convention on Climate Change to protect forests (UNFCCC, 2010). Forests are carbon sinks, and thus many carbon offset programs are built around their protection and expansion (UNFCCC, 2010; van Kooten and Johnston, 2016; Masson-Delmotte et al., 2021). REDD + projects create financial incentives to reduce deforestation by producing carbon offsets (Visseren-Hamakers et al., 2012; UNFCCC Secretariat, 2016; Sheng et al., 2019). While simple enough conceptually, carbon offsets as a governance instrument struggle during implementation. Offset production is plagued by concerns due to differences quality, difficulty in transfering of ownership, monitoring, reporting, limited financial liquidity (they are not easily converted into cash) and verification; with carbon markets themsleves vulnerable to financial fraud (Brunnermeier and Pedersen, 2009; Nellemann, 2012; Interpol Environmental Crime Program, 2013; Funk, 2015; Brohé, 2016; Ellis and Hubbard, 2018; Ochieng et al., 2018; Shelley, 2018; Thomason et al., 2018; Blaufelder et al., 2021). These issues contribute to decreased interest in financial markets for carbon offsets (Blaufelder et al., 2021). The founders of Infinite Earth, a carbon offset company privy to the multitude of problems within the voluntary carbon offsets, saw an opportunity.

Infinite Earth is a carbon offset company that successfully launched the largest for-profit REDD + project in the world: the Rimba Raya Project in Borneo (Indriatmoko et al., 2014; Infinite Earth, 2014). In the mid-2010s, the founders launched a new company: Veridium (Veridium, 2020a, 2017b; Infinite Earth, 2020). Veridium would seek to harness blockchain technology1 to establish a premier marketplace for carbon offsets and other environmental assets2 (Veridium, 2017b; Prisco, 2018). This work contributes to existing scholarship studying Infinite Earth’s work on the Rimba Raya preserve in Indonesia (Indriatmoko et al., 2014).

A blockchain is a database that maintains data over a distributed network of computers (Anascavage and Davis, 2018; Prisco, 2018). Blockchains can maintain greater cybersecurity than a traditional centralized database and enable simultaneous transactions between individuals without the assistance of a third party (Anascavage and Davis, 2018; Prisco, 2018). Some proponents have suggested that blockchain could be used to replace many of the functions performed by governments (Wright and De Filippi, 2015; Golumbia, 2016). To describe them using the parlance of governance literature, blockchains are digitized and automated institutions. Blockchains are sets of digitized rules (institutions) that can self-execute with minimal need for human action. With that, they have agency and they may contribute to the debate over structure and agency (Giddens, 1979; Baber, 1991; Falkheimer, 2018). In this way, blockchains can act as an automated third party to a transaction. Their best-known use is for tracking the ownership of digital assets such as cryptocurrencies (Anascavage and Davis, 2018; Prisco, 2018).

A digital asset is an asset issued or transferred using distributed blockchain technology (SEC, 2021a). Digital assets include “virtual currencies,” “coins,” and “tokens” (SEC, 2021a). Bitcoin, a popular cryptocurrency, by 2017 had risen in value from a few dollars to thousands of dollars per unit (Coin Desk, 2019; Jimenez, 2019). The growth in Bitcoin’s value generated significant interest and investment in firms proposing to use blockchain for other purposes such as supply chain management and finance (Kouhizadeh and Sarkis, 2018; Gartner, 2019; Jimenez, 2019; Nassiry, 2019). There have been proposals for blockchain to automate legal contracts and even multilateral agreements (Wright and De Filippi, 2015; Robey, 2017) Technologists repeatedly propose blockchain to solve issues facing carbon offsets (Veridium, 2017b; Thomason et al., 2018).

Blockchain’s proposed application to carbon offsets comes from its success in the management of digital assets. These digital assets, such as the aforementioned Bitcoin, could be used to symbolize carbon offsets. Veridium intended to solve the bureaucratic challenge of carbon offset markets by purchasing and producing offsets verified by existing carbon registries and enabling customers to purchase representative tokens. Veridium would hold the formal legal ownership of the offsets (Interviewee 1; The Blockchain Show, 2018; VERRA, 2019). The carbon registry VERRA would have managed Veridium’s carbon offsets (Interviewee 1; The Blockchain Show, 2018; VERRA, 2019). The tokens could then be bought and sold among other customers who could redeem the token for the original offset (Interviewee 1; The Blockchain Show, 2018; VERRA, 2019). Veridium’s use of digital assets could solve the financial liquidity issues faced by carbon offsets and address security concerns (Veridium, 2017b; Mansfield-Devine, 2017; Ellis and Hubbard, 2018; Prisco, 2018; Thomason et al., 2018). Blockchain’s potential use for carbon offsets has been a subject of discussion within academic literature. Howson has taken a critical view of this, even indicating it may be contributing to crypto-colonialism3 of developing countries (Howson, 2020, 2019). Previous research on blockchain initiatives have found a focus on using the technology for commodification and embracing neoliberal governance (Stuit et al., 2022). In environmental policy, commodification isolates individual portions of complex systems so they may be economically valued for use in markets (Corbera, 2012). Carbon offsets are an example of such aa commodity (Stuit et al., 2022).

Blockchain’s potential to digitize and automate institutions could be significant for environmental governance processes, institutions, and practices. Blockchain technology itself has been of interest to academic scholars (Wright and De Filippi, 2015; Thomason et al., 2018; Andoni et al., 2019; Casino et al., 2019). However, most scholarship has focused on hypothetical applications instead of actual implementation (Wright and De Filippi, 2015; Thomason et al., 2018; Andoni et al., 2019; Casino et al., 2019). While carbon offsets have existed for decades, Veridium stands out from other providers because of its adoption of blockchain. This case study allowed us to examine how ICT can impact power dynamics and analyze a deployment of blockchain outside of cryptocurrency. We applied the “Four Faces of Power” typology to analyze institutional, compulsory, productive, and structural power within the network of stakeholders and institutions that made up Veridium’s network of stakeholders.

Theoretical and conceptual framework

As discussed in the above, environmental governance refers to the processes, institutions, and practices that determine how socio-ecological systems are managed. The study of informational governance analyzes how ICT’s' generation, processing, transmission, and utilization of information changes the processes, institutions, and practices within environmental governance (Mol, 2006). These processes, institutions, and practices impact and are developed and executed by stakeholders (Klijn, 2008; Klijn and Koppenjan, 2012; Biermann et al., 2019). The decisions during the development and implementation of environmental governance typically reflect the power dynamics at play (Torfing, 2010; Kuindersma et al., 2012).

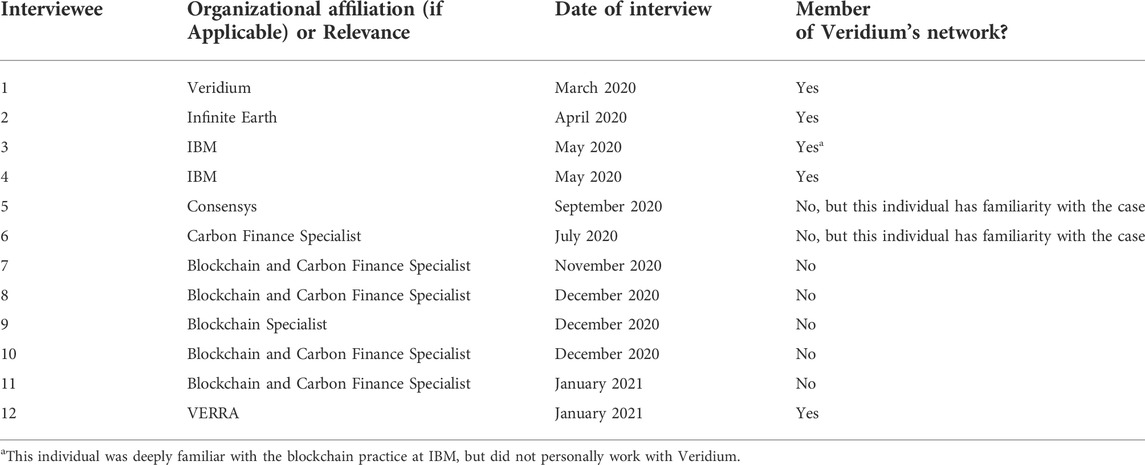

Many assume that power is domination, typically through control of material resources (Kuindersma et al., 2012). In actuality, “power as domination” only reflects a small portion of contemporary power literature (Kuindersma et al., 2012). The exact definition of power is an area of intense and ongoing scholarly debate (Clegg, 1989; Barnett and Duvall, 2005; Allen, 2009; Kuindersma et al., 2012). Different definitions of power are influenced by their authors’ epistemological, ontological, and theoretical perspectives (Barnett and Duvall, 2005). Recognizing this, some scholars interested in power have argued that approaching power from different perspectives provides more utility (Barnett and Duvall, 2005; Kuindersma et al., 2012). This approach to understanding power has led to viewing power in terms of “multiple faces.” From this, Barnett and Duvall, 2005 developed a typology that defines power by the pathway in which it flows and the relational specificity between the stakeholders it is acting upon (see Figure 1).

FIGURE 1. Taxonomy of power (Barnett and Duvall, 2005 pg. 48).

The first distinction between concepts of power is identified by whether power works through the interactions of specific stakeholders or the social relations that produced those stakeholders (Barnett and Duvall, 2005; Haugaard, 2018). Power as interactions treats social relations as comprised of the actions of pre-constituted social stakeholders towards one another (treating power as an attribute that a stakeholder may possess) (Barnett and Duvall, 2005). Power as constitution works through social relations that analytically precede the social or subjective positions of stakeholders and constitute them as social beings with their respective capacities and interests; reflecting how particular social relations are responsible for producing certain kinds of stakeholders (Barnett and Duvall, 2005).

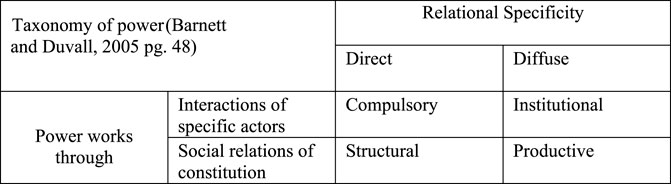

The second distinction is whether power is exercised through direct or diffuse social relations (Barnett and Duvall, 2005). When power works through direct social relations, there is an immediate, direct, and specific relationship between two stakeholders (Barnett and Duvall, 2005). The power that works through diffuse social relations occurs when connections are detached and mediate, or operate at a physical, temporal, or social distance (Foucault and Gordon, 1980). Table 1 contains a list of interviewees. This typology is called the “Four Faces of Power.” This framework has previously been employed in environmental governance research but has not seen wide application in informational governance discussions (Torfing, 2010; Kuindersma et al., 2012). This conceptual framework is applied to understand the power dynamics within Veridium’s network of stakeholders.

Using this framework, we classify power as institutional, compulsive, productive, or structural (Barnett and Duvall, 2005). Institutions are sets of rules, and in turn, institutional power is the ability of a stakeholder to shape other stakeholders’ decision-making by influencing those rules (Barnett and Duvall, 2005). Institutional power is operationalized by asking how institutions mediate between one actor and another and whether they are biased in those mediations (Kuindersma et al., 2012). Compulsory power is the intentional or unintentional direct control of one stakeholder by another through the deployment of resources (Dahl, 1957; Barnett and Duvall, 2005; Lukes, 2015). The concept of compulsory power is operationalized by asking which stakeholders have control over what resources and who “wins” in decision-making (Kuindersma et al., 2012). Productive power controls who and what influences relevant discourses (Barnett and Duvall, 2005; Kuindersma et al., 2012; Jenkins and Lukes, 2017). We operationalize the concept of productive power by asking: what are the relevant discourses and what kinds of new subjects and identities are produced by these discourses (Kuindersma et al., 2012)? Structural power determines social capacities and interests and works through societal structures (Barnett and Duvall, 2005; Hayward, 2018). The concept of structural power is operationalized by asking: what are the structures exist and how are they shaping interactions (Kuindersma et al., 2012)? The “Four Faces of Power” framework takes a pragmatist perspective towards ontological, epistemological, and theoretical perspectives. Pragmatism is used to clarify concepts and hypotheses of inquiry by considering their practical considerations to dissolve ontological dispute (Legg and Hookway, 2019). Pragmatists do not commit to any one philosophical position so that they may utilize a diversity of methods to understand a given problem (Creswell, 2009; Moon and Blackman, 2014). Pragmatist epistemology utilizes an objectivist viewpoints while accepting subjectivist points of view, and taking an “anti-essentialist” position (Tashakkori and Teddlie, 1998 as cited in Visseren-Hamakers, 2018).

The compulsory and institutional power concepts are considered post-positivist (Clegg, 1989; Crotty, 1998). Post-positivism is an objectivist philosophical approach based on Popper’s logic of “falsification” (Popper, 2002; Moon and Blackman, 2014). Critical theory and poststructuralism conceptualize structural and productive power respectively (Clegg, 1989; Crotty, 1998). Critical theory is an interpretive theoretical lens focused on unequal relations of power (Feenberg, 2002; Kincheloe et al., 2011; Creswell and Poth, 2017). Critical theorists often turn their eyes towards societal structures such as colonialism and in turn structural power due to their interest in emancipatory research; with the stated aim of changing the social order under study through their research (Fay, 1987; Feenberg and Grimes, 2013; Moon and Blackman, 2014). As discussed later on, critical theorists have devoted a substantial amount of time to understanding and critiquing structural power dynamics surrounding technology. Poststructuralism claims that different languages and discourses divide the world and is often connected to Michel Foucault (Foucault and Gordon, 1980; Moon and Blackman, 2014). Research done from this philosophical perspective tend to ask what narrative structures are within a system, and in the context of power who these narrative structures serve (Kuindersma et al., 2012; Moon and Blackman, 2014).

Methods

We chose a case study approach to determine how the choice of ICT can change the power dynamics between stakeholders. The need to develop or test theory drives case study research (Yin, 2014). As discussed, the existing theoretical informational governance literature features a limited discussion around the role of ICT and power. Therefore, this case study contributes to building a greater understanding of the role that ICT play in power dynamics in informational governance.

We chose Veridium for this case study because it intends to use blockchain to implement its carbon offset market. The case also has potential for generalizability since multiple companies are attempting to build similar products (Murtaugh, 2019; Nori, 2021). Veridium was also a convenient choice for a case study due to the professional connections of the first author. The bounds of the case study are limited to the network of stakeholders and institutions deemed crucial to Veridium’s implementation of blockchain. We gathered data on Veridium and its network using a snowball sampling approach between January 2020 and January 2021.

The snowball sampling approach identifies sources of information through a previous source such as a previous interview or a document (Creswell and Poth, 2017). Snowball sampling is convenient for working with potentially hesitant subjects and identifying previously unknown individuals or stakeholders. Since subjects identified are referred by individuals they know, they are more likely to respond to requests for interviews. The sampling concludes when additional subjects begin to repeat ideas, and no new information is provided (Creswell and Poth, 2017). We used document analysis and interviews to identify stakeholders and understand their relationships. The documents analyzed and referenced in the bibliography included publicly available documents from each stakeholder, social media posts, podcasts, and a copy of the blockchain program that Veridium intended to use. The documents provided insight into the network structure and the relationships within, relevant discourses influencing the use of blockchain, and triangulated interviewees’ claims. Interviewees were contacted over the internet or by referral by another interviewee. We administered interviews using a semi-structured format, with efforts made to protect the confidentiality of interviewees. Table 1 contains a list of interviewees.

One of the difficulties that arose within the case study was the limited number of responses from potential interviewees. Many we contacted expressed hesitancy or referred us to higher-ranking representatives within their organization. Of the twelve interviewees, five were representatives of stakeholders within Veridium’s network of stakeholders. The remaining interviewees were subject matter experts on blockchain technology or voluntary carbon offset markets. The remaining interviewees worked at companies attempting to use blockchain for carbon offsets. The interviews that involved individuals not representative of stakeholders within Veridium’s network were used to triangulate the claims of other interviewees4.

Results and discussion

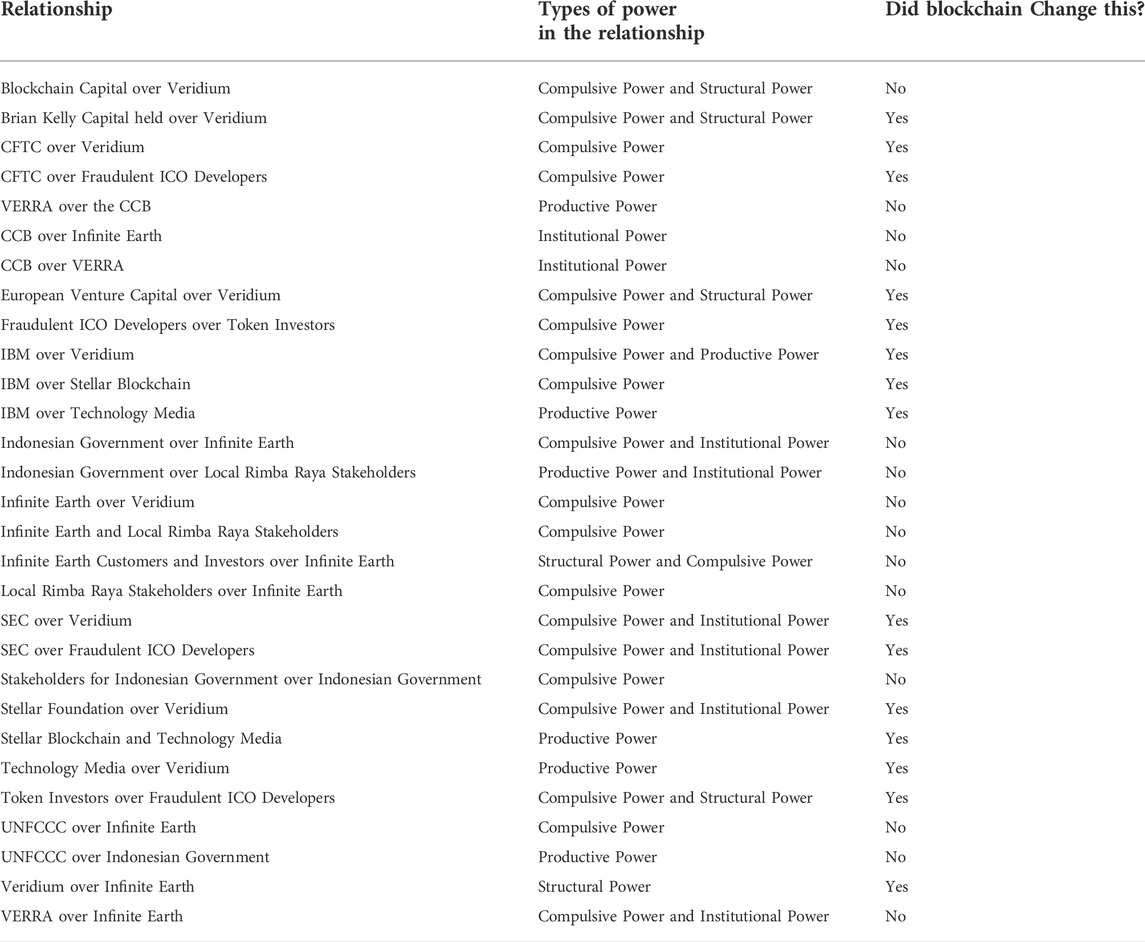

Veridium’s use of blockchain technology impacted the power dynamics within the network. The use of blockchain resulted in additional stakeholders being present within the network. These new stakeholders would not have been present had Veridium not chosen to use blockchain (see Table 2). These new stakeholders resulted in different power dynamics than would otherwise exist in a carbon offset market (see Table 3). The most important was the entrance of the American Securities and Exchange Commission (SEC), the Commodities Futures Trading Commission (CFTC), and the Code of Federal Regulations (CFR) of the United States into the network (interviewee 4). The activities of the SEC and CFTC to counter the use of blockchain for financial fraud impacted the compulsory and institutional power dynamics of Veridium’s network of stakeholders (CFTC, 2018a; Interviewee 1; Interviewee 4; SEC, 2020a). These impacts led to Veridium being unable to launch its carbon market (Interviewee 4). Veridium’s decision to use blockchain was likely due to the structural and productive power dynamics within the technology sector. Blockchain had caught the interest of libertarians, who saw it as a way to eliminate the role of government, as well as venture capitalists, who began investing in what they saw as a promising technology (Interviewee 4; Interviewee 5; Golumbia, 2016; Singh and Wolpert, 2018; Interviewee 4; Interviewee 5). Venture capitalists (VCs) would invest in blockchain startups and then work to influence the discourse around the technology to drive excitement and hopefully investment and adoption (Bair and Wolpert, 2019; Interviewee 5, Resnick and Jackson, 2018; Singh and Wolpert, 2018). Podcasts appeared to be a medium of choice for this purpose (Resnick and Jackson, 2018; Sustainable Jungle and Lemons, 2018; Wolpert and Koo, 2019). The activity of driving the excitement around blockchain technology had begun to influence discussions around its applications to climate change (Hull et al., 2021; Schulz and Feist, 2021).

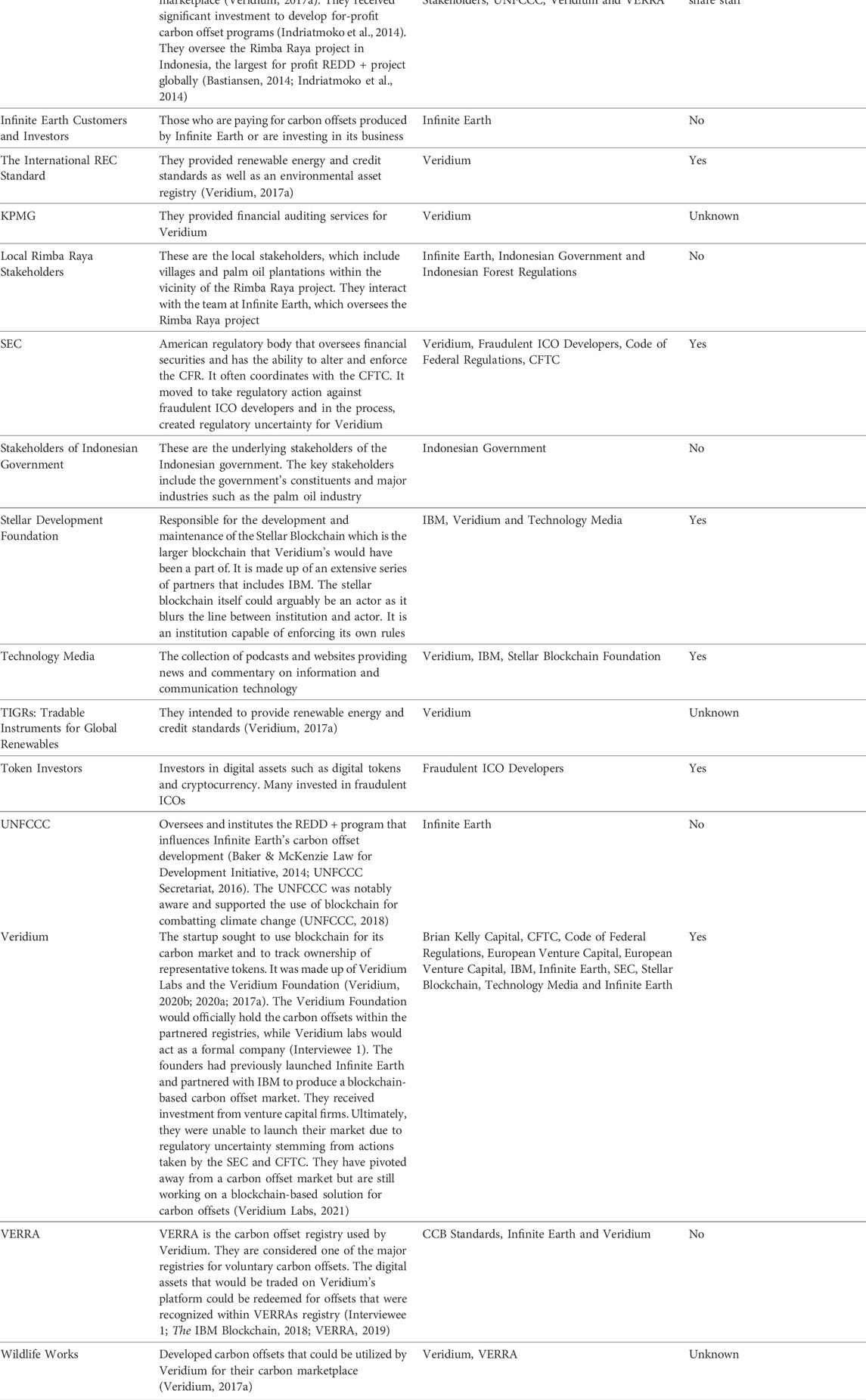

TABLE 2. List of stakeholders, role within the network, and their key relationships. Several are listed as partners in early documents. However, it is unclear if they were still involved at the time of data collection.7

TABLE 3. List of Key Relationships, who held power over whom and the type of power present Note: some of the stakeholders mentioned in Table 4 are not included here because they were not identified as being an active part of the network at the time research was performed.

Veridium was dependent on partnerships with stakeholders to access and manage carbon offsets, technological development, and capital. As mentioned, the same individuals who founded Infinite Earth founded Veridium. They primarily would rely on Infinite Earth and its network for the production of carbon offsets which could be bought and sold on their platform (Veridium, 2017a). VERRA was Veridium’s primary carbon registry (Interviewee 1; The Blockchain Show, 2018; VERRA, 2019). They would rely on IBM and the Stellar Foundation for technology development and to use their there blockchain technology respectively (Interviewee 1; Interviewee 4; Kaplinger, 2019; Miller, 2018; Prisco, 2018; The Blockchain Show, 2018). Several capital firms provided investment. Veridium and its partners were able to produce a viable carbon marketplace but could not launch it due to the SEC and CFTC (Interviewee 1; Interviewee 4; Kale, 2019).

The SEC and CFTC are the financial regulatory agencies with the power to change and enforce the CFR for the United States. The purpose of the SEC is to protect financial investors, facilitate capital formation, and maintain orderly and efficient markets by regulating financial products, including financial securities (SEC, 2020b). The CFTC focuses on regulating the American derivatives markets (CFTC, 2021). Their jurisdiction includes any financial marketplace that an American interacts with (United States of America, 2018). The CFR itself is the codification of regulations published by the United States Federal Government (U.S. Government Publishing Office, 2017). The CFTC and SEC had been monitoring developments in blockchain technology and attempted to keep the public aware of their decision-making processes (Busch and Gorfine, 2017; Busch and Van Valkenburgh, 2017; Commodities Future Trading Commission, 2017; SEC, 2017; Busch, 2018; Busch et al., 2018; Clayton, 2018; Targert et al., 2019). In 2017 digital assets acting as financial securities were determined by the SEC to be within their jurisdiction (SEC, 2017). The CFTC announced in 2014 that they would regulate cryptocurrency as commodities (Massad, 2014). American federal courts would also determine that digital assets fell under the jurisdiction of the CFTC (CFTC, 2018b). They provided multiple reports to the American legislature and had tried to leverage their productive power through public outreach through public hearings and podcasts as interest in blockchain technology grew (Massad, 2014; Clayton, 2018; Targert et al., 2019). The SEC and CFTC became alarmed at the use of blockchain for financial fraud.

The application of blockchain for creating, buying, and selling digital assets created an opportunity for fraudulent financial activities (SEC, 2020c, 2020a, 2017; Gerard, 2017; Weaver, 2018). Specifically, the use of fraudulent “Initial Coin Offerings” (ICOs) alarmed regulators. Companies utilized fraudulent ICOs to lure potential investors (Fridgen et al., 2018; SEC, 2020c). These ICOs were falsely portrayed as promising investments or used for illegal financial practices (Gerard, 2017; Weaver, 2018; SEC, 2020d, 2020a). Investors eager to take advantage of the rapid growth in the value of virtual currency would invest their money (Staff, 2021). Interviewee 5 noted that Maryland financial law enforcement had imparted to them that they had never actually witnessed an ICO that did not turn out to be fraudulent. Ireland has witnessed similar issues, with a news story claiming that as much as 81% of ICOs launched there were fraudulent (Krumina, 2018). As shown in Table 4, starting in 2017 the CFTC and then in 2018 the SEC both began to pursue action against FICOs (CFTC, 2018a; SEC, 2018). The CFTC would release a document clarifying jurisdictional differences with other regulatory bodies in 2020 (LabCFTC, 2020). As of 2021, rulemaking for digital assets is still ongoing (CFTC, 2018b; De, 2019; LabCFTC, 2020; SEC, 2021b).

TABLE 4. Timeline of events regarding Veridium and regulatory uncertainty. The timeline shows that Veridium launched in 2017, the same year as the SEC and CFTC began taking public action on digital assets. The SEC & CFTC would begin to regularly pursue fraudulent uses of blockchain technology (particularly for ICOs). Uncertainty over how these two agencies would ultimately regulate digital assets (and which agency would do so) led to Veridium failing to launch its marketplace. Veridium would release its code onto the code repository website Github for the open-source community in 2019. In 2020, the CFTC would release its final guidance for commodity transactions involving digital assets.

The action of the CFTC and SEC led to a series of announcements that created regulatory uncertainty for Veridium. Veridium and IBM were unsure how the CFTC and SEC would alter the CFR (interviewee 4). This created confusion as to whether Veridium would be subject to the regulatory authority of the SEC or the CFTC (interviewee 4). Uncertainty around whether digital assets that were representative of carbon offsets counted as commodities created regulatory uncertainty. Interviewees 7, 8, 10, and 114 confirmed the existence of this regulatory uncertainty. This changed the perception of risk by Veridium and IBM for their business venture (Interviewees 1 and 4). Veridium and IBM opted not to launch the marketplace (Interviewee 1; Interviewee 4; SEC, 2021a). Despite the internal determination that Veridium’s digital assets should be considered commodities, there was uncertainty whether they fell under the SEC or CFTC (Interviewee 4). Veridium would have preferred to be regulated by the CFTC over the SEC (Interviewee 4). While there is a mechanism for Veridium to be given an exception to the SECs and be regulated by the CFTC, interviewees suggested that the costs to do so were prohibitive (Interviewee 4). Neither IBM nor Veridium have decided to pay these fees in part because they represent a first-mover problem (Interviewee 4). Violation of regulations from the SEC or CFTC can result in punitive fines or even imprisonment for violators and both agencies had begun pursuing criminal cases against companies that used blockchain (SEC, 2020d; 2020c). Since the two agencies use different sets of regulations, Veridium could have found itself in violation of regulations from one agency and not the other (interviewee 4). This would result in either risking an enforcement action or rebuilding their platform to come into compliance. Had Veridium utilized a traditional centralized database instead of a blockchain, it would not have been caught up in this regulatory uncertainty.

Veridium lacked the compulsory power to confront the SEC or CFTC who exercised institutional power through the CFR. Part of Veridium’s lack of compulsory power may have stemmed from a lack of knowledge of SEC and CFTC activities during their early launch. Interviewee 5 was present during a meeting with Veridium when they were looking for partners to develop their blockchain application. During this meeting, Interviewee 5 claimed that while the founders had clear expertise in carbon offsets, they may not have fully understood blockchain technology itself. Thus interviewee 5 was against investing in Veridium. Interviewees 5 and 9 both noted that many blockchain startups fail because they either lacked understanding of critical elements of blockchain technology or the appropriate subject matter expertise for where they sought to use it. Veridium had the subject matter expertise and, based on other interviews, may have correctly identified an application for blockchain technology. Many of the aforementioned problems with carbon offsets stem from issues around supply chain management (Kouhizadeh and Sarkis, 2018; Thomason et al., 2018). Interviewees 4, 5, and 9 claimed that blockchain made sense for financial and supply chain applications but that other proposed applications are unlikely to succeed. Interviewees 7 and 10 even claimed to have already developed the technology for the same use as Veridium.

As of 2020, IBM opted to release Veridium’s blockchain code software into open-source on the programming website Github (DeJonckheere and Vaughn, 2019; Interviewee 4; Kale, 2019; Kaplinger, 2019). Interviewee 4 suggested that this indicated IBM has ended their involvement with the project. IBM has recently scaled back its presence in the blockchain space (Allison, 2021). Veridium itself is still active but appears to have transitioned away from using blockchain for a carbon offset market (Veridium Labs, 2021).

As previously mentioned, the decision to use blockchain was likely an output of the structural and productive power dynamics surrounding blockchain and ICT overall. Structural power in this case study is closely linked to hegemonic capitalist structures. Veridium is a for-profit company whose founders sought to fund the sequestration of carbon and the protection of biodiversity, as well as to support local stakeholders by creating a profit motive that would hopefully attract investors (Resnick and Jackson, 2018; Sustainable Jungle and Lemons, 2018; “The Blockchain Show,” 2018; Veridium, 2017b). Veridium received investment from VCs: Brian Kelly Capital Management, Blockchain Capital, and an unnamed European Venture Capital firm (Business Wire, 2018; Interviewee 1; Veridium, 2017a). VCs are a type of private equity investor that seeks to increase their capital through investment in promising business ventures in the form of startups and new technology (Zider, 1998; Hogarth, 2017). They often play a crucial role in ICT development within the private sector (Hogarth, 2017; Pradhan et al., 2019). The VCs in this case study also lacked enough power to confront the SEC and CFTC.

Veridium came around at a time when blockchain technology was of interest to many technology-focused VCs. Interest in blockchain technology increased following the rapid growth in the value of bitcoin and other cryptocurrencies (Weaver, 2018; Coin Desk, 2019; Dews, 2019; Jimenez, 2019). As previously discussed, blockchain has many other hypothesized applications, so new technology firms began to appear that claimed they could use this new technology. VC funds, eager to invest in potentially the next big company, began making investments. The connection to the increased public interest and VC investment was discussed by interviewee 5, who pointed out that they had run into many individuals who saw blockchain technology as an avenue to obtain VC funding. A subset of these individuals either did not intend to build a fully functional product or lacked enough of an understanding of either the issue they wished to apply the technology to or the technology itself to do so. Those who did not intend to build a fully functional product were among those who launched fraudulent ICOs. Regardless, both VCs and those seeking their investment often seek to shape the narratives around the technology they are using as part of their overall strategy. This leads to understanding the productive power dynamics within the case study5.

Aside from VCs, other influential players we encountered were influenced by and perpetuated neoliberal and libertarian discourses. Neoliberalism and libertarianism discourse are influential in discussions around carbon offsets and blockchain. Neoliberalism is a political ideology and policy model that emphasizes market competition, mainly via laissez-faire economics, to achieve desired political ends (Smith, 2020). Neoliberals often propose utilizing markets or transitioning towards private-public partnerships to increase the role of private capital in achieving policy objectives (Golumbia, 2013a, 2016; Daniel, 2017). Since Veridium’s strategy was to build a marketplace where carbon offsets and other products representing natural capital could be traded, neoliberalism influenced their strategy as a firm. REDD+, the program that Infinite Earth used to produce their offsets, is often seen as part of the neoliberal discourse around climate change and forest protection (Humphreys, 2009; Sheng et al., 2019).

Discussions on the disruption of traditional banking industries and government regulations via technological development were present throughout the study. The development of blockchain technology is linked to techno-libertarian discourses (Chohan, 2017; Cowen, 2018; Golumbia, 2016, 2013b; May, 1992). Techno-libertarianism seeks to eliminate the need for government or societal oversight by replacing its primary functions with digital tools (Winner, 1997; Golumbia, 2013b, 2013a; Farrell, 2015). Techno-libertarians are often resistant to imposed government restrictions in any form and, as predominantly expressed in the American technology sector, seek the near-total abolition of government (Golumbia, 2016, 2013b, 2013a; Daniel, 2017). Interviewees did not express such extreme views, but several were sympathetic to libertarianism more broadly.

Libertarianism was referenced or alluded to in the interviews with interviewees 3, 5, and 8 as ideological motivations for pursuing blockchain technology. One of Veridium’s investors also discussed it during a podcast episode dedicated to Veridium (Resnick & Jackson, 2018). None of the interviewees suggested alternative uses for blockchain in the climate space outside of carbon offsets, and all were involved in the private sector. The lone exception was interviewee 5, who pointed out multiple alternative applications, albeit outside the climate space. The lack of discussion of blockchain for alternatives private capitalist systems could be an example of the productive power of private capital.

As excitement around a technology grows, it attracts additional attention from potential investors and the public (Steinert and Leifer, 2010; Ball, 2019; Gartner, 2019). This can result in a feedback loop sometimes referred to as a “hype cycle” (Steinert and Leifer, 2010; Gartner, 2019). Blockchain became such a popular subject that media outlets such as Coin Desk were launched with the explicit purpose to cover it. The role of the “hype cycle” was mentioned by interviewee 5. This was reinforced by interviewees 3 and 4 who discussed the claims of blockchains potential versus the instances where it had been successfully deployed. Interviewees 5 and 9 both noted that many individuals involved in blockchain were just involved because of the excitement surrounding it.

Beginning in 2017, the SEC and CFTC began to provide multiple reports to congress on digital assets and initiated public outreach efforts as interest in blockchain technology grew (Clayton, 2018; Targert et al., 2019). The role of podcasts as a medium in technology media appears to have been recognized by the SEC and CFTC. They attempted to exercise their own productive power to influence the discourse around blockchain, which included podcasts (Busch and Van Valkenburgh, 2017; Busch, 2018). Their podcast episodes on blockchain tried to inform stakeholders about their plans for the regulation of blockchain technologies (Busch and Van Valkenburgh, 2017; Busch, 2018). These podcast episodes were released the same year that the whitepaper describing Veridium as a company debuted (Veridium, 2017b).

Podcasts were a primary medium for those interested in blockchain to gain press attention and build excitement (Bair and Wolpert, 2019; Brown et al., 2019; Resnick and Jackson, 2018; Round and Paul, 2018; Singh and Wolpert, 2018; Sustainable Jungle and Lemons, 2018; “The Blockchain Show,” 2018; Wolpert and Koo, 2019). There appears to be an entire ecosystem of blockchain-oriented podcasts (Bair and Wolpert, 2019; Brown et al., 2019; Resnick and Jackson, 2018; Round and Paul, 2018; Singh and Wolpert, 2018; Sustainable Jungle and Lemons, 2018; “The Blockchain Show,” 2018; Wolpert and Koo, 2019). This indicates that these podcasts, alongside traditional media, were considered a valuable medium for exercising productive power.

The efforts to increase the visibility of blockchain may not have just been to increase its adoption. IBM has been very active in the blockchain space, being involved with the Stellar blockchain and a different technology called Hyperledger (Allison, 2021; Castillo, 2018; Hyperledger, 2020; IBM Blockchain, 2018; Interviewee 3). Interviewee 3 went as far as to say that IBM’s own involvement in blockchain was effectively just for marketing, taking advantage of the hype cycle to direct potential clients towards their traditional data storage business. Interviewee 3 also claimed that blockchain’s relevance for the development of digital institutions development is minimal. This was disputed by interviewees 7, 8, 9, and 10. Both interviewees 3 and 5 pointed out that the amount of effort it takes to form the conditions upon which a blockchain could be applied to create many proposed digitized institutions, such as for international multilateral agreements, would make any blockchain actually built superfluous6.

Conclusion

This study demonstrates that the choice of ICT for implementing a policy or program can change the power dynamics within a network of stakeholders. Fifteen relationships within the network of stakeholders were changed by the presence of blockchain technology, while fourteen were not. Veridium was unable to launch its carbon offset market as it had planned. The problem appears not to have been with the software or the concept (Interviewee 4; Kale, 2019). The problem stemmed from their technology choice exposing them to regulatory uncertainty from the SEC and CFTC (Interviewee 1; Interviewee 4). The SEC and CFTC were acting to prevent the use of blockchain for financial fraud.

Previous examinations of the impact of ICT on environmental governance have provided a limited analysis of power dynamics (Gabrys, 2020, 2016; Ascui et al., 2018). Critical theorists studying technology have long claimed that data and ICT are capable of influencing power dynamics (Boyd and Crawford, 2012; Kitchin and Lauriault, 2014; Iliadis and Russo, 2016). This research confirms that ICT can change power dynamics within an environmental network of stakeholders. This is also among the first attempts to study an empirical use case of blockchain in environmental governance. Stakeholders should be wary of the nature of technological discourse in the private sector. Private sector entities have an incentive to increase the excitement around their investments to improve their likelihood of making a profit. For stakeholders trying to address urgent environmental issues such as climate change, relying on unproven technologies poses a risk. With the rise of other environmental tech companies that are looking to play a role in global climate governance (Kann and Lacey, 2020; Shieber, 2020), stakeholders will need to be cautious in their vetting of potential tech partners and their technology. Power dynamics, as demonstrated here, can rapidly shift when if a new technology enables illicit activity.

Future research into blockchain and carbon offsets could look into the successes and failures of market launches. At this time, the blockchain-based carbon market AirCarbon in Singapore has been launched (Herman et al., 2019; Murtaugh, 2020; AirCarbon Exchange, 2021). In this research, several functioning use cases for blockchain were alluded to by interviewees that were outside the scope of this work. Future research could analyze the impacts of choosing to use blockchain for companies that successfully launch. Potential overlaps between climate, financial, and informational governance could be an area for further research.

Veridium should be considered a cautionary tale for practitioners. Veridium did not launch its marketplace because its choice to use blockchain technology instead of traditional software packages exposed it to regulatory uncertainty from the SEC and CFTC (Interviewee 4). Veridium and IBM did not wish to expose themselves to potential regulatory enforcement, since such enforcement can bring about fines and potential jail time (Fridgen et al., 2018; De, 2019; CFTC, 2020; SEC, 2020c). The excitement around the technology likely influenced the choice to use blockchain by Veridium. The productive power of venture capital drove this excitement on technology media. The use of productive power by venture capitalists to raise awareness of the technology contributed to the interest of individuals and groups that found a use case for it in financial fraud. The application of blockchain for financial fraud led to regulatory action by the SEC and CFTC, and Veridium fell within their jurisdiction. Had Veridium chosen not to use blockchain for their carbon offset market, they could have avoided entanglement with the SEC and CFTC. This study indicates that the CFTC and SEC should address regulatory uncertainty for blockchain technology. Specifically, the CFTC and SEC should provide clear guidance on whether digital assets representing carbon offsets are commodities or financial securities. While it did create a problem for Veridium, overall the response by the SEC and CFTC could be seen as a positive example of a state pushing back against illicit behavior in the technology sector.

Practitioners should be cautious about adopting novel technologies and ensure that they have access to the technical expertise to independently evaluate the benefits and risks of adoption. Stakeholders that lack the technical expertise to do so may create a vulnerability for their partners. The decision by Veridium to use blockchain for their carbon market added the SEC and CFTC into their network of stakeholders; changing the power dynamics. At the same time many relationships within the network remain unchanged by the presence of blockchain. Specifically, this did not appear to impact many of the relationships connected to Infinite Earth and its REDD + project in Indonesia. Environmental governance has carried on for their work despite this event. New and novel technologies that may be used for environmental governance are constantly being developed and proposed. As we see more proposals ranging from blockchain to geoengineering to confront the climate crisis practitioners must evaluate new technologies from not just a technical standpoint but a political one as well.

This need to evaluate new technologies should not just be a burden on individuals. As technology plays a greater role in sectors such as finance, institutions such as the CFTC and SEC must be better prepared to rapidly evaluate and provide concise guidance on their use. This situation could have been avoided had the rules around ICO’s and carbon offsets been clear early enough that Veridium to continue development. Had Veridium been able to enact its blockchain platform, it would have been another entry in a new form of private sector management of the environment. Instead, because of the actions of fraudsters which mobilized the SEC and CFTC, this chain of stakeholders beginning with Rimba Raya and its stakeholders were blocked from using novel technology to solve for a problem within climate governance.

Data availability statement

The raw data supporting the conclusion of this article will be made available by the authors, without undue reservation.

Ethics statement

The studies involving human participants were reviewed and approved by Office of Research Integrity and Assurance at George Mason University. The patients/participants provided their written informed consent to participate in this study.

Author contributions

All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

Acknowledgments

Dr. Victoria Adams for subject matter assistance and Alexis Bobrik for assistance in editing and transcription.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1It is also sometimes referred to as “distributed ledger technology.” It is colloquially referred to simply as blockchain.

2Veridium also has a product that would allow for companies to automate the purchasing of their carbon offsets, although this is not a focus of the paper.

3Crypto-colonialism, sometimes also referred to as neo-colonialism, is the appropriation of resources from the global south using indirect methods as opposed to military control (Howson, 2021, 2020).

4Several interviewees revealed that the companies they were employed by avoided the regulatory uncertainty from the SEC and CFTC. Based on these interviews, these companies did this by either finding a way to operate outside SEC and CFTC jurisdiction or timing their development so that the uncertainty would hopefully be resolved by the time they were ready to go to market (interviewees 7, 8, 10, and 11).

5Investments in cryptocurrency have grown from ten billion dollars in 2013 to over one trillion dollars in 2021 (Best, 2021; Staff, 2021).

6Everland, Greenoxx, IHS Markit, The International REC Standard, TIGRs, and Wildlife Works were all identified as partners in the Veridium white paper but were not mentioned during interviews, and their current involvement is unclear. Documentation could not be found indicating further involvement.

References

AirCarbon Exchange (2021). Aircarbon. AvaliableAt: https://www.aircarbon.co/about-aircarbon (accessed 3 10, 21).

Allen, J. (2009). Three spaces of power: Territory, networks, plus a topological twist in the tale of domination and authority. J. Power 2, 197–212. doi:10.1080/17540290903064267

Allison, I. (2021). IBM blockchain is a shell of its former self after revenue misses. AvaliableAt: https://www.coindesk.com/ibm-blockchain-revenue-misses-job-cuts-sources (accessed 8 2, 21).

Anascavage, R., and Davis, N. (2018). Blockchain technology: A literature review (ssrn scholarly paper No. ID 3173406). Rochester, NY: Social Science Research Network.

Andoni, M., Robu, V., Flynn, D., Abram, S., Geach, D., Jenkins, D., et al. (2019). Blockchain technology in the energy sector: A systematic review of challenges and opportunities. Renew. Sustain. Energy Rev. 100, 143–174. doi:10.1016/j.rser.2018.10.014

APX (2021). Carbon registries. AvaliableAt: https://apx.com/carbon-registries/(accessed 14 8, 21).

Ascui, F., Haward, M., and Lovell, H. (2018). Salmon, sensors, and translation: The agency of Big Data in environmental governance. Environ. Plan. D. 36, 905–925. doi:10.1177/0263775818766892

Baber, Z. (1991). Beyond the structure/agency dualism: An evaluation of Giddens’Theory of structuration. Sociol. Inq. 61, 219–230. doi:10.1111/j.1475-682X.1991.tb00276.x

Baker & McKenzie Law for Development Initiative (2014). The consolidated guide to the REDD+ rules under the UNFCCC. Report.

Ball, M. (2019). With all of Silicon Valley’s startup money, where’s the investment in climate tech? Marketpl. Tech. Available at: https://www.marketplace.org/shows/marketplace-tech/with-all-of-silicon-valleys-startup-money-wheres-the-investment-in-climate-tech/.

Barnett, M., and Duvall, R. (2005). Power in international politics. Int. Organ. 59 (1), 39–75. doi:10.1017/S0020818305050010

Bastiansen, E. M. V. (2014). Rimba Raya: Contextualizing community responses to the Rimba Raya biodiversity reserve (masters). Oslo, Norway: UNIVERSITY OF OSLO.

Bennett, N. J., and Satterfield, T. (2018). Environmental governance: A practical framework to guide design, evaluation, and analysis. Conserv. Lett. 11, e12600. doi:10.1111/conl.12600

Best, R. (2021). Cryptocurrency market value 2013-2020. AvaliableAt: https://www.statista.com/statistics/730876/cryptocurrency-maket-value/(accessed 8 2, 21).

Biermann, F., Betsill, M. M., Burch, S., Dryzek, J., Gordon, C., Gupta, A., et al. (2019). The Earth system governance project as a network organization: A critical assessment after ten years. Curr. Opin. Environ. Sustain. 39, 17–23. doi:10.1016/j.cosust.2019.04.004

Blaufelder, C., Levy, C., Mannion, P., and Pinner, D. (2021). A blueprint for scaling voluntary carbon markets. McKinsey & Company.

Boyd, D., and Crawford, K. (2012). Critical questions for big data: Provocations for a cultural, technological, and scholarly phenomenon. Inf. Commun. Soc. 15, 662–679. doi:10.1080/1369118X.2012.678878

Brown, R., Wolpert, J., and Al Saqqaf, W. (2019). Ep.53 - debate - public vs private blockchains for enterprises with R3 and consensys. AvaliableAt: https://insureblocks.com.

Brunnermeier, M. K., and Pedersen, L. H. (2009). Market liquidity and funding liquidity. Rev. Financ. Stud. 22, 2201–2238. doi:10.1093/rfs/hhn098

Busch, A., and Gorfine, D. (2017). CFTC talks EP014: Daniel gorfine, CFTC chief innovation officer. CFTC Talks.

Busch, A., Gorfine, D., Rampbell, A., and Horowitz, A. (2018). CFTC talks EP027: Alex rampell, general partner at andreessen horowitz. CFTC Talks.

Busch, A., and Van Valkenburgh, P. (2017). CFTC talks EP024: Coincenter.org peter van Valkenburgh. CFTC Talks.

Business Wire (2018). Brian kelly capital management and BlockTower capital join Veridium as lead token buyers. AvaliableAt: https://www.businesswire.com/news/home/20180920005286/en/Brian-Kelly-Capital-Management-BlockTower-Capital-Join (accessed 527, 20).

Casino, F., Dasaklis, T. K., and Patsakis, C. (2019). A systematic literature review of blockchain-based applications: Current status, classification and open issues. Telemat. Inf. 36, 55–81. doi:10.1016/j.tele.2018.11.006

Castillo, M. D. (2018). IBM to use stellar for its first crypto-token on A public blockchain. AvaliableAt: https://www.forbes.com/sites/michaeldelcastillo/2018/05/15/ibm-to-use-stellar-for-its-first-crypto-token-on-a-public-blockchain/(accessed 31 12, 19).

CFTC (2018a). CFTC charges randall crater, mark gillespie, and my big coin pay, inc. with fraud and misappropriation in ongoing virtual currency scam. AvaliableAt: https://www.cftc.gov/PressRoom/PressReleases/pr7678-18 (accessed 20 6, 21).

CFTC (2020). Enforcement actions | CFTC. AvaliableAt: https://www.cftc.gov/LawRegulation/Enforcement/EnforcementActions/index.htm (accessed 1129, 20).

CFTC, 2018b. Federal court finds that virtual currencies are commodities. AvaliableAt: https://www.cftc.gov/PressRoom/PressReleases/7820-18 (accessed 6.13.21).

CFTC (2021). The commission | CFTC. AvaliableAt: https://www.cftc.gov/About/AboutTheCommission (accessed 13 4, 21).

Chohan, U. W. (2017). Cryptoanarchism and cryptocurrencies (SSRN scholarly paper No. ID 3079241). Rochester, NY: Social Science Research Network. doi:10.2139/ssrn.3079241

Clayton, J. (2018). Chairman’s testimony on virtual currencies: The roles of the SEC and CFTC before the committee on banking, housing, and urban affairs in the United States senate. AvaliableAt: https://www.sec.gov/news/testimony/testimony-virtual-currencies-oversight-role-us-securities-and-exchange-commission (accessed 527, 20).

Coin Desk (2019). Bitcoin crypto-economics index by CoinDesk. CoinDesk. URLAvaliableAt: https://www.coindesk.com/price/bitcoin (accessed 21 2, 19).

Collins (2019). Carbon credit definition and meaning | Collins English Dictionary. AvaliableAt: https://www.collinsdictionary.com/dictionary/english/carbon-credit (accessed 19 2, 19).

Corbera, E. (2012). Problematizing REDD+ as an experiment in payments for ecosystem services. Curr. Opin. Environ. Sustain. 44, 612–619. doi:10.1016/j.cosust.2012.09.010

Cowen, N. (2018). Markets for rules: The promise and peril of blockchain distributed governance. J. Entrep. Public Policy 23, 3728. doi:10.2139/ssrn.3223728

Creswell, J. W., and Poth, C. N. (2017). “Data collection,” in Qualitative inquiry and research design: Choosing among five approaches kindle edition (Thousand Oaks, California: Sage Publications).

Creswell, J. W. (2009). Research design: Qualitative, quantitative, and mixed methods approaches. Los Angeles: Sage.

Crotty, M. (1998). The foundations of social research: Meaning and perspectives in the research process. London: Sage.

Daniel, J. R. (2017). Everybody will be hip and rich: Neoliberal discourse in silicon valley. Present Tense J. 6 (2), 9.

De, N. (2019). SEC, CFTC, FinCEN warn crypto industry to follow US banking laws. AvaliableAt: https://www.coindesk.com/sec-cftc-fincen-warn-crypto-industry-to-follow-us-banking-laws (accessed 30 11, 20).

DeJonckheere, M., and Vaughn, L. M. (2019). Semistructured interviewing in primary care research: A balance of relationship and rigour. Fam. Med. Community Health 7, e000057. doi:10.1136/fmch-2018-000057

Dews, F. (2019). Justin wolfers on bitcoin: There are smart kinds of money and dumb kinds of money. AvaliableAt: https://www.brookings.edu/blog/brookings-now/2013/12/13/justin-wolfers-on-bitcoin-there-are-smart-kinds-of-money-and-dumb-kinds-of-money/(accessed 9 3, 19).

Ellis, P., and Hubbard, J. (2018). “Flexibility trading platform - using blockchain to create the most efficient demand-side response trading market,” in Transforming climate finance and green investment with blockchains. Editor A. Marke (Academic Press), 137–152. doi:10.1016/B978-0-12-814447-3.00010-0

Falkheimer, J. (2018). “On giddens: Interpreting public relations through anthony giddens’s structuration and late modernity theories,” in Public relations and social theory (Routledge).

Farrell, H. (2015). Why the hidden internet can’t be a libertarian paradise | Aeon Essays. AvaliableAt: https://aeon.co/essays/why-the-hidden-internet-can-t-be-a-libertarian-paradise (accessed 11 7, 18).

Fay, B. (1987). Critical social science: Liberation and its limits. 1st edition. Ithaca, New York: Cornell University PRess.

Feenberg, A. (2017). “Critical theory of technology,” in The handbook of science and technology studies. Editors U. Felt, R. Fouché, C. A. Miller, and L. Smith-Doerr (Cambridge, Massachusetts: MIT Press), 259–286.

Feenberg, A., and Grimes, S. A. (2013). “Critical theory of technology,” in The SAGE handbook of digital technology research. Editors S. Price, C. Jewitt, and B. Brown (London EC1Y 1SP United Kingdom: SAGE Publications Ltd, 1 Oliver’s Yard, 55 City Road), 121–129. doi:10.4135/9781446282229.n9

Feenberg, A. (2002). Transforming technology: A critical theory revisited. New York, N.Y: Oxford University Press.

Foucault, M., and Gordon, C. (1980). Power/knowledge : Selected interviews and other writings, 1972-1977. New York: Pantheon Books.

Frank, T. (2011). Final ccba project validation report the rimba raya biodiversity conservation project. ValidationReport.

Fridgen, G., Regner, F., Schweizer, A., and Urbach, N. (2018). “Don’t slip on the initial coin offering (ICO) - a Taxonomy for a blockchain-enabled form of crowdfunding,” in Twenty-Sixth European Conference on Information Systems (ECIS 2018) (Portsmouth,UK: Initial Coin Offering ICO).

Funk, M. (2015). The hack that warmed the world. Foreign policy. AvaliableAt: https://foreignpolicy.com/2015/01/30/climate-change-hack-carbon-credit-black-dragon/(accessed 917, 18).

Gabrys, J. (2019). “How to do things with sensors,” in Forerunners: Ideas first. Kindle Edition (Minneapolis: University Of Minnesota Press).

Gabrys, J. (2016). Practicing, materialising and contesting environmental data. Big Data Soc. 3, 205395171667339. doi:10.1177/2053951716673391

Gabrys, J. (2020). Smart forests and data practices: From the Internet of Trees to planetary governance. Big Data Soc. 7, 205395172090487. doi:10.1177/2053951720904871

Gartner (2019). Gartner 2019 hype cycle for blockchain business shows blockchain will have a transformational impact across industries in five to 10 years. AvaliableAt: https://www.gartner.com/en/newsroom/press-releases/2019-09-12-gartner-2019-hype-cycle-for-blockchain-business-shows (accessed 18 9, 20).

Gerard, D. (2017). “Chapter 9: Altcoins,” in Attack of the 50 foot blockchain: Bitcoin, blockchain, ethereum & smart contracts (Amazon Digital Services LLC), 182.

Giddens, A. (1979). “Agency, structure,” in Central problems in social theory: Action, structure and contradiction in social analysis, contemporary social theory. Editor A. Giddens (London: Macmillan Education UK), 49–95. doi:10.1007/978-1-349-16161-4_3

Golumbia, D. (2013a). Cyberlibertarians’ digital deletion of the left. AvaliableAt: http://jacobinmag.com/2013/12/cyberlibertarians-digital-deletion-of-the-left/(accessed 925, 18).

Golumbia, D. (2016). The politics of bitcoin: Software as right-wing extremism, forerunners. Minneapolis: Ideas First. University of Minnesota Press.

Günther, S. A., Staake, T., Schöb, S., and Tiefenbeck, V. (2020). The behavioral response to a corporate carbon offset program: A field experiment on adverse effects and mitigation strategies. Glob. Environ. Change 64, 102123. doi:10.1016/j.gloenvcha.2020.102123

Hartmann, S., and Thomas, S. (2020). Applying blockchain to the Australian carbon market. Econ. Pap. 39, 133–151. doi:10.1111/1759-3441.12266

Haugaard, M. (2018). Justification and the four dimensions of power. J. Political Power 11, 93–114. doi:10.1080/2158379X.2018.1433759

Hayward, C. R. (2018). On structural power. J. Political Power 11, 56–67. doi:10.1080/2158379X.2018.1433756

Herman, T., Toh, D., and Conley, T. (2019). International chamber of commerce signs landmark deal to support a carbon neutral global aviation industry. AvaliableAt: https://www.aircarbon.co (accessed 5 12, 20).

Hogarth, S. (2017). Valley of the unicorns: Consumer genomics, venture capital and digital disruption. New Genet. Soc. 36, 250–272. doi:10.1080/14636778.2017.1352469

Howson, P. (2020). Climate crises and crypto-colonialism: Conjuring value on the blockchain Frontiers of the global south. Front. Blockchain 3, 22. doi:10.3389/fbloc.2020.00022

Howson, P. (2019). Tackling climate change with blockchain. Nat. Clim. Chang. 9, 644–645. doi:10.1038/s41558-019-0567-9

Howson, P. (2021). The headache of “crypto colonialism”. AvaliableAt: https://www.coindesk.com/markets/2021/07/14/the-headache-of-crypto-colonialism/(accessed 7 3, 22).

Hull, J., Gupta, A., and Kloppenburg, S. (2021). Interrogating the promises and perils of climate cryptogovernance: Blockchain discourses in international climate politics. Earth Syst. Gov. 9, 100117. doi:10.1016/j.esg.2021.100117

Humphreys, D. (2009). Discourse as ideology: Neoliberalism and the limits of international forest policy. For. Policy Econ. 11, 319–325. doi:10.1016/j.forpol.2008.08.008

Hyperledger (2020). About – hyperledger. AvaliableAt: https://www.hyperledger.org/about (accessed 1 4, 20).

IDEAcarbon (2018). Partnerships. AvaliableAt: https://www.ideacarbon.com/partnerships/index.html (accessed 20 6, 21).

Iliadis, A., and Russo, F. (2016). Critical data studies: An introduction. Big Data Soc. 3, 205395171667423. doi:10.1177/2053951716674238

Indriatmoko, Y., Atmadja, S., Ekaputri, A., and Komalasari, M. (2014). “Chapter 20: Rimba Raya biodiversity reserve project, central kalimantan, Indonesia,” in REDD + on the ground: A case book of subnational initiatives across the globe. Editors E. O. Sills, S. Atmadja, C. de Sassi, A. Duchelle, D. Kweka, I. Resosudarmoet al. (Bogor, Indonesia: Centre for International Forest Research (CIFOR).

Infinite Earth (2020). Employees listed on LinkedIn for infinite Earth. AvaliableAt: https://www.linkedin.com/search/results/people/?facetCurrentCompany=%5B%224982190%22%5D (accessed 6 3, 20).

Infinite Earth (2014). Home. AvaliableAt: https://rimba-raya.com/(accessed 11 4, 21).

Interpol Environmental Crime Program (2013). Guide to carbon trading Crime. International Criminal Police Organisation.

Jenkins, D., and Lukes, S. (2017). The power of occlusion. J. Political Power 10, 6–24. doi:10.1080/2158379X.2017.1285156

Jimenez, G. (2019). Bitcoin awareness is soaring in America says new report. AvaliableAt: https://finance.yahoo.com/news/bitcoin-awareness-soaring-america-report-130024928.html (accessed 18 9, 20).

Kann, S., and Lacey, S., 2020. The “climatetech” hype cycle: Buy, sell or hold? | AvaliableAt: https://www.greentechmedia.com/articles/read/the-climatetech-hype-cycle-buy-sell-or-hold (accessed 9.17.20).

Kincheloe, J. L., Hayes, K., Steinberg, S. R., and Tobin, K. G. (2011). Key works in critical pedagogy: Joe L. Kincheloe. Rotterdam; Boston: Sense Publishers.

Kitchin, R., and Lauriault, T. (2014). Towards critical data studies: Charting and unpacking data assemblages and their work (SSRN scholarly paper No. ID 2474112). Rochester, NY: Social Science Research Network.

Klijn, E.-H. (2008). Governance and governance networks in europe: An assessment of. Public Manag. Rev. 10, 505–525. doi:10.1080/14719030802263954

Klijn, E.-H., and Koppenjan, J. (2012). Governance network theory: Past, present and future. Policy Polit. 40, 587–606. doi:10.1332/030557312X655431

Kouhizadeh, M., and Sarkis, J. (2018). Blockchain practices, potentials, and perspectives in greening supply chains. Sustainability 10, 3652. doi:10.3390/su10103652

Krumina, K. (2018). 81% of all ICOs are scams - and other ICO facts that you should know. AvaliableAt: https://irishtechnews.ie/81-of-all-icos-are-scams-and-other-ico-facts-that-you-should-know/(accessed 30 9, 20).

Kuindersma, W., Arts, B., and van der Zouwen, M. W. (2012). Power faces in regional governance. J. Political Power 5, 411–429. doi:10.1080/2158379X.2012.735116

Lansing, D. M. (2013). Not all baselines are created equal: A Q methodology analysis of stakeholder perspectives of additionality in a carbon forestry offset project in Costa Rica. Glob. Environ. Change 23, 654–663. doi:10.1016/j.gloenvcha.2013.02.005

Legg, C., and Hookway, C. (2019). “Pragmatism,” in The stanford encyclopedia of philosophy. Metaphysics research lab. Editor E. N. Zalta (Stanford University).

Sustainable Jungle Lemons, T. (2018). Podcast #09 · todd Lemons · using blockchain to save forests. Report.

Löfgren, K., and Webster, C. W. R. (2020). The value of Big Data in government: The case of ‘smart cities. Big Data Soc. 7, 205395172091277. doi:10.1177/2053951720912775

Lukes, S. (2015). Robert dahl on power. J. Political Power 8, 261–271. doi:10.1080/2158379X.2015.1057988

Mansfield-Devine, S. (2017). Beyond bitcoin: Using blockchain technology to provide assurance in the commercial world. Comput. Fraud Secur., 14, 18. doi:10.1016/S1361-3723(17)30042-8

Massad, T., 2014. Testimony of chairman timothy massad before the U.S. Senate committee on agriculture, nutrition & forestry | AvaliableAt: https://www.cftc.gov/PressRoom/SpeechesTestimony/opamassad-6 (accessed 6.20.21).

Masson-Delmotte, V., Zhai, P., Pirani, A., Connors, S. L., Péan, C., Berger, S., et al. (2021). IPCC, 2021: Climate change 2021: The physical science basis. Contribution of working group I to the sixth assessment report of the intergovernmental panel on climate change. Cambridge University Press.

May, T. (1992). The crypto anarchist manifesto. AvaliableAt: https://www.activism.net/cypherpunk/crypto-anarchy.html (accessed 8 2, 21).

Miller, R. (2018). Veridium Labs teams with IBM and Stellar on carbon credit blockchain | TechCrunch. AvaliableAt: https://techcrunch.com/2018/05/15/veridium-labs-teams-with-ibm-and-stellar-on-carbon-credit-blockchain/(accessed 5 6, 18).

Mol, A. P. J. (2006). Environmental governance in the information age: The emergence of informational governance. Environ. Plann. C. Gov. Policy 24, 497–514. doi:10.1068/c0508j

Mol, A. P. J. (2009). Environmental governance through information: China and vietnam. Singap. J. Trop. Geogr. 30, 114–129. doi:10.1111/j.1467-9493.2008.00358.x

Moon, K., and Blackman, D. (2014). A guide to understanding social science research for natural scientists: Social science for natural scientists. Conserv. Biol. 28, 1167–1177. doi:10.1111/cobi.12326

Nassiry, D. (2019). “The role of fintech in unlocking green finance,” in Handbook of green finance: Energy security and sustainable development, sustainable development. Editors J. Sachs, W. T. Woo, N. Yoshino, and F. Taghizadeh-Hesary (Singapore: Springer), 1–22. doi:10.1007/978-981-10-8710-3_27-1

Nellemann, C. (2012). Green carbon, black trade: Illegal logging, tax fraud and laundering in the worlds tropical forests : A rapid response assessment. AvaliableAt: https://wedocs.unep.org/20.500.11822/8030.

Nori (2021). Nori. AvaliableAt: https://nori.com/company/about (accessed 30 11, 20).

Ochieng, R. M., Arts, B., Brockhaus, M., and Visseren-Hamakers, I. J. (2018). Institutionalization of REDD+ MRV in Indonesia, Peru, and Tanzania: Progress and implications. Ecol. Soc. 23, art8. doi:10.5751/es-09967-230208

Popper, K. R. (2002). The logic of scientific discovery, Routledge Classics. New York NY: Routledge.

Pradhan, R. P., Arvin, M. B., Nair, M., Bennett, S. E., and Bahmani, S. (2019). Short-term and long-term dynamics of venture capital and economic growth in a digital economy: A study of European countries. Technol. Soc. 57, 125–134. doi:10.1016/j.techsoc.2018.11.002

Prisco, G. (2018). IBM and Veridium to transform carbon credits into blockchain-based. AvaliableAt: https://bitcoinmagazine.com/articles/ibm-and-veridium-transform-carbon-credits-blockchain-based-tokens (accessed 5 5, 20).

Resnick, Z., and Jackson, L. (2018). Veridium with jaron lukasiewicz - the tokenomics podcast. Report.

Robey, C. (2017). Whom do you trust? Blockchain technology & smart contracting. Contract Manag. 57, 18.

Round, C., and Paul, B., 2018. Ep. 194 - climate change: Can blockchain help? W/chris Round. Report.

Schulz, K., and Feist, M. (2021). Leveraging blockchain technology for innovative climate finance under the Green Climate Fund. Earth Syst. Gov. 7, 100084. doi:10.1016/j.esg.2020.100084

SEC (2017). Report of investigation pursuant to section 21(a) of the securities Exchange act of 1934. Report.

SEC (2021a). Risk alert: The division of examinations’ continued focus on digital asset securities*. Report.

SEC (2020d). SEC.gov | actor steven seagal charged with unlawfully touting digital asset offering. AvaliableAt: https://www.sec.gov/news/press-release/2020-42 (accessed 22 5, 20).

SEC (2021b). SEC.gov | framework for “investment contract” analysis of digital assets. AvaliableAt: https://www.sec.gov/corpfin/framework-investment-contract-analysis-digital-assets (accessed 1126, 20).

SEC (2020a). SEC.gov | SEC charges film producer, rapper, and others for participation in two fraudulent ICOs. AvaliableAt: https://www.sec.gov/news/press-release/2020-207 (accessed 12 9, 20).

SEC (2018). SEC.gov | SEC halts alleged initial coin offering scam. AvaliableAt: https://www.sec.gov/news/press-release/2018-8 (accessed 527, 20).

SEC (2020c). SEC.gov | unregistered $25.5 million ICO issuer to return money for distribution to investors. AvaliableAt: https://www.sec.gov/news/press-release/2020-124 (accessed 20 7, 20).

SEC (2020b). SEC.gov | what we do. AvaliableAt: https://www.sec.gov/about/what-we-do (accessed 13 4, 21).

Shelley, L. I. (2018). “Destroyers of the planet,” in Dark commerce: How a new illicit economy is threatening our future (Princeton, New Jersey: Princeton University Press), 178–204.

Sheng, J., Hong, Q., and Han, X. (2019). Neoliberal conservation in REDD+: The roles of market power and incentive designs. Land Use Policy 89, 104215. doi:10.1016/j.landusepol.2019.104215

Shieber, J. (2020). As the Western US burns, a forest carbon capture monitoring service nabs cash from Amazon & Bill Gates-backed fund. AvaliableAt: https://social.techcrunch.com/2020/09/17/as-the-western-us-burns-a-forest-carbon-capture-monitoring-service-nabs-cash-from-amazon-bill-gates-backed-fund/(accessed 18 9, 20).

Singh, H., and Wolpert, J. (2018). Masters of blockchain: John Wolpert on ConsenSys and the future of blockchain. Report.

Smith, N. (2020). Neoliberalism | definition, ideology, & examples | britannica. AvaliableAt: https://www.britannica.com/topic/neoliberalism (accessed 4 9, 20).

Steinert, M., and Leifer, L. (2010). “Scrutinizing gartner’s hype cycle approach” in PICMET 2010 TECHNOLOGY MANAGEMENT FOR GLOBAL ECONOMIC GROWTH, Phuket, Thailand, 18-22 July 2010 (IEEE).

Stuit, A., Brockington, D., and Corbera, E. (2022). Smart, commodified and encoded: Blockchain technology for environmental sustainability and nature conservation. Conserv. Soc. 20, 12. doi:10.4103/cs.cs_41_21

Targert, H., Blanco, K. A., and Clayton, J. (2019). SEC.gov | leaders of CFTC, FinCEN, and SEC issue joint statement on activities involving digital assets. AvaliableAt: https://www.sec.gov/news/public-statement/cftc-fincen-secjointstatementdigitalassets (accessed 1129, 20).

Tashakkori, A., and Teddlie, C. (1998). “Pragmatism and the choice of research strategy,” in Mixed methodology: Combining qualitative and quantitative appraoches (Thousand Oaks, California: Sage Publications), 20–39.

Thomason, J., Ahmad, M., Bronder, P., Hoyt, E., Pocock, S., Bouteloupe, J., et al. (2018). Transforming climate finance and green investment with blockchains. Academic Press. doi:10.1016/B978-0-12-814447-3.00010-0

Token Factory (2019). Deploy tokens with the click of a button. AvaliableAt: http://thetokenfactory.com.

Torfing, J. (2010). Local forms of governance in Denmark: The revenge of the supplement. J. Power 3, 405–425. doi:10.1080/17540291.2010.524993

UNFCCC (2010). Report of the conference of the parties on its sixteenth session, held in cancun from 29 november to 10 december 2010. Report.

UNFCCC Secretariat (2016). “Decision 2/CP.13,” in Key decisions relevant for reducing emissions from deforestation and forest degradation in developing countries (REDD+) (United Nations Framework Convention on Climate Change).

UNFCCC (2018). UN supports blockchain technology for climate action | UNFCCC. AvaliableAt: https://unfccc.int/news/un-supports-blockchain-technology-for-climate-action (accessed 15 10, 18).

U.S. Government Publishing Office (2017). Code of federal regulations. AvaliableAt: https://www.govinfo.gov/help/cfr (accessed 11 4, 21).

van Kooten, G. C., and Johnston, C. M. T. (2016). The economics of forest carbon offsets. Annu. Rev. Resour. Econ. 8, 227–246. doi:10.1146/annurev-resource-100815-095548

Veridium Labs (2021). Veridium Labs: The natural capital marketplace. AvaliableAt: https://www.veridium.io/(accessed 13 4, 21).

Veridium (2020b). Veridium foundation: People | LinkedIn. AvaliableAt: https://www.linkedin.com/company/veridium-foundation/people/(accessed 7 3, 20).

Veridium (2020a). Veridium Labs: People. AvaliableAt: https://www.linkedin.com/company/veridium-labs/people/(accessed 7 3, 20).

Veridium (2017b). Veridium: Automating the world’s carbon markets. AvaliableAt: https://www.veridium.io (accessed 117, 19).

VERRA (2019). Rimba Raya reserve project VERRA project database. AvaliableAt: https://registry.verra.org/app/projectDetail/VCS/674 (accessed 12 4, 20).

Visseren-Hamakers, I. J. (2018). A framework for analyzing and practicing Integrative Governance: The case of global animal and conservation governance. Environ. Plan. C Polit. Space 2399654418788565, 1391–1414. doi:10.1177/2399654418788565

Visseren-Hamakers, I. J., Gupta, A., Herold, M., Peña-Claros, M., and Vijge, M. J. (2012). Will REDD+ work? The need for interdisciplinary research to address key challenges. Curr. Opin. Environ. Sustain. 4, 590–596. doi:10.1016/j.cosust.2012.10.006

Weaver, N. (2018). Blockchains and cryptocurrencies: Burn it with fire (nicholas weaver), special lecture. Berkeley, California: Berkeley School of Information.

White, A. E., Lutz, D. A., Howarth, R. B., and Soto, J. R. (2018). Small-scale forestry and carbon offset markets: An empirical study of Vermont Current Use forest landowner willingness to accept carbon credit programs. PLOS ONE 13, e0201967. doi:10.1371/journal.pone.0201967

Winner, L. (1997). Cyberlibertarian myths and the prospects for community. SIGCAS Comput. Soc. 27, 14–19. doi:10.1145/270858.270864

Wolpert, J., and Koo, K. (2019).The silicon valley insider show with keith Koo: John Wolpert, seeker of awesomeness @ consensys, the pivot-facebook libra on apple podcasts. AvaliableAt: https://itunes.apple.com/us/podcast/the-silicon-valley-insider-show/id1282637717?mt=2.

Wright, A., and De Filippi, P. (2015). Decentralized blockchain technology and the rise of lex cryptographia (SSRN scholarly paper No. ID 2580664). Rochester, NY: Social Science Research Network.

Yin, R. K. (2014). Case study research: Design and methods. Thousand Oaks, California: Sage Publications.

Keywords: blockchain, climate change, environmental governance, carbon credit, carbon offset, carbon market, power, informational governance

Citation: Round C and Visseren-Hamakers I (2022) Blocked chains of governance: Using blockchain technology for carbon offset markets?. Front. Blockchain 5:957316. doi: 10.3389/fbloc.2022.957316

Received: 30 May 2022; Accepted: 29 August 2022;

Published: 20 September 2022.

Edited by:

Leanne Ussher, Copenhagen Business School, DenmarkReviewed by:

Tai Young-Taft, Bard College, United StatesIngrid Vasiliu Feltes, University of Miami, United States

Copyright © 2022 Round and Visseren-Hamakers. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Christopher Round, Y3JvdW5kQGdtdS5lZHU=

Christopher Round

Christopher Round Ingrid Visseren-Hamakers2

Ingrid Visseren-Hamakers2