95% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

METHODS article

Front. Blockchain , 12 October 2022

Sec. Blockchain in Industry

Volume 5 - 2022 | https://doi.org/10.3389/fbloc.2022.908912

With the characteristics of anonymity, trust, tamper-proof, etc., blockchain technology can effectively solve some problems faced by the financial market, such as trust issues and information asymmetry issues. To deeply understand the application scenarios of blockchain in the financial market, the issue of securities issuance and trading in the primary market is studied. The authors conducted an empirical study to investigate the main difficulties faced by primary market participants in their business practices and the potential challenges of the deepening adoption of blockchain technology in the primary market. The authors adopted a hybrid method by combing interviews (qualitative methods) and surveys (quantitative methods) to conduct this research in two stages. In the first stage, authors interview 15 major primary market participants with different backgrounds and expertise. In the second phase, authors conducted a verification survey of 54 primary market practitioners to confirm various insights from the interviews, including challenges and desired improvements. The interviews and survey results reveal several significant challenges facing blockchain applications in the primary market: complex due diligence, mismatching, and difficult monitoring. The research shows that primary market participants have a positive attitude towards the application of blockchain technology to the primary market and are ready to adopt blockchain technology to solve some of the current issues.

The financial market can be divided into two types of market, which are primary market and secondary market (Stiglitz, 1989). The primary market is a market where companies conduct transactions before IPO (Initial Public Offering). Stocks and bonds have not undergone a standardized review process before going to the public. Thus, there are many issues such as trust, authenticity, privacy, and etc. in the market. The secondary market is a market for stock/bond trading that has been standardized and reviewed by regulators. There are four parts in the transaction chain of the primary market: raising funds, investing assets, asset monitor, and existence. There are financing companies, investment institutions, brokers, valuation firms, law firms, accounting firms, etc., participating in the primary market. Each participant plays a unique role for its own purpose/interest. These participants help the market to maintain stability.

The primary financial market is enormous. The “McKinsey Global Private Markets Review 2020” (Yang et al., 2019) shows that total global private equity market transactions in 2019 plateaued at 1.47 trillion USD versus 1.49 trillion USD in 2018. Before 2019, the amount of global private equity market transactions has grown 12% annually from 2013 to 2018.

In the current primary market, securities issuance needs to go through processes such as registration, filing, custody, listing and circulation. Securities trading includes steps such as price inquiry, transaction, order confirmation, order matching, transaction amount accounting, and settlement. It is a long and tedious process from preparing for issuance to successful listing, including a lot of instructions and involving multiple market institutions.

As the primary market lacks standardization, information asymmetry, fraud, and high cost on due diligence have led to seriously fragmented ecosystems. Under the background that the development of the securities market puts forward higher requirements for transaction costs, transaction efficiency and transaction transparency, such a cumbersome business process cannot well meet the needs of investment and financing entities. Industry and academia have tried to change this status quo, but there is no noticeable effect. The infrastructure of the primary financial market is not so easy to optimize without solving the challenges as listed above.

Since Bitcoin was invented, the blockchain technology has quickly entered people’s eyes (Zheng et al., 2018). One of the essential purposes of the invention of blockchain was to develop the financial industry (Kshetri, 2018). The decentralized idea and unique features of blockchain, such as decentralization, highly transparent, enhanced security, and immutability of information, make blockchain be the most appropriated technology to along with the logic of financial markets (Walch, 2015).

Blockchain technology can rely on encryption algorithms, consensus mechanisms, timestamps and other means to conduct a highly secure and credible point-to-point transaction with a multi-party peer-to-peer flat structure. In general, blockchain technology can provide full-process, multi-angle technical solutions for securities registration, issuance, trading, clearing and other links, and make subversive changes in business processes. At present, the securities industry has high hopes for the use of blockchain technology. Institutions in the financial market industry are also actively conducting pilot projects and proof-of-concept of blockchain technology, hoping that it can reduce industry operational risks, improve industry operational efficiency, and breed new business models.

Clearly, blockchain technology has been seen by these institutions as the next major technological innovation that could change the entire securities industry. But big changes never happen overnight. What are the pain points and difficulties that the current primary market financial infrastructure development urgently needs to solve? Can blockchain bring new value to the securities industry? Are various institutions ready to embrace blockchain technology at a faster pace and invest in its implementation? These are all questions worth exploring. Only by clarifying these questions can institutions understand the difficulty and commercial value of blockchain implementation in the primary market.

To help advance research in primary financial market infrastructure development, the authors conducted an empirical study to investigate the work practice and potential challenges faced by primary market involvers. The authors followed a blended strategy approach that combines interviews (qualitative method) and surveys (quantitative method). In particular, the authors interviewed a total of 15 primary financial involvers with various backgrounds and expertise. They were asked about their everyday work and relevant challenges faced during their responsibilities in the primary financial market during the interviews. Next, the authors adopted open card sorting (Spencer, 2009) to analyze the interview results. The following categories produced by open card sorting were grouped into three groups, i.e., complex due diligence, mismatching, and difficult monitoring. After that, the authors performed a validation survey with 54 participants to confirm various insights from the interviews, including challenges, best practices, and desired improvements based on the interviews.

According to the interview and survey, the authors realized that the primary market participants cared a lot about due diligence but did not effectively avoid the complex process. Besides, the asymmetric information and lack of trust among the participants make it hard to settle. Also, it is hard to discover each other, which makes the market lack liquidity. The limitations influenced their day-by-day work, particularly for large companies.

The significant contributions of the research are as follows:

• As far as the authors know, this is the first in-depth research investigating primary market participants’ insights on the current status of the primary financial market and blockchain technology through interviews and surveys.

• The authors analyze both qualitative and quantitative data and highlight potential opportunities and implications that investors, financiers, brokers, and other financial market participants can use to improve their daily work under a new infrastructure in the future. The authors point out several challenges and research issues that can be used to guide future research for applying blockchain technology in primary market application domain.

The following sections are organized as below: In the next section, it provides background materials on primary market and blockchain. Section 3 presents 2-parts’ methodology, both quantitative and qualitative. The findings of this study are discussed in Section 4. In Section 5, the authors discuss the threats to the validity of the research. Section 6 is the related work. The final section gives conclusions and future work.

Since the 1970s, the development of information technology has vigorously promoted the popularization and application of the electronic and networked transaction settlement system in the financial market, realizing the rapid development of the multi-level securities market and the informatization of market participants. The most prominent feature of securities trading is a centralized third-party credit or information intermediary agency as a guarantee, which realizes value transfer by reducing information asymmetry and relying on traditional institutions to establish a trust mechanism, whether in the primary or secondary market.

Because of the unique characteristics of the primary financial market, it seems impossible to have a unified exchange system in the world (Kaplan and Stromberg, 2009). In practice, the following process shown in Figure 1 is how to conduct simple private equity transactions in the primary market:

Buyers and sellers know each other through the introduction of a broker, sometimes through a friend’s introduction, but most transactions are reached through a broker, usually called an FA (Financial Advisor). After the buyer and seller contact, they will sign a non-disclosure agreement (NDA) if they intend to continue the transaction. After signing the NDA, the seller sends some of its basic information to the buyer, and the buyer will need to hire third-party service companies to validate the authenticity.

After the buyer reconfirms that this firm or project is the target it is interested in, the buyer will forward to the next step, an on-site interview. After the interview, the DD (Due Diligence) process will be launched, and if both the interview and DD meet the buyer’s requirements, they will sign a TS (Term Sheet), which can be regarded as a promised investment agreement. TS is a letter of intent to invest and is not subject to legal restrictions. Finally, the buyer and seller will sign SPA (Share Purchase Agreement) and other relevant agreements to confirm the investment contract, which is the final step of the investment activity. Other relevant agreements typically include SHA (Shareholders Agreement) and PPAA (Predict Profit Allocation Agreement).

Trust, data sharing, data security, and related personalization characteristics are the main reasons for the existing problems in the primary market (Franzoni et al., 2012).

Blockchain is another disruptive technology after cloud computing, the Internet of Things, and big data (Bublitz et al., 2019). The core technologies of blockchain mainly include cryptographic algorithms, peer-to-peer networks, publicity mechanisms, smart contracts, and data storage. With the adoption of more blockchain-based systems, more application requirements have spawned a series of expansion technologies to optimize the chain system. These optimizations mainly revolve around scalability, interoperability, collaborative governance, security, and privacy (Gao et al., 2018).

Blockchain can improve the efficiency of digital collaboration in the actual business process and provide a value-based interconnection infrastructure for the financial industry and trading methods inside the financial market. According to its unique characteristics of “decentralization” and “trust,” proper application of blockchain technology can ensure that trust is established between multiple parties while protecting data privacy and is expected to become an essential part of the financial market infrastructure (Gao et al., 2018).

An essential purpose of blockchain technology innovation is to provide services for financial transactions. It is a distributed ledger for transactions with an append-only feature. Blockchain was first proposed by Bitcoin (Nakamoto, 2019). Initially, it was a decentralized electronic instalment framework, eliminating any external requirements related to instalment activities. The first Bitcoin blockchain combined information into a chain, coordinated by square hash values named “blockchain.” As stated by (Nakamoto, 2019), Bitcoin is the first form to use blockchain as the overall framework of a distributed system.

General speaking, 3 generations of blockchain have been determined by both scholars and industry experts. blockchain is delimited to Blockchain 1.0, 2.0, and 3.0 (Xu et al., 2019).

The birth of Bitcoin is a sign of the arrival of the blockchain 1.0 era. In the era of blockchain 1.0, the main innovation is to create a set of decentralized, open and transparent transaction record general ledger, whose database is shared by all network nodes, focusing on solving the problem of currency and payment decentralization (Nakamoto, 2019). With the continuous upgrading and maturity of blockchain technology, due to the avaliable programming environment and the application of smart contracts, the blockchain has developed rapidly and entered the era of blockchain 2.0.

The problem solved by blockchain 2.0 is the decentralization of the market. The key word in this period is “contract” (Gao et al., 2018). As a result, blockchain technology has been fully applied in many aspects of finance, such as stocks, bonds, futures, loans, property rights, and smart assets. In the era of blockchain 2.0, the blockchain technology carrying smart contracts will give full play to the function of a decentralized transaction ledger, which can be used to register, determine, and transfer various types of assets and contracts (Xu et al., 2019). However, at present, the blockchain 2.0 era is still in its early stage, many applications are still based on ideas, the implementation of applications has not yet formed a scale, and most projects still need to pass the verification of time.

It entered the era of blockchain 3.0 when blockchain technology was applied to social governance. The application evolution of blockchain can be said to be a development history from Dapp (decentralized application) to DACs (decentralized autonomous corporations) and DAO (decentralized autonomous organization), and then to DAS (decentralized autonomous society) (Tinn, 2017).

Figure 2 illustrates the overview of the methodology design, which combines the interview and survey parts. Interview part: 15 experts from the primary financial market are interviewed to get insights into the primary market. Survey part: it is used to validate the findings from the interviews. The authors present how to design and implement the interview and survey in the following.

This research adopts semi-structured interviews (Shull et al., 2007). The authors first exchanged their introductory information, such as respective institutions and positions, with the interviewees and then introduced the research and purpose. Next, the authors asked some basic qualitative questions to the interviewees. Then, some open questions are designed to guide the interviewee with the ideal directions (Questions are listed in Table 1). These open questions probed the interviewees about their perspectives on the primary financial market and applying blockchain in the primary market. Since the design of semi-structured interviews, the authors arranged subsequent questions to delve further into the interview participant’s perspectives at a later stage. In the end, the authors asked that the interviewee could give whatever other significant data the interviewers may have missed during the interviews.

In this interview, a total of 15 interviewees were interviewed. Among them, 5 are at or above the partner level of equity investment institutions, 4 are from third-party service agencies, 4 are corporate financing directors or directors of the financing department, and 2 are from investment banks with solid experience. The interviewees covered the prominent participants in the primary market.

There is a total of 21 candidates prepared for the interview, but due to uncontrollable reasons, such as covid-19 and timing, only 15 of them were interviewed by us in the end. During the interviews, the authors followed the procedure utilized in (Aniche et al., 2018) and (Singer et al., 2014) to choose when to stop the meeting, i.e., halting interviews when there is enough saturation of findings. Saturation is a methodology that is widely used in qualitative research (Fusch and Ness, 2015), (Morse, 2015), and (Guest et al., 2006).

To ensure that the interviews are of broad-spectrum significance, the interviewees covered most types of primary market participants, such as investment institutions, financing companies, law firms, accounting firms, etc.

The authors interviewed interviewees from various backgrounds (as demonstrated in Table 2) before deciding whether saturation had been reached. In every interview, the interviewers cooperated to pose questions and take notes. After completing each interview, the interviewers would contrast their notes with past ones to check whether there were any new insights from the interview.

Because of the Covid-19, all interviews were conducted remotely via Zoom and WeChat, and the interviewers took notes. The average and standard deviation of the interview time were 35 and 30 min, respectively. Table 2 illustrates the basic demographics of the interviewees. According to the table, the interviewees had an average experience of 12.13 years working experience and 10.4 years in the primary financial market by the time of the interviews.

Two authors used to work in the primary financial market and used their connections to contact an initial group of 10 candidates. The authors utilized a snowball process to generate another group with another 11 candidates (Goodman, 1961), i.e., current participants refer the interview to their target participants. There are a total 21 experts agreed to take part in the interview.

Card sorting (Spencer, 2009) is applied to recognize the classifications from each interview. It is a particular procedure to get classifications from data (Kim et al., 2016; Kim et al., 2017). There are three different types: closed card sorting with predefined categories for data, open card sorting with no predefined categories, and hybrid card sorting, which combines the previous two types (Zimmermann, 2016). Considering the research is exploratory with categories (i.e., challenges of the primary market) being unknown in advance, the authors chose to conduct an open card sorting process to analyze these data.

In particular, after a card was made for each textual unit in the card sorting, the cards were then bunched into influential groups with a theme or topic meanings: these groups, i.e., low-level, mid-level, and high-level categories. The consequences of remarkably open card sorting would allow us to acquire various hierarchical categories. Two authors were involved in the card sorting process. Every card was identified and analyzed by them. The authors identified three high-level categories using card sorting, i.e., complex due diligence, mismatching, and difficult monitoring.

The questionnaire includes three demographic questions, 7 primary financial market questions, and 2 blockchain-related questions. The demographic questions are single choice and designed to understand the background and experience of participants. The primary financial market questions are designed to validate insights the authors have found from the interview. The participants who have been interviewed are not asked to respond to the survey. There are both single choices and 2 choices questions included. The authors regard the 2 choices questions as sorting to analyze more straightforward rather than plan sorting method. The blockchain-related questions are mainly designed to validate the idea that blockchain technology will improve the infrastructure of the primary financial market.

The potential survey participants are professional experts involved in the primary financial market, and their primary roles include investment, financing, brokerage, audit, etc. Since the main participants are from China and some are from Australia and the United States, Chinese and English versions are prepared. This survey is released through the application of Questionnaire Star. The respondents can use any mobile phone/computer/pad to respond to the survey by scanning the code.

When selecting respondents, the authors pay more attention to their work experience in the primary market, preferably compound working experience, to make a more efficient result. No other factors, such as academic qualifications, limit the selection of respondents. Because most of the participants in the primary financial market have higher academic qualifications, and all the target participants have master or doctoral degrees. To eliminate similar ideas from the same company or work period, the authors control that at most two respondents are from the same company.

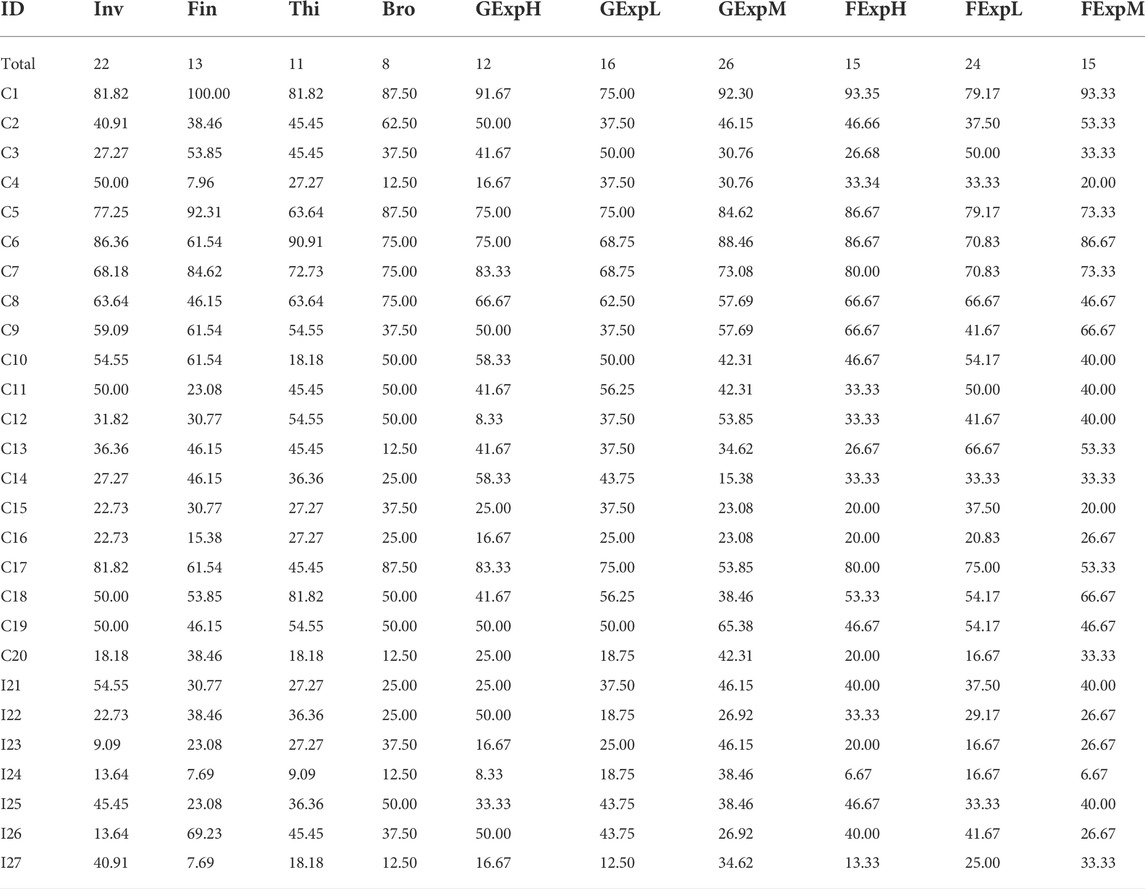

Totally 54 respondents were recruited. From the perspective of the participants’ roles, 40.7% of them are from investment institutions, 24.07% from financing parties, 20.37% from third-party service intermediaries, and 14.81% from brokers. For general working experience, 70.37% of people have more than 4 years of work experience, and only 29.63% have less than 3 years of work experience. For primary financial market working experience, 55.56% of people have more than 4 years of primary market experience, and only 44.44% have less than 3 years of relevant work experience. Pie charts of broad working experience and primary financial market working experience are shown in Figure 3. It is a relatively convincing work background structure.

FIGURE 3. Pie charts of general working experience and primary financial market experience in percentage.

After terminating the questionnaire collection, the authors analyzed the closed-ended questions by adopting different analysis methods. The authors calculated the number of votes for each answer option. Next, the percentage rate for each answer option by dividing the number of votes for the option by 54 (total respondents’ number) was calculated.

To better understand respondents’ perspectives of the primary financial market’s challenges, the authors divided the participants into several demographic groups and compared their voting results with each other’s. Based on previous studies (Halevi et al., 2019; Buterin, 2014), the authors constructed the following demographic groups:

• Respondents from the investment field (Inv)

• Respondents from the financing field (Fin)

• Respondents from third parties (Thi)

• Respondents from brokerage (Bro)

• Respondents with high general working experience (≥10 years) (GExpH)

• Respondents with low general working experience (≤3 years) (GExpL)

• Respondents with medium general working experience (>3, and <10 years) (GExpM)

• Respondents with high primary financial market related working experience (≥7 years) (FExpH)

• Respondents with low primary financial market related working experience (≤3 years) (FExpL)

• Respondents with low primary financial market related working experience (>3, and <7 years) (FExpM)

The authors calculated the percentage ratios of their answers to the primary financial market challenges and desired improvements collected from the interview separately for each demographic group. According to (Zou et al., 2018), Fisher’s exact test (Fisher, 1922) was applied with Bonferroni correction (McDonald, 2009) to these numbers to make sure if one group tended to vote differently with others. Fisher’s exact test reveals the frequency distribution of the variables (e.g., each option votes from each group in the research) in the analysis of contingency tables. It can determine if the observed difference between two proportions (i.e., the ratio of votes) is statistically significant. The family-wise error could be controlled by Bonferroni correction while making multiple comparisons. Section 4.4.2 shares the analysis results in detail.

In this part, the authors first present the findings for each category (a total of three categories) that were identified by utilizing open card sorting on the interview data here are subcategories for each category. The authors select some of the most effective content and analyze some statistics according to the survey feedback to highlight the generality of these findings. Next, it introduces the voting results of each population group in response to these challenges, the potential solutions mentioned by the interviewees, and the related significance tests of these results. Finally, it briefly concludes the interview and survey results.

The due diligence process of primary market transactions is mainly carried out through written reviews, on-site inspections, public channel searches, interviews, and entrusted third-party investment. As investors continue to pay more attention to issues such as consistency of interest and information transparency, the level of detail in their preliminary due diligence process has also increased. Although detailed and meticulous due diligence meets investors’ requirements for companies to some extent, it often takes too long, reduces transaction efficiency, and increases transaction costs. On the other hand, due to the lack of a standardized due diligence checklist, some investors do not know the extent of their due diligence on the company.

The primary market is dominated by “over-the-counter transactions”. The two parties may negotiate between the two parties or through the “matching” of third-party service agencies to complete the transaction. In this process, there is asymmetric and redundant information in the transaction, making it difficult for both parties to match the transaction accurately, and the transaction time is lengthened indefinitely. At the same time, some trading platforms lack the guarantee of credibility, and the ability to label information is weak. Forming a mature trading loop in the primary market is difficult. This also leads to low matching efficiency between the two parties in the primary market, and it is not easy to achieve transactions quickly.

Post-investment monitoring means that investors need to understand the company’s trends in time, understand the direction of capital use, identify problems in the company’s development process, help companies carry out standardized management, and to a certain extent restrict and deter the company. It is necessary to grasp the appropriate degree, which can meet your own needs and do not make the invested company feel too troublesome and controlled in the monitoring step. At present, a considerable part of the post-investment work in the primary market is in a state of groping. Post-investment work is relatively casual, lacks standardized procedures, and lacks assessment standards. The most direct consequence is that post-investment personnel do not know what to do, and this causes laxity. Investors seem to have paid human resources and financial resources, but the actual monitoring effect is unsatisfactory.

Primary market transactions’ pain points and difficulties run through all the links of “funding, investment, monitor and withdrawal”. Funding is to raise funds. People who need to maintain or increase their assets will invest the money in investment institutions for management. Investment is to find a good company or project to invest in equity or debt. The monitoring is to track and manage invested projects and conduct follow-up reviews. Withdrawal is the process of finally selling the investment product and cashing out.

Among the 15 respondents, 14 respondents (93.3%) believed that the current due diligence procedures for securities issuance are too complicated, time-consuming, and costly, and they are on the premise of ensuring the quality of issuance. The issuance efficiency will be affected to a certain extent under complex due diligence. 10 respondents (66.67%) believe that matching investment institutions' needs with those of invested companies is challenging. For the equity investment process, 7 (46.67%) believe that the drawer agreement is difficult to implement. Regarding the follow-up management of equity investment, 11 respondents (73.3%) believe that the effective implementation of post-investment management is facing specific difficulties and that there are challenges in fully obtaining various types of information on invested companies. At the same time, due to the imperfect exit mechanism, lack of professional intermediaries, and insufficient attention to exit management in the primary market, it is difficult for the primary market to exit equity.

All respondents agreed that the above-mentioned pain points and difficulties in the current primary market are rooted in two aspects: lack of trust (100%) and difficulty in ensuring the authenticity of data (100%).

Faced with the current pain points and difficulties in the primary market, respondents believe that the complexity of the due diligence process (93.3%) and post-investment management and exit (66.67%) should be resolved first. In addition, 79.63% of the respondents believe that improving the matching of the needs of investment institutions and invested companies is also an urgent problem that needs to be resolved.

Although all the interviewees have varying degrees of understanding of blockchain technology, there are still some disagreements on whether blockchain technology can solve the pain points and difficulties of the primary market. 86.67% of the respondents have a positive attitude towards the application of blockchain technology, believing that based on the advantages of blockchain technology, the application of this technology can solve some of the pain points and difficulties. Furthermore, for the specific application scenarios of blockchain technology in the primary market, the vast majority of interviewees did not have a deeper understanding and knowledge, and only one person was familiar with the application scenarios of blockchain technology and believed that part of the trust and process problems could be solved through the characteristics of the blockchain.

100% of the interviewees believe that, on the premise that the transaction cost has not increased significantly if the products based on blockchain technology can better solve the pain points and difficulties of the primary market, they will choose to use related products.

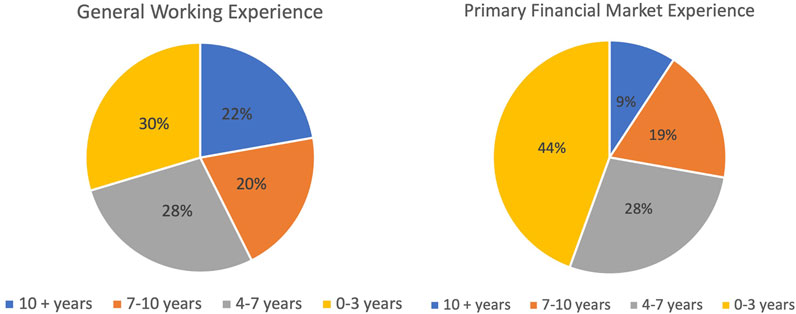

Table 3 lists 20 challenges and 7 desired improvements mentioned by interviewees in the above sections. C1 to C4 were significant challenges of the pre-investment stage. C5 to C16 were significant challenges during the investment stage, and C17 to C20 were significant challenges in the post-investment stage. I21 to I24 were desired internal optimization in the primary financial market environment in the future. I25 to I27 were expected external support in the future. The last column is the ratio (percentage) of respondents who voted for the second column challenges.

After analyzing the overall voting result of individual challenges and desired improvements, the authors will analyze them by different demographic groups. Table 4 illustrates the detailed results of the voting.

TABLE 4. Voting results of different groups towards 20 challenges and 7 desire improvements highlighted by questionaries. The Total row illustrates the number of respondents in each group. The rows C1 to I27 represent the percentages (%) of respondents from each group.

From Table 4, it could observe that the voting results varied from the demographic group. For example, for C17, FexpH and FExpL were 80% and75%, while the ratio was only 53.33% for group FExpM. Another example, for I22, the ratios of GexpH, GexpL, and GExpM were 50%, 18.75%, and 26.92%, respectively. To check whether the observed ratio differences are statistically significant, for each challenge/desired improvement, the authors applied Fisher’s exact test with Bonferroni correction on three sets of demographic groups, i.e., groups with different roles (Inv vs. Fin vs. Thi vs.Bro), groups with different general working experiences (GExpH vs. GExpL vs. GExpM), and groups with different primary financial market-related working experiences (FExpH vs.FExpL vs.FExpM).

After conducting 270 (10 group pairs ⇥ 27 challenges/improvements), Fisher’s exact tests with Bonferroni corrections found that three tests showed that the relevant difference is statistically significant. It is Inv vs. Fin L on I26 (p-value = 0.002 < 0.05/6 after Bonferroni correction).

Based on the testing results, it can say with some certainty that: respondents from the financing field (Fin) are significantly more likely to rate I26 (Docking with outstanding target companies and tapping investment opportunities) as a significant desired external support than those respondents from investment field (Inv) (69.23% vs. 13.64%).

From the analysis of the interview and survey, the authors could find the following:

It is urgent to solve problems with complex due diligence processes, mismatching, and difficulty monitoring. Traditional solutions are challenging to eliminate the cost increase and efficiency loss caused by these problems. In the future, you can consider choosing emerging technologies, such as blockchain, to solve these problems in the primary market. The current traditional solution is to reduce the friction of information/trust issues by introducing a financial agency, proving a lack of efficiency.

The respondents pay more attention to the primary market issues, mainly focusing on the following aspects:

In the initial stage: mismatch of investors and financiers. As the starting point for primary market trading, the search for suitable counterparties puts forward extremely high requirements for investors and financiers. At present, primary market participants generally encounter difficulties in limited information access channels, low information credibility and high potential risks of business ethics when screening counterparties. Participants often invest huge costs and spend much time when screening counterparties, making it difficult to match the needs of the supply and demand of funds. The feature of blockchain, open and verifiable to the whole network nodes can help to solve the problems. Participants can view the open market for inquiry and quotation information, which helps both parties to understand the actual needs.

In pre-investment stage: complex due diligence processes. Under the influence of multiple factors such as an increasingly complex business environment, accelerated business model change and opaque information, it is more difficult for investors to identify transaction risks accurately, and often face difficulties such as excessive transaction valuation, problems in subsequent integration and difficulty to achieve synergies. Although complex due diligence processes are conducive to ensuring transaction security and reducing transaction risk, it also brings about problems such as reduced efficiency and increased cost. Therefore, it is essential to explore how the information that has a significant impact on investment decisions in the process of securities issuance or investment, such as an annual report, financial report and significant matters, to improve the efficiency of due diligence and reduce costs. The feature of blockchain can ensure that all transaction information is not tampered with, true and effective through the consensus mechanism.

In post-investment stage: difficulty monitoring. Post-investment management needs to ensure that the use of funds is consistent with due diligence and supervise the financing party. The purpose of the investment funds shall not be changed. In fact, the post-investment management relies more on the tracking of capital flow and the monitoring of enterprise business conditions, so it is difficult to establish a multi-dimensional and full-cycle post-investment evaluation and supervision system. The distributed ledger automatically operates business logic and regulatory rules through smart contracts based on fully consistent data among all parties. Smart contracts are transparent and open, and all parties (all nodes) will participate in the verification of the contract during the execution process. Synchronously ensure that each transaction meets the requirements of business logic and regulatory rules, automatically find problems, prevent in advance and intervention, provide a safe and credible execution environment for multi-party cooperation, and force the performance, to ensure the safety of transactions.

In addition to the above problems, exit mechanisms, fair and objective company information sources, information transparency and other issues are also the main issues for investors in the primary market. These issues also reflect the same information asymmetry, true and effective information, mutual trust mechanism and other issues. Therefore, these problems can also be solved through blockchain technology.

In this research, the survey questions are designed based on the conclusion of the interviewers. However, it may sometimes misunderstand or fail to fully understand the intention of the interviewees. To eliminate this threat, the authors slowed down as much as possible during the interview and confirmed the content once they did not understand it clearly. The card sort step is handled by two authors together, so there is the possibility of mistakes, but the authors have tried their best to avoid them.

Interviews and surveys also have the possibility of interviewees providing dishonest answers for any reason. To reduce this bias, the authors have made the following efforts in the survey: 1) In the letter of invitation, the authors stated that the research team would not publish and try their best to avoid leaking personal information (if provided) and it is entirely confidential; 2) The survey is anonymous, and it is guaranteed that it will not track the participants by answering the questionnaire content. If the interviewee wants to provide contact or other personal information, it can be added voluntarily. Based on (Ong and Weiss, 2000), confidentiality and anonymity might help to obtain honest answers from interviewees.

In addition, based on the following suggestion (Kitchenham and Pfleeger, 2008), that is to provide services to prospective respondents in an appropriate language. Besides the English version of the survey, there is also a Chinese version. The Chinese version of the survey can help Chinese respondents more easily understand the questions from the questionnaire. Again, it may also draw the wrong analysis based on the survey's answers. To avoid this threat, the authors read their answers as carefully as possible.

Besides, the authors have adopted reliability test for the questionnaire. In general, the primary consideration is the internal reliability of the scale and whether there is a high internal consistency between data. At present, the Cronbach’s alpha coefficient is widely used in the reliability test. In this research, Stata software is used to test the alpha coefficient. The overall alpha coefficient of the questionnaire is 0.97, which is greater than the acceptable range of reliability of 0.7, indicating that the research has a particular reference value. In addition, the questions related to the primary market investigated by the questionnaire have undergone many discussions and revisions, and pre-investigation experiments have been carried out. Respondents generally gave real and accurate feedback when answering the survey questions. Therefore, the authors believe that the questionnaire has high content validity.

According to the interview strategy, there are only 15 interviewees because the authors believe the saturation has reached. It is clear that the number of interviews is not very large, and the strategy is saturated and cannot fully represent all situations, but the interviewees have been reset to cover all essential primary market roles.

Considering that some interviewers will have some ideas or opinions that the authors might miss or have new and meaningful ideas after being interviewed by us, all interviewees are experienced. Their rich work experience will increase the completeness of the answers to open questions.

To validate the results of interview, 54 participants were surveyed. Since most survey respondents are from China, Australia, and the United States, the authors cannot guarantee that the survey results apply to the world. It is anonymous and does not require identity verification, so there is no guarantee that the interviewees will include all participants in the primary financial market. To further improve the generalizability of the research results, the authors encourage other scholars to replicate the research with a more extensive group of participants.

This section highlights related work on applying blockchain technology to the primary financial market, including proposed systems to help the primary ecosystem, core technologies of blockchain, and core advantages and applications of blockchain.

Blockchain is continuously innovated and expanded on top of Bitcoin’s infrastructure. At present, blockchain can be divided into the public chain, alliance chain, and private chain according to the access mechanism of nodes and the degree of decentralization. Blockchain technology has gone through the Bitcoin era of blockchain 1.0 and the blockchain 2.0 era represented by the alliance chain. At present, blockchain technology has transitioned to the blockchain 3.0 era represented by EOS. In terms of technical application, according to different actual application scenarios and design concepts, current blockchain projects are heterogeneous blockchains developed using different technical frameworks.

There are relatively few articles talking about the application of blockchain technology in the primary financial market in practice compared with the secondary market. However, the relevant issues still attracted the attention of some scholars.

Regarding securities issuance, (Buterin, 2014) points out that replacing the securitization third party in the primary market with a blockchain-based system can more accurately track process details, reduce costs, increase issuance speed, and increase transparency and liquidity. (Ahmad et al., 2018) believes that the fraud issues of information asymmetry in the primary market can be reduced by adopting blockchain technology in the financial market infrastructure. It proposes a Linked Data-based model, which provides both data verification and tamper-proof functions to prevent collusion and increase trust in financial markets effectively.

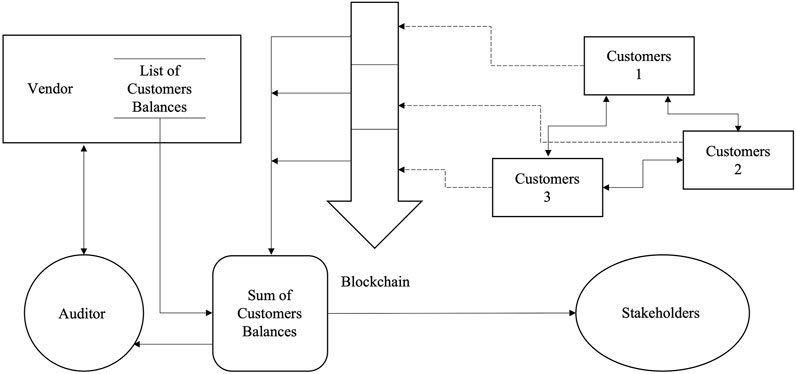

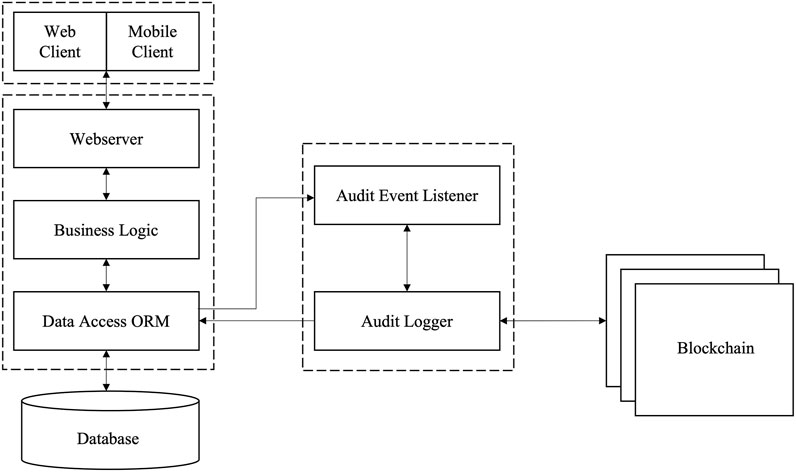

Authorized participants may get all information on the blockchain immediately, and the information accessed by all parties is consistent, which saves a lot of due diligence expenses and probable errors in the copying process, according to (Cohen et al., 2017). It proposed a prototype in Figure 4 for an accounting information system with public and private access to record the entity’s data of access or update for the information. It will improve the accuracy of financial reporting information provided to shareholders and other approved persons. (Düdder and Ross, 2017) demonstrates that due diligence data is on-chain, open, and transparent, significantly increasing information transparency, reducing information asymmetry, and lowering fraud risks. It presented the ORM model in Figure 5, which includes a copy of the data before entering the database and a blockchain-verified mirror file. The blockchain will genuinely update the verified data given to the database after relaying it back to the database, preventing the original information from being tampered with.

FIGURE 4. Public and private access for accounting information system (Fisher, 1922).

FIGURE 5. ORM model (McDonald, 2009).

Scholars are debating how blockchain technology may help save expenses and increase efficiency. (Tinn, 2017) claims that using blockchain to promote corporate governance and legal frameworks may promote corporate transparency and efficiency when the record is established, and that blockchain technology has enhanced automation. (Sutton and Samavi, 2017) shown that when pre-set criteria are satisfied, equity transactions may be automatically completed by putting smart contract terms into an automated programming language. More specifically, it employs machine learning to assess the desire and ability of borrowers, and it leverages a blockchain-based system to predict the borrower’s future willingness instantaneously.

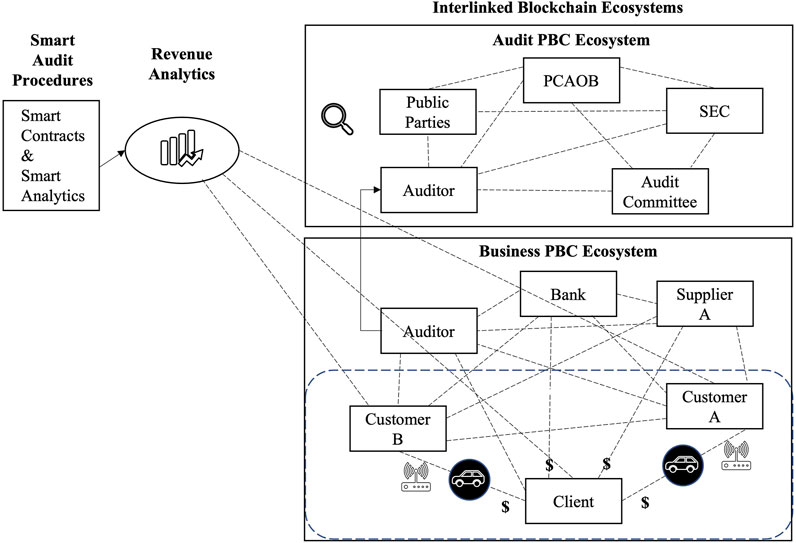

Furthermore, several publications are based on a governance standpoint, believing that apps aid departmental monitoring. (Aitzhan and Svetinovic, 2016) outlines why blockchain technology can replace finance agencies and discusses the history of employing blockchain in the primary market at an early level. (Lamarque, 2016) describes how the supervision department identifies the nodes on the chain and acquires the public key to monitor the fundamental data in real-time. At the same time, the information's validity and traceability are ensured by the blockchain's infallibility (McCallig et al., 2019) show that auditing and supervision might no longer be limited to sampling but will collect and process all data via a blockchain network that is maintained and shared. In contrast to the previous architecture (Figure 6), the auditor can evaluate the data inside before going outside (Sheldon, 2019). In Figure 6, the auditor system will be placed in the external ecosystem to prevent external institutions and customers from regularly altering the data after the auditing process. It eliminates data transmission manipulation and leakage while increasing data authenticity.

FIGURE 6. Interlinked blockchain ecosystems (Sheldon, 2019).

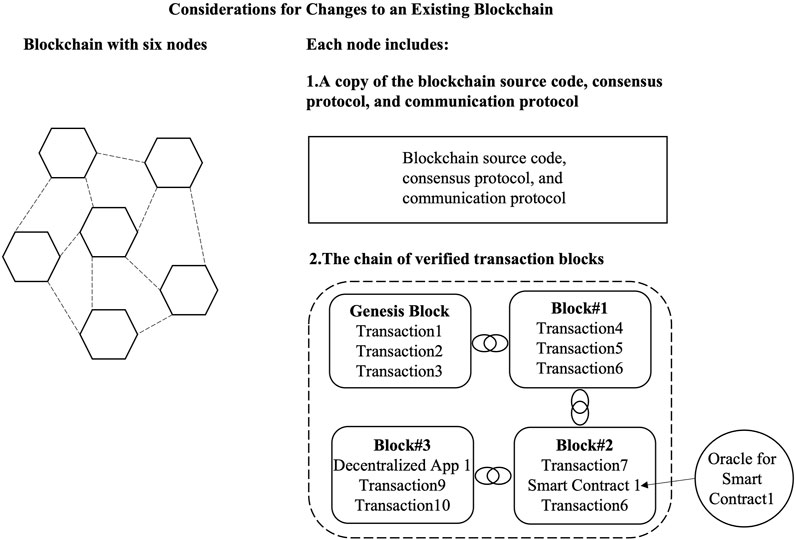

(Sulkowski, 2018) proposed a paradigm for considering modifications to an existing Blockchain, which is depicted in Figure 7. The information is sent to all blockchain participants when someone changes financial or commercial data. The operator will have a tough time removing the signs of their change. Data exchange assists the system inefficiently in preventing property fraud.

FIGURE 7. Considerations for changes to an existing blockchain (Sulkowski, 2018).

Although the deployment of blockchain in the primary market is technically viable, the present progress in practice is modest. It is mainly owing to regulatory constraints, and no consistent norm exists (Zhu and Zhou, 2016). Some current regulatory prohibitions will be lifted because of the government’s acknowledgement of blockchain and the technological progress of distributed systems in the future.

Based on our research by combining qualitative and quantitative methods, the authors concluded that the most concerning issues in the primary financial market are complex due diligence, mismatch, and difficult monitoring. When the current challenges are combined with the advantages of blockchain technology, it clearly shows that blockchain may be a suitable technology that can solve the above challenges in primary financial markets.

The blockchain has an available feature. Except that the private information of each transaction party is encrypted, market participants can query and obtain data on the blockchain through a public interface. Therefore, the information transparency of the entire system is extremely high, and it is more convenient for transaction parties to obtain information, which is conducive to reducing the information asymmetry of both parties in the market, improving the matching efficiency of both parties, and faster settlement.

The use of blockchain technology can reduce the reduction in transaction efficiency and the increased transaction costs caused by the excessively long due diligence process. Using the consensus of blockchain technology, tamper-proof, traceable features, and the automaticity of timely update of node information, all aspects of information involved in the transaction can be recorded on the blockchain. Therefore, investors can clearly understand and view the investment and, based on ensuring the credibility of assets, minimize the complicated process involved in the due diligence process.

The block-based intelligent contract technology can help non-standard off-site contracts be presented in executable code form, making it easier to realize automated transactions of non-standardized contracts. Each market participant in the blockchain has a complete transaction record, and the transaction assets are anchored on the blockchain. The conclusion of the contract becomes flat and automatically executed, which improves the ability of both parties to perform the contract and reduces the transaction counterparty risk.

For post-transaction events, like derivatives transactions and clearing, etc., rely on blockchain technology to manage the DLT network, monitor related assets, and redesign and optimize related processes, improving market transparency and enhancing the efficiency of derivatives transaction management and reducing transaction costs. Benben.

Due to the difficulty in carrying out large-scale survey activities, obtaining a large amount of research data is difficult. Although this survey has covered all types of primary financial market participants with different roles, the overall sample size is still limited. In addition to the technical, application, supervision and other factors involved in the practice, this paper only provides a relatively comprehensive and suggestive application framework for the application of blockchain to improve the the infrastructure of the primary financial market. A more systematic investigation is required to comprehensively, accurately, and scientifically grasp the district cross-chain application prospects in the primary market. Further refinement and development have not been carried out for specific application details involving the primary market.

Blockchain technology can potentially bring the infrastructure of the primary financial market into the next generation. It is significant to carry out a continuous and systematic investigation and research on the application of cross-chains in the primary financial market. In the future, the authors will focus on combining of technology and business. The authors will also try to build a blockchain system to solve the existing issues in the primary financial market according to the result of this research.

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

JL is the primary author, involved in everything. ZX is the second author, for getting the data and analysing. YZ and WD contribute equally as the structure design, data analysis, and edit. HW contribute for editing. SC is the supervisor of the project, and the supervisor of JL.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Ahmad, A., Saad, M., Bassiouni, M., and Mohaisen, A. (2018). “Towards blockchain-driven, secure and transparent audit logs,” in Proceedings of the 15th EAI International Conference on Mobile and Ubiquitous Systems: Computing, Networking and Services. New York, NY, USA, 443–448.

Aitzhan, N. Z., and Svetinovic, D. (2016). Security and privacy in decentralized energy trading through multi-signatures, blockchain and anonymous messaging streams. IEEE Trans. Dependable Secure Comput. 15 (5), 840–852. doi:10.1109/tdsc.2016.2616861

Aniche, M., Treude, C., Steinmacher, I., Wiese, I., Pinto, G., Storey, M. A., et al. (2018). “How modern news aggregators help development communities shape and share knowledge,” in 2018 IEEE/ACM 40th International Conference on Software Engineering (ICSE) (Gothia Towers Congres Center, Sweden: IEEE), 499–510.

Bublitz, F. M., Oetomo, A., Sahu, K. S., Kuang, A., Fadrique, L. X., Velmovitsky, P. E., et al. (2019). Disruptive technologies for environment and health research: An overview of artificial intelligence, blockchain, and internet of things. Int. J. Environ. Res. Public Health 16 (20), 3847. doi:10.3390/ijerph16203847

Buterin, V. (2014). A next-generation smart contract and decentralized application platform. White Paper, 3 (37).

Cohen, L. R., Samuelson, L., and Katz, H. (2017). How securitization can benefit from blockchain technology. J. Struct. Finance 23 (2), 51–54. doi:10.3905/jsf.2017.23.2.051

Düdder, B., and Ross, O. (2017). Timber tracking: Reducing complexity of due diligence by using blockchain technology. BIR Workshops. https://ssrn.com/abstract=3015219, http://dx.doi.org/10.2139/ssrn.3015219. (Accessed August 8, 2017).

Fisher, R. A. (1922). On the interpretation of χ 2 from contingency tables, and the calculation of P. J. R. Stat. Soc. 85 (1), 87–94. doi:10.2307/2340521

Franzoni, F., Nowak, E., and Phalippou, L. (2012). Private equity performance and liquidity risk. J. Finance 67 (6), 2341–2373. doi:10.1111/j.1540-6261.2012.01788.x

Fusch, P. I., and Ness, L. R. (2015). Are we there yet? Data saturation in qualitative research. Qual. Rep. 20 (9), 1408. doi:10.46743/2160-3715/2015.2281

Gao, W., Hatcher, W. G., and Yu, W. (2018). “A survey of blockchain: Techniques, applications, and challenges,” in 2018 27th international conference on computer communication and networks (ICCCN) (Hangzhou, China: IEEE), 1–11.

Goodman, L. A. (1961). “Snowball sampling,” in The annals of mathematical statistics, 148–170. doi:10.1214/aoms/1177705148

Guest, G., Bunce, A., and Johnson, L. (2006). How many interviews are enough? An experiment with data saturation and variability. Field methods 18 (1), 59–82. doi:10.1177/1525822x05279903

Halevi, T., Benhamouda, F., De Caro, A., Halevi, S., Jutla, C., Manevich, Y., et al. (2019). “Initial public offering (IPO) on permissioned blockchain using secure multiparty computation,” in 2019 IEEE International Conference on Blockchain (Blockchain) (Atlanta, United States of America: IEEE), 91–98.

Kaplan, S. N., and Stromberg, P. (2009). Leveraged buyouts and private equity. J. Econ. Perspect. 23 (1), 121–146. doi:10.1257/jep.23.1.121

Kim, M., Zimmermann, T., DeLine, R., and Begel, A. (2017). Data scientists in software teams: State of the art and challenges. IIEEE. Trans. Softw. Eng. 44 (11), 1024–1038. doi:10.1109/tse.2017.2754374

Kim, M., Zimmermann, T., DeLine, R., and Begel, A. (2016). “The emerging role of data scientists on software development teams,” in 2016 IEEE/ACM 38th International Conference on Software Engineering (ICSE) (Austin, TX, USA: IEEE), 96–107.

Kitchenham, B. A., and Pfleeger, S. L. (2008). “Personal opinion surveys,” in Guide to advanced empirical software engineering (London: Springer), 63–92.

Kochhar, P. S., Xia, X., Lo, D., and Li, S. (2016). “Practitioners' expectations on automated fault localization,” in Proceedings of the 25th International Symposium on Software Testing and Analysis. United States, 165–176.

Kshetri, N. (2018). 1 Blockchain’s roles in meeting key supply chain management objectives. Int. J. Inf. Manag. 39, 80–89. doi:10.1016/j.ijinfomgt.2017.12.005

Lamarque, M. (2016). The blockchain revolution: New opportunities in equity markets. Cambridge, Boston Metropolitan Area, Massachusetts, USA: Massachusetts Institute of Technology. Doctoral dissertation.

McCallig, J., Robb, A., and Rohde, F. (2019). Establishing the representational faithfulness of financial accounting information using multiparty security, network analysis and a blockchain. Int. J. Account. Inf. Syst. 33, 47–58. doi:10.1016/j.accinf.2019.03.004

McDonald, J. H. (2009). Handbook of biological statistics, Baltimore, MD: sparky house publishing, 2, 6–59.

Morse, J. M. (2015). Data were saturated. Qual. Health Res. 25 (5), 587–588. doi:10.1177/1049732315576699

Nakamoto, S. (2019). Bitcoin: A peer-to-peer electronic cash system. Manubot. https://bitcoin.org/bitcoin.pdf.

Ong, A. D., and Weiss, D. J. (2000). The impact of anonymity on responses to sensitive questions 1. J. Appl. Soc. Psychol. 30 (8), 1691–1708. doi:10.1111/j.1559-1816.2000.tb02462.x

Sheldon, M. D. (2019). A primer for information technology general control considerations on a private and permissioned blockchain audit. Curr. Issues Auditing 13 (1), A15–A29. doi:10.2308/ciia-52356

Shull, F., Singer, J., and Sjøberg, D. I. (Editors) (2007). Guide to advanced empirical software engineering (Springer Science & Business Media). doi:10.1007/978-1-84800-044-5

Singer, L., Figueira Filho, F., and Storey, M. A. (2014). “Software engineering at the speed of light: How developers stay current using twitter,” in Proceedings of the 36th International Conference on Software Engineering. Hyderabad India: ACM, 211–221.

Stiglitz, J. E. (1989). Financial markets and development. Oxf. Rev. Econ. Policy 5 (4), 55–68. doi:10.1093/oxrep/5.4.55

Sulkowski, A. (2018). Blockchain, business supply chains, sustainability, and law: The future of governance, legal frameworks, and lawyers. Del. J. Corp. L. 43, 303. doi:10.2139/ssrn.3262291

Sutton, A., and Samavi, R. (2017). “Blockchain enabled privacy audit logs,” in International semantic web conference (Cham: Springer), 645–660.

Tinn, K. (2017). Blockchain and the future of optimal financing contracts. SSRN Electron. J. doi:10.2139/ssrn.3072854

Walch, A. (2015). “The bitcoin blockchain as financial market infrastructure: A consideration of operational risk,” in NYUJ legis. & pub. Pol'y. New York University, Journal of Legislation and Public Policy, 837. 18.

Xu, M., Chen, X., and Kou, G. (2019). A systematic review of blockchain. Financ. Innov. 5 (1), 27–14. doi:10.1186/s40854-019-0147-z

Yang, Q., Liu, Y., Chen, T., and Tong, Y. (2019). Federated machine learning: Concept and applications. ACM Trans. Intell. Syst. Technol. 10 (2), 1–19. doi:10.1145/3298981

Zheng, Z., Xie, S., Dai, H. N., Chen, X., and Wang, H. (2018). Blockchain challenges and opportunities: A survey. Int. J. Web Grid Serv. 14 (4), 352–375. doi:10.1504/ijwgs.2018.10016848

Zhu, H., and Zhou, Z. Z. (2016). Analysis and outlook of applications of blockchain technology to equity crowdfunding in China. Financ. Innov. 2 (1), 29. doi:10.1186/s40854-016-0044-7

Zimmermann, T. (2016). “Card-sorting: From text to themes,” in Perspectives on data science for software engineering (Cambridge, MA, USA: Morgan Kaufmann), 137–141.

Keywords: blockchain, FinTech, DEFI, exchange, clearing house, primary market

Citation: Liu J, Xu Z, Zhang Y, Dai W, Wu H and Chen S (2022) Digging into primary financial market: The issues of primary financial market issuance and investigations from the perspective of blockchain. Front. Blockchain 5:908912. doi: 10.3389/fbloc.2022.908912

Received: 31 March 2022; Accepted: 27 September 2022;

Published: 12 October 2022.

Edited by:

Srinath Perera, Western Sydney University, AustraliaReviewed by:

Samudaya Nanayakkara, Western Sydney University, AustraliaCopyright © 2022 Liu, Xu, Zhang, Dai, Wu and Chen. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Shiping Chen, c2hpcGluZy5jaGVuQGRhdGE2MS5jc2lyby5hdQ==

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.