- 1Pan Sutong Shanghai-HK Economic Policy Research Institute, Lingnan University & HK Institute of Asia-Pacific Studies, The Chinese University of Hong Kong, Hong Kong, Hong Kong SAR, China

- 2Department of Economics, Lingnan University, Hong Kong, Hong Kong SAR, China

- 3Department of Medicine and Geriatrics, Alice Ho Miu Ling Nethersole Hospital and Tai Po Hospital, Hospital Authority, Hong Kong, Hong Kong SAR, China

- 4Department of Statistics and Actuarial Science, The University of Hong Kong, Hong Kong, Hong Kong SAR, China

- 5Centre for Safe Medication Practice and Research, Department of Pharmacology and Pharmacy, Li Ka Shing Faculty of Medicine, The University of Hong Kong, Hong Kong, Hong Kong SAR, China

- 6Hong Kong Adventist College, Hong Kong, Hong Kong SAR, China

The cost of treatment for rare diseases is notoriously high imposing threats to the global healthcare system. Existing market-based tools for orphan drugs are not designed to reduce drug prices and could be hampered by adverse selection. We propose an alternative insurance mechanism, Massive Group Insurance (MGI), which aims at reducing the prices of orphan drugs through offering separate Intellectual Property Right (IPR) Fees to the drug company from an MGI Agency, which will collect insurance premiums from each country on each orphan drug that the country wants all its citizens to enjoy access to. The premiums will be calculated so as to ensure that the drug company will collect a profit no smaller than what it enjoys under the traditional model. The plan uses the group insurance concept and will generate a significant increase in drug use. Blockchain technology is used to facilitate authentication and effective IPR payments and ensure data security and low administrative cost. This model can potentially be extended to other categories of expensive drugs and vaccines.

Introduction

According to the European Medicines Agency, there are between 5,000 and 8,000 distinct rare diseases, and together they affect some 27–36 million people in the European Union (EMA, 2020). Assuming similar prevalence globally 470–627 million people suffer from different kinds of rare diseases (De Vrueh et al., 2013; Nguengang Wakap et al., 2020). The cost of effective treatments is notoriously high and out of reach for most people and for health authorities (Chiu et al., 2018), imposing huge risks for insurers (FoCUS, 2018a). Luzzatto et al. (2018) warned that the increasing number of new Orphan Medicinal Products introduced each year may threaten the sustainability of healthcare systems around the world.

A white paper from the Financing and Reimbursement of Cures for the US (FOCUS) project initiated by MIT (FoCUS, 2018b) suggested that much of the problem is attributed to high development costs, limited populations in the case of rare diseases, and, in some cases, the single dose. That paper reviewed such financing tools as 1) Annuities Consumer Loans, 2) Milestone-Based Contract, 3) Pay-for-Performance, 4) Performance-Based Annuities, 5) Reinsurance, and 6) Risk Pooling, and found that “the key financing challenge for patients is out-of-pocket costs, co-pays and income loss. Few financing solutions can address these concerns … ” This problem stems from the fact that none of them is designed to reduce drug prices insurance companies or patient have to pay. Moreover, as Robinson et. al. (2014) noted, it will also unavoidably face the problem of adverse selection. Users of the drugs will need to have relatively strong life-time incomes in addition to smartly designed insurance or reinsurance schemes. The purpose of this paper is to propose a viable alternative insurance mechanism that deals with the problem of adverse selection directly, taking advantage of the group insurance concept. This will be enabled by a blockchain-based payment system that pays the owners of the Intellectual Property Right (IPR), which would allow a much lower drug price paid by patients or their insurers.

As explained by Haleem et al. (2021) the blockchain is a decentralised peer-to-peer network of personal computers (“nodes”). The network maintains, stores, and records historical or transaction data and allows the integration of disparate networks while ensuring immutability and safety. Unlike a centralized database system, the network of computers copies and spreads the information. Each node in this network processes, verifies, and records each data input. Blockchain therefore offers all the key qualities that we need to implement the proposed Massive Group Insurance (MGI) concept (Abramowicz, 2019; Popovic et al., 2020), which we will explain in Section 2. Section 3 will offer a glimpse into the actuarial basis of the proposed insurance concept using an illustrative statistical model. The final section will provide a summary and reiterate the key advantages of the proposed insurance and business model.

A “Massive Group Insurance” Scheme Supported by the Blockchain Technology

The new financing model consists of the following elements:

• The proposed insurance is subscribed by the government of a country/jurisdiction on behalf of ALL citizens, hence the name Massive Group Insurance;

• Insurance premiums are specific to each identified existing drug for an identified purpose and specific to the country;

• Each prescription will be authenticated with identified patient, doctor, pharmacist, dosage, when and where, with all information on each transaction recorded in the blockchain;

• The Massive Group Insurance Agency (MGIA) will pay an Intellectual Property Right Fee to the drug company according to the dosage, while the patient or his/her insurer will pay the cost excluding the IPR fee, which under competitive markets will be equal to the marginal cost;

• The developer of the drug company will approve and license manufacturers to produce and sell the drug according to the protocols established by the company competitively.

• The proposed use of blockchain technology will offer ease of use, low cost of administration, data security, and access to authenticated and secure data by both the MGI Agency and researchers, including scientists from drug companies.

When a drug company decides the price for an orphan drug under the traditional business model, profit maximization dictates that it targets at only high-income patients and the very few very rich countries that might cover selected expensive orphan drugs in their national health insurance schemes. As a result the drug will be out of reach for the majority of patients. Still, the drug company would also like to sell to low-income patients at lower prices if the price it charges high-income patients would not be affected. However, this is infeasible in practice due to parallel trade and political pressures to reduce prices in high-income countries if the prices charged to patients in lower-income countries are significantly lower.

The lack of access to the drug for the majority of patients who otherwise would benefit from it under the traditional business model implies a significant welfare loss. Remarkably, the proposed Massive Group Insurance MGI Scheme offers a mechanism that enhances welfare by giving drug companies compensations through Intellectual Property Right fees, affordable drug prices to patients, and the prospect of affordable drug prices to “would-be patients”. “Would-be patients” are people who are not currently suffering from the diseases but nevertheless could (Pfliegler et al., 2014). Everybody would enjoy peace of mind, being assured that, should the misfortune befall them or their loved ones they could handle the costs. This is an improvement in the public interest (Ho, 2013).

Under the proposed approach, citizens in the country that has subscribed to MGI are entitled to buy the designated drug at the cost of production that covers normal profit. While normal profit is difficult to estimate, the market mechanism will take care of that. The key is to open up the production to all qualified producers that will comply with the dispensation protocols and will follow the authentication procedures. Competition will drive prices low enough so that producers will survive and not high enough as to create abnormal profits. Drug developers will receive an IPR fee from the MGI Agency for each authenticated prescription for the given drug based on a formula (to be explained in Section 3) according to the volume of doses consumed within each period. As all patients in the subscribing country are covered under massive group insurance, adverse selection will not happen. The design of the proposed financing model will ensure that drug companies will be better off than under the traditional business model, so that they will have the incentive to participate. We can assume that by beating the traditional business model, the IPR fees will be sufficient to sustain R&D incentives. Our proposed model is intended only for drugs that have been proven effective and are already in the market. As far as these drugs are concerned, drug development cost is a “sunk cost,” so that as long as our proposed new business model beats the traditional business model drug companies will have sufficient incentive to participate.

For drugs that have already hit the market, drug companies certainly would know how much they are getting each year, and most probably also would have a good idea of how much they are going to get within the patent-effective period. They certainly know that, under the traditional model, the market will be limited because many patients will not use them. By lowering the user price in all the countries that subscribe to the MGI, it is possible to estimate the increased size of the market over the next twenty to 30 years. The IPR fee per dosage will be negotiated with the drug company to ensure that the new arrangement will beat the traditional model. During the negotiation process, it is expected that the drug company will present evidence about the revenues derived over the years since the drug was approved. We propose that the MGI Agency should be under the World Health Organization (WHO) to ensure credibility and proper governance. Despite some controversies the WHO is still the predominant authority on global health in the best position to negotiate with powerful drug companies.

The MGI Agency is free to reject a proposed IPR fee that is deemed too high. The drug company also knows that the higher the IPR fee, the higher will also be the MGI premiums which will reduce the number of countries that will participate in the insurance scheme, ultimately reducing the total IPR fees that it can get. This gives the drug company the incentive to cooperate with the MGI Agency to work out the optimal IPR fee that will benefit all parties.

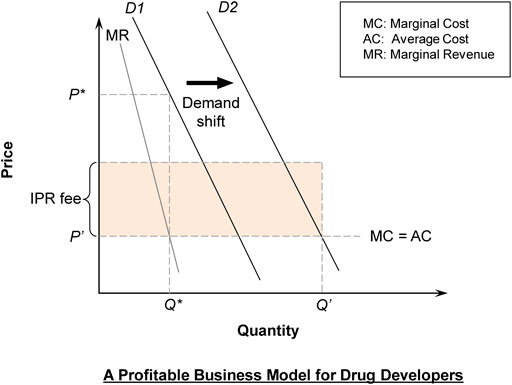

In Figure 1, a drug company faces the original demand curve (D1) and maximizes profit based on Marginal Cost (MC) = Marginal Revenue (MR), leading to price at P*. The development cost of the drug is a fixed cost that is a bygone, but the drug company would argue for the highest IPR fee that is agreeable to the MGI Agency, on the ground that a big enough profit is needed to motivate the development of new drugs.

It is assumed for simplicity that excluding the development cost, MC = AC, implying that production is subject to “constant returns to scale.” Constant returns to scale means that the average cost is the same for bigger or smaller scale production, which is often taken to be the case beyond a minimum efficient scale. A socially optimal pricing formula should be Price = MC, although this would not cover the development cost nor yield the profit necessary to motivate research and development. At this price, total quantity demanded will be Q′, which is much higher than Q*, the quantity prior to the implementation of the proposed scheme.

In the proposed new business model, the drug company will collect IPR fee × Q′ each year (shaded area). The IPR fee is set at such a level as to ensure that the drug companies will not be worse off than under the traditional model. Thus IPR fee × Q′ > (P*–AC) × Q*. More precisely, in a framework that involves time going into the future, we have:

where

When the cost of the drug is reduced, more patients will use the drugs and more will survive. With the exception of one-dose drugs, survivors will continue to need the drug (probably in reduced dosage) so the demand curve will shift to the right (D2) (Figure 1).

Consider an illustrative example as follows. Suppose that under the traditional model with demand at D1, P (=Average Revenue) = 11−Q and MC = AC = 1. We can compute that MR = 11−2Q. Thus, the profit-maximizing output (by setting MR = MC) for the drug company under the traditional model is Q* = 5. The corresponding market price is P* = 6 while the profit is 25.

Further suppose that under the proposed new business model, the market demand expands to D2 with P = 15−Q. The corresponding market output and price under the new scheme are Q′ = 14 and P′ = 1, respectively. With the collection of the IPR fee, the drug company’s profit is IPR fee × Q′.

We can compute that consumer surplus will increase from 12.5 under traditional model to 98 under the new business model (with 37.5 or 44% of the increase due to the gain from a lower price and with 48 or 56% of the increase due to the gain from a demand expansion effect). Moreover, if r = 0.05 (interest rate used for discount = 5% p.a.), T = 20 years and T′ = 30 years, by Eq. 1, we can compute that the drug company earns higher profit as long as IPR fee is higher than 1.45. For example, if the IPR fee is set at 1.8 the drug developer will earn 24% more profit in present value terms over the 30 years when the IPR fee is payable.

Blockchains enjoy a number of important advantages including decentralization and security (WorldBank, 2018). In our model, all key aspects of prescription for a drug can be verified including the prescribing physician, the patient receiving the drug, the diagnosis, the dosage, when and where the prescription is filled, and the pharmacist filling the prescription. To ensure privacy, each user has a public key and a private key. Users can view past transactions without access to the personal information of the parties of the transactions (Prashanth Joshi et al., 2018). Compared to Central Open Database systems, blockchain offers much stronger, hamper-free security apart from authentication of filled prescriptions that forms the basis for calculating payments to the IPR owner. Without authentication there will be possibility of abuse that will threaten the sustainability of the mechanism.

One handy choice for the implementation of the MGI is the use of an Ethereum blockchain. Since 2015 the Ethereum blockchain has proven to enjoy the core benefits of being immutable, decentralized, secure, reliable, and offering fast transactions (Soulsby, 2018). The smart contract algorithm approach used in Ethereum blockchains allows accurate, authenticated transactions by authorized physicians and pharmacists to be recorded so the MIGA can pay IPR fees to the IPR holder periodically according to the filled, authorized prescriptions.

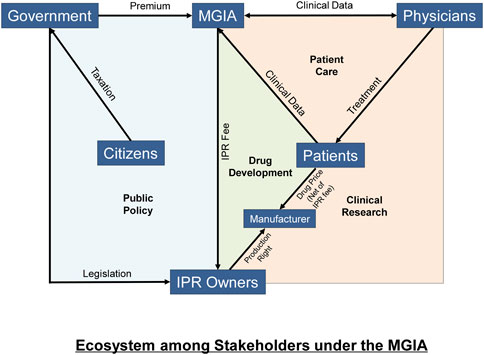

We present the new ecosystem in Figure 2. Premiums are paid by governments, which collect revenue from citizens. The MGIA with the revenue received will pay IPR fees to drug companies and this can be done using a smart contract. Patients or their insurers therefore pay much lower drug prices net of IPR fees to manufacturers. Data is generated in the process that enables the IPR payments and supports clinical research.

Blockchain technology is going mainstream in health care and insurance industries. Haleem et al’s (2021) review of the use of the technology concludes that blockchain has reached the healthcare industry with a rising acceptance rate (Haleem et al., 2021, p. 132). Purohit et al. (2021) demonstrated that a novel HonestChain system can be used for data sharing that offers data security, privacy, applicability in terms of speed, and economic gain, allowing providers to achieve “faster data decision making when processing protected data requests from requesters. These provider benefits for multi-source data sharing and analysis can support rapid innovations for clinical research informatics and engender next-generation decision support for researchers/clinicians in the cure of diseases” (p. 3025). A report from Chang and Freidman (2016) on the use of blockchain in health insurance concludes that “The greatest opportunities may extend beyond making incremental improvements in current business models to harnessing blockchain’s unique attributes to create entirely new types of interactive policies and launch innovative services that add value and grow the business.” Justinia (2019) and Abramowicz (2019) offer extensive discussions on how the application of blockchain in insurance may offer opportunities for solving real-world problems in healthcare and biomedical sciences.

An Illustrative Statistical Model for Calculating Insurance Premium for the Massive Group Insurance

We now propose a statistical model, for illustrative purposes only1, that may allow some initial estimates for the insurance premium for the MGI which will be applicable for a specific drug. This will better illuminate the conceptual basis for the insurance model. To tackle the calculation of this premium, the first step is to estimate an equation, using global data.

Suppose there are five age brackets. We propose to regress the number of new cases for some orphan disease δ for each age bracket in country i in year t against the ethnic composition for the same age bracket for each gender, plus any other known variables that may affect incidence. The sum of new cases for each country can then be derived. This can then be added to the number of existing cases. Thus we will have the total number of cases Ciδ for each country.

Assuming that a percentage of

The total premiums collected by the MGIA will be equal to the sum of premiums across all subscribing countries. All these proceeds net of the cost of MGI administration would be paid to the developer of the drug. The MGIA will need to satisfy the condition that the compensation under the new insurance and financing model will result in a present value of income stream that is bigger than the present value of income stream under the status quo as indicated in equation (EMA, 2020).

Having worked out the standard IPR fee, the actual premiums to be paid by each country will be worked out by considering its per capita income relative to median per capita income among subscribing countries. This will be based on a factor

It is up to each country to figure out how to raise the money for the insurance premium. If a subscribing country has a universal health insurance scheme in place, the national insurance scheme will still have to pay the insured price of the drug, which is the cost excluding IPR cost. Given that the insured price is much lowered, the risk of collapse of the healthcare system is much alleviated. In the absence of traditional national health insurance but with a subscription to MGI, patients or their private insurers will pay for the drug at the MGI-insured price.

Summary and Key Advantages of the Proposed Insurance and Business Model

Although enactment of legislations including the Orphan Drug Act (United States, 1983) and the EU Orphan Medicinal Products Regulation has allowed R&D incentives for orphan drugs (Hughes-Wilson et al., 2012), a balance between the profits that industry expects and the cost of health services the public can bear should be sought. Price negotiation is warranted to deal with the distorted free-market competition at country level (Luzzatto et al., 2018).

We acknowledge that in principle the drug price should provide sufficient incentive for R&D. However, there can be no ex ante estimate of how much a new drug yet to be developed is going to cost. Therefore in this paper we avoid the problem by focusing only on drugs already developed and approved by the authorities. We argue that as long as the income stream going to the IPR holder under our proposed scheme beats what can be expected under the traditional business model, it will produce a win-win situation. The proposed financing model directly lowers the drug price in all the countries that have subscribed to the MGI. Because all prescriptions have to be filled by an authorized pharmacist for an authenticated patient, there will be no worry for parallel trade. Given the potential for greater profit after development and approval made possible by MGI, drug developers of should also be incentivized by the proposed mechanism. All in all, thanks to a new technology, there is much promise for greater accessibility of the presently very expensive drugs that can relieve the pains and financial burdens of potentially millions of patients and their families.

Whereas data collected using blockchain is completely secure, a centralized open database is subject to serious risks, especially when a lot of money is involved in IPR fee payments. The most serious risks are data leaks and data loss. Over the years, multiple incidents of hacking have occurred, and even companies like Facebook, Yahoo, and Equifax, which are supposed to know how to protect their data, were not spared. Moreover, unlike decentralized encrypted data such as those secured by blockchain technology, a centralized open database is stored up at fixed locations, as a result the chances of data loss cannot be eliminated (Morillo, 2019). In contrast, it has been shown by Haleem et al. (2021) that:

• The distributed blockchain platform offers the health sector opportunities to trace fraud, reduce overhead costs, reliably manufacture jobs, eliminate duplication of labour, enforce openness in the health environment.

• It offers “immutability and confidence, and decentralization.” “Blockchain technology will generate a hash for individual blocks of patient health records. Blockchain system would also encourage patients to show their required data to third parties while keeping their identity confidential.”

• By boosting medical professionals’ and researchers’ reliability, auditability, and accountability, blockchains will strengthen trust in clinical trials, enhancing benefits for patients over the long run.

• “Many drug makers want to record the findings that will provide their businesses with such advantages. Thus, researchers use blockchain technology to make clinical studies fairer and more straightforward. It will help record clinical trials that are secure, uneven, and straightforward.”

The authors concluded that despite initial difficulties due to lack of expertise, “blockchain technology is core to validating transactions and transfers of information” (Haleem et al., 2021, p. 137).

The launch of the Global Trust over IP (Internet Protocol) Foundation is a sign of maturation of digital identity verification and transaction authentication. Established in 2020 with 29 other founding member organizations from across the world, the project hosted by the Linux Foundation aims to enable the trustworthy exchange and verification of data between any two parties on the Internet based on a robust, common standard that gives people and businesses the confidence that data are coming from a trusted source (Wallen, 2020).

Our proposed insurance mechanism rewards the patent holder not through price mark-up, but through a brand-new IPR fee, which is paid to the drug company by an MGIA. Because the premiums are charged to governments and involve cross subsidies from rich to poor countries, the incentive to subscribe among poor countries will be greatly enhanced. This will greatly improve accessibility. Production will then benefit from economies of scale.

Our proposed mechanism is consistent with the mission of the World Intellectual Property Organization (WIPO). In May 2020, the WIPO launched WIPO PROOF, which provides electronic signed certification to prove the existence of a digital file at a specific date and time. Electronic certification allows dramatic reduction in the risk of challenges to trademark registrations, and by the same token, the ownership of intellectual property rights (Rose, 2020).

The use of the proposed financing model is not just restricted to orphan drugs. There is also the potential to extend to other expensive drugs and even vaccines. Because patent holders’ interests are protected with IPR fees collected from the MGIA, the drug company can license other drug manufacturers to produce large quantities with the necessary quality control. This advantage is particularly pronounced when there is a need to produce a vaccine or a drug in large quantities in a short time. Wouters et al. (2021) reminded us both of the need of timely production in sufficient quantities, and also the need to search for a mechanism “to ensure the affordability and sustainable financing” of the vaccines.

It may be worth pointing out that the proposed insurance scheme in a way resembles yet differs from the common practice of international price discrimination (Danzon, 1997) by many pharmaceutical companies (i.e., a same drug is sold at different prices in different countries).

First, the prices of the covered drugs will be lower in countries that subscribe to the MGI and higher elsewhere, and MGI premiums are higher in rich countries and lower in poor countries. Drug companies collect the IPR fees from the MGIA, but not from the markups on production cost. Unlike the markups in the commercial world practicing price discrimination which reflect differences in purchasing power as well as the bargaining power of different countries to negotiate deals with the drug companies, our proposed scheme streamlines the pricing model that is much fairer and over time produces a huge incentive for every country to participate. The differences in the per capita MGI premium from country to country reflect a meticulous and systematic consideration of factors that go into the formula for calculation which applies across the world.

Second, unlike in the current market mechanism, under which many patients cannot afford the needed drugs for lack of means or lack of insurance, with the MGI insurance premium paid through government funds all eligible patients in the subscribing country would benefit from lower prices.

Third, under international price discrimination, the possibility of parallel imports for drugs may greatly affect the profits of a pharmaceutical company (Maskus, 2001). Pharmaceutical companies may choose not to sell a drug in low-income countries to reduce these possibilities. However, in our proposed scheme, thanks to the blockchain technology, drug prescriptions will be traceable to ensure that they are prescribed by specific authorized physicians for specific patients’ personal use, which ensures that resale for profit is not possible. Over the long run, in a world where the prescriptions of all authorized medical practitioners need authentication, the intellectual property rights of drug companies will be much better protected.

Finally, the interactions among the different stakeholders using blockchain technology generate big data that will benefit the R&D for drugs and the further improvement of health policy (left panel in Figure 2).

The Massive Group Insurance Agency (MGIA) model is implemented using a blockchain system congruent with patient care, drug development and clinical research. Payment to the IPR owners are recorded using a payment system (Green area) whereas clinical data (Orange area) generated during patient care can be recorded using a health record system which serves similar purposes as a registry used in clinical research. The MGIA receives premiums at the country level from governments (Blue area) with all citizens covered under the group insurance principle. Patients or their insurers will pay drug price, net of IPR fee, to the licensed manufacturers of the drug.

Data Availability Statement

The original contributions presented in the study are included in the article, further inquiries can be directed to the corresponding author.

Author Contributions

LH first proposed the MGI and presented it in an international conference. He gathered the research team with expertise in patents and IPR, medical and pharmaceutical research, actuarial science, and blockchain. TZ, TK, KW, FL and SL each contributed ideas from their backgrounds to this manuscript.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Acknowledgments

We thank the Pan Sutong Shanghai-HK Economic Policy Research Institute for supporting this research and in particular Dr. Wing Lok Hung for helping to coordinate the meetings among the authors. We also thank the organizers of the HK Public Key Infrastructure Forum Conference—Evolution and Localization of Public Key Infrastructure and Digital Identity—Digital Trust Ecosystem, for inviting the first author to present the concept of Mass Group Insurance based on blockchain Technology to an international audience on 19 January, 2021. We thank the referees for very helpful comments and suggestions.

Footnotes

1A formal model to predict the incidence of a rare disease would deserve a full original research paper.

References

Abramowicz, M. (2019). Blockchain-Based Insurance, in Blockchain and the Constitution of a New Financial Order: Legal and Political Challenges. Availble at: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3366603.

Berger, J., Dunn, J. D., Johnson, M. M., Karst, K. R., and Shear, W. C. (2016). How Drug Life-Cycle Management Patent Strategies May Impact Formulary Management. Am. J. Manag. Care 22 (16Suppl. l), S487–S495.

Chang, C. F., and Freidman, S. (2016). Blockchain in Health and Life Insurance: Turning a Buzzword into a Breakthrough. London, England, UK: Deloitte Insights.

Chiu, A. T. G., Chung, C. C. Y., Wong, W. H. S., Lee, S. L., and Chung, B. H. Y. (2018). Healthcare burden of Rare Diseases in Hong Kong - Adopting ORPHAcodes in ICD-10 Based Healthcare Administrative Datasets. Orphanet J. Rare Dis. 13 (1), 147. doi:10.1186/s13023-018-0892-5

Danzon, P. M. (1997). Price Discrimination for Pharmaceuticals: Welfare Effects in the US and the EU. Int. J. Econ. Business 4 (3), 301–322. doi:10.1080/758523212

De Vrueh, R., Baekelandt, E. R. F., and De Haan, J. M. H. (2013). Background Paper 6.19 Rare Diseases. Geneva: WHO.

EMA (2020). Orphan Designation: Overview, European Medicines Agency. Available at: https://www.ema.europa.eu/en/human-regulatory/overview/orphan-designation-overview.

FoCUS (2018b). Designing Financial Solutions to Ensure Affordable Access to Cures, an Overview of the MIT FoCUS Project. Availble at: https://newdigs.mit.edu/sites/default/files/NEWDIGS%20FoCUS%20Frameworks%2020180823.pdf.

FoCUS (2018a). Impact of Actuarial Risk on Health Plans. Available at: https://newdigs.mit.edu/sites/default/files/FoCUS%20Research%20Brief%202018F204v018.pdf.

Haleem, A., Javaid, M., Singh, R. P., Suman, R., and Rab, S. (2021). Blockchain Technology Applications in Healthcare: An Overview. Int. J. Intell. Networks 2, 130–139. doi:10.1016/j.ijin.2021.09.005

Hughes-Wilson, W., Palma, A., Schuurman, A., and Simoens, S. (2012). Paying for the Orphan Drug System: Break or bend? Is it Time for a New Evaluation System for Payers in Europe to Take Account of New Rare Disease Treatments? Orphanet J. Rare Dis. 7, 74. doi:10.1186/1750-1172-7-74

Justinia, T. (2019). Blockchain Technologies: Opportunities for Solving Real-World Problems in Healthcare and Biomedical Sciences. Acta Inform. Med. 27 (4), 284. doi:10.5455/aim.2019.27.284-291

Luzzatto, L., Hyry, H. I., Schieppati, A., Costa, E., Simoens, S., Schaefer, F., et al. (2018). Outrageous Prices of Orphan Drugs: a Call for Collaboration. The Lancet 392 (10149), 791–794. doi:10.1016/s0140-6736(18)31069-9

Maskus, K. E. (2001). Parallel Imports in Pharmaceuticals: Implications for Competition and Prices in Developing Countries, 13. Geneva, Switzerland: J Final Report to World Intellectual Property Organization.

Morillo, J. E. B. (2019). The Perils of Centralized Database. Available at: https://www.linkedin.com/pulse/perils-centralized-database-james-elijah-braganza-morillo.

Nguengang Wakap, S., Lambert, D. M., Olry, A., Rodwell, C., Gueydan, C., Lanneau, V., et al. (2020). Estimating Cumulative point Prevalence of Rare Diseases: Analysis of the Orphanet Database. Eur. J. Hum. Genet. 28 (2), 165–173. doi:10.1038/s41431-019-0508-0

Pfliegler, G., Kovács, E., Kovács, G., Urbán, K., Nagy, V., and Brúgós, B. (2014). Adult-onset Rare Diseases. Orvosi Hetilap 155 (9), 334–340. doi:10.1556/oh.2014.29857

Popovic, D., Avis, C., Byrne, M., Cheung, C., Donovan, M., Flynn, Y., et al. (2020). Understanding Blockchain for Insurance Use Cases, 25. Cambridge, UK: Cambridge University Press. doi:10.1017/s1357321720000148

Prashanth Joshi, A., Han, M., Han, M., and Wang, Y. (2018). A Survey on Security and Privacy Issues of Blockchain Technology. A Surv. security privacy Issues blockchain Technol. 1 (2), 121–147. doi:10.3934/mfc.2018007

Purohit, S., Calyam, P., Alarcon, M. L., Bhamidipati, N. R., Mosa, A., and Salah, K. (2021). HonestChain: Consortium Blockchain for Protected Data Sharing in Health Information Systems. Peer-to-peer Netw. Appl. 14 (5), 3012–3028. doi:10.1007/s12083-021-01153-y

Robinson, S. W., Brantley, K., Liow, C., and Teagarden, J. R. (2014). An Early Examination of Access to Select Orphan Drugs Treating Rare Diseases in Health Insurance Exchange Plans. Jmcp 20 (10), 997–1004. doi:10.18553/jmcp.2014.20.10.997

Rose, A. (2020). Blockchain: Transforming the Registration of IP Rights and Strengthening the protection of Unregistered IP Rights. Geneva, Switzerland: J WIPO Magazine.

Soulsby, M. (2018). The Benefits of the Ethereum Blockchain. Available at: https://medium.com/plutus/the-benefits-of-the-ethereum-blockchain-f332e62f7659.

Wallen, J. (2020). Linux Foundation Will Host the Trust over IP Foundation. Available at: https://www.techrepublic.com/article/linux-foundation-will-host-the-trust-over-ip-foundation/.

WorldBank (2018). Blockchain & Distributed Ledger Technology (DLT). Available at: https://www.worldbank.org/en/topic/financialsector/brief/blockchain-dlt.

Wouters, O. J., Shadlen, K. C., Salcher-Konrad, M., Pollard, A. J., Larson, H. J., Teerawattananon, Y., et al. (2021). Challenges in Ensuring Global Access to COVID-19 Vaccines: Production, Affordability, Allocation, and Deployment. The Lancet 397 (10278), 1023–1034. doi:10.1016/s0140-6736(21)00306-8

Keywords: orphan drug pricing, massive group insurance, new financing model, welfare gains, blockchain

Citation: Ho LS, Zhang T, Kwok TCT, Wat KP, Lai FTT and Li S (2022) Financing Orphan Drugs Through a Blockchain-Supported Insurance Model. Front. Blockchain 5:818807. doi: 10.3389/fbloc.2022.818807

Received: 20 November 2021; Accepted: 21 March 2022;

Published: 13 April 2022.

Edited by:

Peng Zhang, Vanderbilt University, United StatesReviewed by:

Thomas F. Heston, University of Washington, United StatesTsung-Ting Kuo, University of California, San Diego, United States

Copyright © 2022 Ho, Zhang, Kwok, Wat, Lai and Li. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Tony Chun Tak Kwok, dG9ueWt3b2s4ODhAZ21haWwuY29t

Lok Sang Ho

Lok Sang Ho Tianle Zhang2

Tianle Zhang2 Tony Chun Tak Kwok

Tony Chun Tak Kwok Francisco T. T. Lai

Francisco T. T. Lai Spencer Li

Spencer Li