- 1Kellogg School of Management, Northwestern University, Evanston, IL, United States

- 2Columbia Business School, Columbia University, New York, NY, United States

- 3Weizmann Institute of Science, Rehovot, Israel

Human decision making is often prone to biases and irrationality. Group decisions add dynamic interactions that further complicate the choice process and frequently result in outcomes that are suboptimal for both the individual and the collective. We show that an implementation of a Blockchain protocol improves individuals’ decision strategies and increases the alignment between desires and outcomes. The Blockchain protocol affords (1) a distributed decision, (2) the ability to iterate repeatedly over a choice, (3) the use of feedback and corrective inputs, and (4) the quantification of intrinsic choice attributes (i.e., greed, desire for fairness, etc.). We test our protocol’s performance in the context of the Public Goods Game. The game, a generalized version of the Prisoner’s Dilemma, allows players to maximize their own gain or act in ways that benefit the collective. Empirical evidence shows that participants’ cooperation in the game typically decreases once a single player favors their own interest at the expense of others’. In our Blockchain implementation, “smart contracts” are used to safeguard individuals against losses and, consequently, encourage contributions to the public good. Across different tested simulations, the Blockchain protocol increases both the overall trust among the participants and their profits. Agents decision strategies remain flexible while they act as each other’s source of accountability (which can be seen as formalized distributed “Ulysses contract”). To highlight the contribution of our protocol to society at large we incorporated an entity that represents the public good. This benevolent independent beneficiary of the contributions of all participants (e.g., a charity organization or a tax system) maximized its payoffs when the Blockchain protocol was implemented. We provide a formalized implementation of the Blockchain protocol and discuss potential applications that could benefit society by more accurately capturing individuals’ preferences. For example, the protocol could help maximize profits in groups, facilitate democratic election that better reflect the public opinion, or enable group decision in circumstances where a balance between anonymity, diverse opinions, personal preferences and loss-aversion play a role.

1. Introduction

Among the fundamental assumptions of traditional economic theory is the belief that individuals act to maximize the utility they receive from the decisions they make (Smith, 1776). Any deviation from that behavior is considered irrational. However, contrary to the traditional economic theory, years of research in behavioral economics have shown that people frequently behave irrationally (Thomas, 1993; Ariely, 2008). Examples for such irrational behaviors are seen in marketing, healthcare, dating, the legal system, and numerous other domains (Levy et al., 2010; Cerf et al., 2015; Mentovich et al., 2016).

One explanation for the reason individuals deviate from an optimal, utility maximizing, economic decision making model is the bias that emerges from psychological and sociological attributes of the decision. For example, individuals are likely to be influenced by the decisions of others around them, adhere to social norms, or conform to with a group majority despite their better judgment of a certain decision (Asch and Guetzkow, 1951; Cialdini and Goldstein, 2004). Whether a person manages to save money or eat healthily, for example, is not only determined by their mere rationality but also by the decisions made by those around them (Christakis and Fowler, 2007). Furthermore, people’s decisions are typically influenced by context, by their emotional state, or by situational factors. For example, people are more easily persuaded to behave in ways that violate their normal personality traits when they are in a good mood (Bless et al., 2001), or, on online dating platforms, are more likely to display preference toward users whose name sound like theirs, despite stating explicitly that their decisions were not biased (Levy et al., 2010).

Decision making is particularly prone to group influence if the decisions of individuals interdependently impact the outcomes of the entire group. Such decisions include elections, the division of shared resources, or contributions to public goods. Research has shown that individuals are more altruistic when cooperation benefits the public good rather than other individuals (Gächter et al., 2017). This is true for resources that are socioeconomic (i.e., a shared financial resources; Levin, 2014), ecological (i.e., climate change; Ostrom, 2010), or even at the level of micro-organisms (Nadell et al., 2008). Group effects such as spite, competitiveness, retribution, alongside compassion, prosociality and altruism have all been shown to alter the magnitude of adherence to norms in the context of decisions that cater toward a public good (Levin, 2014). Finally the likelihood of altruistic behavior (i.e., higher contributions to public goods) is Increased when decisions are not made Individually but as a team (Coxb and Stoddard, 2016). Altogether, prior works point to a delicate balance between the individual’s self-interest of maximizing their utility and their desire to adhere to social norms that signal cooperation.

A key component that influences individual decision making in a broader social context is trust. Individuals establish trust in order to form agreements, navigate personal relationships, create alliances, and maintain functioning societies (Gambetta, 1988; Fukuyama, 1995; Jones and George, 1998; Leana and van Buren, 1999). For example, numerous sovereign institutes rely on citizens’ trust in the governing body to enable a collective pooling of resources to aid the community as a whole. Governments collect taxes and use those taxes to build roads, subsidize healthcare or fund education. The citizens contribute their income to the collective pool via the taxation system with an implied trust that the government will make use of the funds to help the community. Similarly, people pay insurance companies regularly with the belief that if they encounter grave circumstances those insurance companies will use the money collected to pay for their needs. The core idea behind such systems is that social life can be managed more efficiently when resources are pooled rather than exploited individually.

In line with this proposition, empirical evidence shows that decision making at various social structures (e.g., companies or countries) becomes more efficient when these structures show greater levels of trust among individuals (e.g., employees, or citizens). For example, research has demonstrated that high levels of trust between business partners or firms is associated with a more pronounced focus on long-term relationships, higher levels of cooperation, and higher relationship satisfaction (Fukuyama, 1995; Coxb and Stoddard, 2016). Likewise, higher levels of trust on a country-level are related to a higher likelihood of citizens complying with the country’s laws (Jones, 2015), higher levels of prosociality (Zak and Knack, 2001), as well as higher GDP (Bjørnskov, 2012).

Contrary, the absence of trust can severely undermine the quality of decision making. Individuals in countries where the level of trust in the sovereign institutions is low are more likely to make decisions that are detrimental to their own long-term wellbeing (Jachimowicz et al., 2017). For example, if people do not trust that the money they deposited in a bank will be available to them in the future then they are unlikely to deposit it in the first place. This, in turn, leads to an increased likelihood that they will spend the money on impulsive immediate gratification rather than long-term goals, which often leads to shortage of income in dire times.

Despite the benefits of trust for both individuals and society at large, empirical evidence shows that trust is fragile and easily deteriorates (Schweitzer et al., 2006). All it takes is one single instance in which trust has been broken for individuals to make generalizations about the trustworthiness of others. At the same time, once trust is broken, it is difficult – and sometimes impossible – to repair (Johnson et al., 2001; Schweitzer et al., 2006; Smith and Freyd, 2014). Countries that suffer from systemic corruption tend to remain corrupt without intervention (Bjørnskov, 2012; Jachimowicz et al., 2017), negotiations that uncover a deceptive party often lead to retribution and a failure to reach an agreement (Johnson et al., 2001; Schweitzer et al., 2006), and couples who experience a betrayal in the form of cheating frequently end up in separation (Perel, 2017).

This led behavioral economists and researchers in psychology to suggest various scenarios that can model breakage of trust – allowing for the study of its antecedents and consequences (Gunnthorsdottir et al., 2007). A number of those scenarios involve a game played over multiple rounds [e.g., a multiple-iteration Prisoners Dilemma game, the Trust Game (Berg et al., 1995), or the Public Goods game; Ledyard, 1995; Hauert and Szabo, 2003; Camerer and Fehr, 2004; Levitt and List, 2007]. Typically, those games have two conceptual states of equilibria: complete trust and complete distrust (Hauert and Szabo, 2003). Empirical evidence, however, shows that while players typically initiate their behavior with complete trust (i.e., do not defect in the Prisoners Dilemma game on the first iteration), the games tend to converge toward a state of complete distrust (Levitt and List, 2007; McGinty and Milam, 2013). This is because a breakage of trust frequently leads to a loss for the players who were suffering the consequences. As a quid-pro-quo those players tend to become more cautious and less trusting in future rounds, which, in turn, leads the remaining players to become cautious too. The resulting decay toward the equilibrium of complete distrust is rapid and nearly impossible to reverse.

To withstand the challenges that emerge from lack of trust various protocols have been suggested to enforce a collective rule, to prevent trust breakage or to minimize the likelihood of dishonesty (Buterin et al., 2019). Those protocols rely on mathematics, cryptography and anonymized majority-rule to enable complete accountability by all participants. That is, each player acts as other players’ checks-and-balances and is able to call-out departure from the norm rapidly. One such protocol is Blockchain (Tapscott and Tapscott, 2016).

1.1. Blockchain

Blockchain is a protocol by which individuals are able to use an anonymized ledger to code, sign, and timestamp decisions. The individuals can generate contracts that incorporate a set of conditions which can revoke and nullify a commitment based on pre-determined criteria (Tapscott and Tapscott, 2016). For example, person A can state publicly within a shared ledger that they commit to giving person B an amount of money only if person C gives them a sum of money prior. All parties code the contract and honor it only if evidence for all transactions occur and are shared across the ledger. As such, Blockchain can function as mechanism by which all parties act as the others’ regulators. Consequently, Blockchain protocols can be used to improve the collective outcomes of all individual decision makers.

As a simple illustration of a Blockchain protocol, one can imagine the baggage claim belts at airports. While no single entity checks that arriving passengers only claim their own suitcase and not others’, the fact that all suitcases arrive together and that all suitcase-owners are looking for their personal belongings, effectively generates a way by which every person claims only their own luggage.

While Blockchain protocols have been used primarily in the financial domain (e.g., in the form of cryptocurrencies) the effective use of the protocol can go beyond the monetary use (Camerer and Fehr, 2004). Indeed, some groups have formed alliances that rely on Blockchain to enable collective decision making in the form of voting, supply-chain management, transportation management, and more (Hauert and Szabo, 2003).

Here we show an implementation of Blockchain protocol to allow multiple players in a generalized version of the Prisoner’s Dilemma, known as the “The Public Goods” Game (PG) (Camerer and Fehr, 2004). We first replicate the classical behavioral results of the PG game using a computer simulation. That is, we show that the game deteriorates to a state of complete and permanent distrust in nearly all conditions. Following, we test two hypotheses. First, we propose that the inclusion of a Blockchain protocol in the PG enables a recovery of trust after a violation by a defector (Hypothesis 1). Second, we propose that the Blockchain implementation yields a higher gain for a third-party entity that represents the public good (Hypothesis 2).

Across multiple simulations, we demonstrate that an implementation of the anonymous Blockchain protocol enables agents to regain trust in one another, generate higher payoffs, and increase the overall contribution to a collective pool. Additionally, we show that optimizing the Blockchain model – while allowing individuals to maximize their own interests – yields an increased reward for all agents as well as an independent 3rd-party beneficiary. That is, adding a representation of individuals’ personal preferences, while keeping within the reigns of the trust protocol, leads to an increase in trust even following a momentary betrayal. We suggest that the protocol effectively allows for a democratic decision making process that maximizes all individuals benefit while contributing to the public goods in an optimal fashion.

2. Materials and Methods

2.1. The Public Goods Game

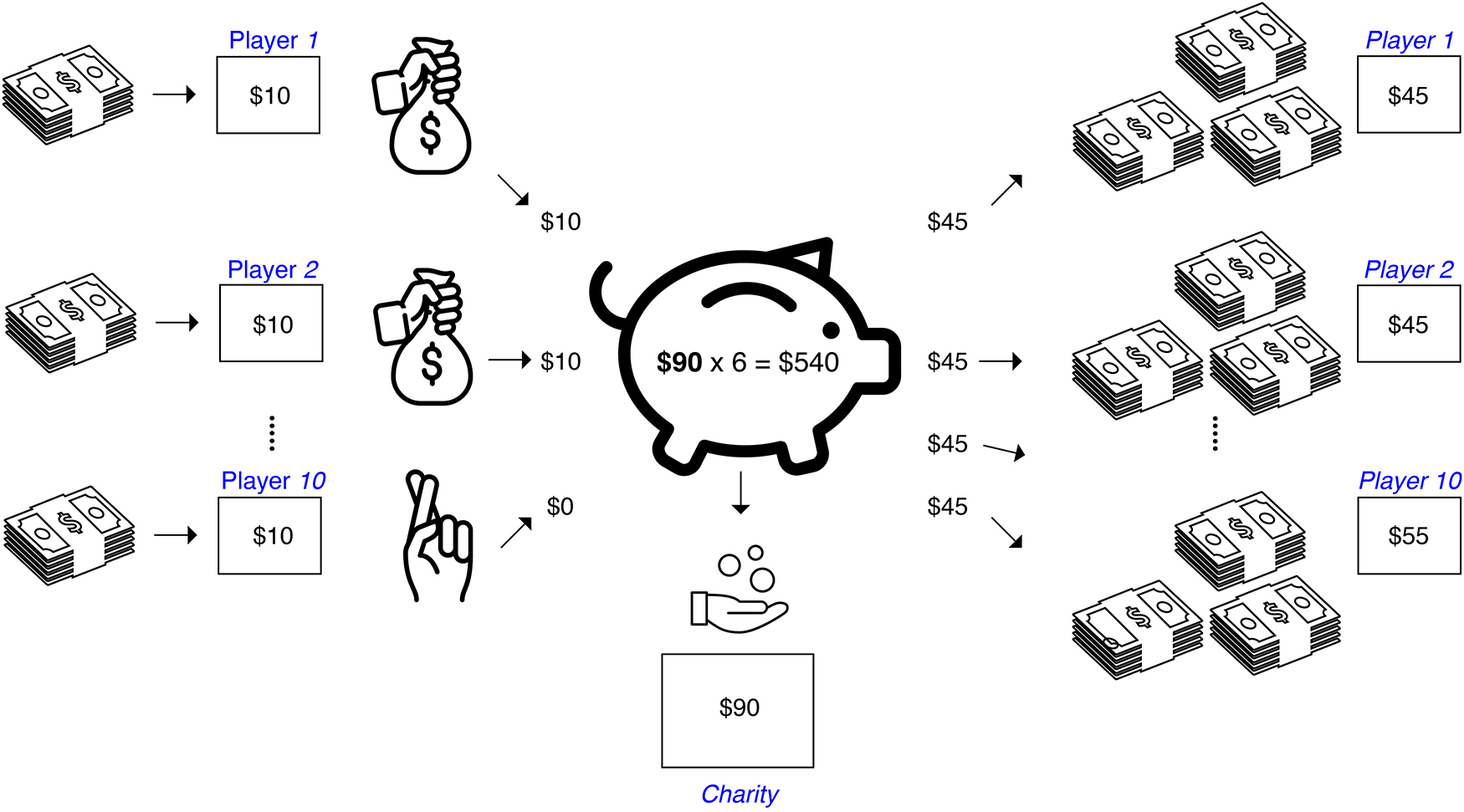

To illustrate the conditions of our work, we first describe the protocol of the PG game. The PG game is typically portrayed in the context of a scenario where n players are working in a village and receive equal daily wages (w) for their work, every morning. For example, each of 10 players may receive a wage of $10. The total amount earned by all the players is then n x w (10 x $10 = $100).

Each player can decide, each morning, whether to keep their income, or to put it in a shared account (e.g., a collective savings account with fixed interest, or a bond that yields a static increase). Over the course of the day the shared account multiplies by a fixed amount (e.g., 600%). Once the day is over, the money in the shared account is divided equally among all players. Importantly, all players receive their dividend regardless of whether they contributed to the public good or not. The same procedure is repeated daily, and each player is free to decide every day whether or not to contribute their wages to the shared account. In the standard PG game protocol, all players can only contribute the full amount or nothing, and the decision is anonymous such that no player known who may have betrayed. This scenario is often seen as analogous to a taxation system, a shared mutual fund or pension plan, an insurance, or other systems that collect money from a group and use it to promote everyone interests equally.

In the outlined scenario (see Appendix 1 for complete breakdown of the game), if all players contribute their wages the shared account will end up having $600 ($100 × 600%) at the end of the day, and each of the 10 players will receive a cut of $60. This condition is termed “complete trust.” Complete trust is a state of equilibrium where players have no immediate incentive to change the status quo and would benefit from continuous contribution to the shared account. However, each player may increase their payoff if they chose to betray the public good. This can happen by electing to independently not share their wages with the remaining players. For example, in a scenario where one player chooses to not share their wages only nine players will contribute their wages and the shared account will hold 9 x $10 = $90. Multiplied by the interest, the daily total will be $540. This money would then be equally split among all the players, including the one who did not contribute. Each of the nine contributing players will receive $54 while the one player that betrayed the community would end up with $64 ($10 of the wages they kept, along with $54 from the joint contributions of everybody else).

Similar versions of the game have been developed, which highlight specific attributes of the overall experience. A version of the game with only a single iteration focuses on the behavior of individuals without the opportunity to engage in norm-enforcement and long-term planning (Gunnthorsdottir et al., 2007). Other versions force players to play without the veil of anonymity, thereby forcing transparent disclosures and group dynamics effects (i.e., emergence of group leaders, or increase in cooperation due to public shaming of defectors) (Rege and Telle, 2004). Other versions allow for alteration of the contributed amount by agents, asymmetry in the dividend yielded, asymmetry in punishment for defection, sequential versus simultaneous contributions, and the reframing of the public good’s meaning (i.e., instead of focusing on financial outcomes, the public goods can be seen as a climate outcome or a shared water resource) (Willinger and Ziegelmeyer, 1999; Andreoni et al., 2003; Sefton et al., 2007; Rand et al., 2009; Gächter et al., 2010). While the plurality of the works mentioned overwhelmingly replicate the results pertaining to decay in trust and cooperation, some studies have shown that under various conditions (i.e., larger groups of players) trust and cooperation may be restored after a decay (Isaac et al., 1994). This suggests that some variables of the game could be tuned to alter the behavior of individuals for prosocial outcomes. Those works, however, are still the minority. Finally, similar games such as the single/repeated-trials Prisoner’s Dilemma and the Trust Game have focused primarily on two-player interactions and show how an equilibrium of lack of cooperation and lack of trust are the more frequent outcome under most experimental conditions (Berg et al., 1995) [despite some differences in interpretation of the generalization of those games from two players to n players. See Barcelo and Capraro (2015) for discussion]. Recent works in neuroscience have investigated potential neural drivers of the decay in trust [i.e., in the context of peer influence (Van Hoorn et al., 2016), political outcomes (Barnett and Cerf, 2018) and even the view of public goods entities as human or not (Mentovich and Cerf, 2014)].

2.1.1. Additional Third-Party Beneficiary

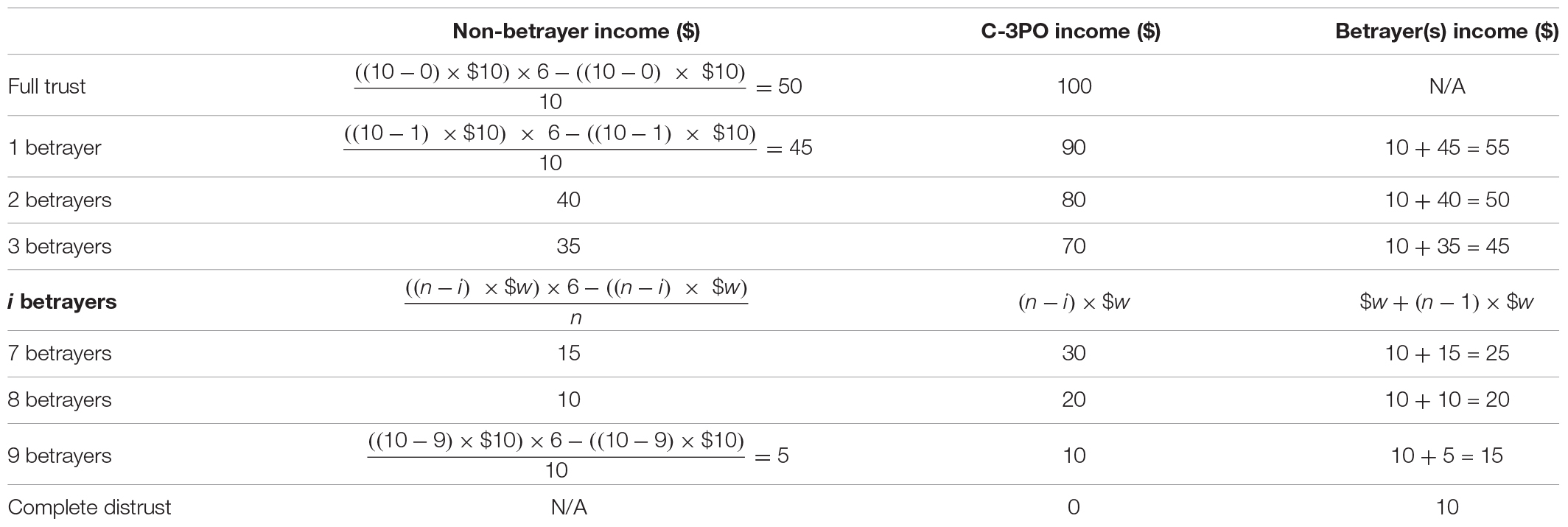

We implemented a modified version of the PG game (see Table 1 for experimental parameters) with one additional element to amplify the fact that a shared account can be seen as a public good. We added an independent, benevolent entity that only stands to gain from the contribution of all players without the ability to hurt or be hurt by anyone. That is, in addition to dividing the total amount generated by the shared account among all the players we introduced an additional third-party beneficiary that receives a cut from the total amount without contributing. This third-party can be seen as representing a taxation body, a charity receiving donations, or fund manager receiving fees for their clever investments that yield the daily interests. We term the third-party beneficiary: Charity/3rd-Party Organization (C-3PO).

In our implementation the C-3PO receives 1/6 of the funds generated in each round (which is equal to the amount contributions by all players in the round). The remaining 5/6 of the funds are equally distributed among all n players. The game setup is illustrated in Figure 1. The main focus of our analyses will be the amount the C-3PO generates from the game after N consecutive iterations. This is a proxy of the overall utility of all players and the ability of the group to maximize profits.

Figure 1. Illustration of the Iterative Public Goods Game with a Charity/3rd-Party Organization. Left: agents either contribute their wages into the shared account, or anonymously defect. The amount in the shared account is multiplied during the day. Center: A cut of the total yield is donated to Charity (/3rd-Party), and the rest (right) is divided equally among all players (including the defecting ones).

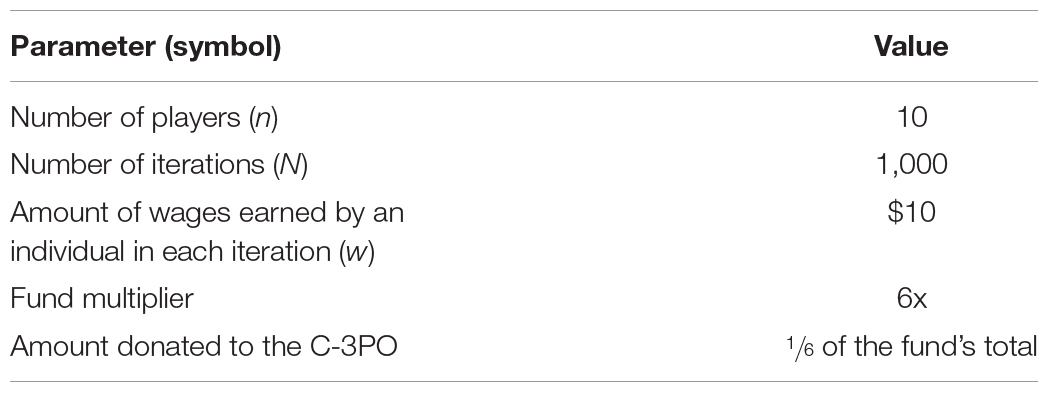

We define the game properties “parameters” and keep those constant (see Table 1) across all simulations.

To test the effect of the Blockchain protocol on the system and demonstrate that the performance is improved irrespective of the game conditions we test various experimental variables (Table 2). Our performance measures are the amount of money earned by the C-3PO at the end of N iterations and the average trust among all players. Specifically, we test the increase in earnings following the introduction of the Blockchain protocol and the optimal conditions that enable maximum increase in trust. All the codes for the simulations are available online at http://www.morancerf.com/publications.

2.1.2. Nomenclature

For ease of reading we used the following nomenclature throughout the work. For a complete list of all variables/parameters symbols used in the study, see Appendix 2.

- Simulation: one of four conditions we manipulate (i.e., Blockchain condition, Realistic condition).

- Game: a single N-iterations (i.e., 1,000 iteration) test with a fixed set of variables.

- Parameters: fixed arguments used in this work (i.e., number of participants).

- Variables: manipulated arguments tested in this work.

- Participants/players/subjects/people/persons: human individuals in a game.

- Agents: simulation/modeled individuals in a game.

- Nodes: individual clients in the Blockchain implementation.

- Trial/iteration/round: a single step, t, out of N, in each game.

2.2. Experimental Variables in the Simulations

We manipulated multiple decision making parameters to simulate how different levels of trust and personal variables impact the collective outcome (measured, primarily, as the dividend for the C-3PO) after N iterations of the adapted PG game in both a regular condition as well as three Blockchain conditions.

Recent empirical work investigating the behavior of agents in PG games identified four factors that contribute to an individual’s decision making in the game: self-interest, the behavior of others, the reaction to rewards, and the reaction to punishment (Dong et al., 2016). Of those four, financial rewards and punishments show the weakest effects. Consequently, we incorporated into our model elements that correspond to the following drivers of a decision: self-interest, group dynamics (the behavior of others), and external circumstances.

2.2.1. Trust

The main experimental variable we manipulated was individuals’ trust (T). Agents’ initial level of trust was set to a number ranging from 100% (complete trust) to 0% (no trust).

In each iteration an agent’s level of trust was calculated as a function of two variables:

(1) η1,s - the level of decay in trust by agent s in response to betrayal by other agents in the previous iteration (t-1).

(2) η2,s - the level of increase in trust in response to an increase of collective trust from trial t-2 to t-1.

The second variable, η2, corresponds to an increase in trust by an individual in response to a gradual creation of trust in the group. Therefore, as agents see that others are contributing to the game, they, too, will update their priors with respect to the group’s likelihood to trust one another.

Additionally, we varied the initial level of trust each agent had as the game started (iT). Effectively, an agent’s trust in each iteration, T, is modeled as a Bayesian Markov chain where each iteration depends on the previous one, starting with iT.

Notably, although we separated the decrease in group trust following a betrayal from the increase in group trust following a collective renewed belief in the system, the two variables can be observed as a single argument labeled as “change in trust” (η) corresponding to the sum of the two. This is because at any given trial either a decrease or increase in trust occurs – but not both. We elected to use two variables in our model since: (1) prior experimental data were shown to have dynamic ratio between people’s decrease in trust and increase in trust, and (2) because this closely aligns with the literature’s view of trust as a process that involves decrease and increase that are not necessarily identical in magnitude. Based on empirical evidence suggesting that individuals show a higher decline in trust after a betrayal than an incline after trust recovery (ηs,1 ≫ ηs,2) we modeled the parameters to reflect these conditions.

Trust in each iteration can therefore be operationalized as:

where, T1 = iT, η = η2∨η1 and t is the iteration number ∈ [1,1000]

In our simulations we varied the values of η1 and η2 from 95% (nearly complete trust) to 15% in decrement of 5%.

In each game we allocated the three variables to each of the n agents using a random distribution centered around the value, with standard deviation of 1%. That is, if in a certain game iT was set to 95%, then all n agents’ initial trust values were assigned from a normal distribution with mean 95% and standard-deviation 1%.

This decision simplifies the computations but is not mandated by the model. More complicated models can use different distributions thereby increasing the model’s degrees of freedom. Notably, given the large number of iterations compared to the number of agents starting with such distributions typically does not affect the results. Multiple tests using the same random selections should converge to the same trust values.

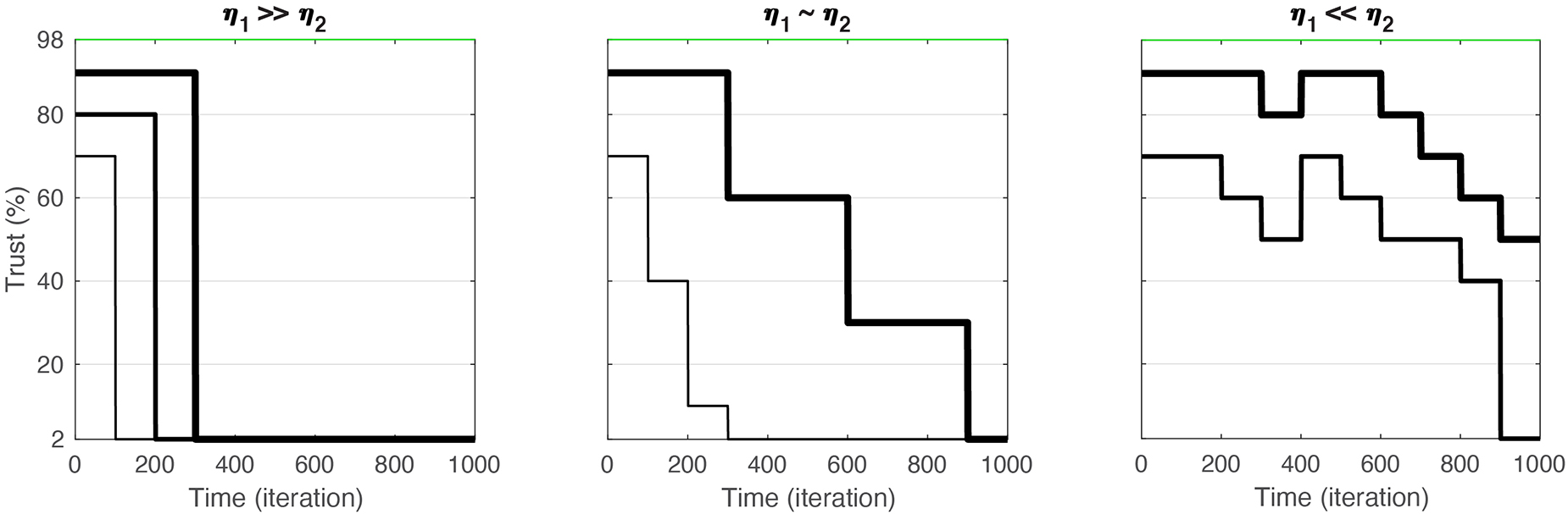

To give the reader an intuition about the effects of η1/η2 ratios on the trust outcome we illustrate three combination of values (Figure 2). When η1 is notably bigger than η2 the decrease following a betrayal is large, dropping the trust altogether to 0 rapidly. Lower levels of initial trust suggest a higher likelihood of betrayal by an agent, and therefore a faster decrease in trust as well. Effectively, the lower the initial trust, the faster the game will converge to complete distrust. Games that end with total distrust make for the plurality of empirical data (Ledyard, 1995; Hauert and Szabo, 2003; Camerer and Fehr, 2004). We, therefore, deem this condition the “realistic” scenario.

Figure 2. Illustration of three scenarions depicting ratios of η1/η2 in the PG game. While the three conditions show different styles of operation, “realistic” (left), “reciprocal” (middle), and “lovers” (right), all scenarios typically ultimately converge to a state of complete distrust. This is because of the disproportional opportunity for η1 (decrease in trust) to occur compared to η2 (increase in trust). The initial trust (iT) simply determines the speed of decay. Lower values of iT lead to faster convergence to distrust. Lines illustrate different trust trajectories across games.

When η1 is proportional to η2 trust converges to 0 as well. This is because the effect of even a single betrayal is a decrease in trust, whereas increase in trust requires multiple participants to elect to contribute their wages. Therefore, not only do games with η1 > η2 converge to complete distrust, but also games with similar sized η values. Same-sized η values games take more iterations to converge to 0. We name the scenario depicted in η1∼η2 games the “reciprocal” scenario.

Finally, when participants are playing in conditions where η2 is notably bigger than η1 they manifest a scenario where they do not see betrayal as a devastating behavior or a violation of trust. Participants are therefore likely to recover trust irrespective of prior trials. This scenario is uncommon in most situations of human relationship and reflect a uniquely psychological characteristic. This may be attributed to “lovers” who choose to confide in their partner despite momentary breakage of trust. This Ghandi/Jesus-like approach of “turning the other cheek” is not observed frequently in empirical data from the PG game. However, we can imagine situations by which it is the norm, primarily in places where trust is so fundamental and strong that even a momentary failure is seen as an anomaly. Nevertheless, even in those conditions, over time, the overall trust is likely to converge to a state of complete distrust, albeit over numerous iterations and while potentially demonstrating momentary increases in trust. The reason this scenario, too, converges to 0 is similar to reason in the “reciprocal” scenario: the number of opportunities for a betrayal to occur is approximately n times higher than the number of opportunities for random honesty of multiple players. Therefore, the small decreases in trust happen more frequently and are unlikely to be balanced by the infrequent increases in trust unless the ratio of η1/η2 is greater than n (i.e., a betray leads to a drop of 6% in trust, but a sign of honesty leads to a 60% increase).

2.2.2. Betrayal Due to Lack of Trust

To implement an agent’s decision to betray the public good in a given trial due to lack of trust we randomly selected a number between 0–100% from a uniform distribution, 𝕌(0,100), (i.e., 66%). If the random number was higher than the current trust level for the agent [i.e., T(3,21) = 60%, for the trust level of agent 3 in iteration 21] then we deemed the agent a “betrayer” on that trial. If the number was lower – the agent would not betray due to trust issues. Therefore, higher levels of trust would yield a likely selection to contribute the wages. Lower levels of trust are likely to lead to a withholding of the wages. This function of trust, f(T), ultimately yields a number, 0/1, indicating whether the agent chooses to betray, or not.

2.2.3. Betrayal Due to Reasons Independent of Trust

Participants can choose to not include their wages in the shared account for reasons outside of lack of trust. These reasons can be driven by external circumstances (i.e., a person may get ill and need to pay for his healthcare) or internal preferences (i.e., the person chooses to not contribute their wages despite the loss of profit in order to engage in norm-enforcement; behavioral economics suggest that such behavior plays significant role in people’s decision making Fehr et al., 2002; Fehr and Fischbacher, 2004a).

2.2.3.1. Betrayal due to external reasons

A person might be forced (rather than decide) to not contribute because an external circumstance does not allow them to do so. For example, a person could be forced to keep their initial wages because of an immediate need for liquid cash (e.g., the need to pay a mortgage in the morning may lead to an inability to wait a full day for the funds to multiply).

We incorporated in the model the ability for agents to manifest those external factors using a single variable, which we term “external reasons for betrayal” (ε). The value of ε is either 0 or 1, and is selected from a binomial distribution, 𝔹. We set the probability to betray as a result of external reasons to 10%. Importantly, the outcome of this variable does not depend on an agent’s level of trust. The value is calculated in each trial.

2.2.3.2. Betrayal due to internal reasons

In addition to external reasons over which the person has no control, there might also be internal reasons that result in a person deciding to not contribute. For example, a person might trust the other people in the game to contribute their wages, but decide against doing so themselves because he/she dislikes the other players. This could lead a player to make a decision that intentionally harms the other players in the game even if it comes at a personal cost. Similarly, people may consider not contributing their wages as a way to signal to other agents that they are willing to withstand an immediate financial loss as a way to elicit norm-enforcement (Fehr et al., 2002). In addition, people might simply make a mistake in their decision due to an incorrect estimate of anticipated payoffs. All of those options lead to a behavior that does not obey the classical utility functions, but incorporate psychological factors into the decision.

We incorporated these factors into the model as a term we call “internal reasons for betrayal” (ρ). Similar to the external reasons, the value of ρ is either 0 or 1 and is selected from a binomial distribution, 𝔹. The value of ρ is independent of the agent’s level of trust. Corresponding to the external factors, we set the probability to betray as a result of external reasons to 30%.

Altogether, our experimental variables are, show in Table 2.

2.3. Decision to Contribute in “Regular” Game

The equations determining the decision to contribute the wages in each iteration in a regular game are:

where s is the agent number ∈ [1,n] and t is the trial ∈ [1,N]

where Es,t ∈ [0,1] indicates whether agents will betray (0) in trial t, or not (1).

f(Ts,t) = 1 if Ts,t >𝕌(0,100), such that 𝕌(0,100) is a random number generated uniformly between 0-100.

The process of deciding whether to contribute can be described in the following way:

(1) First, an agent determines whether there are external circumstances that would force them to not contribute to the coming trial, ε. If the answer is “yes” [p(0) = 10%] then the agent does not contribute.

(2) Following, the agent determines whether they have personal internal reasons to not participate,. If the answer is “yes” [p(0) = 30%] then the agent does not contribute.

(3) Following, the agent determines whether they should contribute to the trial based on their trust in the group. This is determined according to their current value of T. If their current level of trust is higher than the randomly generated number, the agent does not contribute.

Consequently, for an agent to contribute in a given trial, three conditions need to be met simultaneously: The agent cannot have (1) external or (2) internal reasons for not playing, and they have to have (3) sufficiently high levels of trust. At the end of each trial all agents update their trust values based on the outcomes (number of agents betraying/contributing) of the previous trial. An increase in number of agents contributing in the previous trial (or maintenance of the maximal number of agents contributing in the previous trial) would yield an increase in trust, whereas a decrease in the number (or equal number that is lower than n) would yield a decrease in trust.

Our study is aimed at identifying the optimal combination of variables, in each condition that yield the highest profit for the C-3PO (an independent entity that cannot betray anyone, does not contribute to the shared account, and is perceived as benevolent by all other participants). Importantly, we sought a protocol that is realistic against the backdrop of real-world decision making and enables the participants to exert their “free will” (their individual independent decision making process) during each choice iteration (i.e., one can still elect to not contribute their wages in a trial for personal reasons).

2.4. Blockchain Protocols

The Blockchain implementation of the model adds a certification system that is monitored by all agents in the following way: a “smart contract” (a commitment to act in a certain way, Es,t, that is logged in a ledger shared by all players) is created in each trial, t, by each agent, s, such that the agent states, anonymously their intent to invest their wages in the fund. Every agent can then see how many of the n agents have committed to contribute () in the trial. The contract is executed only if a minimum number of agent, μ have agreed to contribute their wages. The value of μ is fixed, for each agent, throughout a game. See section “Discussion” for details on the Blockchain protocol’s implementation).

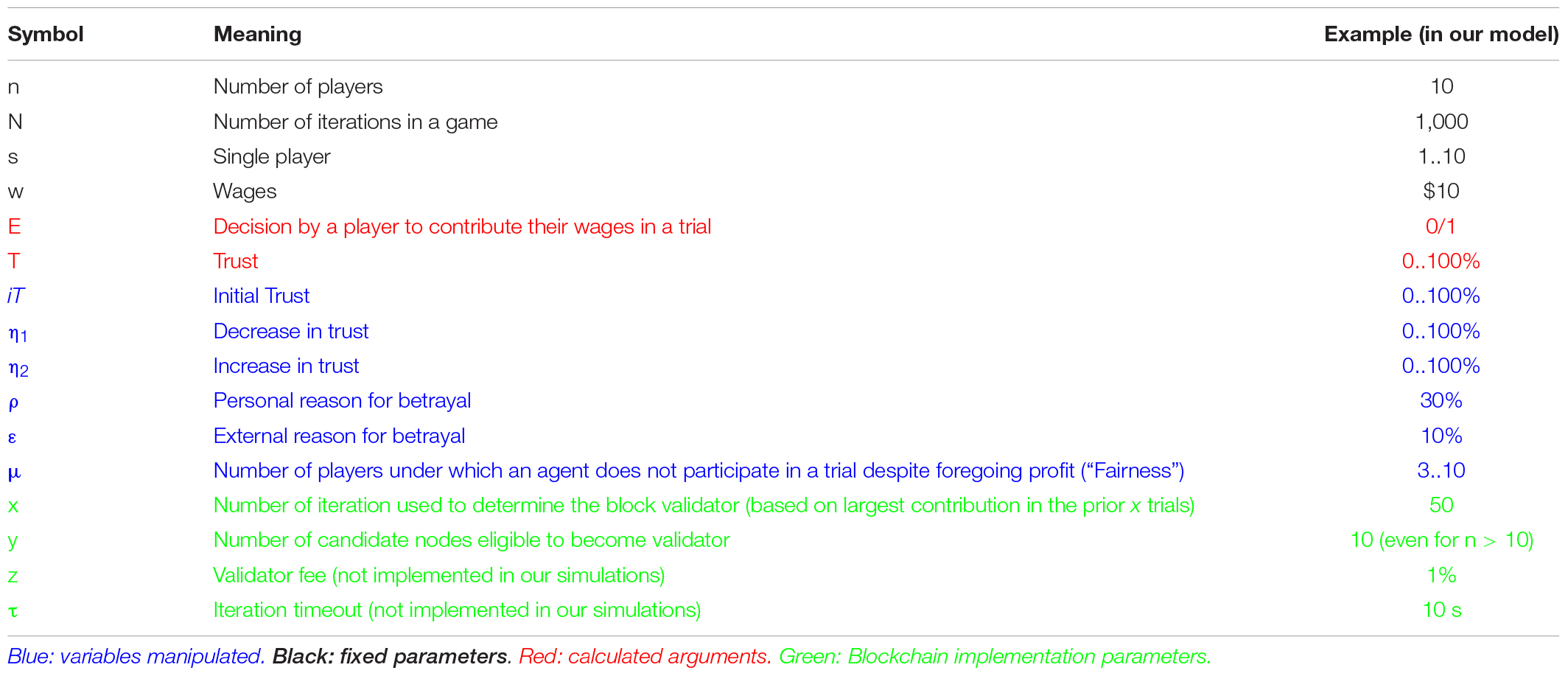

We test the Blockchain protocol under three different scenarios that vary in their level of resembles of real-world decision making and complexity:

2.4.1. Blockchain (Homo Economicus)

The first scenario assumes that the agents’ only goal in the game is to optimize their monetary utility from the game. That is, the goal of each agent is to leave the game with as much money as possible. This implies that participants are willing to accept contracts in which their payoff is bigger than their initial wage even if others are making a higher profit. In this “Blockchain – homo economicus” scenario, the threshold for executing the contract, μ, is equal to the lowest number of agents that need to contribute in order to yield a positive revenue for each contributing agent. The value of μ is similar for all agents.

For the parameters used in our simulations, μ = 3 is that lower cutoff. If at least 3 agents participated, the payoff at the end of the day is $15 (3 players x $10 wages x 600% interest - $30 C-3PO cut; divided by all 10 players), which is higher than the initial $10 wages.

Formalized, the equation to compute the minimal cutoff for agent to accept the contract is:

The homo economicus Blockchain protocol guarantees that no agent will lose money. If the minimal number of agents needed for the contract to be fulfilled is not reached, the contract is voided and none of the rows in the ledger are executed.

In this model, the certification system acts as an insurance against loss. Trust becomes less instrumental for the choice as one can participate in each trial with the assurance that no money is lost. However, the experience of trust T is still updated continuously as it is an indicator of the group dynamics. For example, low trust values signal that other agents may need liquid cash and cannot contribute to the public good, or that they are malevolent. Therefore, one may lower their trust in the group.

Practically, the model incentivizes agents to contribute their wages in every trial because it offers a safeguard against losing money. If agents elect not to do so they are likely driven by personal reasons, both internal (ρ) or external (ε). This shared understanding among all agents makes the collective trust increase over time even after a betrayal has occurred.

Equations 2–3 in the Blockchain model are, therefore, identical to the ones in the “regular” case. However, f(Ts,t) = 1 since trust is no longer affecting the decisions to contribute and there is no risk of losing money.

2.4.2. Blockchain (Homo Reciprocans)

The homo economicus Blockchain model assumes that the goal of players is to maximize their financial gains. If a player earns more than their initial wage (w = $10) they should be willing to accept the executed contract if they contributed their wages. However, as we have outlined in the introduction, prior research suggest that people make decisions that are not fully rational and that do not follow the logic of maximizing one’s economic utility (Dohmen et al., 2009). More so, research in behavioral economics argues that a rational actor in a repeated trials game may deliberately engage in a behavior that results in an immediate loss but maximizes long-term gain. Specifically, behavior that signals to other agents that some behavior is not tolerated may lead to norm-enforcement and future gains at the expense of a momentary loss (Fehr et al., 2002).

In the context of smart contracts facilitated by Blockchain technology, it is reasonable to assume that not everybody would be willing to accept the conditions put forward in the rational Blockchain model. That is, even though people stand to gain more than their initial wages if they contribute to a trial and are willing to execute a contract with only two other players, they might have moral standards that require the number of other people contributing to the game to be higher. These moral standards can be thought of as a person’s individual sense for fairness (Wang et al., 2010), for example. Fairness is known to be a fundamental human need that may place constraints on profit seeking (Wang et al., 2009; Perel, 2017). That said, the extent to which people desire and strive for fairness can vary (Dohmen et al., 2009). Having a relatively low sense of fairness might lead a person to accept a contract in which other participants benefit from free-riding the system (making more money than those contributing to the shared account). In contrast, a person with a higher sense of fairness might reject any contract that has less than maximum contributors – even they stand to lose potential payoff.

This more realistic homo reciprocans Blockchain scenario, in which people might forsake monetary gains in a trade-off against fairness, is implemented by varying the threshold between agents. That is, each agent is assigned a random variable, μs, ranging between μ and n (3–10 in our case) to reflect the degree to which they value fairness versus personal monetary gains (Table 3). Given that this threshold is considered to be a fundamental individual disposition, μs remains constant across all trials for each agent.

Effectively, this means that we add an additional variable to our model. We assign this variable randomly to each agent at the beginning of each game.

The result of this additional constraint is that both the levels of trust as well as the levels of payoffs to the C-3PO are expected to drop compared to the homo economicus Blockchain condition. This is because the additional constraint makes it less likely for the contract to be executed due to personal preferences. However, it is expected to outperform the regular model (without Blockchain) both with regards to trust and C-3PO payoffs. Additionally, it is expected to be more realistic in its depiction of human behavior. We term this model the “homo reciprocans” Blockchain model.

2.4.3. Blockchain (Optimized Homo Reciprocans)

While the homo reciprocans model provides a more realistic picture of human decision making, it also lowers both the trust and the profits compared to the homo economicus model. While still higher than the regular simulation, it may not benefit the public good in an optimal way. In order to optimize the yield of the public good, while offering individuals a chance to increase their yield and trust, we suggest an optimized version of the homo reciprocans model. In this model we include an intervention mechanism that benefits from the Blockchain implementation. This optimization allows agents to update their decision in each iteration (before the contract is executed) based on information on “what the market looks like” (i.e., the decisions of all the other agents, which determine the expected payoffs in each round). Effectively, this allows agents to keep updating their beliefs after all other participants have declared anonymously their intentions, in a way that maximizes profits and increases trust.

To illustrate the optimization we depict an agent that has decided to not contribute to the particular round due to internal reasons (ρ). The agent might wish to update their decision if they found out that 8 other agents are participating in the current round. They might change their mind since they learn that the group’s trust is increasing (more participants are willing to contribute their wages), that they may have made an irrational choice in not contributing (as others do not align with their preference to defect), or simply because the wave of support for the C-3PO by others may be contagious.

Either way, this update should depend on people’s personal standards and their sense of fairness (μs). If a person generally does not accept contracts with less than 8 people, they are unlikely to change their opinion if a given round has, say, 7 people contributing their wages. However, if a person generally accepts contracts with only 4 people playing, but was about to betray, they might change their mind if they see that 7 other players elected to contribute their wages. The person might be inclined to change their mind and contribute their wages as it both signals higher than expected levels of trust in the community, and yields higher profit.

Intuitively this means that the information on how many people choose to contribute to a round should update the person’s internal beliefs, manifested in our model as ρ. The higher the difference between one’s fairness level and the group’s willingness to express trust, the more likely the individual to change their mind, for example.

Operationalized, this is reflected in the following equation:

Simplified, this is equivalent to taking the difference between each agent’s fairness level, the group’s current willingness-to-participate, and updating the probability ρ both in the numerator and denominator.

As an example, let us use and agent s’s fairness level of μs=6. If, in a certain trial, 8 other agents are willing to contribute their wages (), then agent s will update their rationality value to

is embedded in equation 3 in each trial and returns to the initial value, ρs, before re-calculating the next iteration.

As this optimization suggests, agents are able to revisit their decisions repeatedly via the public ledger. The Blockchain therefore enables an anonymous update of the decision process such that agents maximize the alignment between their preferences and the outcomes.

Practically, this means that agents are allowed to repeatedly add rows to the ledger with updated information within a single iteration until all choices converge to a state that satisfies all participants. In our example the update happens only once (from ρs,t → ).

3. Results

We examine each model separately with the same fixed parameters (Table 1) and alternating variables (Table 2).

To illustrate the trust trajectory in the game we selected, first, a subset (n = 510) of all combinations of η1,η2,iT such that they focus on the realistic conditions that are reflected in behavioral games. The values reflect situations where, η1≫η2 and ones with, η1≈η2 which align with individuals’ tendency to decrease their trust after a betrayal and increase their trust in response to cooperation. This combinations selection corresponds to 10.38% of all 4,913 possible combinations of η1,η2,iT (17 x 17 x 17).

The η1,η2 pair combinations were selected from the following three options:

(1) both η1,η2 reflect small changes in trust (i.e., η1,η2∼15%).

(2) both η1,η2 reflect big changes in trust (i.e., η1,η2∼90%).

(3) the values of η1,η2 are of different magnitude (i.e., η1∼ 70%, η2∼15%).

We used the remaining possible combinations in following robustness checks. The probability of betraying due to external reasons (ε) was kept constant at p(1) = 90%.

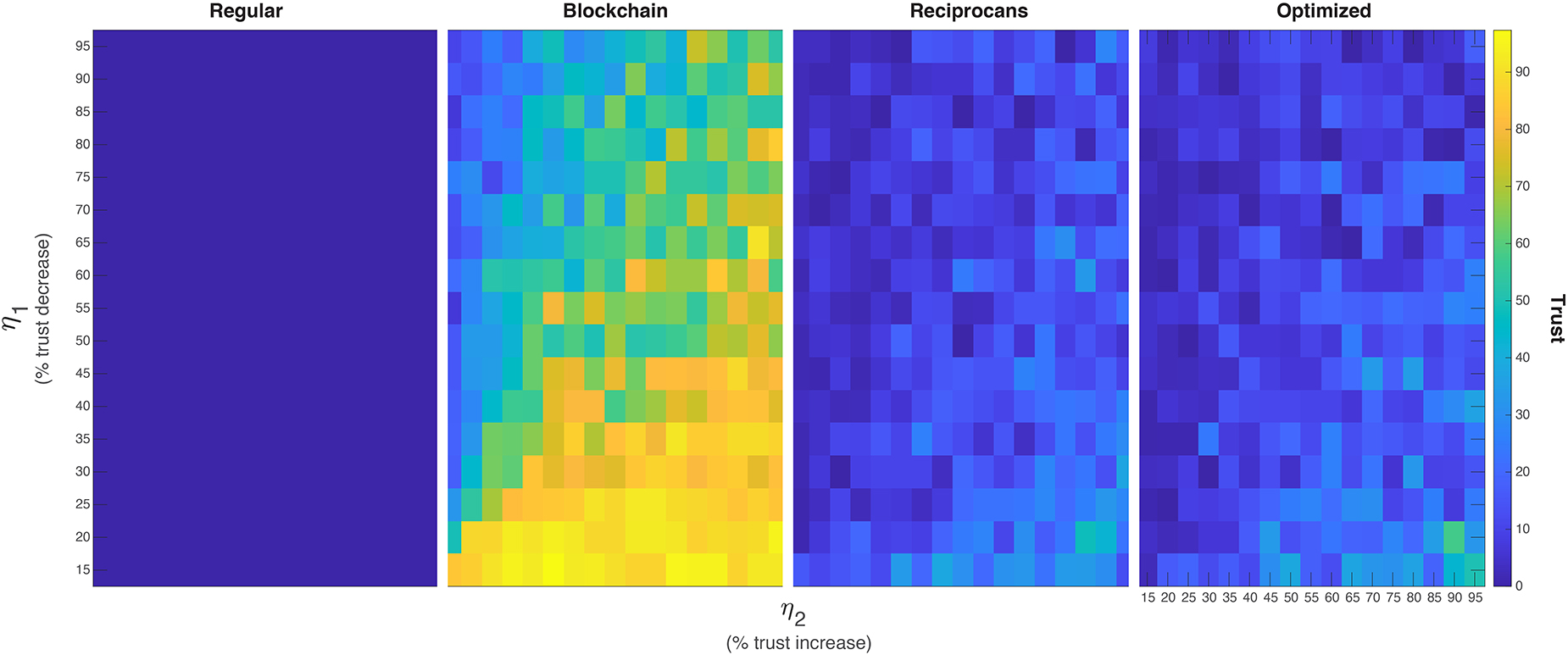

We used the same η1/η2 combinations in all four models to demonstrate their effect on trust and on the income generated by the C-3PO across conditions. After depicting the results for subsets of the data, for ease of visualization (Figures 3–7), we show the broader case with all combinations of η1/η2 (Figure 8).

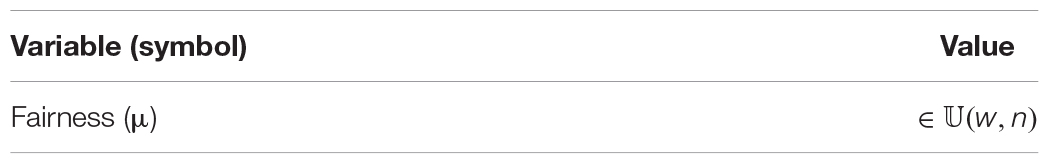

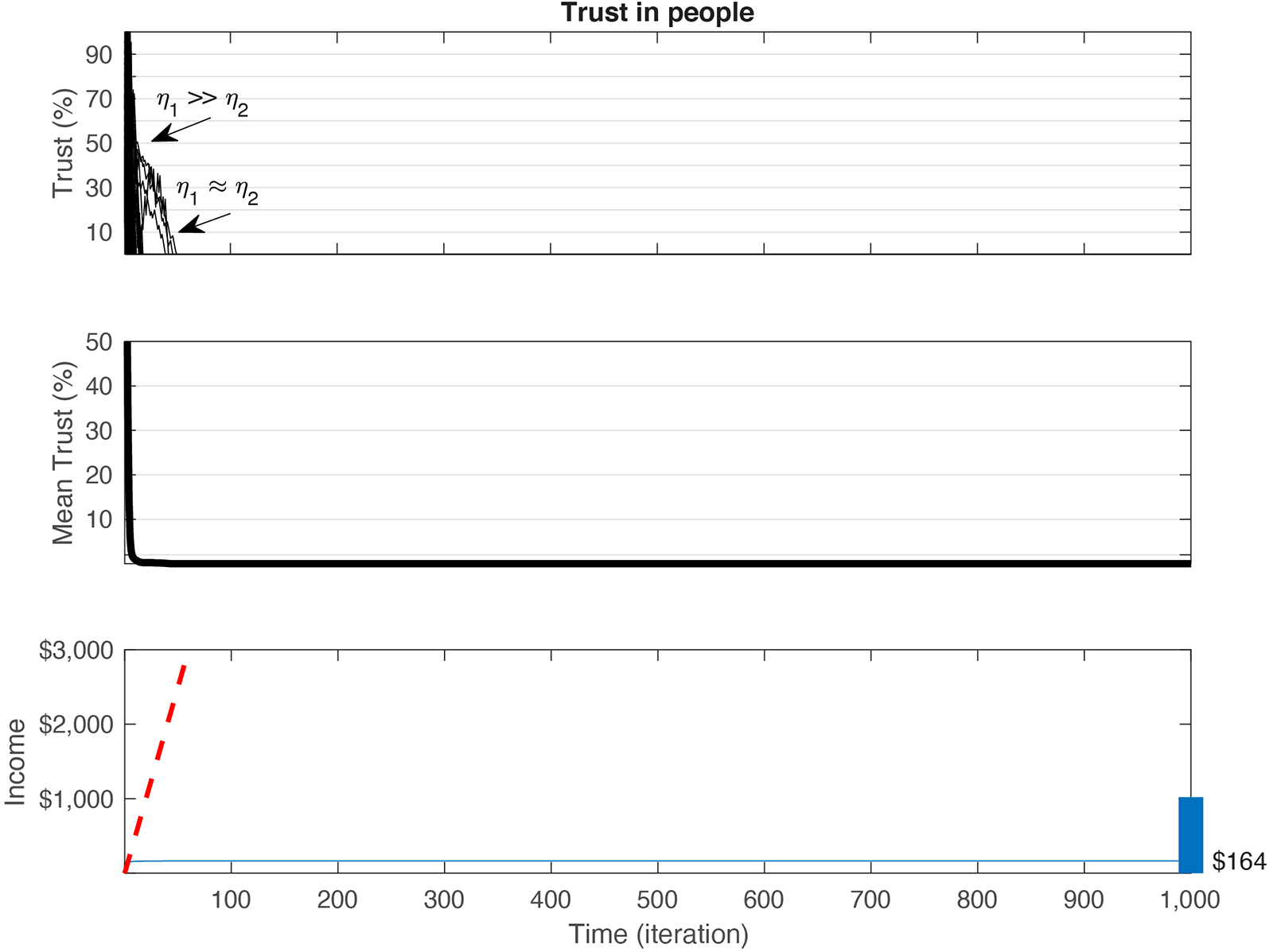

Figure 3. Simulation of regular PG games with varying values for η1 and η2. (Top) across 1,000 iterations, the trust (see equation 2) decays in all games and converges to 0, irrespective of the initial value (iT) and the ratio between η1 and η2. (Middle) Average trust across all games in the top panel. (Bottom) For each of the games and combinations of iT,η1,η2 we calculated the cumulative sum generated by the C-3PO (blue line). While the initial trials typically yield a steady revenue for the C-3PO, once trust breaks and converges to 0 no payoff is received by the C-3PO. Value of $164 correspond to the average scenario where in the first trial all agents contributed to C-3PO ($100 payoff to the C-3PO), followed by a few trials (ranging between 1 to 5 trials) where the income drops because of lower trust by participants, until the payoff decreased to 0 and remains 0 perpetually. Blue bar on the right axis depicts the range of income values generated by the C-3PO across all simulations ($0 – $1,020). Red dashed line marks the optimal cumulative sum if all agents maintained trust throughout the game.

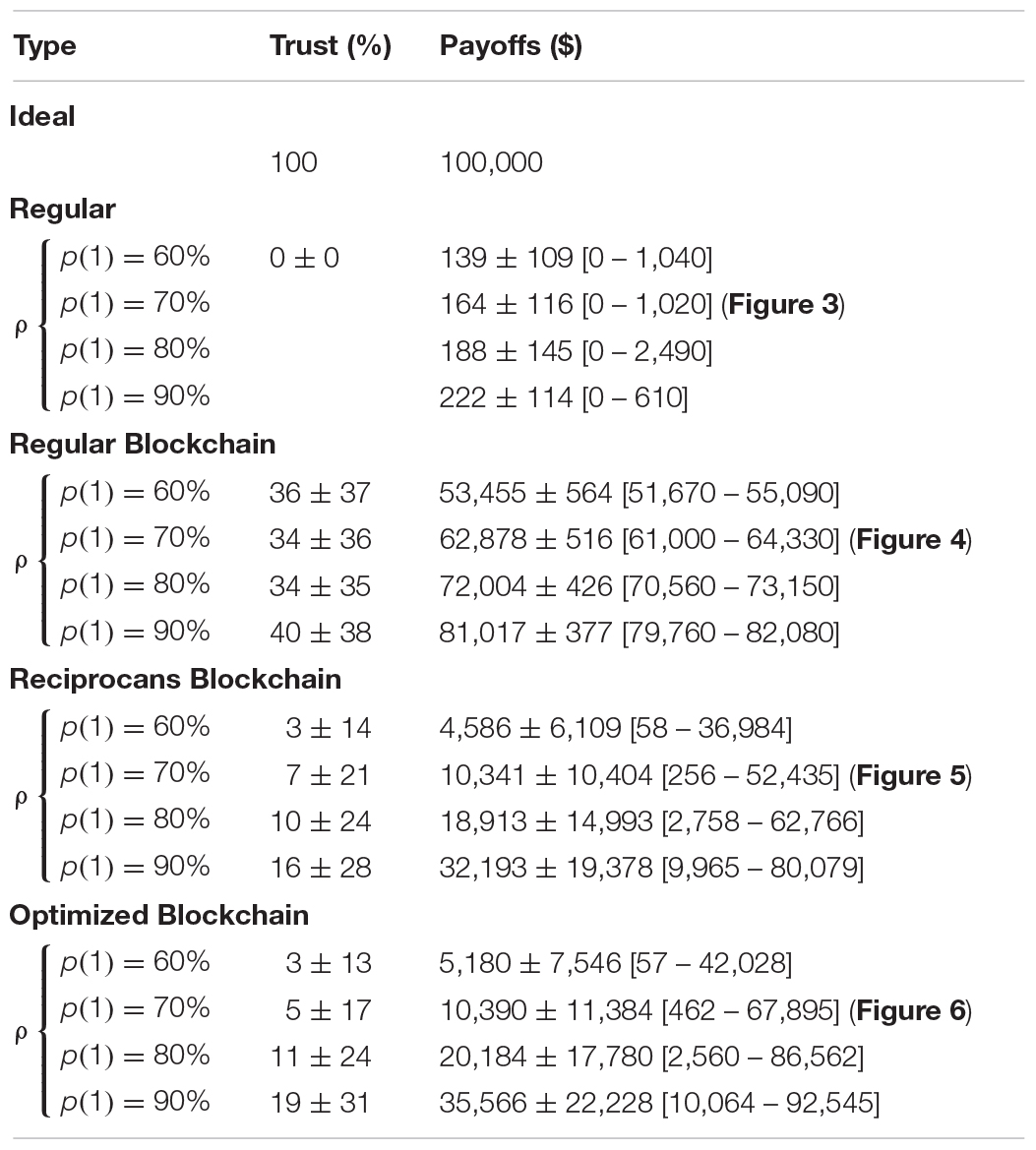

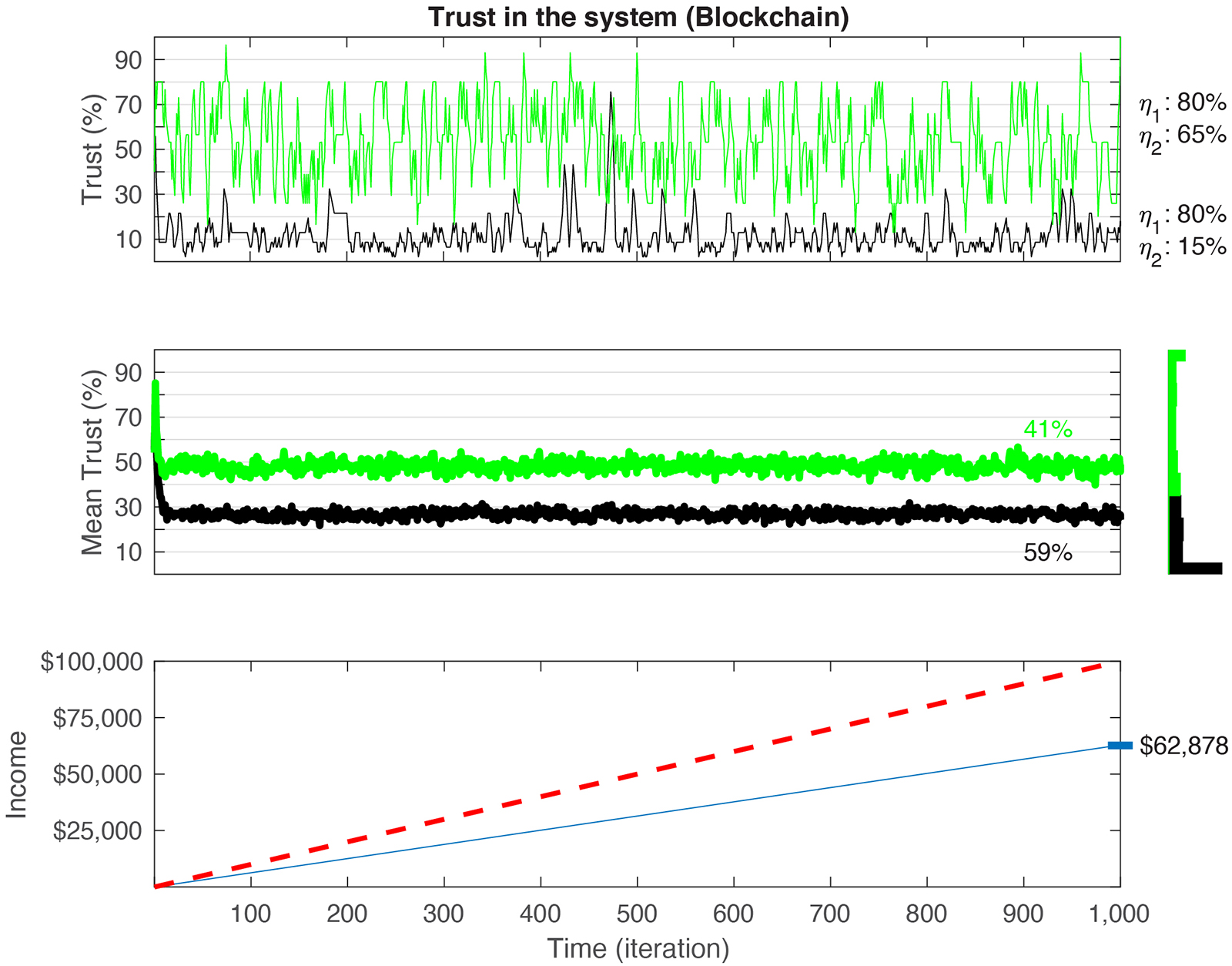

Figure 4. Simulation of Blockchain games with varying values of η1 and η2. (Top) Depiction of two examples of games with η1≫η2 and η1≈η2 ratios. (Middle) Trust (see equation 2) decays in 59% of games to a value lower than the mean (34%), irrespective of the initial trust and the ratio between η1 and η2 (black line in the Top, Middle). Green line corresponds to the average of all trials that ended with trust values above the mean. A histogram of all final trust values is shown on the right. While high trust values have broader range, convergence to 0 trust is still dominant. This, however, has no effect on the individual/C-3PO income. (Bottom) Blue line corresponds to the average cumulative sum in the Blockchain games. The total cumulative sum generated by the C-3PO is $62,878. Red dashed line depicts the optimal (“Full trust”) revenue that the C-3PO could generate if all 1,000 trials were played with maximum payoff (1,000 × $100). Thin blue rectangle on the right axis corresponds to the upper/lower boundaries of income generated by the C-3PO, across all games. The values are stable and range between $61,000 and $64,330.

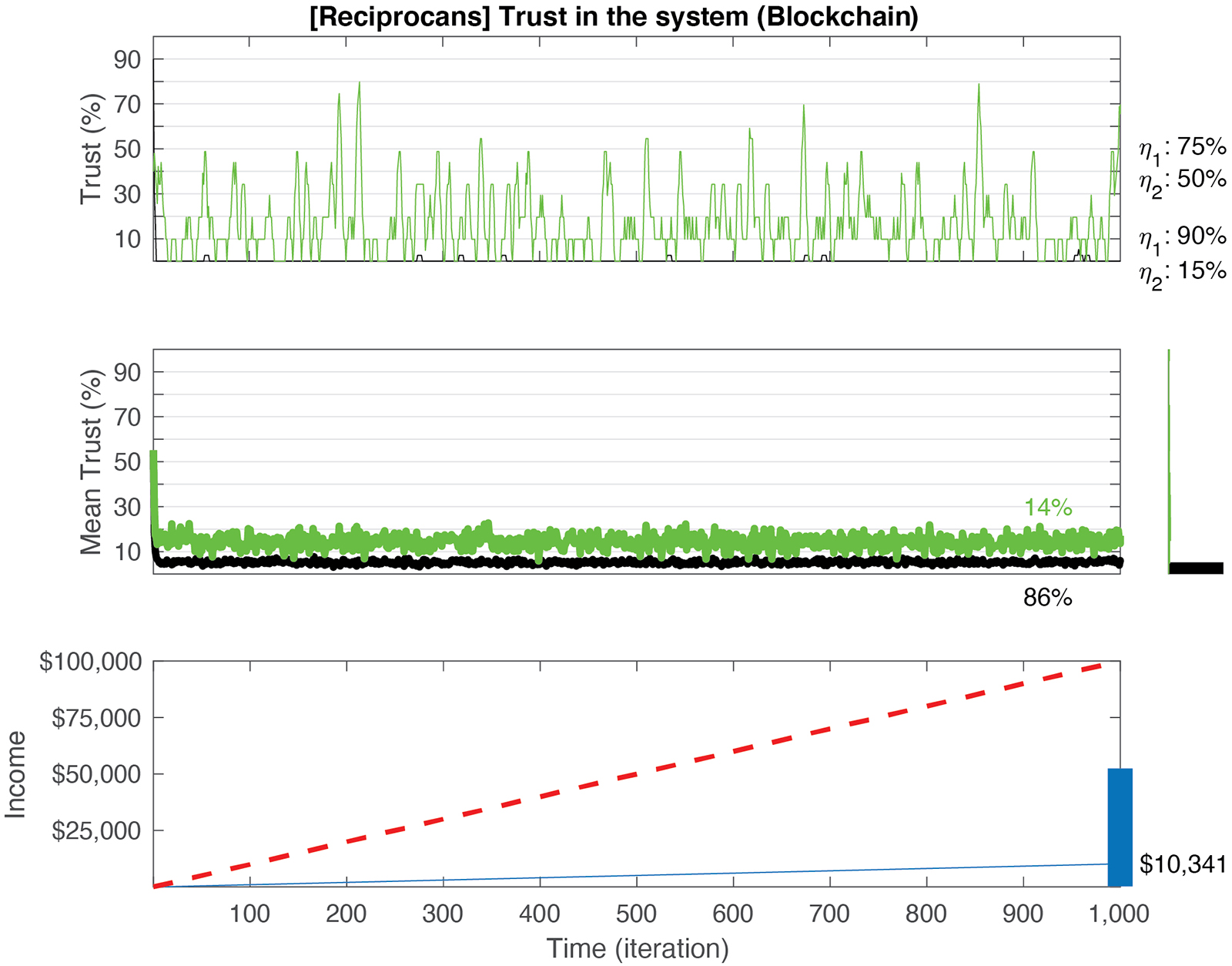

Figure 5. Simulation of reciprocans Blockchain games with varying values of η1 and η2. Top: depiction of two examples of games with η1≫η2 and η1≈η2 ratios. Middle: trust (see equation 2) decays in 86% of games to a value lower than the mean (7%), irrespective of the initial trust and the ratio between η1 and η2 (black line in the middle/top panels). Green (/black) line corresponds to the average of all trials that ended with trust values above (/below) the mean. A histogram of all final trust values is shown to the right. While high trust values have broader range, convergence to 0 trust is still dominant. This, however, has no effect on the individual/C-3PO income. Bottom: Blue line corresponds to the average cumulative sum in the games. The total cumulative sum generated by the C-3PO is $10,341. Red dashed line depicts the optimal (“Full trust”) revenue that the C-3PO can generate if all 1,000 trials were played with maximum payoff (1,000 × $100). The blue rectangle on the right axis corresponds to the upper/lower boundaries of income generated by the C-3PO, across all simulations. The values range between $256 and 52,435.

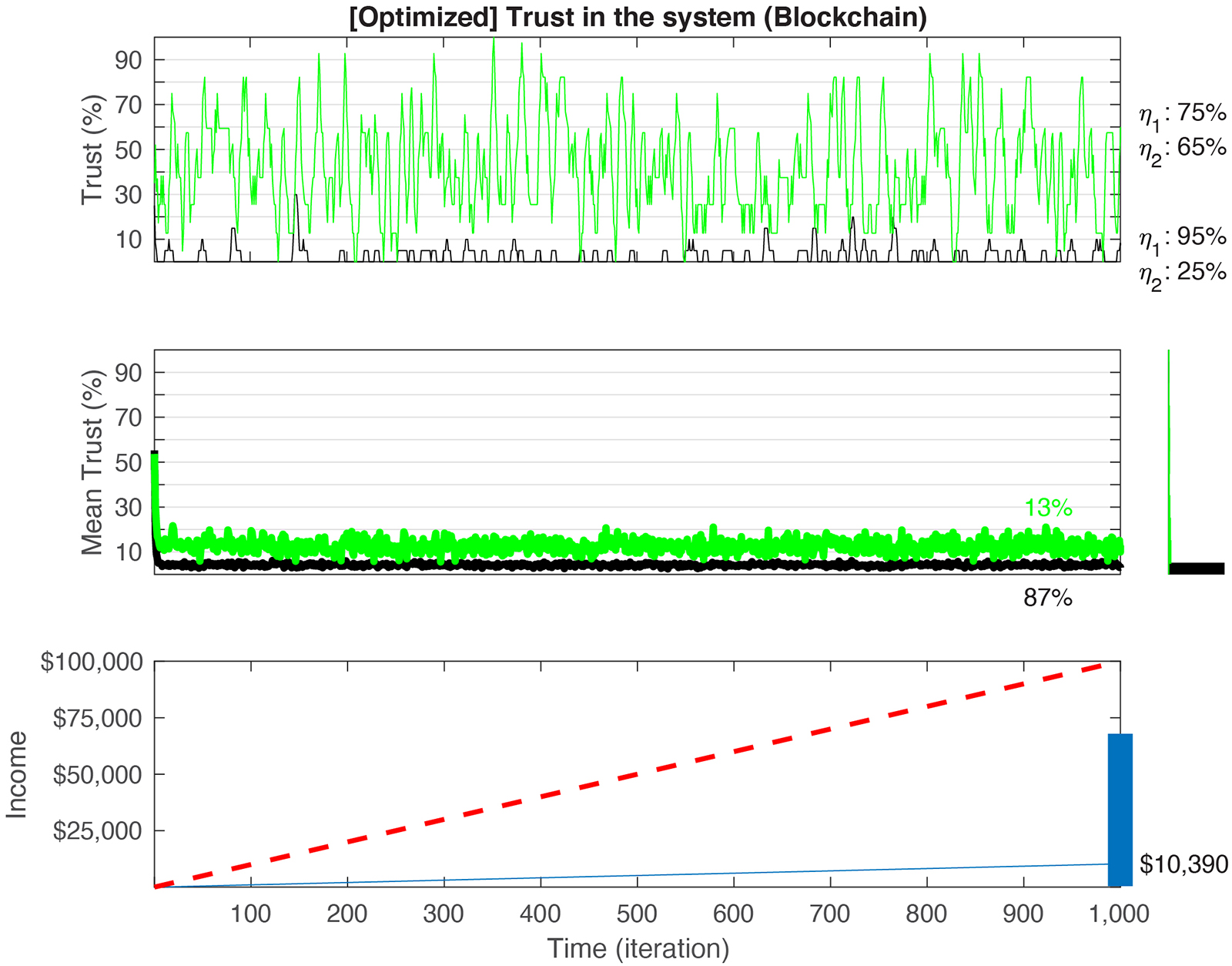

Figure 6. Simulation of optimized Blockchain games with varying values of η1 andη2. Top: depiction of two examples of games with η1≫η2 and η1≈η2 ratios. Middle: trust (see equation 2) decays in 87% of games to a value lower than the mean (5%), irrespective of the initial trust and the ratio between η1 and η2 (black line in the middle/top panels). Green line corresponds to the average of all trials that ended with trust values above the mean (Black: below the mean). A histogram of all final trust values is shown to the right. While high trust values have broader range, convergence to 0 trust is still dominant. Bottom: The total cumulative sum generated by the C-3PO is $10,390. Red dashed line depicts the optimal (“Full trust”) revenue that the C-3PO can generate if all 1,000 trials were played with maximum payoff (1,000 × $100). Blue rectangle on right axis corresponds to the upper/lower boundaries of income generated by the C-3PO, across all simulations. The values range between $462 and $67,895.

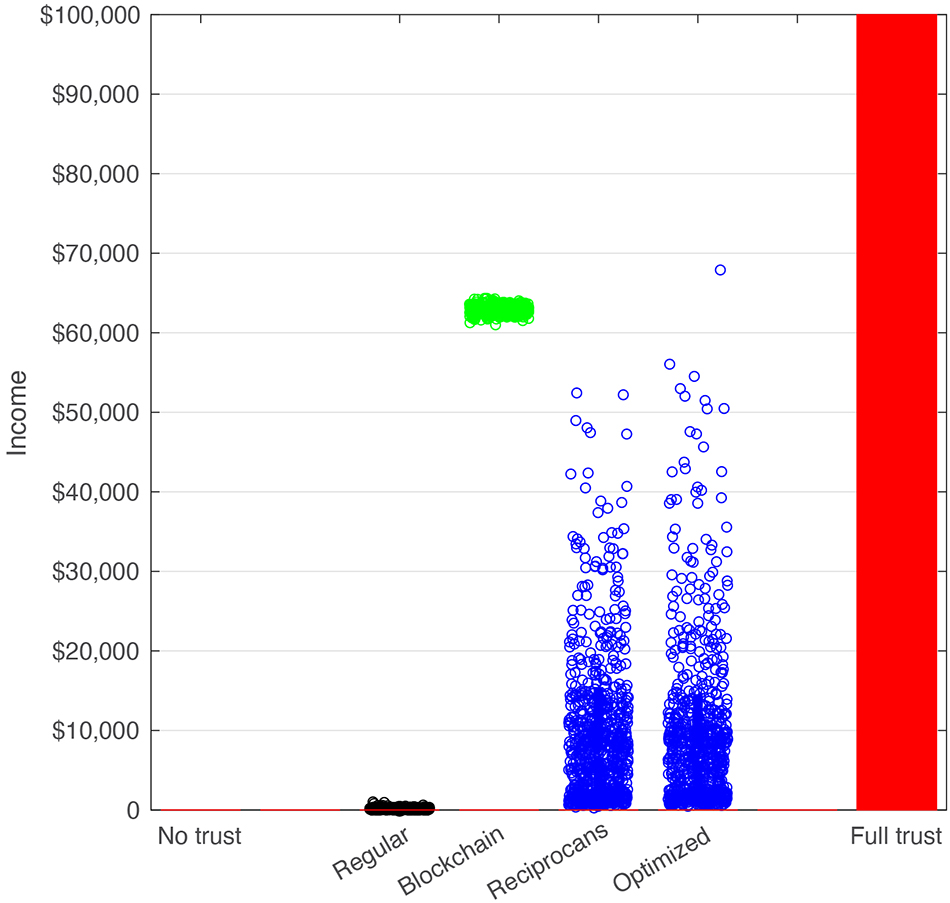

Figure 7. Profit generated by the C-3PO in each simulation condition. Red bar depicts the maximum possible payoff in a 1,000-iteration game with full trust, where each agent contributes all their wages to the shared account (1,000 × $100). Dots reflect the ultimate outcome of a game played with the simulation variables. “No trust” (left) yields $0 for the C-3PO. Regular games (black) yield low gains compared to the Blockchain (green), Reciprocans and Optimized (blue) implementations.

Figure 8. Ultimate trust value in all games for all variables. Each cell corresponds to the final trust value (after 1,000 iterations) in a simulation with a mix of the variables: iT,η1,η2, and μ. Left: ultimate trust value in the average of 4,913 (17 η1 × 17 η2 × 17 iT combinations) of regular games. Second from left: ultimate trust value in 4,913 conditions with regular Blockchain simulation. Second from Right: ultimate trust values in a reciprocans Blockchain condition. Rightmost panel: ultimate trust values in an optimized Blockchain simulation. The upper-left triangle in the “Blockchain,” “Reciprocans” and “Optimized” simulations are nearly same in their value. As these triangles correspond to a more realistic trust scenario (see Figure 2, left) we suggest that trust is increasing similarly in all conditions (albeit less frequently in the simulations that allow fairness as a variable). In games with “lovers” conditions (η2≫η1) all the trust outcomes are different that the norm, as is often the case with love.

3.1. Simulating a Regular Game

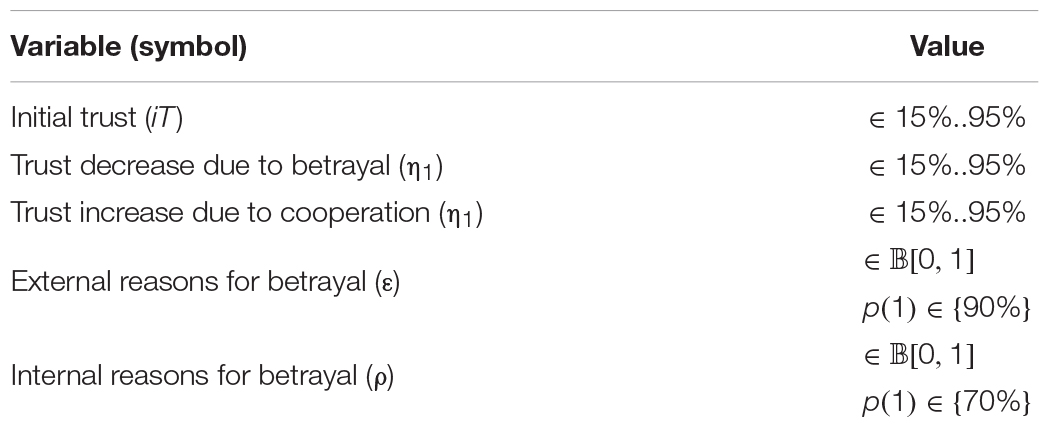

The standard model (i.e., model with no Blockchain) reflects the performance in a regular version of the PG game. Importantly, the results of this model resemble the results shown in empirical behavioral data (Ledyard, 1995; Hauert and Szabo, 2003; Camerer and Fehr, 2004). That is, in all combinations of η1 and η2 the trust converged to 0 (Figure 3). The decay in trust depended on the ratio between η1 and η2 and the initial trust (iT) of all agents. Values of η1 greater than η2 sped up the converge to 0, whereas η1 proportional to η2 slowed down the decay.

The average decay to 0 happened within 9 iterations for η1 > >η2, and within 41 iterations when η1≈η2.

Given that the C-3PO benefits from the public good only when agents contribute to the shared account, the yield in a regular game is low. Averaging the ultimate C-3PO payoff in 510 η1,η2,iT combinations after 1,000 iterations, yielded an income of $164 ± 116 (mean ± s.d.; Figure 3 Bottom). The slope of cumulative increase in revenue for the C-3PO is 0.16, compared to 100 in the ideal “full trust” condition.

3.1.1. Robustness Check

As a robustness check, we ran the model with alternative values of ρ [p(1) = 60, 80, 90%]. The average amount of money generated by the C-3PO in those cases is $139 ± 109, $188 ± 145, and $222 ± 114, respectively. The monetary gains for the C-3PO is affected by the level of different values ofρ, but these remain low compared to the values in the Blockchain cases. The maximum gain shown was $1,020 (1% of the ideal case). See Table 4 for summary of the results.

3.2. Simulating a Game With Blockchain

Adding a certification system in the form of a Blockchain contract allows agents to lower their reliance on trust and enable a steady payoff. Operationalized, the decision to contribute in a specific iteration still depends on one’s personal preferences and external drivers, ε and, ρ but not on their trust, T.

Agents effectively create a binding contract that minimized the likelihood of a betrayal by others. If at least two other players participate – then agent s is contributing, as the total of three players will yield a revenue for all agents (see equation 4). If less than three players declare their willingness to contribute their wages on the ledger then no deposit into the shared account is done by anyone. While trust itself fluctuates in response to the group dynamic in each trial, it is more likely to increase. This increase is due to the safety network provided by the Blockchain insurance, which allows agents to focus on their desire to maximize profits while assuming that others do the same.

The average ultimate trust (average of trust value on the 1,000th iteration) in a Blockchain game is 34% ± 36%. This is significantly different than the average trust in a regular game [Figure 4 Top; t(509) = 21.34, CI = (31 38), p < 10–10, t-test; Cohen’s D: 1.34]. Similarly, the income generated by the C-3PO is 383.4 times higher ($62,878 ± 516; Figure 4 Bottom) than in a regular game. The C-3PO, therefore, benefits from the agents’ desire to profit. While defections still lead to drop in income for the C-3PO, the chances of a contract with at least three people being executed is 99.2% [with ε = 90% and ρ = 70%; ]. Therefore, the expected payoff for the C-3PO in 1,000 iterations is $64,480 (992 iterations x $65 average yield per iteration — with minimum yield of $30 and maximum $100). Our results are within 2.4% of the expected estimate.

Overall, C-3PO is generating a steady increase in revenue (slope of 62.8) in a Blockchain-moderated game, suggesting that within up to three iterations the C-3PO can match the amount of money yielded in a regular game across the entire 1,000 iterations. That is, adding the Blockchain certification helps the C-3PO and the players increase their revenue and allows the group to increase their trust in one another.

3.2.1. Robustness Check

Similar to the robustness checks in the regular game, we ran the Blockchain model with alternative values of ρ [p(1) = 60, 80, 90%; Table 4]. The average amount of money generated by the C-3PO in those cases is $53,454 ± 564, $72,004 ± 426, and $81,017 ± 377, respectively. Altogether, the elasticity of ρ is therefore 117 (that is, an increase in 1% in rationality, ρ, increases the yield for the C-3PO by $117 dollars). Put differently, an increase of 1% in rationality in the Blockchain-enabled game is nearly equivalent to all the money generated by the C-3PO in the average regular game.

3.3. Simulating a Homo Reciprocans Blockchain Scenario

As expected, implementing a more realistic homo reciprocans model in which agents may elect to not contribute to a trial for reasons outside of profit, shows a drop in the financial performance and in trust. Here, agents are able to exhibit internal reasoning for betray and exercise a sense of fairness thereby foregoing profit (they may do so to signal that they are dissatisfied with the trust in the group, or because they may not be motivated purely by the financial gains). While trust may still recover after a betrayal it is overall lower than in the regular Blockchain implementation (7% ± 21%; Figure 5). Only 14% of the trials end up with a trust value above the mean. The mean trust itself is significantly lower than the one in the regular Blockchain simulation [t(509) = 14.27, CI = (23 31), p < 10–10, t-test; Cohen’s D: 0.91]. While the majority of games ended up with 0 trust, even those show an occasional, momentary recovery of trust. Accordingly, the income generated by the C-3PO is significantly higher (by an order of magnitude) compared to the regular game without Blockchain [t(509) = 21.84, CI = (9,164 10,975), p < 10–10, t-test; Cohen’s D: 1.37]. The financial performance is also significantly different than the yield in the regular Blockchain game [t(509) = 113.92, CI = (51,734 53,550), p < 10–10, t-test; Cohen’s D: 7.15].

3.3.1. Robustness Check

Similar to the previous specifications, we ran the model with alternative values of ρ [p(1) = 60, 80, 90%; Table 4]. The average amount of money the C-3PO yields is $4,586 ± 6,109, $18,913 ± 14,993, and $32,193 ± 19,378, respectively. The only trials where the yield for the C-3PO is not $100 happen when agents do not contribute due to personal reasons. That is, from the C-3PO perspective, the model performs best when agents exert more utility maximizing decision making and have no external demand for the wages (ε). The Blockchain model still yields higher trust values and higher financial yield for the public goods than the regular game, across all ε, ρ values. As a metric for the influence of personal reasons on the income we used the elasticity (increase of 1% in rationality’s effect on the C-3PO revenues). A quadratic fit of the ρ values (best fit for the data, with a norm of residuals of 422.8) shows that the differential value is 214. That is, while the regular Blockchain shows a higher income for the C-3PO than the reciprocans one, the effect of ρ in the regular Blockchain is smaller. Put differently, in the reciprocans case, an increasing tendency to maximize monetary utility by an agent helps the public good more than in the regular Blockchain model.

3.4. Simulating an Optimized Homo Reciprocans Blockchain Scenario

Finally, we tested a Blockchain simulation that not only protects agents from losing money, but also enables a dynamic updating of preferences and therefore a more effective recovery of trust based on common interests in maximizing profits.

Trust in the optimized Blockchain model is above 0 in 13% of trials (5% ± 17%, Figure 6). The C-3PO profit here is similar in magnitude compared to the one in the previous homo reciprocans Blockchain model. While trust in the optimized model is significantly different than in the regular game [t(509) = 7.29, CI = [4 7], p < 10–10, t-test; Cohen’s D: 0.46] and the regular Blockchain simulation [t(509) = 15.94, CI = (25 33), p < 10–10, t-test; Cohen’s D: 1.02] the regular and optimized homo reciprocans models are not significantly different from one another [t(509) = 1.63, CI = [0 4], p = 0.1, t-test]. However, with respect to the C-3PO yield, the ultimate maximum values for the optimized games are higher than the reciprocans ones. Some of the extreme values surpass even the regular Blockchain maximal values (Figures 6, 7).

3.4.1. Robustness Check

Running the model with alternative values of ρ shows similar improvement as in the previous models (see Table 4). p(1) = 60% yields an income of $5,180 ± 7,546 to the C-3POT. p(1) = 80%, yields $20,184 ± 17,780. And p(1) = 90% yields $35,566 ± 22,228. Fitting the values of ρ here (best done with a quadratic equation that minimizes the norm of residues to 224.5) shows that the elasticity is 195. That is, an increase of 1% in rationality yields an increase of $195 for the C-3PO.

Although the optimized version of the homo reciprocans model does not substantially increase the trust, it yields higher payoffs for the C-3PO. This suggests that the optimized model is less sensitive to individual agents’ decisions and maintains an overall higher profit across all games.

3.5. Identifying an Optimal Set of Variables

Comparing all the models (Figure 7) illustrates that the regular Blockchain model shows the highest financial gain for the C-3PO. The financial gain is not only higher but also most stable compared to the two other Blockchain models. However, as the two other models are more reflective of real-world human behavior (i.e., the desire for fairness) we suggest that improvement and optimizations of all three models should incorporate the identification of common levers that drive and influence such desired outcomes (both trust and payoffs).

To that effect we tested the various combinations of all manipulated variables to identify configurations that enabled ultimate trust recovery. That is, we observed the combinations of trust decay/increase values that yield maximal trust across all models (Figure 8).

The optimal conditions for our experimental variables (η1,η2,iT) were fixed for 4,913 combinations, with μs randomly selected for all n = 10 agents. For each combination of variables, we examined the final value of trust after 1,000 iterations in all the four models (regular, Blockchain, reciprocans Blockchain, and optimized Blockchain; Figure 8). We varied η1,η2,iT from 15 to 95% in steps of 5% (17 conditions each).

Trust in the regular game converges to 0 for all variable combinations (regardless of the initial trust and ratio between η1 and η2). The incorporation of Blockchain shows an improvement in mean trust throughout the game. The outcome is driven by the ratio of η1/η2. When η2 is notably higher than η1 (a large increase in trust following a cooperative game, and a small decay following a betray, which we termed earlier the “lovers” setting) the ultimate trust is highest. This is replicated in all three Blockchain implementations.

Manipulating ε across all four conditions shows that the optimal combination of η1, η2 emerges always when η2 > >η1 (the typical scenario for regular games with no Blockchain) and that external reasons do not alter the results in a robust way.

4. Discussion

4.1. Summary

We incorporated a Blockchain smart contract into a simulation of the Public Goods game. We show that the smart contracts help agents improve their decision making, and, in turn, the outcomes of the decision (in terms of financial gains, fairness, cooperation and trust). We tested multiple implementations of the Blockchain protocol and varied the degree to which they reflected the real world. The outcomes were compared to a simulation of empirical behavioral data from humans playing the PG game.

To explicitly estimate the improvement of our model we investigated two main outcomes: (1) the level of trust among the group members, and (2) the financial profits yielded by a 3rd-party that was defined as independent and benevolent.

Our results show that, overall, the implementation of a Blockchain smart contract in the game leads to a recovery of trust after a betrayal and significantly higher payoffs for the 3rd-party entity. In all Blockchain implementations the ultimate payoffs were two orders of magnitude higher than in the regular game. This is primarily driven by the fact that the Blockchain protocol removes the risk of losing money. The model that yielded the highest levels of trust and payoffs was a Blockchain model in which people accept any contract that allows them to make a profit. This model (“homo economicus”) yielded an over 38,000% increase in payoff for the public good compared to the regular model without Blockchain. When introducing additional constraints that reflect the fact that people are not always maximizing immediate gains, and, at times, forsake monetary utility to fulfill their desire for norm-enforcement or fairness (termed: “homo reciprocans” model; Fehr and Schmidt, 1999), the levels of trust and payoffs dropped, but still remained significantly higher than those observed in the regular game. Specifically, the “homo reciprocans” Blockchain model yields a 6,305% increase in payoff for the public good compared to the regular model without Blockchain. However, given that this model incorporates human decision making that is not driven by a desire to maximize monetary utility, it inevitably falls short compared to the initial Blockchain model. The payoffs for the 3rd-party are over six times lower, and the trust is converging to 0 in 86% of the games, compared to 59% in the standard Blockchain.

In an attempt to recover some of this drop in trust and profits, we implemented an optimized Blockchain model that allows agents to update their own preferences as a function of how profitable and “trusting” the market seems in each round. Allowing such feedback loops within each trial results in a model that yields 6,335% higher payoffs for the public good than the regular model without Blockchain. While the average payoffs are similar to the ones in the regular “homo reciprocans” model, the breadth of outcomes (standard deviation) is higher, with some tests outperforming even the regular Blockchain model. Effectively, the optimized model adds to the regular “homo reciprocans” model a property that allows agents to benefit from a key feature of the repeated games – the ability to norm-enforce and adapt the agent’s behavior to the group. Repeated trial games typically engage with such norm-enforcing and adaptive behavior across trials (i.e., agents act in trial t in behaviors that respond to action in trial t-1 in hopes of changing the behavior of others in trials t+1). The benefit of the optimized model is that it allows for such signaling and adaptive behavior within a single trial. The combination of the fairness variable (intrinsic property of the agent that does not change, but responds to group behavior), with trust (changes based on behavior in previous trials), and the anonymity afforded by the Blockchain protocol enable agents to maximize their benefit while signaling to others about their preferred outcomes. The unique property of the Blockchain’s smart contract mechanism allows for an effective communication under the veil of anonymity. This, we argue, is an improvement upon existing protocols that either: (1) limit the communication and signaling to ones that happen across-trials, or (2) force agents to not be anonymous in order to engage in norm-enforcing behavior, or (3) require a dynamic alteration of the fairness variable to align with the groups’. Effectively, the optimized model allows for the group’s behavior to stabilize within a trial. It allows agents to defect or to increase their contribution to the public good in response to a combination of fairness and utility maximization. The rational, purely economic and utility-maximizing behavior, that is often exhibited in single trial games differs from the one shown in multi-trial games. An optimized Blockchain model serves as a way to allow the benefits or signaling and dynamic group adaptations that are seen in repeated trials games even within a single trial.

Finally, we see that in all Blockchain implementations trust can increase even after it converged to 0.

In short, adding a Blockchain implementation to a public goods function (1) contributes to the likelihood that a multi-player system will recover its trust after a betrayal, and (2) increases the rewards yield by a public goods entity (charity, income tax, etc.). While various models have shown improved mechanisms for increased financial gains, recovery of trust after a breach of honesty is rare.

4.2. Recovery of Trust

Prior research on trust has shown that it is a challenge to restore trust after a betrayal (Schweitzer et al., 2006). The main methods shown to increase trust after a breach of honesty involve: (1) apologizing, (2) accepting blame, and (3) demonstrating consistent honest behavior over long periods of time (Schweitzer et al., 2006). Importantly, while accepting blame is helpful in restoring trust, studies have shown that this only works if the breach of trust is framed as the outcome of an incompetence rather than dishonesty or immoral behavior (Kim et al., 2004). Given that the first two trust-recovery methods require communication between the parties, these methods cannot always be implemented (i.e., in situations where signaling or communication between all parties are difficult to accomplish). Consequently, the Blockchain protocols suggested in this paper could provide a new alternative to recover trust that does not rely on any of the previously suggested mechanisms. The protocol makes it easier for collective trust to recover as the systemic nature of Blockchain technology partially replaces the need for individual accountability. It is noteworthy that the Blockchain implementation allows for trust increase while maintaining full anonymity of the individuals. This is important as recent discussion on mechanisms to improve trust have raised debates on whether transparency is useful for trust increase (Walker, 2016). While longstanding belief among researchers was that increased transparency leads to increased trust (Grimmelikhuijsen, 2012b), some works argue that indeed the opposite is true (Grimmelikhuijsen, 2012a). Countries where transparency is opaque (i.e., China) actually show high levels of trust in the government among citizens (Edelman trust barometer, 2019). It is suggested that this is because of the fact that the break of trust is not disclosed to the citizens (Edelman trust barometer, 2019). Similarly, countries where transparency is high (i.e., the United States) has also exposed its citizens to a plethora of fake news and misinformation that are fueled by lack of rein on exposure.

4.3. Contributions to the Scientific Literature

Our findings contribute to the existing scientific literature in a number of ways.

First, our findings contribute to the literature on trust and decision making while introducing a technological solution to collectively align individual’s interests more efficiently. The Blockchain implementation assures high levels of trust among a particular population. These trust levels supersede the current existing best-case scenarios for trust recovery in the literature.

While the public goods game has been studied for decades and resulted in a substantial body of work exploring the antecedents and consequences of trust in collaborative-competitive decision making contexts (Levitt and List, 2007; Cerf, 2009) the vast majority of these works show that a breakage of trust usually leads to a downward spiral with potentially devastating consequences for both individuals and groups (Boles et al., 2000; Kim et al., 2004; Schweitzer et al., 2006; Wang et al., 2009). Against this backdrop of decades of research, our findings suggest that technological solutions such as Blockchain technology can positively impact trust through an assurance that one cannot be exploited by others. This might open the door to a new line of research that investigates ways in which human decision making in a context that is both competitive and cooperative can be facilitated by similar technologies.

Second, our findings contribute to the growing literature on Blockchain. Specifically, they highlight an application of this technology which could have a tremendous positive impact on individuals, societies and groups. We show that interventional model (the “optimized” model, where individuals are able to repeatedly reflect on their preferences) improves upon models that do not allow for iterative optimization. The optimized model uses the Blockchain not just as a passive database that collects historical data, but rather a signaling mechanism for all participants on the status of the collective. It allows participants to improve their estimates pertaining to the group dynamics. More complex implementations of such signaling mechanism (i.e., additional corrective steps within each iteration) could optimize the performance of the Blockchain usage further.

Therefore, the elucidation of the specific levers for trust increase should be investigated further, and our work offers a first brick in this exploration.

4.4. Practical Implementation of Blockchain in Interdependent Decision Making Contexts

We implement the suggested Blockchain models using an architecture akin to the ones featured in Ethereum and in probabilistic collaborative decision making (Salman et al., 2018).

The key functionality used by those architectures is the smart contract, which allow each node to apply the set of rules suggested in a transaction and execute the transaction.

A complete transaction works in the following way:

(1) Each node in the architecture operates a client that, first, executes the internal processing of the agent’s decision to contribute. An agent uses their own internal/external reasons to betray, their fairness level, and their trust state to decide whether they are interested in contributing the coming trial. (note: in an architecture with n users, there would be n+2 nodes, including one node pertaining to the shared account – the recipient of the daily wages, before they multiply – and another node for the C-3PO).

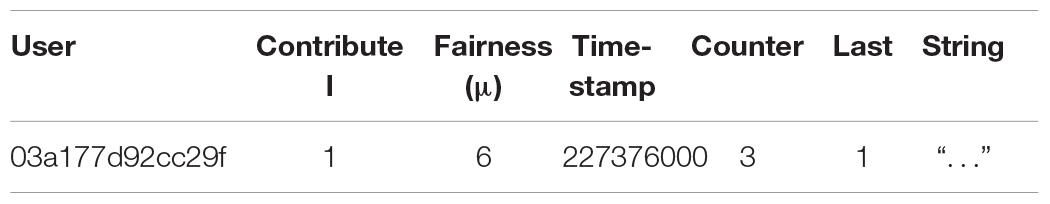

(2) After an agent’s decision is made, they initiate a transaction that is communicated over the Blockchain protocol (peer-to-peer) to all other nodes. The transaction details are (Table 5):

(3) The smart contract is then implemented. This may include multiple iterations, depending on the model executed. In the “reciprocans” model only one iteration occurs. In the “optimized” model a repeated back and forth between the agents and the clients enables all nodes to ensure that their entry logic is applied.

(4) Note that our implementation includes only the entry decision, E, and fairness, μ, as variables of the transaction. More complicated models may include also the exact amount of money contributed (i.e., instead of a fixed $10 amount one may select a different number), a punishment mechanism applied toward a specific node, or even a string that can be used to communicate and signal desired behaviors directly.

(5) Once the smart contract was validated by all nodes, the “block” that includes the final entry/contribution decisions is being sent to a validator to sign. Signing implies working through all the final transactions and ensuring that all nodes indeed have the funds needed for the transaction. Effectively, this moves from the “logical implementation” (the smart contract) to the transaction validation.

(a) A block can have as little as n entries (in the regular game implementation) and as many as allowed by the optimization algorithm. If the algorithm allows, for example, for multiple updates by nodes based on their updates the block may have multiple entries from each user. The final entry – based on timestamp – is the one that is used by the validator.

(b) If the model is implemented with a “timeout” rather than a finite set of iterations within a trial, then all transactions which arrived by the timeout are included. Transactions that did not arrive by the time are considered as E = 0.

(c) To avoid errors on noisy networks, the transaction can add a field: “last” (= 1/0) where a user can indicate whether they are still iterating or are ready to seal their entry decision. Similarly, a “counter” field can be used to maintain the agreed number of iterations.

(6) Once the validator receives the entries block, they go over the ledger and check that all users indeed have the funds and are part of the network. This ensures that no double spending is occurring and that all users are indeed legitimate players. The validator is selected from within the participating nodes based on the contribution amounts (“Proof of Stake”). That is, users that contributed the most in the last x trials has the highest probability of becoming the validator. The choice of validator occurs randomly from within the top y players. In our implementation we selected x as 50 (i.e., whoever contributed the most in the last 50 trials has the highest probability of becoming the validator in each trial) and y = 10 (i.e., all players may become validators). The numbers x,y should be selected either based on the number of iterations expected, or as a function of the desired time for each round.