- 1Doctoral School of Regional Sciences and Business Administration, Széchenyi István University, Győr, Hungary

- 2Henley Business School, University of Reading Greenlands, Henley-on-Thames, United Kingdom

- 3Department of International Management, Modul University Vienna, Vienna, Austria

The proliferation of sophisticated e-commerce platforms coupled with mobile applications has ignited growth in business-to-consumer (B2C) commerce, reshaped organizational structures, and revamped value creation processes. Simultaneously, new technologies have altered the dynamics of brand marketing, enabling a broader reach and more personalized targeting aimed at increasing brand trust and enhancing customer loyalty. Today, the Internet allows marketers to penetrate deeper into their existing markets, create new online marketplaces and to generate new demand. This dynamic market engagement uses new technologies to target consumers more effectively. In this conceptual paper, we discuss how blockchain technology can potentially impact a firm's marketing activities. More specifically, we illustrate how blockchain technology acts as incremental innovation, empowering the consumer-centric paradigm. Moreover, blockchain technology fosters disintermediation, aids in combatting click fraud, reinforces trust and transparency, enables enhanced privacy protection, empowers security, and enables creative loyalty programs. We present six propositions that will guide future blockchain-related research in the area of marketing.

Introduction

Customer-centric marketing is crucial for firms who want to survive in fiercely contested B2C environments (Sheth et al., 2000). Marketing helps companies to understand and explain the value a consumer perceives and derives from a product or service (Larivière et al., 2013). The communication methods a firm selects might differ from one industry to another. However, the fundamental objectives and challenges related to consumer engagement remain the same. The proliferation of new technologies often has a democratizing effect for companies and consumers alike, transcending the reach and size of the firm and making new technologies more affordable to smaller firms. Despite uncertain financial returns, small firms are now investing in fee-based technologies and platforms that they perceive as essential for sustaining a competitive position in their markets (Rishel and Burns, 1997). Given this trend, the emergence of “Mar-tech” as a mix of marketing automation and technology solutions has positively impacted the way firms reach and engage with their customers (Cvitanović, 2018). Not only do they reshape the modus operandi for a firm's outreach, but they alter and raise customers' expectations, thus changing the dynamics of customer-brand relationships (Treiblmaier and Strebinger, 2008).

In the new economy, brands are no longer focusing solely on running one campaign after the other. Instead, they are capitalizing on new forms of consumer engagement and dialogue to extend their market coverage and enforce a more synergistic and attuned marketing communication strategy (Santomier, 2008). Firms today are building a portfolio of technologies and exploiting various media channels and publicity methods to position their brands, as well as sell their products, services, and ideas (McAllister and Turow, 2002). Digital marketing is leveraging new channels across social media that provide firms with new, innovative, cost-effective and influential capabilities to engage with customers (Melewar et al., 2017). In turn, customers are becoming an integral part of the evolving engagement dialogue and are strengthening their influence on the marketing process (Berman and McClellan, 2002).

The growth of the Internet, along with emerging technologies, has made a substantial impact on the traditional marketing mix (i.e., product, price, place, and promotion). For example, advanced technologies often termed as big data analytics have allowed firms to aggregate large and complex data sets and use sophisticated analytics to gain additional consumer insights (Stone and Woodcock, 2014). Likewise, retailers and online businesses are increasingly investing in social media as part of their marketing communications practices and attempts to outperform their competitors (Vend, 2018). In this regard, DeMers (2016) forecasted that the trend toward cyber shopping is likely to intensify with an increased future consumer propensity to engage in online shopping experiences. As a consequence, more people in the United States prefer to do their shopping online than to purchase from brick and mortar stores (Marketo, 2017). Modern technologies put consumers at the forefront of security, privacy, trust, and transparency challenges. Prabhaker (2000) argues that each time individuals engage in an online transaction, they leave behind a digital trail of detailed information about their identity, their buying preferences, spending habits, credit card details, and other personally identifiable information (PII) (i.e., data that can be used to identify a particular person). From a privacy perspective, this situation has worsened over the years as data collection practices have become more versatile and ubiquitous. Online businesses regularly fail to meet regulatory requirements, and privacy leaks are frequent and have a lasting impact on consumers' trust (Ingram et al., 2018; Martin, 2018; Bodoni, 2019). As a result, consumer awareness heightens, their suspicions raise, and they are more prudent about online transactions as their PII can be used or sold for monetary gain without their permission (Norman et al., 2016). Avoiding online purchases is not a solution since brick and mortar retailers also encourage the use of loyalty cards and maintain a centralized database which may be vulnerable to hacking or misuse. Moreover, many developing countries do not have privacy regulations in place to protect consumers PII. Therefore, brands must keep abreast of the latest privacy regulations, understand consumer expectations, and keep up-to-date with technology innovation and best practices. Advocates for enhanced consumer privacy suggest that systems should be built with a “privacy-by-design” framework (Cavoukian, 2011).

The recent hype around blockchain technology has led to promising use cases in areas such as finance, supply chain management, healthcare, tourism, real estate, and the marketing field is no exception. Initially launched for underpinning the cryptocurrency Bitcoin, the primary feature of blockchain technology is peer-to-peer communication, eliminating the need for centralized third parties to control the flow of transactions (Yli-Huumo et al., 2016). Treiblmaier (2018, p. 547) defines blockchain as a “digital, decentralized and distributed ledger in which transactions are logged and added in chronological order with the goal of creating permanent and tamperproof records.” A specific blockchain configuration is usually a combination of multiple technologies, tools and methods that address a particular problem or business use case (Rejeb et al., 2018). Thus, marketing managers need to understand the possibilities of blockchain technology as a protocol of communication that marks the transition from the Internet of information to the Internet of value and trust (Twesige, 2015; Zamani and Giaglis, 2018).

In this paper, we discuss the possibilities of blockchain technology from a marketing perspective. Despite the growing literature on the potentials of blockchain applications, more rigorous academic research is needed to illustrate how this emerging technology can potentially provide a foundational layer for enhanced transparency and trust in marketing activities. The structure of this paper is as follows: In Features of Blockchain Technology, we briefly review the concept of blockchain technology and some of its key features. In Disrupting Marketing with Blockchain Technology, we discuss various areas in which the technology can impact marketing activities and benefit brands and consumers alike. In the final part, we summarize the paper and highlight future research directions. In this paper, we refer to personally identifiable information as PII and the terms “consumers” and “customers” may be used interchangeably unless otherwise specified.

Features of Blockchain Technology

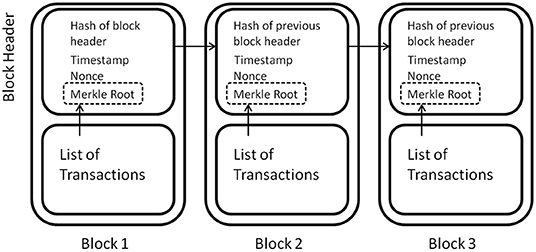

Following the 2007–08 global financial crisis, a marked fall in public trust in the conventional banking system prevailed (Ehrmann et al., 2010). Technology enthusiasts and software developers envisioned and created an alternative financial system that falls outside the sphere of influence of conventional trusted third parties. The pseudonymous Satoshi Nakamoto proposed the digital currency Bitcoin as a peer-to-peer electronic cash system (Nakamoto, 2008). This new technology relies on a protocol of cryptographic rules and techniques for processing transactions (Papadopoulos, 2015). These include the use of hashing, time-stamping, consensus mechanisms (a collection of rules that allow network nodes to reach mutual agreement), and asymmetric encryption using public and private keys. Not only has the proposed cryptocurrency model ingeniously solved the double-spending problem (Treiblmaier, 2019a), but it sets out a new paradigm for performing transactions and exchanging value in an online environment (Clohessy et al., 2019). More precisely, any transaction triggered on the blockchain follows a set of predefined rules that are based on security, verifiability and peer consensus to ensure the validity of transactions (Münsing et al., 2017). All transactions are time-stamped, captured in datasets called blocks, and sequentially chained (i.e., each block header contains the hash of the previous block header) to form the ledger (see Figure 1). Tampering with a public transaction record is technically tricky and viewed as infeasible because it requires substantial computing power to attempt to alter the cryptographic hash of previous blocks on the chain (Hackius and Petersen, 2017).

Beyond the cryptocurrency jargon, a blockchain is not only a combination of technologies but also the integration of multiple technologies (Lu, 2019). Most scholars and practitioners commonly understand blockchain as one method within the distributed ledger technology family (Fosso Wamba et al., 2020). Moreover, the ledger is a virtual book or a unique collection of all transactions carried out by the blockchain's exchange parties. The technology can be viewed as a new way of authenticating assets used in a transaction and can be applied to many business activities and functions (Ertemel, 2018; Rejeb et al., 2019). In the following sections, we will elaborate on how the core characteristics of blockchain technology enable functions and applications that can fundamentally change marketing strategies.

Disrupting Marketing With Blockchain Technology

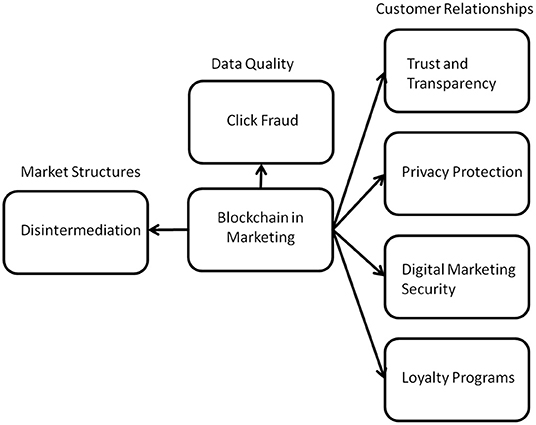

Rigorous academic studies on blockchain applications in support of marketing activities are scarce. Despite this, in the practitioner-based literature, the benefits of blockchain are viewed as indisputable (Ghose, 2018). In this paper, we lay the foundation for future academic studies by identifying several important research areas, as shown in Figure 2. First and foremost, blockchain technology is based on peer-to-peer communication which alters market structures by fostering disintermediation, namely the removal of intermediaries who process and filter data streams and add cost. By creating immutable and shared data records, blockchain technology can also help to improve data quality and facilitate data access. From a consumer-centric perspective, blockchain technology has the potential to substantially transform consumer relationships by enhancing data and information transparency and improving privacy and security. It also allows for innovative forms of consumer loyalty programs which might help to create additional value. All these features will be discussed in more detail in the sections below.

Fostering Disintermediation

The advent of the Internet has enabled disintermediation and drastically changed the way companies distribute their products and services (Buhalis and Licata, 2002). New technologies have displaced traditional trading mechanisms, reduced the reliance on traditional intermediaries, and introduced new forms of electronic intermediaries (Cort, 1999). Simultaneously, the Internet has led to the emergence of new online intermediaries which offer a new range of products and services (McCole, 2004). The process of realigning the value-adding role through information and shifting the control in the value chain to different players is called re-intermediation (Pineda and Paraskevas, 2004). Examples of services offered by new e-commerce intermediaries are information brokering, online search capabilities, advertising, communication, and trust provision. Moreover, the prevalence of social media has emphasized the growing need for businesses to reach out to customers through social networks and messaging platforms such as Facebook, Twitter, and YouTube. Instead of generating revenues through customers' payments for content and services, these platforms rely on income through data and targeted advertisements. They have also developed a virtuous cycle in which further interaction with consumers results in the accumulation of knowledge and better integration of content (Nieves and Diaz-Meneses, 2016). While these electronic intermediaries support businesses and consumers by personalizing their brands and products, they also gain the power to lock them into their proprietary platforms.

On the one hand, businesses exhibit a heavy reliance and dependency on intermediaries to recognize their potential customers' needs and wants. On the other hand, businesses seek to attract consumers' attention but often rely on communication channels served by many information intermediaries as they provide a wealth of information about the demand for goods and services (e.g., the quantity and type of those goods and services, prices as well as existing trade requirements; Tönnissen and Teuteberg, 2019). It may occur that these intermediaries do not allow brands to make their own dissemination decisions and therefore impede their innovativeness and their ability to generate new prospects and target offerings (Hübner and Elmhorst, 2008). Moreover, if the channels are not efficiently managed, the spin-off will lead to misunderstandings, loss of customers and foment ill will (Boyer and Hult, 2005). On the other hand, consumers may dislike the monetization of their data by e-intermediaries. This intermediated approach often precludes consumers from reaping the benefits of directly engaging with brands, such as co-creation, more customer-centered support, as well as increased and dynamic personalization.

To address the aforementioned concerns, blockchain technologies can be a propitious tool enabling brands and consumers to bypass intermediation and to forge stronger relationships. The technology allows brands to expand their advertising campaigns, improve their customer targeting capabilities, and enhance service responsiveness. Its interactive and ubiquitous features allow marketers to efficiently communicate their commercial content and reduce costs by bypassing intermediaries (Sarkar et al., 1995). For example, retailers routinely pay credit card companies +3% payment processing, and many online platforms charge listing fees or sales commissions (Harvey et al., 2018). With blockchain technology, brands can limit or remove costs and eliminate non-value adding activities at the intermediation layer. Brands can then incentivize their customers to disclose and share information through loyalty rewards (i.e., points, cryptocurrency rewards, micropayments, and cash-back incentives). Therefore, blockchain technology can potentially strengthen the direct relationship between brands and consumers. Blockchain technology unfolds a new model for enhanced consumer engagement and collaboration. Consumers can interact and engage directly with the brand or firm while responding to their marketing campaigns with an authentic and verified product or service reviews (Deighton and Kornfeld, 2008). We, therefore, suggest our first research proposition:

RP1: Blockchain technology creates new market structures by fostering disintermediation.

Combating Click Fraud

The emergence of the Internet as a marketing channel and an advertising platform has enabled brands to promote their products and services online and to establish and maintain relationships with their clients (Geiger and Martin, 1999). The Internet is also an efficient communication tool that allows firms to interact directly with consumers and keep them informed about their latest products, services and firm developments. Although the importance of having an online presence is undisputed, the reputation of the marketing and advertising industry has been plagued by a never-ending series of frauds, scandals, and deceptive campaigns (Hongwei and Peiji, 2011). As online sponsored search dominates the business model for a majority of search engines (Jain et al., 2010), click fraud considerably tarnishes the credibility of the online advertising landscape. This phenomenon is a result of the automated nature of online advertising and the increasing sophistication of target marketing. Click fraud is an intentional act in which a natural person or organization tries to obtain illegitimate interests or drain a competitor's advertising budget using automated scripts, computer programs or employing natural persons to mimic legitimate web users to click on online advertising (Hongwei and Peiji, 2011). Click fraud has been identified as a severe threat to online advertising, with additional costs for advertisers amounting to $44 billion by 2022 (Juniper Research, 2017). Of prime importance is the economic incentive of fraud perpetrator and publishers who have been accused of committing click fraud to increase their revenues (Haddadi, 2010).

Although some search engines try to compensate advertisers for click fraud, reports have shown that they have attempted to understate its magnitude (Click Quality Team, 2006). To combat click fraud, numerous solutions were suggested, such as selling a particular percentage of all impressions to advertisers or the application of pay-per-click advertising models (Goodman, 2005; Mungamuru et al., 2008). However, these preventive measures are not sufficient (Kshetri and Voas, 2019). The pervasiveness of click fraud is due to a lack of intermediaries who track online advertising and provide third party measurement approaches capable of increasing trust and reducing some of the concerns. That is to say, advertisers must engage with independent click fraud monitoring companies to resolve the ambiguity surrounding the divergence in the reported click fraud rates. Even though an external audit service might be beneficial, it can also be unaffordable for small and medium-sized companies. Besides, it is highly likely that search engines refuse to compensate an advertiser based on click fraud metrics generated by an independent audit firm, especially in cases reporting significant click fraud numbers. Also, the lack of transparency in search engine efforts to fight click fraud has created the impression that they have not done enough to track or prevent click fraud (Dinev et al., 2008). The advertisers are still unable to gain full, trusted knowledge and control over the state of their online ads.

The consequences of click fraud for marketing and advertising are severe since it jeopardizes advertising's effectiveness of targeting potential customers involved in content, service, or product-related information search (Schultz and Olbrich, 2007). Search engine marketing tactics may diminish trust and the reputation of network media. The impact of click fraud manifests itself in increasing advertising costs. Moreover, unsuccessful advertising campaigns are caused by the reliance on unreliable, inadequate, and untrusted analytical data. For example, Pearce et al. (2014) estimate that advertising losses caused by a botnet's fraudulent activities will amount to USD $100,000 per day (a botnet is a term derived from “robot” and “network” to mean a collection of internet-enabled devices running code or “bots” usually with a malicious intent). The losses span from financial to brand reputational damage and can be significant in the case of peer-to-peer botnets, which use an overlay network for exchanging and controlling data, making their detection challenging (Alauthaman et al., 2018). Therefore, brands need to embrace resilient defense mechanisms as the online environment is rife with high traffic botnets.

Blockchain technology can mitigate certain risks associated with the potentially devastating impact of click fraud by creating a more trustworthy digital marketing environment for consumers and brands alike. A blockchain-based platform can motivate stakeholders in the advertising industry to operate in an open and collaborative environment where each party acts with honesty and integrity (Chartier-Rueg and Zweifel, 2017). For example, information asymmetry (i.e., when one party has more or more accurate information than the other party) is one of the motivations for click fraud which can be addressed in a blockchain ecosystem. More precisely, supervision and control over the publishers can be reinforced by leveraging the comprehensive analysis of qualifications, credibility and historical information, and by creating a collaborative modus operandi (Hongwei and Peiji, 2011). Much of this is owing to the immutable, transparent, and auditable nature of transactions that the technology enables. For instance, it is possible to ensure end-to-end transparency over online advertising-related activities such as the authentication of clicks. The “adChain” platform serves as a transformative protocol within the advertising technology industry which allows ad space users to benefit from campaign auditing and near-real-time impression tracking (Goldin et al., 2017). The platform draws on the strength of blockchains immutability to curb the attempts of pay-per-click providers to benefit from fraudulent ad clicks and traffic. Another novel advertising platform called “Ubex” harnesses blockchain technology along with other critical emerging technologies such as Artificial Intelligent and neural networks to achieve more precise media marketing data for advertisers, publishers and target consumers (Ubex, 2019). In this model, blockchain assists in eliminating irrelevant ads and better managing data clicks, impressions, and revenues for each web site linked to the system, thus helping advertisers to optimize their budgets.

Apart from promoting transparency, the prevention of click fraud allows advertisers to more effectively assess consumers' habits online. As such, the traceability features provided by the technology (Alvarenga et al., 2018) guarantee genuine customer visits. Practically, this can be achieved by assigning customers to authenticated and verified profiles on the blockchain. This removes the possibility of using device emulation software to fake installs from the advertising model and will result in higher accuracy in targeting and personalization due to real-time ads traceability. This approach enables marketers to obtain reliable data, generate more enhanced analytics, and thus to craft compelling marketing campaigns. By way of illustration, Lucidity's blockchain pilot with the Japanese car manufacturer Toyota resulted in a 21% increase in campaign performance (Lucidity, 2018). A blockchain-based platform marks the transition from the probabilistic measurement of clicks and impressions to a deterministic data model. Likewise, Pinmo integrates blockchain infrastructure into its overall media advertising strategy aimed at better ad campaign tracking and more precise analytics (Pinmo, 2019). These examples are illustrative of the blockchain's potential to prevent click fraud and to promote enhanced trust and transparency in the marketing and advertising industry. We therefore propose:

RP2: Blockchain technology helps to combat click fraud.

Reinforcing Trust and Transparency

The academic literature has recognized that trust is vitally important in B2C e-commerce (Lee and Turban, 2001). Despite this strong assertion, consumer confidence and trust in brands have been severely eroded (Quelch, 2009). According to the 2018 Edelman Trust Barometer, brands witnessed a significant decline in consumer trust in 2017 (Jones, 2018). To a large extent, the level of trust is determined by the quality of the technological infrastructure (Koenig-Lewis et al., 2010). Today, the Internet enables transactions in the absence of face-to-face contact. For this reason, a brand's success is contingent on the level of trust and transparency that it can generate (Strebinger and Treiblmaier, 2004; Tapscott and Tapscott, 2016). To empower trust and transparency in digital marketing, blockchain technology can allow brands and consumers to operate in a more secure and transparent ecosystem. Building on features such as the consistency of information, transparency, and immutability, blockchain technology helps to establish trust in the system itself (i.e., “trust by design”). The trust protocol of blockchain guarantees consumers (e.g., potential buyers) and the firm's existing customers that brands and marketers are behaving with integrity and honesty (Chapron, 2017). In this context, blockchain-enabled trust is both an antecedent and an outcome of consumer-centric transparency, especially when consumers share their PII. Blockchain can help to avoid malicious marketing of counterfeit products that infringe upon the intellectual property (IP) rights of the original manufacturer and violate copyright laws. This is owing to the ability of the technology to facilitate end-to-end product traceability (Galvez et al., 2018) and strict monitoring rules. Furthermore, blockchain-enabled transparency breeds trust because consumers have greater visibility and verifiability over the compliance obligations of brand claims. This can include the verification of credence claims such as organic, halal, and other third party certifications, the firm's business practices, and even their involvement in corporate social responsibility activities (e.g., fair trade, ethics, and sustainability measures; Treiblmaier, 2019a). Ensuring this high level of transparency, marketers will be able to signal several positive traits, emphasizing their altruistic motive to look out for the best interest of consumers (DeCarlo, 2005). The example of NYIAX (New York Interactive Advertising Exchange) demonstrates the role of blockchain technology to promote a transparent marketplace where a matching engine ensures a fair exchange of future premium advertising inventory as guaranteed contracts (Epstein, 2017). We thus propose:

RP3: Blockchain technology can help to reinforce consumers' trust in brands.

Enhancing Privacy Protection

Privacy is a complex issue that potentially amplifies individuals' anxiety about using an online technology service (Compeau and Higgins, 1995). Research has repeatedly shown that customers worry about their transaction anonymity and confidentiality (Ratnasingham, 1998). These concerns are caused by the increased risk of improperly obtaining, misusing, and divulging their PII. Privacy issues have increased since website cookies capture personal information and store them in information systems (McParland and Connolly, 2007). Moreover, vast improvements in data collection technologies coupled with new data mining techniques enable brands to more easily identify, track, collect and process consumer information. This creates new problems of intrusiveness in the privacy of online shoppers. To counteract these threats, consumers express a strong desire to control their personal information. This is confirmed by a survey which found that 87% of respondents (n = 2,136) decided to protect their privacy by requesting that companies remove their PII from their databases (Harris Poll, 2004). Additionally, consumers sometimes chose to purposely supply false information on a web site, in order to block online-ad targeting techniques or to disable cookies (Culnan and Milne, 2001).

While the need for heightened online privacy protection is rising, blockchain technology can alleviate many issues impeding consumers from shopping online. For example, consumers can entrust their PII on a blockchain platform since transactions are not bound to real identities once they are routed to a random set of points in the network (Jesus et al., 2018). Online privacy of consumers can be adequately engineered to control the access of network members to the information contained in the blocks. Transactions can be entirely private, but at the same time, they are verified by a consensus of participants in the shared network. Moreover, the blockchain platform can be an effective privacy-enhancing or privacy-by-design technology as it appeals to the technological savviness of online consumers by allowing them to encrypt their credentials resiliently (e.g., users' IDs, passwords, electronic IDs cards). Consequently, consumers can gain more control over their PII in digital marketing because their PII cannot easily be commoditized (Kosba et al., 2016). Consumers can rely on the blockchain's transactional history to generate more robust analytics and precise forecasting regarding their expectations, tastes, and brand perceptions. Additionally, there are new opportunities for consumers to securely and effectively trade their PII with brands (Travizano et al., 2018), which leads to our proposition:

RP4: Blockchain technology can enhance privacy protection.

Empowering Digital Marketing Security

Kalakota and Whinston (1997, p. 853) define a security threat as a “circumstance, condition, or event with the potential to cause economic hardship to data or network resources in the form of destruction, disclosure, modification of data, denial of service and/or fraud, waste and abuse”. Information security can be viewed as the heart of information systems, both at the technological and organizational levels (Dubois et al., 2010). This implies that ensuring a high level of preventative measures and transaction security is a crucial differentiator for many businesses. In the digital world, the delivery of products and services with well-communicated and adequate security is a crucial success factor for brand trust. Similarly, information security is turning into a must-have feature as brands become the stewards of consumers' PII (Madhavaram et al., 2005). This development is referred to by Greenlow (2018) as “Marketing security” which is the real-time control and management of consumers' PII to prevent data leakages and abuses.

Previous research has shown that information security concerns are a significant barrier to online marketing (Sathye, 1999; Udo, 2001). This is because online shopping and e-commerce are based on individuals' credentials and sensitive information such as home address and credit card details (collectively PII), much of which consumers are very reluctant to provide. The reason for this negative perception is the multitude of potential online threats, which involves data loss or theft, identity theft, credit card information theft, content manipulation, unauthorized account access, database attacks, patent and copyright violations (Chehrehpak et al., 2014). In the online marketing context, Internet banking still faces security threats through data transaction and transmission attacks or unauthorized uses of bank cards enabled through false authentication (Yousafzai et al., 2003). Moreover, the application of behavioral targeting (Beales, 2010) requires the need for cookies that are susceptible to cloning or misappropriation by a malicious party. A cookies-based approach and weblog records for tracking shoppers online activities might compromise consumers' privacy (Lee et al., 2019). The many security threats are now so prevalent that by 2021 the costs of cybercrimes are expected to reach $6 trillion annually (Empius marketing, 2019).

Prior to incorporating information security into the marketing narrative, brands have to establish a robust technological infrastructure that addresses existing security loopholes and enhances consumers' confidence in the digital marketing environment. In this respect, the emergence of blockchain technology can benefit both brands and consumers, ensuring an unprecedented level of security. The power of blockchain security is based on its distributed and decentralized storage of data (Yanik and Kiliç, 2018). Besides, the usage of several security mechanisms such as asymmetric encryption, digital signatures and access control (i.e., assigning reading and writing permissions) can secure the appropriate storage, transmission, and retrieval of large amounts of consumer information. The technology aligns well with the factors listed by Ma et al. (2008) for implementing a resilient information security management system: integration of information, information availability, information reliability, and accountability. Not only does the technology entail a new way of decentralizing and self-organizing the business ecosystem of brands, it can help to synchronize and integrate marketing-related information across the members of the network. This includes pricing policies, product listings, advertisements, outputs of market research and analysis, discounts and promotional benefits, and marketing plans. Decentralization can help to ensure that every party is economically better off and more secure (Epstein, 2017). For instance, consumers will have a single version of the truth and precise insights about a brand's values and traits. They would also maintain more control over their PII. Besides, the decentralized approach of blockchain technology allows brands to remove a single point of failure, thus achieving a high level of resistance against Denial of Services (DoS) attacks (Helebrandt et al., 2018) and ensuring network availability. In case of errors and misappropriation, information ubiquity and availability enabled by blockchain technology increases accountability and provides more accurate monitoring and evaluation (Omran et al., 2017). This means that the technology can provide consumers and brands with some redress and counteract measures in worst-case scenarios. For example, promoting marketing convenience and new secure models of advertisements, Keybase.io is a blockchain platform which has been developed to check the integrity of social media users' signature chains and to identify malicious rollbacks (Keybase.io., 2019). We propose:

RP5: Blockchain technology can empower digital marketing security.

Enabling Creative Loyalty Programs

In an increasingly competitive market environment, brands strive to ensure consumers remain loyal to their products and services. To enhance consumer retention, brands have been systematically collecting and storing their customer data, primarily through loyalty programs (Cvitanović, 2018). These tools serve to increase brand loyalty, reduce price sensitivity, encourage word of mouth, and enlarge their customer base (Uncles et al., 2003). Moreover, customer loyalty programs may significantly benefit brands as they can generate higher sales and profits. Increasingly, marketers have implemented loyalty programs in a wide variety of industries (Blattberg and Deighton, 1996). They continuously seek to understand which tactics are ideal for reaching consumers and which reward schemes serve them effectively.

Technological advancement has facilitated the collection of consumers' data (e.g., purchasing patterns, transactional history, preferences) and the tailoring of effective loyalty programs. For example, the use of database management software has paved the way for a new era in loyalty marketing by allowing sophisticated and personalized tracking of customers (Buss, 2002). The same is true for mobile marketing, which develops a customer-centric paradigm where loyalty programs are instantly communicated to prospective members. Similarly, the Internet has been a conducive environment for the growth of customer loyalty programs (Ha, 2007). The emergence of these technologies has intensified consumers' interest and access to information regarding loyalty rewards information, although gaining loyal customers is still a challenge for brands (Shaw and Lin, 2006). Furthermore, discussions in Internet forums have long revealed that participating members are often frustrated with some loyalty programs (Stauss et al., 2005; Lee and Jung, 2017).

Even though loyalty programs shift from an aggregate level to an individual level (Kumar et al., 2013), they are still very limited in terms of program components. Instead of diversifying reward program features to appeal to new potential members, many firms are adopting loyalty programs aimed at retaining their existing member base (Omar et al., 2011). Customers appreciate being involved in attractive and flexible loyalty programs. However, some brands tend to lock in their customers and exert monopoly power on them (Varian, 1999). The situation is exacerbated if loyalty points are unused or unredeemed. For instance, a report by Bond Brand Loyalty indicated that more than 25% of the participants in loyalty programs never redeem their reward points (Bond Brand Loyalty, 2016). The low redemption rates result from stringent, time-based procedures to redeem rewards. This strategy might invoke a state of significant frustration among loyal members, especially when a potential reward expires (Colman, 2015). The lack of integration of loyalty programs between brands is also a common problem as many loyalty programs are still fragmented and unable to generate information about members attitudes toward the programs themselves (Allaway et al., 2006). For the reasons mentioned above, several scholars in marketing have started questioning the effectiveness of loyalty programs in customer retention (Magatef and Tomalieh, 2015).

Blockchain technology has the potential to reform how loyalty programs are designed, tracked, and communicated to consumers. In a blockchain-based marketing ecosystem, loyalty programs are fully integrated. All participating parties in such programs such as loyalty programs operators, marketers, consumers, information system managers, call centers, sales offices, and other organizations will be efficiently integrated and interlinked. Instead of being fragmented, loyalty program partners could work synergistically to improve the members' experience and to attract different consumer segments. For example, blockchain technology can help to address the problem of incompatibility in many loyalty programs systems (Meyer-Waarden and Benavent, 2001), resulting in increased channel harmony and consistent experience among brands. Different partners of loyalty programs can exploit the interactive features of the technology to leverage operations like the joint development and design of loyalty programs, the inter-convertibility of reward points, and exchange transactions. More precisely, blockchain technology can create a more secure, and interoperable environment that is unattainable with centralized loyalty databases (Zhang et al., 2017). The technology appeals for both B2B and B2C loyalty programs as auditability of critical transactions and data is necessary to curb fraudulent activities and support customer advocacy (Lacey and Morgan, 2008).

Through real-time access to the blockchain platform, marketers can gain visibility over members' profiles, points, purchase patterns, payment history, and promotion responses, which will help them to craft more attractive, valuable, and customized loyalty programs. For example, American Express has integrated the Hyperledger blockchain to provide reward points to members based on individual products, instead of the spending behavior at a particular merchant (Coleman, 2018). Besides, the decentralized nature of blockchain technology also allows members to track their loyalty and reward points, freeing them and marketers from the physical possession of coupons (Chatterjee and McGinnis, 2010). Additionally, the technology can help to create more value for members by enabling them to trade and exchange their loyalty points. We propose:

RP6: Blockchain technology can enable creative loyalty programs.

Conclusion and Limitations

Rapid technological progress and the growth of e-business and e-commerce have significantly shaped the process of value creation. Many businesses exhibit a heavy reliance on technologies to offer seamless products and services to their existing customers. Emerging technologies can assist in better designing new products and services, improving data quality, and making the production process more responsive and economical (Cavalieri et al., 2013). New technologies have also significantly reshaped the marketing discipline, and they have brought new marketing terms and tactics (Bordonaba-Juste et al., 2012). Today, brands are increasingly using technology to leverage their global reach by penetrating new marketplaces and creating consumer demand. In this process, the Internet has enabled marketers to reach consumers with enhanced electronic communications and interactive media (Peltier et al., 2010). Meanwhile, consumers have become more knowledgeable about available offers and can make informed decisions in a convenient manner (Spann and Tellis, 2006). Businesses have benefited from data mining techniques and big data to draw conclusions regarding consumers' needs and wants. Analyzing large data sets help businesses to gain actionable insights through predictive analytics (Johnston, 2014). Blockchain technology is one technological advancement that can help brands to gain a better understanding and target their customers, but at the same time allow customers to regain control over their PII.

In this paper, we discussed several blockchain possibilities in the marketing landscape and presented six research propositions. The current online marketing world is rife with intermediaries (or so-called e-mediaries) who fail to configure active alliance networks (Dale, 2003) and lock both brands and consumers into platforms with limited capabilities. In doing so, they hamper the creativity of brands and deprive consumers of potential benefits of direct engagement. In this context, blockchain technology promises disintermediated markets where consumers can transact directly without passing through intermediary layers. Instead of operating in an opaque environment where information asymmetry prevails and dominates the relationship between brands and consumers, blockchain technology can create a new topology of enhanced transaction trust and information transparency, resulting in more trusted campaigns and customer-centricity (Shah et al., 2006). Moreover, the high level of technological sophistication and the intrinsic features of blockchain have demonstrated viability for protecting consumers' privacy and enhancing security in digital marketing. Not only that, the technology can assist in combating the widespread phenomenon of click fraud, thus creating a healthier marketing space for consumers, brands, and other participants involved in the value creation and delivery process. From a company's perspective, establishing loyalty is often challenging, since consumers always consider switching costs and economic benefits in their purchases (Reinartz, 2006). Blockchain technology can bring a renewed approach of crafting, integrating, and promoting marketing loyalty programs. Blockchain-based reward programs allow members to gain benefits from their brand loyalty, resulting in a more sustainable brand attachment.

This research has some limitations. It was our goal to present future blockchain applications in marketing in a concise way and to derive several research propositions. Consequently, we were not able to elaborate on the many intricacies and subtleties of blockchain technologies which we see as an excellent opportunity for future research. We also recommend that future research discusses the architecture as well as the operational environment in some detail to foster the understanding of how blockchain can help to create organizational value. Furthermore, it was our goal to highlight the potentials of blockchain in marketing, but we also need to mention potential challenges that might emerge from the (inter-)organizational integration of blockchain technology. Blockchains are not silver bullets or a panacea for all contemporary marketing issues but rather exhibit several shortcomings and potential negative consequences (Treiblmaier, 2019b). Compared to conventional databases, blockchain technology has several downsides. Storing information and transactions on the blockchain is still complicated and expensive (Baldimtsi et al., 2017). The cost of blockchain security and redundancy may far outweigh the values derived from its applications for marketing. As such, the redundant nature of blockchain offers increased costs since the processing of transactions on the blockchain takes longer than single-source transactions (Smith, 2017). Moreover, the adoption of blockchain is hampered by the lack of a suitable governance structure, the cost of blockchain maintenance and the high energy consumption where a proof-of-work consensus protocol on a public blockchain is used. According to Truby (2018), the initial application of blockchain, namely Bitcoin, has been designed with no consideration of the potential impacts on the environment. Aside from the insufficient built-in consumer protections and the high price volatility, the leveraging of Bitcoin in companies' marketing activities can cause undue environmental damage through high rates of electricity consumption and emissions (Truby, 2018), which might prevent organizations from adopting blockchain.

From an architectural perspective, it is noteworthy that different types of blockchains exist that can be applied to marketing activities such as private, consortium or public blockchains. Private blockchains can establish different levels of permission for the parties involved in the network. They aim at providing a better degree of privacy, handle large amounts of data, optimize existing and future recordkeeping, smoothen the audit process and compliance reporting and provide decision-makers with the unified data they need (Poberezhna, 2018). Brands wishing to retain their traditional business and governance models may, therefore, consider the adoption of private blockchains. However, according to Prasad and Rohokale (2019), consortium blockchains are the most suitable solutions for interdisciplinary, cross-industry applications in areas such as financial services, media, and telecommunication. Consortium models give brands the opportunity to reap the benefits of a distributed network while restricting access and consensus to particular users. In addition, these platforms are able to significantly support the co-creative interactions and collaborative marketing relationships between a brand and its stakeholders. Public blockchains are especially useful for brands that seek to capitalize on transparency in order to deliver consumer value. For example, creating product packaging with blockchain-based information transparency can enhance green marketing efforts (Kouhizadeh and Sarkis, 2018) as consumers will likely purchase products that they are sufficiently well informed about. Overall, the choice of blockchain type is a critical decision that should respond to the requirements of different marketing applications.

From the technological innovation perspective, we consider the adoption of blockchain to represent an incremental innovation that can lead to substantial changes in marketing. The cumulative gains from this technology can significantly reshape existing marketing practices and improve established business processes. However, as stated by Christensen (2013), new technologies could have sustaining or disruptive effects on organizations depending on the firm's resources, processes, and values. Therefore, new technologies, if not strategically approached and adequately embedded in the organizational structure, can erode the competitive position of brands in general and shrink their marketing edge in particular. Future research needs to explore and analyze the barriers to blockchain adoption in marketing. The six propositions we suggest provide starting points for further research and more refinement is needed to identify enablers and barriers as well as antecedents and consequences of blockchain application in marketing. A further note relates to PII retention and the immutability of blockchain technology. Some regulators are exploring consumer-based policies where the consumers' right to be “digitally forgotten” is central. In this latter scenario, researchers could explore privacy in the context of “mutable” blockchains to meet evolving regulatory requirements.

Author Contributions

All authors listed have made a substantial, direct and intellectual contribution to the work, and approved it for publication.

Funding

The publication of this work was supported by EFOP- 3.6.1-16-2016-00017 (Internationalization, initiatives to establish a new source of researchers and graduates and development of knowledge and technological transfer as instruments of intelligent specializations at Széchenyi István University).

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Acknowledgments

AR is grateful to Dr. Katalin Czakó and Mrs. Tihana Vasic for their valuable support.

References

Alauthaman, M., Aslam, N., Zhang, L., Alasem, R., and Hossain, M. A. (2018). A P2P botnet detection scheme based on decision tree and adaptive multilayer neural networks. Neural Comput. Appl. 29, 991–1004. doi: 10.1007/s00521-016-2564-5

Allaway, A. W., Gooner, R. M., Berkowitz, D., and Davis, L. (2006). Deriving and exploring behavior segments within a retail loyalty card program. Eur. J. Mark. 40, 1317–1339. doi: 10.1108/03090560610702830

Alvarenga, I. D., Rebello, G. A., and Duarte, O. C. M. (2018). “Securing configuration management and migration of virtual network functions using blockchain,” in NOMS 2018-2018 IEEEIFIP Network Operations and Management Symposium (Taipei: IEEE), 1–9. doi: 10.1109/NOMS.2018.8406249

Baldimtsi, F., Kiayias, A., and Samari, K. (2017). “Watermarking public-key cryptographic functionalities and implementations,” in Information Security Lecture Notes in Computer Science, eds P. Q. Nguyen and J. Zhou (Cham: Springer International Publishing), 173–191. doi: 10.1007/978-3-319-69659-1_10

Beales, H. (2010). The value of behavioral targeting. Netw. Advert. Initiat. 1, 1–23. Available online at: https://www.networkadvertising.org/pdfs/Beales_NAI_Study.pdf

Berman, S. J., and McClellan, B. E. (2002). Ten strategies for survival in the attention economy. Strategy Leadersh. 30, 28–33. doi: 10.1108/10878570210697513

Blattberg, R. C., and Deighton, J. (1996). Manage marketing by the customer equity test. Harv. Bus. Rev. 74, 136–144.

Bodoni, S. (2019). Mastercard Alerts Privacy Watchdogs After Loyalty Program Leak. Bloomberg.Com. Available online at: https://www.bloomberg.com/news/articles/2019-08-23/mastercard-tells-belgian-german-privacy-watchdogs-of-breach (accessed August 22, 2019).

Bond Brand Loyalty (2016). The 2016 Bond Loyalty Report. Available online at: https://cdn2.hubspot.net/hubfs/352767/Resources/2016_Bond_Loyalty_Report_Executive_Summary_CAN_Launch_Edition.pdf (accessed September 10, 2019).

Bordonaba-Juste, V., Lucia-Palacios, L., and Polo-Redondo, Y. (2012). Antecedents and consequences of e-business adoption for european retailers. Internet Res. 22, 532–550. doi: 10.1108/10662241211271536

Boyer, K. K., and Hult, G. T. M. (2005). Welcome home: innovating the forward supply chain. Bus. Strategy Rev. 16, 31–37. doi: 10.1111/j.0955-6419.2005.00360.x

Buhalis, D., and Licata, M. C. (2002). The future ETourism intermediaries. Tour. Manag. 23, 207–220. doi: 10.1016/S0261-5177(01)00085-1

Buss, D. (2002). As Loyalty Programs Expand, Customer Fatigue Forces Creativity and Caution. Resource Center Article, MCI.COM.

Cavalieri, S., Romero, D., Strandhagen, J. O., and Schönsleben, P. (2013). “Interactive business models to deliver product-services to global markets,” in IFIP International Conference on Advances in Production Management Systems (Berlin; Heidelberg: Springer), 186–193. doi: 10.1007/978-3-642-41263-9_23

Cavoukian, A. (2011). Privacy by Design: The 7 Foundational Principles. Available online at: https://www.ipc.on.ca/wp-content/uploads/Resources/7foundationalprinciples.pdf (accessed September 5, 2019).

Chapron, G. (2017). The environment needs cryptogovernance. Nat. News 545, 403–405. doi: 10.1038/545403a

Chartier-Rueg, T. C., and Zweifel, T. D. (2017). Blockchain, leadership and management: business as usual or radical disruption. EUREKA Soc. Humanit. 4, 76–110. doi: 10.21303/2504-5571.2017.00370

Chatterjee, P., and McGinnis, J. (2010). Customized online promotions: moderating effect of promotion type on deal value, perceived fairness, and purchase intent. J. Appl. Bus. Res. 26, 13–20. doi: 10.19030/jabr.v26i4.302

Chehrehpak, M., Afsharian, S. P., and Roshandel, J. (2014). Effects of implementing information security management systems on the performance of marketing and sales departments. IJBIS 15, 291–306. doi: 10.1504/IJBIS.2014.059752

Christensen, C. M. (2013). The Innovator's Dilemma: When New Technologies Cause Great Firms to Fail. Boston, MA: Harvard Business Review Press.

Click Quality Team (2006). How Fictitious Clicks Occur in Third-Party Click Fraud Audit Reports. Google Inc. 1–17. Available online at: https://static.googleusercontent.com/media/www.google.hu/fr/hu/adwords/ReportonThird-PartyClickFraudAuditing.pdf (accessed June 5, 2019).

Clohessy, T., Acton, T., and Rogers, N. (2019). “Blockchain adoption: technological, organisational and environmental considerations,” in Business Transformation Through Blockchain, Vol. I, eds H. Treiblmaier and R. Beck (Cham: Springer International Publishing), 47–76. doi: 10.1007/978-3-319-98911-2_2

Coleman, L. (2018). American Express Gives Loyalty Program a Blockchain Upgrade. CCN. Available online at: https://www.ccn.com/american-express-taps-hyperledger-blockchain-for-rewards-program-revamp (accessed April 25, 2019).

Colman, A. M. (2015). The Oxford Dictionary of Psychology, 2014th Edn. Oxford: Oxford University Press.

Compeau, D. R., and Higgins, C. A. (1995). Computer self-efficacy: development of a measure and initial test. MIS Q. 19, 189–211. doi: 10.2307/249688

Cort, S. G. (1999). Industry corner: industrial distribution: how goods will go to market in the electronic marketplace. Bus. Econ. 34, 53–55.

Culnan, M. J., and Milne, G. R. (2001). Culnan-Milne Survey on Consumers and Online Privacy Notices. Available online at: https://www.bentley.edu/newsroom/latest-headlines/culnan-milne-survey-on-consumers-and-online-privacy-notices-reveals-onli-0 (accessed April 22, 2019).

Cvitanović, P. L. (2018). “New technologies in marketing as competitive advantage,” in 2018 ENTRENOVA Conference Proceedings (Split: ECONSTOR), 294–302.

Dale, C. (2003). The competitive networks of tourism e-mediaries: new strategies, new advantages. J. Vacat. Mark. 9, 109–118. doi: 10.1177/135676670300900201

DeCarlo, T. E. (2005). The effects of sales message and suspicion of ulterior motives on salesperson evaluation. J. Consum. Psychol. 15, 238–249. doi: 10.1207/s15327663jcp1503_9

Deighton, J., and Kornfeld, L. (2008). Digital Interactivity: Unanticipated Consequences for Markets, Marketing, and Consumers. Boston, MA: Harvard Business School. Availble online at: http://weigend.com/files/teaching/tsinghua/readings/DeightonKornfeldHBS2007.pdf (accessed September 22, 2019).

DeMers, J. (2016). New Technologies Shaping Online Marketing for the Better. Forbes. Availble online at: https://www.forbes.com/sites/jaysondemers/2016/08/15/7-new-technologies-shaping-online-marketing-for-the-better-we-hope/#3a801a9f61fd (accessed September 22, 2019).

Dinev, T., Hu, Q., and Yayla, A. (2008). Is there an on-line advertisers' dilemma? A study of click fraud in the pay-per-click model. Int. J. Electron. Commer. 13, 29–60. doi: 10.2753/JEC1086-4415130202

Dubois, É., Heymans, P., Mayer, N., and Matulevičius, R. (2010). “A systematic approach to define the domain of information system security risk management,” in Intentional Perspectives on Information Systems Engineering, eds S. Nurcan, C. Salinesi, C. Souveyet, and J. Ralyté (Berlin; Heidelberg: Springer), 289–306. doi: 10.1007/978-3-642-12544-7_16

Ehrmann, M., Michel, S., and Livio, S. (2010). Explaining the Fall in Citizens ‘Trust in the ECB During the Global Financial Crisis. Available online at: https://scholar.google.fr/scholar?hl=en&as_sdt=0%2C5&q=+Explaining+the+fall+in+citizens+%27trust+in+the+ECB+during+the+global+financial+crisis&btnG= (accessed April 20, 2019).

Empius marketing (2019). Website Security. Available online at: https://empiusmarketing.com/website-security/ (accessed April 22, 2019).

Epstein, J. (2017). Blockchain and the CMO. Whitepaper. Availble online at: https://s3.us-east-2.amazonaws.com/brightline-website/downloads/reports/Brightline_Epstein_Blockchain-and-the-CMO_Blockchain-Research-Institute.pdf?utm_source=resource-page&utm_medium=skip-link (accessed September 22, 2019).

Ertemel, A. V. (2018). Implications of blockchain technology on marketing. J. Int. Trade Logist. Law 4, 35–44. Available online at: http://jital.org/index.php/jital/article/view/98/pdf_61

Fosso Wamba, S., Kamdjoug, J. R. K., Bawack, R. E., and Keogh, J. G. (2020). Bitcoin, blockchain and fintech: a systematic review and case studies in the supply chain. Prod. Plan. Control 31, 115–142. doi: 10.1080/09537287.2019.1631460

Galvez, J. F., Mejuto, J. C., and Simal-Gandara, J. (2018). Future challenges on the use of blockchain for food traceability analysis. Trends Anal. Chem. 107, 222–232. doi: 10.1016/j.trac.2018.08.011

Geiger, S., and Martin, S. G. (1999). The internet as a relationship marketing tool-some evidence from irish companies. Ir. Mark. Rev. 12, 24–36.

Ghose, A. (2018). What blockchain could mean for marketing. Harv. Bus. Rev. 2–5. Available online at: https://hbr.org/2018/05/what-blockchain-could-mean-for-marketing

Goldin, M., Soleimani, A., and Young, J. (2017). The Adchain Registry. Whitepaper. Available online at: https://blockchain-x.eu/wp-content/uploads/2018/02/The_adChain_Registry_ENG.pdf (accessed January 27, 2020).

Goodman, J. (2005). “Pay-per-Percentage of impressions: an advertising method that is highly robust to fraud,” in Workshop Spons. Search Auctions. Citeseer.

Greenlow, M. (2018). Marketing Security: The Phrase Every Executive Needs to Understand in 2019. Availble online at: https://www.martechadvisor.com/articles/marketing-analytics/marketing-security-the-phrase-every-executive-needs-to-understand-in-2019/ (accessed April 22, 2019).

Ha, S. (2007). How customer loyalty programs can influence relational marketing outcomes: using customer-retailer identification to build relationships (Ph.D. thesis). The Ohio State University, Columbus, OH, United States of America.

Hackius, N., and Petersen, M. (2017). Blockchain in Logistics and Supply Chain: Trick or Treat? Digit. Supply Chain Manag. Logist. Proc. Hambg. Int. Conf. Logist. 3–18. doi: 10.15480/882.1444

Haddadi, H. (2010). Fighting online click-fraud using bluff Ads. ACM SIGCOMM Comput. Commun. Rev. 40, 21–25. doi: 10.1145/1764873.1764877

Harris Poll (2004). Privacy and American Business. Availble online at: https://www.epic.org/privacy/survey/ (accessed April 26, 2019).

Harvey, C. R., Moorman, C., and Toledo, M. (2018). How blockchain can help marketers build better relationships with their customers. Harv. Bus. Rev. Availble online at: https://hbr.org/2018/10/how-blockchain-can-help-marketers-build-better-relationships-with-their-customers (accessed April 21, 2019).

Helebrandt, P., Bellus, M., Ries, M., Kotuliak, I., and Khilenko, V. (2018). “Blockchain adoption for monitoring and management of enterprise networks,” in 2018 IEEE 9th Annual Information Technology, Electronics and Mobile Communication Conference IEMCON (Vancouver, BC: IEEE), 1221–1225. doi: 10.1109/IEMCON.2018.8614960

Hongwei, L., and Peiji, S. (2011). The study on supervision model for online advertising click fraud. Manag. Sci. Eng. 5, 111–119. doi: 10.3968/j.mse.1913035X20110503.1z413

Hübner, U., and Elmhorst, M. A. (2008). eBusiness in Healthcare: From eProcurement to Supply Chain Management. London: Springer-Verlag. doi: 10.1007/978-1-84628-879-1

Ingram, D., Panchadar, A., and Auchard, E. (2018). Facebook Privacy Scandal Widens as Data Leak Hits 87 Million Users. CIO. Available online at: https://www.cio.com.au/article/635768/facebook-privacy-scandal-widens-data-leak-hits-87-million-users/ (accessed September 5, 2019).

Jain, V., Midha, V., and Animesh, A. (2010). Whose click fraud data do you trust? effect of click fraud on advertiser's trust and sponsored search advertising decisions. In ECIS 2010 Proc. 1–10.

Jesus, E. F., Chicarino, V. R., de Albuquerque, C. V., and Rocha, A. A. (2018). A survey of how to use blockchain to secure internet of things and the stalker attack. Secur. Commun. Netw. 2018, 1–27. doi: 10.1155/2018/9675050

Johnston, W. J. (2014). The future of business and industrial marketing and needed research. J. Bus. Mark. Manag. 7, 296–300. Available online at: https://www.econstor.eu/bitstream/10419/96103/1/783119623.pdf

Jones, K. (2018). How Much Will Blockchain Really Affect Digital Marketing? Forbes. Availble online at: https://www.forbes.com/sites/forbesagencycouncil/2018/10/04/how-much-will-blockchain-really-affect-digital-marketing/ (accessed April 21, 2019).

Juniper Research (2017). Ad Fraud to Cost Advertisers $19 Billion in 2018. Availble online at: https://www.juniperresearch.com/press/press−releases/ad−fraud−to−cost−advertisers−19-billion-in-2018 (accessed June 24, 2019).

Kalakota, R., and Whinston, A. B. (1997). Electronic Commerce: A Manager's Guide. Boston, MA: Addison-Wesley Professional.

Keybase.io. (2019). Keybase. Availble online at: https://keybase.io/docs/server_security (accessed April 23, 2019).

Koenig-Lewis, N., Palmer, A., and Moll, A. (2010). Predicting young consumers' take up of mobile banking services. Int. J. Bank Mark. 28, 410–432. doi: 10.1108/02652321011064917

Kosba, A., Miller, A., Shi, E., Wen, Z., and Papamanthou, C. (2016). “Hawk: the blockchain model of cryptography and privacy-preserving smart contracts,” in Proceedings - 2016 IEEE Symposium on Security and Privacy. SP 2016 (San Jose, CA: IEEE), 839–858. doi: 10.1109/SP.2016.55

Kouhizadeh, M., and Sarkis, J. (2018). Blockchain practices, potentials, and perspectives in greening supply chains. Sustainability 10:3652. doi: 10.3390/su10103652

Kshetri, N., and Voas, J. (2019). Online advertising fraud. Computer 52, 58–61. doi: 10.1109/MC.2018.2887322

Kumar, V., Dalla Pozza, I., and Ganesh, J. (2013). Revisiting the satisfaction–loyalty relationship: empirical generalizations and directions for future research. J. Retail. 89, 246–262. doi: 10.1016/j.jretai.2013.02.001

Lacey, R., and Morgan, R. M. (2008). Customer advocacy and the impact of B2B loyalty programs. J. Bus. Ind. Mark. 24, 3–13. doi: 10.1108/08858620910923658

Larivière, B., Joosten, H., Malthouse, E. C., Van Birgelen, M., Aksoy, P., Kunz, W. H., et al. (2013). Value fusion: the blending of consumer and firm value in the distinct context of mobile technologies and social media. J. Serv. Manag. 24, 268–293. doi: 10.1108/09564231311326996

Lee, M. K., and Turban, E. (2001). A trust model for consumer internet shopping. Int. J. Electron. Commer. 6, 75–91. doi: 10.1080/10864415.2001.11044227

Lee, S. H., and Jung, K. S. (2017). Loyal customer behaviors: identifying brand fans. Soc. Behav. Personal. Int. J. 46, 1285–1304. doi: 10.2224/sbp.6482

Lee, W., Chen, H., Chang, S., and Chen, T. (2019). Secure and efficient protection for HTTP cookies with self-verification. Int. J. Commun. Syst. 32, 1–10. doi: 10.1002/dac.3857

Lu, Y. (2019). The Blockchain: state-of-the-art and research challenges. J. Ind. Inf. Integr. 15, 80–90. doi: 10.1016/j.jii.2019.04.002

Lucidity (2018). Lucidity's Blockchain Pilot with Toyota Results in 21% Lift in Campaign Performance. Availble online at: https://www.prnewswire.com/news-releases/luciditys-blockchain-pilot-with-toyota-results-in-21-lift-in-campaign-performance-300731983.html (accessed April 24, 2019).

Ma, Q., Johnston, A. C., and Pearson, J. M. (2008). Information security management objectives and practices: a parsimonious framework. Inf. Manag. Comput. Secur. 16, 251–270. doi: 10.1108/09685220810893207

Madhavaram, S., Badrinarayanan, V., and McDonald, R. E. (2005). Integrated marketing communication (IMC) and brand identity as critical components of brand equity strategy: a conceptual framework and research propositions. J. Advert. 34, 69–80. doi: 10.1080/00913367.2005.10639213

Magatef, S. G., and Tomalieh, E. F. (2015). The impact of customer loyalty programs on customer retention. Int. J. Bus. Soc. Sci. 6, 78–93. Available online at: https://www.uop.edu.jo/download/Research/members/loyalty%20programs.pdf

Marketo (2017). Stark Contrasts in Technology Priorities for U.S. and International Marketers, Marketo Survey Finds. Available online at: https://www.prnewswire.com/news-releases/stark-contrasts-in-technology-priorities-for-us-and-international-marketers-marketo-survey-finds-30039 (0070).html (accessed April 20, 2019).

Martin, K. (2018). The penalty for privacy violations: how privacy violations impact trust online. J. Bus. Res. 82, 103–16. doi: 10.1016/j.jbusres.2017.08.034

McAllister, M. P., and Turow, J. (2002). New media and the commercial sphere: two intersecting trends, five categories of concern. J. Broadcast. Electron. Media 46, 505–514. doi: 10.1207/s15506878jobem4604_1

McCole, P. (2004). Marketing is not dead: a response to “Elegy on the death of marketing.” Eur. J. Mark. 38, 1349–1354. doi: 10.1108/03090560410560137

McParland, C., and Connolly, R. (2007). “Online privacy concerns: threat or opportunity,” in Proceedings of 2007 Mediterranean and Middle Eastern Conference on Information Systems. EMCIS2007. Citeseer. 64-1_64-11. Valencia, 24–26 June 2007. Polytechnic University of Valencia.

Melewar, T. C., Foroudi, P., Gupta, S., Kitchen, P. J., and Foroudi, M. M. (2017). Integrating identity, strategy and communications for trust, loyalty and commitment. Eur. J. Mark. 51, 572–604. doi: 10.1108/EJM-08-2015-0616

Meyer-Waarden, L., and Benavent, C. (2001). Loyalty programs: strategies and practice. FEDMA Res. Day Madr. Sept. 14, 1–33. Available online at: https://www.researchgate.net/profile/Lars_Meyer-Waarden/publication/228396280_Loyalty_programs_Strategies_and_practice/links/546204250cf2c1a63c028a41/Loyalty-programs-Strategies-and-practice.pdf

Mungamuru, B., Weis, S., and Garcia-Molina, H. (2008). Should Ad Networks Bother Fighting Click Fraud? (Yes, They Should.). Technical Report. Stanford Infor Lab.

Münsing, E., Mather, J., and Moura, S. (2017). “Blockchains for decentralized optimization of energy resources in microgrid networks,” in 2017 IEEE Conference on Control Technology and Applications (CCTA) (Mauna Lani, HI: IEEE), 2164–2171. doi: 10.1109/CCTA.2017.8062773

Nakamoto, S. (2008). Bitcoin: A Peer-to-Peer Electronic Cash System | Satoshi Nakamoto Institute. Available online at: http://nakamotoinstitute.org/bitcoin/ (accessed February 3, 2019).

Nieves, J., and Diaz-Meneses, G. (2016). Antecedents and outcomes of marketing innovation: an empirical analysis in the hotel industry. Int. J. Contemp. Hosp. Manag. 28, 1554–1576. doi: 10.1108/IJCHM-11-2014-0589

Norman, G., Pepall, L., Richards, D., and Tan, L. (2016). Competition and consumer data: the good, the bad, and the ugly. Res. Econ. 70, 752–65. doi: 10.1016/j.rie.2016.09.002

Omar, N. A., Alam, S. S., Aziz, N. A., and Nazri, M. A. (2011). Retail loyalty programs in Malaysia: the relationship of equity, value, satisfaction, trust, and loyalty among cardholders. J. Bus. Econ. Manag. 12, 332–352. doi: 10.3846/16111699.2011.573297

Omran, Y., Henke, M., Heines, R., and Hofmann, E. (2017). Blockchain-Driven Supply Chain Finance: Towards a Conceptual Framework from a Buyer Perspective. Working paper. Available online at: https://www.alexandria.unisg.ch/251095/1/WP29-Blockchain-driven%20supply%20chain%20finance%20Towards%20a%20conceptual%20framework%20from%20a%20buyer%20perspective.pdf

Papadopoulos, G. (2015). “Blockchain and digital payments: an institutionalist analysis of Cryptocurrencies,” in Handbook of Digital Currency, Bitcoin, Innovation, Financial Instruments, and Big Data, ed D. L. K. Chuen (Boston, MA: Elsevier), 153–172.

Pearce, P., Dave, V., Grier, C., Levchenko, K., Guha, S., McCoy, D., et al. (2014). “Characterizing large-scale click fraud in zeroaccess,” in Proceedings of 2014 ACM SIGSAC Conference on Computer and Communications Security (Scottsdale, AZ; New York, NY: ACM), 141–152. doi: 10.1145/2660267.2660369

Peltier, J. W., Milne, G. R., Phelps, J. E., and Barrett, J. T. (2010). Teaching information privacy in marketing courses: key educational issues for principles of marketing and elective marketing courses. J. Mark. Educ. 32, 224–246. doi: 10.1177/0273475309360164

Pineda, J. M., and Paraskevas, A. (2004). “Web analytics: a missed opportunity for hotel online strategy?” in Proceedings of 11th ENTER Conference (Vienna: Springer Verlag), 623–633. doi: 10.1007/978-3-7091-0594-8_58

Pinmo (2019). How Pinmo Will Utilize Blockchain to Revolutionize the Advertising Industry. Pinmo. Available online at: http://blog.pinmo.ca/advertising-industry/ (accessed September 22, 2019).

Poberezhna, A. (2018). “Chapter 14 - Addressing water sustainability with blockchain technology and green finance,” in Transforming Climate Finance and Green Investment with Blockchains, ed A. Marke (Cambrige, MA: Academic Press), 189–196. doi: 10.1016/B978-0-12-814447-3.00014-8

Prabhaker, P. R. (2000). Who owns the online consumer? J. Consum. Mark. 17, 158–171. doi: 10.1108/07363760010317213

Prasad, R., and Rohokale, V. (2019). “Blockchain Technology,” in Cyber Security: The Lifeline of Information and Communication Technology (Springer Series in Wireless Technology), eds R. Prasad and V. Rohokale (Cham: Springer International Publishing), 249–62. doi: 10.1007/978-3-030-31703-4_17

Quelch, J. (2009). Improving Market Research in a Recession. Harvard Business School Working Knowledge. doi: 10.1002/ltl.340

Ratnasingham, P. (1998). Trust in web-based electronic commerce security. Inf. Manag. Comput. Secur. 6, 162–166. doi: 10.1108/09685229810227667

Reinartz, W. J. (2006). “Understanding Customer Loyalty Programs,” in Retail. 21st Century, eds M. Krafft and M. K. Mantrala (Heidelberg: Springer), 361–379. doi: 10.1007/3-540-28433-8_23

Rejeb, A., Keogh, J. G., and Treiblmaier, H. (2019). Leveraging the internet of things and blockchain technology in supply chain management. Future Internet 11:161. doi: 10.3390/fi11070161

Rejeb, A., Sűle, E., and Keogh, J. G. (2018). Exploring new technologies in procurement. Transp. Logist. Int. J. 18, 76–86. Available online at: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3319424

Rishel, T. D., and Burns, O. M. (1997). The impact of technology on small manufacturing firms. J. Small Bus. Manag. 35, 2–10.

Santomier, J. (2008). New media, branding and global sports sponsorship. Int. J. Sports Mark. Spons. 10, 9–22. doi: 10.1108/IJSMS-10-01-2008-B005

Sarkar, M. B., Butler, B., and Steinfield, C. (1995). Intermediaries and cybermediaries. J. Comput. Mediat. Commun. 1:JCMC132. doi: 10.1111/j.1083-6101.1995.tb00167.x

Sathye, M. (1999). Adoption of internet banking by australian consumers: an empirical investigation. Int. J. Bank Mark. 17, 324–334. doi: 10.1108/02652329910305689

Schultz, C. D., and Olbrich, R. (2007). Consequences of Click Fraud on the Effectiveness of Search Engine Advertising. Available online at: http://citeseerx.ist.psu.edu/viewdoc/download? (accessed September 23, 2019).

Shah, D., Rust, R. T., Parasuraman, A., Staelin, R., and Day, G. S. (2006). The path to customer centricity. J. Serv. Res. 9, 113–124. doi: 10.1177/1094670506294666

Shaw, C. W., and Lin, S. W. (2006). “The antecedents of consumers' loyalty toward online stores,” in 11th Annu. Conf. Asia Pac. Decis. Sci. Inst (Hong Kong), 14–18.

Sheth, J. N., Sisodia, R. S., and Sharma, A. (2000). The antecedents and consequences of customer-centric marketing. J. Acad. Mark. Sci. 28, 55–66. doi: 10.1177/0092070300281006

Smith, T. D. (2017). “The Blockchain Litmus Test,” in 2017 IEEE International Conference on Big Data 2299-2308 (Botson, MA: IEEE). doi: 10.1109/BigData.2017.8258183

Spann, M., and Tellis, G. J. (2006). Does the internet promote better consumer decisions? The case of name-your-own-price auctions. J. Mark. 70, 65–78. doi: 10.1509/jmkg.2006.70.1.65

Stauss, B., Schmidt, M., and Schoeler, A. (2005). Customer frustration in loyalty programs. Int. J. Serv. Ind. Manag. 16, 229–252. doi: 10.1108/09564230510601387

Stone, M. D., and Woodcock, N. D. (2014). Interactive, direct and digital marketing: a future that depends on better use of business intelligence. J. Res. Interact. Mark. 8, 4–17. doi: 10.1108/JRIM-07-2013-0046

Strebinger, A., and Treiblmaier, H. (2004). E-adequate branding: building offline and online brand structure within a polygon of interdependent forces. Electron. Mark. 14, 153–164. doi: 10.1080/10196780410001675095

Tapscott, D., and Tapscott, A. (2016). Blockchain Revolution: How the Technology behind Bitcoin Is Changing Money, Business, and the World. Toronto, ON: Penguin.

Tönnissen, S., and Teuteberg, F. (2019). Analysing the impact of blockchain-technology for operations and supply chain management: an explanatory model drawn from multiple case studies. Int. J. Inf. Manag. 1–10. doi: 10.1016/j.ijinfomgt.2019.05.009

Travizano, M., Minnoni, M., Ajzenman, G., Sarraute, C., and Della Penna, N. (2018). Wibson: A Decentralized Marketplace Empowering Individuals to Safely Monetize Their Personal Data. Whitepaper. Available online at: https://wibson.org/wp-content/uploads/2019/04/Wibson-Technical-Paper-v1.1.pdf (accessed September 23, 2019).

Treiblmaier, H. (2018). The impact of the blockchain on the supply chain: a theory-based research framework and a call for action. Supply chain Manag. 23, 545–559. doi: 10.1108/SCM-01-2018-0029

Treiblmaier, H. (2019a). Combining blockchain technology and the physical internet to achieve triple bottom line sustainability: a comprehensive research agenda for modern logistics and supply chain management. Logistics 3, 1–13. doi: 10.3390/logistics3010010

Treiblmaier, H. (2019b). Toward more rigorous blockchain research: recommendations for writing blockchain case studies. Front. Blockchain 2:3. doi: 10.3389/fbloc.2019.00003

Treiblmaier, H., and Strebinger, A. (2008). The effect of E-commerce on the integration of IT structure and brand architecture. Inf. Syst. J. 18, 479–498. doi: 10.1111/j.1365-2575.2007.00288.x

Truby, J. (2018). Decarbonizing bitcoin: law and policy choices for reducing the energy consumption of blockchain technologies and digital currencies. Energy Res. Soc. Sci. 44, 399–410. doi: 10.1016/j.erss.2018.06.009

Twesige, R. L. (2015). A Simple Explanation of Bitcoin and Blockchain Technology. Available online at: https://www.researchgate.net/profile/Richard_Twesige/publication/270287317_Bitcoin_A_simple_explanation_of_Bitcoin_and_Block_Chain_technology_JANUARY_2015_RICHARD_LEE_TWESIGE/links54a7836f0cf267bdb90a0ee6/Bitcoin-A-simple-explanation-of-Bitcoin-and-Block-Chain-technology-JANUARY-2015-RICHARD-LEE-TWESIGE.pdf (accessed September 23, 2019).

Ubex (2019). Artificial Intelligence in Advertising. Available online at: https://www.ubex.com (accessed April 24, 2019).

Udo, G. J. (2001). Privacy and security concerns as major barriers for E-commerce: a survey study. Inf. Manag. Comput. Secur. 9, 165–174. doi: 10.1108/EUM0000000005808

Uncles, M. D., Dowling, G. R., and Hammond, K. (2003). Customer loyalty and customer loyalty programs. J. Consum. Mark. 20, 294–316. doi: 10.1108/07363760310483676

Vend (2018). Vend's retail trends and predictions for 2018. Available online at: https://www.vendhq.com/2018-retail-trends-predictions (accessed April 24, 2019).

Yanik, S., and Kiliç, A. S. (2018). “A framework for the performance evaluation of an energy blockchain,” in Energy Management—Collective and Computational Intelligence with Theory and Applications, eds C. Kahraman and G. Kayakutlu (Cham: Springer), 521–543. doi: 10.1007/978-3-319-75690-5_23

Yli-Huumo, J., Ko, D., Choi, S., Park, S., and Smolander, K. (2016). Where is current research on blockchain technology?—A systematic review. PLoS ONE 10:e163477. doi: 10.1371/journal.pone.0163477

Yousafzai, S. Y., Pallister, J. G., and Foxall, G. R. (2003). A proposed model of E-trust for electronic banking. Technovation 23, 847–860. doi: 10.1016/S0166-4972(03)00130-5

Zamani, E. D., and Giaglis, G. M. (2018). With a little help from the miners: distributed ledger technology and market disintermediation. Ind. Manag. Data Syst. 118, 637–652. doi: 10.1108/IMDS-05-2017-0231

Keywords: blockchain, marketing, brand, customer-centric paradigm, trust, loyalty, e-commerce

Citation: Rejeb A, Keogh JG and Treiblmaier H (2020) How Blockchain Technology Can Benefit Marketing: Six Pending Research Areas. Front. Blockchain 3:3. doi: 10.3389/fbloc.2020.00003

Received: 26 September 2019; Accepted: 20 January 2020;

Published: 19 February 2020.

Edited by:

Victoria L. Lemieux, University of British Columbia, CanadaReviewed by:

Beth Kewell, Business School, University of Exeter, United KingdomRemo Pareschi, University of Molise, Italy