95% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

TECHNOLOGY AND CODE article

Front. Blockchain , 21 November 2019

Sec. Blockchain for Good

Volume 2 - 2019 | https://doi.org/10.3389/fbloc.2019.00021

This article is part of the Research Topic Blockchain Technology and the Global South View all 8 articles

The Global South harbors some of the planet's most precious natural resources and is hence key in addressing the pressing environmental challenges of the Anthropocene. Here, payments for ecosystem services (PES) have recently gained importance as a means of environmental governance, increasingly complementing conventional command-and-control approaches. For instance, climate change is now mitigated through carbon offset payments and biodiversity loss is addressed through wildlife conservation performance payments. However, such payment schemes in the Global South face numerous challenges as identified by a large body of literature. This paper investigates if blockchain technology can help address some of the challenges by reinforcing PES programs with tamper-proof blockchain smart contracts. To this end, the paper presents a proof-of-concept of a blockchain-based wildlife conservation performance payments scheme in Namibia: the habitat integrity of an elephant corridor is assessed by remote sensing algorithms, which in turn trigger fictitious blockchain smart contract payments to surrounding communities. The application allows to practically discuss the potential of blockchain technology regarding three key aspects of PES: (i) effectiveness (conditionality) of environmental monitoring (ii) efficiency and transaction costs, as well as (iii) equity and benefit distribution. The case presented here is an example for linking the digital Blockchain sphere to practical challenges of natural resource management in the physical world. As such, it illustrates some potentials of the technology, but also shows how Blockchain technology is unlikely to provide transformative solutions in geographies with complex environmental governance.

Anthropogenic climate change and biodiversity loss are unprecedented challenges for humanity (Dirzo et al., 2014; IPCC, 2018). In both domains, environmental governance following conventional command-and-control approaches is losing grip (Kolstad et al., 2014; Watson et al., 2014). Therefore, much hope is placed on market-based governance instruments like payments for ecosystem services (PES) (Ferraro and Kiss, 2002). The underlying ecosystem services framework, a utilitarian framing of nature as service provider to humanity, is gaining traction in economic and political decision-making (Costanza et al., 1997; Daily, 1997; Millennium Ecosystem Assessment, 2005). In PES, landholders receive financial incentives to engage in land-use practices that supply desired ecosystem services (Wunder, 2005). PES are emerging in a variety of fields such as carbon sequestration, biodiversity conservation, and water purification (Sattler et al., 2013). Roughly 550 schemes exist around the globe with an annual turnover of USD 36–42 billion (Salzman et al., 2018).

The academic literature on PES is divided into three main strands, the environmental economics perspective, the ecological economics perspective, and the political ecological critique (Farley and Costanza, 2010; Tacconi, 2012; Van Hecken et al., 2015). The arguably most influential environmental economics perspective is rooted in market-oriented neoclassical economics. It is theoretically grounded in the Coase theorem (Coase, 1960) which assumes that stakeholders will, without government intervention, bargain toward optimal outcomes for society if transaction costs are low and property rights clear (Farley and Costanza, 2010). PES are here defined as a voluntary, conditional transaction in exchange of a well-defined ecosystem service (ES) between an ES buyer and an ES provider (Wunder, 2005). Research within this body of literature is mainly concerned with identifying the optimal institutional design of PES schemes (Van Hecken et al., 2015). Regarding the Global South, PES are attributed the potential to complement command-and-control approaches in the face of weak governance (Engel et al., 2008; Ezzine-de-Blas et al., 2016) and to potentially generate synergies between conservation and development (Pattanayak et al., 2010; Samii et al., 2014). The approach also identifies weak institutions, above all unclear property rights, as obstacle to the emergence of PES in such geographies (Wunder, 2013).

The ecological economics perspective on PES puts greater emphasis on social and environmental justice. It originated from the observation that the market-oriented environmental economics ideal type of PES is rarely found in practice (Vatn, 2010). Theoretically grounded in institutional economics and political economy and concerned with distributional issues (Muradian et al., 2010), it advocates for involving intermediaries like the state in PES schemes. PES are defined as “transfer of resources between social actors, which aims to create incentives to align individual and/or collective land use decisions with the social interest in the management of natural resources” (Muradian et al., 2010, p. 1205). While research following the ecological economics perspective is similar to the environmental economics approach in both methodology and the aim of identifying optimal PES scheme design, it differs in its stronger emphasis on contextuality and distributional justice (Pascual et al., 2010; Van Hecken et al., 2015). This stance prevails when looking at the Global South, where the ecological economics perspective pays attention to equity issues and livelihood impacts of PES schemes (Adhikari and Agrawal, 2013; Muradian et al., 2013; Liu and Kontoleon, 2018).

The political ecological critique of PES rejects the concept as a whole, condemning it as “selling nature to save it” (McAfee, 2012, p. 106). Marketing of isolated aspects of ecosystems in the form of PES is understood as a commodification of nature which “denies the multiplicity” of values associated with it, inevitably reduces human-nature interactions, and reinforces unjust constellations of power (Kosoy and Corbera, 2009, p. 1228). PES are further seen as a strategy of neoliberal capitalism to expand into the rural periphery, a process which is believed to rather exacerbate than ameliorate the current environmental crisis (Arsel and Büscher, 2012; Büscher et al., 2012; Fletcher and Büscher, 2017). Post-structuralist voices within this strand of literature, whether adopting neo-Gramscian (Igoe et al., 2010) or Foucauldian understandings (Kolinjivadi et al., 2019), criticize PES for reconstructing detrimental human-environment relations and suppressing alternative frames. Regarding global justice, PES is criticized for adding to the marginalization of potential ES providers in the Global South by subjecting them to the will of wealthier ES buyers in the North (McAfee, 2012) along the lines of “underdevelopment”(Frank, 1966).

There is remarkable overlap between issues identified by the PES literature and promises made by blockchain enthusiasts. Chapron (2017, p. 403), who believes that “the environment needs cryptogovernance,” sees potential in at least three aspects. First, distributed ledgers could immutably register land titles and secure property rights, one of the key institutional preconditions for PES as identified by both the environmental economics approach (Engel, 2016) and the ecological economics approach (Börner et al., 2017). Second, blockchain could increase transparency in transactions of different kinds, guaranteeing that “funding is used as intended” (Chapron, 2017, p. 404) and that corruption is minimized, thereby addressing equity issues as pointed to by the ecological economics understanding of PES (Muradian et al., 2010). Third, blockchains of the second tear could revolutionize governance by decentralizing power, thereby enabling the reconfiguration of power structures as demanded by the political ecological critique of PES (Kolinjivadi et al., 2019). Similarly far-reaching hopes about the potentials of blockchain technology have been articulated by authors in the field of international development (Le Sève et al., 2018; UNDP, 2018).

While the overlap between PES challenges in the global South and potential blockchain solutions is indeed striking, the thin literature on blockchain for environmental governance or on blockchain and the global South is more skeptical. Saberi et al. (2018), in a piece on resource conservation, point to the fact that blockchain is undergoing the same hype cycle as many new technologies. Expectations might be inflated, and sober assessment are necessary. Technical challenges as well as organizational, cultural, and behavioral concerns must be addressed by transdisciplinary research. Adams and Tomko (2018), branding Chapron's paper utopian, analyze the potential of blockchain for spatial applications like land registries. They conclude that blockchain is still at a “conceptual state” and that advocates have therefore “been able to largely gloss over detailed discussion” (Adams and Tomko, 2018, p. 18:2). Reinsberg (2019) attributes blockchain technology less disruptive potential than Chapron. The character of blockchain being “complementary rather than substitutive,” it would not cut through existing institutions but rather reinforce them (Reinsberg, 2019, p. 3). He agrees that blockchain could alter the typical principal-agent setting of development cooperation by tracing funds and enforcing the conditions under which they are released. Taking a similar stance, Pisa (2018) states that during the blockchain hype, obstacles to practical adoption have been overlooked. It would now be necessary to examine specific applications for the technology. And indeed, blockchain solutions for social impact are increasingly operationalized. In a report titled “Moving Beyond the Hype,” Galen et al. (2018) find that more than half of the 193 reviewed blockchain initiatives are estimated to become operational in 2019. Finally, Howson et al. (2019, p. 7), providing a high-level analysis of how blockchain technology could potentially be of use for carbon sequestration PES under the UN REDD+ framework, call for “more case-specific exposition” and state that “practical critique will prove essential” for conceptualizing the realities of blockchain-based PES interventions (Howson et al., 2019, p. 7).

This paper adds to the thin literature on the real-world potential of blockchain for environmental governance and PES. It presents a proof of concept (POC) of a blockchain-based PES mechanism, consisting of an Ethereum smart contract for PES benefit distribution, cloud-based remote sensing algorithms detecting land cover change, and an oracle-link between these two components. The paper illustrates the potential and limitations of the POC by hypothetically applying it to a real-world PES program, the Wildlife Credits scheme in Namibia. Here, rural communities of the global South offer a cultural ES by maintaining elephant corridors in order to safeguard a global wildlife common. The case study allows to touch on all three above mentioned schools of thought about PES because it combines market-oriented PES transactions, complex local governance, and questions of global justice. The paper proceeds as follows: chapter 2 describes the methods, mainly focusing on the blockchain POC. Chapter 3 summarizes the results of situating the POC in the case study. Chapter 4 discusses the results from the different perspectives of the above outlined strands of literature on PES. It further discusses whether conservation should engage with technology and touches on the scalability and general limitations of the presented blockchain POC. The final chapter concludes.

The PES program at the center of this case study is a wildlife conservation performance payment scheme embedded in the Namibian community-based natural resource management (CBNRM) framework. In Southern Africa, conservation has experienced a shift from centralized state government to decentralized multi-actor governance including CBNRM (Muchapondwa and Stage, 2015). The Namibian framework evolved in the 1990s and granted formerly marginalized rural populations use-rights over natural resources like wildlife on their territory (Jones et al., 2015). Communities can register as “conservancies,” which requires them to define members and physical boundaries, develop a constitution as well as a plan for equitable benefit sharing, and elect a management committee (Jones and Weaver, 2009). As of 2018, 83 conservancies are registered. They stretch over 163,017 km2 or roughly 20% of the country and are home to approximately 190,000 people or roughly 8% of Namibia's population (NACSO, 2016). The Namibian CBNRM framework has been conceptualized as a biodiversity PES scheme in which conservancies protect the provision of ecosystem services by conserving nature and in turn receive benefits (Naidoo et al., 2011). For instance, conservancies provide natural environment and wildlife resources and in turn receive payments from safari tourism and trophy hunting (Naidoo et al., 2016).

Against the background of growing wildlife populations and increasing human-wildlife conflict, conservancies need better compensation. Namibian CBNRM-support organizations have therefore developed the Wildlife Credits scheme1 Wildlife Credits is a payment scheme that offers conservancies direct payments for wildlife sightings on their territory and for maintaining habitat, mainly in the form of migration corridors. Wildlife Credits is currently prototyped in four Namibian conservancies. It can be conceptualized as a conservation performance payment scheme, a subcategory of PES (Dickman et al., 2011). Conservation performance payment schemes face similar challenges like PES schemes in general, including issues around benefit distribution, environmental monitoring, and financial sustainability (cf. Nelson, 2009).

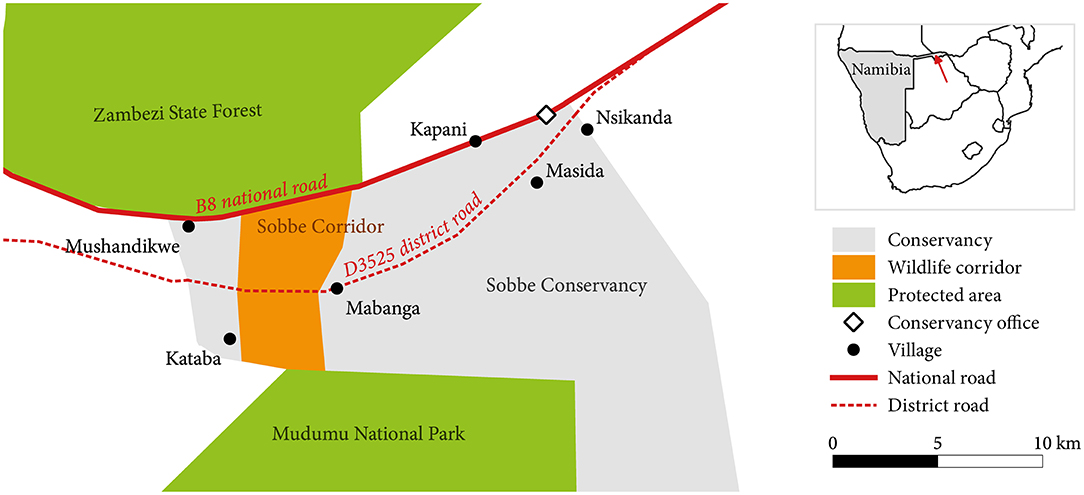

The POC presented here is hypothetically applied to Sobbe conservancy in Zambezi region in north-eastern Namibia. Figure 1 is a schematic map of Sobbe conservancy. Sobbe, founded in 2006, is home to roughly 1,085 people living in an area of 404 km2. Stretching along the B8 national road, the conservancy borders Mudumu National Park in the South and the Zambezi State Forest Reserve in the North2 Sobbe has declared a wildlife corridor which crosses two roads and links the two protected areas. This link is crucial for transboundary animal migration as it is at the core of the Kavango-Zambezi Transfrontier Conservation Area between Angola, Botswana, Namibia, Zambia, and Zimbabwe. The conservancy wants to maintain the corridor as members expressed that it would reduce human-wildlife conflict. However, agricultural activity is now increasingly developing along the roads, slowly encroaching on the corridor. The conservancy management therefore asked for Wildlife Credits payments to internally offset the opportunity cost of maintaining the integrity of the corridor. The payments are in recognition of the crucial service that the conservancy is providing to safeguard large-scale animal migration in the region. The incentive payments for maintaining the corridor are subject of the POC presented here.

Figure 1. Schematic map of Sobbe conservancy in north-eastern Namibia. The conservancy is nestled between the Zambezi State Forest in the North and Mudumu National park in the South. The protected areas are connected by the Sobbe wildlife corridor. Two roads cut through the corridor.

To better understand the local context of Wildlife Credits and how blockchain technology might be applicable to the case study, 11 key informant interviews and one focus group attended by 3 participants were conducted. Participants were selected by purposeful sampling and targeted upon their administrative role in the Namibian CBNRM framework and the Wildlife Credits scheme. Semi-structured interviews were conducted to gather information about current challenges in the Namibian CBNRM and Wildlife Credits scheme, about the practical applicability of potential blockchain-based solutions, and about their anticipated limitations. Interviews were initiated by introducing participants to sketches of different elements of potential blockchain prototypes. Thereby, the concept behind blockchain technology and smart contracts was made accessible for interviewees, largely conservation practitioners on the ground.

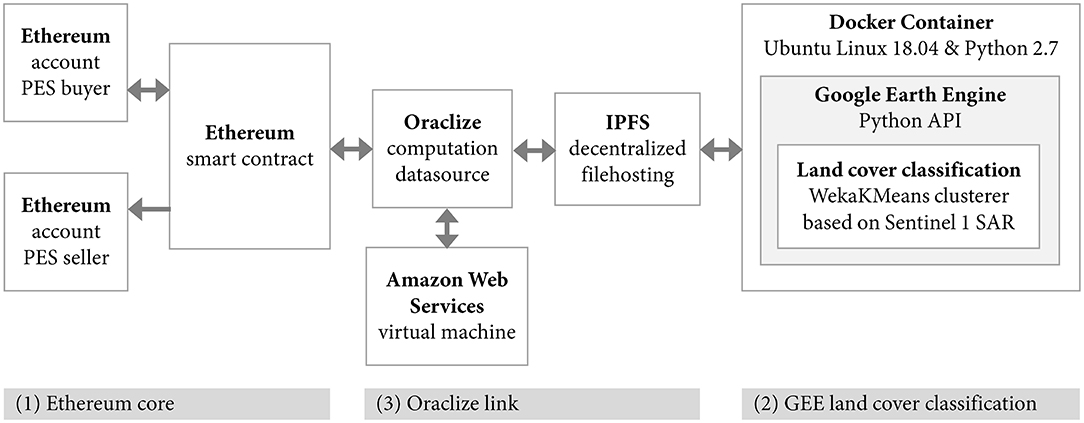

The blockchain-based PES POC is available on GitHub3. It consists of three components as depicted in Figure 2. First, an Ethereum backbone, consisting of an Ethereum smart contract and two Ethereum accounts. Second a land cover classification algorithm executed on Google Earth Engine (GEE) and accessed through the GEE Python API. Third, a link based on the Oraclize webservice connecting the above components. In the following, we describe the individual components in detail.

Figure 2. Schematic diagram of the presented proof of concept, which has three components: an Ethereum core, the Oraclize link, and the Google Earth Engine land cover classification.

The backbone of the application is an Ethereum smart contract (GitHub: payment-for-ecosystem-service.sol). The Ethereum blockchain is used because it allows for the implementation of arbitrary complex programs in its blocks coded in the Turing complete programming language Solidity. On Ethereum, two kinds of accounts exist. Externally owned accounts (EOAs) are accessed using private keys and usually associated with a private user. EOAs can hold a balance and can send transactions to other accounts but they cannot contain program code. Contract accounts (CAs), also known as smart contracts, are deployed on the blockchain an not directly associated with a private user. Smart contracts can hold a balance and can contain program code. Functions on smart contracts can be called by transactions originating from EOAs or other smart contracts (Bashir, 2018).

The Ethereum smart contract uses an oracle to retrieve data from the off-chain world. As functions on Ethereum smart contracts can only call other Ethereum accounts, they cannot directly interact with the off-chain world. To nonetheless connect the smart contract to the GEE Python API, it uses Oraclize (now Provable). Oraclize is a service that provides an on-chain API for linking smart contracts to the web. It allows customers to send queries from smart contracts to their own Ethereum accounts, takes the content of the queries off the blockchain for processing, and feeds the result back onto the chain by using another Ethereum account. Queries to Oraclize can request data from different sources. The POC uses the “computation datasource,” which can provide results of arbitrary complex computations that Oraclize executes on a sandboxed Amazon Web Services virtual machine4.

The PES setup was replicated by creating two EOAs and one smart contract on the Ethereum blockchain. The EOAs resemble the PES buyer and the PES seller. The smart contract governs the PES transaction. It was developed in the Remix5 integrated development environment and deployed on the Ropsten6 test net using the Metamask7 browser extension for Google Chrome. For illustration purposes, the contract is kept as simple as possible. It therefore only contains four state variables and three functions. The state variables are the amount of the PES payment defined as 1 Ether (payment_for_ecosystem_service), the percentage in land cover change (percentage_landcover_change), and the two addresses of the PES buyer (PES_buyer) and the PES seller (PES_seller) defined as the hashes of the respective EOAs. The first function (InitializePES) initializes the PES payment. It can only be called from the PES buyer account and is payable, i.e., Ether can be deposited into the smart contract through this function. The function queries Oraclize. The query includes a timestamp in the Unix format for the execution of the query, the specification to use the Oraclize computation data source, and a hash of the address on the IPFS network of the Docker container to be executed (see below). The IPFS hash is encrypted with the Oraclize public key. The function “__callback” is the Oraclize call-back function. It can only be called by the Oraclize call-back account and takes a string, which is returned from the computation, as an argument. Upon call, the function parses the string as an integer and updates the percentage land cover change variable. It then calls the transfer function. The third function (TransferPES) is the transfer function. It is internal and can therefore not be called from outside the contract. The function executes the PES transfer to the PES seller account if the percentage of land cover change, as just updated by the callback function, is below a predefined threshold. It then returns the remaining balance of the smart contract to the PES buyer account. This is because we assume the PES buyer covers the transaction fees occurring from Ethereum transactions and charged by the Oraclize service. When originally calling the function that initializes the PES, the PES buyer therefore must transfer more than the actual PES payment into the smart contract.

Google Earth Engine is used for land cover classification. GEE is an openly accessible, cloud-based remote sensing service provided by Google. The smart contract queries GEE using its Python API. Requests to the API were written in a Python script (GitHub: land-cover-classification.py). The script first delineates relevant geometry objects, including a bounding box of the study area, the outline of an elephant corridor, and a training region for the land cover classification. Second, the script obtains remote sensing imagery. Sentinel 1 Synthetic aperture radar imagery of the study area is used. Spaceborne synthetic aperture radar provides high resolution imagery independent from daylight, cloud cover and weather conditions. The C-band (4–8 GHz), as provided by Sentinel, is commonly used for remote sensing in agriculture (Moreira et al., 2013). Bare soil reflects radar waves while woody vegetation scatters the signal, resulting in a reduced radar echo. The classification included both cross-polarized (C-VH) as well as single-polarized (C-VV) modes with a spatial resolution of 10 m. Sentinel 1 imagery is available in 14-day intervals. Third, the actual land cover classification is executed. GEE provides a suite of classification algorithms. An unsupervised K-means classification with two distinct spectral classes as target was used. K-means clustering is a common way of image classification in remote sensing. To train the classifier, the researcher specifies how many distinct classes are expected. The algorithm then arbitrarily places mean vectors in the multidimensional measurement space and assigns pixels to those clusters whose means are closest. Means are revised based on new assignments until the means change no longer. The eventually obtained means are then the basis for the actual classification (Lillesand et al., 2008). For the case study, it is assumed that the so derived spectral classes resemble the two most dominant land cover types in the study area: cleared land for agriculture and uncleared bushland. Running an X-means classifier beforehand, which established the ideal number of spectral classes within the analyzed imagery, gave assurance that there are only two relevant spectral classes in the study area. The classifier was trained and run on the obtained Sentinel 1 imagery. As a final step, the script computes land cover change in the elephant corridor, distinguishing between cleared and uncleared land. The last line of code prints the result, i.e., the percentage of cleared land within the elephant corridor, which effectively feeds the result back into the smart contract.

Linking the land cover classification algorithm to the Ethereum backbone is realized using the Oraclize webservice. As described above, the smart contract queries the Oraclize computation data source. The application that Oraclize is supposed to run when processing a computation data source query must be hosted on the Interplanetary File System (IPFS). IPFS is a decentralized peer-to-peer filesharing network. Hosted files are identified by a unique hash generated with the SHA-256 cryptographic hash algorithm (Bashir, 2018). The application was hosted on the IPFS network and included its unique hash in the query to the Oraclize computation data source.

For Oraclize to execute them, applications must be stored on the IPFS in the form of a Docker container. Docker is a software that virtualizes Linux operating systems. It allows developers to package applications in containers which include all necessary information and components to seamlessly execute the application on any other machine8. A Docker container based on Ubuntu Linux 18.04 (GitHub: DOCKERFILE) was created. The container includes specifications to install Python 2.7 and several Python packages that are necessary to interact with the GEE Python API. Further, it contains an authentication token to communicate with the GEE API as well as the Python script that includes the actual requests. On execution of the Docker container, the Python environment is set up within the virtual Linux system and the Python script executes the above described requests to the GEE API. It closes by printing the result of the computation as a string. Upon request from a smart contract, Oraclize pulls the Docker container from the specified IPFS address. It then executes the contained application on an Amazon Web Services virtual machine and feeds back the result, the printed string, to the call-back function in the smart contract from which the query originated. In the case presented here, the result was the percentage of land cover change, which updated the respective state variable in the call-back function of the smart contract.

To illustrate the potential and limitations of the POC, the paper hypothetically applies it to Wildlife Credits payments related to an elephant corridor in Sobbe conservancy. The institutional setup of the payment scheme in the conservancy is straightforward. There is only one PES seller, the conservancy represented by the management committee. Payments are not made to households, which is the case in some other conservancies in Namibia. Benefit distribution within the conservancy is subject to internal governance and not part of the PES agreement. The conservancy decides how the funds are spent, for instance to pay its game guards for corridor management, to reimburse farmers for human-wildlife conflict, or to pay for communal infrastructure. The PES buyer is the Namibian Association of CBNRM-Support Organizations (NACSO). Currently, an annual payment is made after the PES buyer manually evaluates satellite imagery of the elephant corridor at the end of the calendar year. If an increase in agricultural activity in the corridor is discovered, payments are reduced or halted. The following paragraphs elaborate on three main challenges that according to interviewees exist within the Wildlife Credits scheme and the CBNRM scheme more generally: (i) equitable benefit distribution, (ii) efficient environmental monitoring, (iii) and financial efficiency and sustainability. The paragraph proceeds by first describing the respective challenge, then the element of the blockchain POC presented here that could address it, and finally limitations of the suggested solution.

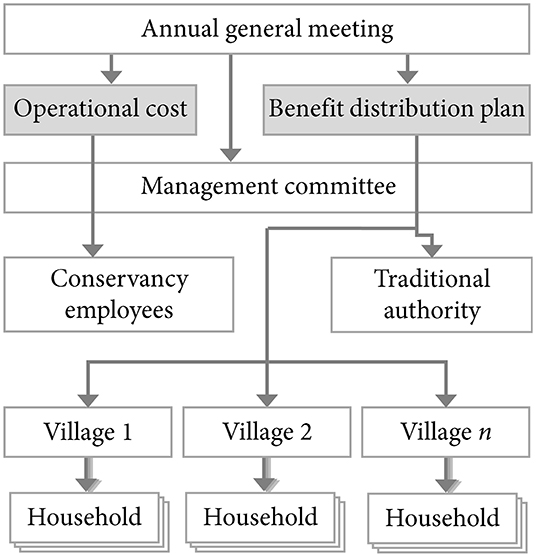

A lack of capacity in financial management is a significant challenge in the institutional setup of the CBNRM program, as stated by several interviewees. Policy guidelines for the management of conservancies state that “developing accountability and good governance in conservancies is one of the most important aspects of conservancy development and operation” which requires that “finances are well managed, there is no corruption.” It is therefore a conservancy committee's task to “ensure fair and equitable distribution of benefits” and sound management of the conservancy's funds (MET, 2014, p. 6). In practice, however, several interviewees stated that elite capture of funds and corruption are not uncommon (cf. Bollig, 2016; NACSO, 2016). Figure 3 schematically depicts benefit distribution in a conservancy. Conservancies are legally required to hold an annual general meeting in which all members discuss and decide on a “benefit distribution plan” (MET, 2014). While most conservancies hold annual general meetings, benefit distribution plans are rarely rigidly enforced. Often, management costs are inflated, or benefits are reaped by the conservancy committee and do not reach conservancy members. The effect of this is twofold. First, resentment against CBNRM is rising as people for instance bear the cost of living with wildlife without receiving tangible benefits from it. Second, the lack of tangible benefits undermines the democratic accountability within the system: conservancy members that have never received any benefits are unlikely to actively participate in the democratic management procedures of the conservancy.

Figure 3. Simplified schematic of benefit distribution in a Namibian conservancy. An annual general meeting determines how income is split between operational cost and benefit distribution. The elected management committee executes the budget planning, including the distribution of benefits.

The POC presented here has three characteristics that are relevant for benefit distribution. First, smart contracts can technically make benefit distribution tamper proof. In the example smart contract, the EOA of the recipient of the PES payment is defined in a constant state variable in the contract code (PES_seller). Once the contract is deployed on the Ethereum blockchain, this address cannot be changed. Therefore, every transaction executed by the transfer function will transfer the predefined sum of Ether only to the specified recipient. While the smart contract includes only one recipient EOA, here representing Sobbe conservancy, it could theoretically include an arbitrary number of recipient addresses. These could be different bodies within the conservancy administration, different villages within the conservancy, or even individual households. Further, the transfer function could specify how the payment is distributed amongst these recipients. For instance, splitting the payment according to a benefit distribution plan agreed upon by the democratic institutions of the conservancy would be possible. The smart contract could then serve as an immutable benefit distribution mechanism guaranteeing that payments are received by their rightful recipients. Second, because the Ethereum blockchain records executed transactions as new blocks on the blockchain, there is a perfect record of how benefits were distributed in the past. Given that Ethereum is a public blockchain, this record is technically accessible for everyone. Hence, full transparency about benefit distribution is theoretically given. Even if the smart contract would get hijacked, e.g., if false information about recipient addresses is provided during contract development, there will at least be a public record of that which can be used to hold the responsible people accountable. The practical limitations of this are discussed below. Third, the contract allows for detailed timing of transactions. In the proof-of-concept, this is a random point in time (Unix timestamp “1553008500” in the Oraclize query) to execute a single transaction. Transactions can be scheduled to reoccur in predefined intervals or to end after a certain period has elapsed. In the presented case, the used satellite provides new imagery of the corridor in a biweekly interval and payments could be adjusted to this. More frequent payments might increase the subjective tangibility and thereby the effectiveness of PES payments. Overall, the precise timing of PES payments is an improvement of benefit distribution as payments cannot be withheld by individuals and recipients can therefore rely on the punctual delivery of payments.

While the above is appealing in theory, the case study shows that there are several obstacles in practice. Most importantly, using smart contracts requires technological literacy. In order to benefit from benefits related to immutability and transparency, stakeholders need to be able to understand the technology. If they do not, a trusted intermediary is required which undermines the core concept of blockchain. In the case-study presented here, none of the locally involved stakeholders, whether the conservancy committee, individual households, the facilitating NGOs, or government agencies command the technological knowledge required to scrutinize smart contract code or remote sensing algorithms. Roughly one-quarter of the population in the study region is illiterate.

Moreover, the governance of benefit distribution will not change just because new technology is available. The presented smart contract could in theory deliver benefits securely to rightful recipients but it cannot determine who these recipients shall be. What constitutes a fair way of benefit distribution is arbitrary and subject to power relations in the local context. If an intermediary, in this case an NGO or the government, insisted on enforcing their idea of just benefit distribution using smart contracts, existing power relations might get disrupted, potentially leading to unintended consequences. That said, authorities in Namibia are steadily trying to enhance compliance with CBNRM legislation which abstractly requires equitable benefit distribution (MET, 2014).

Finally, the case study points to limitations arising from the reliance on cryptocurrencies. An Ethereum smart contract can only transfer its native cryptocurrency Ether (ETH). Fiat currencies like USD or Namibia Dollar cannot be handled. Relying on cryptocurrency as a medium of exchange poses two challenges. First, in order to transfer ETH through a smart contract, PES funds available in a fiat currency like USD would first need to be converted to ETH using crypto-exchanges. Similarly, recipients of the payments would have to convert the received ETH back to a fiat currency because cryptocurrencies are generally not accepted as medium of payment in the rural settings where PES schemes occur. In order to exchange currencies on crypto-exchanges, a fiat bank account, a smart phone or computer, and compliance with know-your-customer legislation is necessary, adding additional complexity to the setup of a PES scheme. Interviewees pointed to the fact that in the study area, this might be affordable at the community level but rather not at the household level, which reduces the scope for benefit distribution. For delivering benefits to lower organizational levels, e.g., to households, an automated exchange solution that converts cryptocurrencies to mobile money, the latter being increasingly used in the global South, would be ideal (Thompson, 2017). To our best knowledge, no convenient solution existed at the time of writing.

There are several ways of environmental monitoring for Wildlife Credits in Sobbe conservancy according to interviewees. First, the intactness of the elephant corridor is assessed by using satellite imagery. Once a year, the PES buyer NACSO manually assesses whether there has been any significant land cover change in the corridor. Based on that, payments are adjusted for the following year. Second, because even extensive human activity not resulting in land cover change can prevent animals from using the corridor, remote sensing alone is insufficient to measure corridor success. Therefore, camera traps have been installed to keep track of how many animals make use of the corridor. This currently incurs high transaction costs as it requires the attention of a researcher to maintain the cameras, collect the memory cards, and evaluate the footage. Additionally, wildlife is monitored on touristic game drives. In those conservancies with tourism lodges, Sobbe is not one of them, guides on game drives record animal sightings manually. Sightings are recorded on paper, the paperwork is collected and evaluated once a year, based on which predefined payments per animal sighting are made to the respective conservancy. As a new form of monitoring, local game guards are currently equipped with smartphones that allow for the recording of animal tracks. All these methods have high transaction costs due to the significant amount of human labor involved, which increases the overhead of the PES scheme. The scalability of these solutions is hence low. Further, particularly the paper-based records are prone to errors and manipulation.

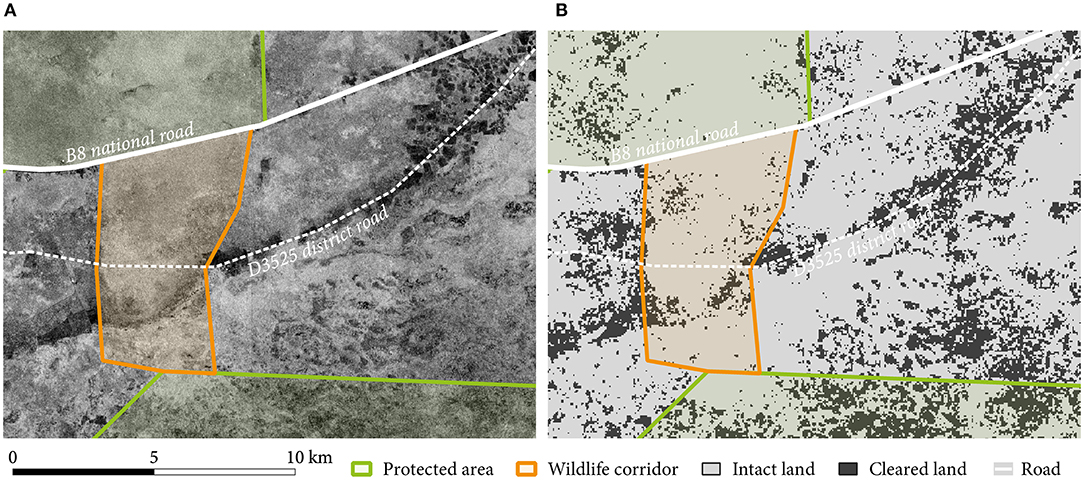

In the presented POC, environmental monitoring is undertaken by evaluating satellite imagery using land cover classification algorithms executed on the GEE Python API. The result is fed back into the smart contract. The approach toward land cover classification is simplified for illustration purposes. The unsupervised classifier only distinguished between “cleared” land and “uncleared” land. Figure 4 shows the Sobbe elephant corridor, which links Mudumu National Park in the South and a forest reserve in the north. Figure 4A shows how the clearing of land and establishing of agricultural fields progresses mainly along the tared roads in the region as it is convenient for farmers to have road access. Cleared land and fields appear dark in the image. Two roads, the B8 national road and the D3525 district road cut through the corridor. If the observed pattern of intensifying agriculture along roads continues, animal movement through the corridor will soon be blocked. Currently, as Figure 4A shows, the corridor is still widely intact.

Figure 4. Agricultural encroachment on the Sobbe corridor. Sentinel 1 SAR imagery from 2018 (A) shows that fields are increasingly being established along roads. The land cover classification (B) is based on recent imagery from March 2019. It identifies cleared but not exclusively agricultural land. Contains modified Copernicus Sentinel data [2018, 2019].

Figure 4B shows the result of the land cover classification. Light gray signifies uncleared land, dark gray patches are cleared land. As the comparison of both figures show, there are some “naturally clear” spots in the corridor. However, there are no significant agricultural activities in the corridor yet. The total area of the corridor is 39 km2. In the most recent computation based on Sentinel imagery from March 2019 roughly 1.9 km2 or 5% of the corridor area were classified as “cleared” land. This result was fed back into the smart contract, updating the percentage land cover change variable. Because the result was below the threshold of 10% cleared land for continuation of payments as determined by the if-then condition, the PES payment was authorized, and the transfer function called. The classification is kept simple for illustration purposes. However, the GEE Python API allows for unsupervised and supervised classification algorithms of arbitrary complexity drawing from a range of sources of satellite imagery. Additional elements like error and confusion matrices can be integrated, allowing to establish error margins for PES payments. Further, a full suite of remote sensing products other than land cover classification is available on GEE.

In sum, the monitoring solution is effective in that it enforces environmental conditionality (Wunder et al., 2018): the PES buyers' funds are only spent if predetermined environmental outcomes are met. Vice versa, the PES seller will certainly receive the agreed upon payment if the environmental target is met. The purposeful decoupling of the entire monitoring process from human interference leaves little room for manipulation once the system is running. As such, environmental conditionality becomes quasi self-enforcing. Moreover, the scalability of this type of environmental monitoring is theoretically high due to the high degree of automation.

Decoupling environmental monitoring from human interference is a strength but at the same time a limiting factor in the case study presented here. Locking out humans increases the reliance on technology which can obviously fail. Unforeseen events can undermine the functionality of the setup. From a technological perspective, it has occurred that remote sensing satellites have failed unexpectedly. From an ecological perspective, any force majeure events that jeopardize the environmental outcome beyond the influence of the PES seller pose difficult questions about the continuation of the PES scheme. In the case study, such events could be large wildfires or floods, as stated by interviewees. A potential solution to this kind of challenge could be fallback functions that allow to terminate the contract. Such functions would only get activated by the contract itself if certain abnormal conditions occur. They could then be called by either the PES buyer, the seller, or by both simultaneously, establishing consensus about discontinuation of the contract.

The case study further underlines that solutions based on remote sensing are not able to monitor a wide range of ecological parameters relevant for PES schemes. As described above, the Wildlife Credits scheme not only assesses corridor intactness remotely, but also measures corridor success by counting animals on touristic game drives and with camera traps. This cannot be monitored via satellite. The challenge of finding suitable proxies for PES schemes is widely reported in the literature (Engel, 2016) and particularly for conservation performance payments (Dickman et al., 2011). As part of this research, it was asked how data sources relevant for wildlife payments other than remote sensing could be integrated into smart contracts following a similar architecture as the POC. For instance, animals could be fitted with GPS-collars. GPS-collars are available with integrated geofencing technology which registers if an animal roams within a predefined area. Such collars can be queried online using services like Oraclize. Information about whether an animal makes use of a wildlife corridor could then directly be fed into a smart contract and PES payments could be executed. While technically feasible, the costs of acquiring and deploying collars is as of now beyond any reasonable limit. Another potential solution are broadband-enabled and solar-powered camera traps in an internet-of-things setup. These could be deployed in the corridor and upload imagery to a web application. Here, machine learning software could evaluate the imagery and feed the results into the smart contract through an oracle.

The third and most significant limitation of the remote sensing element of our POC lies in the fact that increased automation detaches environmental monitoring from PES sellers on the ground. Interviewees pointed out that anonymous monitoring could lead to the exclusion and alienation of community members. Conservancy employees are involved in counting animals on game drives, based on which performance payments are made. In other cases, members of the community are maintaining camera traps and obtained imagery is evaluated jointly, reinforcing a sense of ownership. While detached remote sensing solutions have much less potential in this regard, both approaches might be applied in a complimentary way, allowing to combine their strengths and weaknesses.

Interviewees stated that the generation of sustainable financing is amongst the most pressing challenges for the Wildlife Credits scheme. This is because of three reasons: first, public sector contributions are increasingly rare as the Namibian government is currently in an unfortunate financial situation resulting in significant budget cuts. Moreover, because Namibia is now an upper middle-income country, international donor support for the CBNRM program as a whole is shrinking. That said, the situation for Wildlife Credits is slightly better due to the novelty of the scheme. Second, rising international pressure on trophy hunting threatens a so far reliable and essential income stream for conservancies. While this is not directly related to Wildlife Credits funding, it raises the importance of wildlife conservation performance payments as alternative income stream for conservancies. Third, interviewees pointed to the fact that some donors were skeptical about the benefit distribution within and the conservation impact of the Namibian CBNRM scheme and therefore hesitate to donate funds.

The presented POC addresses funding issues by lowering transaction costs for PES payments. A PES transaction through the POC comprises five steps: (i) the deployment of the smart contract, (i) the initial payment from the PES buyer that calls the initialize function and starts the PES mechanism, (ii) the query to and callback from Oraclize, (iii) the payment to the EOA of the PES seller, and (iv) the transfer of remaining funds back to the PES buyer. For all these transactions the usual Ethereum transaction fees (gas fees) associated with mining the new blocks on the blockchain occur. The deployment fees are linearly related to the length of the contract code. The sum of Ether transferred in the transactions does not affect the transaction fees. All fees are directly paid in Ether when the transactions are made. The use of the GEE Python API as well as the IPFS file hosting network do not incur any charges. Table 1 shows that when testing the POC on the Ropsten test net in March 2019, all transactions combined, including the fee to Oraclize, summed up to ETH 0.0076 or USD 1.04. Given that this includes the transfer of arbitrary PES funds across the globe independently of national boundaries, a potentially tamper-proof benefit distribution mechanism linked to state-of-the-art remote sensing, and an immutable record of all this, the operational transaction costs might be considered rather low. Additionally, the POC can help overcome the funding shortages described above by generating trust in the system. Donors might be less hesitant to provide funds if they can be assured that benefits are transparently delivered to the rightful recipients based on the principle of environmental conditionality.

Finally, the POC might have the potential to develop into a fundraising channel for wildlife payments itself. Interviewees suggested that the smart contract backbone could be combined with an informative crowdfunding front end. Here, live updates about the elephant corridor based on satellite imagery could be presented. Individual donors would have the opportunity to directly provide funds for PES payments, the straightforwardness and immutability of the system being the main selling point. Further, interviewees suggested that if a link between camera trap footage and smart contracts is made in the future, game-like applications involving wildlife imagery could be developed. The success of platforms like Zooniverse (e.g., Swanson et al., 2015) or “CryptoKitties” (Butler, 2018) hints at public interest in engaging with such applications, while others paint more nuanced pictures of conservation gaming (Sandbrook et al., 2015; Fletcher, 2017). It might be a way to unlock value for wildlife in developing countries by tapping into global demand. The wider implications of this are considered in the discussion.

The case study further reveals that using applications like the POC to reduce PES transaction costs faces several limitations. Above all, the calculation of transaction fees does not include the transaction cost of bargaining what constitutes equitable benefit distribution. This is a central process of CBNRM and essential for any PES agreement in similar contexts. Further, the above calculation ignores development costs. A specific skillset is required to develop a PES application like the presented POC, including smart contract development and remote sensing skills. None of the stakeholders in the case study commands such skills and hence costly external experts would need to be hired. Further, interviewees raised concerns about the fluctuation of cryptocurrencies. This could raise the cost of a PES payment unexpectedly. Finally, financial transaction fees for exchanging fiat currencies to cryptocurrencies and back again add to the above described costs. Crypto exchanges commonly charge fees in the low single-digit percentage. For instance, Coinbase, one of the major exchanges, charges 1.49% per transaction.

Having outlined how a specific blockchain-based POC might be applicable to the Wildlife Credits PES scheme, this chapter discusses the potentials and limitations of blockchain-based PES mechanisms more generally and refers to the wider literature. First, it evaluates the potentials and pitfalls of blockchain-based solutions from the perspective of the initially described schools of thought on PES. Second, it discusses the scalability of blockchain-based payment mechanisms for PES. Finally, it points toward some general limitations for implementing blockchain-based applications in natural resource governance.

Significant overlap between scholarship on PES and CBNRM renders integrating both literatures beneficial. Both concepts create “local incentives for collective action under communal tenure arrangements,” particularly so in Africa's communal lands, where the case study presented here is situated (Roe et al., 2009, p. xi). Therefore, PES design in such contexts will “necessarily involve community-based frameworks” for conservation (Roe et al., 2009, p. xi). The following paragraphs hence draw from both, the PES and the CBNRM literature.

The environmental economics understanding of PES might see great potential in blockchain technology, but this potential is unlikely to materialize in communal settings comparable to the presented case study. As outlined in the introduction to this paper, the environmental economics approach to PES subscribes to the Coasean understanding of market-oriented transactions enabled by clear property rights and low transaction costs (Engel et al., 2008; Wunder, 2008; Wunder et al., 2018). Wherever such preconditions exist or can be created, financial transactions can incentivize PES sellers to deliver the demanded outcomes to interested PES buyers. However, the PES literature finds that such preconditions hardly exist in geographies like the one under investigation in this paper (cf. Frost and Bond, 2008; Milne and Niesten, 2009; Lopa et al., 2012; Jayachandran et al., 2017). Blockchain would then be seen as a technological fix to such “weak” institutions. This is repeatedly expressed by practitioners and academics who attribute the technology for instance the potential to secure tenure rights in the form of digital land-registries (Chapron, 2017; Le Sève et al., 2018; UNDP, 2018; Maupin et al., 2019). In the presented case study, blockchain smart contracts would guarantee property rights by immutably registering rightful PES sellers, whether households or communities, and would guarantee them their fair share of PES payments if environmental targets are met. CBNRM literature labels such institutional-fix thinking the “techno-interventionist model” common amongst development practitioners (Taylor and Murphree, 2009). Neglecting that CBNRM emerged as a counter-hegemonic approach to colonial government that should prioritize participation of locals, the techno-interventionist way of thought would oversimplify local contexts, overly rely on foreign expert opinion (Dressler et al., 2010), and put a wrong focus on generalizable institutional design principles of CBNRM or PES frameworks (Brechin et al., 2012). Following this line of thinking, using inaccessible blockchain applications to “fix” institutions of communal resource governance seems to be somewhat detached from reality. This is in line with skeptical views on the use of blockchain in related fields (Adams and Tomko, 2018; Saberi et al., 2018; Reinsberg, 2019).

By opening the black box of “community,” the ecological economics understanding of PES shifts the focus on difficulties that might arise when trying to fit inaccessible technologies to complex settings of environmental governance. Critical CBNRM scholars have long argued that the concept of “community” neglects ethical heterogeneity within such resource management units, effectively depoliticizing them, paying too little attention to disadvantaged groups and gender dynamics (Sullivan, 2000, 2003), and resulting in a “myriad of marginalizations” (Brockington, 2004, p. 428). Binot et al. (2009, p. 57) see one of the main lessons of CBNRM in sub-Saharan Africa in the insight that “local governance is no panacea for institutional transparency and equity.” They rather believe that it is an adaptive, time-consuming process and that transparent institutions “are highly unlikely to emerge overnight.” It is on these internal aspects of CBNRM that the ecological economics understanding of PES puts emphasis: (Muradian et al., 2010, p. 1207) conclude that “PES schemes are not just a matter of reducing transaction costs, defining clearly the traded environmental services and straightforwardly allocating property rights” but rather a “transfer of resources between social actors” (Muradian et al., 2010, p. 1205, emphasis added). Van Hecken et al. (2015) suggest a “socially-informed, actor-oriented and power-sensitive” understanding of PES. Following this way of thinking, blockchain technology needs to be scrutinized for its potential to bring about empowerment and democratization in rural setting of communal resource management. In fact, the technology is repeatedly framed as an enabling and empowering technology (Chapron, 2017; Davidson et al., 2018; Graglia and Mellon, 2018). However, the complex social setting of CBNRM and PES in communal contexts does not seem to be an ideal playing field, as the inaccessibility of the technology and the heavy reliance on trusted intermediaries renders genuinely participatory approaches difficult. Furthermore, scholars widely agree that the comprehensive devolution of rights over resources is quintessential for successful CBNRM. Implementing interventions that heavily rely on a technology like blockchain is likely to require centralized technocratic donor support which opposes such devolution (Nelson and Agrawal, 2008).

The political ecological critique is skeptical of PES and CBNRM in their current mode and would rather see potential in blockchain as a tool to alter the underlying global power dynamics. As such, it is in line with critical writing about CBNRM. Scholars point to the fact that environmental NGOs and Western donors promoting CBRNM would make their support for communities conditional on a commitment to wildlife conservation (Campbell and Vainio-Mattila, 2003). At the same time, revenues from wildlife are often insufficient for it to become a major livelihood, also in Namibia (Binot et al., 2009, p. 70; Naidoo et al., 2011). It would hence be fairer to give communities an actual choice of how much wildlife conservation they want—while not assuming that “this will lead to a ‘conservation' outcome per se” (Taylor and Murphree, 2009, p. 113). From a PES perspective, it follows that if conservation is to be prioritized over other forms of development, then communities as PES sellers must be offered the real opportunity cost of conservation by those who demand it, usually the global North. Such fair and direct transfers are requested by critical voices on CBNRM in Namibia (Sullivan, 2002, 2003)—while they would not nullify more fundamental concerns about the commodification of nature in the neoliberal hegemony (Igoe et al., 2010; Büscher et al., 2012; McAfee, 2012; Kolinjivadi et al., 2019). An interesting question is then how blockchain technology would fit into this picture of global (in)justice. Are blockchain-based wildlife payments an extension of an “imperial ecology” (Sullivan, 2011, p. 113) originating in the global North? Or does blockchain, described as inherently political (Graglia and Mellon, 2018) and as an “institutional technology” (Davidson et al., 2018, p. 655), have the potential to alter power relations in the realm of PES? The following paragraphs discuss the interplay of technological advances and natural resource management in rural Africa to shed light on these questions.

The recent spread of mobile phones in rural geographies of sub-Saharan Africa suggests that new technologies have a supportive rather than a transformative impact in these geographies, moderating voices that enthusiastically depict blockchain technology as a game-changer in resource governance. Mobile technology is inevitably linked to many blockchain applications and was attributed the potential to enhance PES (Thompson, 2017). The beginning of the century has seen a remarkable increase in mobile phone usage in Africa, with hundreds of millions of devices now in circulation (Lewis et al., 2016). The technology has spread into rural geographies, transcending lines of age, wealth, class and education so that “herders now leave their bomas (homesteads) armed not only with spears, but also with mobile phone” (Butt, 2015, p. 10). Interviewees reported similar trends in the region of the case study presented here. The literature on mobile phone usage in Africa is similarly divided as the literature on PES and CBNRM: on the one hand, development practitioners with a techno-fix mindset claim that technological innovation enables “rapid solutions to socio-environmental problems” (Butt, 2015, p. 1). On the other hand, scholarship informed by political ecology carefully investigates the societal impact of such developments (Butt, 2015). Several studies investigate the impact of mobile technology on livelihoods in rural sub-Saharan Africa in the context of farming (Baird and Hartter, 2017; Arvila et al., 2018), pastoralism (Butt, 2015; Asaka and Smucker, 2016; Debsu et al., 2016), and human-wildlife conflict (Graham et al., 2012; Lewis et al., 2016). All authors acknowledge that the impact of new technologies in rural African contexts is mediated by preexisting social realities and neither clearly good nor bad. Further, the majority of authors attributes mobile technology a supportive rather than a transformative role in the societal development in these geographies (Butt, 2015; Baird and Hartter, 2017). Transferring these finding to the potential impact of comparatively less accessible blockchain technology suggests that transformative quick fixes to externally identified problems of natural resource management cannot be reasonably expected.

Along the same lines it remains unclear whether engaging with technologies like blockchain can kick-off a step change in global conservation efforts. While the above studies are situated in specific contexts, there is an emerging body of literature investigating the relationship between conservation and technology more generally. Adams (2019) criticizes that the increasing use of technology in conservation further removes conservation decisions from the people on the ground and concentrates power in the hands of experts. Therefore, he asks “who owns, programmes and controls” technologies (Adams, 2019)—a valid question as the case study presented here shows. Further, engaging with technology on the demand side of conservation in the global North would inevitably reinforce the commodification of nature along capitalist development trajectories (Büscher, 2014) by counterproductively reducing complex socio-ecological realities to marketable spectacles that “shield” Northern consumers from the adverse impacts of their lifestyles (Igoe, 2010, p. 389). Other scholars arrive at more nuanced appraisals. Acknowledging the “patchy record” of nature conservation with regard to social impact, Arts et al. (2015, p. 670) see potential for democratization and empowerment of underrepresented rural populations in digital technologies, while also pointing to the fact that access to such technologies is uneven. “Digital exclusion” needs to be avoided and technology is no “magic wand to solve conservation problems at a stroke” (Arts et al., 2015, p. 668f). Concerns of equity notwithstanding, some argue that the simultaneous arrival of the current information revolution and the Anthropocene is an unprecedented event in history. As the former is propelling the latter, harnessing its potential could be key in reversing devastating environmental trends (Joppa, 2015). Similarly, Jepson and Ladle (2015, p. 831) underline the importance of engaging with technologies in optimistic ways and that “failure to do so could comprise the future of conservation as a cultural force.” One such example from practice is the killing of Cecil the lion in Zimbabwe which caused a spike in social media attention and fundraising, leading Macdonald et al. (2016, p. 10) to believe that “if conservationists are able to harness this enthusiasm and action then perhaps there is hope that global society could pay for global commons.” An interesting question is, then, whether blockchain can play a role in harnessing this enthusiasm. Naidoo et al. (2011) see the Namibian CBNRM framework, inter alia, as a mechanism that translates the global demand for the existence of charismatic wildlife into tangible benefits for Namibia communities, e.g., through safari-tourism, trophy-hunting or grant-funding from international donors. Interviewees suggested that the trustworthy features of blockchain could be leveraged to add another payment channel, for instance by developing applications that present wildlife imagery to interested audiences. That there is potential in this can be inferred from the recently announced partnership between Wildlife Credits and a south African beverage company that produces a liquor with elephant branding. In exchange for camera trap footage for marketing purposes, the company will pay a fixed amount per bottle sold to Sobbe conservancy for corridor maintenance9. Optimistic voices might now argue that exposing consumer audiences to such imagery might resonate with their “emotional” or “philosophical” connections to nature, thereby addressing “leverage points” in the global social-ecological system and enhancing the prospects for pro-environmental political agenda-setting within the capitalist hegemony (cf. Hansen, 2018; Ives et al., 2018). More skeptical voices would object that this idea is flawed due to the inherent contradiction of “selling nature to serve it” (McAfee, 2012, p. 106) or even discard it as a coercive “imperial ecology” (Sullivan, 2011, p. 111). Developing further blockchain proof-of-concepts that establish such a direct link between South and North could shed light on this divide.

The case study shows that the presented POC is not easily scalable for PES in CBNRM settings where governance is a complex social process. This is in line with findings in the emerging literature on PES initiatives under the UN REDD+ framework. Despite great initial enthusiasm and considerable resources, such PES arrangements have largely not made it past the pilot phase and implementation has “proven much slower and costlier to realize than expected” (Lund et al., 2017, p. 124). One of the reasons being that one-size-fits-all solutions are impossible to succeed given the “diversity in legal frameworks; variations in social, economic, demographic, cultural, and political contexts; and different rates of change in ecosystems and social systems” (Agrawal et al., 2011, p. 390). In order to avoid similar disillusionment, it cannot be reasonably assumed that blockchain technology is a magical game-changer for environmental governance in such contexts. Similarly, it will not resolve corruption and elite capture overnight.

The potential for scaling up blockchain-based PES payments might rather lie in harnessing efficiency gains in settings where resource governance is less complicated. If property rights are clear and power-dynamics straightforward, e.g., in geographies where land is largely privately owned, an application like the presented POC can potentially increase efficiency by combining several aspects of a PES system in one tool. It might then be scalable for those PES that rely on remote sensing for environmental monitoring. Examples are (i) carbon sequestration payments, where landowners are usually paid for maintaining forest, (ii) watershed payments, where landowners are often but not exclusively incentivized to maintain vegetation in catchment areas, and (iii) biodiversity and habitat payments, where landowners generally receive payments for maintaining habitat. Combined, these three types of PES account for transactions of USD 30–35.9 bn per annum (Salzman et al., 2018). Such conducive institutional preconditions are not widely found in rural sub-Saharan Africa though (Roe et al., 2009). Hence, there is little reason to believe that blockchain applications will contribute to reducing the staggering transaction costs of PES programs in low-income countries, which have been reported to account for 50–65% of overall PES project cost (Frost and Bond, 2008; German et al., 2011; Hegde and Bull, 2011; Jindal et al., 2012; Lopa et al., 2012; Jayachandran et al., 2017).

In geographies with conducive institutional settings, applications like the POC might be scalable as they decentralize the enforcement of environmental conditionality to the benefit of both, PES seller and PES buyer. In a recent review, Wunder et al. (2018) find that only one-fourth of PES schemes consistently enforces environmental conditionality, i.e., that payments are only made if the agreed upon environmental outcome is delivered, one of the reasons being the costliness of environmental monitoring. The POC presented here addresses this conundrum by decentralizing and automating environmental monitoring. Once deployed on the blockchain, the smart contract cannot be tampered by any stakeholder and will execute environmental monitoring as well as the resulting dispersal of funds independently. PES buyers will hence know that their funds are only spent if PES sellers meet the agreed upon environmental targets. Vice versa, PES sellers can rely on receiving payments if they manage to meet the environmental targets. The potential notwithstanding, further research will have to show if automated remote-sensing solutions can reliably monitor PES targets.

The most significant limitation of the presented POC, but also of blockchain technology more generally, lies in its inaccessibility. The case study illustrates that implementing blockchain-based solutions requires a high level of technological literacy amongst stakeholders. Else, intermediaries with the respective skillset are needed. Blockchain applications then lose what sets them apart, i.e., their decentralized and empowering character. While progress has been made in recent years, blockchain applications other than cryptocurrencies will only scale if their end-user friendliness improves (cf. Le Sève et al., 2018). Today's social media for instance is shaping reality and has even played a role in political revolutions because it is so easily accessible, not because laypeople understand the complex technology behind it (Howard et al., 2011).

A similar obstacle to making blockchain products widely applicable is the limited acceptance of cryptocurrencies and their recent instability. The case study shows that cryptocurrencies do have the potential to transfer value across the globe at comparatively low cost. However, this is of little use if the transferred value cannot practically be used in the everyday life of recipients, which is the case in rural sub-Saharan Africa. Moreover, recent fluctuations in Bitcoin and Ether have been widely covered by mainstream media, resulting in diminished trust for use other than speculation (Polasik et al., 2015).

Another common problem of current blockchain-based applications is the reliance on oracles for connecting to the off-chain world. Oracles generally undermine the decentralized character of blockchains as they are centralized entities (Bashir, 2018; Mohanty, 2018). Oraclize, the oracle service used for the POC presented here, is a private company controlled by a limited number of individuals. The centralized architecture of the service cannot rule out the potential of getting corrupted. As long as centralized oracles are part of blockchain applications, critics will argue that centralized web application can do the same job. This notwithstanding, there are some advantages of the POC that can only be realized with a blockchain backbone. For instance, executing PES payments on a public blockchain will generate an immutable public record of the transactions.

Using public blockchains for transparency reasons poses questions related to privacy and data security. Ideally, every single component of the presented POC should be publicly accessible to increase transparency and trustworthiness. For instance, the IPFS hash pointing to the docker file executing the land cover classification algorithm when the Oraclize computation data source is queried should be shared for maximum transparency. Thereby, the public could scrutinize and verify the executed code (if they command the necessary skills, see above). However, code might contain sensitive data. In the presented example, the Python script for land cover classification contains coordinates of the elephant corridor. Such information should be handled with care against the background of recent developments in international wildlife trade (cf. Wittemyer et al., 2014). This illustrates the trade-off between fully embracing with the decentralized concept of blockchain for maximum transparency and trustworthiness on the one hand, and privacy and security considerations on the other hand (Chapron, 2017).

Finally, blockchain's considerable energy consumption contradicts using the technology for resource governance purposes. Blockchain is now a significant contributor to global greenhouse gas emission (Truby, 2018). A single bitcoin transaction has temporarily consumed as much energy as an average American household per week, the energy consumption of the entire Ethereum network has at times exceeded those of small countries (Malmo, 2017). It would be ironic if a PES scheme for carbon sequestration nullified its achievements because it uses blockchain technology.

This paper has asked if and to what extent blockchain technology can address challenges widely faced by PES programs. In order to avoid abstract reasoning, it presented a proof of concept of a blockchain-based PES mechanism. The application links Ethereum smart contracts to land cover classification on Google Earth Engine by using a blockchain oracle. The paper hypothetically applied the proof of concept to the Wildlife Credits conservation performance payment scheme in Namibia, where communities offer to maintain wildlife corridors and in return receive reward payments. The proof of concept automatedly measured agricultural development in a wildlife corridor using cloud-based land cover classification algorithms, fed back the result into the Ethereum smart contract, and eventually triggered a financial transaction from PES buyer to PES seller. Applying the proof of concept to a real-world example of natural resource management allowed to examine aspects of (i) effectiveness (conditionality) of environmental monitoring, (ii) equity and benefit distribution, as well as (iii) financial efficiency and sustainability. The results were discussed, drawing from different schools of thought on PES, namely the environmental economics approach, the ecological economics approach, and the political ecological critique. The discussion further touched on the nexus of conservation and technology as well as the scalability and general limitations of blockchain-based PES applications.

The paper arrives at three findings. First and most importantly, it is unlikely that the decentralized and immutable character of blockchain smart contracts can be harnessed to address issues of equity and benefit distribution in complex constellations of communal natural resource management as found in many PES settings. This is mainly due to the inaccessibility of blockchain technology for the relevant stakeholders, which results in heavy reliance on trusted intermediaries. Thereby, the distinguishing properties of blockchain are largely nullified and genuinely participatory approach are ruled out.

Second, the presented proof-of-concept shows how environmental monitoring using open-access remote sensing algorithms can be linked to smart contracts on the Ethereum blockchain. This is an interesting application for PES as it provides a mechanism to enforce environmental conditionality with a high degree of automation, thereby reducing transaction costs and potentially increasing the efficiency of PES. Such applications could be of use in settings where the institutional configuration is more conducive to PES than in CBNRM, for instance where land is privately owned. Further research must address the remaining open questions about automated environmental monitoring as identified by this paper.

Third, departing from the political ecological critique of PES, the paper briefly touched on the potential of using blockchain technology to establish direct links between people in the global South who make an effort to conserve charismatic megafauna and those in the rest of the world who demand it as a global common. Whether the theoretical trustworthiness of decentralized blockchain technology can be leveraged to enable such connections in order to exchange different kinds of value is an interesting question that requires further attention.

The final thought of this paper is a reminder that PES are always interventions into preexisting configurations of environmental governance. In the settings of community-based natural resource management widely found in sub-Sahara Africa, such configurations are a delicate product of surviving customary elements as well as repeated and at times forceful outside intervention. Taylor and Murphree (2009, p. 107) hence describe two forms of community-based natural resource management: “one customary, and generally high in internal legitimacy but low on external legitimacy. The other formal with high external legitimacy but low internal legitimacy. They co-exist but the new forms need the internal legitimacy of the old, and the old needs external legitimacy, particularly in the eyes of the state.” Scholars and practitioners should always carefully ask how suggested interventions will influence this process—particularly so if they advocate technologies that originated in the global North for natural resource governance in the global South. After all, some of the planet's most precious natural resources have not endured in the North as they have in the South.

All datasets generated for this study are included in the article/supplementary material.

DO assessed the potential of Blockchain technology for payments for ecosystem services in Namibia and developed the presented proof of concept.

Fieldwork for this research was supported by the School of Geography and the Environment, University of Oxford, and the German National Academic Foundation.

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

I would like to thank Richard Diggle and Charlotte Chesney for fruitful discussion about the research presented in this paper. Thanks also go to Paul Jepson whose thinking on conservation and technology inspired this work. Special thanks go to the three reviewers whose comments led to substantial improvements of the manuscript. I am grateful for financial support from the School of Geography and the Environment, University of Oxford, and the German Academic Scholarship Foundation.

1. ^https://www.wildlifecredits.com/

2. ^http://www.nacso.org.na/conservancies/sobbe

3. ^https://github.com/blockchain-ecosystem-payments/proof-of-concept

4. ^https://docs.oraclize.it/#data-sources-computation

5. ^https://remix.ethereum.org/

6. ^https://ropsten.etherscan.io/

8. ^https://www.docker.com/resources/what-container

9. ^https://wildlifecredits.com/living-with-wildlife/the-human-story/amarula-and-wildlife-credits-join-forces

Adams, B., and Tomko, M. (2018). “A critical look at cryptogovernance of the real world: challenges for spatial representation and uncertainty on the blockchain,” in 10th International Conference on Geographic Information Science (GIScience 2018) (Melborne, VIC: Leibniz International Proceedings in Informatics).

Adams, W. M. (2019). Geographies of conservation II: technology, surveillance and conservation by algorithm. Prog. Hum. Geogr. 43, 337–350. doi: 10.1177/0309132517740220

Adhikari, B., and Agrawal, A. (2013). Understanding the social and ecological outcomes of pes projects: a review and an analysis. Conserv. Soc. 11, 359–374. doi: 10.4103/0972-4923.125748

Agrawal, A., Nepstad, D., and Chhatre, A. (2011). Reducing emissions from deforestation and forest degradation. Annu. Rev. Environ. Resour. 36, 373–396. doi: 10.1146/annurev-environ-042009-094508

Arsel, M., and Büscher, B. (2012). NatureTM Inc: changes and continuities in neoliberal conservation and market-based environmental policy. Dev. Change 43, 53–78. doi: 10.1111/j.1467-7660.2012.01752.x

Arts, K., van der Wal, R., and Adams, W. M. (2015). Digital technology and the conservation of nature. Ambio 44, 661–673. doi: 10.1007/s13280-015-0705-1

Arvila, N., Fischer, A., Keskinen, P., and Nieminen, M. (2018). “Mobile weather services for Maasai farmers: socio-cultural factors influencing the adoption of technology,” in Proceedings of the Second African Conference for Human Computer Interaction on Thriving Communities - AfriCHI'18 (New York, NY: ACM Press), 1–11. doi: 10.1145/3283458.3283466

Asaka, J. O., and Smucker, T. A. (2016). Assessing the role of mobile phone communication in drought-related mobility patterns of Samburu pastoralists. J. Arid Environ. 128, 12–16. doi: 10.1016/j.jaridenv.2015.12.001

Baird, T. D., and Hartter, J. (2017). Livelihood diversification, mobile phones and information diversity in Northern Tanzania. Land Use Policy 67, 460–471. doi: 10.1016/j.landusepol.2017.05.031

Bashir, I. (2018). Mastering Blockchain : Distributed Ledger Technology, Decentralization, and Smart Contracts Explained. 2nd Edn. Birmingham: Packt Publishing.