- 1Department of Management and Quantitative Sciences, Parthenope University of Naples, Naples, Italy

- 2Department of Methods and Models for Economics, Territory and Finance, Sapienza University of Rome, Rome, Italy

- 3Department of Human Sciences, European University of Rome, Rome, Italy

Based on increasing ESG awareness, executives, and investment professionals consider ESG factors in strategic and operational decisions. Like other companies, insurers recognize that the ESG transition offers opportunities for long-term value creation. In our research, we evaluate how ESG corporate engagement impacts an insurance company's balance sheet in economic and financial terms, unlocking financial resources throughout the sustainability premium. We resort to the theoretical paradigms of behavioral finance applied to actuarial portfolio evaluations. Our findings show that ESG engagement is significantly performing since it determines higher expected profits. We offer our framework as a tool for the strategic decision-making process.

1 Introduction

There is growing interest in ethical values by consumers, employees, and other stakeholders in the marketplace. In a very critical way, ethics is shaping business decisions at all levels. In particular, ESG exemplifies the practice of ethical leadership, pointing toward ethical conduct for environmental, social, and governance activities. In 1981, Stigler stated the conflict between self-interest theory and ethical values. Nevertheless, the strand of literature on “gift exchange” based on a collection of laboratory experiments confuted the dispute between business and wellbeing-oriented practices [1, 2]. Hence, it is commonly recognized that social preferences affect market transactions [3]. Huge theoretical research, linked to game experiments in Economics, investigates repeated long-run interactions in the problem of corporate reputation. Reputational issues are regarded as repeated games that reinforce each other, by stressing one of the main features of the reputation which is the reciprocity between the agents (for instance see Berg et al. [4] and Xia et al. [5]). According to List [3], “People behave in a reciprocal manner even when the behavior is costly and yields neither present nor future material rewards.” In the empirical and theoretical research that has an impact on the management field as a whole, a positive corporate reputation involves competitive advantages and increased market share. As described in Blajer-Gołębiewska [6] “Good reputation improves a firm's financial performance and increases its goodwill and market value.”

This idea introduces the concept of sustainability premium, which we can define as a premium that consumers are willing to pay on the basis of the firm's commitment to certain sustainable objectives. Indeed sustainable products are often more expensive – they cost more to produce, and the firms are not yet being enjoyed by the economies of scale that allow them to pass cost savings on to consumers. According to PwC's 2024 Voice of the Consumer Survey [7], consumers are willing to spend an average of 9.7% more on sustainably produced or sourced goods. In other words, companies can leverage the willingness of consumers to pay a premium for sustainably produced goods as a competitive advantage. Some authors [8] define the ESG premium as the extra amount due to the uncertainty associated with ESG, by which we mean operational, reputational, and/or litigation, so the investors recognizing these risks are willing to pay a premium to potentially hedge them. They analyse the impact of ESG performance on option returns and measure the economic magnitude of ESG premiums. Other authors [9] propose to apply return-based ESG exposures to measure ESG risks and integrate these into asset management, by highlighting that there is no evidence for a systematic ESG-related return premium or discount, particularly regarding asset pricing. Ciciretti et al. [10] stress the idea that there exists an ESG premium to be explained in stock market risky portfolios. They show that such ESG premium appears to be negative and significant, probably due to the lower risk associated with high high-ESG (betas). This aspect is addressed in a broader sense by Albuquerque et al. [11], showing that social corporate responsibility affects companies' policies and consequently their risk profiles, becoming an important driver in the field of portfolio optimisation. On the other side, in Luo and Balvers [12], it is pointed out that the boycott risk factor is particularly powerful in explaining differences in average returns across industries. In particular, the authors show that the boycott risk premium rises according to the socially responsible investment (herein SRI) intensity measure. Galema et al. [13], set out to investigate the effect of SRI on stock returns. They suggest a relationship between SRI and stock returns, in particular, portfolios that score positive on diversity, environment, and product have a significant impact on stock returns.

The underlying idea recently accepted by the international community relies on a company's environmental and social impacts can affect not only the company's own financial performance but also the broader economic, social, and environmental systems in which it operates. In a certain sense, the sustainability premium properly represents an expression of double materiality considering both the external influences on the organization and the organization's impacts on the broader ESG criteria.

According to the double materiality principle in Corporate Sustainability Reporting Directive—CSRD [14], firms are obliged to report how ESG criteria affect the corporate activities and their financial performance, as well as the impact of their activities on the society and economic system.

In our study, we investigate ESG sustainability premiums in the insurance industry. In particular, a few studies deal with reputational risk in this sector. For instance, the study of Fiordelisi et al. [15] points out that significant reputational losses occur following the announcement of operational losses, with fraud being the event type that generates the greatest reputational impact. According to Eckert and Gatzert [16], reputational losses can overcome operational losses. Gatzert et al. [17] analyses the growing influence of social media and the related reputational risks in insurance. In Boado-Penas et al. [18], the authors propose strategies for a pension provider to avoid a loss of reputation. In this research, we fill the gap in the literature about the relationship between reputation and sustainability premiums, particularly related to the insurance sector. Based on a formal theoretical valuation system on ESG reputation, we frame in the paradigms of behavioral finance the subjective probabilities on preferences set by the potential trustees, such as actors or objects in whom others may seek to place trust. We compute the sustainability premium or discount which measures the economic impact of the good or bad reputation due to ESG investments. The layout of the study is the following. In Section 2, the behavioral ESG scoring and the sustainability premium are defined. Section 3 presents the main empirical outcomes. Section 4 describes the concluding remarks.

2 ESG sustainability premiums based on subjective expected utility

Our objective consists of measuring the ESG sustainability premiums arising from the commitment of the insurance companies to ESG criteria. As recognized by behavioral experiments, consumers are willing to pay for products and services related to companies engaged in ESG activities. A recent survey shows that “72% of investors have abandoned transactions over ESG concerns, and more than 83% are willing to pay a premium of at least 3% for an asset with a strong ESG profile” [19]. According to our approach, the final premium will be embedded in a safety loading directly to the value function of the prospect that represents the actual insurer's commitment to the ESG pillars. The attitude to embrace ESG criteria by the policyholders, who are the main stakeholders of the insurance industry, depends on their expectations about the insurer's capability to impact their subjective wellbeing and, conditional on these beliefs, they assess the insurer's reputation. Indeed in Apicella et al. [20], policyholders' subjective beliefs are drivers of the insurer's ESG reputation assessment. The assessment of the insurance company's reputation, based on the policyholder expectations, is intrinsically influenced by the study of consumer behavior. Behavioral finance properly investigates consumer behaviors with a particular type of preferences and cognitive biases, i.e., overreactions and underreactions to news instead of the rational agents. The primary focus of the behavioral finance theoretical approach uncovers how decisions are made and how people really behave when they make financial decisions. Many factors affect a consumer's willingness to pay such as income, age, gender, geography, and expectations. Furthermore, the customers' willingness to pay a certain price for products or services is not static. Consumer financial behavior represents a very complex domain influenced by insights and behavioral theories from cognitive, economic, and social psychology (biases, heuristics, and social influences). The recent firm's approach is to design social experiments to determine consumers' willingness to pay, for testing price adjustments, to see how sales are impacted. According to Gigerenzer [21], heuristic ways of information are not inferior in processing and decision-making but are evolutionary functional in a complex world to make often even unconscious financial estimations and decisions [22]. In essence, especially in the insurance market, insurance behavior consists of the avoidance of potential financial losses. The requirement of protection against losses that are only potential shows how emotions affect insurance demand. Some studies highlight the impact of psychological traits on the predictability of insurance demand [23]. In this research, we propose a modeling framework for pricing ESG sustainability premiums, based on the mathematical description of the relationship between the policyholder's expectations and the value that is assigned to the insurers' reputation. The beliefs of policyholders are related to the expected impact that the insurers' performance in ESG investments will have on their subjective wellbeing [20]. We represent the value function as the sum of the value functions of the engagement of the insurance company in the ESG pillars, weighed by the unbiased probabilities (denoting the actual insurer's commitment to ESG pillars).

where s is the global ESG score of the insurance company. ψ(.) is a strictly increasing value function, as defined in Equation 2. pr(.) is a decision weight as defined in Equation 3. where E, S, and G are the prospects defined by Tversky and Kahneman [24], assigning a value to insurance companies according to the contribution in E, S, or G pillars and the value function ψ(s) assesses the reputation of insurance companies in the ESG perspective. Value functions are defined as follows:

where a and b are the individual risks for the gains and the losses, l is the individual risk aversion, s(i) is the score for the pillar i, and q3 is the third quantile of the score. The two-part power function of the above functional form reflects the homogeneity preference axiom, where a represents the power coefficient of the value function, and the loss aversion is modeled by the coefficient l, which is a positive scale factor, so as to guarantee that the functions are strictly increasing. Broadly speaking, according to the cumulative prospect theory [24], the value function we refer to is described by a curve that is concave for the profits and convex for the losses, being steeper for the losses than for gains.

Score distribution is obtained by simulation of a market of 100 insurance companies, assuming that scores follow a Beta distribution. In this way, the cumulative distribution function of the Beta random variable represents the probability of obtaining a score lower than the one already observed. In other words, a measures the marginal sensitivity to gains for the individual in terms of the subjective perceived impact of gains on ψ. A similar interpretation applies to b concerning losses. Decision weights are defined as follows:

where p(i) is the observed probability and w(.) the probability weighting function, defined as follows:

where c is the bias in the perception of probabilities.

Following the literature [24], suggested parameter values of Equations 2, 4 are a = b = 0.88, l = -2.55, and c = 0.61.

In the prospect theory, the objective probabilities (unbiased according to the behavioral paradigms, i.e., without any consideration of the subjective perception and risk attitude of the consumer) of the value function prospect have been transformed by a subjective probability weighting function (in this case, the obtained probabilities are subjective or biased since they reflect the tendency of preferences to be overly sensitive to probabilities close to zero [25]. In this framework, the bias we refer to is behavioral-cognitive, in other words is not in compliance with statistical aspects as the properties of estimators, rather than to the systematic thinking errors or distortion of reality that significantly affect the decisions of the agents. A baseline score, or the observed ESG scores, and the effects of an E, S, and G pillars score deviation (i.e., –60%, –40%, –20%, 20%, 40%, and 60%) are interpolated using non-linear least squares to determine how different scores affect the value function functional form. This allows us to assess the reputation in terms of the value function. Deviations from the mean indicate how policyholders misunderstand the real insurer's commitment to ESG issues.

From the insurers' point of view, the slope of the curve defined by the cumulative value function ψ(s) will be an indicator of the average-ESG refund rate μ it can apply to its product, namely,

Equation 5 states μ as the incremental ratio between ψ(s) and s, that is, the variation of the value function in correspondence with a certain variation of ESG score. In this sense, μ indicates a possible commitment by the insurance company in terms of improving its ESG score, given that the refund rate represents how much the insurance company is willing to invest in ESG compared to its available capital.

2.1 ESG premium

To quote the ESG sustainability premium in the insurance industry due to an increase of good reputation perceived by the policyholders as an improvement of subjective wellbeing, we develop the following framework by introducing the Homans formula [26] for life insurance contracts, which allows for the quantification of profits resulting from the transition from a first-order technical basis BT1↔(i; q) (technical interest rate and mortality table) to a realistic one BT2↔(i*; q*). We consider now a generic endowment contract during n year with periodic premium P paid for m ≤ n years, and we introduce the following characteristic functions.

π(τ) the function for premium installments

ξ(τ) the function for death coverage

η(τ) the function for life coverage

and the additional function σ(τ), defined as follows:

which is necessary to indicate at time t whether the contract continues in the following year.

So, the Homans formula can be written as follows:

where Vt represents the mathematical provision in t. Accordingly, on the basis of the annual expected profits, we calculate the total expected profit as the actuarial value of the profits based on the second-order bases.

According to Pitacco [26], the overall expected cost in expense terms of running an insurance operation in the period (t, t + 1] paid at time t is determined by Et(α, β, γ).

Letting /mäx the expected present value (herein EPV) of a temporary annuity of duration m with anticipated installments, we define

• Pe loading for purchase (sales) expense (all at the beginning of the contract), equal to α rate of the insured capital C.

• Pa loading for collection expenses applied at the payment of annual or single premiums equal to β rate of the tariff premium PT.

• Pg loading for general administration expenses, due to the all contract duration, assumed as rates γ based on the insured capital C

Accordingly, we can calculate the tariff premium as expressed by

The annual expected profits and the total expected profit can be also computed on the basis of the tariff premium, by considering the expense loadings on a technical basis and changes of the expenses that those ex-ante assumed. Changing the expense rate vector from the expected (α, β, γ), to the realistic one (α*, β*, γ*), we obtain

by indicating Vt as the technical provision in t, respectively, being and as the provision related to the sales and the operational costs. The total provision is defined as . The total profit can be described as in the following:

Our idea suggests that ESG reputation should be priced in the market, by modeling a framework for determining an ESG sustainability premium, devoted to ESG firm's activities, so that a virtuous circle can be triggered. The increasing engagement in ESG activities is expected to lead to an improvement in the insurance company's good reputation, as reflected in the ESG score, addressing an improvement in the wellbeing of the policyholder. So that the willingness to pay an extra for ESG insurer's commitment increases.

We assume that the inflows devoted to the ESG activities in the insurance company are constant for the contractual duration and equal to μ, which represents a sort of ESG refund rate to devolve in arrears. The refund rate is intrinsically related to the ESG insurer score. By setting the equilibrium equation at inception

we can obtain ESG safety loading for m periodic premiums Psl

μC is the value of the withdrawal addressed by the insurer to given ESG activities, along the contractual duration. Finally, we determine the ESG sustainability premium PT′ as developed in

From an actuarial point of view, the ESG sustainability premium is paid by the policyholder for m periods, the ESG withdrawals by the insured to the ESG activities being postponed for the all contractual duration n. There exists a temporal shift among m and n that involves the creation of a technical provision, by transforming the complete reserve into a sort of ESG reserve as expressed in

Changing the first-order technical hypotheses with the second-order ones allows for obtaining annual expected profits and total expected profit, respectively, as we express in the following:

We specify that our approach is developed in a local accounting framework.

3 Numerical application

3.1 ESG reputation function

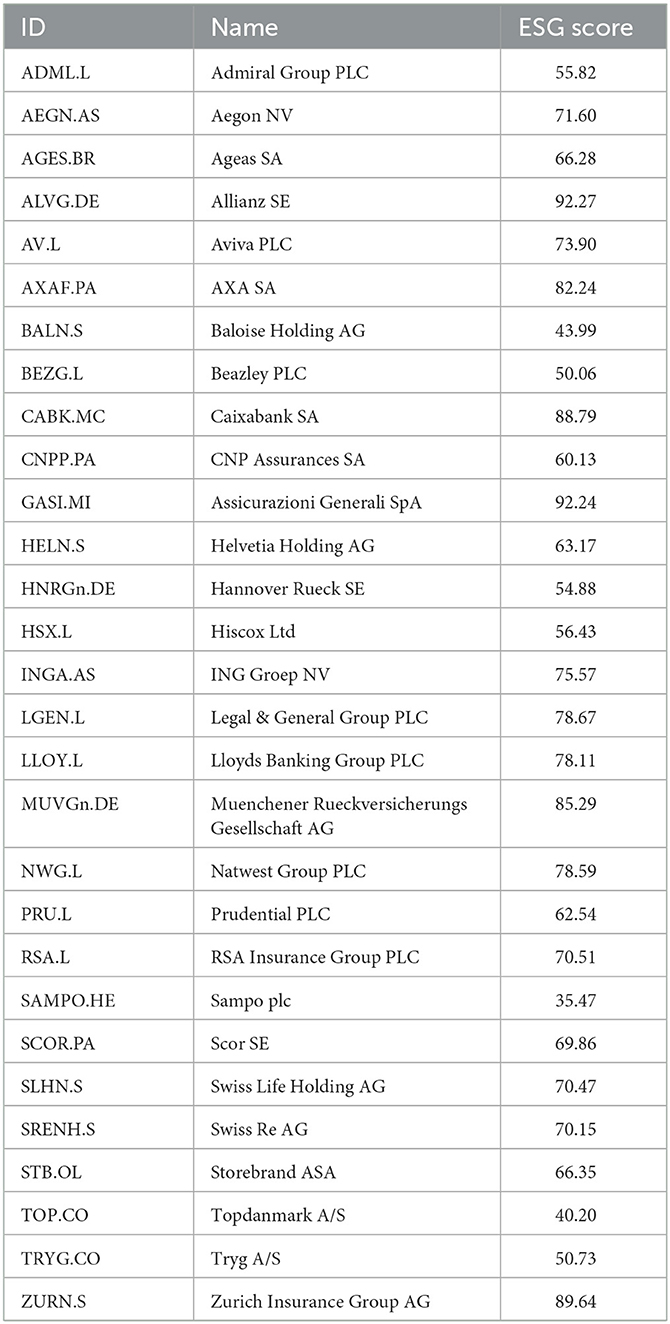

Numerical application aims to justify the opportunity for insurance companies to add ESG refunds to their products. To do this, we analyse data from a 2-fold perspective. The former is the evaluation of a non-material benefit for policyholders wishing to address a sustainable insurance company, putting into effect an ESG refund in the product, and the latter is the higher profit deriving from the higher returns choosing a sustainable second-order technical basis. For the analysis of the sustainability of insurance companies, we use data from Bloomberg ESG Data Service, a data warehouse that aggregates information from various sources approximately 11,500 companies across 83 countries on all ESG aspects, and we focus on a portfolio derived from the STOXX Europe 600 index data for the year 2019. This index covers 90% of the European stock market, including large-cap companies from 17 European countries. It serves as the foundation for constructing sustainable investment indices based on ESG scores for the European market and for the STOXX Global 1,800 index, which represents developed markets worldwide. Given the large number of companies in the portfolio, we simplify the presentation of the results by considering a sample of 29 companies offering insurance products included in the index, as shown in Table 1.

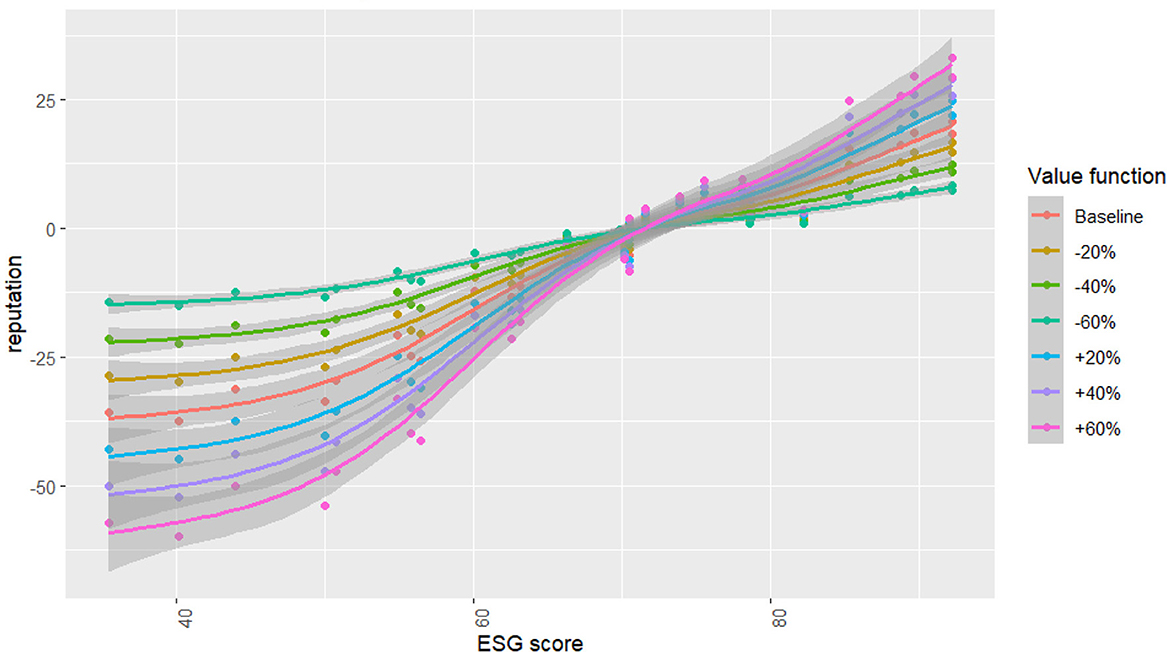

As shown in Table 1, over half of the companies score above 0.7, with only 10% scoring below 0.5. This finding suggests that the insurance sector has a noteworthy responsiveness in its dedication to ESG. Following the approach presented by Apicella et al. [20], we estimate the cumulative value function for the insurance companies, considering a function interpolation, considering a baseline score, i.e., observed ESG scores, and the effects one among an E, S, or G pillars score deviation (namely, –60%, –40%, –20%, 20%, 40%, and 60%), using non-linear least squares. This approach allows assessing the impact of a single score on the value function functional form. We can define the increasing of value function due to a high-ESG score as a “reputation gain,” while the decreasing of value function due to a low-ESG score is a “reputation penalty.” Figure 1 shows the results.

Figure 1 shows that deviations lead to different slopes of the curve in a directly proportional manner. Specifically, the value function shows nearly equal values for positive and negative deviations, indicating that most insurance companies below the median exhibit scores proportionally similar to those above the median. This suggests a general engagement of insurance companies in ESG issues. Moreover, larger deviations from the baseline value function result in higher reputation penalties for companies. While the ratio between reputation gain and reputation penalty remains consistent, penalties are nearly four times greater in magnitude than gains.

Sustainability can be perceived in several ways, such as a regulatory burden, an extra risk involving increased costs or conversely as a considerable commercial upside for those insurers who are aligning and developing their environmental, social, and governance (ESG) product portfolios. Even if the insurers try to become more attractive to ESG-conscious customers, ESG gets more attention in their conduct and communication, and sustainability is not always a decisive factor for all clients buying insurance products, as suggested by some surveys [14]. The focus on sustainability suggests a relatively low importance in the respondents' decision-making process. The situation changes in the case of business clients dealing directly with an insurer, where “the sustainability factor also receives a score of 36%, making it the least significant criterion among the 12 options provided to respondents” [14]. Broadly speaking, regardless of the increasing risks involved in ESG engagement, sustainable approaches are becoming increasingly relevant to all stakeholders, particularly investors and policyholders. Life insurers and a number of non-life insurers have already made good progress in this area. Despite the alignment to ESG criteria, it is not an easy process, leading insurers have launched a number of new product lines.

In this section, we set out what ESG criteria alignment might mean in financial terms, by measuring the ESG sustainability premium by considering blended term life insurance, combining a mix of term and whole life coverage. In the assessment, we propose a measurement of the ESG contribution throughout the insurance value chain, by determining its economic value.

In particular, let us consider for instance an insured capital C = 50, 000 euros, the duration being n = 10, where x = 52 is the age of the insured, with m = 8 periodic constant premiums P, computed on the first-order technical bases (i; q) = (2%; qSI2022), where qSI2022 is the initial rate of mortality of demographic life table for both male and female provided by the Italian Institute of Statistics (ISTAT) for the year 2022, computed on the basis of its survey of people canceled from the civil registry due to death, being P the periodic pure premium equal to 5, 559.37.

3.2 ESG portfolio selection

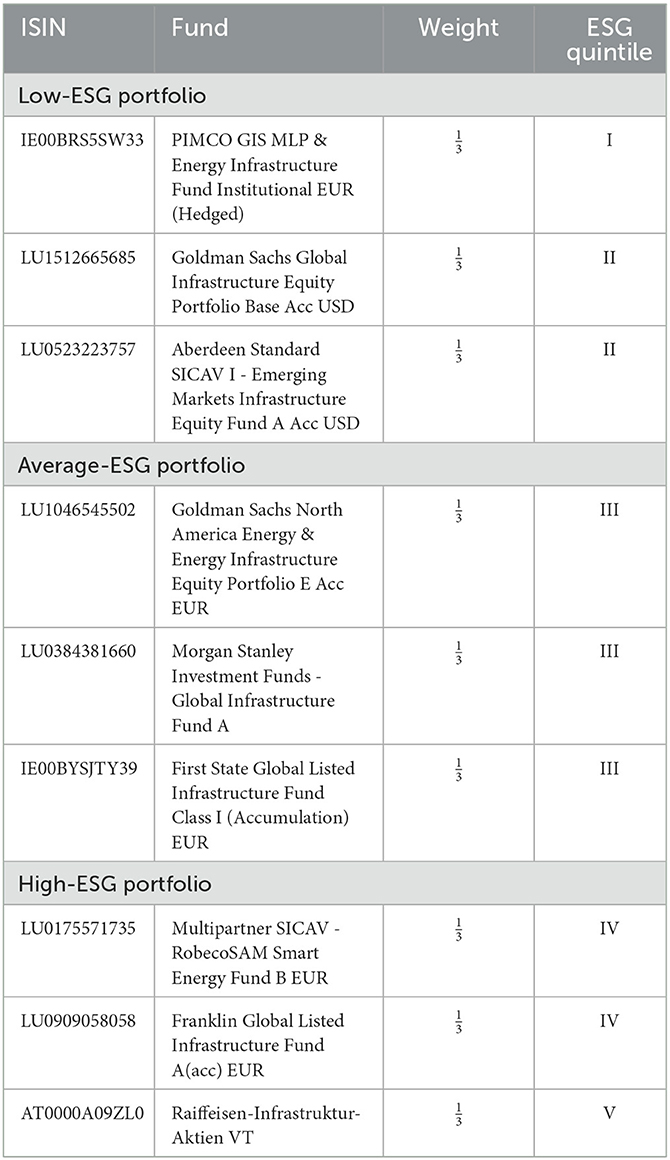

To assess the affection of ESG score on a second-order technical basis, we selected three portfolios based on infrastructure funds with varying levels of ESG, considering energy, public utility, technology, and communication sectors, of which we computed performance indices for the 2016–2019 period. Morningstar provides ESG ratings for funds, which processes Sustainalytics data to build the Morningstar Sustainability Rating. The rating concerns five quintiles calculated on a composite indicator normalized from 0 to 100. Portfolios are building considering the Morningstar Sustainability Rating quintile as follows: The low-ESG portfolio includes funds in the first and second quintile, the average-ESG portfolio includes funds in the third quintile, and the high-ESG portfolio includes funds in the fourth and fifth quintile. Table 2 shows the portfolios' details.

Portfolios are optimized based on the MSCI WORLD INDEX (herein MWI) as a benchmark and the 3-month Euribond as a risk-free asset. Expected returns are obtained using the CAPM model of MWI and benchmark on portfolio returns. Table 3 shows the optimum portfolio main indices.

Table 3 shows all the portfolios have an oscillation compared to the market of the same sign but lower and increases as the ESG score increases. It can also be noted that the ESG score has a positive relationship with both the expected return and the volatility of the portfolio, a sign that portfolios with a higher ESG score have a higher return, but also a greater risk. Furthermore, the Treynor index does not show particular differences between portfolios when compared to the risk/return ratio of the entire market, while the Sharpe ratio favors portfolios with an average-ESG score. Therefore, despite the higher expected return, the choice of an ESG portfolio may not always be optimal because it may present greater risk.

3.3 ESG premium assessment

In life insurance offices, the pure premiums and reserves are computed on the basis of the first-order prudential technical bases (i; q), i.e., not realistic, but rather favorable to the insurance company. The analysis we provide considers the second-order realistic technical bases (i*; q*) as well, to detect the financial and demographic profits from the insurer's perspective.

In line with the double materiality principle, we assess the impact produced by an insurance company's activities on the external environment (so-called “Impact Materiality”) and, conversely, the impact that external phenomena—environmental, social, and governance—can generate on the organization itself (so-called “Financial Materiality”).

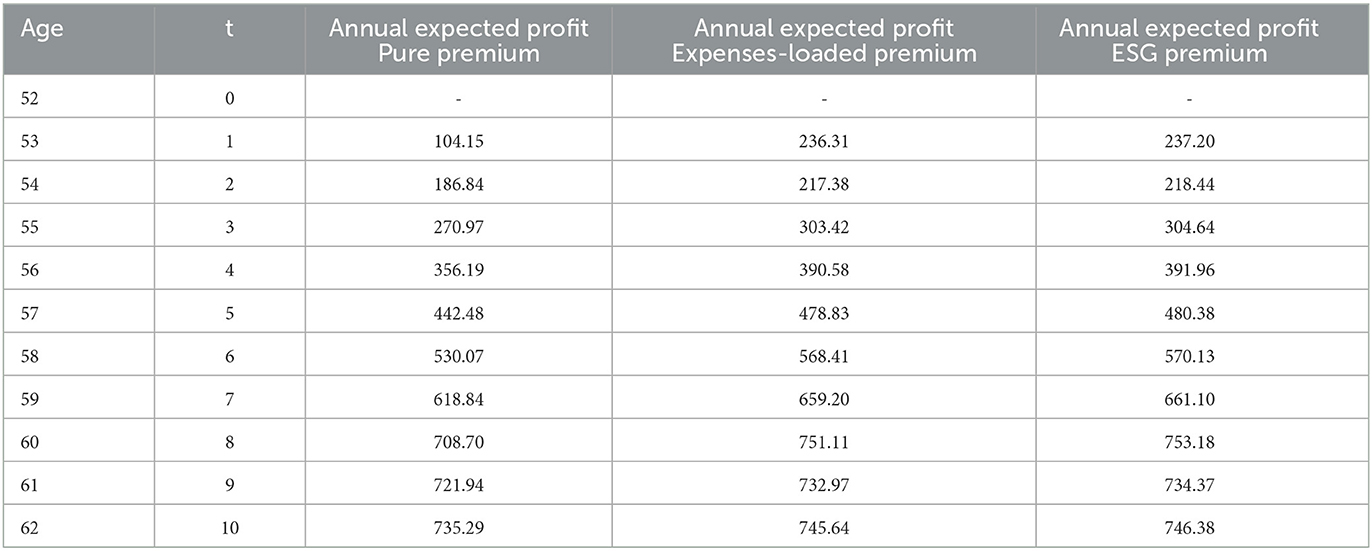

In our example, we assume a first-order basis equal to (i; q) = (2%; qSI2022) and the expenses loading rates (α, β, γ) = (2%, 3%, 0.1%). With these data, we obtain P = 5, 559.37 pure premium, PT = 5, 933.62 tariff premium, and PT′ = 5, 993.51 ESG premium using the refund rate μ = 0.05%, 0.1%, and 0.15%. Then, using a second-order basis equal to and the realistic expenses loading rates (α*, β*, γ*) = (1.8%, 2.5%, 0.08%) by Equations 10, 17, 23, we can calculate the annual expected profits, as shown in Table 4.

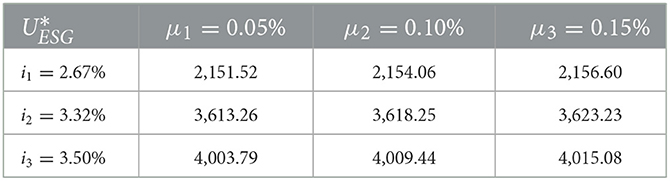

Table 5 shows the total expected profits for pure expenses-loaded and ESG premia.

Having re-balanced the premium according to the improved reputation the insurance market recognizes to the ESG-compliant insurance companies, we propose a tool for enabling insurers to make robust decisions about their strategy and approach to driving sustainability across all business activities. In other terms by measuring the ESG sustainability premium, we try to quantify the market consensus increasing for the more pressing engagement in ESG criteria. On the basis of Tables 4, 5, we observe how the ESG commitment is performing in terms of profitability since they show the unlocking of financial resources that materialize in the annual and total expected profits.

Taking into account the different engagement of insurance companies determined by μ, we can determine the difference in terms of premia, which is PT′ − PT = 29.95, where μ = 0.05%, and PT′ − PT = 59.89, where μ = 0.10%, and PT′ − PT = 89.84, and where μ = 0.15%. This value corresponds exactly to the anticipated periodic premium expected for m years for a capital annuity contract to be paid in t if the insured person is alive in time t − 1 for a maximum duration of n installments. If the installment plan were in n years, each year the contractor would pay a loading for ESG payment which would be made exactly 1 year later with certainty. Therefore, this loading would be exactly equal to the current value of μC with rate i. In this case, an insurance company would have any potential creation of profit for this component of the premium only from excess interest, while any possible under-mortality would not have an impact. If the installment payment instead occurs with m premiums with m < n, then the profit created, always for this component of the premium, would be due to both the excess interest and the under-mortality. Table 6 shows the total expected profit as the realistic technical basis and the refund rate change.

In Table 6, we can observe the increase of the metric as the realistic technical basis increases, as well as the refund rate increases. This result is linked to the ESG provisions. In particular, we have defined an insurance contract combining a classic mixed coverage benefit with a constant payment for the period in which the contract is in force, which we have called ESG refund, in addition to management costs. As a result of these benefits, the policyholder pays an enhanced premium, assumed to be constant for m years. At the time of the contract, there must be an actuarial balance between the benefits and the compensating performance. Since installments are constant, it is necessary to set up a mathematical provision for the ESG engagement, as defined in Equations 19–22.

4 Conclusion

Pressure on companies to pay attention to environmental, social, and governance (ESG) issues continues to mount. A majority of surveyed executives and investment professionals agree that ESG programmes create shareholder value. Nevertheless, it is unclear how ESG programmes contribute to financial performance. Our idea is that the subjective wellbeing of the consumers modifies their subjective probabilities and expectations depending on the ESG corporate reputation. We assume that the behavioral finance paradigms could reveal how ESG corporate reputation influences the ESG reputation value function. In particular, the slope of the curve allows for defining the ESG loading rate, which describes the linkage among ESG score perceived in terms of reputation and the ESG sustainability premium, that is, the willingness of the customers to pay an extra premium. We propose a framework for enabling insurers to make robust decisions about their strategy and approach to driving sustainability across all business activities, by offering a tool for quantifying the subjective wellbeing of the policyholders in economic terms, as a higher propensity to pay an extra amount. Our approach relies on the double materiality principle as promoted in the European Corporate Sustainability Reporting Directive (CSRD) [27] and the related European Sustainability Reporting Standards (ESRS). The assessment scheme we develop can represent a tool through which a company or a group identifies strategic issues, in terms of positive and/or negative - potential and/or actual - impacts- for the organization itself, for the environment, and for the communities in which it operates. It allows quantification of the financial resources unlocked by the ESG sustainability premiums recognized by the market.

For the sake of clarity, we declare that one of the main drawbacks of the research consists of assuming symmetric information on reputation among the policyholders and insurance companies. The asymmetric information causes significant inefficiencies in the market as well as in the insurance industries by leading to the phenomenon of adverse selection. “Trust is an important condition for bilateral and informal trade that cannot be undertaken under formal contracts. For a potentially welfare-improving trade to take place, one party must choose to trust the other by, for example, lending money, delegating tasks, or exerting effort in a project.” [28]. In future research, we will investigate the impact on our framework of the asymmetry in the reputation as perceived by the market.

Another relevant aspect to be explored will be devoted to the lapses in assumptions in our model by comparing the results under different approaches.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

MC: Data curation, Investigation, Validation, Writing – original draft, Writing – review & editing. VD'A: Investigation, Methodology, Validation, Writing – original draft, Writing – review & editing. MS: Conceptualization, Formal analysis, Methodology, Writing – original draft, Writing – review & editing.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

The reviewer RC declared a shared affiliation with the author VD'A to the handling editor at time of review.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

1. Camerer C, Weigelt K. Experimental tests of a sequential equilibrium reputation model. Econometrica. (1988) 56:1–36. doi: 10.2307/1911840

2. Fehr E, Kirchsteiger G, Riedl A. Does fairness prevent market clearing? An experimental investigation. Quart J Econ. (1993) 108:437–59. doi: 10.2307/2118338

3. List JA. The behavioralist meets the market: measuring social preferences and reputation effects in actual transactions. J Polit Econ. (2006) 114:1–37. doi: 10.1086/498587

4. Berg J, Dickhaut J, McCabe K. Trust, reciprocity, and social history. Games Econ Behav. (1995) 10:122–42. doi: 10.1006/game.1995.1027

5. Xia C, Wang J, Perc M, Wang Z. Reputation and reciprocity. Phys Life Rev. (2023) 46:8–45. doi: 10.1016/j.plrev.2023.05.002

6. Blajer-Gołębiewska A. Individual corporate reputation and perception of collective corporate reputation regarding stock market investments. PLoS ONE. (2021) 16:e0257323. doi: 10.1371/journal.pone.0257323

7. PWC. Voice of the Consumer Survey. (2024). Available at: https://www.pwc.com/c1/en/voice-of-the-consumer-survey-2024.html (accessed July 18, 2024).

8. Cao J, Goyal A, Zhan X, Zhang WE. Unlocking ESG premium from options. Swiss Finance Institute Research Paper No. 21-39. (2023). Available at: https://ssrn.com/abstract=3878123 (accessed July 25, 2024).

9. Hübel B, Scholz H. Integrating sustainability risks in asset management: the role of ESG exposures and ESG ratings. J Asset Manag. (2019) 21:52–69. doi: 10.1057/s41260-019-00139-z

10. Ciciretti R, Daló A, Dam L. The contributions of betas versus characteristics to the ESG premium. J Empir Finance. (2023) 71:104–24. doi: 10.1016/j.jempfin.2023.01.004

11. Albuquerque R, Koskinen Y, Zhang C. Corporate social responsibility and firm risk: theory and empirical evidence. Manage Sci. (2019) 65:4451–69. doi: 10.1287/mnsc.2018.3043

12. Luo HA, Balvers RJ. Social screens and systematic investor boycott risk. J Finan Quantit Anal. (2017) 52:365–99. doi: 10.1017/S0022109016000910

13. Galema R, Plantinga A, Scholtens B. The stocks at stake: return and risk in socially responsible investment. J Bank Finance. (2008) 32:2646–54. doi: 10.1016/j.jbankfin.2008.06.002

14. EY Insurance Barometer. Will sustainability in insurance become business clients' next focus? (2023). Available at: https://www.ey.com/en_be/financial-services/will-sustainability-in-insurance-become-business-clients-next-focus (accessed July 18, 2024).

15. Fiordelisi F, Soana MG, Schwizer P. Reputational losses and operational risk in banking. Eur J Finance. (2014) 20:105–24. doi: 10.1080/1351847X.2012.684218

16. Eckert C, Gatzert N. Modeling operational risk incorporating reputation risk: an integrated analysis for financial firms. Insurance. (2017) 72:122–37. doi: 10.1016/j.insmatheco.2016.11.005

17. Gatzert N, Schmit JT, Kolb A. Assessing the risks of insuring reputation risk. J Risk Insur. (2016) 83:641–79. doi: 10.1111/jori.12065

18. Boado-Penas MC, Brinker LV, Eisenberg J, Korn R. Managing reputational risk in the decumulation phase of a pension fund. Insurance. (2023) 109:52–68. doi: 10.1016/j.insmatheco.2022.12.005

19. SEISMIC. Unlocking the ESG Premium: Driving Value Creation Through Actionable Social and Environmental Performance. (2024). Available at: https://www.seismic-change.com/insights/unlocking-the-esg-premium-driving-value-creation-through-actionable-social-and-environmental-performance/ (accessed July 18, 2024).

20. Apicella G, Carannante M, D'Amato V. Policyholders' Subjective Beliefs: Approaching New Drivers of Insurance ESG Reputational Risk. (2023). doi: 10.2139/ssrn.4400019

21. Gigerenzer G. Gut Feelings the Intelligence of the Unconscious. New York: Penguin Books. (2008).

22. van Raaij WF. Consumer financial behavior. Found Trends Market. (2014) 7:231–351. doi: 10.1561/1700000039

23. Brighetti G, Lucarelli C, Marinelli N. Do emotions affect insurance demand? Rev Behav Finance. (2014) 6:136–54. doi: 10.1108/RBF-04-2014-0027

24. Tversky A, Kahneman D. Advances in prospect theory: cumulative representation of uncertainty. J Risk Uncertain. (1992) 5:297–323. doi: 10.1007/BF00122574

25. Booij AS, van de Kuilen G. A parameter-free analysis of the utility of money for the general population under prospect theory. J Econ Psychol. (2009) 30:651–66. doi: 10.1016/j.joep.2009.05.004

26. Pitacco E. Matematica e tecnica attuariale delle assicurazioni sulla durata di vita. Lint Editoriale. (2022).

27. European Commission. Directive (EU) 2022/2464 of the European Parliament and of the Council of 14 December 2022 amending Regulation (EU) No 537/2014, Directive 2004/109/EC, Directive 2006/43/EC and Directive 2013/34/EU, as regards corporate sustainability reporting. (2022). Available at: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:32022L2464 (accessed July 18, 2024).

28. Janas M, Oljemark E. Trust and reputation under asymmetric information. J Econ Behav Organ. (2021) 185:97–124. doi: 10.1016/j.jebo.2021.02.023

Appendix

A. ESG provision formula

Recalling Equations 19–20

The ESG withdrawal μC is performed in t + 1 if the policyholder is alive in t.

Therefore, in t = 0, the EPV is the following:

where nax is the EPV of a temporary annuity of duration n, näx is the EPV of a temporary of duration n with anticipated installments, and nAx is the EPV of a term insurance of duration n.

If t < m

if m ≤ t < n

if t < m

if m ≤ t < n

And .

Keywords: ESG, prospect theory, corporate reputation, behavioral finance, actuarial evaluations

Citation: Carannante M, D'Amato V and Staffa MS (2024) How ESG corporate reputation affects sustainability premiums in the insurance industry. Front. Appl. Math. Stat. 10:1474565. doi: 10.3389/fams.2024.1474565

Received: 01 August 2024; Accepted: 26 November 2024;

Published: 10 December 2024.

Edited by:

Andrea Mazzon, University of Verona, ItalyReviewed by:

Roy Cerqueti, Sapienza University of Rome, ItalyGian Paolo Clemente, Catholic University of the Sacred Heart, Milan, Italy

Ilaria Stefani, Sapienza University of Rome, Italy

Copyright © 2024 Carannante, D'Amato and Staffa. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Maria Carannante, bWFyaWEuY2FyYW5uYW50ZUBjb2xsYWJvcmF0b3JlLnVuaXBhcnRoZW5vcGUuaXQ=

Maria Carannante

Maria Carannante Valeria D'Amato

Valeria D'Amato Maria Sole Staffa

Maria Sole Staffa