- Research Laboratory in Management Sciences of Organizations, Business and Management Department, National School of Business and Management, Ibn Tofail University, Kenitra, Morocco

Introduction

Coronavirus, also named SARS-CoV-2, has been spreading around the world since December 2019. It is a new virus member of the SARS family that causes a disease called COVID-19. The virus causes a respiratory illness with symptoms such as cough, fever, fatigue, shortness of breath and loss of smell and taste, but also more serious ones that can lead to the death of the host, especially if they are elderly or have multiple comorbidities. To date (April 16, 2022) COVID-19 has already killed more than 6.22 million people worldwide, while more than 504 million cases have been officially diagnosed. Starting from a market in the city of Wuhan, in central China, the coronavirus then spread to the country's major metropolitan areas, then to neighboring states such as Japan and South Korea, before spreading to the rest of the world, from the United States (the most affected country in the world in terms of both deaths and cases) to European and African countries, including Morocco. On March 11, 2020, the COVID-19 was declared a pandemic by the WHO, which called for essential protective measures to prevent the saturation of intensive care units and to reinforce preventive hygiene (elimination of physical contact, kissing and handshaking, end to gathering and unnecessary travel, promotion of hand washing, implementation of quarantine, etc.) [1]. According to the World Trade Organization (WTO), the coronavirus could reduce global trade by a third, it suggested that the recession caused by the COVID-19 pandemic could have a more devastating effect on trade than the financial crisis of 2007–2008 [2]. The pandemic has affected businesses around the world. Measures to prevent the spread of the virus have halted the flow of goods and people, stalled economies and are causing a global recession, affecting some industries more than others. The Coronavirus disease has led to disruptions in supply chains, a significant drop in demand for many industries and has impacted the stock market. Unemployment has also reached record levels [3].

In Morocco, the COVID-19 pandemic officially started on March 2, 2020. As of April 17, 2022, the death toll is 16 062, During the week of 9–15 March 2020, Morocco put in place measures to contain the spread of the pandemic. On March 19, 2020 the ministry of the interior declared a state of health emergency and restricted traffic in Morocco, declaring this to be the only unavoidable way to keep the coronavirus under control. In July 2021, Morocco faced a second wave of COVID-19 with almost 150,000 infections and more than 850 deaths were reported and a 3rd wave in January and February 2022 with a number of infected individuals exceeding 50,000 and more than 60 deaths. The ministry of health, has called for a general mobilization at the level of national and regional hospitals in critical and intensive care as well as resuscitation.

Morocco's Strategy for facing COVID-19

With a total of 1,164,345 confirmed cases, 1,147,643 recoveries, and 16,062 deaths as of April 17, 2022, Morocco is one of the most affected African countries by the COVID-19 pandemic. Measures were quickly taken to slow the spread of the pandemic and ensure follow-up and coordination with health services. The Moroccan government has declared a state of health emergency. Strict measures have been taken to impose a mandatory general lockdown from March to May 2020, including closing borders, banning gatherings and closing schools. Restrictions were placed on sporting and cultural events, including closing stadiums to the public. Local stores were no longer authorized to remain open after 6 p.m. [4].

As Health Measures, the actions focused on expanding and reorganizing hospital capacity and improving patient care conditions in different cities in Morocco, especially those cities with high human density that are most exposed to risk. Military field hospitals have been installed in or around cities to reinforce the civilian health system with beds and resuscitation equipment. Batches of medical and sanitary equipment have been deployed to health facilities. Stocks of medicines have been created, including chloroquine produced by a pharmaceutical group based in Morocco. Moroccan companies specializing in the manufacture of medical equipment (e.g., ventilators) were also asked to follow accelerated procedures. Industrial companies were able to readjust their production tools and processes to produce ventilators and protective masks. In order to support the populations most affected by the crisis, Morocco has taken socio-economic measures. it has set up an economic monitoring committee (EMC) to evaluate and anticipate the direct and indirect economic impact of COVID-19 on the population. To limit the social and economic impact of the COVID-19 pandemic and to maintain an adequate level of their official reserves, Morocco mobilized on April 7, 2020 an amount of 2.97 billion USD from the International Monetary Fund (IMF), likewise a “Special Fund for the Management of the Coronavirus Pandemic,” with a capacity of 3% of the GDP, was created. this Fund received contributions from various private and public entities for an amount of more than 32 billion dirhams (about 3.2 billion USD) of donations [5, 6].

Effect of COVID-19 on the Moroccan Dirham

On the foreign exchange market, the fluctuation band of the national currency in relation to its reference rate had widened from ±2.5 to ±5%, and this since March 2020. It should be recalled that Morocco has decided to adopt a partially liberalized exchange rate regime since January 2018. The dirham has been allowed to fluctuate within a band of ±2.5% (± 0.3 before) in relation to a central rate set by Bank Al-Maghrib (Central Bank) on the basis of a basket of currencies composed of the euro (EUR) and the U.S. dollar (USD) up to 60 and 40% respectively [7]. The dirham suffered, in the first quarter of 2021, a depreciation against the euro and an appreciation against the dollar. After losing 1.7% of its average value against the euro in Q4 2020, the dirham depreciated by 1.4% in Q1 2021. The calculation of the nominal effective exchange rate of the dirham, established by the HCP (High Commission for Planning of Morocco), which represents its nominal value on the basis of the basket of currencies of indexation of the national currency, allowed to identify an appreciation of the dirham, that is to say a gain of 2.4 points in the first quarter of 2021 compared to a year earlier.

To date, there are few research works to analyze the impact of COVID-19 on the Moroccan financial market and no research study dedicated to the effect of the pandemic on the Moroccan dirham. Thus, the objective of this research study is to see the impact of the outbreak of COVID-19 daily new cases on the exchange rate of Moroccan Dirham against the Euro, using the Vector Autoregressive approach, in order to provide the researcher and practitioner of the Moroccan foreign exchange market with financial information based on a mathematical analysis.

Materials and Methods

In this section, we will present the methodology, data and the model used to show the impact of new infected cases of COVID-19 on the MADEUR exchange rate.

Data and Data Source

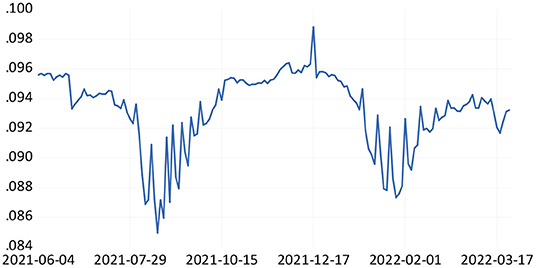

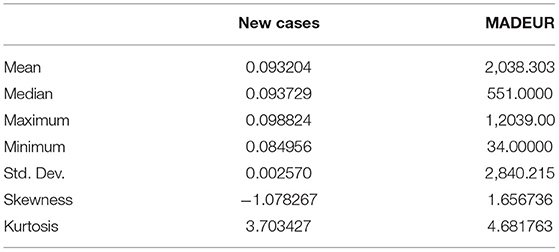

In this research study, we use two lists of data: The daily new cases of COVID-19 declared in Morocco (From Jun 04, 2021 to March 18, 2022) obtained from the website of the Ministry of Health of Morocco and the daily exchange rate MADEUR over the same period obtained from the financial information provider DirectFn (Figure 1). To analyze the data, we used the Eviews software.

Research Model

The objective of this study is to show the impact of COVID-19 on the exchange rate of the Moroccan Dirham against the European Union currency (MADEUR). The model used is the Vector Autoregressive model (VAR).

VAR is a form of linear dynamic model [it was introduced by Sims (1980)] [8] in which each variable is a function of its own lagged values but also the past values of the other variables. The main advantage is that the VAR model is empirical, i.e., only the data decide on the possible interactions between the variables. The researcher's intervention to set restrictions or hypotheses is almost absent [8]. The only restrictions in a VAR are the choice of variables to include in the model and the number of lags. This VAR model is based on the idea that all variables in the model are endogenous and the errors in each equation are correlated. VAR processes are a generalization of AR processes or multivariate cases or a form of an infinite moving average vector process. We note X (COVID-19) daily infected new cases and Y(MADEUR) daily closing values of the Moroccan exchange rate of European Union currency. A VAR(p) model has the following form:

Where Yt is a k × 1 vector of endogenous variables and Xt is a d × 1 vector of variables.

A1, ….., Ap : re matrices of lag coefficients to be calculated and B is k × d matrix of exogenous variable coefficients to be estimated. εt is a k × 1 white noise innovation process.

To model the effect that the COVID-19 pandemic may have on the exchange rate of the Moroccan Dirham against the Euro currency, the VAR model seems to be the best approach to monitor and study such a causal interaction. The analysis of the shocks caused by COVID-19 on the exchange rate and the evaluation of the causal link between the two variables are done with the help of structural analysis, which includes the methods of causality in the sense of Granger, impulse response function and variance decomposition of the prediction errors [9].

Granger Causality Test

Causality in the sense of Granger (1969) is an approach that refers not to the theoretical character of causality (cause-effect) but to the predictive character of the possible cause on the effect. Indeed, according to Granger (1969) [10], a variable X causes another variable Y, if the knowledge of past values of X makes the prediction of Y better. In other words, we will say that the variable X causes the variable Y in the sense of Granger if the past values of X significantly influence the contemporary value of Y. From a statistical point of view, the Granger causality test amounts to a test of the overall significance of the coefficients associated with the past values of the causal variable in the equation for the caused variable [11].

Impulse Response Function

The impulse response function traces the effect of a unit residual shock on the present and future values of the endogenous variables. The effect of the shock is transmitted through the dynamics of the models. In this study, and in order to align our work with that of Cochrane (1994), we will carry out Cholesky-type shocks. Cholesky shocks are constructed in such a way as to orthogonalize the impulses [12].

Variance Decomposition Method

Decomposition of variance method is used to explain the variance of an endogenous variable by the variances of other variables. This makes it possible to assess the impact of the variability of one variable on another. The objective of the decomposition of the forecast error is to calculate for each of the innovations its contribution to the variance of the error. Using a mathematical technique, we can write the variance of the forecast error at a time horizon h as a function of the variance of the error attributed to each of the variables, and then simply relate each of these variances to the total variance to obtain its relative weight in percentage [13]. In this regard, Hairault [14] maintains that they (response function and decomposition) constitute two exercises that make it possible to synthesize the essential information contained in the internal dynamics of a VAR system. They measure the relative influence, at different horizons, of different shocks in the dynamics of each variable [15].

Results and Discussion

Stationarity Test and Lag Length Selection

Augmented Dickey-Fuller and Phillips-Perron Tests

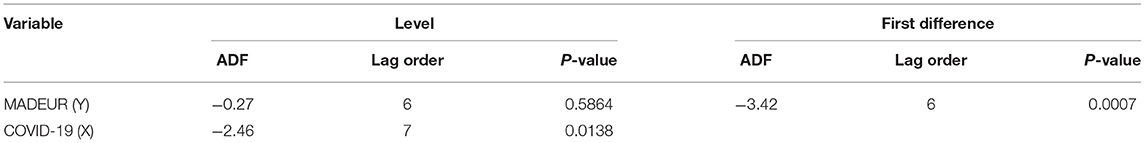

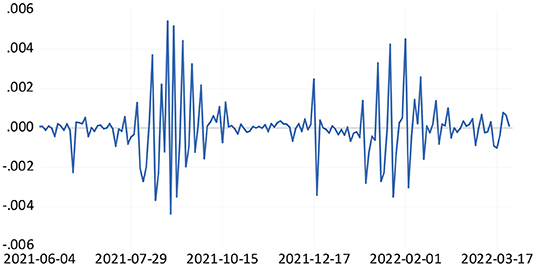

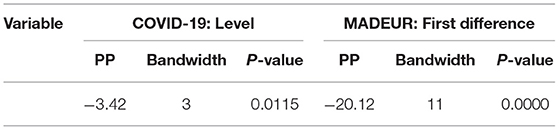

The augmented Dickey-Fuller test (ADF) is used to show whether a time series is stationary or not by identifying a deterministic or stochastic trend using three basic models. The test principle is simple: If the null hypothesis (H0) is accepted in one of these three models, then the process is non-stationary; in this case, the first difference variable is tested. If we accept this hypothesis for one of the variables we want to use, then all the variables must be tested to the first difference. If the alternative hypothesis (H1) is accepted, then the process is stationary [16, 17]. Table 1 shows the test values for the two variables X(COVID-19) and Y(MADEUR). The variable Y is stationary in first difference (ADF = −3.42) (Figure 2) while the variable X is stationary in Level (ADF test = −2.46) (Figure 3). We note that the stationarity is significant at 5%. For ADF, the AIC criterion suggests an optimal number of lags equal to 7 for the X variable (AIC = 17.39) and 6 for the Y variable (AIC = −10.44).

Table 2 also shows the results of the PP test which is a non-parametric adaptation of the ADF test. The null hypothesis of the test is, as for the ADF test, the presence of a unit root.

After having verified the stationarity of the two variables by performing the ADF and PP tests. The results showed that the variable X (COVID-19) is stationary in level and Y (MADEUR) is stationary in first difference. In what follows, we will estimate the VAR model and then test the causality by performing the Granger test, then we analyze the effect of COVID-19 on the exchange rate of the Moroccan dirham against the EU currency using the impulse response function and the variance decomposition method.

AR Model

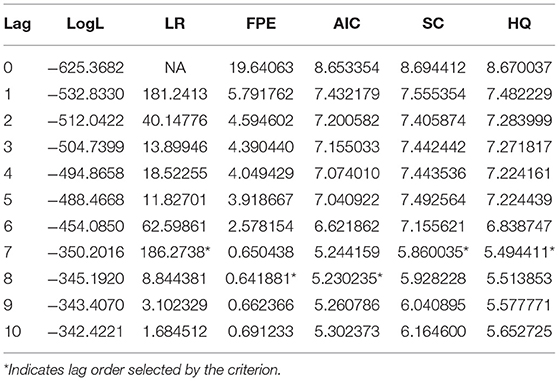

Lag Length Selection Criteria

To determine the number of lags p of the VAR model, we will consider the AKAIKE, SCHWARZ and HANNAN-QUINN criteria. The procedure for selecting the order of the representation consists of estimating all the VAR models for an order ranging from 0 to 10. Thus, the determination of the number of lags in model is based on the AKAIKE (AIC) and SCHWARZ (SC) criteria which allow us to determine the number of lags in the VAR model. Table 3 shows that the number of delays that minimizes the information criterion of SC (5.860035) and HQ (5.494411) is 7 and 8 for the AIC criterion (5.230235). In the following, we retain a number of lags equal to 7 for the model VAR (7), which corresponds to the number of days required for the COVID-19 effect to be transmitted to the exchange rate of the Moroccan Dirham against the Euro currency.

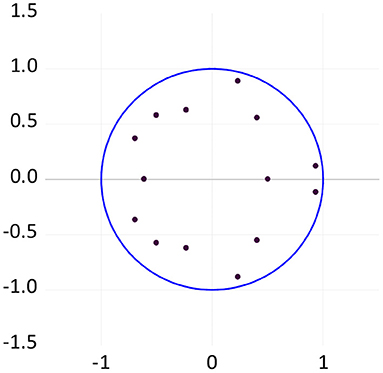

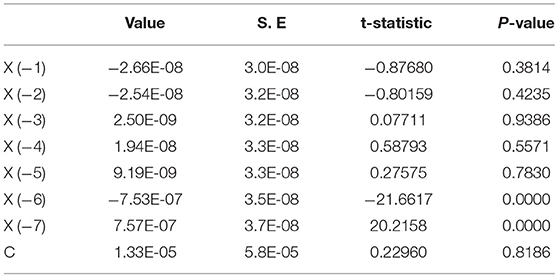

Model Stability

The stability of the Vector Autoregressive model consists in checking if all its roots are outside the unit circle. A VAR model with one or more roots inside the unit circle is not a stable model. To analyze the stability of the model, we will therefore observe the graph in Figure 4 which illustrates the inverse roots of the autoregressive polynomial characteristic of the model. From this graph, it appears that no inverse root is outside the unit circle. Then we can conclude that the developed VAR (7) model is stable and admissible for variance decomposition operations and impulse response functions. Table 4 shows the values of the lags of the variable X as well as their t-stat and p-value for our model.

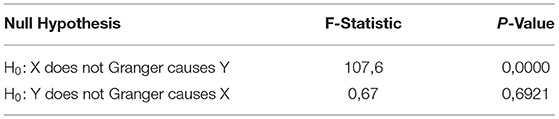

Result of Granger Causality Test

We will proceed to the Granger causality test. A “granger causes” the dependent variable when the null hypothesis is rejected. The null hypothesis H0 are defined as follows: “X(COVID-19) does not granger-cause the variable Y(MADEUR)” and “Y(MADEUR) does not granger-cause the variable Y(COVID-19).” We obtain the results shown in Table 5.

The null hypothesis “X does not Granger causes Y” is rejected without error because the associated probability is 0. And the null hypothesis “Y does not Granger causes X” is accepted (p = 0.6921>0.05) which proves that it is an unidirectional causality. We can therefore conclude that the new cases of “COVID-19” granger-cause the “MADEUR” exchange rate (Table 6).

Result of Impulse Response Function

By subjecting the model to Cholesky-type shocks, we obtain the result shown in the Figure 5. (The dotted lines represent 95% confidence interval):

We notice that a shock caused by the new cases of COVID-19 leads to a declining effect of the exchange rate on the 7th day: Time necessary to transmit the effect of COVID-19 to the exchange rate of Moroccan dirham against the Euro, then it returns to the positive zone on the 8th day. During the next 4 days the impact returns to the negative zone and then starts to fluctuate, which shows that the effect of the COVID-19 on the MADEUR persists and that the long-term effect is possible.

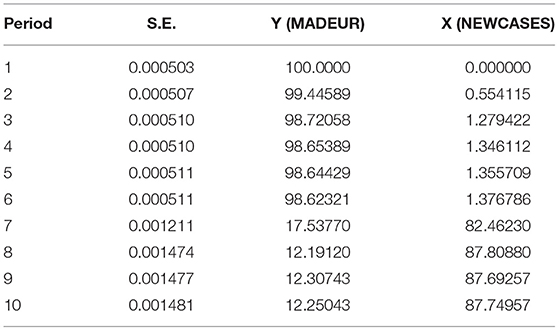

Results of Variance Decomposition Method

The findings of the variance decomposition method for MADEUR exchange rate are reported in Table 7.

The number of daily new cases of COVID-19 in Morocco has significantly impacted the exchange rate of the Dirham against the Euro, the variance decomposition of the variable Y (MADEUR) shows that the impact caused by X (COVID-19) for the 2nd, 3rd, 4th, 5th and 6th day is respectively equal to: 0.554, 1.279, 1.346, 1.355, and 1.376%. The quantity of shocks transmitted to the exchange rate by the new COVID-19 cases jumps to 82.46% on the 7th day and reaches 87.74% on day 10. Therefore, the variance decomposition is not stable when the number of daily COVID-19 cases increases, which explains the possibility of a long-term impact found by the impulse response function.

Conclusion

In this study, we began by investigating a possible causal link between the new cases of COVID-19 pandemic and the exchange rate of the Moroccan Dirham against the official currency of the European Union by adopting the Autoregressive Vector (VAR) as the basic model. This impact was confirmed using the Granger causality test. On the other hand, the analysis based on the impulse response function and the variance decomposition method, showed that the effect of an increase of COVID-19 new cases is transmitted to the exchange rate on the 7th day as well as the shock caused by the pandemic on the exchange rate persists and lasts in time which explains the possibility of a long-term effect.

Data Availability Statement

The datasets presented in this study can be found in online repositories. The names of the repository/repositories and accession number(s) can be found below: www.investing.com.

Author Contributions

The author confirms being the sole contributor of this work and has approved it for publication.

Conflict of Interest

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary Material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fams.2022.941845/full#supplementary-material

References

1. Zhang L, Zheng Z, Hu G, Yuan X. Prevention and control measure to avoid cross infection during radiotherapy in coronavirus disease 2019 (COVID-19) epidemic in Wuhan, China. Radiother Oncol. (2020) 149:104–6. doi: 10.1016/j.radonc.2020.04.011

2. Ando M. Hayakawa K. Impact of COVID-19 on trade in services. Japan World Econ. (2022) 62:101131. doi: 10.1016/j.japwor.2022.101131

3. Louati A, Firano Z, Fatine FA. COVID-19 and cross-border contagion: Trade and financial flows. Res Glob. (2022) 4:100082. doi: 10.1016/j.resglo.2022.100082

4. Hammoumi A, Qesmi R. Impact assessment of containment measure against COVID-19 spread in Morocco. Chaos Solitons Fractals. (2020) 140:110231. doi: 10.1016/j.chaos.2020.110231

5. Samlani Z, Lemfadli Y, Ait Errami A, Oubaha S, Krati K. The impact of the COVID-19 pandemic on quality of life and well-being in Morocco. Arch Community Med Public Health. (2020) 6:130–4.

6. El Otmani Dehbi Z, Sedrati H, Chaqsare S, Idrissi Azami A, Merzouki M, Raji M, et al. Moroccan Digital Health Response to the COVID-19 Crisis. Front Public Health. (2021) 9:690462. doi: 10.3389/fpubh.2021.690462

7. Ezzahid E, Maouhoub B. Real effective exchange rate dynamics in Morocco: Exploring Balassa-Samuelson effect under capital account liberalization. J Int Stud. (2020) 13:373–94. doi: 10.14254/2071-8330.2020/13-1/24

8. Sims CA. Are forecasting models usable for policy analysis? Quarterly review. Fed Reserve Bank of Minneapolis. (1986) 10:2–16. doi: 10.21034/qr.1011

9. Akhtar A, Abiad M, Mashwani WK, Aamir M, Naeem M, Khan DM. The implications of COVID-19 pandemic on dollar exchange rate of Pakistan. Front Appl Math Stat. (2022) 8:808489. doi: 10.3389/fams.2022.808489

11. Toda HY, Phillips PCB. Vector autoregression and causality: a theoretical overview and simulation study. Econ Rev. (1994) 13:259–85. doi: 10.1080/07474939408800286

12. Lütkepohl H. Impulse response function. In: Macroeconometrics and Time Series Analysis. London: Palgrave Macmillan (2010). p. 145–150. doi: 10.1057/978-1-349-95121-5_2410-1

13. Brooks C. Introductory Econometrics for Finance. 4th edn. Cambridge: Cambridge University Press (2019).

14. Hairault J-O. Presentation and evaluation of the real business cycles approach. In: Advances in Business Cycle Research. Berlin; Heidelberg: Springer (1995). p. 21–54.

15. Ahalawat S, Patro A. Exchange rate and Chinese financial market: Variance decomposition under vector autoregression approach. Cogent Econ Finance. (2019) 7:1628512. doi: 10.1080/23322039.2019.1628512

16. Mushtaq R. Augmented dickey fuller test. Econom: Math Methods Program eJ. (2011) 1–19. doi: 10.2139/ssrn.1911068

Keywords: Vector Autoregressive model, COVID-19, Moroccan exchange rate, Moroccan dirham, MADEUR

Citation: Bouasabah M (2022) The Shock of COVID-19 Pandemic on the Moroccan Exchange Rate Dirham/Euro. Front. Appl. Math. Stat. 8:941845. doi: 10.3389/fams.2022.941845

Received: 11 May 2022; Accepted: 17 June 2022;

Published: 08 July 2022.

Edited by:

Henry Penikas, Central Bank of Russia, RussiaReviewed by:

Ibrahim Mahariq, American University of the Middle East, KuwaitMohammed K. A. Kaabar, University of Malaya, Malaysia

Copyright © 2022 Bouasabah. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Mohammed Bouasabah, bW9oYW1tZWQuYm91YXNhYmFoQHVpdC5hYy5tYQ==

Mohammed Bouasabah

Mohammed Bouasabah