- Department of International Economics and Trade, School of Business, Hohai University, Nanjing, China

Introduction: Digital finance is the combination of digital information technology and traditional finance. And digital financial agglomeration plays a pivotal role in the process of improving economic resilience in the new era.

Method: This paper introduces digital financial agglomeration, measures the economic resilience of each province and conducts spatial correlation tests by using 30 inter-provincial (except Hainan Province) panel data from 2011 to 2020, and constructs a Spatial Durbin Model to empirically analyze the relationship between digital financial agglomeration and economic resilience based on the theory of diffusion effect of digital financial agglomeration and research hypotheses.

Result: The results show that: (1) Digital financial agglomeration can have a positive effect on economic resilience by expanding the scale of consumption. (2) Digital financial agglomeration has a direct effect on the economic resilience of the region and an indirect spillover effect on the economic resilience of neighboring regions. (3) The effects of the main explanatory variables on economic resilience pass the robustness test: the positive effects of digital financial agglomeration, consumption scale and the interaction term of the two on economic resilience are significant.

Discussion: This paper focuses on the phenomenon of digital financial agglomeration, which is a unique perspective, and explores the influence mechanism of digital financial agglomeration on economic resilience from the perspective of spatial spillover effects of digital financial agglomeration, which is somewhat innovative.

1. Foreword and literature review

1.1. Foreword

China's digital inclusive finance business has achieved leapfrog development between 2011 and 2020, with the digital inclusive finance index of 33.6 by provinces in 2011, grew to 214.6 with a 548% increase at the end of 2015 when inclusive finance was officially promoted to the national level. Accompanied by big data, cloud computing and other wide application of digital technology, the digital inclusive finance index grew to 334.8 in 2020 (1). The development of digital finance has slowed down in near years, but it still maintains a considerable growth rate, and digital inclusive financial services are still growing. Digital finance has developed a variety of specific forms with the support of digital technology, including third-party payment, P2P network lending, and Internet financial products, etc. Among them, the third-party payment form refers to the intermediary platform that provides payment and settlement services for merchants and consumers. The representative platforms in China include Alipay, CaiPay, UnionPay e-wallet, etc; P2P network lending platform means “person-to-person lending,” and aims to build a third-party network platform to realize the direct match between the suppliers and the demanders of funds; Internet financial products mean that various financial institutions use big data mining technology to accurately design precise marketing models to meet different customers' financial needs, such as balance funds and zero money pass.

Chinese National Bureau of Statistics announced that Chinese economy reached 114.37 trillion yuan in 2021, with a year-on-year growth of 8.1% (2). As a result, we lead to the basic judgment that Chinese economy is resilient and sufficiently potential. However, the intricate domestic and international environment, such as unilateralism, rising protectionism and recurring epidemics, have had a huge impact on the sound development of Chinese economy. How to promote economic development steadily has become a major topic of current research, and at the same time, improving economic resilience provides a kind of guidance to address the issue. Does the current development of digital finance have a positive effect on the improvement of economic resilience? How to use the cluster of digital financial resources to further promote economic resilience, so as to promote the stable development of the domestic economy, and drive the world economic recovery, has become a popular topic for academic research.

And the overall structure of the article is shown below: the first part, introduction and literature review part. The introduction section mainly describes the history and current situation of digital finance development in China and the significance of this paper; the literature review section summarizes the existing literature on the interaction between digital finance and economic development, the marginal contribution of this paper. The second part is theoretical analysis. This section gives economic theoretical support, such as financial geography and inclusion theory, and explains the impact mechanism of digital financial agglomeration on economic resilience. In the third part, the evaluation system of digital financial agglomeration is constructed from two perspectives of digital financial scale and digital financial efficiency, and the economic resilience is constructed from absorption, resistance, recovery and transformation. In the fourth part, the Spatial Durbin Model is constructed. In the fifth part, the empirical results are analyzed. The last part includes conclusion and recommendation.

1.2. Literature review

In recent years, with the popularization of digital technology applications, the development of digital finance has gained high momentum, and many scholars have begun to focus on the economic effects of digital finance. From a macro perspective, Han et al. (3) used SYS-GMM method and mediated effect model to study the transmission mechanism of the impact of digital finance on the high-quality economic development; Ma and Qu (4) analyzed the impact of digital inclusive finance on high-quality economic development from the perspective of rural human capital and digital divide; Lv et al. (5) studied the relationship between digital finance and the issue of green transformation of industrial economy; Zhou et al. (6) analyzed the mechanism of the role of digital finance for poverty alleviation and income increase, and believed that digital finance can increase income and reduce the regional income gap. From a microscopic perspective, Zhang et al. (7) analyzed the impact of the breadth of coverage, depth of use and the degree of digitization of digital finance on the high-quality development of enterprises through heterogeneity; Jiang and Jiang (8) found that the impact of digital finance on urban green economy efficiency is positive “U” shaped, and the impact was limited by the resource endowment of many cities from a non-linear perspective; Tian and Pan (9) studied the effect of digital finance development on urban economic efficiency and found that the effect was non-linear with increasing “marginal effect” as the level of digital finance development in cities increase. From the perspective of agglomeration, Liu and Dong (10) explored the impact of financial agglomeration on the development of the real economy from the perspective of digital financial inclusion. A few studies focused on digital finance and economic resilience, such as Cui (11) analyzed the impact of digital finance on economic resilience from the perspective of heterogeneity and intermediation effects. Whether from macro, micro or agglomeration perspectives, numerous scholars' studies have shown that digital finance has obvious effects on economic development, enterprise sustainability and urban efficiency, providing valuable reference values for the next studies in this paper.

Throughout the existing literature, it is found that the economic effects of digital finance and economic development have been richly researched, but there are still the following shortcomings: firstly, most studies focused more on the economic effects of digital finance, and less literature focused on the economic effects or spillover effects generated by digital financial agglomeration; secondly, there was a lack of literature combining digital financial agglomeration and economic resilience. Therefore, different from previous studies, this paper makes the following marginal contributions: (1) The existing literature focuses more on the impact of digital finance on economic development and ignores the agglomeration phenomenon of digital finance in more developed regions. This paper focuses on the economic effects and spillover effects generated by the agglomeration of digital finance. (2) The existing literature about the impact of digital financial agglomeration on economic resilience is relatively little, and how digital financial agglomeration affects economic resilience needs further analysis and proof. In this paper, we investigate the mechanism of the impact of digital financial agglomeration on economic resilience from the perspective of spatial spillover effects, and use the Spatial Durbin Model to decompose the impact of digital financial agglomeration on economic resilience into direct and indirect effects.

2. Theory

2.1. Economy theory

Financial geography is an emerging discipline between finance and geography, which refers to the study of finance-related issues by introducing spatial factors such as geographical distance and considering the impact of spatial geography on the issues under study (12). The “information externality,” “information hinterland,” and “information asymmetry” constitute the core theory of financial geography. The “information externality” suggests that in a certain geographical area, information itself has a certain public nature, and the place where the financial industry is concentrated is where there are many financial resources and banks and other financial institutions, and these banks and other financial institutions generate and aggregate a lot of information, and financial institutions can profit from the “information externality”; the “information hinterland” is the center of a region, where information is most concentrated and at the lowest cost, and where information can flow efficiently. Within the “information hinterland,” enterprises can obtain information at the lowest cost, which facilitates the flow of information between the demanded enterprises and financial institutions; the “asymmetric interest” divides information into standardized (public) information and non-standardized (internal) information, which is largely uncertain, and in the transmission of such information, ambiguity will arise due to distance loss and increase marginal costs, asymmetric information will prompt enterprises and financial institutions to gather in the information hinterland in order to grasp more information, forming financial agglomerations.

And the core view of financial inclusion theory is that financial inclusion is conducive to equitable economic development, helping to achieve the economic development goal of full employment, can promote the transformation of economic growth mode to intensive and efficient, realize the sharing of the fruits of economic development, and finally promote sustainable economic development (13). At the same time, financial inclusion is conducive to narrowing the gap between the rich and the poor, reducing the differences in financial development between regions, enhancing the regional allocation efficiency of financial resources, facilitating the overall regulation of financial development, and ensuring the stability of financial markets and economic operations. In addition, financial inclusion is also further generating more financial innovation products and services, changing the more backward part of traditional finance helps to provide a brand-new development momentum for the economy, and make financial markets more competitive.

2.2. Hypothesis

Consumption is an important source and driving force of economic growth, as well as an activity closely related to residents' daily life. Digital technology has greatly reduced the cost of financial services and at the same time lowered the cost of consumption for residents; Digital credit has lowered the capital borrowing constraint and improved the borrowing efficiency, while various kinds of financial innovation products are emerging one after another, such as consumer and mortgage credit, relieving the borrowing pressure and stimulating residents' willingness to consume. The combination of finance and science technology has led to the rapid development of digital finance, and digital finance is constantly developing in the direction of inclusiveness, comprehensiveness, directness and convenience. The development of Internet technology and digital technology has led to the flourishing of digital finance (9). Analyzed from the demand-side dimension, digital financial agglomeration firstly effectively reduces the cost of financial intermediary services, as many financial intermediaries in the agglomeration area compete fiercely to provide guaranteed financial innovation products while effectively lowering the price of the intermediary services they provide such as consulting and agency, providing urban and rural residents with lower cost consumption conditions; Secondly, digital financial agglomeration can also effectively reduce the lending constraints of funds by providing more financial innovation products such as consumer credit and mortgage credit, which widen the channels for individual residents to obtain consumption funds and are conducive to the expansion of the scale of consumption demand (10); Finally, financial agglomeration provides urban and rural residents with diversified investment, value preservation and quality services, which are conducive to improving the living conditions of urban and rural residents and stimulating their consumption requirements for social life. The expansion of consumption scale at the demand level triggered by digital financial agglomeration can not only crack the factor bottlenecks encountered in the production process of enterprises in local and larger regions to a greater extent, but also fundamentally solve the problem of excess products of enterprises. At the same time, it makes the product competition environment between enterprises increasingly intense, stimulates enterprises to continuously innovate and develop, and enhances the overall resistance and resilience of the economy. This leads to the hypothesis that:

H1: Digital financial agglomeration can have a positive effect on economic resilience by stimulating the expansion of consumption scale.

With the support of modern digital information technology, financial services have become more convenient, inclusive and comprehensive, and customers can conduct relevant business via the internet anytime and anywhere, no longer highly dependent on hardware devices such as banking institutions and ATM devices. In recent years, the rapidly developing digital finance has produced aggregation in spatial geography, which has a direct effect on enhancing the absorption, recovery, resistance and transformation of the regional economy. When digital finance clusters to the corresponding degree, it will produce a diffusion effect. The reasons are as follow: firstly, if a space gathers high-quality information technology, digital financial resources will be richer based on information technology; secondly, the supply will be greater than demand, which will lead to the squeeze effect, rising costs and profit-seeking phenomenon will also appear; Thirdly, a large number of digital financial resources, such as talent, technology and investment will be transferred from the high aggregation areas to neighboring, which will have an indirect effect on the improvement of economic resilience of neighboring regions. There are two main flow directions of digital financial resources, namely, the concentration and diffusion of digital financial resources (13). Concentration refers to the process of attracting a large amount of digital financial resources to a certain area to converge to that area continuously under the location advantage; Diffusion refers to the process of transferring digital financial resources to the surrounding areas, so that the resource density of the original agglomeration area slowly decreases (14). The development of digital financial agglomeration in the core region to a certain scale gradually leads to the transfer of inefficient resources from the core agglomeration to the surrounding areas, and at the same time attracts advanced technology and high-quality resources to the core agglomeration, thus improving the quality of economic development in the core region, which has a direct effect on the economic resilience of the region, and also drives the development of digital financial resources in the surrounding backward areas, which has an indirect effect on the economic resilience of the surrounding areas (15). This has an indirect effect on the economic resilience of the surrounding areas. It can be seen that financial agglomeration is not only the process of increasing “quantity,” but also the process of improving “quality.” This leads to the hypothesis that:

H2: Digital financial agglomeration has a direct effect on the improvement of economic resilience in the region, and can also contribute to the improvement of economic resilience in neighboring regions through indirect effects.

3. Index system

3.1. Index system of digital financial agglomeration

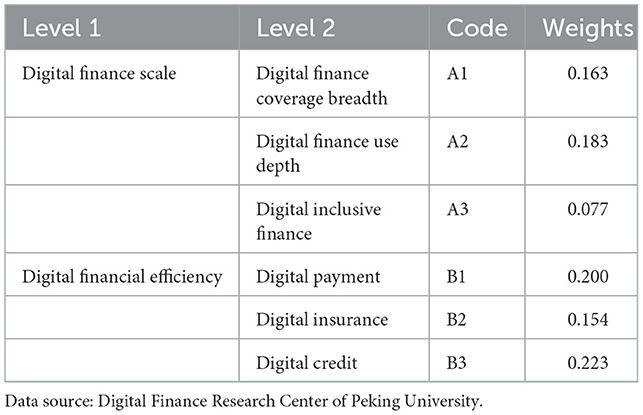

In this paper, we define digital financial agglomeration as the phenomenon that digital financial resources are spatially concentrated and distributed, and links are established between many economic agents, thus promoting the development of regional digital finance. According to the index provided by the Digital Finance Center of Peking University, interpretation of the indicators are given as follows: breadth of digital financial coverage is third-party account coverage, with greater third-party coverage indicating broader digital financial coverage. Depth of digital financial usage is the actual total amount of digital business and the degree of active usage; a higher actual total amount and a higher degree of active usage indicate a deeper use of digital finance; the degree of digital financial inclusion describes the convenience, low cost and creditability of digital financial services. The higher the convenience, lower the cost and higher the creditability, the higher the degree of digital financial inclusion. Digital payment, insurance, and credit refer respectively to the number of payments made by digital means per capita, the number of insured users per 10,000 Alipay users and the number of users of Internet consumer loans and small and micro business loans per 10,000 Alipay adult users.Therefore, the evaluation index system of digital financial agglomeration level is constructed, as shown in Table 1.

Based on Huggins and Thompson (16) coefficient of variation method, this paper confers weights to the comprehensive evaluation indicators of digital finance agglomeration level, the formulas are as follows:

wi, cvi, ϑi, and , respectively denote indicator weights, coefficients of variation, standard deviations, and means. Scholar Ma et al. (17) provided a reference to measure the digital financial agglomeration level of each province with the comprehensive weighting method, and the formula is as follow, where ln Xi is the digital financial index taken as the logarithm.

According to the calculation results of indicator weights shown in Table 1, the lowest is the indicator weight of digital extent of inclusive finance, which is 0.077, and the weights of the remaining indicators are >0.150. The indicator weight of digital insurance is twice the weight of the digital inclusive finance digitization index, which is 0.154, indicating that it is less important in the scale of digital finance, and digital insurance index is more important. Digital finance coverage breadth and depth indicators are only second in importance to digital payment and digital credit, with digital credit indicator having the highest weight of 0.223, indicating that digital penetration is the most important for the development of credit business in the process of digital financial agglomeration.

3.2. Index system of economic resilience

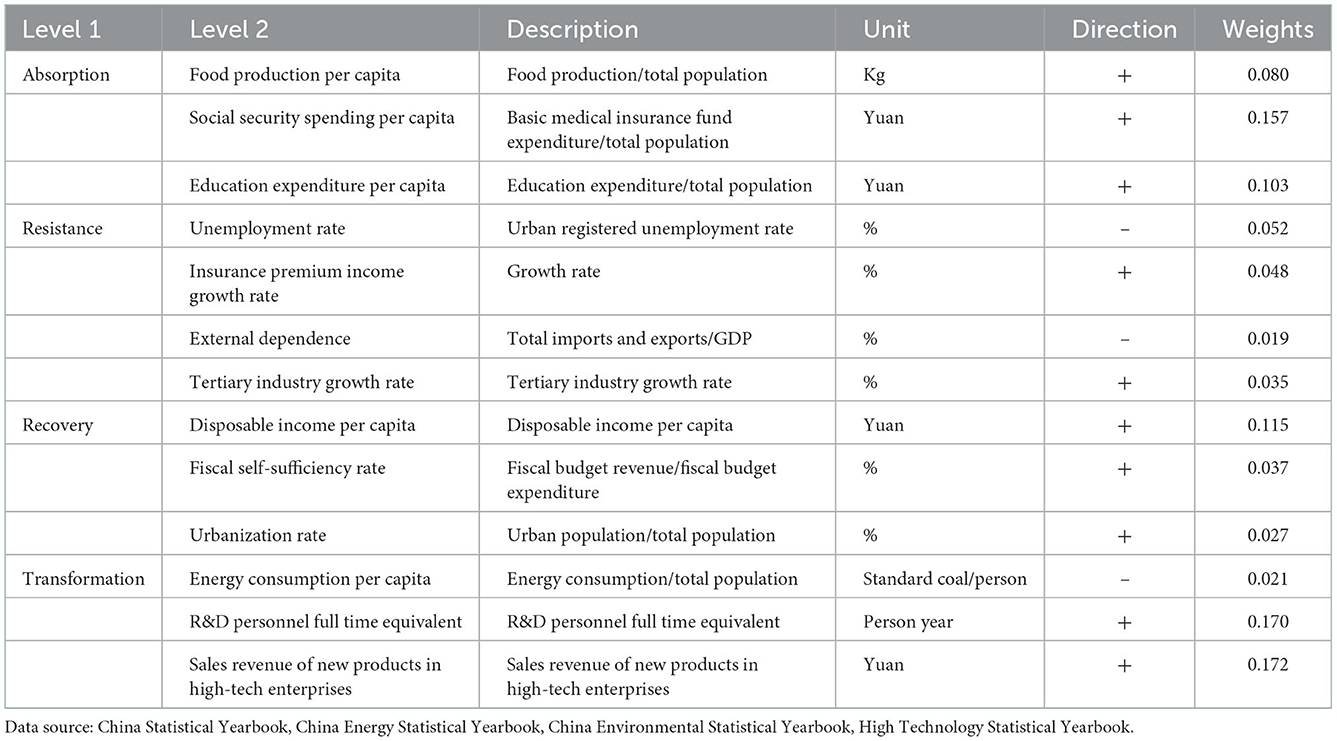

Economic resilience refers to the ability of the economy to resist and recover from external shocks. Economies need to have four capabilities when facing strong shocks, which are the ability to bear losses, to react, to restore stability and to transform the development path. Therefore, four primary indicators of absorption, resistance, recovery and transformation are set as follows, and 13 secondary indicators are selected to build the evaluation system of economic resilience indicators.They are shown in Table 2.

Considering that the most basic material security and education security are essential when an economy is at risk, thus food production per capita, social security spending per capita, and education expenditure per capita are selected for the indicators of absorption capacity. For resistance, indicators are selected from social, financial, trade, and industrial perspectives. High unemployment rate indicates the weakness of the economy, insurance premium income growth rate represents the resilience of the financial sector, external dependence is the dependence of the economy on foreign trade, and tertiary sector growth rate measures the resilience of the service sector to risks. In terms of recovery, disposable income per capita represents consumption capacity, which can rapidly drive economic growth and promote economic recovery in a short period of time; a high fiscal self-sufficiency rate indicates that government can better balance fiscal revenue and expenditure, which also plays a role in economic recovery; a high urbanization rate indicates that the urban population is increasing and the economy has a strong ability to recover. Lastly, the higher the energy consumption per capita, the higher the demand and dependence on energy, and the more difficult the transformation of the economy, while the full-time equivalent of R&D personnel and the sales revenue of new products in high-tech enterprises reflect the strength of the high-tech field, which plays an important role in enhancing the transformation ability of the economic system.

With the evaluation provinces in the year l are m and the evaluation indicators are n, the original sample is assumed to be X = (xij)m×n, xij is the value of the i provinces under the j indicators, where i = {1, 2, ..., m}, j = {1, 2, ..., n}, Eqs 3, 4 are treated for indicators with different directions of action. Equation 5 calculates the weight of different provinces in the evaluation index. Equation 6 calculates the entropy value of the index and Eq. 7 calculates the weights of the indicators. In Eq. 8, where σj is the weight of each indicator and aij is the corresponding value of the indicator after the positive and negative directional processing.

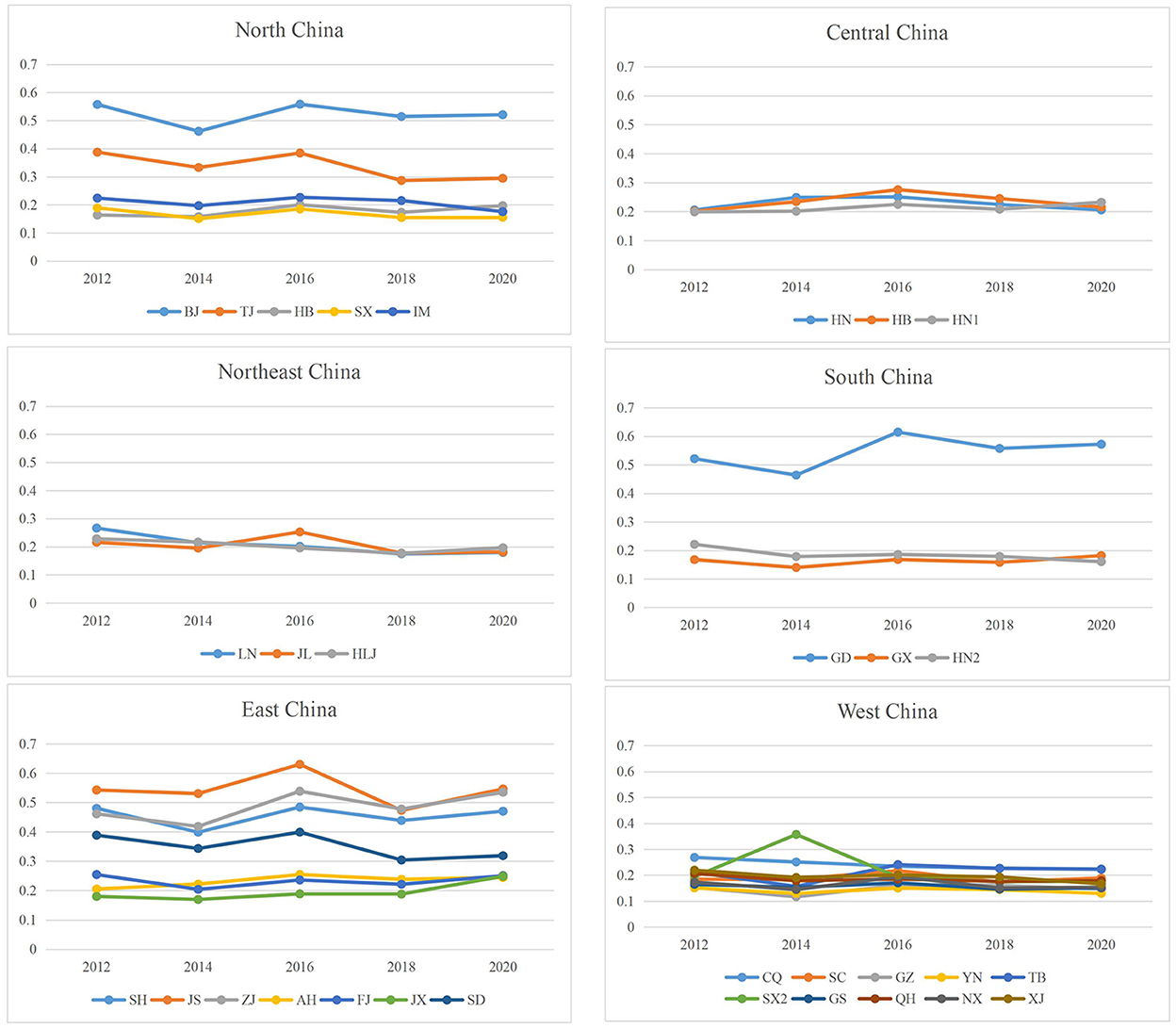

Therefore, the economic resilience is calculated and the results are shown with the form of Figure 1. And at the same time, 30 provinces are divided into six parts. We can clearly see that the economic resilience of six provinces in Central China and Northeast China in 2012–2020 is generally between 0.2–0.3, and the western regions are more overlapping, indicating that the economic resilience of similar regions is closer, but the economic resilience of Shanxi (SX) Province in 2014 increased from the 0.1–0.2 range to 0.3–0.4, and after 2014 it returned to 0.1–0.2 range, indicating that the economy of Shanxi Province was more resistant to risks in 2014, and in general, it still tends to be stable. The economic resilience of Beijing (BJ), Jiangsu (JS), Shanghai (SH), Zhejiang (ZJ) and Guangdong (GD) is higher, which is in the 0.5–0.6 range, indicating that these regions are strong in economic absorption, resistance, recovery and transformation. While the economic resilience of other provinces is mostly in the 0.2–0.3, 0.3–0.4 range, with a few provinces in the 0.2–0.3, 0.3–0.4 range. The economic resilience of other provinces is mostly in the range of 0.2–0.3, 0.3–0.4, and a few are lower, such as Guizhou (GZ) and Yunnan (YN), in the range of 0.1–0.2, and the overall trend is also relatively stable.

3.3. Statistic

Table 3 provides a statistical description of the main variables. Since this paper studies the spillover effect of digital financial agglomeration on economic resilience, economic resilience (ROE) is the explanatory variable and digital financial agglomeration (DDF) is the core explanatory variable. Based on research hypothesis H1, the mediating variable is selected as consumption scale (CS), expressed as total retail sales of consumer goods per capita, and the interaction term is digital financial agglomeration × consumption scale (DDF × CS). In addition, to prevent significant errors in the measurement results, public infrastructure (INF), industrial scale (IND), and environmental governance (ENV) are therefore selected as the control variables. The control variables are selected to ensure that these additional other factors do not cause significant errors for the study of the spillover effects of digital financial agglomeration on economic resilience. Public infrastructure includes various categories, referring to Jiang scholar (18), the number of highways, communication cables, and airport stations are selected to represent the level of public infrastructure; Industrial scale is represented by the ratio of the number of industrial enterprises above the scale to the number of all types of enterprises, and environmental governance is selected as the amount of domestic waste removal, the higher the amount of domestic waste removal, the more importance the region attaches to the environment The higher the amount of domestic waste removal, the higher the importance of the environment (19).

4. Method

4.1. Spatial correlation test

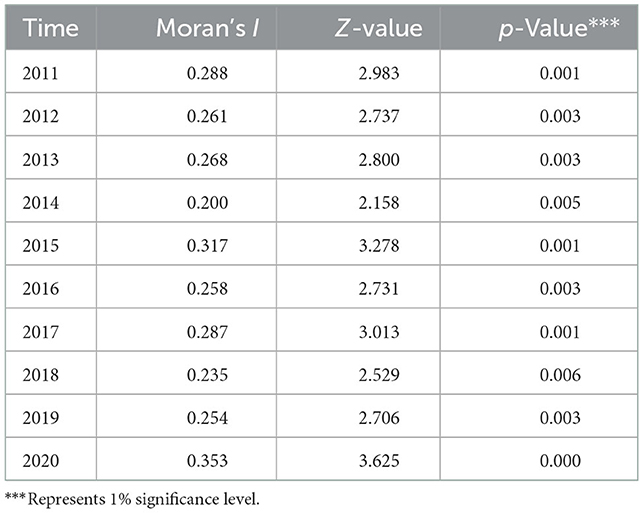

Moran index is used to describe the average degree of correlation and its significance among all spatial units of the whole study area quotient. Thirty provinces are used as a sample to examine whether there is spatial self-relation of the variables. If the high-efficiency areas are surrounded by high-efficiency, and the low-efficiency areas are surrounded by low-efficiency, it indicates the existence of positive self-relation. This spatial self-relation test was conducted by Matlab2021.B software to examine the explanatory variable, economic resilience. The calculation results are shown in Table 4.

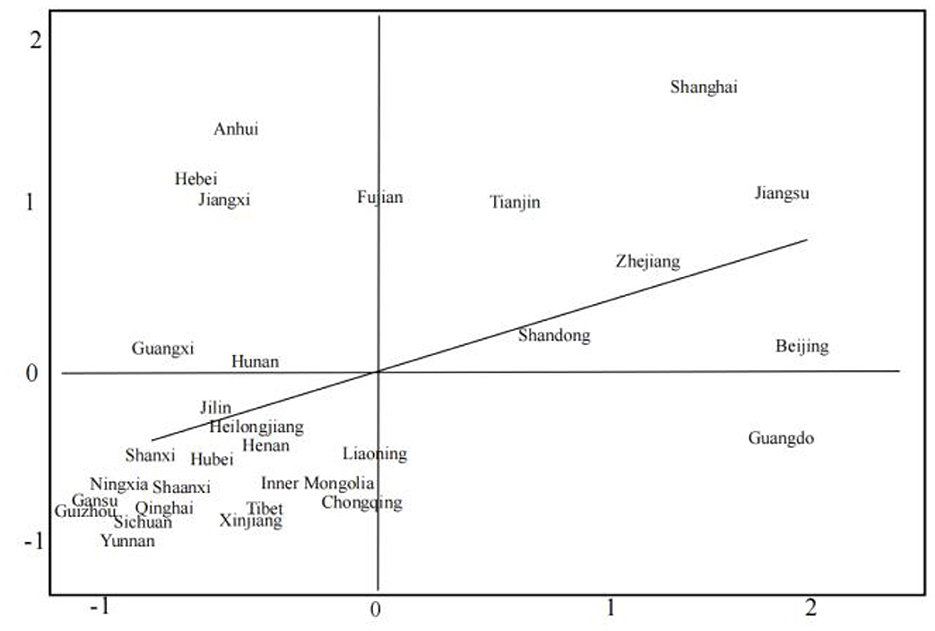

The p-values in Table 4 are significant at the 1% level and pass the test, and the Moran index of economic resilience are positive in the range of 0.200–0.353, indicating that there is a positive spatial correlation between the economic resilience of 30 provinces (except Hainan Province) in China during 2011–2020. From the trend of index change, it is obvious that the trend is unstable before 2018, and the spatial correlation of economic resilience has increased in the past 3 years. And from the Moran scatter plot (Figure 2), it can be seen that Beijing, Tianjin, Shanghai, Jiangsu, Zhejiang, and Shandong fall in the high-high aggregation range, indicating that the economic resilience of these provinces themselves and the surrounding areas are high, while Heilongjiang, Jilin, Inner Mongolia, Chongqing, and Yunnan fall in the low-low aggregation range, indicating that the observed values of economic resilience of these provinces and the surrounding areas are low, and Guangdong falls in the high-low aggregation range, indicating that the economic resilience of Guangdong province is higher compared to the surrounding areas, while Anhui and Guangxi fall in the low-high aggregation range, which indicates that the economic resilience of the surrounding areas in these regions is observed to be higher.

4.2. Spatial Durbin model

The results of the Moran index test for economic resilience in 30 provinces indicate the existence of spatial positive correlation of the explanatory variables, so it is necessary to construct a spatial panel model. Firstly, consider the construction of a general panel model as a reference, with all variables added individually, denoted as model 1. On the basis of model 1, the interaction term of digital financial agglomeration and consumption scale is added, which is denoted as model 2; On the basis of model 1, a spatial panel model is constructed, which is denoted as model 3; On the basis of model 3, the interaction term of digital financial agglomeration and consumption scale is added, which is denoted as model 4.

Model 1:

The explanatory variable is economic resilience (ROE), the core explanatory variable is digital financial agglomeration (DDF), the moderating variable is consumption size (CS), and the control variables are public infrastructure (INF), industrial size (IND), and environmental governance (ENV). i denotes province, j denotes year, α0 is the constant term, the rest are the coefficients of each variable, and ϑij is the error term.

Model 2:

Based on the ordinary panel model construction, the interaction term of digital financial agglomeration and consumption scale (DDF × CS) is added to explore how the interaction between digital financial agglomeration and consumption scale affects economic resilience.

Model 3:

Based on the ordinary panel model construction, a spatial panel model without the interaction terms of digital financial agglomeration and consumption size is constructed. β0 is the constant term, the rest are the coefficients of each variable, W is the spatial weight matrix, and τij is the residual term.

Model 4:

Based on model 3, the interaction term of digital financial agglomeration and consumption size (DDF × CS) is added as a way to explore how the interaction between digital financial agglomeration and consumption size affects economic resilience in the spatial model.

5. Results analysis

5.1. Analysis of regression results

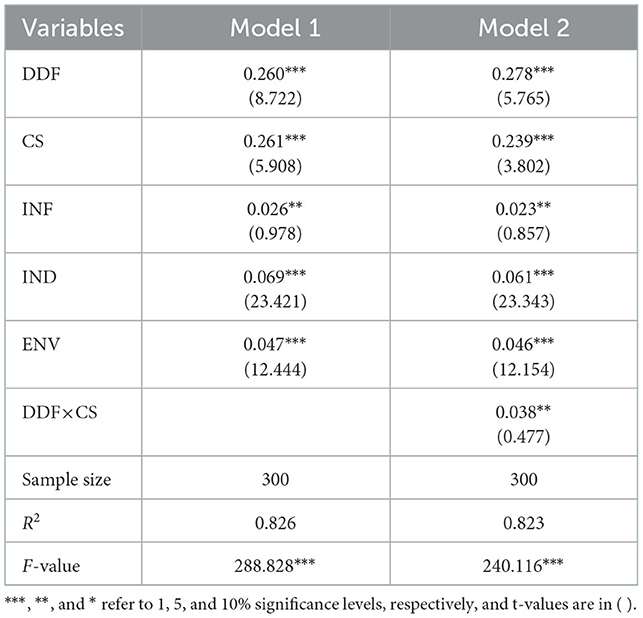

With the help of SPSSPRO software, the results are shown in Table 5, where the interaction term between digital financial agglomeration and consumption scale does not exist in Model 1. The effect of public infrastructure and environmental governance on economic resilience is also positive, but not significant enough compared to digital financial agglomeration, consumption scale and industrial scale, especially public infrastructure, which has the least significant effect on economic resilience, with a regression coefficient of 0.026, passing the test at the 5% level.

The most significant effect of digital financial agglomeration on economic resilience can be seen in model 2, which passes the test at the 1% level; the regression coefficient of the interaction term between the two is 0.038, which passes the test at the 5% level and is significantly positive, indicating that digital financial agglomeration can have a positive effect on economic resilience by expanding the scale of consumption, confirming hypothesis H1.

With the help of Stata15.0, this paper leads to a result that the Hausman test on the panel data yields a p-value of 0.002, rejecting the original hypothesis of random effects and determining the choice of fixed effects for the model. The LM test reveals that the p-value is significant at the 1% level, indicating that both spatial error effects and spatial lag effects exist, and either the spatial error model (SEM), spatial lag model (SLM) or spatial Durbin model (SDM) can be selected. The p-value in the LR test is also significant at the 1% level, indicating that the SDM model cannot be degraded to SLM or SEM model, so this paper selects the Spatial Durbin model (SDM) is chosen for the empirical analysis.

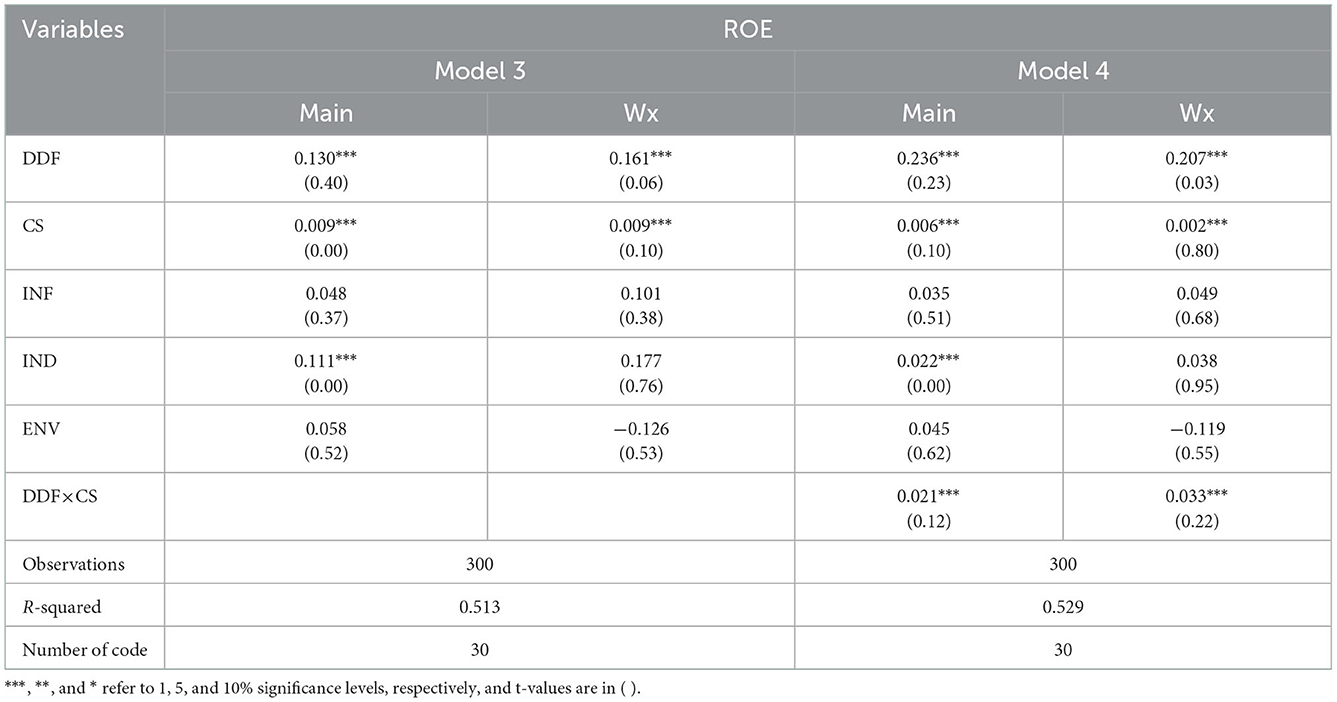

Table 6 shows the SDM regression results for models 3 and 4. It can be seen that the regression coefficient of the interaction term between digital financial agglomeration and consumption size in model 4 is significantly positive at the 1% level, indicating that digital financial agglomeration can have a positive effect on economic resilience by means of expanding consumption size, confirming hypothesis H1 again.

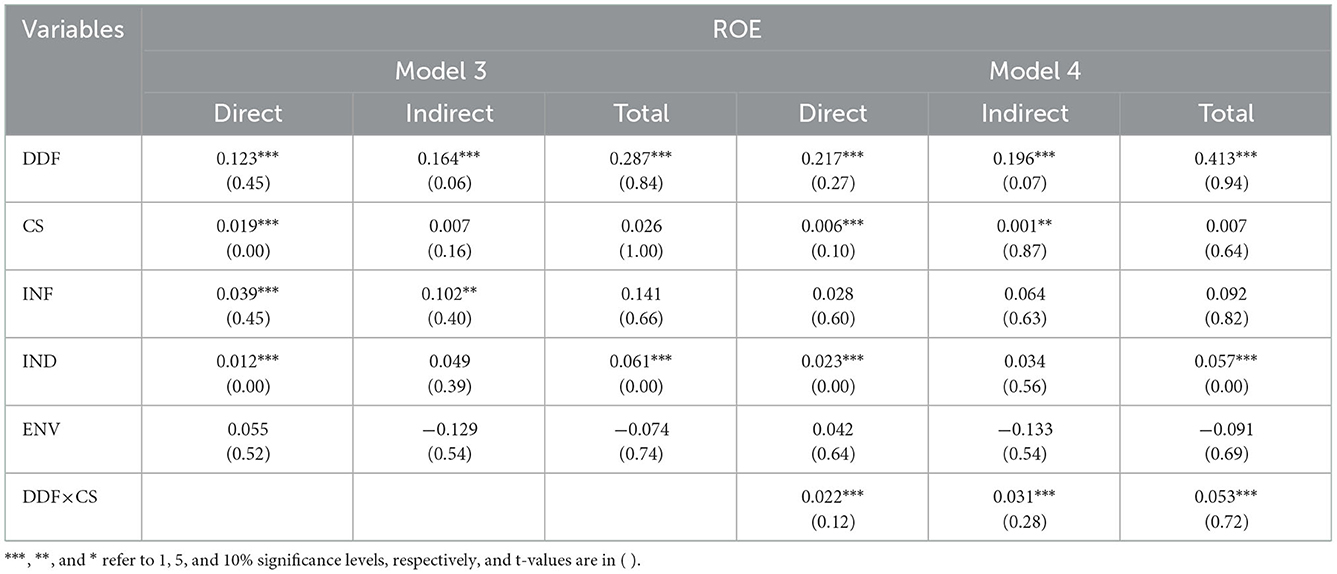

The direct, indirect, and total effects of each variable on economic resilience cannot be specifically known by observing only the spatial term regression coefficients of the Spatial Durbin model, so decomposition is performed. Before decomposing the spillover effects, the type of fixed-effects model needs to be determined, and the panel data are tested for time, individual, and double fixed-effects models, and the R2 value is the largest for the double fixed-effects model, so the double fixed-effects model is chosen. On the basis of the double fixed-effects model, the spillover effects are decomposed, including direct effect (Direct), indirect effect (Indirect) and total effect (Total).

In Table 7, we can see the direct effect coefficient of digital financial agglomeration is 0.123 and the indirect effect coefficient is 0.164 from model 3, which are significant at 1% level of significance, indicating that digital financial agglomeration can enhance the economic resilience of neighboring regions, confirming hypothesis H2; the indirect effect coefficient of consumption scale is 0.007, which is not significant enough, and the indirect effect coefficient of environmental governance is −0.129, which is not significant, thus indicating that the effect of consumption scale and environmental governance in this region on the enhancement of economic resilience of neighboring regions is not significant enough.

The direct effect coefficient of digital financial agglomeration is 0.217 and the indirect effect coefficient is 0.196 in model 4, both of which are significantly positive at 1% significance level; there is also a positive effect of consumption scale on the improvement of economic resilience; the direct effect coefficient of the interaction term between digital financial agglomeration and economic resilience is 0.022, that means digital financial agglomeration promotes the improvement of economic resilience through stimulating consumption scale. The indirect effect coefficient of both is 0.031, which is significant at 1% significance level, indicating that digital financial agglomeration, after stimulating the scale of consumption, can also lead to the improvement of economic resilience in the neighborhood; Among the three control variables, the indirect effect coefficients of public infrastructure, industrial scale, and environmental governance are 0.064, 0.034, and −0.133, indicating that in model 4, the control variables are not significant in enhancing the economic resilience of neighboring regions.

5.2. Robustness tests

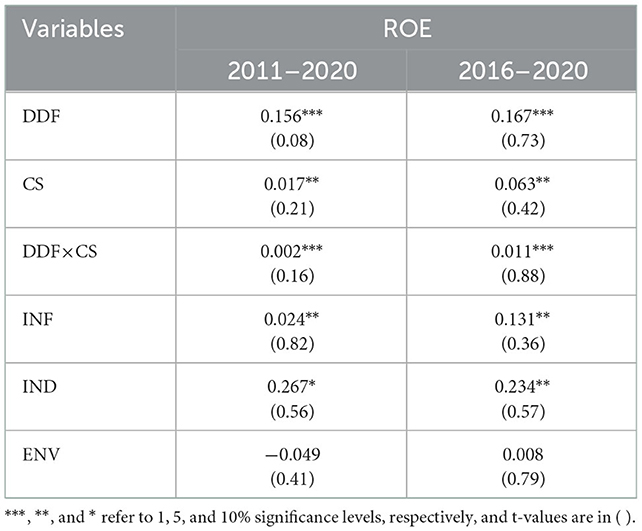

In order to ensure the basic conclusion that digital financial agglomeration has a positive effect on economic resilience, robustness tests are conducted. The significance of the robustness test is to ensure that the conclusions drawn in the article do not change dramatically depending on the change in the data used now, such as when others use a similar piece of data, or when the sample size of the data in this paper differs, the conclusions still hold, which ensures the reliability of the conclusions (20). Since 2011–2016 (noted in the foreword) was a high rate of digital financial development, while it slowed down after 2016, thus, this paper test data 2016–2020 separately from the overall sample of 2011–2020 concerning the impact of digital financial agglomeration on economic resilience. Compare with the test for the overall sample from 2011 to 2020, if the effect of digital financial agglomeration on economic resilience remains significant after reducing the sample data to 2016–2020, it passes the robustness test.

The results are shown in Table 8. Obviously we can see that DDF and CS variables are significant under the level of 1 and 5%. And the interactive item DDF × CS is still significant under the level of 1%. Major variables all pass the robustness tests whether based on sample data from the 2011–2020 or 2016–2020.

6. Discussion

This paper uses panel data of 30 provinces (except Hainan Province) from 2011 to 2020, introduces digital financial agglomeration, measures the economic resilience of each province and conducts spatial correlation tests, makes research hypotheses based on the theory of diffusion effect of digital financial agglomeration, and constructs an SDM model to empirically analyze the spillover effect of digital financial agglomeration on economic resilience. The main conclusions are as follows: (1) Digital financial agglomeration can have a positive effect on the improvement of economic resilience by expanding the scale of consumption. (2) Digital financial agglomeration has a direct effect on the economic resilience of the region and an indirect spillover effect on the economic resilience of neighboring regions. (3) The effects of the main explanatory variables on economic resilience pass the robustness test, and the positive effects of digital financial agglomeration, consumption scale and the interaction term of the two on economic resilience are significant.

To further leverage the positive effects of digital financial agglomeration on the economic resilience of the region and neighboring regions, suggestions are made as follows.

Firstly, the digital financial agglomeration can play an economic effect or a spillover effect, so it is recommended to increase the support for the financial industry, improve the construction of financial infrastructure, optimize the financial ecological environment, and provide guarantees for giving full play to the financial function.

Secondly, digital financial agglomeration can have a positive effect on economic resilience by stimulating residents' consumption. Therefore, it is recommended to focus on residents' consumption power, implement various policy measures such as fiscal and taxation to encourage consumption, and guarantee residents' consumption demand, so as to boost digital financial agglomeration to promote the economic resilience of the region and neighboring regions.

Thirdly, regarding the distribution of regional digital financial resources, it is recommended that efforts be made to eliminate the unevenness of financial resources and promote the coordinated development of regional economies. Formulate differentiated financial development policies according to local conditions. For cities with a low level of digital financial concentration, set preferential policies to attract banks and insurance institutions from outside the region to set up institutions in the region, promote the construction of local financial institutions, enhance the supply capacity of commercial banks in the region by optimizing and adjusting the credit structure, further relax the management of asset-liability ratio, appropriately increase the intensity of credit issuance, and improve the financial investment in the region. For cities with a high level of digital financial agglomeration, they should strengthen the cooperative relationship with neighboring cities, accelerate the flow of financial resources between different cities, make full use of the spatial and temporal radiation effect of financial industry clustering, and pull the development of the financial industry market in neighboring cities.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fams.2022.1085563/full#supplementary-material

References

1. Guo F, Wang JY, Wang F, Kong T, Zhang X, Cheng ZY. Measuring the development of digital inclusive finance in China: indexing and spatial characteristics. China Econ Q. (2020) 19:1401–18. doi: 10.13821/j.cnki.ceq.2020.03.12

2. Commentary Department of this Newspaper. Implementing the New development concept is the only way for China to grow and develop in the new era [N]. People's Daily. (2022) March 18.

3. Han A, Li M, Gao ZH. Measurement of economic resilience under epidemic shock and analysis of influencing factors. Stat Decis Mak. (2021) 37:85–9. doi: 10.13546/j.cnki.tjyjc.2021.18.019

4. Ma HL, Qu XE. The impact of digital inclusive finance on high-quality economic development: an analysis based on the perspective of rural human capital and digital divide. Explor Econ Issues. (2021) 173–90.

5. Lv ZX, Bao Q, Ren LM, Li YC. Can digital finance promote the development of green transformation of industrial economy? –an empirical analysis based on data of industrial enterprises above the scale. Sci Technol Manag Res. (2021) 41:184–94. doi: 10.3969/j.issn.1000-7695.2021.24.024

6. Zhou L, Liao JL, Zhang H. Digital inclusive finance, credit availability and resident poverty alleviation - micro evidence from Chinese household survey. Econ Sci. (2021) 145–57.

7. Zhang CZ, Chang B, Yang JN. Research on the impact of digital finance on the high-quality development of real enterprises–empirical evidence based on Zhejiang. East China Econ Manag. (2022) 36:63–71. doi: 10.19629/j.cnki.34-1014/f.210727008

8. Jiang HL, Jiang PC. Available online at: https://kns.cnki.net/kcms/detail/51.1268.G3.20220211.1206.012.html (accessed February 14, 2022).

9. Tian HS, Pan MQ. Study on digital financial development and urban economic performance spatial effects and threshold characteristics. Econ Issues. (2021) 22–8. doi: 10.16011/j.cnki.jjwt.2021.12.005

10. Liu WG, Dong YH. Research on the impact of financial agglomeration on the development of real economy from the perspective of digital inclusive finance. Hainan Finan. (2021) 53–61. doi: 10.3969/j.issn.1003-9031.2021.08.007

11. Cui GR. Can digital finance enhance China's economic resilience. J Shanxi Univ Finan Econ. (2021) 43:29–41. doi: 10.13781/j.cnki.1007-9556.2021.12.003

12. Sun YQ. Spatial Spillover Effect of Financial agglomeration on Industrial Structure Upgrading in the Eastern Region. Qingdao: Qingdao University (2021).

13. Jiang FJ. Research on the Impact of Digital Inclusive Finance on Urban Economic Resilience. Shanghai: Shanghai Normal University (2021).

14. Kindle Berger CP. The formation of Financial Centers: A Study of Comparative Economics History. Princeteon: Princeton University Press (1974).

15. Zhang TD. Financial agglomeration and science and technology innovation: facilitation or crowding out? —a panel threshold study based on 17 cities and states in Hubei Province. Sci Technol Manag Res. (2019) 39:8–14. doi: 10.3969/j.issn.1000-7695.2019.05.002

16. Huggins R, Thompson P. Local entrepreneurial resilience and culture: the role of social values in fostering economic recovery. Camb J Reg Econ Soc. (2015) 8:313–30. doi: 10.1093/cjres/rsu035

17. Ma Y, Jiang YC, Fu L. Economic openness, financial agglomeration and efficiency of financial support to the real economy. Int Financ Stud. (2021) 3–11. doi: 10.16475/j.cnki.1006-1029.2021.02.001

18. Jiang GG. Study on the Spatial Spillover Effect of Financial Agglomeration on China's Regional Economic Growth. Kunming: Yunnan University of Finance and Economics. (2020).

19. Yan YK, Chen HY, Yang ZZ. Analysis of the impact effect of financial agglomeration on regional economic growth in Guangdong–based on threshold characteristics and spatial spillover empirical evidence. North Financ. (2022) 23–29. doi: 10.16459/j.cnki.15-1370/f.2022.10.009

20. Lian YJ,. What are the Methods of Robustness Test? Zhihu (2021). Available online at: https://www.zhihu.com/question/394735840

Keywords: digital financial agglomeration, economic resilience, SDM, spillover, effect

Citation: Zhu Z, Yang Y and Li H (2023) A study of the spillover effects of digital financial agglomeration on economic resilience. Front. Appl. Math. Stat. 8:1085563. doi: 10.3389/fams.2022.1085563

Received: 31 October 2022; Accepted: 23 December 2022;

Published: 11 January 2023.

Edited by:

Stefan Cristian Gherghina, Bucharest Academy of Economic Studies, RomaniaReviewed by:

Shuangshuang Fan, China University of Mining and Technology, Beijing, ChinaJiajun Ning, Beijing Normal University, China

Lixin Xiong, Central South University Forestry and Technology, China

Copyright © 2023 Zhu, Yang and Li. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Hongyan Li,  MTc1NTU3NTA5OCYjeDAwMDQwO3FxLmNvbQ==

MTc1NTU3NTA5OCYjeDAwMDQwO3FxLmNvbQ==

Zhiming Zhu

Zhiming Zhu Hongyan Li

Hongyan Li