- Economics Unit, School of Technology and Business Studies, Dalarna University, Falun, Sweden

Italy is facing high pressure to meet objectives to recycle waste and national waste management targets set by the European Union Waste Framework Directive (2008/98/EC; EC European Commission, 2008). However, waste collection and recycling waste costs pose major problems (addressed here) at municipal level for the Italian waste management system. The empirical literature on waste management has paid much more attention to demand-side aspects (reduction and discouragement of land disposal and promotion of recycling and recovery) than to supply-side issues such as analysis of waste management costs. This paper addresses the gap in this research field by estimating the cost function of providing waste collection and recycling services for Italian municipalities during the years 2011–2017. Specifically, we estimate cost elasticity and marginal costs to determine if there are economies of scale for recycling urban waste. Our findings suggest that increasing recycling rates would not substantially increase total costs for most of the municipalities, so recycling should be encouraged, especially for municipalities with low recycling rates. In particular, we observe that cost elasticity is higher in northern municipalities than in central and southern Italian municipalities. Our cost function exhibits economies of scale until a certain amount of recycled waste. The results provide insights into the cost structure of recycling that may lead to more efficient waste management.

Introduction

Due to increasing costs of urban waste collection, transportation and processing, in recent years many municipalities have assessed their waste management programs (Greco et al., 2015), and waste management costs have become a serious issue in several countries (Passarini et al., 2011; Jacobsen et al., 2013; Victor and Agamuthu, 2013). Waste management also has increasingly important political implications in the European Union (EU). A revised legislative framework on waste, within the EU's action plan for a Circular Economy (EU, 2018; European Commission, 2018), came into force in July 2018. It establishes clear targets to reduce waste, setting an ambitious long-term plan for waste management, particularly for recycling waste. New targets include recycling 65 and 75% of all waste by 2025 and 2030, respectively, recycling 60 and 70% of urban waste by these dates, and reducing shares of waste going to landfill to 25% in 2025 and 5% in 2030.

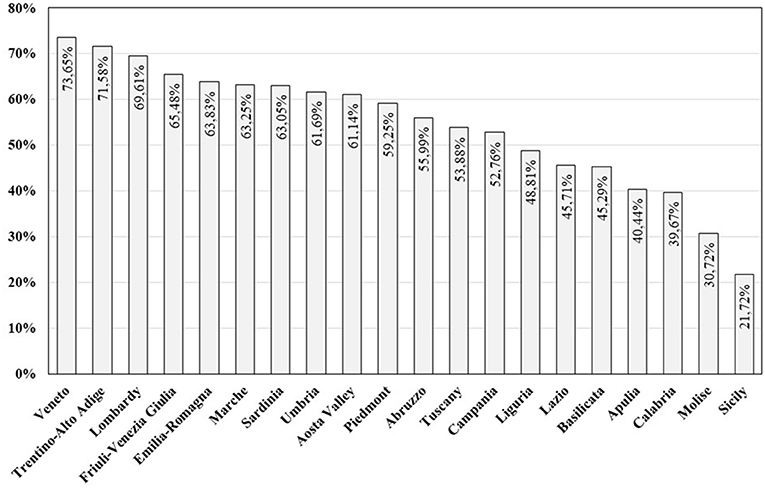

Accordingly, waste management and recycling have been major concerns in Italy in recent years. The separate urban waste collection rates are increasing in all Italian regions and for all waste fractions. In 2017, the national average separate urban waste collection rate was 55% (66, 51, and 41% in the north, center and south; ISPRA, 2018). Overall, Italy seems to be making good progress toward reaching another EU target, of a separate municipal waste collection and recycling rate of 50% by 2020 [The Waste Framework Directive (EU, 2008, 2018; European Commission, 2018)]. However, there is strong geographical heterogeneity in waste management and recycling in Italy, with substantial cross-regional differences. In 2017, only 13 out of 20 regions achieved the national separate collection target (50%) and rates ranged from just 21.7% in Sicily to 73.65% in Veneto. Thus, there are strong macro-area differences, with northern regions having comparable performance to the best in Europe, but southern regions lagging behind (Mazzanti et al., 2008; Agovino et al., 2017; Cerciello et al., 2018; Musella et al., 2019). There are also substantial variations within regions, provinces, and among municipalities, due to various factors that affect costs of sorting and collecting waste (Fiorillo, 2013; Greco et al., 2015; Agovino et al., 2016) and policies promoted by the local municipality (Bucciol et al., 2013).

Much of the empirical literature on waste management has focused mainly on demand-side aspects (discouragement of land disposal and encouragement of recycling and recovery) rather than supply-side aspects such as costs of waste management (Callan and Thomas, 2001).

Since the percentage of waste collected for recycling is now substantial but still not uniform across Italy, an analysis of the costs of recycling waste seems highly important. Our paper contributes to the literature in this field by investigating the Italian waste management system, in which the cost of separate waste collection and handling is a major issue. To do so, we estimate the cost function and cost elasticity of recycling waste for Italy at municipal level, exploiting a very rich panel dataset covering the years 2011–2017.

Provincial level datasets have been used in most previous empirical studies of waste management in Italy (Mazzanti et al., 2008; Musmeci et al., 2010; Agovino et al., 2016; Cerciello et al., 2018). In contrast, our dataset covers waste management in more than 3,000 Italian municipalities in each of the covered years, providing a strong element of novelty and enabling very detailed analysis. To our knowledge, this is the first paper using data covering such a huge sample of Italian municipalities and very recent years. We take into account costs of waste collection and recycling, economies of scale at different output levels and marginal costs of collecting and recycling waste. Marginal cost refers here to the additional cost associated with an additional unit of waste, such as changes in the total costs to recycle an additional kg of waste, while average costs are total costs of recycling waste divided by the total quantities of waste. Thus, the paper also contributes to the literature by estimating cost elasticities and marginal costs of recycling waste.

As cost estimation is a basic requirement for planning municipal solid waste management systems, the results may be useful for policymakers formulating strategies to increase proportions of recycled waste, and for determining levels of recycling waste at which there are positive returns to scale. The study provides estimates of marginal costs and cost elasticities of recycling waste across a wide range of output levels and all the macro-areas in Italy. Municipal-level costs of recycling an additional kg of waste provided in the paper may also be useful for policymakers.

The rest of the paper is organized as follows. Section legislative framework presents important background information about waste management legislation. Section overview of Italian waste production and costs gives an overview of Italian waste production and costs. Section literature review introduces relevant literature on costs of waste management. Section material and methods describes the dataset we employ and outlines the empirical framework. Section results and discussion presents the results, and section conclusions presents our final concluding remarks.

Legislative Framework

The EU has developed a common legal framework for waste management and treatment. This includes the Waste Framework Directive (2008/98/EC; EC European Commission, 2008), which establishes how waste should be treated within the Community. Its primary objective is to protect the environment and human health, by preventing the negative and dangerous effects associated with waste production and management. According to the Directive, this requires implementation of the following ‘hierarchy' of measures: prevention of waste, if possible, and sequential prioritization otherwise of preparation for reuse, recycling, other types of recovery (for example of energy) and disposal.

Every EU Member State can implement further legislative measures to strengthen this hierarchy, but human health must always be guaranteed and the environment respected. Furthermore, since waste production is tending to increase in Europe, the legislation strengthens measures intended to prevent its production, reduce related impacts and encourage waste recovery.

The Directive also includes two waste recycling and recovery targets to be achieved by 2020. These are: preparation for re-use and recycling of 50% of certain waste materials from households (municipal solid waste) and similar origins; and preparation for re-use, recycling or other recovery of 70% of construction and demolition waste.

In Italy, until the 1970's urban or “municipal” solid waste (MSW) was collected in an undifferentiated manner and disposed of mainly in uncontrolled landfills. Recycling and material recovery practices involving separate collection only began to spread in the country in the 1990's. Cardinal principles of waste management (which were previously fragmented) were established in the country by Ronchi's decree (law 22/1997), which introduced rules for: reducing waste production; encouraging recovery and recycling; increasing citizens' environmental awareness; and fostering active collaboration between companies and municipalities. However, the main innovation of the Ronchi Decree was introduction of a more equitable system of taxation for waste production, based on a simple principle: “the more you pollute, the more you pay”. To achieve the decree's objectives, waste services must be provided by a single operator in each of a set of Optimal Territorial Areas (OTAs) covering the country, designed to exploit economies of scale, scope and/or density (Massarutto, 2010).

Legislative Decree 152/2006, subsequently modified by Decree 205/2010 to transpose the 2008 Waste Framework Directive into national law, defines responsibilities of actors in the waste management system at national level. Italian national laws contribute to implementation of the waste management strategy by defining roles of regions, provinces and municipalities (NUTS−2,−3, and−4 in Nomenclature of Territorial Units for Statistics; reference). Regional authorities plan waste management strategies, provincial authorities control the waste collection process, and municipal authorities implement the operational strategies. Currently, municipalities are the key public managerial units.

Along with the common legislation, national laws contribute to the design and implementation of the waste management strategy and continue to follow the European legislation, which includes new recycling targets for 2025 and 2030, as mentioned in the introduction.

Overview of Italian Waste Production and Costs

In this section, we provide a short overview of the separately collected waste in Italy in 2017. We illustrate the percentage of recycling waste and provide costs in Euro for a kg of recycling waste in the period 2011–2017. As displayed in Figure 1, the European target of 50% of collected waste was not reached during this period by all Italian regions.

There were still clear cross-regional variations during the covered period. In 2017, the national separate collection target (50%) was not achieved by seven out of 20 regions, so Italy as a whole had not yet achieved the target. The regions with the highest and lowest separate collection rates were Veneto (73.65%) and Sicily (21.72%), respectively. Regions that did not meet the target are all in the south of Italy, except the northern region Liguria.

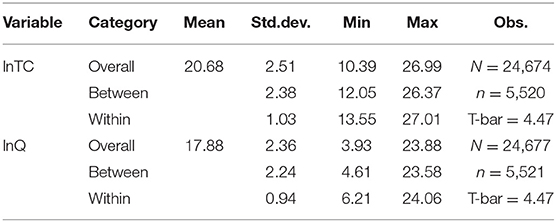

As shown in Table 1, the urban waste collection and recycling percentages increased over time between 2011 and 2017, but differences remained across the three macro-areas, and rates were consistently higher in the north than in the central and southern areas. On average, the overall national waste recycling rate was around 50%. These results reflect changes in the rate of waste collection, a key step for any waste recycling activities.

Table 2 shows costs (in Euro per kg) of recycling waste across Italy, and (inter alia) that costs of collecting and recycling it are lower in the north than in the center and south of Italy.

Literature Review

Substantial literature on the estimation of waste management costs has been published in the last 50 years. Authors of seminal studies lacked suitable data, so they used various proxies for unmeasured quantities of collected and disposed waste in waste cost functions, for example, municipal populations (Kitchen, 1976) or numbers of garbage trucks in operation. Scholars who used mainly proxy variables included Hirsch (1965), Kemper and Quigley (1976), Collins and Downes (1977), and Petrovic and Jaffee (1978). The cited authors estimated simple cost function models, by regressing average or total costs against output (generally the quantity of waste collected in a year, number of pick-up points, or other explanatory variables). Some of the studies also detected economies of scale in waste collection and disposal services. In one of the first, Tickner and Mcdavid (1986) found a relation between effects of scale in solid waste collection and market structure of 132 Canadian municipalities using a log-linear function. Their main conclusion was that doubling the size of pickup units (proxied using tonnage of waste collected) provided 14.5% estimated savings in costs.

In recent years, partly because the quality of available databases and econometric techniques used has improved, and partly because of the increasing needs to increase waste collection and recycling rate, numbers of studies on associated costs and drivers of costs have increased. Inter alia, various econometric methods have been applied to estimate cost functions of waste. Stevens (1978), Carroll (1995), Dubin and Navarro (1988) and Sorensen (2007), and Callan and Thomas (2001), among others, used Ordinary Least Squares (OLS) regression to estimate cost functions. Bohm et al. (2010) used Seemingly Unrelated Regression (SUR) methodology, while Zafra-Gómez et al. (2013) applied pooled OLS. Antonioli and Filippini (2002) applied a transcendental logarithmic (translog) function to estimate the cost function of waste collection for 30 Italian firms in the years 1991–1995. Their cost function allows values of economies of scale and density to vary with most of the output level.

The economies of scale (if any) in waste collection, disposal and recycling have also been addressed using estimated cost functions in previous empirical studies. In a study focused solely on recycling costs, Carroll (1995) found that average recycling costs per household in 1992 in 57 cities in Wisconsin (USA) were negatively correlated with a measure of population density. Moreover, no economies of scale were found. In another study, Callan and Thomas (2001) estimated curbside costs of collecting recycling materials, using data from 1996 to 1997 on 101 municipalities in Massachusetts (USA), and provided the first estimates of economies of scale in curbside recycling. They estimated two cost functions (one for disposing of waste, and one for recycling it) and identified economies of scale and scope effects of 5%. Their findings suggested the presence of constant returns to scale for waste disposal and increasing returns to scale for recycling waste.

In another investigation of disposal and recycling costs, at municipal level, Bohm et al. (2010) analyzed disposal and recycling costs of 428 municipalities in the USA in 1996 using two non-linear log cost functions (one for disposal and the other for recycling). They estimated these two quadratic cost functions simultaneously using Zellner's (1962) SUR model. Their results suggested the presence of economies of scale in both waste collection and disposal, and curbside recycling. However, economies of scale seemed to disappear at high levels of recycling. Their findings suggest that average waste disposal costs declined with increases in waste quantities, with increasing returns to scale. In contrast, the cost function for recycling they obtained had a U shape, suggesting that after a certain point costs per unit recycled waste started to increase sharply.

Bel and Fageda (2010) used a total cost function derived for 65 municipalities in Galicia, northwest Spain, in 2005, including the percentage of the total waste volume collected for recycling among the explanatory variables. Their results suggested that local governments should promote policies to increase recycling activities. More recently, Abrate et al. (2014) used two cost function specifications (translog and composite) in conjunction with non-linear generalized least squares estimation (NLGLSE) to investigate costs of waste disposal and recycling services for more than 500 Italian municipalities. They found that the studied refuse collection technology exhibited constant returns to scale, and economies of scope in waste disposal and recycling. Their analysis showed that as the size of municipalities increased the economies of scope rose up to 20%, accompanied by overall diseconomies of scale. They concluded that joint management of disposal and recycling waste should be supported and increasing the share of recycling waste would not necessarily result in considerable increases in total costs. In addition, Greco et al. (2015) analyzed determinants of solid waste collection costs of 67 Italian municipalities, and found that population size and density, percentage of separate collection, as well as percentages of home collection and private delivery, were significant drivers of the waste costs.

In summary, previous studies have provided valuable insights, but have estimated cost functions and identified economics of scale mainly for a country or municipalities, and mainly for 1 or 2 years.

Materials and Methods

This section provides an overview of the dataset we use and to provide a description of the empirical framework to estimate the function cost of collecting and recycling waste and describes the empirical framework applied to derive the cost function of collecting and recycling waste. The data are presented in Subsection data, while theoretical foundations of our modeling are introduced in Subsection econometric analysis.

Data

The data used in this work are taken from the Italian Institute for Environmental Protection and Research (ISPRA, 2019) which provides the annual statistical report on the waste sector according to the Eurostat and the European Environmental Agency guidelines (EEA, 2003a,b,c). The huge number of observations is a highly advantageous feature of our dataset, which has provided unique analytical opportunities.

Before introducing the variables that we are using in our econometric model, it is import to define boundaries of our “waste system.” The system boundaries begin at the point of collecting the waste to be recycled and end at the point at which the waste has been processed and transformed in product/secondary material that could be re-processed or re-used and re-sold. We must point out that the costs are expressed at the net of the revenues generated by the selling the secondary materials.

We consider the following variables:

- Cost of recycling urban waste (TC) in Euro per total kg of recycling waste; we consider only the direct costs represented by the separated waste collection costs and the treatment and recycling costs. We exclude all indirect costs (for example administrative costs, transport, etc.) in order to estimate effects of determinants of costs.

- Recycling waste (Q) expressed in kg produced at municipal level. This includes the sum of organic, paper and cardboard, glass, wood, metal, plastic, textile, electric, electronic, bulky, mixed, and recovery waste.

Both variables were converted to log form. Descriptive statistics are shown in Table 3. In addition, we control for the macro-area of Italy, following the Eurostat NUTS-1 classification, as follows:

Here: i = 1 is the north-west of Italy (Aosta Valley, Piedmont, Lombardy, Liguria) and the reference group of regions, i = 2 is the north-east (Friuli-Venezia Giulia, Veneto, Trentino-Alto Adige, Emilia-Romagna); i = 3 is the center (Tuscany, Marche, Lazio, Umbria), i = 4 is the south (Abruzzo, Molise, Campania, Basilicata, Apulia, Calabria), and i = 5 is the islands (Sicily and Sardinia).

The descriptive statistics show that there are quite large ranges of both costs and quantities of produced collected and recycled waste (Table 3). It is worth noting that we have a huge number of observations that makes our database unique.

Econometric Analysis

We specify a model in which the log of total costs is a cubic polynomial function of the log of output. This specification is flexible and allows determination of increasing, constant and decreasing returns to scale. However, the model is very parsimonious as it considers output quantity as the sole determinant of total costs. Generally, the single output cubic function is expressed as follows:

When using panel data, we can use a fixed effects or random effects model. The difference between fixed and random effects is whether the unobserved individual effect includes elements that are correlated with regressors in the model, not whether these effects are stochastic or not (Green, 2011).

A way to choose between the two models is to use the Hausman test (H) which tests the null hypothesis that errors (uit) are correlated with the regressors and thus the random effects model is more appropriate than the fixed effects model (Green, 2011).

From results of the estimation of Equation (1), we can then estimate cost elasticity, using the following expression:

The standard error of the cost elasticity is computed using the Delta method (Green, 2011, Appendix D.2.7).

A cost elasticity value, Ê allows us to determine if there are economies of scale, i.e., if the proportionate change in the total cost of production will be smaller than the proportionate change in total output, all else equal (and thus long-run average total costs decline with increases in output).

If Ê is smaller than unity, there will be economies of scale (increasing returns to scale), and average total cost will decline with increases in output.

If Ê is greater than unity, there will be diseconomies of scale (decreasing returns to scale), and long run average total cost will increase with increases in output.

If Ê is unity, there will be neither economies nor diseconomies of scale (constant returns to scale), and long run average total cost will be constant.

We also calculate the marginal cost of recycling. The rate of change in total cost per unit change in output is marginal cost, as defined in Equation (3). The ratio of total cost of the production to the output is the average cost.

The marginal cost is calculated by multiplying the cost elasticity by the average cost for each kg of waste as follows:

where average total costs (ATC) are total costs divided by output of recycling waste.

Results and Discussion

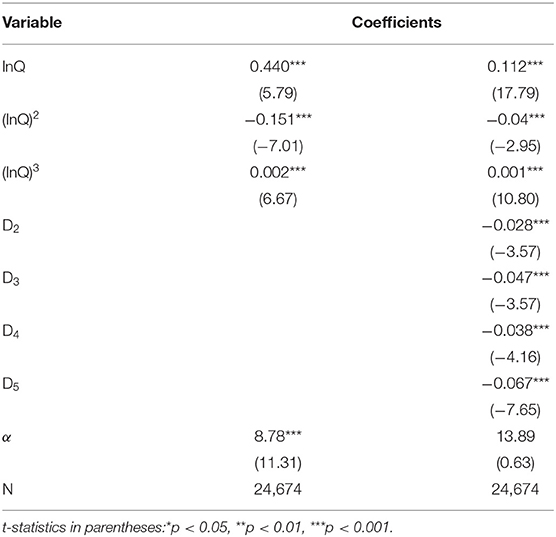

Results of estimating the fixed effects model (preferred according to the Hausman test (Hausman, 1978): H = 21; Prob > χ2 = 0.0000) expressed in Equation (1) are presented in Table 4. Since the municipalities are very different in size, robust standard errors are estimated to correct the heteroscedasticity. All parameter estimates are statistically significant and the coefficients have the expected signs. The coefficients in a log-log model represent the elasticity, which is defined as the percentage change in the dependent variable associated with a percentage change in an independent variable. Because higher order terms are included, these elasticities are not constant [see Equation (2)].

We can also obtain semi-elasticity, that is the relative change in cost of recycling waste, with respect to a dummy regressor, taking the antilog (to base e) of the estimated dummy coefficient and subtracting one from it then multiplying by 100: . Such calculations show that recycling costs in the north-east, center, south and islands (Sicily and Sardinia) of Italy are about 2.8, 4.8, 3.6, and 6.5% lower than in the north-west, respectively.

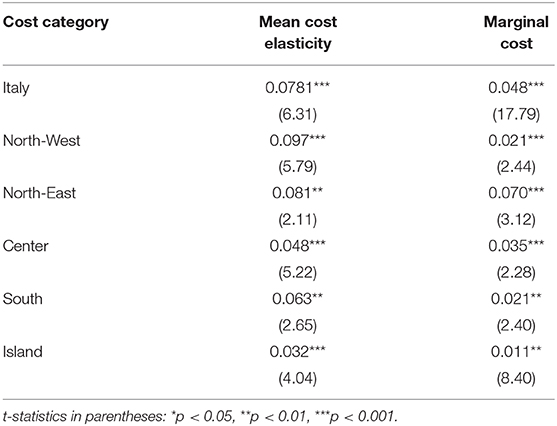

The calculation of cost elasticities for specific regions (or kinds of waste) is based on Equation (2). The estimated mean cost elasticity across Italy is 0.078 (significant at P < 0.05, Table 5). Thus, a 1% increase in recycling waste will give (or, more strictly, would have given during the study period) a 0.078% increase in costs of recycling waste, which is extremely low and pratically insignificant. Table 5 also displays cost elasticities and marginal costs for the five geographic areas in Italy. Interestingly, both cost elasticities and marginal costs are higher in the north-west area of Italy and decrease from the north to the south of the country.

The estimated mean cost elasticity in north-west and north-east are respectly 0.097 and 0.081. Thus, a 1% increase in recycling waste in north-west and north east will give a 0.097 and 0.081% increase, respectively in costs of recycling waste. In the south, center and in the islands of Italy, a 1% increase in recycling waste will give a 0.063, 0.048, and 0.032% increase in costs of recycling waste. Our results suggest that over the country from north to south, on average, there are decreasing return of scale, therefore waste recycling should be strongly supported.

We turn now into the marginal cost and our results suggest that it is more expensive to recycle an additional kg of waste in the north-east (by 0.070 Euro per Kg) than in the rest of Italy. The lower marginal cost is in the Islands and in the south of Italy, with 0.011 and 0.021 Euro per Kg, respectively. In the center of Italy, the marginal cost is lower (0.035 Euro per Kg) than the overall country (0.048 Euro per Kg). Our results indicate a lower marginal cost than previous works. In the study of (Dijkgraaf et al., 2008) the marginal cost of recycling was $80 per ton while in analysis of Bohm et al. (2010) results suggest that marginal costs vary with quantity, and they decreases from 111.40 to 12.19$ and achieve a minimum at about $75 per ton.

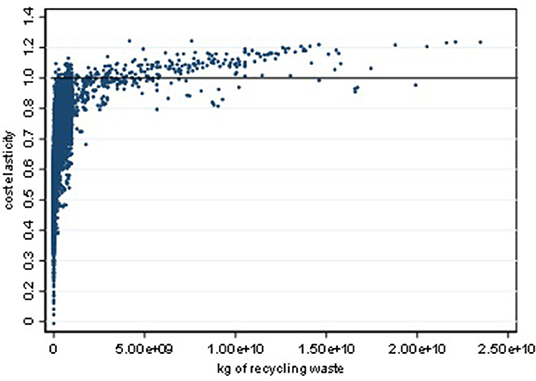

A scatter plot of predicted cost elasticities is displayed in Figure 2. A more detailed analysis of the cost elasticities shows that most of them are quite low and range from −0.01 to 1.22. The cost elasticity with respect to recycling waste is increasingly significantly with increases in quantities of recycling waste up to 500 billion kg per year, then it starts increasing at decreasing rate and levels off at around 1 with <500 billion kg of recycling waste and between 500 and 1,000 billion kg of recycling waste. Our results suggest that there are economies of scale in recycling waste at municipal level up to a certain level of recycling waste for most municipalities in Italy. Cost elasticity larger than one indicates that costs increase proportionally more than increases in recycling waste. In Figure 2, we can observe that when cost elasticity is above one, some municipalities exhibit diseconomies of scale as the amount of the recycling waste increases. Diseconomies of scale may result from the size of the municipalities, and lack of infrastructure, especially in municipalities in the south of Italy. Disoeconomies of scales may also be due to different municipal waste and recycling programs. Waste recycling activities are still dishomogeneous over Italy from north to the south. A possible explanation is that there is still a strong dependence on landfills, which in some regions are the only solution for waste management. Moreover, comsumer behavior and different regulations among regions can also be a possible cause of diseconomies of scales. Collection, treatment and waste recycling should be organized in order to overcome the current fragmentation of these activities within the same region in order to optimize the waste management. Therefore, regulatory stability is key to planning and financing investments to increase waste recycling in those municipalities which exhibit diseconomies of scale. The presence of diseconomies of scale was also found by Antonioli and Filippini (2002) for the largest firms in the sample using data on 30 Italian waste and disposal collection firms for years 1991–1995. In their paper, diseconomies of scale are larger for waste recycling than for waste disposal. Bohm et al. (2010) reported economies of scale for municipalities that recycle up to 13,200 tons and diseconomies of scale for larger quantities. Our sample of Italian municipalities exhibits diseconomies to scale, too, but they appear at higher output of waste recycling (see Figure 2). Dubin and Navarro (1988) found the existence of positive economies of scale in municipalities with fewer than 20,000 inhabitants, but not in municipalities with more than 20,000 inhabitants. Their results are in line with analyses of Bel and Fageda (2010) who also found economies of scale in small municipalities. Our analysis cannot support the same results because we did not separate our sample according to the size of the population of the municipalities.

Our results also reveal approximate waste recycling intervals of decreasing, constant and increasing returns to scale for the five geographic macro-areas. Returns to scale decrease at levels between 250 and 500 billion kg per year of recycling waste in the north-west and north-east areas, then increasing returns to scale at higher levels. In the center of Italy, returns to scale decrease between zero and 1,000 billion kg of recycling waste per year, and are constant at higher levels. In the south of Italy and the Islands, returns to scale decrease from zero to 400 billion kg per year, and there are constant returns to scale up to 600 billion kg. Carroll (1995) found constant economies of scale using in waste recycling of 4,468 tons per year in 57 municipalities in Winsconsin. Evidence of economies of scale was also found by Callan and Thomas (1997) in 324 towns in Massachusetts with the annual mean of 11,098 tons of recycling materials. Abrate et al. (2014) found that average municipality, which collects 3,770 tons waste recycling exhibits constant returns to scale for 500 Italian municipalities during years 2004–2006. Their results suggested that it is not very costly to increase the percentages of recycling for relatively small municipalities, therefore these activities must be supported.

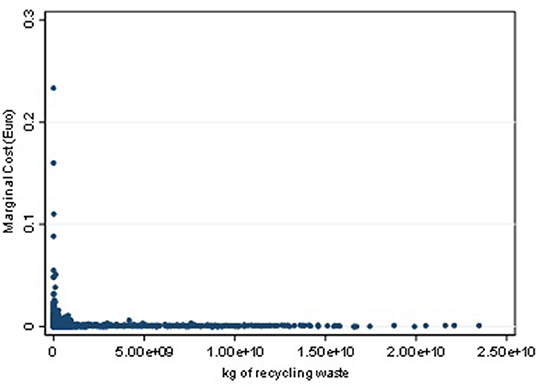

A scatter plot of the predicted marginal costs for recycling waste is presented in Figure 3.

As illustrated in Figure 3, we estimated economies of scale in recycling waste for all observed quantities of waste in our sample. Marginal cost decreases with quantity and it seems to be high at the beginning of the recycling process, probably due to the high fixed cost. As soon as the production increases the marginal cost tends to decrease and become constant over the production of recycling waste. One explanation for this is that increasing recycling activities may allow more efficient allocation of production factors to specialized tasks. Our results are in contrast with the findings of Bohm et al. (2010); they found the marginal and average cost curves for recycling activities take on the common U-shaped appearance. The results of our study may be useful to policy-makers who are interested in pursuing strategies to increase volumes of recycling waste. As already noted, waste recycling rates are still rather low in Italy, especially in the southern regions and islands. Our findings suggest that, at least if total collected amounts of waste remain the same, it is worth increasing recycling rates where they are very low (taking into account the size of the municipality).

Conclusions

In this study, we estimate the cost function of urban recycling waste in Italy and calculate the cost elasticity and marginal cost of recycling waste, using a fixed effect municipal-level model with a rich dataset from the ISPRA covering the years 2011–2017. We gathered data for the total costs and total recycling waste produced by more than 3,000 municipalities. The empirical works, in this field, rarely included into the analysis the cost elasticities and marginal cost of waste recycling. Therefore, our study provides some new evidence on the estimates of costs of waste recycling at muncipal level.

The estimates of our econometric model add new important insights. First, our findings suggest that there are increasing returns to scale across most of the municipalities in Italy. This is also confirmed by the trends in the marginal cost that after decreasing it becomes constant irrespective of additional quantity of waste recycling. This means that the waste recycling is an industry in which the increase of recycling by the municipalities has no impact on costs. We show that collection and recycling waste has the highest cost advantage when the quantity of recycling waste increases and does not exceed 500 billion kg. Over this amount, the recycling waste activities have higher costs and lower economies of scale, although the cost elasticity increases at a decreasing rate. These results provide indications for the policy maker on how much waste must be recycled to avoid exceeding the constant returns to scale. Our findings also show that economies of scale, and particularly cost elasticities, vary across macro-areas in Italy and are larger in the north of Italy (where the largest quantities of waste are collected and recycled) than in other geographical areas. Above the level of 500 billion kg of waste recycling per year, there are no more economies of scale, as the cost function shows decreasing returns to scale. From a policy perspective, our results provide some useful insights. They suggest that recycling activities should be encouraged as long as the cost elasticity does not exceed unity. This is valid for the majority of the municipalities. This is important for Italy, especially for the municipalities that still have low waste recycling rates and are planning to increase their recycling activities. Our findings may be particularly useful for recycling strategies in municipalities in the south regions and islands of Italy. This requires appropriate investments to increase the waste recycling which also could have some environmental policy implications for a more efficient waste management system. In fact, an increase of waste recycling would lead to a reduction of unsorted waste to be disposed in landfills with relevant benefits for health and the environment. Furthermore, the reduction of waste to landfills will reduce pollutants, for example CO2 and greenhouse gas emissions and save non-renewable raw materials. Marginal cost seems to be high at the beginning of the recycling process with probably high fixed costs. As soon as the production increases, the marginal cost tends to decrease and become almost constant over the production of recycling waste. This implies that increasing the amount of recycled waste will not necessarily increase additional cost. Policy-makers can use this information to increase amounts of collected and recycled waste, especially in small municipalities where there are increasing returns to scale.

In future research it would be interesting to investigate in detail cost functions and elasticities of waste recycling for different size of the municipalities and of single types (paper, glass, textiles, etc.) of urban recycling waste.

Data Availability Statement

Publicly available datasets were analyzed in this study. This data can be found here: https://www.catasto-rifiuti.isprambiente.it/index.php?pg=ru.

Author Contributions

CC had the main idea of the paper. She collected the data and proposed the model. RM had helped in developing the econometric model. The model was run by CC. RM also gave contribution in coding the software to run the model. CC wrote the majority of the paper. RM check all consistency of the results and made comments in all parts of the paper. Both researchers made comments on all paper.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

References

Abrate, G., Erbetta, F., Fraquelli, G., and Vannoni, D. (2014). The costs of disposal and recycling. An application to Italian municipal solid waste services. Reg. Stud. 48, 896–909. doi: 10.1080/00343404.2012.689425

Agovino, M., Casaccia, M., and Crociata, A. (2017). Effectiveness and efficiency of European regional development fund on separate waste collection: evidence from italian regions by a stochastic frontier approach. Econ. Polit. 34, 105–137. doi: 10.1007/s40888-016-0050-2

Agovino, M., Ferrara, M., and Garofalo, A. (2016). An exploratory analysis on waste management in Italy: a focus on waste disposed in landfill. Land Use Policy 57, 669–681. doi: 10.1016/j.landusepol.2016.06.027

Antonioli, B., and Filippini, M. (2002). Optimal size in the waste collection sector. Rev. Ind. Organ. 20, 239–252. doi: 10.1023/A:1015043524679

Bel, G., and Fageda, X. (2010). Empirical analysis of solid management waste costs: some evidence from galicia, Spain, Resour. Conserv. Recycl. 54, 187–193. doi: 10.1016/j.resconrec.2009.07.015

Bohm, R. A., Folz, D. A., Kinnaman, T. C., and Podolsky, M. J. (2010). The costs of municipal waste and recycling programs. Resour. Conserv. Recycl. 54, 864–871. doi: 10.1016/j.resconrec.2010.01.005

Bucciol, A., Montinari, N., Piovesan, M., and Valmasoni, L. (2013). “Measuring the impact of economic incentives in waste sorting,” in Waste Management in Spatial Environments (London; New York, NY: Routledge Press), 28–42.

Callan, S., and Thomas, J. (1997). The impact of state and local policies on the recycling effort. East. Econ. J. 23, 411–423.

Callan, S. J., and Thomas, J. M. (2001). Economies of scale and scope: a cost analysis of municipal solid waste services. Land Econon. 77, 548–560. doi: 10.2307/3146940

Carroll, W. (1995). The organization and efficiency of residential recycling services, East. Econ. J. 21, 215–225.

Cerciello, M., Agovino, M., and Garofalo, A. (2018). Estimating urban food waste at the local level: are good practices in food consumption persistent? Econ. Politica 36, 863–886. doi: 10.1007/s40888-017-0089-8

Collins, J., and Downes, B. (1977). The effects of size on the provision of public services: the case of solid waste collection in smaller cities. Urban Aff. Rev. 12, 333–347. doi: 10.1177/107808747701200306

Dijkgraaf, E., Gradus, R., Kinnaman, T., Jorgenson, D. W., Ho, M. S., and Stiroh, K. J. (2008). Comments: elbert dijkgraaf and raymond gradus, thomas kinnaman; and a correction. J. Econ. Perspect. 22, 243–246. doi: 10.1257/jep.22.2.243

Dubin, J. A., and Navarro, P. (1988). How markets for impure public goods organize: the case of household refuse collection. J. Law Econ. Organ. 4, 217–241.

EC European Commission (2008). Directive 2008/98/EC of the European Parliament and of the Council of 19 November 2008 on Waste and Repealing Certain Directives (Waste Framework Directive, R1 Formula in Footnote of Attachment II). Available online at: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=celex,%3A.32008L.0098 (accessed September 18, 2019).

EEA (2003a). Evaluation Analysis of the Implementation of the Packaging Directive. Copenhagen: European Environment Agency.

EEA (2003b). Assessment of Information Related to Waste and Material Flows. Copenhagen: European Environment Agency.

EU (2008). Directive 2008/98/EC of the European Parliament and of the Council of 19 November 2008 on waste and repealing certain directives. OJ L 312, 3–30.

EU (2018). Directive (EU) 2018/851 of the European Parliament and of the Council of 30 May 2018 amending Directive 2008/98/EC on waste. OJ L 150, 109–140.

European Commission (2018). Available online at: https://ec.europa.eu/environment/circular-economy/index_en.htm (accessed September 18, 2019).

Fiorillo, D. (2013). Household waste recycling: national survey evidence from Italy. J. Environ. Plan. Manage. 56, 1125–1151. doi: 10.1080/09640568.2012.709180

Greco, G., Allegrini, M., Del Lungo, C., Savellini, P. G., and Gabellini, L. (2015). Drivers of solid waste collection costs. Empirical evidence from Italy. J. Clean. Prod. 106, 364–371. doi: 10.1016/j.jclepro.2014.07.011

Hausman, J. A. (1978). Specification tests in econometrics, Econometrica 46, 1251–1271. doi: 10.2307/1913827

Hirsch, W. (1965). Cost functions of urban government service. Refuse collection. Rev. Econ. Stat. 47, 87–92. doi: 10.2307/1924127

ISPRA (2018). Urban Waste Report, 297/2018. Available online at: http://www.isprambiente.gov.it/it/pubblicazioni/rapporti/rapporto-rifiuti-urbani-edizione-2018

ISPRA (2019). Available online at: https://www.catasto-rifiuti.isprambiente.it/index.php?pg=ru (accessed September 19, 2019).

Jacobsen, R., Buysse, J., and Gellynck, X. (2013). Cost comparison between private and public collection of residual household waste: multiple case studies in the Flemish region of Belgium. Waste Manage. 33, 3-11. doi: 10.1016/j.wasman.2012.08.015

Kemper, P., and Quigley, J. (1976). The Economics of Refuse Collection. Cambridge, MA: Ballinger Publishing Company.

Kitchen, H. (1976). A statistical estimation of an operating cost function for municipal refuse collection. Public Finance Q. 4, 56–76. doi: 10.1177/109114217600400105

Mazzanti, M., Montini, A., and Zoboli, R. (2008). Municipal waste generation and socioeconomic drivers: evidence from comparing Northern and Southern Italy. J. Environ. Dev. 17, 51–69. doi: 10.1177/1070496507312575

Musella, G., Agovino, M., Casaccia, M., and Crociata, A. (2019). Evaluating waste collection management: the case of macro-areas and municipalities in Italy. Environ. Dev. Sust. 21, 2857–2889. doi: 10.1007/s10668-018-0164-5

Musmeci, L., Bellino, M., Cicero, M. R., Falleni, F., Piccardi, A., and Trinca, S. (2010). The impact measure of solid waste management on health: the hazard index. Ann. Ist. Super. Sanita. 46, 293–298. doi: 10.4415/ANN_10_03_12

Passarini, F., Vassura, I., Monti, F., Morselli, L., and Villani, B. (2011). Indicators of waste management efficiency related to different territorial conditions. Waste Manage. 31, 785–792. doi: 10.1016/j.wasman.2010.11.021

Petrovic, W., and Jaffee, B. (1978). The garbage of the mid continent: its generation and collection. Reg. Sci. Perspect. 9, 78–95.

Sorensen, R. J. (2007). Does dispersed public ownership impair efficiency? The Case of Refuse Collection in Norway. Public Admin. 85, 1045–1058. doi: 10.1111/j.1467-9299.2007.00681.x

Stevens, B. J. (1978). Scale, market structure, and the cost of refuse collection. Rev. Econ. Stat. 60, 438–448. doi: 10.2307/1924169

Tickner, G., and Mcdavid, J. C. (1986). Effects of scale and market structure on the costs of residential solid waste collection in Canadian cities. Public Finance Rev. 14, 371–393. doi: 10.1177/109114218601400401

Victor, D., and Agamuthu, P. (2013). Strategic environmental assessment policy integration model for solid waste management in Malaysia. Environ. Sci. Policy 33, 233–245. doi: 10.1016/j.envsci.2013.06.008

Zafra-Gómez, J. L., Prio, D., Plata Diáz, A. M., and Lopez-Hernandez, A. M. (2013). Reducing costs in times of crisis: delivery forms in small and medium sized local governments' waste management services. Public Admin. 91, 51–68. doi: 10.1111/j.1467-9299.2011.02012.x

Keywords: costs, urban waste management, recycling, cost elasticities, marginal cost, municipalities, regions, Italy

Citation: Cialani C and Mortazavi R (2020) The Cost of Urban Waste Management: An Empirical Analysis of Recycling Patterns in Italy. Front. Sustain. Cities 2:8. doi: 10.3389/frsc.2020.00008

Received: 24 October 2019; Accepted: 06 March 2020;

Published: 08 April 2020.

Edited by:

Amalia Zucaro, Energy and Sustainable Economic Development (ENEA), ItalyReviewed by:

Marco Casazza, Università degli Studi di Napoli Parthenope, ItalyCecilia Maria Villas Boas Almeida, Paulista University, Brazil

Copyright © 2020 Cialani and Mortazavi. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Catia Cialani, Y2NpQGR1LnNl

Catia Cialani

Catia Cialani Reza Mortazavi

Reza Mortazavi