- 1Capital University of Economics and Business, Beijing, China

- 2China Academy of Railway Sciences, Beijing, China

This study evaluates the asymmetric impact of international oil price uncertainty on firms' investment in China using a sample of listed renewable energy firms over the period 2000–2017 based on the fixed effect model. The empirical results show that the coefficient of oil price uncertainty on corporate investment is significantly negative, and it significantly affects corporate investment efficiency. Further, it reveals that from the total sample, no matter whether the oil price rises or falls, or the oil price is higher or lower, there is no asymmetry. However, after grouping companies according to the average investment opportunity, we found that for companies with better investment opportunities, the effect of oil price uncertainty on investment is asymmetric, since the coefficient of the interaction term between high oil prices and oil price uncertainty is significant positive. It also shows that increasing oil price uncertainty will reduce the investment efficiency of companies with poor investment opportunities, and the results of regression using inefficient investment as the explanatory variable also confirm this. Sale capital ratio, firm size, firm age, and administrative expense ratio are also vital factors in determining renewable energy firms' investment. This study has important policy implications for both government and enterprise.

Introduction

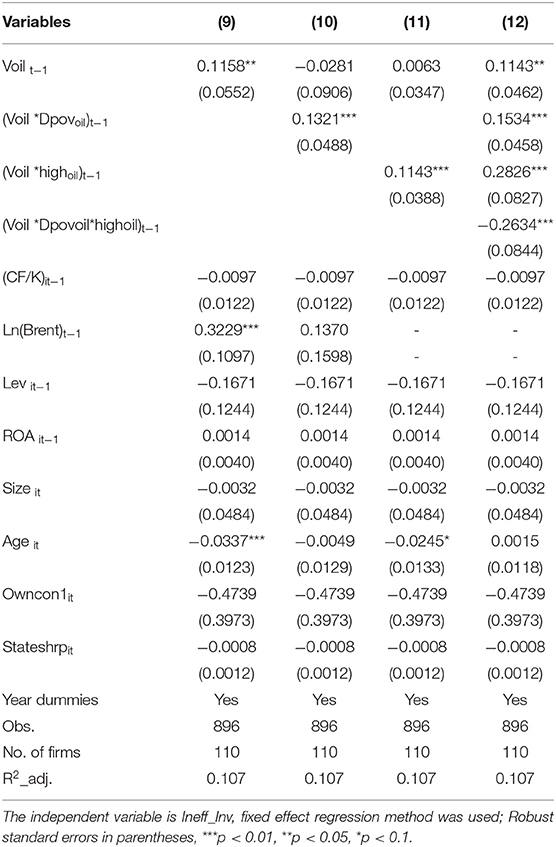

In recent years, in order to solve its energy shortage problem and relieve the pressure of environmental pollution, the renewable energy sector in China was strongly encouraged by the government, and several supporting measures and regulatory guidelines have been introduced. In addition, the public's environmental demands have also prompted local governments to implement stricter environmental regulations, thereby encouraging companies to increase green investment (Liao and Shi, 2018). Correspondingly, China's investment in the renewable energy sector has increased significantly, from 3 billion USD in 2004 to more than 115.4 billion USD in 2015. However, the total amount of investment in this sector shrank by 32% to USD 78.3 billion in 2016, with the solar market in particular decelerating sharply1. From a global point of view, the growth of new investment in renewable energy went through a period of fast growth from 2004 until 2010, and then it became volatile (as shown in Figure 1). At the same time, there is evidence that the development of China's renewable energy industry has encountered some problems. The study of Liu (2013) indicates that the recent sharp hike in China's wind power capacity may be attributed to overinvestment. Zhang et al. (2016) points out that the whole sector was exposed to high risks caused by rapid expansion, and confirms the existence of overinvestment in China's renewable energy sector. Zeng et al. (2017) reveals that the investment efficiency of Chinese new energy companies is relatively low. Therefore, determining which factors affect the investment of China's renewable energy companies, and thinking about how to increase firms' investment efficiency, has become a topic worthy of discussion.

Figure 1. Global statistics new energy investment by sector, 2004-2016, $BN (Source: UN Environment, Bloomberg New Energy Finance).

There is no doubt that investment is related to the healthy development of companies. Studies have shown that external shocks, such as oil price shocks, have an increasingly important impact on corporate investment, including the investment behavior of energy companies (Bernanke, 1983; Pindyck, 1991; Elder and Serletis, 2010; Wang et al., 2017; Cao et al., 2019). Statistics show that during the period of the rapid development of China's renewable energy industry, international crude oil prices have experienced significant fluctuations. China is the world's largest oil importer with a dependence on oil imports of up to 70%, and the uncertainty of oil prices significantly affects the Chinese economy (Cheng et al., 2019). Even if the government adopts price control and other measures, it cannot eliminate the negative impact of oil price uncertainty on economic development (Shi and Sun, 2017). Taking the close relationship between renewable energy and fossil energy into consideration, oil price uncertainty, as one of the representative external shocks, may have a significant impact on the investment of Chinese renewable energy companies.

Compared to enterprises in other industries, the effect of oil price uncertainty on renewable energy enterprise's investment may be more complicated. In theory, the impact of oil price volatility on the investment of renewable energy companies is mainly in two aspects. One is that the uncertainty of oil prices means that the input cost of an enterprise is uncertain. Since oil can be used as one of the raw materials for renewable energy companies, uncertainty in oil prices can affect costs and benefits, which improves the company's business risks and default risks, and ultimately changes the investment behavior. Second, the uncertainty of oil prices can lead to uncertainty in demand for renewable energy products due to the partial substitution relationship between fossil energy and renewable electricity. And from this perspective, it may also bring some other changes for the companies, such as inefficient corporate investment behavior. If the uncertainty increases when oil prices are high, this means that risks and opportunities coexist for renewabke energy companies. In this case, different companies may have different attitudes toward investment, which may lead to changes in investment efficiency. Therefore, it requires more detailed research to discuss the response of renewable energy firms' investment to the changes of oil price uncertainty, especially considering the possible asymmetry. However, as far as we know, few articles have investigated this issue.

In this paper, we focus on the renewable energy industry in China and discuss the asymmetric influences of international oil price uncertainty on the investment of listed firms in this industry. We will mainly analyze the possible asymmetric impacts of oil price uncertainty on corporate investment. The article compares the impact of oil price uncertainty on investment when oil prices rise or fall, and when oil prices are high or low. It also investigates the different responses of companies with different investment opportunities to oil prices uncertainty. Finally, we analyzed the impact of oil price volatility on corporate inefficient investment. Our empirical results contributes to the growing body of literature by providing evidence that oil price uncertainty has an asymmetric impact on corporate investment of renewable energy firms and rise in oil price volatility will increase the possibility of over-investment.

The rest of the paper is structured as follows: in Section Literature Review, we give a review of relevant literature; Section Empirical Model Specification introduces the methods used in the empirical studies; in Section Data and Variables, we gives an introduction to sample selection, variable definition, and statistical description.; Section Empirical Results reports the empirical regression results; and finally, Section Conclusion summarizes and concludes.

Literature Review

Investment Under Uncertainty

Many articles have analyzed the influence of uncertainty on corporate investment. Theoretically, there are several channels through which uncertainty may affect firms' investment. Based on the waiting value of real options, Dixit and Pindyck (1994) indicate that uncertainty will reduce the level of corporate investment if investment is irreversible. Appelbaum and Katz (1986) prove that under the uncertain circumstances, enterprises with high risk-aversion tend to reduce input and output, and points our that there is a negative correlation between corporate investment and uncertainty under the combined effects of investment irrevocability, financing constraints and risk aversion. But controversially, Abel (1983) emphasizes that risk may constitute an incentive to invest if the ability of firms to adapt after uncertainty is resolved, which implies a positive correlation between uncertainty and investment.

Empirically, numerous studies have examined whether investments respond to changes in uncertainty. Much attention has been given to macro uncertainty, such as volatility of stock market returns, interest rates and inflation. There are also many articles that study the correlation between capital investment and uncertainty using industry or firm-level data, but most of the research focus on the manufacturing industry, and there are lots of unresovled issues related to the uncertainty–investment relationship. Among these, Bloom et al. (2007) suggests that uncertainty can reduce firms' investment in response to shocks to sales, and argues that the company will become more cautious when the uncertainty of a company's stock returns is greater. Rashid (2011) report that high uncertainty significantly reduce firms' capital investment expenditures by testing the idiosyncratic and financial market uncertainty on the investment decisions of manufacturing firms. Baum et al. (2008) examine the uncertainty-investment relationship for U.S. firms, and concludes that investment responds negatively to firm-specific and CAPM-based uncertainty, whereas the uncertainty driven by S&P 500 index returns has a positive effect on firm-level investment. Beaudry et al. (2001) examine the impact of macroeconomic uncertainty on investment expenditure using the firm-level data from the UK, and maintain that inflation uncertainty has a negative and significant impact on investment. Baum et al. (2010) investigate the effect of uncertainty on corporate investment directly and the indirect effect via cash flow, it reveals that the impact of market uncertainty through cash flow on investment is negative. Gulen and Ion (2016) investigate the effect of economic policy uncertainty on corporate investment using the US data.

A few recent studies have begun to focus on the influence of uncertainty on the investment decision of Chinese companies. For instance, Xie (2009) examines how fluctuates in the volatility of daily stock returns affect corporate investment in China. The results indicate a negative effect, and it still holds even after controlling corporate investment opportunities and fund availability. Using data from listed companies in China, Xu et al. (2010) find a negative connection between total firm uncertainty and investment, Wang et al. (2014) shows that companies tend to reduce their investment expenditures when facing high economic policy uncertainty, Wang et al. (2014) indicate that the impact of policy and market uncertainty on corporate R&D expenditures is also negative. Taking external economic factors and managerial behavior into consideration, Wang et al. (2016a) studies the same issues and highlights the time-varying interaction between inflation uncertainty and managerial overconfidence, it concludes that overconfidence in management can exacerbate the reinforcing effect of low inflation uncertainty on overinvestment.

Investment Under Oil Price Uncertainty

With the increasing importance of natural resources in economic development, more and more scholars are paying attention to the impact of natural resources price volatility on coporate investment. Several empirical articles have studied the influence of oil price volatility on investment, and have reached a relatively consistent conclusion, that is, the former has a significant negative impact on investment. However, most of previous studies are limited to developed countries. Recently, focusing on the volatility of international oil prices, Elder and Serletis (2010) argue that this kind of uncertaity has had a statistically significant negative influence on several measures of investment, durables consumption and aggregate output in the United States. Henriques and Sadorsky (2011) investigate the effect of oil price uncertainty on firms' strategic investment in the USA and show that there exists a U shaped relationship between them. Using error correction techniques and data from US manufacturing companies, Yoon and Ratti (2011) find that higher energy price uncertainty reduces the positive effect of sales growth on investment. Kellogg (2014) estimate the impact of changes in uncertainty of future oil prices on investment, and discover that a surge in expected volatility of the future oil price reduce firms' drilling activity. Wang et al. (2017) investigate the influence of international oil price volatility on corporate investment expenditures in China. Lee et al. (2011) analyzes the effect of real oil price shocks on corporate investment from both direct and indirect impacts, and the results show that oil price shocks have a greater inhibitory effect on corporate investment for firms with high stock price volatility. Using firm-level data from 54 countries, the recent study of Phan et al. (2019) explores this effect again, and also reveals a negative impact of oil price uncertaity on investment.

The influence of international crude oil price uncertainty on the investment behavior of energy enterprises should be more special and complex, but few articles discuss this issue. It's worth noting that Mohn and Misund (2009) and Cao et al. (2019) have done some exploration in this area. The previous study used panel data from 15 oil and gas companies, and the latter study used data from Chinese renewable energy companies, both of which examined the impact of oil price uncertainty on investment. Unfortunately, the possible asymmetry in the relationship has not been addressed.

Investment Behavior of Renewable Energy Firms

Although few scholars have analyzed the effect of international oil price uncertainty on renewable energy companies' investment, there are many articles that have discussed the investment issues of renewable energy companies. For example, Wustenhagen and Menichetti (2012) propose a conceptual framework for renewable energy investment and reveales that risk, return, and policy all affect firms' current investment levels. Liu (2013) points out the overinvestment problem in wind power capacityand explores the factors that may affect companies' overinvestment Zhang et al. (2016) test the overinvestment hypothesis based on mainstream finance methodology and shows that renewable energy companies do have over-investment issues in China. Zeng et al. (2017) evaluates the investment efficiency of Chinese new energy companies using a four-stage semi-parametric DEA analysis framework, and finds that such companies have low investment efficiency. It states that the investment efficiency of Chinese new energy companies is affected by global and domestic macroeconomic conditions and characteristic variables of enterprises.

In summary, there are still some shortcomings in the research field of how does oil price uncertainty influence the investment of renewable energy enterprises. In particular, few scholars have conducted in-depth research on the possible asymmetry in the relationship. To make up for this gap, this is exactly what this article is trying to do.

Empirical Model Specification

Benchmark Model

Given that a large amount of literature uses the Q investment model, we also use this model to test the effect of oil price volatility on corporate investment. Under standard neoclassical assumptions about firm behavior, the Q investment model can be represented as the following formula:

in which, It stands for firm's gross long-term investment, Kt represents the book value of the company's fixed capital stock, Qt means the marginal q, and εt is a random error term. In empirical specifications, Equation (1) is usually augmented with other explanatory variables, and it has fixed effects for cross section and time. According to the studies of Baum et al. (2010), Henriques and Sadorsky (2011), Yoon and Ratti (2011) and Khan et al. (2017), the empirical model of this article is set as follows:

(I/K)i, t represents the investment-capital ratio, which is obtained by dividing the current investment by the fixed capital at the beginning of the period. Voil is the volatility of international oil prices. (CF/K) stands for cash flow scaled by the beginning-of-period capital stock, which indicates the possible role of liquidity. S/K means the firm's sale dividing by capital stock, and Z stands for the control variable vector. μi and θt stand for the firm-specific and time-specific fixed effects. In line with the research of other works (Chen et al., 2011; Jiang et al., 2011; McLean et al., 2012; Wang et al., 2016b), we add Tobin Q as a proxy variable for investment opportunities to the regression equation.

Asymmetry Analysis Model

Considering that there may be asymmetry in the impact of oil prices uncertainty, we further added an interaction term to the equation.

The first is to compare and analyze the different effects of oil price uncertainty when oil prices rise and fall. Therefore, we construct a dummy variable for oil price rise, Doilpov, and the interaction term is Voil × Doilpov. In addition to affecting investment spending, the uncertainty of oil prices may also affect corporate investment efficiency, we also include the interaction term Q and oil volatility (TQ × Voil)t−1, into the empirical model. Correspondingly, the extended models are set as:

The second is to introduce another dummy variable, highoil, which measures whether the oil price is at a relatively high level, then the interaction term becomes to TQ × highoil. Based on the daily oil price data, we chose the median value of oil prices, $75 per barrel, as the dividing line, and generate the dummy variable. Thus, highoil equals to 1 if Brent oil price is >75, otherwise it equals to 0. The empirical model is further extended as follows:

Finally, in order to further analyze the possible asymmetry in the impact of the uncertainty of oil prices, we divided the companies into two groups, that is, firms with good investment opportunities and firms with bad investment opportunities, and then conducted a comparative analysis of the two samples.

Inefficient Investment Analysis Model

In order to verify the effect of oil price uncertainty, we further analyze its impact on the inefficient investment of enterprises. The empirical model to identify its influence on inefficiency investment is set as:

Ineffinvi, t stands for the inefficient investments, ROA is the return of total assets. The fixed effect model is implemented to estimate Equation (5).

Finally, we examine the impact of oil price uncertainty on corporate over-investment. The explanatory variables in the model are replaced by dummy variable, Over_Inv, which is equal to 1 if the enterprise is overinvested, otherwise it is equal to 0. Logit regression is used to estimate the following equation.

Data and Variables

Sample Selection

The information from Sina finance (http://finance.sina.com.cn/) are used to collect the renewable energy listed firms of China, similar to the methods of Broadstock et al. (2012), Zhang et al. (2016), and Cao et al. (2019). A total of 113 firms in solar, wind and biomass sectors that listed during the period from 1990 to 2017 are identified. The data used in the empirical analysis part is the unbalanced panel from 2000 to 2017. All the financial data used was collected from the RESSET financial research database (www.resset.cn).

Variable Definition

(1) Oil price uncertainty

The uncertainty of oil price is usually measured by two methods. One is the standard deviation of daily return of oil prices, and the other is the GARCH model. Following Sadorsky (2008) and Henriques and Sadorsky (2011), the annual oil price volatility (Voilt) can be measured as:

where rt is the daily return of international oil price (rt = 100 × ln(Pt/Pt−1), Pt is the daily oil price, N is the number of trading days in the year. Brent crude oil prices from the U.S Energy Information Agency are used in this paper.

Following Hamilton (2003), Sadorsky (2006), and Yoon and Ratti (2011), oil price uncertainty can be calculated using the GARCH (1, 1) model as shown blow:

According to the Akaike's Information Criterion (AIC), we begin with the fifth lag. the daily crude oil returns' volatilities in a particular year are estimated firstly, and then obtain their arithmetic mean, Hoilt, as the indicator of international oil price annual uncertainty.

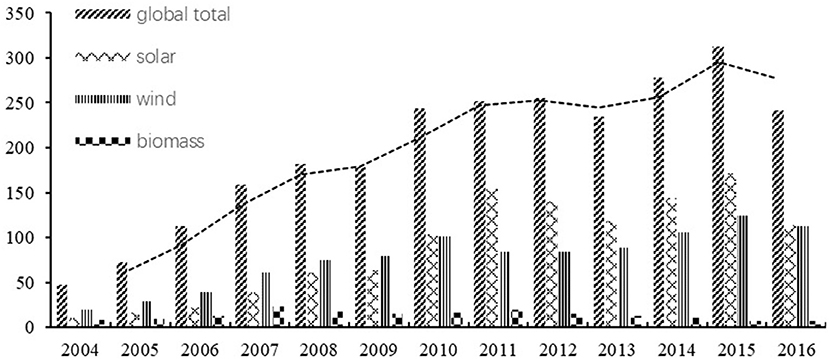

The daily Brent crude oil prices and daily crude oil return volatility are plotted in Figure 2. It shows that before 2005 and from 2008 to 2009, the volatility of oil prices was higher. While, during 2010–2014, oil prices were higher, but their volatility was relatively low. After entering the low oil price stage in 2015, the uncertainty of oil prices increased.

In the empirical analysis part, we mainly uses the volatility calculated by the first method as a measure of oil price uncertainty, and the volatility calculated by the GARCH model is used for robustness test.

(2) Dependent variable

The investment expenditures (I) used in this paper is measured as cash outflow for purchase of new fixed assets and other long-term assets minus any net cash recovered from the disposal of fixed assets as shown in the cash flow statement. Investment dividing by fixed assets at the beginning of the year, I/K, are used as the dependent variable.

We plot the annual average of the investment capital ratio (I/K) across sample firms in Figure 3. It shows that investment was booming during the period from 2000 to 2002, and it has shown obvious up and down fluctuations since 2003. Since 2014, the investment ratio has shown a clear upward trend. At the same time, international oil prices have begun to enter a low price and a small fluctuation range as shown in Figure 1.

In addition to the investment capital ratio (I/K), we also use inefficiency investment indicators as explanatory variables. In order to build this variable, we construct an expected investment model based on Biddle et al. (2009) and Gomariz and Ballesta (2014). The expected investment model is written as:

where sales_growtht−1 is the growth rate of sales in the previous year. This model is estimated for each year, and a positive (negative) residual indicates over- (under-) investment. We define the variable inefficiency investment (Ineff_inv) as the absolute value of the residual, which stands for the departure from the normal investment level. If the residual of the above regression is greater than zero, it can be considered that the enterprise has excessive investment in that year according to (Wang et al., 2016a). Therefore, we define the dummy variable of over-investment (Over_Inv) based on whether the residual is greater than zero or less than or equal to zero. Over_Inv is equal to 1 if ϵit is greater than zero, otherwise it equals to 0.

(3) Control variables

The control variables include cash flow capital ratio (CF/K), Tobin's Q (TQ), sale's capital ratio (S/K), leverage (lev.), firm size (size), administrative expense ratio (Adm., scaled by sales,), firm age (age), returns on total assets (ROA), State-owned shareholding ratio (stateshrp), and the shareholding ratio of the largest shareholder (owncon1).

Capital stock (K) is equal to the book value of fixed assets net of depreciation, Cash flow (CF) is calculated as the sum of the depreciation of fixed assets plus the operating profit before payments of tax, interest and preference dividends, which is consistent with Bond and Meghir (1994). Tobin's Q (TQ) is defined as the ratio of firms' total market value to total assets. The construction of these variables are similar to that of Chen et al. (2013) and Zhang et al. (2016).

The median value of Tobin's Q based on the average value of each enterprise in all years is used to distinguish whether a company has good investment opportunities or bad investment opportunities. That is, a company will be assigned to the group with good investment opportunities if the company's annual average for Tobin Q is greater than the median above, otherwise it is divided into the group with poor investment opportunities.

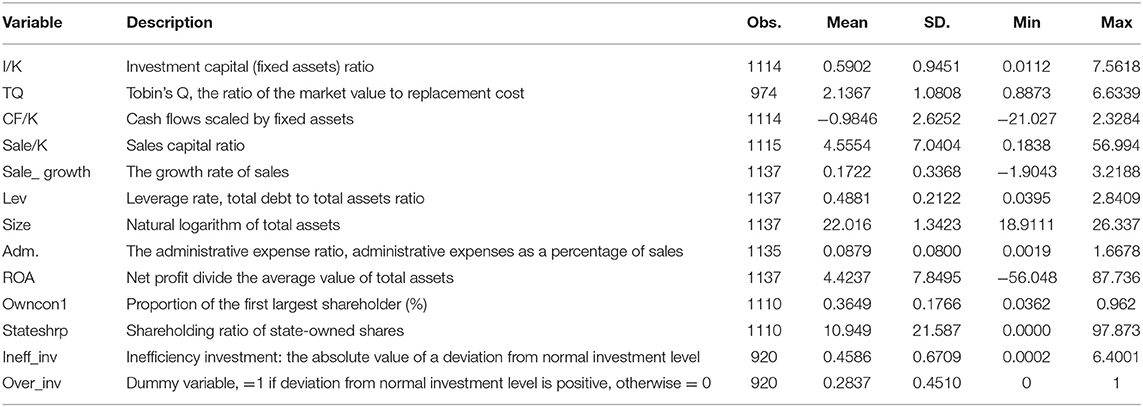

Descriptive Statistics

Thestatistics of main variables are summarized in Table 1. The continuous variables, I/K, CF/K, Sale/K, TQ, are winsorized at the 1st and 99th percentiles before they are used in the empirical analysis. It shows that the mean of firms' investment capital ratio is 0.5902, and the maximum and minimum values are 7.5618 and 0.0112 respectively. The average value of Tobin's Q is >1, which is 2.1367. The average value of the sales capital ratio is 7.0404, also very high. The average asset-liability ratio of the company is 48.81%. From the average value, management expenses account for 8% of sales, the lowest is 0.19%. The mean of Ineff_inv is 0.4586. In samples with inefficient investment observations, about 28% of enterprises have over-investment.

Empirical Results

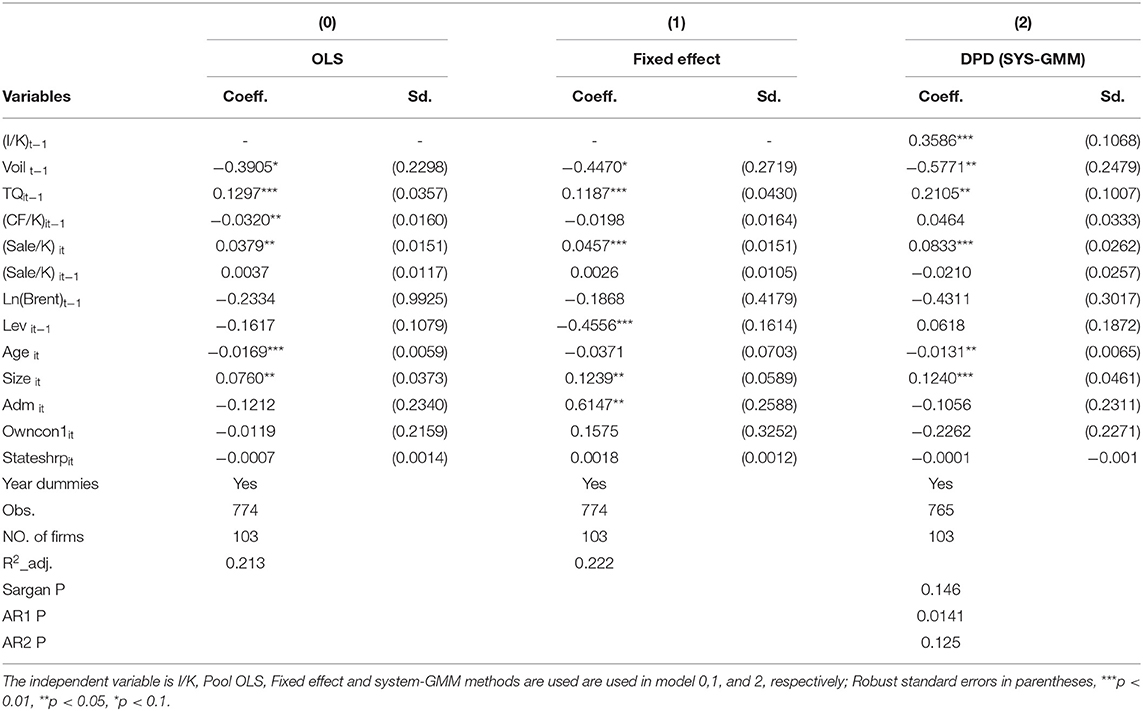

Impact of Oil Uncertainty on Investment

The benchmark regression results are shown in Table 2. Models (0) to model (2) are the results of regression using three methods: pooled ordinary least squares method, fixed effect regression, and dynamic panel system-GMM. As shown in Table 2, no matter which model is used, the results obtained indicate that increasing oil price uncertainty will significantly reduce renewable firms' investment, and this result is consistent with previous studies. And the coefficients of investment opportunities (TQ), Sales ratio (Sale/K), firm size (Size) are all significantly positive in the three models. We also add the natural logarithm of Brent oil price variable, Lnbrent, into the regression equation and find that it has no significant effect on investment.

Asymmetric Effect of Oil Uncertainty on Investment

(1) Possible asymmetry tests when oil prices rise or fall

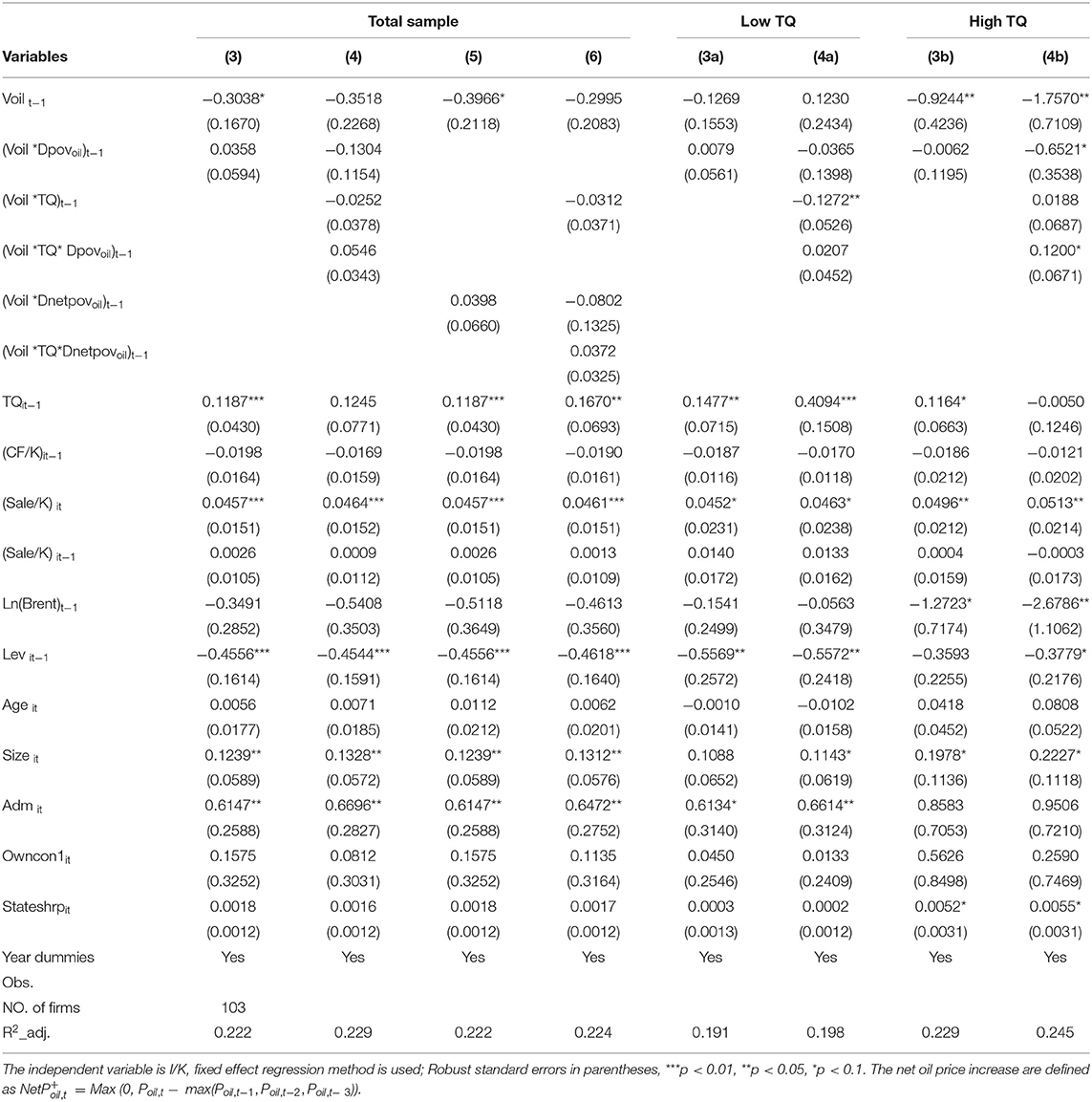

In order to verify whether there is a possible asymmetric effect, the dummy variable of whether the price of oil has risen, Dpovoil (= 1 when the oil price rises, otherwise it = 0), is introduced here. The empirical results are shown in Table 3 below.

Based on the benchmark regression, in model (3), the interaction term between the dummy variable of whether oil price rise and oil price volatility, (Voil*Dpovoil)t−1, is added. It can be found that the uncertainty of oil prices still has a significant negative impact on investment, but the coefficient of the interaction term (Voil*Dpovoil)t−1, is not significant, indicating that there is no significant asymmetry in this effect when oil prices rise or fall.

In model (4), we further add the interaction term of oil price volatility and Tobin Q, (Voil*TQ)t−1, and the interaction term of high oil price dummy variable, Tobin Q and oil price uncertainty (Voil*TQ*Dpovoil)t−1, in the regression. Although the coefficients for (Voil*Dpovoil)t−1 and (Voil*TQ)t−1 are negative, they are not significant. The coefficients and statistical significance of other variables are all consistent with the results of model (1).

In models (5) and (6), we used a net oil price change indicator to measure the rise or fall in oil prices. That is, we compare the current oil price with the price of the past 3 years, if the current oil price is higher than the highest oil price in the past 3 years, it is defined as the net increase in oil price, corresponding net oil price increase dummy variable, Dnetpovoil, is equal to 1, otherwise it equals to zero. The results of these two regressions are basically consistent with models (3) and (4), again indicating that in the entire sample, here is no asymmetry in the impact of oil price uncertainty on investment when prices rise or fall.

In the right four columns of Table 3, we further consider another possible asymmetry, that is, different companies may have different investment behaviors when they face uncertainties in oil prices. Based on the average Tobin Q value of each company during the observation period, we divide the total sample into two sub-samples: companies with poor investment opportunities and companies with good investment opportunities. The division criterion is whether the average TQ of the enterprise is less than or greater than the median value of firms' average annual TQ. Based on these two subsamples, we performed the regression again, according to the design of Equation 3. The results of companies with poor investment opportunities are shown in models (3a) and (4a), and the results of companies with better investment opportunities are shown in models (3b) and (4b). The results show that among renewable energy companies with poor investment opportunities, the coefficient of the variable (Voil*TQ)t−1 is significantly negative, and other variables related to oil prices uncertainty are not significant, which indicates that increasing of oil prices uncertainty will not directly reduce the company's investment, but will indirectly reduce the company's investment by reducing the investment-investment opportunity sensitivity coefficient. However, this indirect impact does not exist in renewable energy companies with better investment opportunities.

The regression results of (3b) and (4b) further show that the coefficients of Voil t−1 and (Voil*Dpovoil)t−1 are significantly negative, and the coefficient of the interaction terms (Voil*TQ*Dpovoil)t−1, is significantly positive. It reveals that the oil price volatility has a significant inhibitory effect on the investment of renewable energy companies with better investment opportunities, and this effect is more obvious when the oil price rises, but if the oil price volatility increases when the oil price rises, it will also increase corporate investment-investment opportunities sensitivity coefficient, which means that it can promote enterprises to improve investment efficiency to a certain extent. In addition, the results of several control variables also differ in the two subsamples, for example, in the sub-sample with better investment opportunities, the oil price level variable, lnbrent, has a significant negative impact on investment, and the state-owned shareholding proportion coefficient is significantly positive, but in the other sub-sample, both coefficients are not significant. However, the debt ratio, levt−1, has a significant negative impact on the investment of companies with poor investment opportunities.

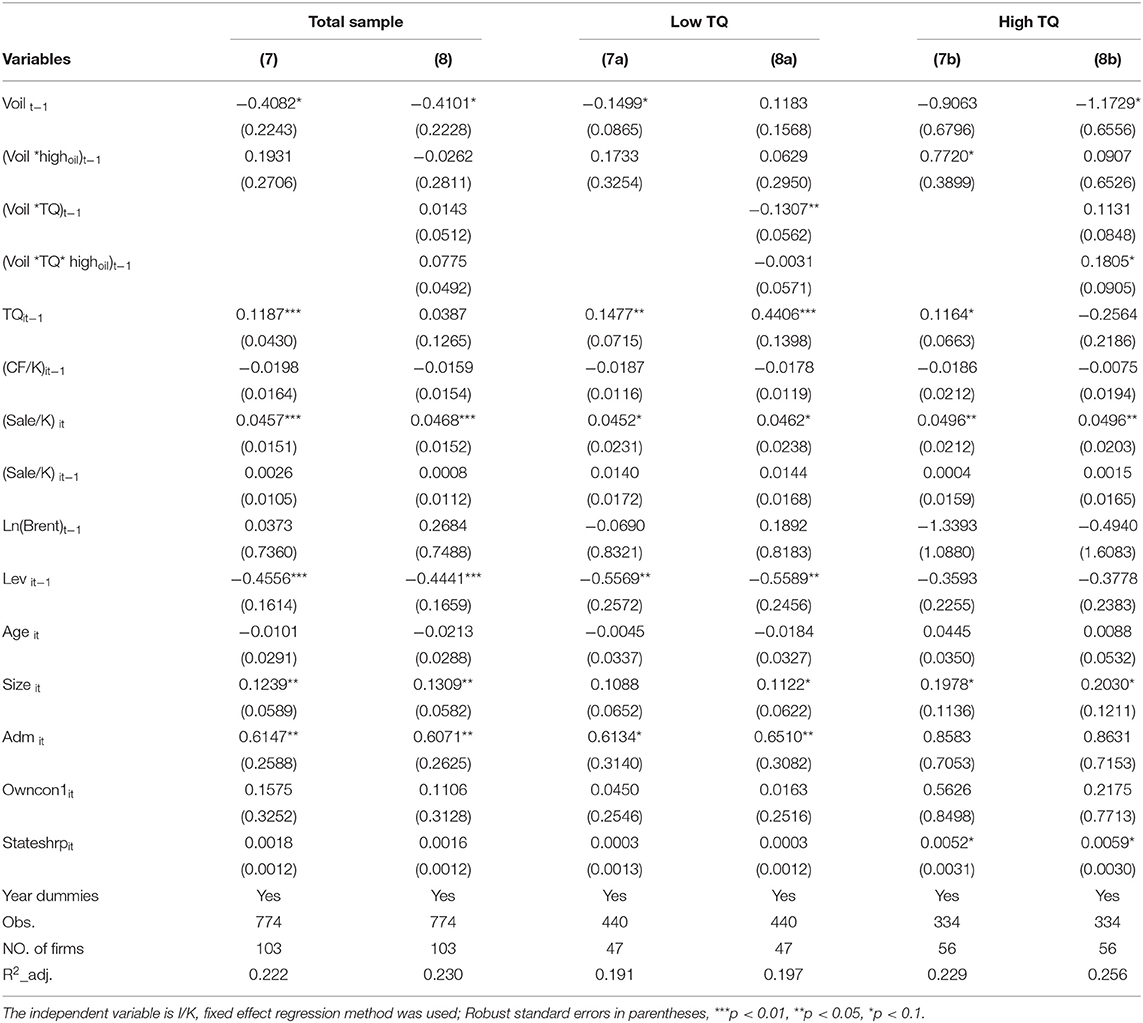

(2) Possible asymmetric tests when oil prices are higher or lower

The data description of the oil price and oil price volatility in Figure 2 shows that when the oil prices are at a high level or a low level, the volatilities are different. We then analyze whether there is a third type of asymmetry, that is, whether the impact of oil price volatility on corporate investment when oil prices are higher is different from the effect when oil prices are lower. The results are given in Table 4.

In model (7), it shows the coefficient of oil price volatility is still significantly negative, however, the interaction term between the oil prices uncertainty and whether the price is higher (Voil*highoil)t−1, is not significant. Consistent with Model 4 in Table 3, two other interaction terms (Voil*TQ)t−1 and (Voil*TQ*highoil)t−1 are added here, but they are also not significant, indicating that when the oil price is high or low in the entire sample, there is no asymmetry in the impact of oil price uncertainty on corporate investment.

Here, the entire sample is also divided into two groups of companies with poor investment opportunities and companies with better investment opportunities. We find that the oil price volatility has a significant negative impact on the investment of companies with poor investment opportunities in model (7a), with a coefficient of −0.1499, by comparison. The results of model (8a) show that an increase in oil price volatility will reduce the investment efficiency of such enterprises because the coefficient of (Voil*TQ)t−1 is significantly negative, Which is −0.1307.

In the enterprise with better investment opportunities, the coefficient of the variable (Voil*highoil)t−1 in the model (8a) is significantly positive, indicating that the enterprise will increase investment when the oil price is high. After adding the variables (Voil*TQ)t−1 and (Voil*TQ*highoil)t−1 to the model (8b), the coefficient of variable (Voil*highoil)t−1 is no longer significant, but at this time the variable (Voil*TQ*highoil)t−1 is significantly positive. The results indicate that there is asymmetry in the impact of oil price uncertainty in companies with better investment opportunities, and the main reason is that if oil price volatility increases when oil prices are high, such companies will increase investment efficiency.

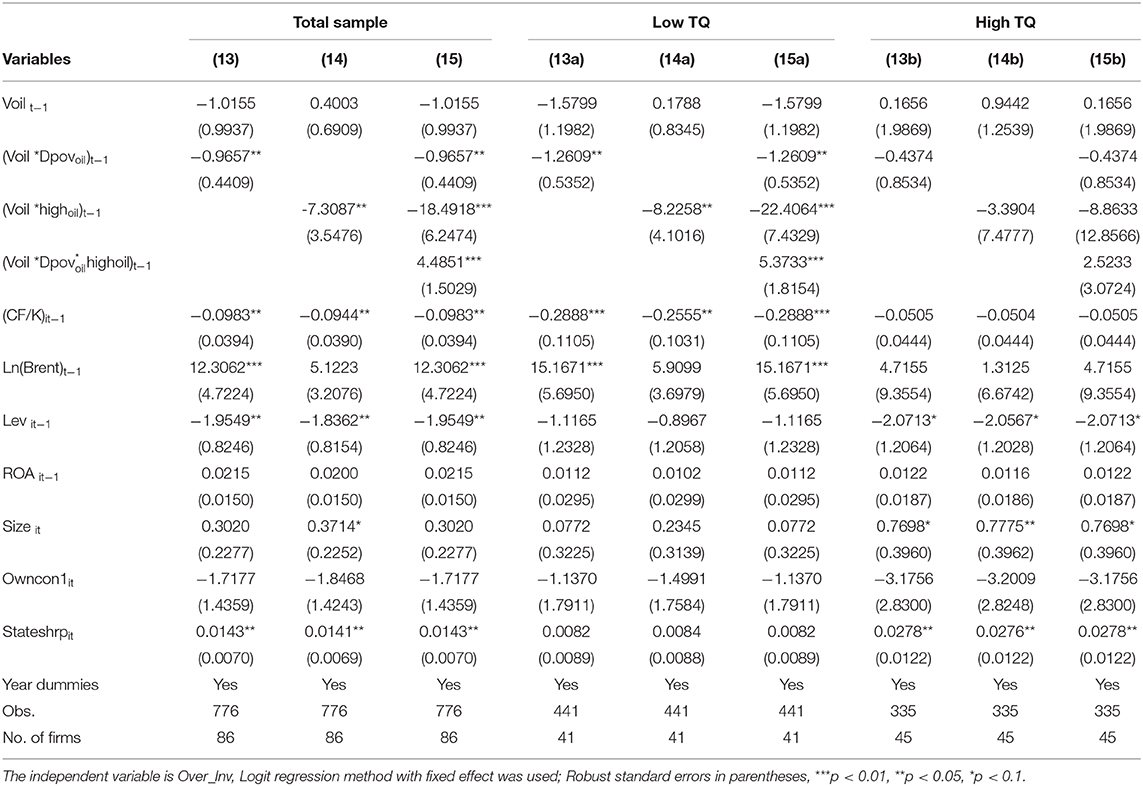

Impact of Oil Price Uncertainty on Inefficiency Investment

The above empirical results show that When oil prices rise, and when oil prices are at a high level, oil price uncertainty can improve corporate investment efficiency, but it mainly exists in enterprises with better investment opportunities; oil price volatility will reduce the investment efficiency of enterprises with poor investment opportunities. In order to verify these results, we replace the explanatory variables with inefficiency investments (Ineff_Inv), and further analyze the impact of oil price uncertainty on corporate investment. Table 5 reports the results obtained from the fixed-effect regression model.

It shows that oil price uncertainty has significant positive impact on firms' inefficiency investment in model (9), however, after considering the possible asymmetry in model (10), we find that coefficient of the interaction term between the dummy variable of positive oil price growth and oil price volatility (Voil*Dpovoil)t−1, is significantly positive, indicating the increase in oil price uncertainty will increase the company's inefficient investment level when oil prices are rising. The interaction term in model (11) is replaced by (Voil*highoil)t−1, and its coefficient is also significantly positive, which is 0.1143. The results of these two regressions show that the uncertainty of oil prices has an asymmetric effect on the inefficient investment behavior of renewable energy companies. In model (12), we simultaneously add the two interaction terms of oil price uncertainty and rising oil price, oil price uncertainty and higher oil price to the regression equation, the result remains essentially the same.

In Table 6, we further adjust the explanatory variable to a dummy variable, Over_Inv, that is, whether the company has overinvestment, and the panel logit regression method is used. The explanatory variables in models (13)–(15) in Table 6 are completely consistent with the variables in models (10)–(12) in Table 5. The empirical results here show that, compared with the decline in oil prices, the increase in the uncertainty of crude oil prices when the oil price rises will significantly reduce the possibility of increasing overinvestment, but it also means that the probability of underinvestment will increase. Similarly, the increase in crude oil price uncertainty when oil prices are higher than when oil prices are lower will also significantly reduce the likelihood of companies overinvesting.

Once again we divide the sample into two sub-samples. Models (13a) to (15a) are the results of companies with poor investment opportunities, and models (13b) to (15b) are the results of companies with good investment opportunities. The results of the sub-samples reveal that the above-mentioned effects of oil price uncertainty on corporate over-investment mainly occur in renewable energy companies with lower investment opportunities. Since in our sample, the sum of over-investment and under-investment dummy variables is equal to 1, this result also means that an increase in oil price volatility may increase the probability of underinvestment in companies with lower investment opportunities. This is also consistent with the significant impact of variable (Voil*TQ)t−1 found in model (4a) and (8a) on the investment of low investment opportunity firms.

Robustness Tests

To ensure the robustness of the results, we use the alternative measure of oil price uncertainty, Hoilt. We also adjusted the leverage ratio (Lev) in the control variable to the debt-to-capital ratio (D/K), which is defined as the sum of short-term loan, long-term loans and bonds payable on the balance sheet deflated by fixed assets at the beginning of the year. The results are highly consistent with the empirical results in Tables 2–6 above.

Conclusion

China's central government has issued a number of policies since 2005, correspondingly, investment in the renewable energy sector has increased rapidly. However, such an investment is risky. One of the factors that cannot be ignored is the volatility of oil prices and the resultant uncertainties in macroeconomic and monetary policy.

In this paper, we examine the response of corporate investment to the uncertainty of oil prices, especially considering the possible asymmetric effects. The most obvious finding to emerge from this study is that the increasing in oil prices uncertainty have a significant negative impact on investment in China's renewable energy companies, and it significantly affects corporate investment efficiency. Asymmetry test results show that, from the total sample, no matter whether the oil price rises or falls, or the oil price is higher or lower, these factors do not have a significant impact on how the uncertainty of oil prices affects corporate investment, that is, there is no asymmetry. However, after grouping companies according to the average investment opportunity, we found that for companies with better investment opportunities, when oil prices are at a higher level, that is, greater than 75 US dollars per barrel, the variable of oil price uncertainty has a significant positive impact on corporate investment, because at this time such companies tend to improve investment efficiency. This study also revealed that oil price uncertainty reduces the investment efficiency of companies with poor investment opportunities, and the analysis of non-efficiency investment also verifies it, that is, this kind of uncertainty increases the inefficiency investment level of enterprises with poor investment opportunities and improves the probability of under-investment in such companies. The results related to firm characteristics has shown that sale capital ratio, firm size, firm age and administrative expense ratio are also crucial in the determination of renewable energy firms' investment.

Overall, the empirical evidence from this paper support the idea that the impact of oil price uncertainty on the investment of renewable energy companies in China is multi-faceted. For renewable energy entities, oil price volatility implies both risk and opportunities. The impact of oil price uncertainty on the investment of renewable energy enterprises in China is affected by whether the oil price is high or low, and whether the investment opportunities of enterprises are good or bad, etc. Therefore, the enterprise managers need to distinguish between different situations to cope with the influence of international oil price uncertainty on investment, to better grasp the investment opportunities and to improve firms' investment efficiency. And, for energy policy makers, the investment response of renewable energy companies in the face of changes in oil prices uncertainty should be considered when formulating oil and other energy policies.

Data Availability Statement

The datasets generated for this study are available on request to the corresponding author.

Author Contributions

HC finished the research and writing. PS responsible for data collection. LG works with the other authors for the discussion part.

Funding

The authors acknowledged financial support from the China National Natural Science Fund (Grant no. 71804116).

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Footnote

1. ^Bloomberg New Energy Finance, Global Trends in Renewable Energy Investment 2017.

References

Appelbaum, E., and Katz, E. (1986). Measures of risk aversion and comparative statics of industry equilibrium. Am. Econ. Rev. 76, 524–529.

Baum, C. F., Caglayan, M., and Talavera, O. (2008). Uncertainty determinants of firm investment. Econ. Lett. 98, 282–287. doi: 10.1016/j.econlet.2007.05.004

Baum, C. F., Caglayan, M., and Talavera, O. (2010). On the sensitivity of firms' investment to cash flow and uncertainty. Oxf. Econ. Pap. 62, 86–306. doi: 10.1093/oep/gpp015

Beaudry, P., Caglayan, M., and Schiantarelli, F. (2001). Monetary instability, predictability of prices and the allocation of investment: an empirical investigation using UK panel data. Am. Econ. Rev. 91, 648–662. doi: 10.1257/aer.91.3.648

Bernanke, B. S. (1983). Irreversibility, uncertainty and cyclical investment. Q. J. Econ. 98, 85–106. doi: 10.2307/1885568

Biddle, G. C., Hilary, G., and Verdi, R. S. (2009). How does financial reporting quality relate to investment efficiency? J. Account. Econ. 48, 112–131. doi: 10.2139/ssrn.1146536

Bloom, N., Bond, S., and Van Reenen, J. (2007). Uncertainty and investment dynamics. Rev. Econ. Stud. 74, 391–415. doi: 10.1111/j.1467-937X.2007.00426.x

Bond, S., and Meghir, C. (1994). Dynamic investment models and the firm's financial policy. Rev. Econ. Stud. 61, 197–222. doi: 10.2307/2297978

Broadstock, D. C., Cao, H., and Zhang, D. (2012). Oil shocks and their impact on energy related stocks in China. Energy Econ. 34, 1888–1895. doi: 10.1016/j.eneco.2012.08.008

Cao, H., Guo, L., and Zhang, L. (2019). Does oil price uncertainty affect renewable energy firms' investment? Evidence from listed firms in China. Finance Res. Lett. doi: 10.1016/j.frl.2019.06.003. [Epub ahead of print].

Chen, A. A., Cao, H., Zhang, D., and Dickinson, D. G. (2013). The impact of shareholding structure on firm investment: evidence from Chinese listed companies. Pac. Basin Finance J. 25, 85–100. doi: 10.1016/j.pacfin.2013.08.002

Chen, S., Sun, Z., Tang, S., and Wu, D. (2011). Government intervention and investment efficiency: evidence from China. J. Corp. Finance 17, 259–271. doi: 10.1016/j.jcorpfin.2010.08.004

Cheng, D., Shi, X. P., Yu, J., and Zhang, D. Y. (2019). How does the Chinese economy react to uncertainty in international crude oil prices? Int. Rev. Econ. Finance 64, 147–164. doi: 10.1016/j.iref.2019.05.008

Dixit, A. K., and Pindyck, R. S. (1994). Investment Under Uncertainty. Princeton, NJ: Princeton University Press. doi: 10.1515/9781400830176

Elder, J., and Serletis, A. (2010). Oil price uncertainty. J. Money Credit Bank. 42, 1137–1159. doi: 10.1111/j.1538-4616.2010.00323.x

Gomariz, M. F. C., and Ballesta, J. P. S. (2014). Financial reporting quality, debt maturity and investment efficiency. J. Bank. Finan. 40, 494–506. doi: 10.1016/j.jbankfin.2013.07.013

Gulen, H., and Ion, M. (2016). Policy uncertainty and corporate investment. Rev. Financ. Stud. 29, 523–564. doi: 10.1093/rfs/hhv050

Hamilton, J. D. (2003). What is an oil shock? J. Econom. 113, 363–398. doi: 10.1016/S0304-4076(02)00207-5

Henriques, I., and Sadorsky, P. (2011). The effect of oil price volatility on strategic investment. Energy Econ. 33, 79–87. doi: 10.1016/j.eneco.2010.09.001

Jiang, L., Kim, J-B., and Pang, L. (2011). Control-ownership wedge and investment sensitivity to stock price. J. Bank. Finance 35, 2856–2867. doi: 10.1016/j.jbankfin.2011.03.017

Kellogg, R. (2014). The Effect of uncertainty on investment: evidence from texas oil drilling. Am. Econ. Rev. 104, 1698–1734. doi: 10.1257/aer.104.6.1698

Khan, M. K., He, Y., Akram, U., and Sarwar, S. (2017). Financing and monitoring in an emerging economy: can investment efficiency be increased. China Econ. Rev. 45, 62–77. doi: 10.1016/j.chieco.2017.05.012

Lee, K., Kang, W. S., and Ratti, R. A. (2011). Oil price shocks, firm uncertainty, and investment. Macroecon. Dyn. 15, 416–436. doi: 10.1017/S1365100511000496

Liao, X. C., and Shi, X. P. (2018). Public appeal, environmental regulation and green investment: evidence from China. Energy Policy 119, 554–562. doi: 10.1016/j.enpol.2018.05.020

Liu, X. M. (2013). The value of holding scarce wind resource—a cause of overinvestment in wind power capacity in China. Energy Policy 63, 97–100. doi: 10.1016/j.enpol.2013.08.044

McLean, R. D., Zhang, T., and Zhao, M. (2012). Why does the law matter? investor protection and its effects on investment, finance, and growth. J. Finance 67, 313–350. doi: 10.1111/j.1540-6261.2011.01713.x

Mohn, K., and Misund, B. (2009). Investment and uncertainty in the international oil and gas industry. Energy Econ. 31, 240–248. doi: 10.1016/j.eneco.2008.10.001

Phan, D. H. B., Tran, V. T., and Nguyen, D. T. (2019). Crude oil price uncertainty and corporate investment: new global evidence. Energy Econ. 77, 54–65. doi: 10.1016/j.eneco.2018.08.016

Pindyck, R. (1991). Irreversibility, uncertainty and investment. J. Econ. Lit. 29, 1110–1148. doi: 10.3386/w3307

Rashid, A. (2011). How does private firms' investment respond to uncertainty? Some evidence from the United Kingdom. J. Risk Finance 12, 339–347. doi: 10.1108/15265941111158514

Sadorsky, P. (2006). Modeling and forecasting petroleum futures volatility. Energy Econ. 28, 467–488. doi: 10.1016/j.eneco.2006.04.005

Sadorsky, P. (2008). The oil price exposure of global oil companies. Appl. Finan. Econ. Lett. 4, 93–96. doi: 10.1080/17446540701537764

Shi, X. P., and Sun, S. Z. (2017). Energy price, regulatory price distortion and economic growth: a case study of China. Energy Econ. 63, 261–271. doi: 10.1016/j.eneco.2017.02.006

Wang, Y., Xiang, E., Cheung, A., Ruan, W. J., and Hu, W. (2017). International oil price uncertainty and corporate investment: evidence from China's emerging and transition economy. Energy Econ. 61, 330–339. doi: 10.1016/j.eneco.2016.11.024

Wang, Y. Z., Chen, C. R., Chen, L. F., and Huang, Y. S. (2016a). Overinvestment, inflation uncertainty, and managerial overconfidence: firm level analysis of Chinese corporations. North Am. J. Econ. Finance 38, 54–69. doi: 10.1016/j.najef.2016.07.001

Wang, Y. Z., Chen, C. R., and Huang, Y. S. (2014). Economic policy uncertainty and corporate investment: evidence from China. Pac. Basin Finance J. 26, 227–243. doi: 10.1016/j.pacfin.2013.12.008

Wang, Y. Z., Wei, Y. L., and Song, F. M. (2016b). Uncertainty and corporate R&D investment: evidence from Chinese listed firms. Int. Rev. Econ. Finance 47, 176–200. doi: 10.1016/j.iref.2016.10.004

Wustenhagen, R., and Menichetti, E. (2012). Strategic choices for renewable energy investment: conceptual framework and opportunities for further research. Energy Policy 40, 1–10. doi: 10.1016/j.enpol.2011.06.050

Xie, F. X. (2009). Managerial flexibility, uncertainty, and corporate investment: the real options effect. Int. Rev. Econ. Finance 18, 643–655. doi: 10.1016/j.iref.2008.11.001

Xu, L. P., Wang, J. W., and Xin, Y. (2010). Government control, uncertainty, and investment decisions in China's listed companies. China J. Account. Res. 3, 131–157. doi: 10.1016/S1755-3091(13)60022-2

Yoon, K. H., and Ratti, R. A. (2011). Energy price uncertainty, energy intensity and firm investment. Energy Econ. 33, 67–78. doi: 10.1016/j.eneco.2010.04.011

Zeng, S. H., Jiang, C. X., Ma, C., and Su, B. (2017). Investment efficiency of the new energy industry in China. Energy Econ. 70, 536–544. doi: 10.1016/j.eneco.2017.12.023

Keywords: asymmetric effect, renewable energy, oil price uncertainty, investment, investment inefficiency

Citation: Cao H, Sun P and Guo L (2020) The Asymmetric Effect of Oil Price Uncertainty on Corporate Investment in China: Evidence From Listed Renewable Energy Companies. Front. Energy Res. 8:47. doi: 10.3389/fenrg.2020.00047

Received: 15 December 2019; Accepted: 06 March 2020;

Published: 03 April 2020.

Edited by:

Xunpeng Shi, University of Technology Sydney, AustraliaReviewed by:

Jingli Fan, China University of Mining and Technology, Beijing, ChinaTroy Shen, Nanjing Audit University, China

Copyright © 2020 Cao, Sun and Guo. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Hong Cao, Y2FvaG9uZ0BjdWViLmVkdS5jbg==

Hong Cao

Hong Cao Pengfei Sun1

Pengfei Sun1