94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Energy Res. , 24 March 2020

Sec. Sustainable Energy Systems

Volume 8 - 2020 | https://doi.org/10.3389/fenrg.2020.00035

This article is part of the Research Topic Energy Market and Energy Transition: Dynamics and Prospects View all 22 articles

Balancing the oil pass-through to consumer and producer prices is crucial for policymakers. This study aimed to advance associated thinking by examining how consumer and producer prices in China related to changes in global oil prices from 2006 to 2018. First, we investigated the pass-through of oil spot prices to consumer prices as indicated by the consumer price index (CPI) and means of consumption price index (MCPI), and to producer prices as indicated by the producer price index (PPI) and means of production price index (MPPI), with a monetary policy in China. This study also explored the non-linear and mediating effects of financial markets and government debt on linkages between oil prices and consumer/producer prices based on non-linear framework and causal steps approach, respectively. Our findings indicated some key points; for example, the pass-through of oil prices with a monetary policy in China shed light on a benchmark role in global oil markets. Additionally, the non-linear effect of oil prices on consumer/producer prices varied across the Brent and West Texas Intermediate (WTI) crude oil markets. The mediating effect of government debt also reflected the effectiveness in balancing the relationship between oil prices and producer prices. Government debt explained the −0.091 transition between the Brent oil price and the PPI and could explain the −0.095 transition between the Brent oil price and the MPPI, whereas the transition due to financial markets were −0.064 and −0.080, respectively. These outcomes have important implications for stabilizing price levels in countries.

What is the extent of oil price pass-through in relation to consumer and producer prices within Chinese monetary policy? This question sheds light on the crucial role oil price plays in macroeconomic instability (Hamilton, 1983; Kim, 2012; Bloch et al., 2015; Ratti and Vespignani, 2016; Sodeyfi and Katircioglu, 2016; Kang et al., 2017; Shi and Sun, 2017; Ji et al., 2019c). Multiple studies exploring the positive relationships between oil prices and consumer/producer prices have not yielded consistent results (Alvarez et al., 2011; Gomez-Loscos et al., 2011; Guo et al., 2016; Choi et al., 2018; Gong and Lin, 2018). Recently, Humbatova et al. (2019) modeled the dependence of the CPI on oil price and concluded that the CPI significantly and positively depends on oil price. Additionally, He and Lin (2019) studied the transmission from oil price to the PPI and showed that oil price also has a positive ability to affect the operation of the PPI. However, consumer/producer prices could be asymmetrically related to the volatility in oil prices (Ajmi et al., 2015; Sek and Lim, 2016; Castro et al., 2017; Rangasamy, 2017; Gonzalez-Concepcion et al., 2018); for instance, Ajmi et al. (2015) documented an asymmetric relationship by disentangling the effects of positive shocks from negative ones. Additionally, Lim and Sek (2017) concluded that the impact of oil prices may vary across oil exporting and importing economies, because of oil dependency factors; otherwise, oil prices exert negative effects on the CPI in organization for economic co-operation and development (OECD) countries (Katircioglu et al., 2015). This occurs because studies ignore the crucial effect of monetary policy on consumer and producer prices. Changes in the workings of monetary policy could have a recessionary influence, causing devastating oil shocks (Wen et al., 2019a); therefore, the monetary authorities may react to oil price shocks by implementing diverse monetary policies to stabilize macroeconomic performance during certain periods (Gomez-Loscos et al., 2011; Lim and Sek, 2018; Sek, 2019). Furthermore, the pass-through of oil price could be strongly related to the heterogeneous oil-dependence of various crude oil markets. In this context, the first objective of this research was to test the pass-through of oil prices, especially the Brent and WTI oil prices, in relation to consumer/producer prices within Chinese monetary policy.

Pass-through effects are primarily a problem caused by a non-linear relationship between oil prices and consumer/producer prices. Extensive studies have employed data showing the non-linear responses of consumer and producer prices to oil price increases and decreases (Ozdemir and Akgul, 2015; Yalcin et al., 2015; Guo et al., 2016; Ahmed et al., 2017; Sek, 2017, 2019; Long and Liang, 2018; Tiwari et al., 2019). It is widely accepted that non-linear relationships provide crucial information about the stabilizing effect of energy policies and the response of prices to positive and negative shocks; for instance, Myers et al. (2018) conducted a permanent-transitory decomposition to examine long-term and short-term relationships between oil prices, producer prices, and consumer prices. They found that oil prices could be regarded as a permanent shock. Similarly, Sek (2017) employed a non-linear autoregressive distributed lag (ARDL) model to explore the asymmetric effect of oil price changes on producer/consumer prices. They indicated that there is a limited effect of oil prices on the CPI in the long run, but that oil prices exert an indirect effect through the transmission from import prices to production costs. Sek (2019) divided the study's sample into oil-importing and oil-exporting countries, providing evidence that changes in oil prices could cause increases in consumer prices in oil-importing countries. As mentioned above, large-scale studies have provided feasible evidence for the asymmetric relationships between oil prices and consumer/producer prices, but one issue that remains unsolved is the non-linear nature of these relationships. It is well-known that oil dependency factors, such as refined oil prices, production costs, and the demand for refined oil products, may create non-linear price transmissions (Ozdemir and Akgul, 2015; Long and Liang, 2018; Ji et al., 2019d; Song et al., 2019; Tiwari et al., 2019). In this vein, this study explored the question of whether oil prices exert non-linear effects on consumer and producer prices, with the aim of providing a richer framework for identifying how authorities should respond to oil price shocks.

The pass-through effect of the oil price occurs via two indirect channels: financial markets and government debt. First, the fluctuation of oil prices could affect future stock prices, thereby impacting consumer/producer prices, since financial markets can be an important determinant of domestic economies (Razmi et al., 2016; Ji et al., 2018; Wen et al., 2019c; Zheng and Du, 2019). The link between oil price movements and financial markets has important implications for portfolio management, so the financial market channel was considered in this study (Arouri, 2011; Cong and Shen, 2013; Ahmed et al., 2017; Ji et al., 2019a). Theoretically, the oil price's relationship to production costs and future cash flow could affect confidence in financial markets (Liu et al., 2019a). As a result, higher oil prices may decrease share prices, dampening profits and changing investment strategies, thus further stabilizing domestic prices (Razmi et al., 2016; Wen et al., 2019b). The second channel concerns the fiscal changes used to model expected consumer and producer prices. It is widely accepted that rising oil prices often reflect fiscal revenues, causing a subsequent increase of government debt (Katircioglu et al., 2015; Sek and Low, 2016). However, little attention has been paid to the analysis of the fiscal channel in the oil price–consumer/producer price mechanism. Specifically, when oil prices change and government debt increases, this increases investors' willingness to invest in enterprises and results in a consequent stabilization of consumer/producer prices (Akar, 2019); therefore, the primary aim of this study was to explore the role of financial market and government debt channels in transmitting oil price shocks to consumer/producer prices.

The contributions of this study are 3-fold. Considerable evidence exists regarding oil price–consumer/producer price connections, but one issue that remains unresolved is monetary policy's role in this linkage. Even though previous studies have focused on the relationships between oil price, the PPI, and the CPI, no study has analyzed the pass-through of oil price with Chinese monetary policy, or analyzed the oil price-inflation pass-through, taking into account not only the CPI/PPI, but also two other measures of core inflation: the MCPI and MPPI. Both the Brent and WTI oil prices have displayed a new pattern of volatility since 2011. To analyze these factors, this paper included monetary policy to explore the Brent and WTI oil prices' pass-through to both the CPI/MCPI and the PPI/MPPI. This extension is crucial for capturing the fundamental reasons for price spreads in different crude oil markets, based on their typical price movement differences.

A second contribution of the study is its examination of the non-linear relationship between oil prices, consumer prices, and producer prices. Some related studies have pointed out that the pass-through of oil prices to the CPI and PPI is asymmetrical (Sek, 2017). It is well-known that oil prices and the CPI/PPI may exhibit non-linear relationships, due to factors, such as policy uncertainty, oil dependence, energy crises, etc. Furthermore, diverse mechanisms in the Brent and WTI oil prices could provide a heterogeneous pass-through to consumer and producer prices, suggesting that the extent of the relationship between oil prices and domestic prices could vary across crude oil markets. This allowed us to create a non-linear framework for oil price pass-through and to identify a heterogeneous effect in different local representative oil markets.

Finally, this study provides a rich framework for identifying the indirect effect of oil prices on consumer/producer prices through stock market and government debt channels. Most of the previous literature has investigated the financial market channels' (e.g., share prices') effect on oil price–consumer/producer prices pass-through, or has calculated the transmission coefficients of government debt from global oil prices to domestic prices. Very little is known about the extent and manifestations of this indirect effect, which is increasingly important for policymakers regarding government debt and equally important for explaining how government debt plays an indirect role in domestic price shocks.

The remainder of the study is structured as follows. Section The Pass-Through of Oil Prices to Consumer and Producer Prices With a Monetary Policy in China examines the pass-through of oil prices to consumer and producer prices. Section The Non-linear Pass-Through of Oil Prices With a Monetary Policy provides evidence of the non-linear effects, while section Mediating Mechanism of Oil Price Pass-Through on Consumer and Producer Prices depicts the mediating effect of financial markets and government debt on oil price–consumer/producer price mechanisms. The conclusions are presented in section Conclusions.

This study adopted a vector autoregressive (VAR) model to explore the oil price pass-through. Since the seminal work by Kilian (2009), the existing literature has explored the effect of oil price shocks on macroeconomics or financial markets (Kilian, 2009; Moya-Martinez et al., 2014; Pinho and Madaleno, 2016; Coronado et al., 2018). The role of oil prices in the overall economy has been widely documented in energy economics literature (Song et al., 2019; Xia et al., 2019a). The identification of oil price pass-through is crucial, not just for exploring oil price movements, but also for investigating the response of domestic prices to oil prices (Ratti and Vespignani, 2016; Sodeyfi and Katircioglu, 2016). In other words, oil price movements could be regarded as endogenous events, as is commonly believed. In particular, China's consumer price level has been seen to begin to settle down, compared with the previously high levels since 2014 (Wei, 2019). These comparative changes indicate that there may be a close relationship between oil prices and China's general price level for both consumer and producer prices. To solve this, we estimated a pth-order VAR for each variable with oil price (op), consumer prices (cp), and producer prices (pp). Thus, the reduction in this paper of VAR(p) could be written as (1):

where Yt is a three-dimensional price vector made up of three prices over time t; that is, op, cp, and pp. stands for (3 × 3) matrices relating to the coefficient. Additionally, εt is a vector of residuals.

Second, this study tested the oil price pass-through with Chinese monetary policy. Based on (1), the measurements of the monetary policy were added as control variables, so the reduced form of VAR(p) is shown as (2):

where MSt and IRt represent the money supply and the interest rate at time t, respectively. Additionally, we present a brief description of all the variables in Table 1.

Oil prices are determined by global markets. Overall, the changes in oil supply and demand in different countries highlight the benchmark role of the Brent and WTI oil prices in global crude oil markets. The WTI oil prices have historically outweighed those of Brent by $1–3 per barrel every trading day, due to West Texas's better oil quality. Nevertheless, this trend has been broken in recent years, due to changes in the demand of emerging economies for Brent oil and the US government legally restricting crude oil exports. Specifically, Brent largely represents the Northwest European sweet market, while WTI draws its oil from the USA, Canada, and Mexico. Because of diverse price mechanisms, this study selected the Brent and WTI oil prices to measure op. Data for the Brent and WTI oil prices was collected from the U.S. Energy Information Administration.

Considering China's consumer/producer price levels, we selected the CPI, MCPI, PPI, and MPPI to capture the consumer and producer price levels. It is widely accepted that the CPI and PPI help to determine China's consumer and producer prices, respectively. Moreover, the MCPI could be regarded as a tool for measuring the social products that meet the demand of consumers in daily life. The MPPI is a direct measure of production and is the main determinant of the cost of production materials and labor. Therefore, this study also used the MCPI and MPPI to calculate consumer and producer prices. These price levels were collected from the National Bureau of Statistics of China.

To assess the Chinese monetary policy, this study employed two widely used metrics of monetary supply (MS) and 1-week SHIBOR (IR). We collected this data from the People's Bank of China. All the data was monthly data covering January 2006 to December 2018, transformed into log form because of the existence of heteroscedasticity. According to the results of a unit root test and lagged selection, we finally estimated VAR (3) to explore the oil price pass-through to the CPI, VAR (2) to investigate the oil price–MCPI/PPI mechanism, and VAR (1) for the mechanism of oil price–MPPI.

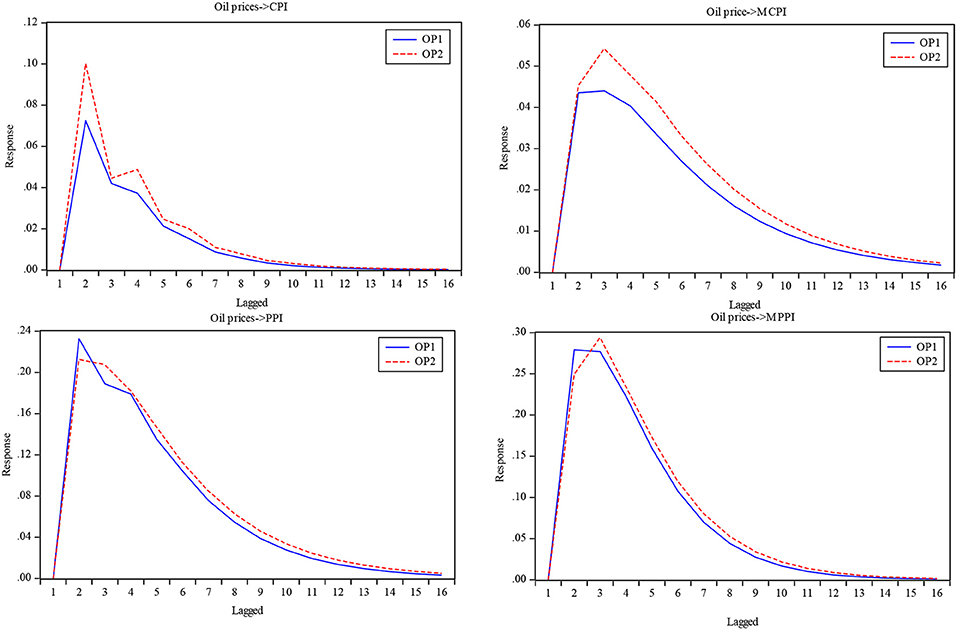

Exploring the impulse response is a standard process in the VAR model for depicting the lag pass-through of oil prices to consumer/producer prices. Additionally, the accumulated response could be an effective tool for capturing the total effect of oil prices on domestic price levels; therefore, Figure 1 shows the changes in the pass-through of oil prices (Brent and WTI) to the domestic price levels used in this paper: the CPI, MCPI, PPI, and MPPI. The accumulated responses to oil prices are summarized in Table 2.

Figure 1. The response of consumer/producer prices to oil prices without a monetary policy. OP1 and OP2 stand for Brent oil price and WTI oil price, respectively.

Consumer/producer prices showed positive relationships with oil prices, but not consistently. As shown in Figure 1, we observed that the oil prices were positively transmitted to consumer and producer prices, and this phenomenon was completed within the first 2–3 months. However, the results of the standardized response analysis showed a much greater change in producer prices than in consumer prices, which were 0.24–0.28 for producer prices and 0.05–0.10 for consumer prices. These results were not surprising, due to the dependence on oil. Crude oil is the lifeblood of our modern economic development. Movements in oil prices can change production costs, so higher oil prices may lead to an increase in production costs and a consequent decrease in production markets (He and Lin, 2019), which in turn may increase consumer/producer price levels. However, the inconsistent responses of the CPI/MCPI and the PPI/MPPI occurred because of the differences in dependence on oil between consumers and producers (Sakashita and Yoshizaki, 2016; Jongwanich et al., 2019). As a rule of thumb, we could conclude that producer prices were more sensitive than consumer prices to changes in oil prices.

There were differences in the pass-through of Brent and WTI oil prices to price levels of different types. Specifically, it was noteworthy that the pass-through of the WTI oil price to consumer price was higher than that of the Brent price over lagged periods, whereas the pass-through of the Brent oil price to producer prices was higher within the first 2 months. These differences suggest that both consumers and producers focused on WTI oil prices. This was due to the economic status of the United States, coupled with the trade agreement between China and the United States (Li et al., 2019b; Xu et al., 2019). Since the advent of the benchmark role played by Brent oil prices, producers have begun to reconcile global crude oil markets by using both the Brent and WTI oil prices in the short-term (Zhang and Zhang, 2015). This paper specifically explored the accumulated response of consumer and producer prices to oil prices.

First, the total pass-through of the oil price behaved quite heterogeneously with regard to consumer and producer prices. The accumulated response represented the effect of total oil price shocks on domestic price levels. Reflecting the dependence on oil, the pass-through of the Brent oil price to the PPI had, relatively, the highest performance (0.011), followed by the Brent oil price to the MPPI (0.009), with the Brent pass-through to the CPI ranking last (0.002).

It was particularly noteworthy that the durations of the periods of oil price pass-through, for both the Brent and WTI oil prices, were seemingly consistent. Generally, periods when oil price shocks converge to zero can reflect the general equilibrium between oil prices and China's consumer/producer prices. It is worth noting that the total period for the oil price–consumer/producer price mechanism could be 9 months, except for Brent–PPI and WTI–MCPI.

There were differences between the characteristics of oil price–domestic price transitions. In terms of average levels, we observed the difference between the two prices, with the pass-through of oil prices to producer prices being four times greater than that to consumer prices. This result was in line with the figures shown above. According to Table 2, the standard deviation of oil price–producer prices was generally larger than that of oil price–consumer prices. Moreover, we found that the Brent oil price appeared to be more stable than the WTI price, regardless of consumer prices (Gonzalez-Concepcion et al., 2018; Zivkov et al., 2019). In brief, the dependence on oil and the impact of oil price on producer prices, leaves countries macroeconomically vulnerable (Sakashita and Yoshizaki, 2016; Sek, 2017; Zhou et al., 2017).

Having explored the relationship between oil prices and consumer/producer prices, this study further examined monetary policy factors, such as money supply and interest rate. As in section Oil Price Pass-Through Without a Monetary Policy in China, we first analyzed the accumulated response of consumer and producer prices. Figure 2 depicts the response of consumer/producer prices to oil prices for both the Brent and WTI oil prices. In addition, Table 3 summarizes the statistical descriptions of the accumulated responses.

Figure 2 shows several interesting results for the pass-through of oil prices with a monetary policy. On the one hand, the response of consumer/producer prices appeared similar to that without a monetary policy. It is worth noting that the positive response of consumer/producer prices to oil prices had the best performance within the first 2–3 months. This result matched the historical determining factors of market participants on relationships between oil prices and domestic price levels. On the other hand, the evaluation of oil price shocks with a Chinese monetary policy was similar to the results in section Oil Price Pass-Through Without a Monetary Policy in China; for example, the results suggested that the pass-through of the WTI oil price to the CPI was larger than for the Brent oil price. Taking into account the crucial role of monetary policy, we noticed the same picture for the oil price–CPI mechanism.

Nevertheless, there were differences between these two results. Specifically, the Brent oil price pass-through to the PPI was larger than that of the WTI oil price over the lagged periods. In view of the increasing role of Brent oil in global crude oil markets, and its pivotal role as a determinant of oil demand in emerging markets, the Brent oil market could be regarded as an important tool for measuring China's price levels.

The total pass-through of oil prices and the durational periods varied across consumer and producer price levels. As shown in Table 3, oil price movements generally had a larger impact on producer prices, as represented by the PPI and MPPI. The standard deviation of the oil price–producer prices mechanism was also larger than that of the response of consumer prices to oil prices. Since consumer prices are not oil-intensive, the CPI and MCPI may not heavily depend on oil price movements. In brief, this result implied that oil price is not a crucial contributor to consumer prices, thereby indicating that oil price movements are likely to have a greater impact on price levels that are more oil-dependent.

To see how reasonable this pass-through estimate was, we compared the accumulated responses obtained in sections Oil Price Pass-Through Without a Monetary Policy in China and Oil Price Pass-Through With a Monetary Policy in China. It was interesting to note that the comparison in Figure 3 indicated that there were two differences, with and without a monetary policy. On the one hand, the accumulated response to the WTI oil prices showed an increasingly positive relationship between oil prices, consumer prices, and producer prices, except for the WTI–MPPI mechanism. On the other hand, the effects on producer prices were broadly similar in both models, except for the WTI–PPI mechanism. This difference was largely due to the forward-looking nature of money supply with regard to WTI oil prices and consumer prices. First, Brent oil prices are more stable than WTI prices because of the strong predictive power of economic policy uncertainty (Kang et al., 2017; Dong et al., 2019; Li and Zhong, in press). With monetary policies in China, the increasing role of WTI oil prices in affecting price levels, such as CPI, MCPI, and PPI, could highlight the oil price-consumer/producer prices mechanism. The primary aim of monetary policy is to stabilize consumer prices and further improve GDP growth; thus, the changing role of oil price with monetary policy in China could provide evidence for monitoring oil shocks at the macroeconomic level. In this vein, the evidence confirmed that monetary policy may be an accurate tool for capturing the pass-through of oil prices to consumer/producer prices (Razmi et al., 2016; Alvarez and Sanchez, 2019; Wen et al., 2019a). Overall, these results, combined with Figure 2, indicated that the pass-through of oil prices, coupled with a monetary policy, is indeed informative regarding consumer and producer prices.

Having found a significant pass-through of oil prices to consumer and producer prices, this paper further empirically investigated the non-linear pass-through. In this section, we first document the non-linear pass-through of oil prices to consumer prices with Chinese monetary policy, then we provide evidence of the oil price non-linear pass-through to producer prices.

The results in section The Pass-Through of Oil Prices to Consumer and Producer Prices With a Monetary Policy in China indicated a linear relationship between oil price movements and changes in the corresponding price levels with a monetary policy in China. Therefore, this paper first assumed a linear framework to depict this relationship, specifically shown as (3):

where plt stands for price levels in China, including four price indexes (the CPI, MCPI, PPI, and MPPI) at time t.

However, the pass-through of the oil price to price levels was expected to be non-linear. Due to the existence of diverse share prices, oil prices may exert an effect on consumer and producer prices that varies across oil price levels. In addition, it is widely accepted that excise duties play a crucial role in relationships between oil prices and consumer/producer prices (Alvarez et al., 2011). To provide an accurate assessment, we added a quadratic term into (3), which allowed us to capture the non-linear pass-through of oil prices. The corresponding equation could be defined as (4):

Our interest lay mainly in α2, which provided information on the non-linearly varying pass-through of oil prices to consumer and producer prices.

Data preprocessing was carried out for all the variables under standardization for oil prices, consumer prices, producer prices, and monetary policy, to insulate our regression results from spurious results. To do this, we employed Z-score normalization, so constant term c0 could be omitted in (4). Lastly, we estimated the empirical specifications as shown in (5) and (6):

Table 4 reports the results from regressing the pass-through of oil prices, for both the Brent and WTI oil prices, to the CPI and MCPI. Accordingly, Model 1 presented regressions drawn from Equation (5), and Model 2 reported regressions based on Equation (6).

The comparison in Table 4 revealed that there was a non-linear pass-through of oil prices to consumer prices, which strongly related to the fundamentals of global oil markets. On the one hand, referring to the comparative results of Models 1 and 2, the positive relationships, with added quadratic terms for both the CPI and MCPI, were stronger than those without non-linear terms. This result indicated that oil prices exert their effect on consumer prices in a non-linear way. On the other hand, the pass-through of oil prices to consumer prices behaved quite differently for crude oil markets. Since the Brent oil price was employed as an explanatory variable in Equation (6), it provided us with some empirical evidence concerning the fact that there was no significant non-linear effect on either the CPI or MCPI. By contrast, since the WTI oil price was employed as an explanatory variable, it was notable that the WTI oil price had a significantly inverted “U” pass-through to both the CPI and MCPI. In this manner, we were able to compare the pass-through of the Brent and WTI oil prices. These results heavily related to the spillover and fundamentals of different crude oil markets (Zhang et al., 2019a). On the spillover side, the evidence in section The Pass-Through of Oil Prices to Consumer and Producer Prices With a Monetary Policy in China indicated a greater response of consumer prices to WTI oil prices. This suggested that WTI plays a crucial role in changes in consumer prices. In terms of the different fundamentals between the Brent and WTI oil markets, higher market power and relative policy uncertainty increase economic uncertainty as a result of changes in consumer demand (Kang et al., 2017), which in turn affects the movement of consumer prices. To shed further light on the non-linear pass-through of WTI oil prices, in Figure 4 we present the non-linear relationship between WTI oil prices and the CPI and MCPI.

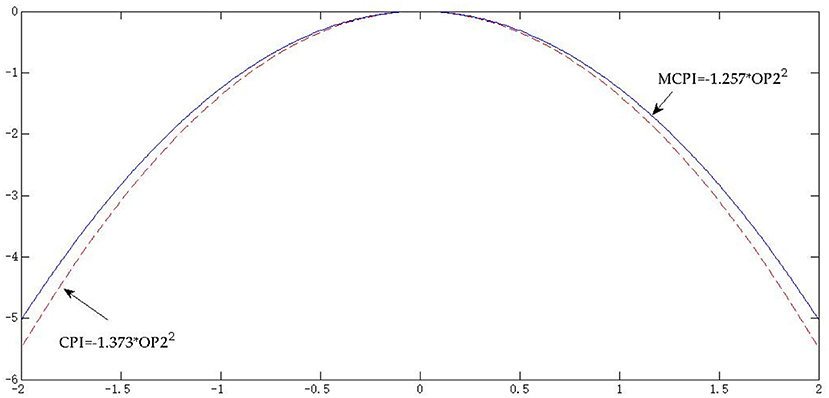

Figure 4. Snapshot of the non-linear pass-through of the WTI oil price. For simplicity, we have omitted the other variables in Equation (6) and only report the non-linear term; thus, there is no effect of WTI oil price on consumer prices for both CPI and MCPI when they are located at the coordinates (0,0).

The extent of the non-linear pass-through of WTI oil prices to different consumer prices differed significantly. It was clear that the inverted “U” relationship between the WTI oil price and the CPI was greater than that between the WTI oil price and the MCPI, at −1.373 and −1.257, respectively. On the one hand, this inverted “U” linkage could relate strongly to WTI's important role in the macroeconomic guidance of policy. From the perspective of the markets' role, it is widely accepted that oil price movements can immediately pass through to products that depend on oil prices, such as fuels and heating oils that are consumed by households. However, the inflationary effect of oil price movements is limited (Alvarez et al., 2011; Choi et al., 2018). With the increase of WTI oil prices, cleaner energies, such as electricity and natural gas, offer some alternative products for consumers. Additionally, the attitude of policy gives guidance to households, encouraging them to turn their attention to alternative products and, consequently, changing the relationships between WTI oil prices and both the CPI and MCPI (Hewitt et al., 2019). On the other hand, the diverse pass-through to the CPI and MCPI is heavily dependent on their characteristics; for instance, this result indicated the existence of diverse share prices. Accordingly, the share prices related to the CPI to WTI was higher than that of the MCPI. This result suggested a need to design a full range of CPI and further monitor the pass-through of the WTI oil price to consumer prices.

This section discusses the non-linear pass-through of oil prices to producer prices. Table 5 presents the regression results for the pass-through of oil prices, for both the Brent and WTI oil prices, to the PPI and MPPI. Specifically, Model 1 presents the regression results of Equation (5) and Model 2 reports the regression results of Equation (6).

The picture changed somewhat with regard to the pass-through of oil prices to producer prices. As expected, Brent oil prices exerted a “U” pass-through effect on producer prices, whereas the effect of the WTI oil prices on producer prices was linear. This interesting result could be related to the fact that the global oil benchmark has been transferred from the WTI to the Brent crude oil market. Section The Pass-Through of Oil Prices to Consumer and Producer Prices With a Monetary Policy in China provided evidence that the relationship between the Brent oil price and producer prices, with the added effect of Chinese monetary policy, was stronger than that of the WTI oil price. This suggested a more crucial role for Brent oil prices in determining producer prices. Furthermore, because of the increasing demand in emerging markets and the restrictive policy of the US government, Brent oil overthrew WTI as the global oil benchmark and has, consequently, become directly linked to a larger market. In this manner, although most Brent oil has been destined for European markets, it is used as a price benchmark for other grades of oil. Overall, higher pass-through may take place for Brent oil price movements. To obtain more informative findings, in Figure 5 we present the non-linear relationship between Brent oil prices and the PPI and MPPI.

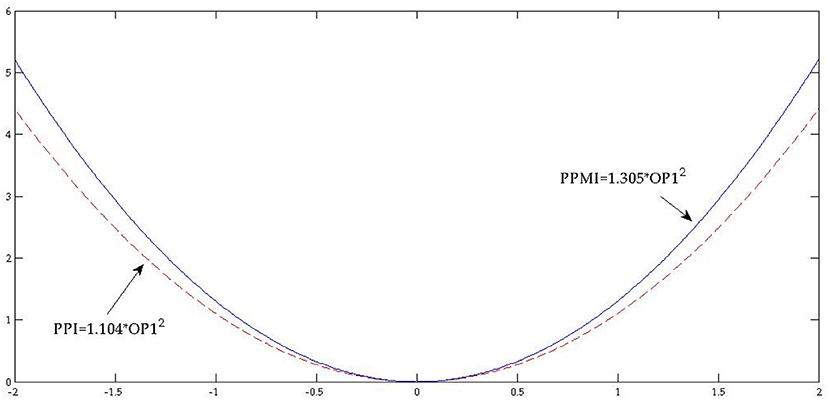

Figure 5. Snapshot of the non-linear pass-through of the Brent oil price. For simplicity, we have omitted the other variables in Equation (6) and only report the non-linear term; thus, there is no effect of Brent oil price on consumer prices for both the PPI and MPPI when they are located at the coordinates (0,0).

Figure 5 gives a sense of the extent of the variation in the PPI and MPPI. Specifically, it is particularly interesting that the “U” relationship between the Brent oil price and the MPPI was greater than that between the Brent oil price and the PPI, at 1.305 and 1.104, respectively. Accordingly, the “U” pass-through of Brent oil prices to producer prices could heavily depend on the market power of Brent crude oil and the balance between oil supply and demand. As expected, higher oil prices could decrease producer price levels due to their specific impact on production costs. Nevertheless, non-linear pass-through may be impacted by financial policy and the balance of supply and demand in crude oil markets (Liao et al., 2019). Slumps in oil prices are reflected in an imbalance between supply and demand in crude oil markets, resulting in an increase in the demand for clean and renewable energy within countries. Consequently, the negative pass-through of Brent oil prices to producer prices gradually led to a decline in price regimes. With the increase of Brent oil prices, the positive pass-through to producer prices related to the increased dependence on refined oil products. Differences in energy policy in different economies may create heterogeneous mechanisms for international crude oil markets (Liu et al., 2019b).

In the previous section, we presented one mechanism for evaluating the pass-through of oil prices to consumer and producer prices: namely, its non-linear impact in relation to a monetary policy in China. This section now considers another mechanism for oil price pass-through to domestic prices. First, we provide evidence for the mediating effect of financial markets, then we document the effect of the government debt channel on the oil price–consumer/producer price mechanism.

Given the significant changes that have occurred in the financial and oil markets in last two decades, it was desirable to analyze the existence of a channel mechanism in the links between oil price movements and consumer/produce price levels (Alvarez et al., 2011; Razmi et al., 2016; Sek, 2019). To do this, this study used a causal steps approach to explore the mediating effect (Li et al., 2019c). Specifically, the causal steps were as follows:

Step 1. Estimate a regression for oil prices and consumer/producer prices as shown in (7)

where represents the oil price for market j at time t, j = 1 stands for the Brent oil price, and j = 2 for the WTI oil price. Step 1 proved to be satisfactory if was significantly different from zero. If so, we then estimated according to step 2.

Step 2. Estimate a regression for oil price and the financial or government debt as shown in (8):

where chat represents the channel variables, including the financial market and government debt. These variables were selected because they were commonly used background variables. Specifically, we selected the Shanghai (securities) composite index (SCI) to measure the financial markets and the government debt (GD) to depict debt. Step 2 proved to be satisfactory if was significantly different from zero. If so, we next estimated step 3. If not, other variables were selected to depict the transition mechanism.

Step 3. Estimate a regression for financial markets or government debt and consumer/producer prices as shown in (9):

Step 3 proved to be satisfactory if γ1 was significantly different from zero. If so, we next estimated step 4. If not, other variables were selected to depict the transition mechanism.

Step 4. Estimate a regression for oil price, financial markets, or government debt, and consumer/producer prices as shown in (10):

The coefficients in models (7)–(10) showed the different effects of oil prices on consumer/producer prices. Specifically, Equation (7) could capture the total effect of oil prices, while equation (10) reported the direct effect, and Equations (8) and (9) could be regarded as tools to measure the indirect pass-through of oil prices to consumer/producer prices.

Following the causal steps approach, the mediation test was performed and the results reported in Table 6. Our interest lay in the significance of the coefficients in Equations (7)–(10).

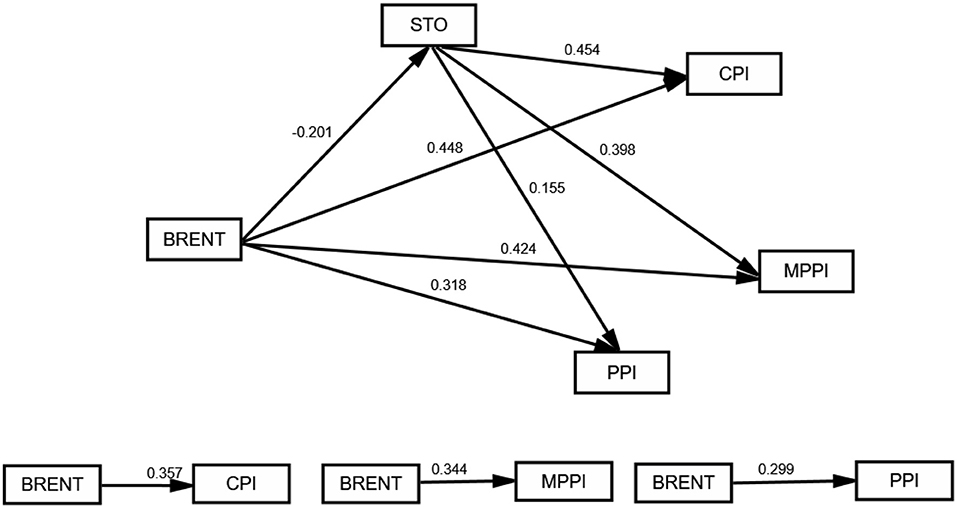

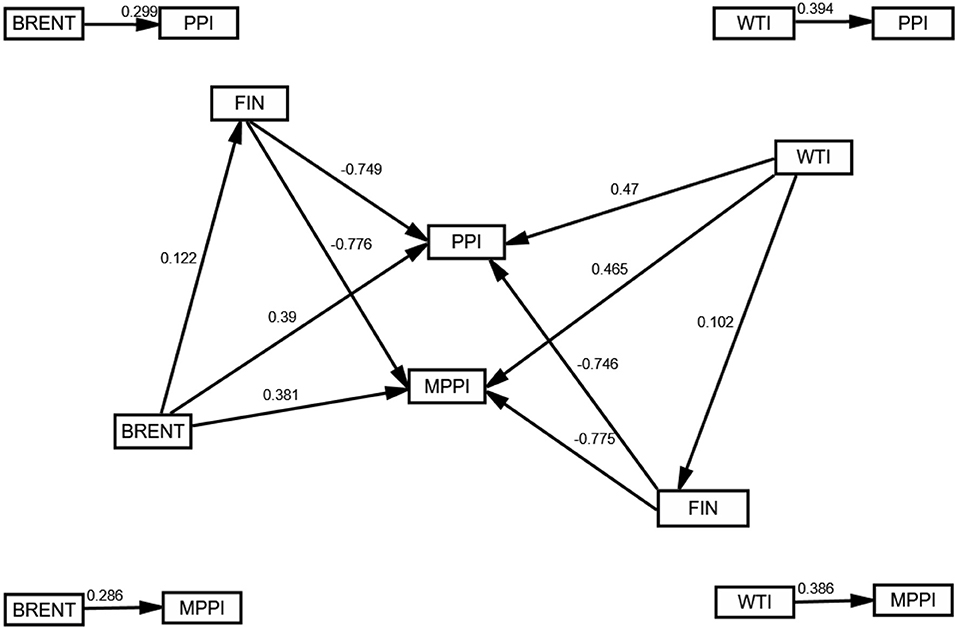

Assessing the mediating effect of financial markets required some significance tests. As estimated in Equation (7), referring to Step 2 in Table 6, we noticed that the impact of the WTI oil price, measured by , was not significantly different from zero. This result provided us with empirical evidence concerning the possibility that there may not be a significant mediating effect of financial markets on the relationships between WTI oil prices and consumer/producer prices. Furthermore, we estimated Equations (9) and (10). According to Step 3 in Table 6, it was interesting to note that the financial market had no significant effect on the MPPI. Moreover, both the Brent oil prices and SCI played a significant role in the CPI, MCPI, and PPI. These results indicated the significant mediating effect of the financial market on the Brent oil price–consumer/producer prices pass-through. To shed further light on the mediating effect of the financial market, in Figure 6 we present the results for a direct effect, indirect effect, and total effect.

Figure 6. The mediating effect of the financial market. The upper section of the figure reports the direct and indirect effects; the lower section of the figure shows the total effect.

The oil price–consumer/producer price mechanisms, combined with financial market channels, are summarized in Figure 6. Accordingly, Brent oil prices could indirectly transmit to the CPI through the financial market. Specifically, it was noteworthy that the direct effect of the Brent oil price on the CPI was 0.448, whereas the indirect effect was −0.091. These results showed that Brent oil price movements have an indirect negative effect on the CPI. This was no surprise, due to the market power of crude oil and the capital flow of households (Alvarez et al., 2011; Li et al., 2019a). On the one hand, because of the policy uncertainty, Brent oil markets could exert an effect on the expectations of participants in crude oil markets (Dong et al., 2019). Policy uncertainty, combined with the trade agreement between China and the USA, causes spillover between different financial markets, leading to vulnerability as a result of changes in investors' expectations (Li et al., 2018a; Xia et al., 2019b). Consequently, this result shed light on the increasing effect of the Brent oil markets on consumer prices. On the other hand, financial markets offer a channel for shared risk for households through changes in capital flow (Moya-Martinez et al., 2014). High oil prices affect investors' expectations by reducing the share price, which may, consequently, benefit consumer price levels. Therefore, these results suggested that the financial market could be regarded as a tool for stabilizing movements in the CPI.

Moreover, Brent oil prices could also indirectly affect producer prices, for both the PPI and MPPI, through the financial market. It is worth noting that the financial market explained the 0.064 transitions between the Brent oil price and the PPI and also explained the 0.080 transitions between the Brent oil price and the MPPI. This result related to the financialization of markets (Ji et al., 2019b). Considering the diverse aims of stakeholders, it is widely accepted that investors aim to maximize profits and reduce risks (Li et al., 2018b; Huang et al., 2019). Financial markets offer an opportunity for investors to share their risks and improve the investment environment in relation to the changes in production costs caused by oil price movements (Cong and Shen, 2013). Furthermore, investments in financial markets can provide extra profit for investors, decreasing the dependence of oil-related enterprises or economies (Zhang et al., 2019b). A higher indirect effect on the MPPI could be related to excise duties. The aggregate producer price level, measured by the PPI, could reduce the indirect effect, because of the possible hedge between the MPPI and other price indexes. These outcomes indicated a significantly negative mediating effect of financial markets.

Table 7 reports the results of the causal steps approach for the government debt channel's role in the oil price–consumer/producer prices mechanism. Similarly, our interest lay in the significance of the coefficients in Equations (7)–(10).

Consistently with the results in section Financial Market Channel's Role in Transmitting Oil Price Pass-Through to Consumer/Producer Prices, to provide an accurate assessment of the mediating effect of government debt also required some significance tests. As estimated in equation (7), referring to Step 2 in Table 7, we noticed that the impact of both the Brent and WTI oil prices, measured by and , were significantly different from zero. These results provided us with some empirical evidence concerning the fact that oil prices exert their effect in combination with government debt. We estimated equations (9)–(10). According to Step 3 in Table 7, it was interesting to note that government debt had no significant effect on consumer prices for either the CPI or MCPI. Moreover, both the Brent and WTI oil prices played a significant role in the PPI and MPPI. These results indicated the significant mediating effect of government debt on the oil price–producer prices mechanism. To obtain more informative results, in Figure 7 we examined the results for the direct effect, indirect effect, and total effect.

Figure 7. The mediating effect of government debt. The center portion of the figure reports the direct and indirect effects. The areas around the figure show the total effect.

The comparison in Figure 7 revealed that there was a negative mediating effect of government debt on the oil price–producer prices mechanism. On the one hand, there was a significant mediating effect of the government debt on the oil price–producer prices mechanism, which was not surprising, due to the relationship between government debt and both the PPI and MPPI. The primary aim of policymakers is to promote investment in enterprises and stabilize producer price levels (Sung, 2019); consequently, this is strongly related to the PPI and MPPI. In this manner, government debt could exert a mediating effect on the relationship between oil prices and producer prices for both the PPI and MPPI. These results suggested that government debt could be regarded as a tool for stabilizing the movements of producer prices. On the other hand, the negative effect of oil prices on government debt could capture the total effect of oil prices. Accordingly, it is worth noting that both the Brent and WTI oil prices had a greater mediating effect on government debt for the MPPI than for the PPI. Since the fiscal market was employed as a channel variable for the Brent oil price to producer prices mechanism, it provided us with evidence that there was a greater mediating effect of government debt on the Brent oil price–PPMI mechanism than on the Brent oil price–PI mechanism, at −0.095 and −0.091, respectively. Similarly, the mediating effect of government debt was greater on the WTI oil price–MPPI mechanism, at 0.079. By contrast, this effect on the WTI–PPI mechanism was 0.076. These diverse mediating effects captured the differences between refined oil-related enterprises and their relative producer prices (Xiao et al., 2013); therefore, due to the significant mediating effect of government debt on both the PPI and MPPI, we concluded that government debt plays a crucial role in changes in the mechanism of oil price pass-through to producer prices.

The pass-through of oil prices to consumer and producer prices could reflect the diverse dependence on oil across global oil markets. This paper aimed to advance this thinking by providing information on how price levels in China depend on movements in oil prices. Specifically, the VAR model was first employed to examine the response of consumer prices, as reflected by the CPI and MCPI, or producer prices as reflected by the PPI and MPPI, for both the Brent and WTI oil prices. Furthermore, we explored the non-linear pass-through of oil prices to both consumer and producer prices. Finally, this paper provided evidence of the mediating effect of financial markets, as well as government debt, on the oil price–consumer/producer price mechanisms.

The pass-through of oil prices to consumer and producer prices could be coupled with a monetary policy. On the one hand, the increasingly positive pass-through of WTI oil prices suggests an influential effect of monetary policy on the oil price–macroeconomic mechanism, due to the primary aim of monetary policy to stabilize price levels on both consumer and producer prices. On the other hand, a higher pass-through of the Brent oil price to producer prices provides evidence of the accuracy of monetary policy.

The non-linear effect of oil prices on consumer/producer prices varies across different crude oil markets. Specifically, the WTI oil price exerted a significantly inverted “U” pass-through to consumer prices for the CPI and the MCPI, and the inverted “U” relationship between WTI oil price and the CPI was stronger than that between the WTI oil price and the MCPI, at −1.373 and −1.257, respectively. Nevertheless, the pass-through of the Brent oil price to producer prices was significant and “U” shaped, and this “U” relationship between the Brent oil price and the MPPI was stronger than that between the Brent oil price and the PPI, at 1.305 and 1.104, respectively.

These mediating effects highlighted the indirect negative impact of oil price on consumer and producer prices, and these effects heavily depend on market power. Empirically, Brent oil prices could indirectly transmit to the CPI, PPI, and MPPI through the financial market. There were mediating effects of government debt on the linkages between both the Brent and WTI oil prices and producer prices, for the PPI and MPPI. Comparatively, the effect of government debt on the Brent oil price–producer prices mechanism, reflected by the PPI and MPPI (−0.091 and −0.095, respectively), was greater than that of financial markets (at −0.064 and −0.080, respectively).

Our outcomes should be valuable in helping to stabilize price levels. The effectiveness of policy depends heavily on the non-linear pass-through of oil prices; thus, policymakers should pay specific attention to stabilizing consumer or producer price levels. In other words, consumer prices relate to changes in the WTI oil market, whereas producer prices are linked to changes in Brent oil prices. In addition, the negative mediating effect of both financial markets and government debt offer an opportunity to prevent the spillover from the global crude oil market to the macroeconomic level; therefore, authorities should not only monitor the financialization of crude oil markets and enterprises, but also promote the effective role of government debt in the oil price–producer prices mechanism. Financial markets could thus be regarded as an accurate tool for stabilizing consumer price levels.

There are some possible limitations to this study; for example, this paper neglected the moderating mechanism of the oil price–price levels on both consumer and producer prices. Accordingly, economic policy uncertainty and institutional distance regarding different oil markets could exert a moderating effect. Additionally, the network structure of oil markets could be regarded as another moderating variable, providing a more accurate tool for policymakers and investors for regulations. Furthermore, the threshold of the mediating and moderating effects on oil price shocks would also be of great interest. In addition, the time-frequency dynamic spillovers between the global crude oil price and the general price levels, such as consumer or producer prices, could provide more evidence for investigating shocks in the external environment.

The datasets generated for this study are available on request to the corresponding author.

SC, SO, and HD: substantial contributions to the conception or design of the work and provide approval for publication of the content. SO and HD: the acquisition, analysis or interpretation of data for the work, drafting the work or revising it critically for important intellectual content.

This research was funded by National Office for Philosophy and Social Sciences, grant number 18CJY052.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Authors would like to thank the editor and three reviewers for their patient and valuable comments on earlier versions of this paper.

Ahmed, R. R., Vveinhardt, J., Streimikiene, D., Ghauri, S. P., and Ahmad, N. (2017). Estimation of long-run relationship of inflation (CPI & WPI), and oil prices with KSE-100 index: evidence from johansen multivariate cointegration approach. Technol. Econ. Dev. Econ. 23, 567–588. doi: 10.3846/20294913.2017.1289422

Ajmi, A. N., Gupta, R., Babalos, V., and Hefer, R. (2015). Oil price and consumer price nexus in South Africa revisited: a novel asymmetric causality approach. Energy Explor. Exploit. 33, 63–73. doi: 10.1260/0144-5987.33.1.63

Akar, S. (2019). Testing the fiscal fatigue phenomenon in turkey using a long-run non-linear fiscal reaction function approach. Q. Finance Econ. 3, 645–660. doi: 10.3934/QFE.2019.4.645

Alvarez, L. J., Hurtado, S., Sanchez, I., and Thomas, C. (2011). The impact of oil price changes on Spanish and Euro area consumer price inflation. Econ. Model. 28, 422–431. doi: 10.1016/j.econmod.2010.08.006

Alvarez, L. J., and Sanchez, I. (2019). Inflation projections for monetary policy decision making. J. Policy Model. 41, 568–585. doi: 10.1016/j.jpolmod.2018.09.005

Arouri, M. E. (2011). Does crude oil move stock markets in Europe? A sector investigation. Econ. Model. 28, 1716–1725. doi: 10.1016/j.econmod.2011.02.039

Bloch, H., Rafiq, S., and Salim, R. (2015). Economic growth with coal, oil and renewable energy consumption in China: prospects for fuel substitution. Econ. Model. 44, 104–115. doi: 10.1016/j.econmod.2014.09.017

Castro, C., Jimenez-Rodriguez, R., Poncela, P., and Senra, E. (2017). A new look at oil price pass-through into inflation: evidence from disaggregated European data. Econ. Polit. 34, 55–82. doi: 10.1007/s40888-016-0048-9

Choi, S., Furceri, D., Loungani, P., Mishra, S., and Poplawski-Ribeiro, M. (2018). Oil prices and inflation dynamics: evidence from advanced and developing economies. J. Int. Money Finance 82, 71–96. doi: 10.1016/j.jimonfin.2017.12.004

Cong, R. G., and Shen, S. C. (2013). Relationships among energy price shocks, stock market, and the macroeconomy: evidence from China. Sci. World J. 9:171868. doi: 10.1155/2013/171868

Coronado, S., Jimenez-Rodriguez, R., and Rojas, O. (2018). An empirical analysis of the relationships between crude oil, gold and stock markets. Energy J. 39, 193–207. doi: 10.5547/01956574.39.SI1.scor

Dong, H., Liu, Y., and Chang, J. (2019). The heterogeneous linkage of economic policy uncertainty and oil return risks. Green Finance 1, 46–66. doi: 10.3934/GF.2019.1.46

Gomez-Loscos, A., Montanes, A., and Gadea, M. D. (2011). The impact of oil shocks on the Spanish economy. Energy Econ. 33, 1070–1081. doi: 10.1016/j.eneco.2011.05.016

Gong, X., and Lin, B. Q. (2018). Time-varying effects of oil supply and demand shocks on china's macro-economy. Energy 149, 424–437. doi: 10.1016/j.energy.2018.02.035

Gonzalez-Concepcion, C., Gil-Farina, M. C., and Pestano-Gabino, C. (2018). Wavelet power spectrum and cross-coherency of Spanish economic variables. Empir. Econ. 55, 855–882. doi: 10.1007/s00181-017-1295-5

Guo, J., Zheng, X. Y., and Chen, Z. M. (2016). How does coal price drive up inflation? Reexamining the relationship between coal price and general price level in China. Energy Econ. 57, 265–276. doi: 10.1016/j.eneco.2016.06.001

Hamilton, J. D. (1983). Oil and the macroeconomy since World-War-II. J. Polit. Econ. 91, 228–248. doi: 10.1086/261140

He, Y. D., and Lin, B. Q. (2019). Regime differences and industry heterogeneity of the volatility transmission from the energy price to the ppi. Energy 176, 900–916. doi: 10.1016/j.energy.2019.04.025

Hewitt, R. J., Bradley, N., Compagnucci, A. B., Barlagne, C., Ceglarz, A., Cremades, R., et al. (2019). Social innovation in community energy in Europe: a review of the evidence. Front. Energy Res. 7:31. doi: 10.3389/fenrg.2019.00031

Huang, Z., Liao, G., and Li, Z. (2019). Loaning scale and government subsidy for promoting green innovation. Technol. Forecast. Soc. Change 144, 148–156. doi: 10.1016/j.techfore.2019.04.023

Humbatova, S. I. Q., Garayev, A. I. O., Tanriverdiev, S. M. O., and Hajiyev, N. Q. O. (2019). Analysis of the oil, price and currency factor of economic growth in Azerbaijan. Entrepreneur. Sustain. Iss. 6, 1335–1353. doi: 10.9770/jesi.2019.6.3(20)

Ji, Q., Bouri, E., Roubaud, D., and Kristoufek, L. (2019a). Information interdependence among energy, cryptocurrency and major commodity markets. Energy Econ. 81, 1042–1055. doi: 10.1016/j.eneco.2019.06.005

Ji, Q., Bouri, E., Roubaud, D., and Shahzad, S. J. H. (2018). Risk spillover between energy and agricultural commodity markets: a dependence-switching covar-copula model. Energy Econ. 75, 14–27. doi: 10.1016/j.eneco.2018.08.015

Ji, Q., Li, J., and Sun, X. (2019b). New challenge and research development in global energy financialization. Emerg. Markets Finance Trade 55, 2669–2672. doi: 10.1080/1540496X.2019.1636588

Ji, Q., Liu, B.-Y., and Fan, Y. (2019c). Risk dependence of covar and structural change between oil prices and exchange rates: a time-varying copula model. Energy Econ. 77, 80–92. doi: 10.1016/j.eneco.2018.07.012

Ji, Q., Zhang, H.-Y., and Zhang, D. (2019d). The impact of opec on East Asian oil import security: a multidimensional analysis. Energy Policy 126, 99–107. doi: 10.1016/j.enpol.2018.11.019

Jongwanich, J., Park, D., and Wongcharoen, P. (2019). Determinants of producer price versus consumer price inflation in emerging Asia. J. Asia Pac. Econ. 24, 224–251. doi: 10.1080/13547860.2019.1574251

Kang, W., Ratti, R. A., and Vespignani, J. L. (2017). Oil price shocks and policy uncertainty: new evidence on the effects of us and non-us oil production. Energy Econ. 66, 536–546. doi: 10.1016/j.eneco.2017.01.027

Katircioglu, S. T., Sertoglu, K., Candemir, M., and Mercan, M. (2015). Oil price movements and macroeconomic performance: evidence from twenty-six oecd countries. Renew. Sustain. Energy Rev. 44, 257–270. doi: 10.1016/j.rser.2014.12.016

Kilian, L. (2009). Not all oil price shocks are alike: disentangling demand and supply shocks in the crude oil market. Am. Econ. Rev. 99, 1053–1069. doi: 10.1257/aer.99.3.1053

Kim, D. H. (2012). What is an oil shock? Panel data evidence. Empir. Econ. 43, 121–143. doi: 10.1007/s00181-011-0459-y

Li, J., Zhang, J., Zhang, D., and Ji, Q. (2019a). Does gender inequality affect household green consumption behaviour in China? Energy Policy 135:111071. doi: 10.1016/j.enpol.2019.111071

Li, Z., Dong, H., Huang, Z., and Failler, P. (2018a). Asymmetric effects on risks of virtual financial assets (VFAS) in different regimes: a case of Bitcoin. Q. Finance Econ. 2, 860–883. doi: 10.3934/QFE.2018.4.860

Li, Z., Huang, Z., and Dong, H. (2019b). The influential factors on outward foreign direct investment: evidence from the “The Belt and Road”? Emerg. Markets Finance Trade 55, 3211–3226. doi: 10.1080/1540496X.2019.1569512

Li, Z., Liao, G., and Albitar, K. (2019c). Does corporate environmental responsibility engagement affect firm value? The mediating role of corporate innovation. Bus. Strategy Environ. 29, 1045–1055. doi: 10.1002/bse.2416

Li, Z., Liao, G., Wang, Z., and Huang, Z. (2018b). Green loan and subsidy for promoting clean production innovation. J. Clean. Prod. 187, 421–431. doi: 10.1016/j.jclepro.2018.03.066

Li, Z., and Zhong, J. (in press). Impact of economic policy uncertainty shocks on China's financial conditions. Finance Res. Lett. doi: 10.1016/j.frl.2019.101303

Liao, G., Li, Z., Du, Z., and Liu, Y. (2019). The heterogeneous interconnections between supply or demand side and oil risks. Energies 12:2226. doi: 10.3390/en12112226

Lim, K. B., and Sek, S. K. (2017). “Examining the impacts of oil price changes on economic indicators: a panel approach,” in 4th International Conference on Mathematical Sciences, eds Z. H. Zamzuri, F. AbdulRazak, W. Z. W. Zin, and S. C. DzulKifli (Melville, NY: American Institute of Physics). doi: 10.1063/1.4981000

Lim, K. B., and Sek, S. K. (2018). “Investigating the impact of oil price changes on monetary policy: oil importing versus oil exporting countries,” in Proceeding of the 25th National Symposium on Mathematical Sciences, eds D. Mohamad, A. B. Akbarally, H. Maidinsah, M. M. Jaffar, M. Mohamed, S. R. Sharif, and W. Rahman (Melville, NY: American Institute of Physics). doi: 10.1063/1.5041687

Liu, K., Luo, C., and Li, Z. (2019a). Investigating the risk spillover from crude oil market to brics stock markets based on copula-pot-covar models. Q. Finance Econ. 3, 754–771. doi: 10.3934/QFE.2019.4.754

Liu, Y., Dong, H., and Failler, P. (2019b). The oil market reactions to opec's announcements. Energies 12, 1–15. doi: 10.3390/en12173238

Long, S. B., and Liang, J. (2018). Asymmetric and nonlinear pass-through of global crude oil price to china's PPI and CPI inflation. Econ. Res. Ekon. Istraz. 31, 240–251. doi: 10.1080/1331677X.2018.1429292

Moya-Martinez, P., Ferrer-Lapena, R., and Escribano-Sotos, F. (2014). Oil price risk in the spanish stock market: an industry perspective. Econ. Model. 37, 280–290. doi: 10.1016/j.econmod.2013.11.014

Myers, R. J., Johnson, S. R., Helmar, M., and Baumes, H. (2018). Long-run and short-run relationships between oil prices, producer prices, and consumer prices: what can we learn from a permanent-transitory decomposition? Q. Rev. Econ. Finance 67, 175–190. doi: 10.1016/j.qref.2017.06.005

Ozdemir, S., and Akgul, I. (2015). Inflationary effects of oil prices and domestic gasoline prices: markov-switching-var analysis. Pet. Sci. 12, 355–365. doi: 10.1007/s12182-015-0028-7

Pinho, C., and Madaleno, M. (2016). Oil prices and stock returns: nonlinear links across sectors. Portuguese Econ. J. 15, 79–97. doi: 10.1007/s10258-016-0117-6

Rangasamy, L. (2017). The impact of petrol price movements on south african inflation. J. Energy South. Afr. 28, 120–132. doi: 10.17159/2413-3051/2017/v28i1a1597

Ratti, R. A., and Vespignani, J. L. (2016). Oil prices and global factor macroeconomic variables. Energy Econ. 59, 198–212. doi: 10.1016/j.eneco.2016.06.002

Razmi, F., Azali, M., Chin, L., and Habibullah, M. S. (2016). The role of monetary transmission channels in transmitting oil price shocks to prices in Asean-4 countries during pre- and post-global financial crisis. Energy 101, 581–591. doi: 10.1016/j.energy.2016.02.036

Sakashita, Y., and Yoshizaki, Y. (2016). The effects of oil price shocks on IIP and CPI in emerging countries. Economies 4:20. doi: 10.3390/economies4040020

Sek, S. K. (2017). Impact of oil price changes on domestic price inflation at disaggregated levels: evidence from linear and nonlinear ARDL modeling. Energy 130, 204–217. doi: 10.1016/j.energy.2017.03.152

Sek, S. K. (2019). Effect of oil price pass-through on domestic price inflation: evidence from nonlinear ARDL models. Panoeconomicus 66, 69–91. doi: 10.2298/PAN160511021S

Sek, S. K., and Lim, H. S. M. (2016). “An investigation on the impacts of oil price shocks on domestic inflation: A svar approach,” in Advances in Industrial and Applied Mathematics, eds S. Salleh, N. Aris, A. Bahar, Z. M. Zainuddin, N. Maan, M. H. Lee, T. Ahmad, and Y. M. Yusof (Melville, NY: American Institute of Physics), 060002. doi: 10.1063/1.4954607

Sek, S. K., and Low, R. N. (2016). “Distinguishing the impacts of oil demand and oil supply on volatility of inflation: a comparative study on oil importing versus oil exporting,” in Advances in Industrial and Applied Mathematics, eds S. Salleh, N. Aris, A. Bahar, Z. M. Zainuddin, N. Maan, M. H. Lee, T. Ahmad, and Y. M. Yusof (Melville, NY: American Institute of Physics), 060001. doi: 10.1063/1.4954606

Shi, X., and Sun, S. (2017). Energy price, regulatory price distortion and economic growth: a case study of China. Energy Econ. 63, 261–271. doi: 10.1016/j.eneco.2017.02.006

Sodeyfi, S., and Katircioglu, S. (2016). Interactions between business conditions, economic growth and crude oil prices. Econ. Res. 29, 980–990. doi: 10.1080/1331677X.2016.1235504

Song, Y., Ji, Q., Du, Y.-J., and Geng, J.-B. (2019). The dynamic dependence of fossil energy, investor sentiment and renewable energy stock markets. Energy Econ. 84:104564. doi: 10.1016/j.eneco.2019.104564

Sung, B. (2019). Do government subsidies promote firm-level innovation? Evidence from the korean renewable energy technology industry. Energy Policy 132, 1333–1344. doi: 10.1016/j.enpol.2019.03.009

Tiwari, A. K., Cunado, J., Hatemi-J, A., and Gupta, R. (2019). Oil price-inflation pass-through in the united states over 1871 to 2018: a wavelet coherency analysis. Struct. Change Econ. Dyn. 50, 51–55. doi: 10.1016/j.strueco.2019.05.002

Wei, Y. F. (2019). The relationship between oil and non-oil commodity prices and china's PPI and CPI: an empirical analysis. Energy Sources B Econ. Plann. Policy 14, 125–146. doi: 10.1080/15567249.2019.1630032

Wen, F., Min, F., Zhang, Y.-J., and Yang, C. (2019a). Crude oil price shocks, monetary policy, and China's economy. Int. J. Finance Econ. 24, 812–827. doi: 10.1002/ijfe.1692

Wen, F., Xiao, J., Xia, X., Chen, B., Xiao, Z., and Li, J. (2019b). Oil prices and chinese stock market: nonlinear causality and volatility persistence. Emerg. Markets Finance Trade 55, 1247–1263. doi: 10.1080/1540496X.2018.1496078

Wen, F., Zhao, Y., Zhang, M., and Hu, C. (2019c). Forecasting realized volatility of crude oil futures with equity market uncertainty. Appl. Econ. 51, 6411–6427. doi: 10.1080/00036846.2019.1619023

Xia, T., Ji, Q., Zhang, D., and Han, J. (2019a). Asymmetric and extreme influence of energy price changes on renewable energy stock performance. J. Clean. Prod. 241:118338. doi: 10.1016/j.jclepro.2019.118338

Xia, Y., Kong, Y., Ji, Q., and Zhang, D. (2019b). Impacts of china-us trade conflicts on the energy sector. China Econ. Rev. 58:101360. doi: 10.1016/j.chieco.2019.101360

Xiao, W. L., Zhang, W. G., Yao, Z., and Wang, X. H. (2013). The impact of issuing warrant and debt on behavior of the firm's stock. Econ. Model. 31, 635–641. doi: 10.1016/j.econmod.2013.01.007

Xu, X., Wei, Z., Ji, Q., Wang, C., and Gao, G. (2019). Global renewable energy development: influencing factors, trend predictions and countermeasures. Res. Policy 63:101470. doi: 10.1016/j.resourpol.2019.101470

Yalcin, Y., Arikan, C., and Emirmahmutoglu, F. (2015). Determining the asymmetric effects of oil price changes on macroeconomic variables: a case study of turkey. Empirica 42, 737–746. doi: 10.1007/s10663-014-9274-y

Zhang, D., Ji, Q., and Kutan, A. M. (2019a). Dynamic transmission mechanisms in global crude oil prices: estimation and implications. Energy 175, 1181–1193. doi: 10.1016/j.energy.2019.03.162

Zhang, D., Rong, Z., and Ji, Q. (2019b). Green innovation and firm performance: evidence from listed companies in China. Resour. Conserv. Recycl. 144, 48–55. doi: 10.1016/j.resconrec.2019.01.023

Zhang, Y.-J., and Zhang, L. (2015). Interpreting the crude oil price movements: evidence from the markov regime switching model. Appl. Energy 143, 96–109. doi: 10.1016/j.apenergy.2015.01.005

Zheng, Y., and Du, Z. (2019). A systematic review in crude oil markets: embarking on the oil price. Green Finance 1, 328–345. doi: 10.3934/GF.2019.3.328

Zhou, D. T., Yu, H. Y., and Li, Z. G. (2017). Effects of fluctuations in international oil prices on China's price level based on var model. J. Discrete Math. Sci. Cryptogr. 20, 125–135. doi: 10.1080/09720529.2016.1178909

Keywords: consumer and producer prices, non-linear, mediating effect, crude oil markets, financial markets, debts markets

Citation: Chen S, Ouyang S and Dong H (2020) Oil Price Pass-Through Into Consumer and Producer Prices With Monetary Policy in China: Are There Non-linear and Mediating Effects. Front. Energy Res. 8:35. doi: 10.3389/fenrg.2020.00035

Received: 03 January 2020; Accepted: 19 February 2020;

Published: 24 March 2020.

Edited by:

Qiang Ji, Chinese Academy of Sciences, ChinaReviewed by:

Fenghua Wen, Central South University, ChinaCopyright © 2020 Chen, Ouyang and Dong. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Hao Dong, ZG9uZ2hhb0BlLmd6aHUuZWR1LmNu

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.